North America Testing, Inspection, and Certification (TIC) Market for Building & Construction, By Service Type (Testing, Inspection and Certification), Sourcing Type (In-House, and Outsourced), Testing Type (Structural Testing, Engineering Support, Fire Safety Testing, Indoor Environment Testing, Heat Pump Testing, Acoustics Testing and Wind Load Testing), Application (Infrastructural, Commercial Buildings and Residential Buildings), Country (U.S., Canada, Mexico) Industry Trends and Forecast to 2028

Market Analysis and Insights: North America Testing, Inspection, and Certification (TIC) Market for Building and Construction

Market Analysis and Insights: North America Testing, Inspection, and Certification (TIC) Market for Building and Construction

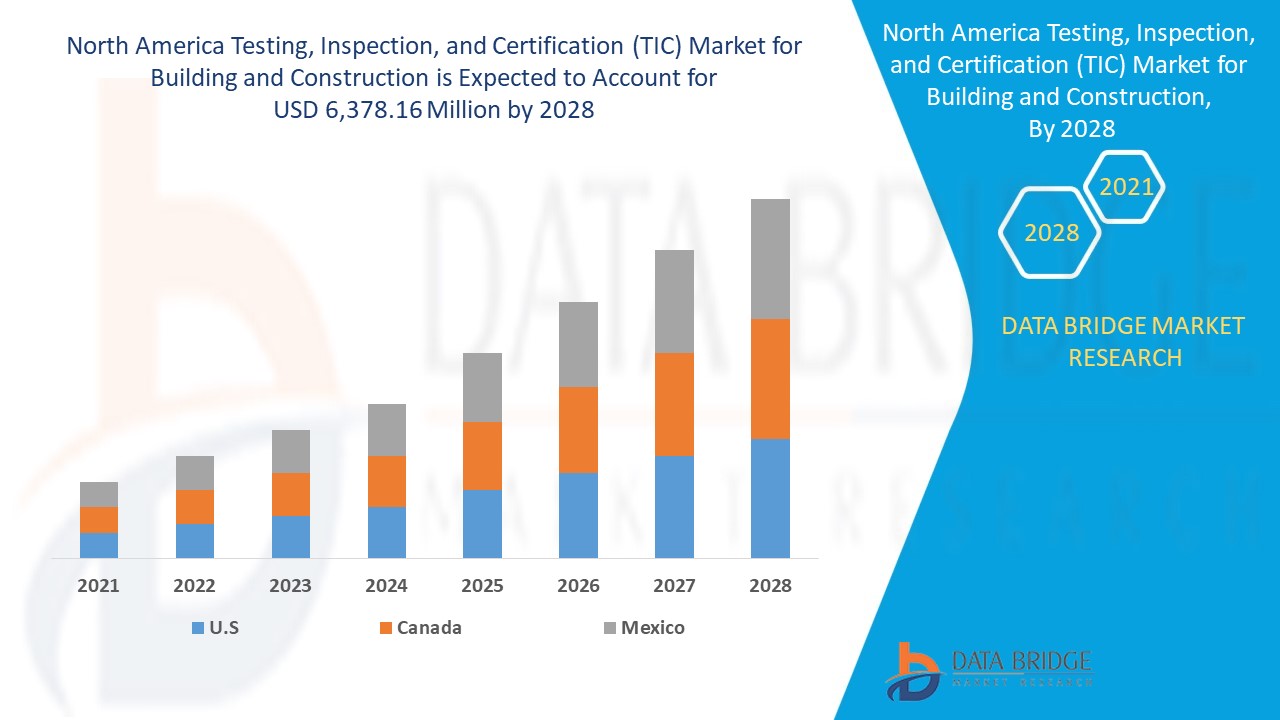

North America testing, inspection, and certification (TIC) market for building & construction is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing at a CAGR of 5.2% in the forecast period of 2021 to 2028 and expected to reach USD 6,378.16 million by 2028.

Testing, inspection and certification (TIC) consists of conformity assessment bodies, which provide various services, such as auditing and inspection, testing, verification, quality assurance and certification. In the building and construction sector, various types of TIC services including acoustics testing, engineering support, fire safety testing, heat pump testing, indoor environment testing, structural testing, and wind load testing are used. They help in providing durability to the products.

The demand for the testing, inspection and certification (TIC) for building & construction is increasing as there is growing demand of for structural safety in building & construction industry. Several builder and contractors prefer TIC as it helps to ensure timely completion of construction projects. Constant variation in the prices of testing methods can be restraint to the market. Emergence of green & sustainable construction can be opportunity for TIC service providers in the market. But lack of testing facilities and skilled resources can be the challenge in the market.

This testing, inspection, and certification (TIC) market for building & construction report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Testing, Inspection, and Certification (TIC) Market for Building & Construction Scope and Market Size

North America Testing, Inspection, and Certification (TIC) Market for Building & Construction Scope and Market Size

North America testing, inspection, and certification (TIC) market for building & construction is segmented of the categorized into service type, sourcing type, testing type and application. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of service type, the North America testing, inspection, and certification (TIC) market for building & construction is segmented into testing, inspection, and certification. In 2021, testing segment is expected to dominate the market as governments have imposed various stringent regulations and standards, which have to be followed by each company.

- On the basis of sourcing type, the North America testing, inspection, and certification (TIC) market for building & construction is segmented into in-house and outsourced. In 2021, the in-house segment is expected to dominate the market because of company has wider presence in cross all over the world.

- On the basis of testing type, North America testing, inspection, and certification (TIC) market for Building & Construction is segmented into acoustics testing, engineering support, fire safety testing, heat pump testing, indoor environment testing, structural testing, and wind load testing. In 2021, structural testing segment is expected to dominate the market because of increasing demand for construction of residential and commercial buildings.

- On the basis of application, North America testing, inspection, and certification (TIC) market for Building & Construction is segmented into residential buildings, commercial buildings, and infrastructural. In 2021, infrastructural segment is expected to dominate the market because of growing infrastructural projects worldwide.

North America Testing, Inspection, and Certification (TIC) Market for Building & Construction Country Level Analysis

North America testing, inspection, and certification (TIC) market for building & construction is analysed and market size information is provided by country, service type, sourcing type, testing type and application. In North America, U.S. will dominate because of growing usage in quality of code and reduce cost of over all projects.

The countries covered in North America testing, inspection, and certification (TIC) market for building & construction report are U.S., Canada and Mexico.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Increasing demand for natural care products

Testing, inspection, and certification (TIC) market for building & construction also provides you with detailed market analysis for every country growth in installed base of different kind of products for testing, inspection, and certification (TIC) market for building & construction, impact of technology using life line curves and changes in requirement of products, regulatory scenarios and their impact on the testing, inspection, and certification (TIC) market for building & construction. The data is available for historic period 2010 to 2019.

Competitive Landscape and Testing, Inspection, and Certification (TIC) Market for Building & Construction Share Analysis

North America testing, inspection, and certification (TIC) market for building & construction competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to North America testing, inspection, and certification (TIC) market for building & construction.

The major market players engaged in the North America testing, inspection, and certification (TIC) market for building & construction are DEKRA e.V., BRE, Applus+, MISTRAS Group, Eurofins Scientific, The British Standards Institution, TÜV Rheinland, Lloyd's Register Group Services Limited.

For instance,

- In May 2021, Applus+ company acquired IMA Dresden testing laboratory in Europe, With these acquisition company has strong potential in the region. Theses testing laboratory help to boost the revenue part of the company.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 SOURCING TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND OF STRUCTURAL SAFETY IN BUILDING AND CONSTRUCTION INDUSTRY

5.1.2 GOVERNMENTS REGULATION AND MANDATE ENCOURAGING THE USE OF QUALITY MATERIALS

5.1.3 GROWING NEED OF TIMELY COMPLETION OF CONSTRUCTION PROJECTS

5.1.4 INCREASED UTILITY OF TIC FOR PROVIDING ACCREDITATION OF QUALITY

5.2 RESTRAINTS

5.2.1 LACK OF INTERNATIONALLY ACCEPTED TIC STANDARDS IN DEVELOPING ECONOMIES OF AFRICA AND MIDDLE EAST

5.2.2 CONSTANT VARIATION IN THE PRICES OF TESTING METHODS

5.2.3 HIGH COST OF TIC SERVICES PERTAINING TO WIDE-RANGING RULES AND REGULATIONS

5.3 OPPORTUNITIES

5.3.1 INCORPORATION OF ADVANCED TECHNOLOGIES SUCH AS ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.3.2 EMERGENCE OF GREEN & SUSTAINABLE CONSTRUCTION

5.4 CHALLENGES

5.4.1 LACK OF TESTING FACILITIES AND SKILLED RESOURCES

5.4.2 LIMITED ACCESS OF AFTERSALES

6 IMPACT OF COVID-19 ON THE NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION

6.3 STRATERGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE

7.1 OVERVIEW

7.2 TESTING

7.3 INSPECTION

7.4 CERTIFICATION

8 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SOURCING TYPE

8.1 OVERVIEW

8.2 IN-HOUSE

8.3 OUTSOURCED

9 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE

9.1 OVERVIEW

9.2 STRUCTURAL TESTING

9.3 ENGINEERING SUPPORT

9.4 FIRE SAFETY TESTING

9.5 INDOOR ENVIRONMENT TESTING

9.5.1 AIR QUALITY

9.5.2 VENTILATION

9.5.3 LIGHTING

9.5.4 THERMAL COMFORT

9.5.5 OTHERS

9.6 HEAT PUMP TESTING

9.7 ACOUSTICS TESTING

9.8 WIND LOAD TESTING

10 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION

10.1 OVERVIEW

10.2 INFRASTRUCTURAL

10.2.1 BY SERVICE TYPE

10.2.1.1 TESTING

10.2.1.2 INSPECTION

10.2.1.3 CERTIFICATION

10.3 COMMERCIAL BUILDINGS

10.3.1 BY APPLICATION

10.3.1.1 CORPORATE OFFICES

10.3.1.2 INDUSTRIAL BUILDINGS

10.3.1.3 SHOPPING CENTERS

10.3.1.4 MULTIPLEXES

10.3.1.5 SCHOOLS

10.3.1.6 COLLEGES & UNIVERSITIES

10.3.1.7 HOTELS & RESORTS

10.3.1.8 STADIUMS

10.3.1.9 RESTAURANTS & CAFES

10.3.1.10 OTHERS

10.3.2 BY SERVICE TYPE

10.3.2.1 TESTING

10.3.2.2 INSPECTION

10.3.2.3 CERTIFICATION

10.4 RESIDENTIAL BUILDINGS

10.4.1 BY SERVICE TYPE

10.4.1.1 TESTING

10.4.1.2 INSPECTION

10.4.1.3 CERTIFICATION

11 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION MARKET FOR BUILDING & CONSTRUCTION, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 MERGERS & ACQUISITIONS

12.3 EXPANSIONS

12.4 NEW PRODUCT DEVELOPMENTS

12.5 PARTNERSHIPS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 INTERTEK GROUP PLC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALISIS

14.1.4 SERVICE PORTFOLIO

14.1.5 RECENT UPDATES

14.2 ELEMENT MATERIALS TECHNOLOGY

14.2.1 COMPANY SNAPSHOT

14.2.2 SERVICE PORTFOLIO

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 RECENT UPDATE

14.3 BRE

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 SERVICE PORTFOLIO

14.3.4 RECENT UPDATES

14.4 LLOYD'S REGISTER GROUP SERVICES LIMITED

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 SERVICE PORTFOLIO

14.4.4 RECENT UPDATE

14.5 BUREAU VERITAS

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SERVICE PORTFOLIO

14.5.5 RECENT UPDATES

14.6 SGS SA

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SERVICE PORTFOLIO

14.6.4 RECENT UPDATE

14.7 UL LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICE PORTFOLIO

14.7.3 RECENT UPDATES

14.8 TÜV SÜD

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 SERVICE PORTFOLIO

14.8.4 RECENT UPDATE

14.9 EUROFINS SCIENTIFIC

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 SERVICE PORTFOLIO

14.9.4 RECENT UPDATES

14.1 APPLUS+

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 SERVICE PORTFOLIO

14.10.4 RECENT UPDATE

14.11 ICC NTA, LLC.

14.11.1 COMPANY SNAPSHOT

14.11.2 SERVICE PORTFOLIO

14.11.3 RECENT UPDATE

14.12 ALS LIMITED

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SERVICE PORTFOLIO

14.12.4 RECENT UPDATES

14.13 ANTYIPOUR2007 LLC

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATE

14.14 DEKRA E.V.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 SERVICE PORTFOLIO

14.14.4 RECENT UPDATES

14.15 DNV AS

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 SERVICE PORTFOLIO

14.15.4 RECENT UPDATE

14.16 MISTRAS GROUP

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 SERVICE PORTFOLIO

14.16.4 RECENT UPDATE

14.17 THE BRITISH STANDARDS INSTITUTION

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SERVICE PORTFOLIO

14.17.4 RECENT UPDATE

14.18 TÜRK LOYDU

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICE PORTFOLIO

14.18.3 RECENT UPDATE

14.19 TÜV NORD GROUP

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 SERVICE PORTFOLIO

14.19.4 RECENT UPDATE

14.2 TÜV RHEINLAND

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 SERVICE PORTFOLIO

14.20.4 RECENT UPDATE

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA INSPECTION IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA CERTIFICATION IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SOURCING TYPE, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA IN-HOUSE IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA OUTSOURCED IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA STRUCTURAL TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA ENGINEERING SUPPORT IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA FIRE SAFETY TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA INDOOR ENVIRONMENT TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA INDOOR ENVIRONMENT TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA HEAT PUMP TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA ACOUSTICS TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA WIND LOAD TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA INFRASTRUCTURAL IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA INFRASTRUCTURAL IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA RESIDENTIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA RESIDENTIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SOURCING TYPE, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA INDOOR ENVIRONMENT TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA INFRASTRUCTURAL IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 ( USD MILLION)

TABLE 33 NORTH AMERICA COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA RESIDENTIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 35 U.S. TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 36 U.S. TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SOURCING TYPE, 2019-2028 (USD MILLION)

TABLE 37 U.S. TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 38 U.S. INDOOR ENVIRONMENT TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 39 U.S. TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 40 U.S. INFRASTRUCTURAL IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 41 U.S. COMMERCIAL BUILDING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 ( USD MILLION)

TABLE 42 U.S. COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 43 U.S. RESIDENTIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 44 CANADA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 45 CANADA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SOURCING TYPE, 2019-2028 (USD MILLION)

TABLE 46 CANADA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 47 CANADA INDOOR ENVIRONMENT TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 48 CANADA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 49 CANADA INFRASTRUCTURAL IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 50 CANADA COMMERCIAL BUILDING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 ( USD MILLION)

TABLE 51 CANADA COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 52 CANADA RESIDENTIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 53 MEXICO TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 54 MEXICO TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SOURCING TYPE, 2019-2028 (USD MILLION)

TABLE 55 MEXICO TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 56 MEXICO INDOOR ENVIRONMENT TESTING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY TESTING TYPE, 2019-2028 (USD MILLION)

TABLE 57 MEXICO TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 58 MEXICO INFRASTRUCTURAL IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 59 MEXICO COMMERCIAL BUILDING IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 2019-2028 ( USD MILLION)

TABLE 60 MEXICO COMMERCIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 61 MEXICO RESIDENTIAL BUILDINGS IN TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION, BY SERVICE TYPE, 2019-2028 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION : SEGMENTATION

FIGURE 2 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION : DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: THE SOURCING TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION : INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION : DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION : MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION : THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: SEGMENTATION

FIGURE 13 EUROPE IS EXPECTED TO DOMINATE THE NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 GROWING NEED FOR TIMELY COMPLETION OF CONSTRUCTION PROJECTS IS DRIVING THE NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 TESTING IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION MARKET IN 2021 & 2028

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION

FIGURE 17 U.S. TALENT SHORTAGES AT RECORD HIGH

FIGURE 18 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY SERVICE TYPE, 2020

FIGURE 19 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY SOURCING TYPE, 2020

FIGURE 20 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY TESTING TYPE, 2020

FIGURE 21 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY APPLICATION, 2020

FIGURE 22 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: SNAPSHOT (2020)

FIGURE 23 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY COUNTRY (2020)

FIGURE 24 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY COUNTRY (2021 & 2028)

FIGURE 25 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY COUNTRY (2020 & 2028)

FIGURE 26 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET FOR BUILDING & CONSTRUCTION: BY SERVICE TYPE (2021-2028)

FIGURE 27 NORTH AMERICA TESTING, INSPECTION, AND CERTIFICATION MARKET FOR BUILDING & CONSTRUCTION: COMPANY SHARE 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.