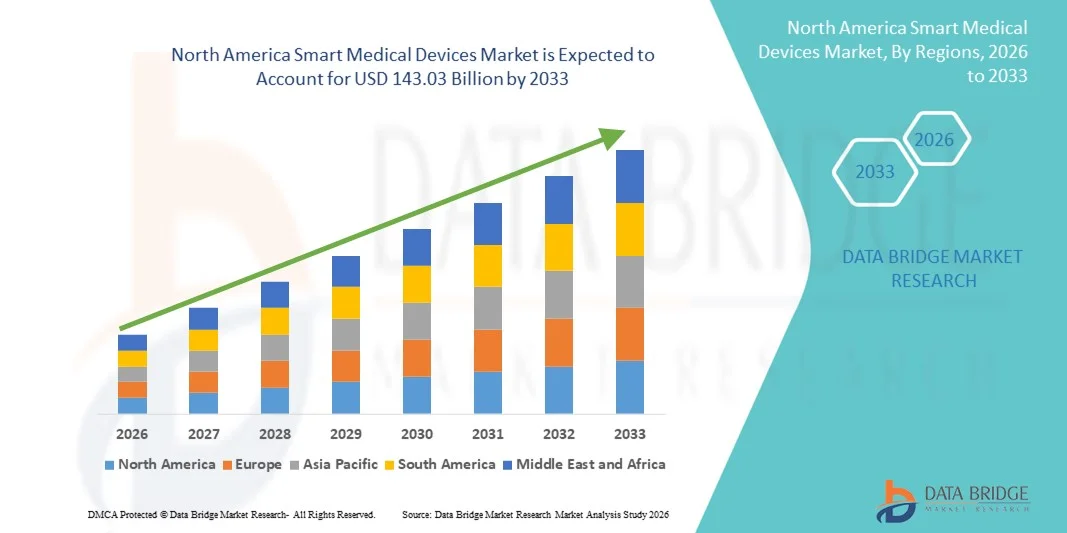

North America Smart Medical Devices Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

33.96 Billion

USD

143.03 Billion

2025

2033

USD

33.96 Billion

USD

143.03 Billion

2025

2033

| 2026 –2033 | |

| USD 33.96 Billion | |

| USD 143.03 Billion | |

|

|

|

|

Segmentação do mercado de dispositivos médicos inteligentes na América do Norte, por tipo de produto (dispositivos de diagnóstico e monitoramento e dispositivos terapêuticos), tipo (próprio ao corpo (adesivo), externo ao corpo (clipe de cinto) e portátil), tecnologia (baseada em mola, acionada por motor, bomba rotativa, bateria expansível, gás pressurizado e outras), modalidade (vestível e não vestível), aplicação (oncologia, diabetes, doenças autoimunes, doenças infecciosas, esportes e condicionamento físico, distúrbios do sono e outras), usuário final (hospitais, clínicas, cuidados domiciliares, clubes esportivos e outros), canal de distribuição (farmácias, canal online e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de dispositivos médicos inteligentes na América do Norte

- O mercado de dispositivos médicos inteligentes na América do Norte foi avaliado em US$ 33,96 bilhões em 2025 e deverá atingir US$ 143,03 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 19,69% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pelos rápidos avanços tecnológicos em tecnologias de saúde conectadas e habilitadas para IoT, pelo uso crescente de dispositivos vestíveis e de monitoramento remoto de pacientes e pela crescente digitalização da saúde em ambientes clínicos e de atendimento domiciliar. Os altos gastos com saúde e a forte adoção de tecnologias médicas avançadas nos EUA e no Canadá sustentam a expansão contínua na região.

- Além disso, a crescente demanda por monitoramento de saúde em tempo real, plataformas de tratamento personalizadas e soluções inteligentes integradas para o gerenciamento de doenças crônicas está consolidando os dispositivos médicos inteligentes como ferramentas essenciais na saúde moderna. Esses fatores convergentes estão acelerando a adoção e impulsionando significativamente a trajetória de crescimento do setor durante o período de previsão.

Análise do Mercado de Dispositivos Médicos Inteligentes na América do Norte

- Dispositivos médicos inteligentes, incluindo monitores vestíveis, diagnósticos habilitados para IoT e soluções de atendimento remoto ao paciente, são componentes cada vez mais vitais dos sistemas de saúde modernos, tanto em ambientes clínicos quanto domiciliares, devido à sua capacidade de fornecer monitoramento de saúde em tempo real, tratamento personalizado e integração perfeita com plataformas de saúde digital.

- A crescente demanda por dispositivos médicos inteligentes é impulsionada principalmente pela adoção cada vez maior de tecnologias de saúde conectadas, pelo aumento da prevalência de doenças crônicas e pela preferência crescente por monitoramento remoto e soluções de telemedicina entre pacientes e profissionais de saúde.

- Os Estados Unidos dominaram o mercado de dispositivos médicos inteligentes na América do Norte, com a maior participação na receita, de 78,9% em 2025, caracterizado pela adoção precoce de tecnologias avançadas de saúde, altos gastos com saúde e forte presença de importantes players do setor.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de dispositivos médicos inteligentes na América do Norte durante o período de previsão, devido ao aumento dos investimentos em infraestrutura de saúde, à crescente conscientização dos pacientes e à adoção cada vez maior de tecnologias de saúde digital.

- O segmento de dispositivos vestíveis dominou o mercado de dispositivos médicos inteligentes na América do Norte, com uma participação de mercado de 42,5% em 2025, impulsionado por sua comprovada eficácia no monitoramento contínuo da saúde, conveniência para o paciente e compatibilidade com plataformas de saúde digital existentes.

Escopo do relatório e segmentação do mercado de dispositivos médicos inteligentes na América do Norte

|

Atributos |

Principais informações sobre o mercado de dispositivos médicos inteligentes na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais players, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de dispositivos médicos inteligentes na América do Norte

Maior comodidade por meio de IA e monitoramento remoto.

- Uma tendência significativa e crescente no mercado de dispositivos médicos inteligentes na América do Norte é a integração cada vez maior de inteligência artificial (IA) e plataformas de monitoramento remoto baseadas em nuvem. Essa fusão de tecnologias está aprimorando a conveniência para o paciente, a personalização do tratamento e a tomada de decisões clínicas.

- Por exemplo, o dispositivo vestível BioSticker monitora continuamente os sinais vitais do paciente e transmite dados aos profissionais de saúde em tempo real, possibilitando intervenções proativas. Da mesma forma, o Fitbit Health Solutions integra algoritmos de IA para análise de tendências e alertas preditivos de saúde.

- A integração da IA em dispositivos médicos inteligentes possibilita funcionalidades como diagnósticos preditivos, recomendações de tratamento adaptativas e alertas inteligentes para anomalias. Por exemplo, alguns monitores de pressão arterial conectados da Omron utilizam IA para detectar batimentos cardíacos irregulares e notificar pacientes e médicos imediatamente.

- A integração perfeita de dispositivos médicos inteligentes com sistemas de registro eletrônico de saúde (EHR) e plataformas de telessaúde permite que os profissionais de saúde gerenciem os dados de múltiplos pacientes a partir de um painel centralizado, melhorando a eficiência operacional e os resultados para os pacientes.

- Essa tendência em direção a dispositivos médicos mais inteligentes, intuitivos e interconectados está remodelando as expectativas dos pacientes em relação à assistência médica remota. Consequentemente, empresas como a iRhythm estão desenvolvendo dispositivos vestíveis com inteligência artificial que detectam irregularidades cardíacas e se integram a sistemas de monitoramento hospitalar.

- A demanda por dispositivos médicos inteligentes que oferecem insights baseados em IA e monitoramento remoto em tempo real está crescendo rapidamente em hospitais, clínicas e atendimento domiciliar, à medida que pacientes e profissionais de saúde priorizam cada vez mais conveniência, eficiência e cuidados de saúde proativos.

- A crescente adoção de aplicativos de saúde móvel e plataformas complementares que se conectam a dispositivos inteligentes pelos consumidores está impulsionando a expansão do mercado, permitindo que os pacientes monitorem tendências de saúde, definam lembretes e compartilhem dados com os profissionais de saúde de forma integrada.

- A crescente colaboração entre fabricantes de dispositivos, desenvolvedores de software e instituições de saúde está acelerando a inovação, possibilitando o desenvolvimento de dispositivos médicos inteligentes mais personalizados e multifuncionais.

Dinâmica do mercado de dispositivos médicos inteligentes na América do Norte

Motorista

Crescente necessidade devido a doenças crônicas e adoção da saúde digital

- A crescente prevalência de doenças crônicas, o envelhecimento da população e a rápida adoção de soluções de saúde digital são fatores importantes que impulsionam a demanda por dispositivos médicos inteligentes.

- Por exemplo, em março de 2025, a Dexcom anunciou monitores contínuos de glicose com inteligência artificial para o controle do diabetes, melhorando o atendimento em tempo real e a adesão do paciente ao tratamento. Espera-se que essas estratégias de empresas líderes impulsionem o crescimento do mercado durante o período de previsão.

- À medida que pacientes e profissionais de saúde buscam monitoramento contínuo e intervenções oportunas, os dispositivos médicos inteligentes oferecem recursos avançados, como transmissão de dados em tempo real, alertas para leituras anormais e análises preditivas, proporcionando uma melhoria significativa em relação aos métodos de monitoramento tradicionais.

- Além disso, a crescente adoção da telemedicina e a expansão do ecossistema de saúde digital estão tornando os dispositivos médicos inteligentes essenciais para o cuidado conectado, permitindo a integração perfeita com aplicativos móveis e plataformas de gestão clínica.

- A conveniência do monitoramento remoto, insights de dados personalizados e relatórios automatizados para profissionais de saúde são fatores-chave que impulsionam a adoção de dispositivos médicos inteligentes. A tendência para o monitoramento domiciliar e o design de dispositivos fáceis de usar contribuem ainda mais para o crescimento do mercado.

- O aumento das iniciativas governamentais e das políticas de reembolso nos EUA que apoiam o monitoramento remoto de pacientes e a adoção da saúde digital está acelerando ainda mais a demanda do mercado.

- A expansão da cobertura de planos de saúde e os incentivos para soluções de monitoramento remoto estão motivando tanto profissionais de saúde quanto pacientes a adotarem dispositivos médicos inteligentes para o gerenciamento de doenças crônicas e cuidados pós-operatórios.

Restrição/Desafio

Preocupações com a segurança de dados e obstáculos à conformidade regulatória

- As preocupações com a segurança dos dados dos pacientes, a privacidade e a conformidade regulatória representam um desafio significativo para uma maior penetração no mercado. Como os dispositivos médicos inteligentes dependem da conectividade de rede, eles são vulneráveis a ameaças cibernéticas, aumentando as preocupações com a integridade dos dados e a confidencialidade dos pacientes.

- Por exemplo, relatos de grande repercussão sobre vulnerabilidades em dispositivos de saúde conectados deixaram alguns hospitais e pacientes cautelosos quanto à adoção de soluções de monitoramento remoto, incluindo dispositivos médicos inteligentes.

- Abordar as preocupações com a cibersegurança e a conformidade por meio de criptografia, protocolos de autenticação seguros e adesão aos padrões da FDA ou HIPAA é crucial para construir confiança. Empresas como a Medtronic enfatizam recursos avançados de segurança e atualizações regulares de software para tranquilizar os usuários.

- Além disso, o custo relativamente alto de dispositivos avançados com inteligência artificial, em comparação com ferramentas de monitoramento convencionais, pode limitar a adoção por parte de profissionais de saúde e pacientes sensíveis a custos. Embora dispositivos básicos de marcas como a Withings sejam mais acessíveis, recursos premium, como ECG contínuo ou análise preditiva, têm preços mais elevados.

- Superar esses desafios por meio de segurança de dados robusta, conformidade regulatória, educação do consumidor e desenvolvimento de dispositivos com boa relação custo-benefício será vital para sustentar o crescimento do mercado na América do Norte.

- A rápida obsolescência tecnológica e as frequentes atualizações de software podem representar desafios para profissionais de saúde e pacientes, exigindo treinamento contínuo e investimento em sistemas compatíveis.

- A variabilidade nas regulamentações estaduais e nos prazos de aprovação para dispositivos médicos conectados pode atrasar o lançamento e a adoção de produtos, principalmente em sistemas de saúde que abrangem múltiplos estados.

Escopo do mercado de dispositivos médicos inteligentes na América do Norte

O mercado é segmentado com base no tipo de produto, tipo de tecnologia, modalidade, aplicação, usuário final e canal de distribuição.

- Por tipo de produto

Com base no tipo de produto, o mercado de dispositivos médicos inteligentes na América do Norte é segmentado em dispositivos de diagnóstico e monitoramento e dispositivos terapêuticos. O segmento de Dispositivos de Diagnóstico e Monitoramento dominou o mercado com a maior participação na receita, de 52,3% em 2025. Essa dominância é impulsionada pela crescente adoção de soluções de monitoramento contínuo para doenças crônicas, como diabetes e distúrbios cardiovasculares. Hospitais e clínicas preferem cada vez mais dispositivos vestíveis de diagnóstico e ferramentas de monitoramento remoto para melhorar os resultados dos pacientes e reduzir as taxas de reinternação. Pacientes em casa também estão usando dispositivos como monitores de glicose, eletrocardiógrafos vestíveis e oxímetros de pulso para monitoramento em tempo real, o que impulsiona o crescimento do segmento. A integração de inteligência artificial e análises baseadas em nuvem aumenta ainda mais o valor dos dispositivos de diagnóstico e monitoramento, fornecendo insights preditivos e recursos de detecção precoce. O foco crescente em saúde preventiva e iniciativas de telessaúde está alimentando a demanda sustentada por esse segmento.

O segmento de Dispositivos Terapêuticos deverá apresentar o crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) de 13,8% entre 2026 e 2033. Esse crescimento é impulsionado principalmente por inovações em soluções de terapia conectada, como bombas de insulina, dispositivos de neuroestimulação e robótica de reabilitação. Por exemplo, bombas de infusão vestíveis com inteligência artificial permitem dosagem precisa e monitoramento remoto, melhorando a adesão do paciente e os resultados da terapia. A expansão da assistência domiciliar e o aumento da prevalência de doenças crônicas estão acelerando a adoção de dispositivos terapêuticos. A integração com aplicativos móveis e plataformas de saúde digital aprimora o engajamento do paciente e a personalização da terapia. Além disso, políticas de reembolso mais abrangentes e maior cobertura de seguro para dispositivos terapêuticos de uso domiciliar estão impulsionando a rápida absorção pelo mercado.

- Por tipo

Com base no tipo, o mercado é segmentado em dispositivos para uso no corpo (adesivo), dispositivos para uso fora do corpo (clipe de cinto) e dispositivos portáteis. O segmento de dispositivos para uso no corpo (adesivo) dominou o mercado com a maior participação na receita, de 45,7% em 2025. A liderança desse segmento é impulsionada pela preferência dos pacientes por monitoramento contínuo e não invasivo, principalmente no manejo de doenças crônicas. Os dispositivos com adesivo fornecem monitoramento de sinais vitais em tempo real, incluindo ECG, níveis de glicose e temperatura, o que é valioso para o atendimento remoto. Hospitais e provedores de assistência domiciliar estão adotando cada vez mais dispositivos com adesivo para reduzir as visitas ao hospital. Seu design compacto e leve garante conforto, aumentando a adesão do paciente. A integração com aplicativos móveis e painéis de controle baseados em nuvem permite que os médicos monitorem os pacientes remotamente e façam intervenções oportunas.

Prevê-se que o segmento de dispositivos portáteis apresente o crescimento mais rápido durante o período de previsão, impulsionado pela crescente demanda por soluções de diagnóstico portáteis e de fácil utilização. Dispositivos como ultrassonógrafos portáteis, glicosímetros portáteis e estetoscópios digitais permitem testes rápidos tanto em ambientes clínicos quanto domiciliares. Por exemplo, dispositivos portáteis permitem que profissionais de saúde em campo monitorem pacientes em áreas rurais com acesso limitado a hospitais. A conveniência de resultados imediatos e a conectividade sem fio para transmissão de dados impulsionam a adoção. Os dispositivos portáteis também estão sendo cada vez mais integrados com sistemas de suporte à decisão baseados em inteligência artificial para maior precisão diagnóstica. A crescente conscientização sobre saúde preventiva e a necessidade de diagnósticos rápidos sustentam um forte crescimento para este segmento.

- Por meio da tecnologia

Com base na tecnologia, o mercado é segmentado em bombas de mola, bombas acionadas por motor, bombas rotativas, bombas de expansão a bateria, bombas a gás pressurizado e outras. O segmento de bombas rotativas dominou o mercado com a maior participação de receita, de 41,5% em 2025. Isso se deve principalmente à sua ampla aplicação em sistemas de administração de medicamentos, como bombas de insulina e dispositivos de infusão. A tecnologia de bombas rotativas oferece dosagem precisa e consistente, o que é fundamental para a eficácia terapêutica e a segurança do paciente. Hospitais e clínicas dependem dessa tecnologia tanto para o atendimento ambulatorial quanto para o de pacientes internados. A durabilidade e a confiabilidade da tecnologia em uso a longo prazo também impulsionam sua adoção em cuidados de saúde domiciliares. A integração com monitoramento digital e aplicativos móveis aprimora o controle da dosagem e a adesão ao tratamento.

O segmento de baterias expansíveis deverá apresentar o crescimento mais rápido durante o período de previsão, impulsionado por dispositivos portáteis e vestíveis que exigem maior tempo de operação sem recargas frequentes. Por exemplo, monitores cardíacos vestíveis e monitores contínuos de glicose utilizam a tecnologia de baterias expansíveis para garantir o monitoramento ininterrupto. Essa tecnologia permite um design compacto do dispositivo e maior conforto para o paciente, o que é fundamental para o atendimento domiciliar. A crescente demanda por monitoramento remoto de pacientes e integração com a telemedicina está acelerando a adoção dessa tecnologia. A tecnologia de baterias permite o monitoramento contínuo por vários dias, reduzindo a necessidade de inatividade do dispositivo e melhorando os resultados para o paciente. O aumento dos investimentos em dispositivos de saúde com eficiência energética também contribui para a expansão do segmento.

- Por modalidade

Com base na modalidade, o mercado é segmentado em dispositivos vestíveis e não vestíveis. O segmento de dispositivos vestíveis dominou o mercado com a maior participação na receita, de 42,5% em 2025. Os dispositivos médicos vestíveis permitem o monitoramento contínuo de métricas de saúde do paciente, como frequência cardíaca, glicose e pressão arterial. Hospitais, clínicas e provedores de assistência domiciliar estão adotando cada vez mais dispositivos vestíveis para viabilizar o atendimento remoto, melhorar a adesão do paciente ao tratamento e reduzir as reinternações hospitalares. Os dispositivos vestíveis oferecem integração perfeita com smartphones e plataformas de saúde digital para monitoramento e alertas em tempo real. Sua conveniência, precisão e mobilidade contribuem para uma forte adoção. O crescente foco na saúde preventiva e no gerenciamento de doenças crônicas impulsiona ainda mais a demanda.

Prevê-se que o segmento de dispositivos não vestíveis apresente o crescimento mais rápido entre 2026 e 2033, impulsionado por dispositivos de diagnóstico no local de atendimento, monitores de cabeceira e equipamentos terapêuticos estacionários. Por exemplo, dispositivos não vestíveis para monitoramento respiratório e diálise em clínicas estão sendo rapidamente adotados. A tecnologia está sendo aprimorada com recursos de IoT e IA para monitoramento remoto e análise preditiva. A expansão do atendimento ambulatorial e dos programas de reabilitação domiciliar está impulsionando a demanda. Os dispositivos não vestíveis são preferidos em ambientes clínicos devido à sua alta precisão e capacidade de lidar com diagnósticos e tratamentos complexos. A integração com sistemas de gestão hospitalar fortalece ainda mais o crescimento do mercado.

- Por meio de aplicação

Com base na aplicação, o mercado é segmentado em oncologia, diabetes, doenças autoimunes, doenças infecciosas, esportes e condicionamento físico, distúrbios do sono e outros. O segmento de diabetes dominou o mercado com a maior participação na receita, de 49,2% em 2025. Essa dominância é atribuída à alta prevalência de diabetes nos EUA, à crescente demanda por dispositivos de monitoramento contínuo de glicose (MCG) e à integração com aplicativos móveis para dados em tempo real e dosagem de insulina. Hospitais e provedores de atendimento domiciliar adotam amplamente o MCG e bombas de insulina conectadas para melhores resultados para os pacientes. A disponibilidade de análises habilitadas por IA aprimora o cuidado preditivo e o tratamento personalizado.

O segmento de Esportes e Fitness deverá apresentar o crescimento mais rápido durante o período de previsão, impulsionado pela crescente adoção de monitores de atividade física vestíveis, rastreadores de frequência cardíaca e dispositivos inteligentes de reabilitação. Por exemplo, dispositivos que monitoram a frequência cardíaca, a saturação de oxigênio e as métricas de desempenho são cada vez mais utilizados em academias, clubes esportivos e por atletas individuais. A crescente conscientização sobre saúde e a integração da IA para recomendações personalizadas impulsionam a adoção. O segmento se beneficia da tendência de programas de condicionamento físico e telerreabilitação em casa. A integração com plataformas digitais e aplicativos móveis para rastreamento de dados e treinamento acelera ainda mais o crescimento.

- Por usuário final

Com base no usuário final, o mercado é segmentado em hospitais, clínicas, assistência domiciliar, clubes esportivos e outros. O segmento de hospitais dominou o mercado com a maior participação na receita, de 44,5% em 2025, devido à alta adoção de dispositivos médicos inteligentes para monitoramento de pacientes internados, cuidados intensivos e gerenciamento de doenças crônicas. Os hospitais implementam cada vez mais dispositivos diagnósticos e terapêuticos com inteligência artificial para melhorar a eficiência operacional e os resultados para os pacientes. A adoção em larga escala é impulsionada pela integração com sistemas de registros eletrônicos de saúde, plataformas de telemedicina e redes de monitoramento de pacientes.

O segmento de cuidados domiciliares deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente demanda por monitoramento remoto, dispositivos vestíveis e soluções terapêuticas para doenças crônicas. Por exemplo, pacientes com diabetes, doenças cardiovasculares ou distúrbios do sono utilizam dispositivos conectados em casa para monitoramento diário e consultas remotas. O foco crescente em cuidados domiciliares, o envelhecimento da população e a maior conscientização sobre soluções de saúde digital impulsionam a adoção. O reembolso por planos de saúde para dispositivos de uso doméstico também contribui para o crescimento. A conveniência, o conforto e a relação custo-benefício das soluções de cuidados domiciliares aceleram ainda mais a adoção.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em farmácias, canal online e outros. O segmento de canal online dominou o mercado com a maior participação na receita, de 38,9% em 2025, impulsionado pela crescente preferência do consumidor por compras diretas ao consumidor, conveniência e entrega em domicílio de dispositivos médicos inteligentes. As plataformas online fornecem informações detalhadas sobre os produtos, ferramentas de comparação e serviços de gerenciamento de dispositivos por assinatura, o que aumenta a adoção.

O segmento de farmácias deverá apresentar o crescimento mais rápido durante o período de previsão, devido à acessibilidade, à orientação profissional e ao aumento das parcerias com fabricantes de dispositivos médicos. Por exemplo, monitores inteligentes de glicose e aparelhos de pressão arterial estão sendo cada vez mais distribuídos em farmácias, permitindo que os clientes comprem os dispositivos juntamente com os medicamentos. Os farmacêuticos também oferecem orientações sobre o uso, a calibração e a integração dos dispositivos com aplicativos móveis. A crescente confiança nos serviços de saúde oferecidos em farmácias e a expansão das redes de farmácias em regiões urbanas e semiurbanas sustentam esse forte crescimento.

Análise Regional do Mercado de Dispositivos Médicos Inteligentes na América do Norte

- Os Estados Unidos dominaram o mercado de dispositivos médicos inteligentes na América do Norte, com a maior participação na receita, de 78,9% em 2025, caracterizado pela adoção precoce de tecnologias avançadas de saúde, altos gastos com saúde e forte presença de importantes players do setor.

- Profissionais de saúde e pacientes da região valorizam muito a conveniência, o monitoramento em tempo real e as informações preditivas oferecidas por dispositivos médicos inteligentes, incluindo ferramentas de diagnóstico vestíveis, soluções de monitoramento remoto e dispositivos terapêuticos conectados.

- Essa ampla adoção é ainda mais impulsionada por uma população tecnologicamente capacitada, fortes iniciativas governamentais que promovem o monitoramento remoto de pacientes e a presença de importantes fabricantes de dispositivos médicos, consolidando os dispositivos médicos inteligentes como ferramentas essenciais tanto em ambientes clínicos quanto em cuidados domiciliares.

Análise do Mercado de Dispositivos Médicos Inteligentes nos EUA

O mercado de dispositivos médicos inteligentes dos EUA detinha a maior participação de receita, com 78,9% em 2025, na América do Norte, impulsionado pela rápida adoção de tecnologias de saúde conectadas e pela expansão das iniciativas de telessaúde. Pacientes e profissionais de saúde priorizam cada vez mais o monitoramento remoto, o diagnóstico contínuo e soluções de tratamento personalizadas. A crescente tendência de cuidados domiciliares, combinada com a forte demanda por dispositivos vestíveis com inteligência artificial e a integração com aplicativos móveis, impulsiona ainda mais o setor de dispositivos médicos inteligentes. Além disso, a integração de dispositivos inteligentes com registros eletrônicos de saúde (EHRs) e plataformas de análise preditiva contribui significativamente para a expansão do mercado.

Análise do Mercado de Dispositivos Médicos Inteligentes no Canadá

Prevê-se que o mercado canadense de dispositivos médicos inteligentes cresça a uma taxa composta de crescimento anual (CAGR) substancial durante o período de previsão, impulsionado pelo aumento dos investimentos em infraestrutura de saúde e por um forte foco em iniciativas de saúde digital. A crescente conscientização dos pacientes, juntamente com a adoção de soluções de monitoramento remoto e telemedicina, está fomentando a adoção de dispositivos médicos inteligentes. Os provedores de saúde canadenses estão adotando dispositivos conectados para o gerenciamento de doenças crônicas, monitoramento de pacientes internados e cuidados preventivos. A integração com aplicativos de saúde móvel e análises de inteligência artificial também está impulsionando melhores resultados para os pacientes e maior eficiência operacional.

Análise do Mercado de Dispositivos Médicos Inteligentes no México

Prevê-se que o mercado de dispositivos médicos inteligentes no México cresça a uma taxa composta de crescimento anual (CAGR) notável durante o período de previsão, impulsionado pela expansão da cobertura de saúde e pela crescente adoção de tecnologias médicas avançadas. A urbanização crescente, as melhorias na infraestrutura hospitalar e as iniciativas governamentais para modernizar os serviços de saúde estão impulsionando o crescimento do mercado. A crescente preferência dos mexicanos por dispositivos de monitoramento domiciliar e terapias vestíveis está contribuindo para a demanda. Além disso, as parcerias entre fabricantes de dispositivos médicos nacionais e internacionais estão facilitando o acesso a soluções médicas inteligentes, acessíveis e inovadoras.

Participação de mercado de dispositivos médicos inteligentes na América do Norte

O setor de dispositivos médicos inteligentes na América do Norte é liderado principalmente por empresas consolidadas, incluindo:

- Medtronic (Irlanda)

- Abbott (EUA)

- Dexcom, Inc. (EUA)

- Boston Scientific Corporation (EUA)

- BD (EUA)

- Masimo Corporation (EUA)

- ResMed Inc. (EUA)

- iRhythm Technologies, Inc. (EUA)

- AliveCor, Inc. (EUA)

- Qardio, Inc. (EUA)

- Sempulse Corporation (EUA)

- Zephyr Technology Corporation (EUA)

- Apple Inc. (EUA)

- Fitbit LLC (EUA)

- GE HealthCare (EUA)

- Stryker (EUA)

- Omron Healthcare, Inc. (EUA)

- Welch Allyn, Inc. (EUA)

- Hill-Rom Services, Inc. (EUA)

- NeuroMetrix, Inc. (EUA)

Quais são os desenvolvimentos recentes no mercado de dispositivos médicos inteligentes na América do Norte?

- Em outubro de 2024, os dispositivos médicos vestíveis EmeTerm Smart e HeadaTerm 2 receberam Licenças de Dispositivos Médicos (MDLs) da Health Canada, permitindo sua comercialização no Canadá para o alívio de enjoo de movimento e enxaqueca. Isso demonstra o progresso regulatório na América do Norte e a crescente adoção de tecnologias terapêuticas vestíveis além da estrutura da FDA (Food and Drug Administration) dos EUA.

- Em agosto de 2024, o relógio médico Masimo W1® recebeu a aprovação 510(k) da FDA para integração com o sistema de telemonitoramento Masimo SafetyNet®, permitindo a transmissão contínua de sinais vitais (por exemplo, SpO₂, frequência cardíaca) a cuidadores e médicos por meio de conectividade segura na nuvem, um avanço significativo no monitoramento remoto de pacientes.

- Em março de 2024, a FDA (Food and Drug Administration) dos EUA aprovou o primeiro monitor contínuo de glicose de venda livre, o sistema Dexcom Stelo Glucose Biosensor, ampliando o acesso ao monitoramento de glicose em tempo real para adultos sem receita médica e permitindo um automonitoramento mais amplo da glicemia fora de ambientes clínicos.

- Em janeiro de 2024, a plataforma vestível SimpleSense‑BP da Nanowear recebeu a aprovação 510(k) da FDA para monitoramento contínuo da pressão arterial sem manguito e com inteligência artificial, representando um avanço para o diagnóstico não invasivo da hipertensão em casa.

- Em novembro de 2023, o relógio médico W1™ da Masimo obteve a aprovação 510(k) da FDA para uso com e sem prescrição médica, permitindo o monitoramento contínuo da saturação de oxigênio e da frequência cardíaca em adultos, tanto em casa quanto em ambientes clínicos. Isso sinaliza a expansão do diagnóstico por dispositivos vestíveis para o sistema de saúde convencional.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.