North America Sleep Disorder Treatment Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

7.46 Billion

USD

14.43 Billion

2025

2033

USD

7.46 Billion

USD

14.43 Billion

2025

2033

| 2026 –2033 | |

| USD 7.46 Billion | |

| USD 14.43 Billion | |

|

|

|

|

Segmentação do mercado de tratamento de distúrbios do sono na América do Norte, por tipo (insônia, apneia do sono, síndrome das pernas inquietas (SPI), narcolepsia e outros), tratamento (terapia farmacológica, terapia mecânica, dispositivos de avanço mandibular, estimulador do nervo hipoglosso, cirurgia e outros), via de administração (oral, parenteral e outras), tipo de medicamento (de marca e genéricos), tipo de população (crianças e adultos), usuário final (hospitais, clínicas especializadas, assistência domiciliar, centros cirúrgicos ambulatoriais e outros), canal de distribuição (venda direta, farmácia hospitalar, farmácia de varejo, farmácia online e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de tratamento de distúrbios do sono na América do Norte

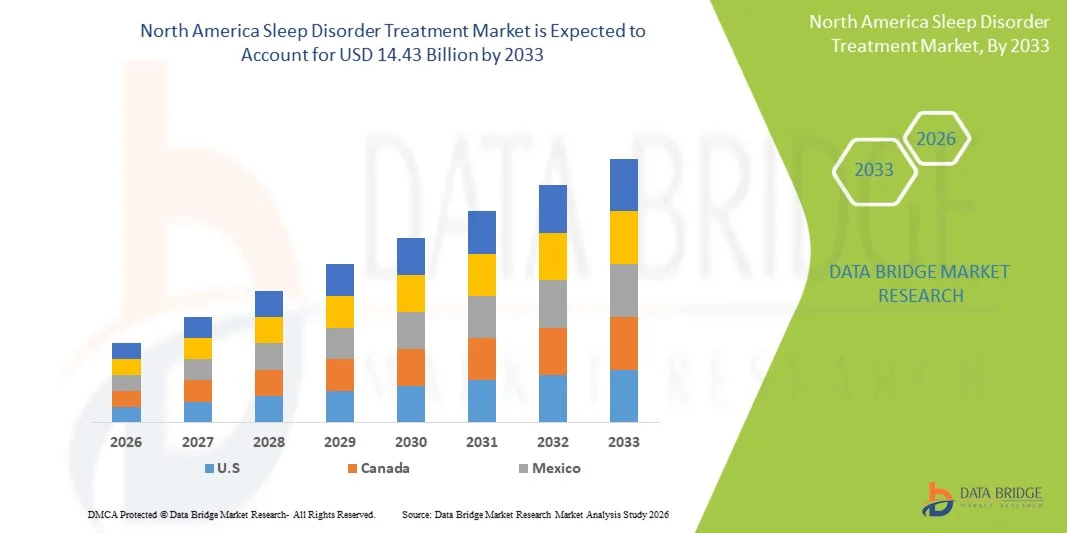

- O mercado de tratamento de distúrbios do sono na América do Norte foi avaliado em US$ 7,46 bilhões em 2025 e espera-se que alcance US$ 14,43 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 8,60% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente prevalência de distúrbios do sono, pela maior conscientização sobre a importância da saúde do sono e pela adoção cada vez maior de tecnologias diagnósticas e terapêuticas avançadas, tanto em ambientes domésticos quanto clínicos.

- Além disso, a crescente demanda do consumidor por soluções personalizadas, eficazes e não invasivas para o gerenciamento do sono está impulsionando a adoção de soluções para o tratamento de distúrbios do sono, aumentando significativamente o crescimento do setor.

Análise do mercado de tratamento de distúrbios do sono na América do Norte

- Dispositivos inteligentes para distúrbios do sono e soluções terapêuticas, que oferecem suporte diagnóstico e tratamento para diversos distúrbios do sono, como insônia, apneia do sono e narcolepsia, são componentes cada vez mais vitais dos modernos sistemas de saúde e assistência domiciliar devido à sua conveniência, recursos de monitoramento remoto e integração com ecossistemas de saúde digital.

- A crescente demanda por soluções para o tratamento de distúrbios do sono é impulsionada principalmente pela prevalência cada vez maior de problemas de saúde relacionados ao sono, pela crescente conscientização do consumidor sobre a saúde do sono e pela preferência cada vez maior por terapias personalizadas e não invasivas.

- Os EUA dominaram o mercado de tratamento de distúrbios do sono na América do Norte, com a maior participação de receita, de aproximadamente 42,5% em 2025, impulsionados por uma infraestrutura de saúde bem estabelecida, alta adoção de dispositivos diagnósticos e terapêuticos avançados, forte presença de importantes players do mercado e alta conscientização do consumidor sobre a saúde do sono. O país está testemunhando um crescimento substancial na adoção do tratamento de distúrbios do sono em hospitais, clínicas e serviços de saúde domiciliar.

- Prevê-se que o Canadá seja o país de crescimento mais rápido no mercado de tratamento de distúrbios do sono na América do Norte durante o período de previsão, registrando uma taxa de crescimento anual composta (CAGR) estimada em cerca de 9,1%, impulsionada pelo aumento dos investimentos em infraestrutura de saúde, pela crescente prevalência de distúrbios do sono, pela maior adoção de soluções digitais e de monitoramento do sono em domicílio e pela crescente disponibilidade de clínicas especializadas em terapia do sono.

- O segmento Adulto representou a maior fatia da receita de mercado em 2025, com 72,5%, devido à alta prevalência de apneia do sono, insônia e síndrome das pernas inquietas na população adulta.

Escopo do relatório e segmentação do mercado de tratamento de distúrbios do sono na América do Norte

|

Atributos |

Principais informações sobre o mercado de tratamento de distúrbios do sono na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de tratamento de distúrbios do sono na América do Norte

“ Adoção crescente de terapias avançadas e não invasivas ”

- Uma tendência significativa no mercado de tratamento de distúrbios do sono na América do Norte é a crescente adoção de intervenções terapêuticas avançadas e opções de tratamento não invasivas, incluindo dispositivos de pressão positiva contínua nas vias aéreas (CPAP), aparelhos orais e terapias digitais.

- Essas abordagens estão ganhando força à medida que pacientes e profissionais de saúde buscam soluções eficazes com maior adesão ao tratamento, conforto e conveniência.

- Por exemplo, em 2024, diversas clínicas do sono nos Estados Unidos e no Canadá relataram uma maior preferência dos pacientes por dispositivos vestíveis de monitoramento do sono e kits de teste do sono para uso doméstico, refletindo uma tendência mais ampla em direção a um tratamento personalizado e acessível dos distúrbios do sono.

- Os avanços tecnológicos contínuos, como os aparelhos CPAP inteligentes com rastreamento de adesão, monitoramento remoto e otimização da terapia baseada em dados, estão aprimorando a eficácia do tratamento e a satisfação do paciente.

- Além disso, a crescente conscientização pública sobre os riscos à saúde associados a distúrbios do sono não tratados, incluindo complicações cardiovasculares, distúrbios metabólicos e problemas de saúde mental, está impulsionando a adoção de modalidades de tratamento não invasivas e mais convenientes para o paciente em toda a região.

Dinâmica do mercado de tratamento de distúrbios do sono na América do Norte

Motorista

“Prevalência crescente de distúrbios do sono e investimentos cada vez maiores em saúde”

- O mercado de tratamento de distúrbios do sono na América do Norte é impulsionado principalmente pela crescente prevalência de condições como apneia obstrutiva do sono (AOS), insônia, síndrome das pernas inquietas e narcolepsia.

- A crescente conscientização sobre a relação entre distúrbios do sono e saúde geral tem levado pacientes a buscar ativamente intervenções médicas.

- Além disso, a expansão da infraestrutura de saúde e os maiores investimentos em clínicas de medicina do sono, pesquisa e terapias digitais estão impulsionando o crescimento do mercado.

- Por exemplo, hospitais e centros especializados em distúrbios do sono nos EUA e no Canadá estão incorporando ferramentas de diagnóstico abrangentes e sistemas de gerenciamento de terapia, permitindo a detecção precoce e planos de tratamento personalizados.

- Além disso, o envelhecimento da população e fatores de estilo de vida, como obesidade, estresse e urbanização, contribuem para uma maior demanda por tratamentos eficazes para distúrbios do sono, impulsionando um crescimento consistente tanto em ambientes clínicos quanto em cuidados domiciliares.

- A melhoria na cobertura de seguros e nas políticas de reembolso para diagnósticos e terapias do sono também está incentivando mais pacientes a buscarem tratamento, impulsionando a adoção geral do mercado na América do Norte.

Restrição/Desafio

“ Altos custos de tratamento e problemas de adesão do paciente ”

- Apesar da crescente demanda, o mercado enfrenta desafios relacionados aos altos custos das terapias avançadas e à adesão do paciente.

- Dispositivos como máquinas CPAP, aparelhos orais e soluções de monitoramento contínuo geralmente exigem um investimento inicial significativo, limitando o acesso para pacientes com orçamento limitado.

- Além disso, a adesão do paciente continua sendo uma questão crítica, visto que desconforto, falta de informação ou complexidade dos regimes de tratamento podem levar ao uso inconsistente da terapia, reduzindo sua eficácia.

- As variações nas políticas de saúde, na cobertura de seguros e no reembolso entre os estados também podem criar barreiras à adoção generalizada, principalmente para tecnologias terapêuticas não invasivas ou mais recentes.

- Por exemplo, um relatório de 2023 da Associação Americana de Apneia do Sono destacou que quase 30% dos pacientes que receberam prescrição de terapia com CPAP interromperam o uso nos primeiros seis meses devido a desconforto ou inconveniência, demonstrando o impacto dos desafios de adesão no crescimento do mercado.

- Abordar esses desafios por meio da educação do paciente, opções de tratamento acessíveis e monitoramento aprimorado da adesão é essencial para impulsionar o crescimento sustentado no mercado de tratamento de distúrbios do sono na América do Norte.

Escopo do mercado de tratamento de distúrbios do sono na América do Norte

O mercado é segmentado com base no tipo, tratamento, via de administração, tipo de medicamento, tipo de população, usuário final e canal de distribuição.

• Por tipo

Com base no tipo, o mercado de tratamento de distúrbios do sono na América do Norte é segmentado em insônia, apneia do sono, síndrome das pernas inquietas (SPI), narcolepsia e outros. O segmento de apneia do sono dominou a maior participação na receita do mercado, com cerca de 42,7% em 2025, impulsionado pela alta prevalência de apneia obstrutiva do sono em todo o mundo. A adoção da terapia com pressão positiva contínua nas vias aéreas (CPAP), a crescente conscientização sobre os riscos cardiovasculares associados e os avanços em dispositivos de monitoramento alimentam essa dominância. O crescimento da população idosa e o aumento das taxas de obesidade contribuem significativamente para esse mercado. A cobertura de seguro saúde e o apoio hospitalar aumentam o acesso dos pacientes. A integração com dispositivos inteligentes melhora a adesão ao tratamento. Iniciativas de pesquisa para diagnóstico precoce fortalecem a adesão. A crescente adoção de cuidados domiciliares expande o alcance do tratamento. Melhorias na infraestrutura regional de saúde reforçam a liderança do mercado. Programas governamentais e campanhas de conscientização pública apoiam o crescimento sustentado.

Prevê-se que o segmento de narcolepsia apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 15,4%, entre 2026 e 2033, impulsionado pelo aumento das capacidades de diagnóstico e pelo maior reconhecimento de distúrbios raros do sono. Empresas biofarmacêuticas estão investindo em novas terapias e intervenções direcionadas a genes. O aumento de ensaios clínicos e financiamento para pesquisa impulsiona o desenvolvimento de novos tratamentos. Programas de conscientização para médicos aprimoram o diagnóstico e a adesão à terapia. A colaboração com clínicas especializadas promove o acesso dos pacientes. A expansão das iniciativas de educação do paciente melhora a adesão ao tratamento. O lançamento de tratamentos inovadores para sonolência diurna impulsiona o crescimento do mercado. A disponibilidade de farmácias online facilita o acesso rápido. O reconhecimento por pacientes pediátricos impulsiona uma maior adesão. A integração tecnológica no monitoramento aumenta a eficiência do tratamento.

• Por tratamento

Com base no tratamento, o mercado é segmentado em Terapia Farmacológica, Terapia Mecânica, Dispositivos de Avanço Mandibular, Estimulador do Nervo Hipoglosso, Cirurgia e Outros. O segmento de Terapia Farmacológica detinha a maior participação na receita de mercado, com cerca de 46,5% em 2025, impulsionado pelo uso generalizado de medicamentos indutores do sono, sedativos e medicamentos que promovem a vigília para insônia, narcolepsia e síndrome das pernas inquietas. A fácil acessibilidade a medicamentos de marca e genéricos, a preferência dos médicos e os protocolos de tratamento estabelecidos contribuem para essa dominância. A cobertura de planos de saúde e as iniciativas de adesão do paciente impulsionam a receita. Os projetos de pesquisa globais garantem inovação contínua. As aprovações regulatórias para novos agentes farmacológicos aumentam a penetração no mercado. A integração com a telemedicina facilita o monitoramento do paciente. A crescente conscientização sobre higiene do sono apoia a adoção da terapia. Parcerias entre empresas farmacêuticas e clínicas melhoram a distribuição. O envelhecimento da população aumenta a demanda por tratamento para distúrbios crônicos do sono.

Prevê-se que o segmento de Estimuladores do Nervo Hipoglosso apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 16,2%, entre 2026 e 2033, impulsionado pela adoção de intervenções minimamente invasivas para apneia obstrutiva do sono. Os avanços tecnológicos em dispositivos implantáveis melhoram a eficácia e o conforto. As aprovações da FDA e a marcação CE expandem a disponibilidade global. O treinamento de médicos especialistas aumenta a adesão aos procedimentos. A crescente conscientização sobre alternativas cirúrgicas ao CPAP impulsiona o crescimento. A expansão das políticas de reembolso em mercados desenvolvidos apoia a adoção. Resultados positivos de ensaios clínicos aumentam a confiança. Hospitais e centros especializados promovem ativamente o implante. Colaborações com fabricantes de dispositivos aceleram a comercialização. O monitoramento do dispositivo por meio de tecnologias conectadas melhora os resultados.

• Por via administrativa

Com base na via de administração, o mercado é segmentado em Oral, Parenteral e Outras. O segmento Oral dominou com uma participação de 51,3% da receita em 2025, devido à conveniência, à adesão do paciente e à predominância da farmacoterapia oral para insônia e narcolepsia. A facilidade de autoadministração em casa e a ampla disponibilidade de formulações orais reforçam a liderança de mercado. A familiaridade dos médicos com a dosagem e os protocolos padronizados melhora as taxas de prescrição. As aprovações regulatórias para novos agentes orais expandem as opções. A integração com a telemedicina facilita o monitoramento da adesão. A disponibilidade de genéricos reduz as barreiras de custo. A preferência do paciente por terapias não invasivas fortalece a adoção. Campanhas de conscientização em saúde pública aumentam a adesão. As necessidades de tratamento de distúrbios crônicos do sono apoiam o uso a longo prazo. As redes de distribuição aprimoram o acesso em todas as regiões.

O segmento de medicamentos parenterais deverá apresentar o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 14,8% entre 2026 e 2033, impulsionado por terapias injetáveis especializadas para narcolepsia e síndrome das pernas inquietas (SPI). O aumento de ensaios clínicos com medicamentos biológicos e terapias direcionadas impulsiona a adoção. A administração hospitalar garante o controle do tratamento. Inovações em dispositivos de administração melhoram o conforto do paciente. A cobertura de reembolso apoia a adesão à terapia. Clínicas especializadas focam na administração injetável de medicamentos de alta eficácia. Aprovações regulatórias expandem as indicações. A adesão de pacientes pediátricos e geriátricos aumenta. A integração com dispositivos de monitoramento favorece a adesão ao tratamento. A crescente conscientização entre os médicos impulsiona a adoção.

• Por tipo de medicamento

Com base no tipo de medicamento, o mercado é segmentado em medicamentos de marca e genéricos. O segmento de medicamentos de marca dominou o mercado, com uma participação de 57,1% da receita em 2025, impulsionado pela alta adoção de terapias patenteadas para apneia do sono, insônia e narcolepsia, respaldadas por evidências clínicas. As empresas farmacêuticas globais promovem ativamente suas marcas. A cobertura de planos de saúde contribui para a acessibilidade. A preferência dos médicos e as iniciativas de marketing fortalecem a dominância do mercado. O lançamento de medicamentos de nova geração melhora a eficácia. A integração da telemedicina melhora a adesão ao tratamento. As aprovações regulatórias garantem segurança e confiança. A educação do paciente apoia a adesão ao tratamento. Os projetos de pesquisa e desenvolvimento mantêm a diferenciação dos produtos. A exclusividade de mercado incentiva o investimento.

Prevê-se que o segmento de genéricos apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 13,9%, entre 2026 e 2033, impulsionado pela expiração de patentes e pela crescente adoção por parte de consumidores preocupados com os custos em mercados emergentes. Iniciativas governamentais e reembolsos favoráveis promovem a adoção de genéricos. Hospitais e farmácias estão cada vez mais estocando alternativas genéricas. A crescente conscientização dos pacientes reduz a dependência de medicamentos de marca. A distribuição em lojas físicas e online amplia o alcance. Terapias com melhor custo-benefício aumentam a adesão ao tratamento. Programas de colaboração entre governos e clínicas melhoram o acesso. A expansão das farmácias online acelera o crescimento.

• Por tipo de população

Com base no tipo de população, o mercado é segmentado em Crianças e Adultos. O segmento de Adultos representou a maior participação na receita do mercado, com 72,5% em 2025, devido à alta prevalência de apneia do sono, insônia e síndrome das pernas inquietas (SPI) nessa população. O aumento das taxas de obesidade, fatores relacionados ao estilo de vida e o envelhecimento da população impulsionam essa dominância. Os tratamentos hospitalares e ambulatoriais são voltados principalmente para adultos. A adoção de CPAP, dispositivos de avanço mandibular e terapia farmacológica é ampla. Campanhas de conscientização são direcionadas à população adulta. A cobertura de planos de saúde abrange o tratamento crônico. O monitoramento por telemedicina melhora a adesão ao tratamento. A população geriátrica requer intervenções de cuidados a longo prazo. Programas de bem-estar corporativo impulsionam a demanda.

Prevê-se que o segmento infantil apresente o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 12,7% entre 2026 e 2033, impulsionado pelo maior reconhecimento dos distúrbios do sono pediátricos e por intervenções especializadas. Clínicas e hospitais pediátricos adotam terapias adequadas à idade. A conscientização dos pais e a triagem proativa melhoram as taxas de diagnóstico. As aprovações regulatórias para medicamentos e dispositivos pediátricos apoiam a adoção. Iniciativas de saúde em escolas e comunidades aumentam a conscientização. A adoção do CPAP pediátrico cresce de forma constante. Soluções especializadas de cuidados domiciliares para crianças são cada vez mais utilizadas. A telemedicina facilita o monitoramento. Colaborações entre a indústria farmacêutica e centros pediátricos aceleram o acesso.

• Pelo usuário final

Com base no usuário final, o mercado é segmentado em Hospitais, Clínicas Especializadas, Assistência Domiciliar, Centros Cirúrgicos Ambulatoriais e Outros. O segmento de Hospitais dominou o mercado com 48,6% da receita em 2025, impulsionado pela disponibilidade de centros multidisciplinares de sono, laboratórios de diagnóstico e instalações para administração de terapias. Os hospitais oferecem acesso a uma ampla gama de intervenções e tratamentos. A cobertura de seguro e as políticas de reembolso reforçam a utilização dos serviços hospitalares. A integração com a telemedicina melhora o acompanhamento dos pacientes. Iniciativas de pesquisa em ambientes hospitalares expandem os portfólios de tratamento. O treinamento de pessoal médico apoia a adoção de procedimentos. Os hospitais oferecem serviços tanto para adultos quanto para crianças. Parcerias com fabricantes de dispositivos fortalecem a capacidade de atendimento. O alto volume de pacientes sustenta a liderança de mercado.

O segmento de assistência domiciliar deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 15,8%, entre 2026 e 2033, impulsionado pela crescente preferência pela terapia CPAP em casa e por dispositivos de telemonitoramento. A maior conveniência para o paciente, a relação custo-benefício e o monitoramento da adesão ao tratamento favorecem a adoção. A cobertura de planos de saúde para terapias domiciliares melhora a acessibilidade. Os provedores de assistência domiciliar oferecem treinamento e suporte. A integração da telemedicina garante o monitoramento contínuo. O envelhecimento da população e os pacientes crônicos impulsionam a demanda por assistência domiciliar. Farmácias online e a entrega de dispositivos diretamente ao paciente ampliam o alcance. Colaborações com empresas de dispositivos médicos melhoram a oferta de serviços. A mudança para o atendimento domiciliar, impulsionada pela pandemia, acelera o crescimento.

• Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em Venda Direta, Farmácia Hospitalar, Farmácia Varejista, Farmácia Online e Outros. O segmento de Farmácia Hospitalar dominou o mercado com 54,2% da receita em 2025, devido ao fornecimento controlado de medicamentos prescritos e à integração com centros de sono hospitalares. A prescrição médica direta garante o uso adequado. O reembolso e os planos de saúde facilitam a preferência pela farmácia hospitalar. O acesso a medicamentos especializados sustenta essa dominância. A integração com os registros hospitalares garante a adesão do paciente ao tratamento. A eficiência da cadeia de suprimentos aumenta a adesão. A familiaridade do médico com o tratamento reforça o uso. Redes hospitalares multicanal expandem o alcance. As farmácias hospitalares mantêm estoque para terapias crônicas. A supervisão regulatória garante a segurança.

O segmento de farmácias online deverá apresentar o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 16,3% entre 2026 e 2033, impulsionado pela crescente adoção digital, integração da telemedicina e entrega domiciliar de terapias para distúrbios do sono. A preferência dos pacientes por conveniência impulsiona as compras online. As plataformas de farmácias online expandem o alcance geográfico. Prescrições digitais e entregas automatizadas melhoram a adesão ao tratamento. Campanhas de conscientização apoiam a adesão à terapia online. As vantagens de custo atraem pacientes. A rápida expansão em mercados emergentes acelera a adoção. A integração tecnológica aprimora o monitoramento do paciente. Colaborações com hospitais reforçam a credibilidade. Os canais online melhoram o acesso a medicamentos de marca e genéricos.

Análise Regional do Mercado de Tratamento de Distúrbios do Sono na América do Norte

- O mercado de tratamento de distúrbios do sono na América do Norte, nos EUA, detinha a maior participação na região, impulsionado pela rápida adoção de ferramentas de diagnóstico avançadas, dispositivos terapêuticos e soluções de monitoramento do sono em domicílio.

- A crescente conscientização sobre distúrbios do sono, a prevalência cada vez maior de condições como apneia do sono e insônia, e a forte presença de empresas líderes de mercado são fatores-chave que impulsionam o crescimento.

- Hospitais, clínicas especializadas em sono e prestadores de cuidados de saúde domiciliares estão integrando cada vez mais tecnologias inovadoras para melhorar os resultados dos pacientes, aumentando a demanda geral do mercado.

Análise do mercado de tratamento de distúrbios do sono no Canadá e na América do Norte

O mercado de tratamento de distúrbios do sono no Canadá e na América do Norte deverá ser o de crescimento mais rápido na região durante o período de previsão, registrando uma taxa de crescimento anual composta (CAGR) estimada em cerca de 9,1%. Esse crescimento é impulsionado pelo aumento dos investimentos em infraestrutura de saúde, pela crescente prevalência de distúrbios do sono e pela adoção cada vez maior de soluções digitais e de monitoramento do sono em domicílio. A expansão da rede de clínicas especializadas em terapia do sono, aliada a iniciativas governamentais de apoio e ao foco na saúde preventiva, está impulsionando significativamente o crescimento do mercado no país.

Participação de mercado no tratamento de distúrbios do sono na América do Norte

O setor de tratamento de distúrbios do sono é liderado principalmente por empresas consolidadas, incluindo:

- Philips Respironics (Países Baixos)

- Fisher & Paykel Healthcare (Nova Zelândia)

- Invacare Corporation (EUA)

- SomnoMed (Austrália)

- Inspire Medical Systems (EUA)

- Respicárdia (EUA)

- Itamar Medical (Israel)

- Zephyr Sleep Technologies (EUA)

- Actelion Pharmaceuticals (Suíça)

- Teva Indústrias Farmacêuticas (Israel)

- GlaxoSmithKline (Reino Unido)

- Novartis (Suíça)

- Johnson & Johnson (EUA)

- Koninklijke DSM (Países Baixos)

- Sleep Number Corporation (EUA)

- Apex Medical (Taiwan)

- Medtronic (EUA)

- BMC Medical (China)

- SomniFix (EUA)

Últimos desenvolvimentos no mercado de tratamento de distúrbios do sono na América do Norte

- Em dezembro de 2024, a Food and Drug Administration (FDA) dos EUA aprovou o Zepbound (tirzepatida), um agonista do receptor GLP-1 desenvolvido pela Eli Lilly, como o primeiro medicamento especificamente indicado para o tratamento da apneia obstrutiva do sono (AOS) moderada a grave em adultos com obesidade, demonstrando reduções significativas nos episódios de apneia, juntamente com benefícios na perda de peso. Essa aprovação representou uma grande expansão das opções de tratamento farmacológico para AOS, historicamente dominadas por terapias baseadas em dispositivos, como o CPAP, e forneceu aos médicos uma nova terapia sistêmica para abordar os fatores metabólicos subjacentes à apneia do sono, particularmente em populações obesas.

- Em janeiro de 2024, a ResMed lançou o AirMini AutoSet Travel CPAP Machine, um dispositivo compacto e leve para terapia da apneia do sono, otimizado para viajantes frequentes. Essa iniciativa representa um movimento estratégico em direção a tecnologias para distúrbios do sono mais portáteis e fáceis de usar, que favorecem a adesão ao tratamento fora do ambiente doméstico tradicional. O lançamento do AirMini reflete as tendências da indústria em direção à miniaturização e à conveniência para o usuário no tratamento de distúrbios crônicos do sono.

- Em junho de 2024, a Philips anunciou uma nova e importante plataforma de CPAP com monitoramento aprimorado do paciente e recursos de compartilhamento de dados em nuvem, projetada para simplificar o gerenciamento remoto de pacientes e melhorar a adesão à terapia a longo prazo por meio de recursos integrados de telessaúde, alinhando a terapia com dispositivos às tendências da saúde digital. Esse lançamento destacou como a conectividade e a análise de dados estão sendo incorporadas à infraestrutura de tratamento do sono para apoiar a supervisão clínica e o engajamento do paciente.

- Em setembro de 2025, a Airway Management recebeu a aprovação da FDA para o Nylon flexTAP®, o primeiro aparelho oral de linha média de ponto único impresso digitalmente para apneia obstrutiva do sono leve a moderada, com a tecnologia patenteada Vertex para maior conforto e eficácia terapêutica, ampliando as alternativas de tratamento não-CPAP. Essa aprovação expandiu o segmento de aparelhos orais, oferecendo aos pacientes terapias não invasivas adicionais que competem com os dispositivos convencionais.

- Em fevereiro de 2025, a Huxley Medical anunciou a aprovação da FDA para seu teste domiciliar de apneia do sono SANSA, com capacidade de upload de dados via celular. Essa inovação elimina a dependência de Bluetooth ou aplicativos de smartphone para transmitir dados diagnósticos, simplifica os procedimentos de estudo do sono em casa e melhora o acesso para populações de pacientes carentes. A inovação apoia a tendência de diagnósticos descentralizados e centrados no paciente no mercado de distúrbios do sono.

- Em março de 2025, a ResMed recebeu a aprovação da FDA para seu novo dispositivo Adaptive Servo-Ventilator, uma plataforma de terapia para apneia do sono de última geração, projetada para pacientes com necessidades respiratórias mais complexas. A plataforma aprimora a precisão da terapia e amplia as opções de tratamento para indivíduos que não respondem bem aos dispositivos CPAP ou BiPAP convencionais. Esse avanço no dispositivo reforça a inovação contínua em hardware terapêutico, atendendo às necessidades não satisfeitas em casos graves de distúrbios do sono e consolidando a expansão do mercado de dispositivos terapêuticos.

- Em janeiro de 2025, o Medicare e o Medicaid esclareceram as diretrizes de cobertura, permitindo que o Zepbound fosse incluído no Medicare Parte D e, potencialmente, nos planos do Medicaid para o tratamento da apneia obstrutiva do sono (AOS), aumentando significativamente o acesso dos pacientes a essa nova opção farmacológica para apneia do sono moderada a grave entre idosos e pessoas de baixa renda. Esse desenvolvimento facilitou vias de reembolso de seguro mais amplas, que são cruciais para a adoção no mundo real de novas terapias para distúrbios do sono além do uso tradicional de dispositivos, abrindo o acesso para milhões de beneficiários.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.