North America Residential Energy Management Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

8.63 Billion

USD

84.06 Billion

2025

2033

USD

8.63 Billion

USD

84.06 Billion

2025

2033

| 2026 –2033 | |

| USD 8.63 Billion | |

| USD 84.06 Billion | |

|

|

|

|

Mercado de gestão de energia residencial (REM) da América do Norte, por aplicação de interface de utilizador (contadores inteligentes, termóstatos inteligentes, monitores internos (IHD) e aparelhos inteligentes), plataforma (plataforma de gestão de energia (EMP), análise de energia e plataforma de envolvimento do cliente (CEP )), Componente (Hardware e Software), Tecnologia de Comunicação (ZigBee, Z-Wave, Wi-Fi, Homeplug, Wireless M-Bus e Thread), Utilizador Final (Casas e Apartamentos Independentes ), País (EUA, Canadá e México) Tendências e previsões da indústria até 2028

Análise de mercado e insights: Mercado de gestão de energia residencial (REM) da América do Norte

Análise de mercado e insights: Mercado de gestão de energia residencial (REM) da América do Norte

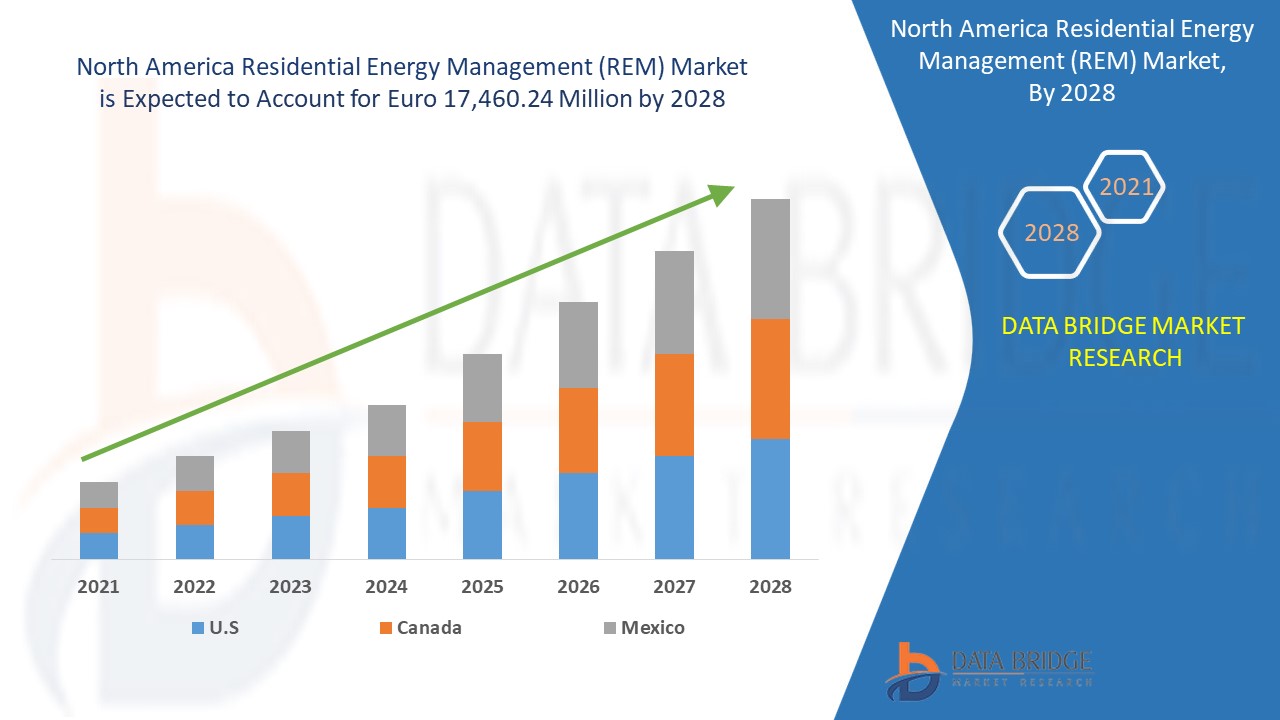

Espera-se que o mercado de gestão de energia residencial (REM) ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 32,9% no período previsto de 2021 a 2028 e prevê-se atingir os 17.460,24 milhões de euros até 2028. A sensibilização dos consumidores em relação ao sistema de gestão de energia eficiente e à implementação de infraestrutura de medição avançada (AMI) são alguns dos fatores que impulsionam o crescimento do mercado de gestão de energia residencial (REM).

Um sistema de gestão de energia residencial é uma plataforma de tecnologia de hardware e software que permite ao utilizador monitorizar a utilização e produção de energia e controlar manualmente e/ou automatizar a utilização de energia dentro de uma casa. Nos sistemas de produção, transmissão e distribuição de redes de sistemas elétricos, a gestão de energia residencial (REM) tem aplicações difíceis. A gestão da procura é importante entre aplicações e a definição de preços em tempo real (RTP) são duas técnicas comuns de gestão do lado da procura (DSM) concebidas por fornecedores de energia especiais com características do sistema de gestão de energia.

A crescente necessidade de melhorar a eficiência do setor dos serviços públicos está a impulsionar o crescimento do mercado de gestão de energia residencial (REM). A falta de sensibilização e orientação padronizada está a restringir o crescimento do mercado de gestão de energia residencial (REM). As casas inteligentes que estão a impulsionar tanto o sector privado como o governo a investir estão a gerar diversas oportunidades para o mercado de gestão de energia residencial (REM). O problema que surge através da conectividade com dispositivos habilitados para IoT, como os smartphones, é a questão da privacidade, que está a representar um desafio para o mercado de gestão de energia residencial (REM).

Este relatório de mercado de gestão de energia residencial (REM) fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos, decisões estratégicas , lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado de gestão de energia residencial (REM), contacte a Data Bridge Market Research para obter um briefing de analista. desejada.

Âmbito e dimensão do mercado de gestão de energia residencial (REM)

Âmbito e dimensão do mercado de gestão de energia residencial (REM)

O mercado de gestão de energia residencial (REM) está segmentado com base na plataforma, aplicação de interface de utilizador, componente, tecnologia de comunicação e utilizador final. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

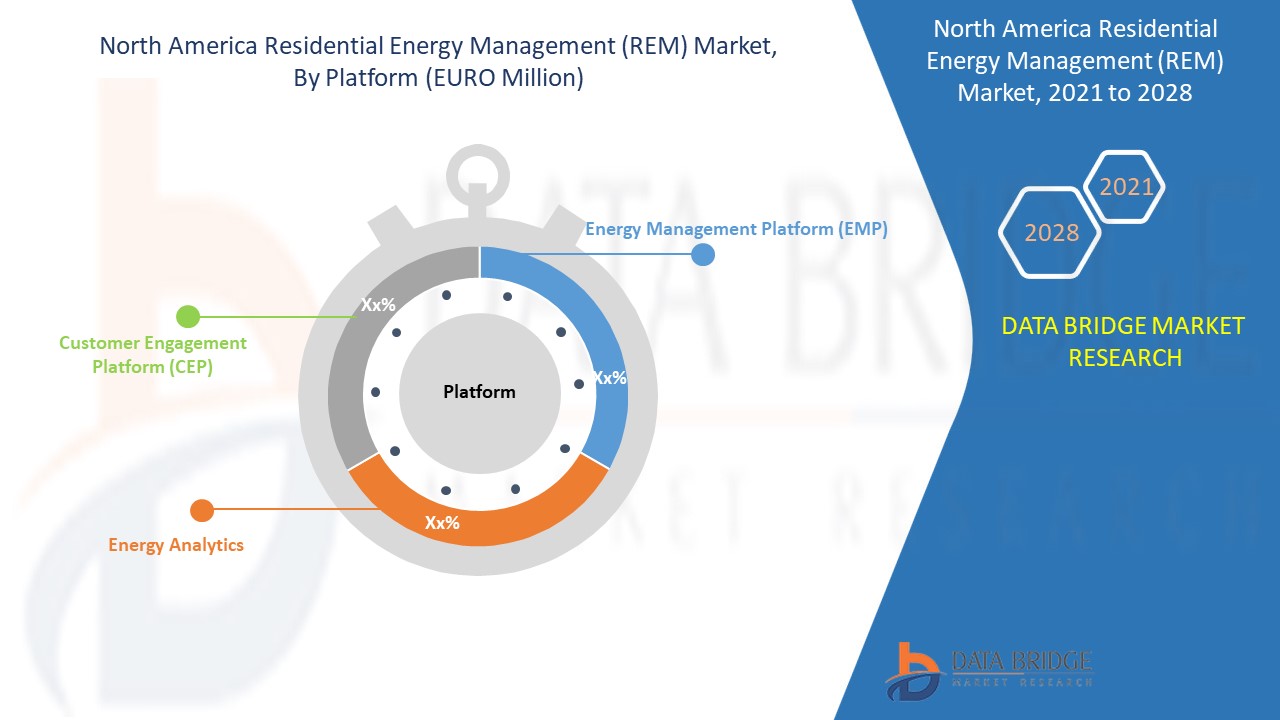

- Com base na plataforma, o mercado de gestão de energia residencial (REM) está segmentado em plataforma de gestão de energia (EMP), análise de energia e plataforma de envolvimento do cliente (CEP). Em 2021, o segmento da plataforma de gestão de energia (EMP) está a dominar devido à crescente adoção de contadores inteligentes, regulamentos governamentais rigorosos para conservar energia, desenvolvimentos tecnológicos que ajudam a recolher e monitorizar a utilização de dados, maior poupança de energia e simplificação de relatórios de energia são alguns dos fatores que ajudam a impulsionar o mercado de gestão de energia residencial (REM).

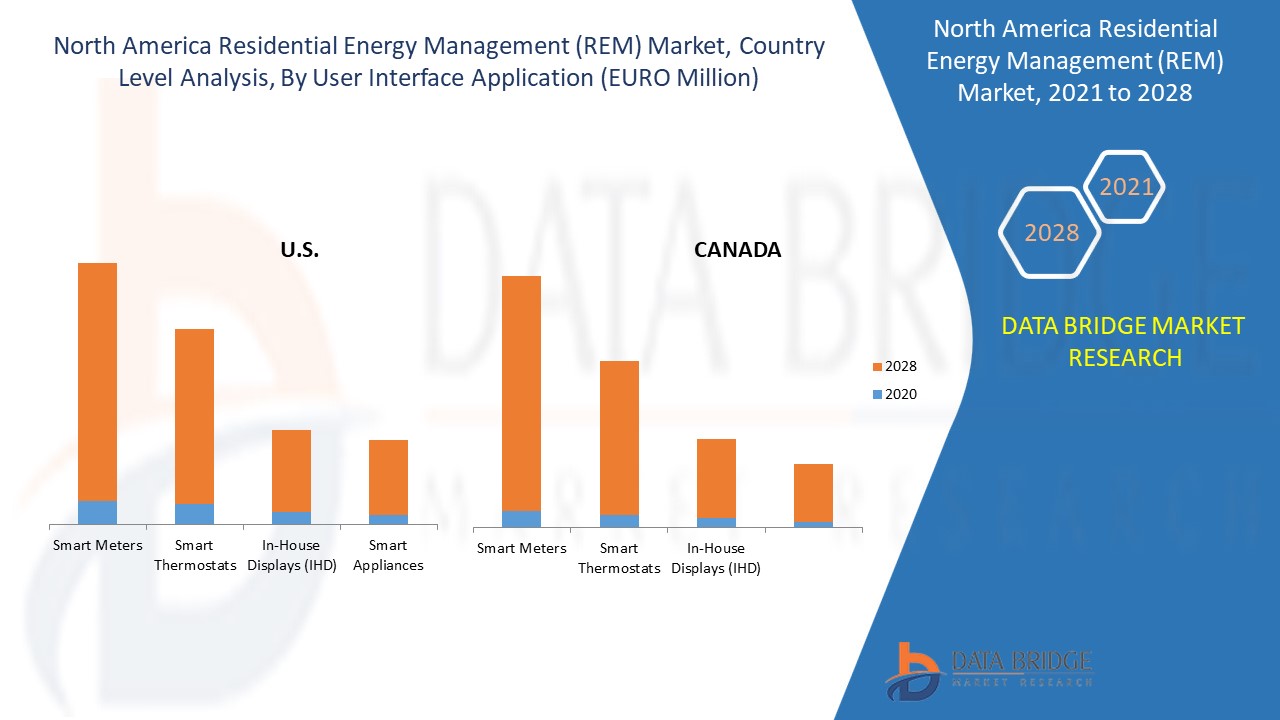

- Com base na aplicação da interface do utilizador, o mercado de gestão de energia residencial (REM) está segmentado em contadores inteligentes, termóstatos inteligentes, ecrãs internos (IHD) e aparelhos inteligentes. Em 2021, o segmento dos contadores inteligentes detém a maior quota de mercado devido ao baixo custo operacional, poupança de tempo para os consumidores reportarem a leitura do contador aos fornecedores de energia, maior precisão nas faturas, consumo real de energia informado e melhor supervisão e gestão de energia. a utilização com exibição de dados em tempo real são alguns dos fatores que ajudam o segmento a dominar o mercado de gestão de energia residencial (REM).

- Com base no componente, o mercado de gestão de energia residencial (REM) está segmentado em hardware e software . Em 2021, o segmento de hardware detém a maior quota de mercado devido ao crescente desenvolvimento de componentes como AVAC, dispositivos de resposta à procura e gateways. Além disso, a análise online com solução de monitorização em tempo real criou uma grande procura por componentes avançados, o que é também um dos fatores que impulsionam o crescimento do segmento no mercado de gestão de energia residencial (REM).

- Com base na tecnologia de comunicação, o mercado de gestão de energia residencial (REM) está segmentado em zigbee, Z-wave, Wi-fi, homeplug, wireless M-bus e thread . Em 2021, o segmento Zigbee detém a maior quota de mercado desde que o Zigbee surgiu como o padrão dominante para redes de automação sem fios.

- Com base no utilizador final, o mercado de gestão de energia residencial (REM) está segmentado em casas e apartamentos independentes. Em 2021, o segmento das residências independentes foi responsável pela maior quota de mercado, uma vez que oferece recursos mais avançados para permitir a transformação de estruturas tradicionais em casas inteligentes.

Análise ao nível do país do mercado de gestão de energia residencial (REM) da América do Norte

Análise ao nível do país do mercado de gestão de energia residencial (REM) da América do Norte

O mercado de gestão de energia residencial (REM) da América do Norte é analisado e são fornecidas informações sobre o tamanho do mercado por país, plataforma, aplicação de interface de utilizador, componente, tecnologia de comunicação e utilizador final, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de gestão de energia residencial (REM) da América do Norte são os EUA, o Canadá e o México.

Os EUA foram responsáveis pela maior quota de mercado no crescimento do mercado de gestão de energia residencial (REM) da América do Norte devido à crescente penetração de casas inteligentes, juntamente com contadores inteligentes, termóstatos inteligentes, ecrãs internos (IHD) e aparelhos inteligentes. Entretanto, o Canadá domina com a segunda maior quota devido ao facto de o país ter um grande número de participantes importantes, juntamente com a automatização inteligente para contadores inteligentes para fornecer uma estrutura ecológica para a gestão fiável de energia residencial (REM).

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da América do Norte e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

Necessidade crescente de melhorar a eficiência do setor dos serviços públicos no mercado de gestão de energia residencial (REM)

O mercado de gestão de energia residencial (REM) também fornece uma análise detalhada do mercado para o crescimento de cada país na indústria com vendas, vendas de componentes, impacto do desenvolvimento tecnológico na gestão de energia residencial (REM) e mudanças nos cenários regulamentares com o seu suporte para a energia residencial. Os dados estão disponíveis para o período histórico de 2011 a 2019.

Análise do cenário competitivo e da quota de mercado da gestão de energia residencial (REM)

O cenário competitivo do mercado de gestão de energia residencial (REM) fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produto, pipelines de testes de produto, aprovações de produto, patentes , largura e amplitude do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado de gestão de energia residencial (REM) da América do Norte.

Os principais participantes abordados no relatório de mercado de gestão de energia residencial (REM) da América do Norte são a Lutron Electronics Co., Inc., a SAVANT TECHNOLOGIES LLC (uma subsidiária da GENERAL ELECTRIC COMPANY), a Schneider Electric, a Elster Solutions (uma subsidiária da Honeywell International Inc. ), ABB, Siemens, Aclara Technologies LLC, ecobee, Uplight, Inc., e-peas, Cisco, LG Electronics, Itron Inc., SAMSUNG SDI CO.,LTD. (uma subsidiária da SAMSUNG ELECTRONICS CO., LTD.), EcoFactor, GridPoint, Landis+Gyr, Panasonic Corporation, COMCAST, entre outras empresas nacionais. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos desenvolvimentos de produtos são também iniciados por empresas de todo o mundo, o que está também a acelerar o crescimento do mercado de gestão de energia residencial (REM).

Por exemplo,

- Em novembro de 2020, a Itron Inc. estabeleceu uma parceria com a Residential Energy Assistance Partnership (REAP) da CPS Energy, que lhe fornece contas de energia geridas. A contribuição implementa a energia do CPS para melhorar a educação em energia e água para inspirar. A empresa melhorou os seus resultados comerciais através da expansão do seu portfólio de produtos através da parceria, atraindo mais clientes.

A colaboração, as joint ventures e outras estratégias dos participantes do mercado estão a aumentar o mercado das empresas no mercado de gestão de energia residencial (REM), o que também traz o benefício para as organizações melhorarem a sua oferta de gestão de energia residencial (REM).

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.