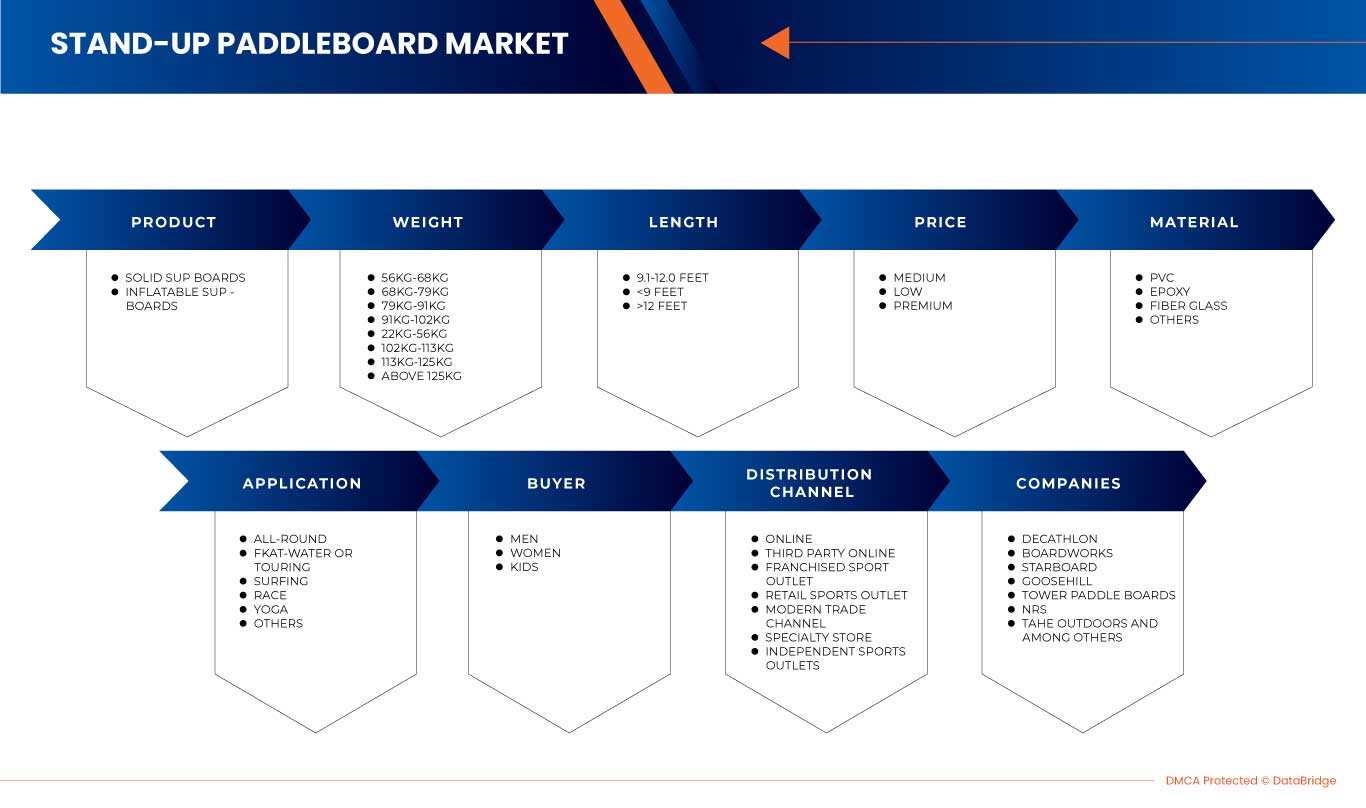

Mercado de Stand-Up Paddleboard da América do Norte, por produto (pranchas de SUP sólidas e pranchas de SUP insufláveis), peso (56 kg-68 kg, 68 kg-79 kg, 79 kg-91 kg, 91 kg-102 kg , 22 kg-56 kg, 102 kg-113 kg, 113 kg-125 kg e Acima de 125 kg), Comprimento (9,1-12,0 pés, 12 pés), Preço (Médio, Baixo e Premium), Material (PVC, EPÓXI, Fibra de Vidro e Outros), Aplicação (All-Round, Fkat- Água ou turismo, surf, corrida, yoga e outros), comprador (homens, mulheres e crianças) e canal de distribuição (online, terceiros online, outlet desportivo franchisado, outlet desportivo de retalho, canal de comércio moderno, loja especializada e outlet desportivo independente ) Tendências e previsões do setor até 2030.

Análise e insights do mercado de stand-up paddleboard na América do Norte

O stand-up paddleboard é também conhecido como SUP, uma atividade desportiva popular que envolve estar de pé numa prancha e usar um remo para andar na água. Este desporto exige o uso dos braços em pé ou ajoelhado para impulsionar a prancha para a frente. Assim, o mercado inclui uma variedade de placas, que são classificadas com base no peso, material, comprimento, produto, aplicação e preço. Além disso, as pranchas de SUP parecem pranchas de surf, mas o design para utilização das pranchas é diferente. Estas pranchas são usadas totalmente com remos. O utilizador tem opções de utilizar as pranchas para diferentes fins, como ioga, corrida, turismo e até para surf.

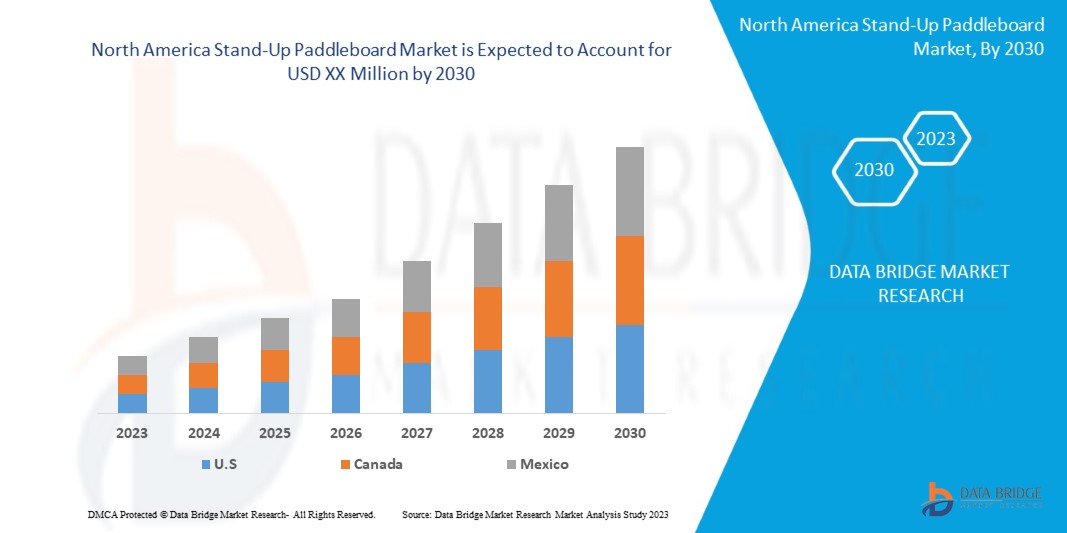

O aumento do número de participantes de desportos de aventura ligeiros tem um impacto proposicional no crescimento e na adoção das pranchas de stand-up paddle, uma vez que recentemente são amplamente utilizadas em desportos aquáticos e ioga. A Data Bridge Market Research analisa que o mercado de stand-up paddleboard na América do Norte irá crescer a um CAGR de 6,6% durante o período previsto de 2023 a 2030.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (Personalizável para 2020-2016) |

|

Unidades quantitativas |

Receita em USD mil, volumes em unidades, preços em USD |

|

Segmentos abrangidos |

Por produto (pranchas de SUP maciças e pranchas de SUP insufláveis), peso (56 kg-68 kg, 68 kg-79 kg, 79 kg-91 kg, 91 kg-102 kg, 22 kg-56 kg, 102 kg-113 kg, 113 kg-125 kg e acima de 125 kg), comprimento (9,1- 12,0 pés, <9 pés e >12 pés), Preço (Médio, Baixo e Premium), Material (PVC, EPÓXI, Fibra de Vidro e Outros), Aplicação (All-Round, Fkat-Water ou Touring, Surf, Race, Yoga e outros), comprador (homens, mulheres e crianças) e canal de distribuição (on-line, on-line de terceiros, outlet desportivo franchisado, outlet desportivo de retalho, canal de comércio moderno, loja especializada e outlet desportivo independente). |

|

Países abrangidos |

EUA Canadá, México |

|

Atores do mercado abrangidos |

Aqua-Leisure Recreation, LLC, Tahe Outdoors, BOARDWORKS, Cascadia Board Co, Starboard, SUP ATX LLC, SURFTECH, LLC, Sea Eagle Boats, inc., Imagine Nation Sports, LLC, Naish International, Bluefin SUP, Goosehill, Atoll Board Company , C4 Waterman, NRS, YOLO Boards & Bikes, Mistral Watersport, Paddle Boards da iROCKERSUP, Wetiz da Zacki Surf & Sport, Sun Dolphin Boats, Red Paddle Co, LAIRDSTANDUP, Tower Paddle Boards, THURSO SURF e Decathlon, entre outros. |

Definição de Mercado

O stand-up paddleboard é também conhecido como SUP, uma atividade desportiva popular que envolve estar de pé numa prancha e usar um remo para andar na água. Este desporto exige o uso dos braços, de pé ou ajoelhado, para impulsionar a prancha para a frente. Assim, o mercado inclui uma variedade de placas, que são classificadas com base no peso, material, comprimento, produto, aplicação e preço.

Além disso, as pranchas de SUP parecem pranchas de surf, mas o design para utilização das pranchas é diferente. Estas pranchas são usadas totalmente com remos. O utilizador pode utilizar as pranchas para diferentes fins, como ioga, corrida, turismo e até surf.

Dinâmica do mercado de stand-up paddleboard na América do Norte

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

-

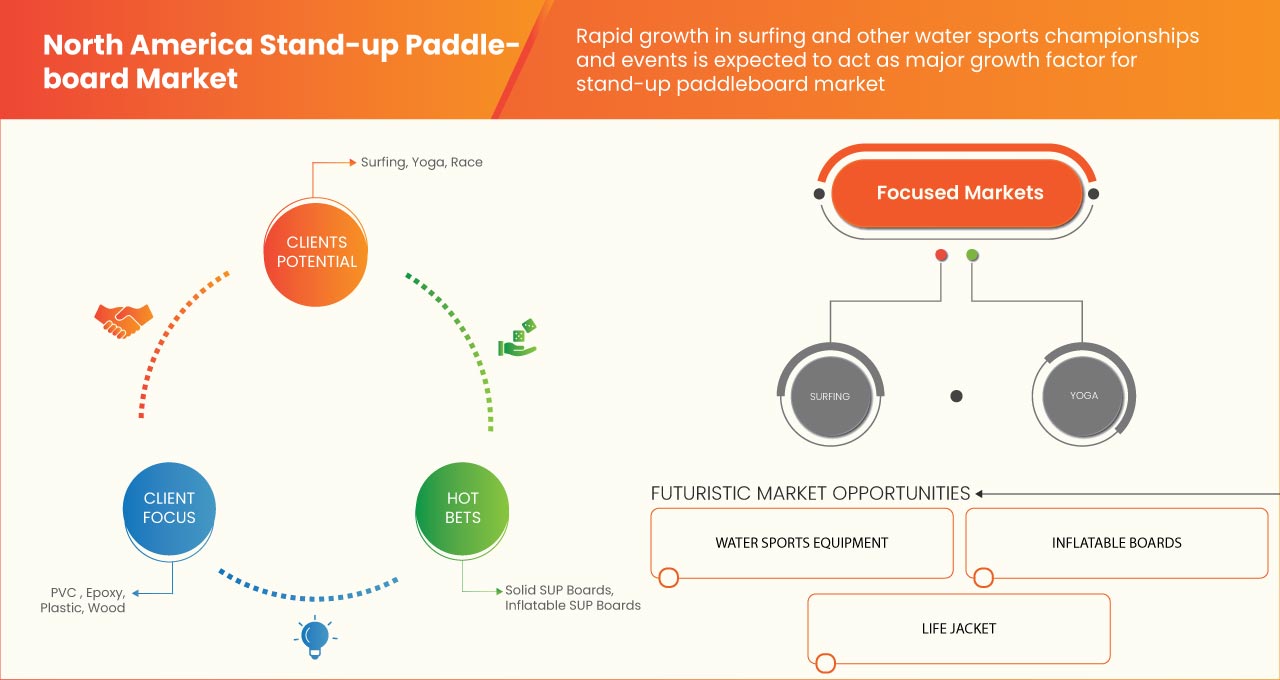

RÁPIDO CRESCIMENTO EM CAMPEONATOS E EVENTOS DE DESPORTO AQUÁTICO DE SUPERFÍCIE

Os desportos aquáticos de superfície incluem uma variedade de desportos, como remo, vela, esqui aquático, surf, caiaque, rafting e muitos outros. Estes desportos não eram familiares nas últimas décadas. No entanto, a maioria destes desportos aquáticos de superfície ganhou um papel de destaque no interesse das pessoas pelos desportos, incluindo o surf e o stand-up paddleboard.

-

AUMENTO DO NÚMERO DE PARTICIPAÇÃO EM DESPORTOS DE AVENTURA

Os desportos de aventura ou desportos radicais são geralmente classificados como atividades com um elevado nível de perigo. Estes desportos de aventura podem ser competitivos ou não competitivos e geralmente envolvem participantes individuais em vez de equipas. Além disso, os desportos aquáticos incluem surf, stand-up paddleboard, rafting, caiaque e muitos outros.

Oportunidade

-

AUMENTO DO RECONHECIMENTO DOS DESPORTOS AQUÁTICOS NOS DESPORTOS INTERNACIONAIS

Os desportos aquáticos estão a ganhar popularidade entre as pessoas de todo o mundo, uma vez que a maioria dos países oferece ótimas oportunidades para os amantes de aventura que procuram uma variedade de experiências. No entanto, um dos desportos aquáticos mais antigos é o remo, que começou em 1864. Após várias décadas, em 1993, este desporto foi reconhecido com o estabelecimento do primeiro centro nacional de remo em Snagov.

Restrição/Desafio

- FALTA DE PROFISSIONAIS QUALIFICADOS E EXPERIENTES

O stand-up paddleboard está associado a vários desportos aquáticos, como o surf e o caiaque. Estes desportos aquáticos são diferentes e são formulados para realizar diferentes atividades. Estes desportos devem ser treinados antes de serem praticados, pois são considerados desportos de aventura e estão associados a riscos de vida. O treino em desportos com riscos de vida exige profissionais.

Impacto da Covid-19 no mercado norte-americano de stand-up paddleboard

A COVID-19 afetou negativamente o mercado. Como a procura de Stand-Up Paddleboard na América do Norte era elevada, empresas como a Decathlon, Starboard, BOARDWORKS, NRS, Tower Paddle Boards e outras na América do Norte enfrentavam dificuldades absolutas no fornecimento de pranchas de remo a novos e antigos clientes devido à escassez de matérias-primas. Além disso, a oferta limitada de matérias-primas e dispositivos afetou significativamente a oferta de pranchas de stand up paddle no mercado.

Desenvolvimento recente

- Em setembro de 2021, a Dotdash Media, Inc. apoiou o SUP yoga. A empresa publicou um blog para reforçar os princípios e a importância do SUP yoga, relatando o seu impacto positivo na saúde mental, que pode ser utilizado para controlar a dor lombar.

Âmbito do mercado de stand-up paddleboard na América do Norte

O mercado norte-americano de stand-up paddleboard está segmentado com base no produto, peso, comprimento, preço, material, aplicação, comprador e canal de distribuição. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de crescimento escassos nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Produto

- Pranchas de SUP sólidas

- Pranchas de SUP insufláveis

Com base no produto, o mercado norte-americano de stand-up paddleboard está segmentado em pranchas de SUP sólidas e pranchas de SUP insufláveis.

Peso

- 56 kg-68 kg

- 68 kg-79 kg

- 79 kg-91 kg

- 91 kg-102 kg

- 22 kg-56 kg

- 102 kg-113 kg

- 113 kg-125 kg

- acima de 125 kg

Com base no peso, o mercado norte-americano de stand-up paddleboard está segmentado em 56 kg-68 kg, 68 kg-79 kg, 79 kg-91 kg, 91 kg-102 kg, 22 kg-56 kg, 102 kg-113 kg, 113 kg-125 kg e acima de 125 kg.

Comprimento

- 9,1-12,0 pés,

- <9 pés

- >12 pés

Com base no comprimento, o mercado norte-americano de stand-up paddleboards está segmentado em 9,1-12,0 pés, <9 pés e >12 pés.

Preço

- Médio

- Baixo

- Prémio

Com base no preço, o mercado norte-americano de stand-up paddleboard está segmentado em médio, baixo e premium.

Material

- PVC

- EPÓXI

- Fibra de vidro

- Outros

Com base no material, o mercado norte-americano de stand-up paddleboard está segmentado em PVC, EPOXY, fibra de vidro e outros.

Aplicação

- Completo

- Águas calmas ou turismo

- Surfe

- Raça

- Ioga

- Outros

Com base na aplicação, o mercado norte-americano de stand-up paddleboard está segmentado em versátil, águas calmas ou turismo, surf, corrida, ioga e outros.

Comprador

- Homens

- Mulher

- Miúdos

Com base no comprador, o mercado norte-americano de stand-up paddleboard está segmentado em homens, mulheres e crianças.

Canal de Distribuição

- Online

- Terceiros Online

- Outlet desportivo franqueado

- Loja de artigos desportivos de retalho

- Canal de comércio moderno

- Loja especializada

- Lojas de desporto independentes

Com base no canal de distribuição, o mercado norte-americano de stand-up paddleboard está segmentado em lojas online, lojas online de terceiros, lojas desportivas franchisadas, lojas desportivas de retalho, canais de comércio moderno, lojas especializadas e lojas desportivas independentes.

Análise regional/insights do mercado de stand-up paddleboard na América do Norte

O mercado norte-americano de stand-up paddleboard é analisado e são fornecidos insights sobre o tamanho do mercado e as tendências por país, produto, peso, comprimento, preço, material, aplicação, comprador e canal de distribuição.

Os países abrangidos pelo relatório do mercado de stand-up paddleboard na América do Norte são os EUA, o Canadá e o México.

Os EUA dominam o mercado na região da América do Norte devido ao rápido crescimento dos campeonatos e eventos de desportos aquáticos de superfície.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações nas regulamentações do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, epidemiologia de doenças e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da América do Norte e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado do stand-up paddleboard na América do Norte

O panorama competitivo do mercado de stand up paddleboard na América do Norte fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento da solução, amplitude e abrangência do produto. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado de stand-up paddleboard na América do Norte.

Alguns dos principais participantes que operam no mercado de stand-up paddleboard na América do Norte são a Aqua-Leisure Recreation, LLC, Tahe Outdoors, BOARDWORKS, Cascadia Board Co, Starboard, SUP ATX LLC, SURFTECH, LLC, Sea Eagle Boats, inc. , Imagine Nation Sports, LLC, Naish International, Bluefin SUP, Goosehill, Atoll Board Company, C4 Waterman, NRS, YOLO Boards & Bikes, Mistral Watersport, Pranchas de remo da iROCKERSUP, Wetiz da Zacki Surf & Sport, Sun Dolphin Boats, Red Paddle Co, LAIRDSTANDUP , Tower Paddle Boards, THURSO SURF e Decathlon, entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA STAND-UP PADDLEBOARD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 FACTORS INFLUENCING BUYING DECISION

4.2.1 INTENTION OR GOAL

4.2.2 TYPE OF SUP

4.2.3 SIZE

4.2.4 HULL TYPE

4.2.5 PRICING AND BRAND

4.3 TECHNOLOGICAL OVERVIEW

4.4 PRODUCT ADOPTION SCENARIO

4.4.1 AWARENESS

4.4.2 INTEREST

4.4.3 CONSIDERATION

4.4.4 SAMPLING

4.4.5 ADOPTION OR REJECTION

4.5 RAW MATERIAL PRODUCTION COVERAGE

4.5.1 SOLID PADDLE BOARD CONSTRUCTION

4.5.2 INFLATABLE PADDLE BOARD CONSTRUCTION

4.6 REGULATION COVERAGE

4.7 SUPPLY CHAIN OF THE NORTH AMERICA STAND-UP PADDLEBOARD MARKET

4.7.1 RAW MATERIAL PROCUREMENT

4.7.2 MANUFACTURING

4.7.3 MARKETING AND DISTRIBUTION

4.7.4 END USERS

4.8 CLIMATE CHANGE SCENARIO

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RAPID GROWTH IN SURFACE WATER SPORTS CHAMPIONSHIPS AND EVENTS

5.1.2 INCREASE IN THE NUMBER OF ADVENTURE SPORTS PARTICIPATION

5.1.3 RISE IN FITNESS TREND

5.1.4 RISE IN INDOOR SUP ACTIVITIES

5.2 RESTRAINTS

5.2.1 LACK OF SKILLED AND EXPERIENCED PROFESSIONALS

5.3 OPPORTUNITIES

5.3.1 INCREASING RECOGNITION OF WATER SPORTS IN INTERNATIONAL SPORTS

5.3.2 CHANGE IN THE LIFESTYLES AND DEMOGRAPHICS OF PEOPLE

5.3.3 INCREASE IN THE ADOPTION OF NORTH AMERICA TRENDS AMONG YOUNGSTERS

5.4 CHALLENGES

5.4.1 RISING NUMBER OF SHAPE LIMITATIONS

5.4.2 HIGH COSTS ASSOCIATED WITH THE PADDLE BOARDS

6 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 SOLID SUP BOARDS

6.3 INFLATABLE SUP BOARDS

7 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY WEIGHT

7.1 OVERVIEW

7.2 56KG-68KG

7.3 68KG-79KG

7.4 79KG-91KG

7.5 91KG-102KG

7.6 22KG-56KG

7.7 102KG-113KG

7.8 113KG-125KG

7.9 ABOVE 125KG

8 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY LENGTH

8.1 OVERVIEW

8.2 9.1-12.0 FEET

8.3 <9 FEET

8.4 >12 FEET

9 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRICE

9.1 OVERVIEW

9.2 MEDIUM

9.3 LOW

9.4 PREMIUM

10 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 PVC

10.3 EPOXY

10.4 FIBER GLASS

10.5 OTHERS

11 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ALL-ROUND

11.3 FKAT-WATER OR TOURING

11.4 SURFING

11.5 RACE

11.6 YOGA

11.7 OTHERS

12 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY BUYER

12.1 OVERVIEW

12.2 MEN

12.3 WOMEN

12.4 KIDS

13 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 ONLINE

13.2.1 3RD PARTY WEBSITES

13.2.2 COMPANY-OWNED

13.3 THIRD PARTY ONLINE

13.4 FRANCHISED SPORT OUTLET

13.5 RETAIL SPORTS

13.6 MODERN TRADE

13.7 SPECIALITY STORES

13.8 INDEPENDENT SPORTS OUTLETS

14 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 DECATHLON

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 BOARDWORKS

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 STARBOARD

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 GOOSEHILL

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 TOWER PADDLE BOARDS

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 AQUA-LEISURE RECREATION, LLC

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ATOLL BOARD COMPANY

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 BLUEFIN SUP

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 C4 WATERMAN

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 CASCADIA BOARD CO

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 IMAGINE NATION SPORTS, LLC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 LAIRDSTANDUP

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 MISTRAL WATERSPORTS

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 NAISH INTERNATIONAL

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 NRS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PADDLE BOARDS BY IROCKERSUP

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 RAVE SPORTS

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 RED PADDLE CO

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 SEA EAGLE BOATS, INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 SUN DOLPHIN BOATS

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 SUP ATX LLC

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 SURFTECH, LLC

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 TAHE OUTDOORS

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 THURSO SURF

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 WETIZ BY ZACKI SURF & SPORT

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 YOLO BOARDS & BIKES

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 3 NORTH AMERICA SOLID SUP BOARDS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA SOLID SUP BOARDS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 5 NORTH AMERICA INFLATABLE SUP BOARDS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA INFLATABLE SUP BOARDS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 7 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (UNITS)

TABLE 9 NORTH AMERICA 56KG-68KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA 56KG-68KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 11 NORTH AMERICA 68KG-79KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA 68KG-79KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 13 NORTH AMERICA 79KG-91KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA 79KG-91KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 15 NORTH AMERICA 91KG-102KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA 91KG-102KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 17 NORTH AMERICA 22KG-56KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA 22KG-56KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 19 NORTH AMERICA 102KG-113KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA 102KG-113KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 21 NORTH AMERICA 113KG-125KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA 113KG-125KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 23 NORTH AMERICA ABOVE 125KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA ABOVE 125KG IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 25 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (UNITS)

TABLE 27 NORTH AMERICA 9.1-12.0 FEET IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA 9.1-12.0 FEET IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 29 NORTH AMERICA <9 FEET IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA <9 FEET IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 31 NORTH AMERICA >12 FEET IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA >12 FEET IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 33 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (UNITS)

TABLE 35 NORTH AMERICA MEDIUM IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA MEDIUM IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 37 NORTH AMERICA LOW IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA LOW IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 39 NORTH AMERICA PREMIUM IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA PREMIUM IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 41 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (UNITS)

TABLE 43 NORTH AMERICA PVC IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA PVC IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 45 NORTH AMERICA EPOXY IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA EPOXY IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 47 NORTH AMERICA FIBER GLASS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA FIBER GLASS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 49 NORTH AMERICA OTHERS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA OTHERS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 51 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (UNITS)

TABLE 53 NORTH AMERICA ALL-ROUND IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA ALL-ROUND IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 55 NORTH AMERICA FKAT-WATER OR TOURING IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA FKAT-WATER OR TOURING IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 57 NORTH AMERICA SURFING IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA SURFING IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 59 NORTH AMERICA RACE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA RACE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 61 NORTH AMERICA YOGA IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA YOGA IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 63 NORTH AMERICA OTHERS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA OTHERS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 65 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (UNITS)

TABLE 67 NORTH AMERICA MEN IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA MEN IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 69 NORTH AMERICA WOMEN IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA WOMEN IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 71 NORTH AMERICA KIDS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA KIDS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 73 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (UNITS)

TABLE 75 NORTH AMERICA ONLINE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA ONLINE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 77 NORTH AMERICA ONLINE IN STAND-UP PADDLEBOARD MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA THIRD PARTY ONLINE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 79 NORTH AMERICA THIRD PARTY ONLINE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 80 NORTH AMERICA FRANCHISED SPORT IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 81 NORTH AMERICA FRANCHISED SPORT IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 82 NORTH AMERICA RETAIL SPORTS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 83 NORTH AMERICA RETAIL SPORTS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 84 NORTH AMERICA MODERN TRADE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 85 NORTH AMERICA MODERN TRADE IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 86 NORTH AMERICA SPECIALTY STORES IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 87 NORTH AMERICA SPECIALTY STORES IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 88 NORTH AMERICA INDEPENDENT SPORTS OUTLETS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 89 NORTH AMERICA INDEPENDENT SPORTS OUTLETS IN STAND-UP PADDLEBOARD MARKET, BY REGION, 2021-2030 (UNITS)

TABLE 90 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 91 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY COUNTRY, 2021-2030 (UNITS)

TABLE 92 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 93 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 94 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (USD THOUSAND)

TABLE 95 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (UNITS)

TABLE 96 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 97 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (UNITS)

TABLE 98 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 99 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (UNITS)

TABLE 100 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 101 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (UNITS)

TABLE 102 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 103 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (UNITS)

TABLE 104 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (USD THOUSAND)

TABLE 105 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (UNITS)

TABLE 106 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 107 NORTH AMERICA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (UNITS)

TABLE 108 NORTH AMERICA ONLINE IN STAND-UP PADDLEBOARD MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 U.S. STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 110 U.S. STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 111 U.S. STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (USD THOUSAND)

TABLE 112 U.S. STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (UNITS)

TABLE 113 U.S. STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 114 U.S. STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (UNITS)

TABLE 115 U.S. STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 116 U.S. STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (UNITS)

TABLE 117 U.S. STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 118 U.S. STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (UNITS)

TABLE 119 U.S. STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 120 U.S. STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (UNITS)

TABLE 121 U.S. STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (UNITS)

TABLE 123 U.S. STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (UNITS)

TABLE 125 U.S. ONLINE IN STAND-UP PADDLEBOARD MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 CANADA STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 127 CANADA STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 128 CANADA STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (USD THOUSAND)

TABLE 129 CANADA STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (UNITS)

TABLE 130 CANADA STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 131 CANADA STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (UNITS)

TABLE 132 CANADA STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 133 CANADA STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (UNITS)

TABLE 134 CANADA STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 135 CANADA STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (UNITS)

TABLE 136 CANADA STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 137 CANADA STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (UNITS)

TABLE 138 CANADA STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (UNITS)

TABLE 140 CANADA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 141 CANADA STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (UNITS)

TABLE 142 CANADA ONLINE IN STAND-UP PADDLEBOARD MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 MEXICO STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 144 MEXICO STAND-UP PADDLEBOARD MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 145 MEXICO STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (USD THOUSAND)

TABLE 146 MEXICO STAND-UP PADDLEBOARD MARKET, BY WEIGHT, 2021-2030 (UNITS)

TABLE 147 MEXICO STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 148 MEXICO STAND-UP PADDLEBOARD MARKET, BY LENGTH, 2021-2030 (UNITS)

TABLE 149 MEXICO STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 150 MEXICO STAND-UP PADDLEBOARD MARKET, BY PRICE, 2021-2030 (UNITS)

TABLE 151 MEXICO STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 152 MEXICO STAND-UP PADDLEBOARD MARKET, BY MATERIAL, 2021-2030 (UNITS)

TABLE 153 MEXICO STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 154 MEXICO STAND-UP PADDLEBOARD MARKET, BY APPLICATION, 2021-2030 (UNITS)

TABLE 155 MEXICO STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (USD THOUSAND)

TABLE 156 MEXICO STAND-UP PADDLEBOARD MARKET, BY BUYER, 2021-2030 (UNITS)

TABLE 157 MEXICO STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 158 MEXICO STAND-UP PADDLEBOARD MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (UNITS)

TABLE 159 MEXICO ONLINE IN STAND-UP PADDLEBOARD MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Lista de Figura

FIGURE 1 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA STAND-UP PADDLEBOARD MARKET :DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: PRODUCT TIMELINE CURVE

FIGURE 11 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: SEGMENTATION

FIGURE 13 RAPID GROWTH IN SURFACE WATER SPORTS CHAMPIONSHIPS AND EVENTS IS BOOSTING THE GROWTH OF STAND-UP PADDLEBOARD MARKET IN THE FORECAST PERIOD OF 2023 -2030

FIGURE 14 SOLID SUP BOARDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA STAND-UP PADDLEBOARD MARKET IN 2023 - 2030

FIGURE 15 PRODUCT ADOPTION

FIGURE 16 SUPPLY CHAIN OF THE NORTH AMERICA STAND-UP PADDLEBOARD MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA STAND-UP PADDLEBOARD MARKET

FIGURE 18 TOP FIVE NORTH AMERICA SURFING EVENTS

FIGURE 19 POPULARITY OF ADVENTURE SPORTS IN INDIA

FIGURE 20 PERCENTAGE OF EUROPEAN TOUR OPERATORS SEEK ADVENTURE TOURISM

FIGURE 21 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY PRODUCT, 2022

FIGURE 22 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY WEIGHT, 2022

FIGURE 23 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY LENGTH, 2022

FIGURE 24 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY PRICE, 2022

FIGURE 25 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY MATERIAL, 2022

FIGURE 26 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY APPLICATION, 2022

FIGURE 27 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY BUYER, 2022

FIGURE 28 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 29 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: SNAPSHOT (2022)

FIGURE 30 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY COUNTRY (2022)

FIGURE 31 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: BY PRODUCT (2023 - 2030)

FIGURE 34 NORTH AMERICA STAND-UP PADDLEBOARD MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.