Mercado de sensores de proximidade da América do Norte, por tecnologia (indutiva, capacitiva, fotoelétrica, magnética, ultrassónica e outras), produto (distância fixa e distância ajustável), intervalo de deteção (0 mm-10 mm, 10 mm-40 mm , 40 mm-60 mm, 60 mm-80 mm e Superior a 80 mm), Tipo de canal (canal único e multicanal), Aplicação (Sistema de alerta de proximidade do solo, sistemas de sensores de estacionamento, automatização de linhas de montagem , guerra antiaérea, montanhas russas, sistema de monitorização de vibrações, dispositivos móveis, sistemas de transporte, deteção de Objeto, Posição, Inspeção e Contagem e Outros), Tipo (Sensor Indutivo Retangular, Sensor Indutivo Cilíndrico, Sensor Indutivo de Anel e Sensor Indutivo de Fendas), Utilizador Final (Aeroespacial e Defesa, Automóvel, Automação Predial, Industrial, Eletrónica de Consumo (Smartphones e Tablets), Alimentos e Bebidas, Farmacêutico, Construção, Energia e Outros), Tendências e Previsão da Indústria do País (EUA , Canadá e México) até 2028

Análise de mercado e insights: Mercado de sensores de proximidade da América do Norte

Análise de mercado e insights: Mercado de sensores de proximidade da América do Norte

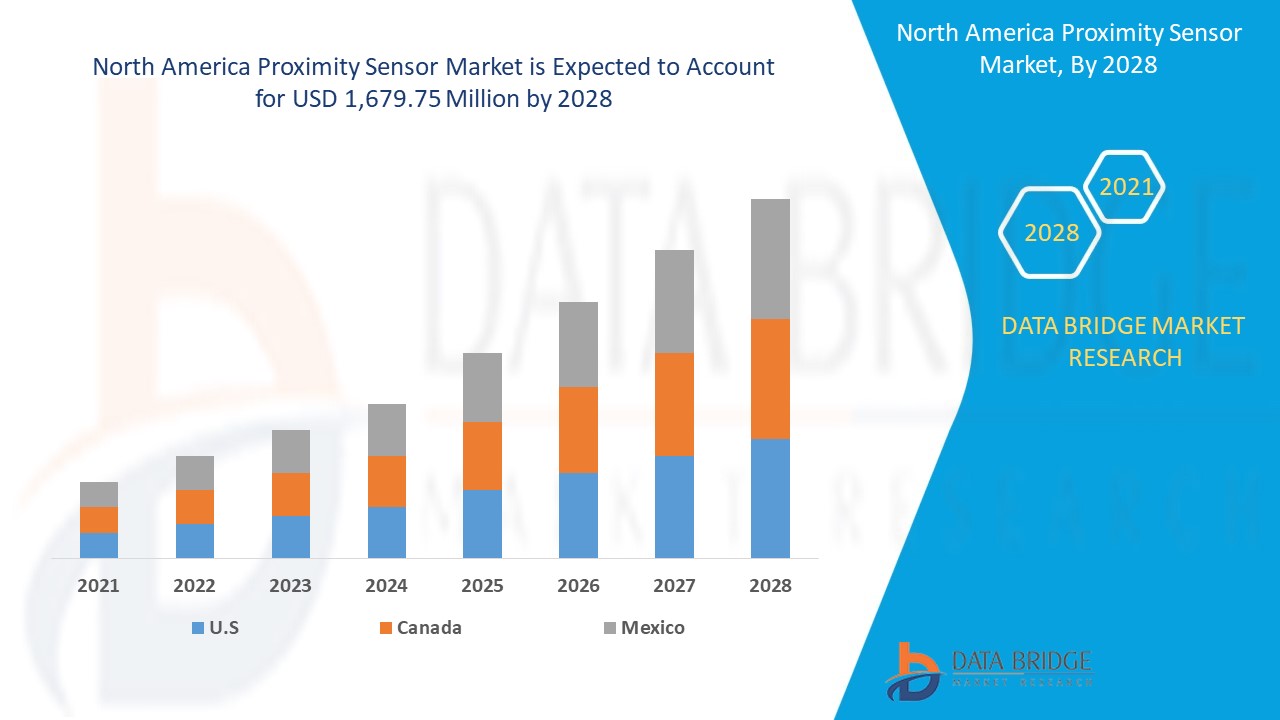

Espera-se que o mercado de sensores de proximidade ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 8,0% no período previsto de 2021 a 2028 e deverá atingir os 1.679,75 milhões de dólares até 2028. As empresas estão a registar um crescimento com a tecnologia de deteção sem contacto para manter a distância física no local de trabalho e atua como um impulsionador para o crescimento do mercado de sensores de proximidade.

Sensor de proximidade refere-se a todos os sensores que realizam deteção sem contacto e que detetam objetos sem contacto físico com os mesmos. Os sensores de proximidade convertem a informação sobre o movimento ou a presença de um objeto num sinal elétrico. Estes sensores são utilizados para detetar qualquer objeto ou alvo sem a necessidade de qualquer contacto físico. Estes sensores são utilizados em parques de estacionamento, telemóveis, sistemas de transporte e muitas outras aplicações industriais.

A crescente adoção de sensores de proximidade na indústria automóvel está a atuar como um fator determinante para o crescimento do mercado de sensores de proximidade. O sensor de proximidade tem certas limitações nas capacidades de deteção, o que restringe a adoção de sensores e atua como um fator de restrição para o crescimento do mercado de sensores de proximidade. A crescente utilização da automação em vários setores, como a indústria transformadora, a energia e outros, também aumentou a necessidade de adotar sensores de proximidade e criou uma janela de oportunidade para o crescimento do mercado de sensores de proximidade. Conceber sensores miniaturizados sem comprometer a qualidade é um desafio para o crescimento do mercado de sensores de proximidade.

Este relatório de mercado de sensores de proximidade fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado nacional e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado de sensores de proximidade, contacte a Data Bridge Market Research para obter um briefing de analista.

Âmbito e dimensão do mercado de sensores de proximidade

Âmbito e dimensão do mercado de sensores de proximidade

O mercado de sensores de proximidade está segmentado com base na tecnologia, produto, alcance de deteção, tipo de canal, aplicação, tipo e utilizador final. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base na tecnologia, o mercado dos sensores de proximidade está segmentado em indutivos, capacitivos , fotoelétricos, magnéticos, ultrassónicos e outros. Em 2021, o segmento indutivo obteve uma maior quota de mercado devido a fatores como a alta resolução, alta precisão, áreas de aplicação cada vez mais amplas, elevada taxa de comutação e capacidade de trabalhar eficientemente em condições ambientais adversas.

- Com base no produto, o mercado de sensores de proximidade foi segmentado em distância fixa e distância ajustável. Em 2021, o segmento de distância ajustável obteve uma maior quota de mercado, devido à crescente procura de alcance de deteção extensível entre sensores de proximidade e à necessidade de grande distância de deteção em diferentes áreas de aplicação.

- Com base no alcance de deteção, o mercado dos sensores de proximidade foi segmentado em 0 mm-10 mm, 10 mm-40 mm, 40 mm-60 mm, 60 mm-80 mm e superior a 80 mm. Em 2021, o segmento de 10 mm a 40 mm deteve a maior quota de mercado porque o sensor de proximidade indutivo oferece um alcance de deteção semelhante e uma grande disponibilidade de sensor de proximidade neste alcance de deteção.

- Com base no tipo de canal, o mercado dos sensores de proximidade foi segmentado em canal único e multicanal. Em 2021, o segmento de canal único conquistou uma maior quota de mercado, uma vez que o canal único é composto por sensores capacitivos que podem detetar diferentes tipos de materiais, tais como plástico, metal, líquidos e outros.

- Com base na aplicação, o mercado de sensores de proximidade foi segmentado em sistema de alerta de proximidade do solo, sistemas de sensores de estacionamento, automatização de linhas de montagem, guerra antiaérea, montanhas-russas, sistema de monitorização de vibrações, dispositivos móveis , sistemas de transporte, detecção de objectos, posição , inspecção e contagem e outros. Em 2021, a deteção de objetos deteve a maior fatia do mercado, uma vez que a principal aplicação do sensor de proximidade é detetar a presença de qualquer objeto sem qualquer contacto físico.

- Com base no tipo, o mercado de sensores de proximidade foi segmentado em sensor indutivo retangular, sensor indutivo cilíndrico, sensor indutivo de anel e sensor indutivo de ranhura. Em 2021, o segmento dos sensores indutivos cilíndricos deteve a maior fatia do mercado devido a fatores como a utilização de oscilação de alta frequência, forte resistência ao calor, produtos químicos e água, além de serem adequados para detetar movimentos de suspensão e outras aplicações que exijam alcances extremos.

- Com base no utilizador final, o mercado de sensores de proximidade foi segmentado em aeroespacial e defesa , automóvel, automação de edifícios, industrial, eletrónica de consumo (smartphones e tablets), alimentos e bebidas, farmacêutico, construção, energia e outros. Em 2021, o segmento automóvel deteve a maior fatia do mercado devido à ampla utilização de sensores de proximidade na indústria automóvel, o que inclui a deteção de veículos muito próximos de um objeto, o desenvolvimento de carros autónomos e a crescente necessidade de movimentação de materiais .

Análise ao nível do país do mercado de sensores de proximidade da América do Norte

O mercado norte-americano de sensores de proximidade é analisado e são fornecidas informações sobre o tamanho do mercado por país, tecnologia, produto, alcance de deteção, tipo de canal, aplicação, tipo e utilizador final, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de sensores de proximidade da América do Norte são os EUA, o Canadá e o México.

Os EUA estão a dominar o mercado de sensores de proximidade na América do Norte devido a fatores como o crescente foco na automatização das indústrias e o apoio favorável do governo à implementação de sensores de proximidade.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da América do Norte e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

Aumento da procura por sensor de proximidade

O mercado de sensores de proximidade também fornece análises de mercado detalhadas sobre o crescimento da indústria em cada país, com vendas, vendas de componentes, impacto do desenvolvimento tecnológico nos sensores de proximidade e mudanças nos cenários regulamentares com o seu apoio ao mercado de sensores de proximidade . Os dados estão disponíveis para o período histórico de 2011 a 2019.

Análise do cenário competitivo e da quota de mercado dos sensores de proximidade

O panorama competitivo do mercado de sensores de proximidade fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produto, pipelines de testes de produto, aprovações de produto, patentes , largura e amplitude do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado norte-americano de sensores de proximidade.

Os principais participantes abrangidos pelo relatório do mercado de sensores de proximidade da América do Norte são a Delta Electronics, Inc., Datalogic SpA, STMicroelectronics, OMRON Corporation, Rockwell Automation, Inc., Schneider Electric, Pepperl+Fuchs SE, Honeywell International Inc., Panasonic Corporation, SICK AG, Baumer, Contrinex AG, Autonics Corporation, Broadcom, Semtech Corporation, Infineon Technologies AG, Balluff Automation India Pvt. Ltd., Hans Turck GmbH & Co. KG, Fargo Controls Inc. e Eaton, entre outros participantes nacionais. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos desenvolvimentos de produtos são também iniciados por empresas de todo o mundo, o que está também a acelerar o crescimento do mercado de sensores de proximidade.

Por exemplo,

- Em junho de 2020, a STMicroelectronics anunciou o lançamento dos sensores de alcance FlightSense ToF denominados VL53L3CX. Este sensor ToF VL53L3CX mede alcances de objetos de 2,5 cm a 3 m, permitindo a introdução de características como detetores de ocupação ou reportando as distâncias exatas para vários alvos dentro do campo de visão do sensor. Isto ajudará a empresa a melhorar as suas ofertas no mercado.

As parcerias, joint ventures e outras estratégias aumentam a quota de mercado da empresa com maior cobertura e presença. Também oferece o benefício para as organizações melhorarem a sua oferta de sensores de proximidade através de uma gama alargada de tamanhos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PROXIMITY SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGY LANDSCAPE

4.2 INDUCTIVE

4.3 CAPACITIVE

4.4 ULTRASONIC

4.5 PHOTOELECTRIC

4.6 MAGNETIC

4.7 COMPARISION OF TECHNOLOGIES

4.8 PREMIUM INSIGHTS

4.8.1 EUROPE

4.8.2 ASIA-PACIFIC

4.8.3 ROW

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND OF NON-CONTACT SENSING TECHNOLOGY

5.1.2 GROWING ADOPTION OF PROXIMITY SENSORS IN AUTOMOBILE INDUSTRY

5.1.3 RESEARCH AND DEVELOPMENT IN PROXIMITY SENSOR

5.1.4 RISING POPULARITY OF MINIATURIZED PROXIMITY AND DISPLACEMENT SENSORS

5.1.5 RISING APPLICATION OF PROXIMITY SENSORS IN OIL AND GAS INDUSTRY

5.2 RESTRAINTS

5.2.1 LIMITATIONS IN SENSING CAPABILITIES

5.2.2 HIGH COST THAN OTHER SENSORS

5.3 OPPORTUNITIES

5.3.1 INCREASING INDUSTRIAL AUTOMATION WORLDWIDE

5.3.2 SURGING FOCUS TOWARDS AUTONOMOUS DRIVING

5.3.3 EMERGING TRENDS OF SMART HOMES

5.3.4 RISING INVESTMENT IN EMERGING MARKETS

5.3.5 GROWING NUMBER OF SMARTPHONES USERS

5.4 CHALLENGES

5.4.1 COMPLEXITIES INVOLVED IN SENSING IN HAZARDOUS ENVIRONMENT

5.4.2 COMPLEXITIES INVOLVED IN DESIGNING OF MINIATURIZED SENSORS

5.4.3 LACK OF UNDERSTANDING REGARDING THE FUNDAMENTALS OF SENSOR DESIGN

6 IMPACT OF COVID-19 ON THE NORTH AMERICA PROXIMITY SENSOR MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA PROXIMITY SENSOR MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 INDUCTIVE

7.2.1 FERROUS METAL SENSING

7.2.2 NON-FERROUS METAL SENSING

7.3 CAPACITIVE

7.3.1 LOAD MODE

7.3.2 TRANSMIT MODE

7.3.3 SHUNT MODE

7.4 PHOTOELECTRIC

7.4.1 THROUGH BEAM

7.4.2 RETRO- REFLECTIVE

7.4.3 DIFFUSE

7.4.4 FIBER OPTICS

7.5 MAGNETIC

7.5.1 VARIABLE RELUCTANCE

7.5.2 MAGNETO-RESISTIVE

7.6 ULTRASONIC

7.6.1 THROUGH BEAM

7.6.2 RETRO- REFLECTIVE

7.6.3 DIFFUSE

7.7 OTHERS

8 NORTH AMERICA PROXIMITY SENSOR MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ADJUSTABLE DISTANCE

8.3 FIXED DISTANCE

9 NORTH AMERICA PROXIMITY SENSOR MARKET, BY SENSING RANGE

9.1 OVERVIEW

9.2MM-40MM

9.3 0MM-10MM

9.4MM-60MM

9.5MM-80MM

9.6 GREATER THAN 80MM

10 NORTH AMERICA PROXIMITY SENSOR MARKET, BY CHANNEL TYPE

10.1 OVERVIEW

10.2 SINGLE CHANNEL

10.3 MULTI-CHANNEL

11 NORTH AMERICA PROXIMITY SENSOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DETECTION OF OBJECT

11.3 POSITION

11.4 GROUND PROXIMITY WARNING SYSTEM

11.5 PARKING SENSOR SYSTEMS

11.5.1 INDUCTIVE

11.5.2 PHOTOELECTRIC

11.5.3 CAPACITIVE

11.5.4 MAGNETIC

11.5.5 ULTRASONIC

11.5.6 OTHERS

11.6 ASSEMBLY LINE AUTOMATION

11.7 ANTI-AIRCRAFT WARFARE

11.8 ROLLER COASTERS

11.8.1 INDUCTIVE

11.8.2 PHOTOELECTRIC

11.8.3 CAPACITIVE

11.8.4 MAGNETIC

11.8.5 ULTRASONIC

11.8.6 OTHERS

11.9 VIBRATION MONITORING SYSTEM

11.1 MOBILE DEVICES

11.10.1 INDUCTIVE

11.10.2 PHOTOELECTRIC

11.10.3 CAPACITIVE

11.10.4 MAGNETIC

11.10.5 ULTRASONIC

11.10.6 OTHERS

11.11 CONVEYOR SYSTEMS

11.11.1 INDUCTIVE

11.11.2 PHOTOELECTRIC

11.11.3 CAPACITIVE

11.11.4 MAGNETIC

11.11.5 ULTRASONIC

11.11.6 OTHERS

11.12 INSPECTION AND COUNTING

11.13 OTHERS

12 NORTH AMERICA PROXIMITY SENSOR MARKET, BY TYPE

12.1 OVERVIEW

12.2 CYLINDRICAL INDUCTIVE SENSOR

12.3 RECTANGULAR INDUCTIVE SENSOR

12.4 RING INDUCTIVE SENSOR

12.5 SLOT INDUCTIVE SENSOR

13 NORTH AMERICA PROXIMITY SENSOR MARKET, BY END USER

13.1 OVERVIEW

13.2 AUTOMOTIVE

13.3 AEROSPACE AND DEFENSE

13.4 BUILDING AUTOMATION

13.5 INDUSTRIAL

13.6 CONSUMER ELECTRONICS (SMARTPHONES, AND TABLETS)

13.7 FOOD AND BEVERAGE

13.8 PHARMACEUTICAL

13.9 CONSTRUCTION

13.9.1 TRUCK

13.9.2 CONSTRUCTION MACHINE

13.9.3 MINING MACHINE

13.9.4 MARINE VEHICLE

13.1 ENERGY

13.10.1 OIL & GAS

13.10.2 WIND TURBINE

13.10.3 OTHER

13.11 OTHERS

1 NORTH AMERICA PROXIMITY SENSOR MARKET, BY REGION

1.1 NORTH AMERICA

1.1.1 U.S.

1.1.2 CANADA

1.1.3 MEXICO

2 NORTH AMERICA PROXIMITY SENSOR MARKET: COMPANY LANDSCAPE

2.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

3 SWOT ANALYSIS

4 CCOMPANY PROFILE

4.1 BROADCOM

4.1.1 COMPANY SNAPSHOT

4.1.2 REVENUE ANALYSIS

4.1.3 COMPANY SHARE ANALYSIS

4.1.4 PRODUCT PORTFOLIO

4.1.5 RECENT DEVELOPMENT

4.2 STMICROELECTRONICS

4.2.1 COMPANY SNAPSHOT

4.2.2 REVENUE ANALYSIS

4.2.3 COMPANY SHARE ANALYSIS

4.2.4 PRODUCT PORTFOLIO

4.2.5 RECENT DEVELOPMENT

4.3 PANASONIC CORPORATION

4.3.1 COMPANY SNAPSHOT

4.3.2 REVENUE ANALYSIS

4.3.3 COMPANY SHARE ANALYSIS

4.3.4 PRODUCT PORTFOLIO

4.3.5 RECENT DEVELOPMENT

4.4 SCHNEIDER ELECTRIC

4.4.1 COMPANY SNAPSHOT

4.4.2 REVENUE ANALYSIS

4.4.3 COMPANY SHARE ANALYSIS

4.4.4 PRODUCT PORTFOLIO

4.4.5 RECENT DEVELOPMENT

4.5 OMRON CORPORATION

4.5.1 COMPANY SNAPSHOT

4.5.2 REVENUE ANALYSIS

4.5.3 COMPANY SHARE ANALYSIS

4.5.4 PRODUCT PORTFOLIO

4.5.5 RECENT DEVELOPMENTS

4.6 AUTONICS CORPORATION

4.6.1 COMPANY SNAPSHOT

4.6.2 PRODUCT PORTFOLIO

4.6.3 RECENT DEVELOPMENT

4.7 BALLUFF AUTOMATION INDIA PVT. LTD.

4.7.1 COMPANY SNAPSHOT

4.7.2 PRODUCT PORTFOLIO

4.7.3 RECENT DEVELOPMENT

4.8 BAUMER

4.8.1 COMPANY SNAPSHOT

4.8.2 PRODUCT PORTFOLIO

4.8.3 RECENT DEVELOPMENTS

4.9 CONTRINEX AG

4.9.1 COMPANY SNAPSHOT

4.9.2 PRODUCT PORTFOLIO

4.9.3 RECENT DEVELOPMENTS

4.1 DATALOGIC S.P.A.

4.10.1 COMPANY SNAPSHOT

4.10.2 REVENUE ANALYSIS

4.10.3 PRODUCT PORTFOLIO

4.10.4 RECENT DEVELOPMENT

4.11 DELTA ELECTRONICS, INC.

4.11.1 COMPANY SNAPSHOT

4.11.2 REVENUE ANALYSIS

4.11.3 PRODUCT PORTFOLIO

4.11.4 RECENT DEVELOPMENT

4.12 EATON

4.12.1 COMPANY SNAPSHOT

4.12.2 REVENUE ANALYSIS

4.12.3 PRODUCT PORTFOLIO

4.12.4 RECENT DEVELOPMENTS

4.13 FARGO CONTROLS INC.

4.13.1 COMPANY SNAPSHOT

4.13.2 PRODUCT PORTFOLIO

4.13.3 RECENT DEVELOPMENTS

4.14 HANS TURCK GMBH & CO. KG

4.14.1 COMPANY SNAPSHOT

4.14.2 PRODUCT PORTFOLIO

4.14.3 RECENT DEVELOPMENT

4.15 HONEYWELL INTERNATIONAL INC.

4.15.1 COMPANY SNAPSHOT

4.15.2 REVENUE ANALYSIS

4.15.3 PRODUCT PORTFOLIO

4.15.4 RECENT DEVELOPMENT

4.16 INFINEON TECHNOLOGIES AG

4.16.1 COMPANY SNAPSHOT

4.16.2 REVENUE ANALYSIS

4.16.3 PRODUCT PORTFOLIO

4.16.4 RECENT DEVELOPMENT

4.17 PEPPERL+FUCHS SE

4.17.1 COMPANY SNAPSHOT

4.17.2 PRODUCT PORTFOLIO

4.17.3 RECENT DEVELOPMENT

4.18 ROCKWELL AUTOMATION, INC.

4.18.1 COMPANY SNAPSHOT

4.18.2 REVENUE ANALYSIS

4.18.3 PRODUCT PORTFOLIO

4.18.4 RECENT DEVELOPMENT

4.19 SEMTECH CORPORATION

4.19.1 COMPANY SNAPSHOT

4.19.2 REVENUE ANALYSIS

4.19.3 PRODUCT PORTFOLIO

4.19.4 RECENT DEVELOPMENT

4.2 SICK AG

4.20.1 COMPANY SNAPSHOT

4.20.2 REVENUE ANALYSIS

4.20.3 PRODUCT PORTFOLIO

4.20.4 RECENT DEVELOPMENT

5 QUESTIONNAIRE

6 RELATED REPORTS

Lista de Tabela

LIST OF TABLES

TABLE 1 NORTH AMERICA PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA INDUCTIVE IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA INDUCTIVE IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA CAPACITIVE IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA CAPACITIVE IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA PHOTOELECTRIC IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA PHOTOELECTRIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA MAGNETIC IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA MAGNETIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA ULTRASONIC IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA ULTRASONIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA PROXIMITY SENSOR MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA ADJUSTABLE DISTANCE IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA FIXED DISTANCE IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA PROXIMITY SENSOR MARKET, BY SENSING RANGE, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA 10MM-40MM IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA 0MM-10MM IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA 40MM-60MM IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA 60MM-80MM IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA GREATER THAN 80MM IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA PROXIMITY SENSOR MARKET, BY CHANNEL TYPE, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA SINGLE CHANNEL IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA MULTI-CHANNEL IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA PROXIMITY SENSOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA DETECTION OF OBJECT IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA POSITION IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA GROUND PROXIMITY WARNING SYSTEM IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA PARKING SENSOR SYSTEMS IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA PARKING SENSOR SYSTEMS IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY,2019-2028, (USD MILLION)

TABLE 31 NORTH AMERICA ASSEMBLY LINE AUTOMATION IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA ANTI-AIRCRAFT WARFARE IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA ROLLER COASTERS IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA ROLLER COASTERS IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY,2019-2028, (USD MILLION)

TABLE 35 NORTH AMERICA VIBRATION MONITORING SYSTEM IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA MOBILE DEVICES IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA MOBILE DEVICES IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY,2019-2028, (USD MILLION)

TABLE 38 NORTH AMERICA CONVEYOR SYSTEMS IN PROXIMITY SENSOR MARKET, BY REGION,2021-2028, (USD MILLION)

TABLE 39 NORTH AMERICA CONVEYOR SYSTEMS IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY,2021-2028, (USD MILLION)

TABLE 40 NORTH AMERICA INSPECTION AND COUNTING IN PROXIMITY SENSOR MARKET, BY REGION,2021-2028, (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN PROXIMITY SENSOR MARKET, BY REGION,2021-2028, (USD MILLION)

TABLE 42 NORTH AMERICA PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA CYLINDRICAL INDUCTIVE SENSOR IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA RECTANGULAR INDUCTIVE SENSOR IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA RING INDUCTIVE SENSOR IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 46 NORTH AMERICA SLOT INDUCTIVE SENSOR IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 47 NORTH AMERICA PROXIMITY SENSOR MARKET, BY END-USER, 2019-2028 (USD MILLION)

TABLE 48 NORTH AMERICA AUTOMOTIVE IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 49 NORTH AMERICA AEROSPACE AND DEFENSE IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 50 NORTH AMERICA BUILDING AUTOMATION IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 51 NORTH AMERICA INDUSTRIAL IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 52 NORTH AMERICA CONSUMER ELECTRONICS (SMARTPHONES, AND TABLETS) IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 53 NORTH AMERICA FOOD AND BEVERAGE IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 54 NORTH AMERICA PHARMACEUTICAL IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 55 NORTH AMERICA CONSTRUCTION IN PROXIMITY SENSOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 56 NORTH AMERICA CONSTRUCTION IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 57 NORTH AMERICA ENERGY IN PROXIMITY SENSOR MARKET, BY REGION,2021-2028, (USD MILLION)

TABLE 58 NORTH AMERICA ENERGY IN PROXIMITY SENSOR MARKET, BY TYPE,2021-2028, (USD MILLION)

TABLE 59 NORTH AMERICA OTHERS IN PROXIMITY SENSOR MARKET, BY REGION,2021-2028, (USD MILLION)

TABLE 60 NORTH AMERICA PROXIMITY SENSOR MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 61 NORTH AMERICA PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 62 NORTH AMERICA INDUCTIVE IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 63 NORTH AMERICA CAPACITIVE IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 64 NORTH AMERICA PHOTOELECTRIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 65 NORTH AMERICA MAGNETIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 66 NORTH AMERICA ULTRASONIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 67 NORTH AMERICA PROXIMITY SENSOR MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 68 NORTH AMERICA PROXIMITY SENSOR MARKET, BY SENSING RANGE, 2019-2028 (USD MILLION)

TABLE 69 NORTH AMERICA PROXIMITY SENSOR MARKET, BY CHANNEL TYPE, 2019-2028 (USD MILLION)

TABLE 70 NORTH AMERICA PROXIMITY SENSOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 71 NORTH AMERICA ROLLER COASTERS IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 72 NORTH AMERICA PARKING SENSOR SYSTEMS PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 73 NORTH AMERICA MOBILE DEVICES IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 74 NORTH AMERICA CONVEYOR SYSTEMS IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 75 NORTH AMERICA PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 76 NORTH AMERICA PROXIMITY SENSOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 77 NORTH AMERICA CONSTRUCTION IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 78 NORTH AMERICA ENERGY IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 79 U.S. PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 80 U.S. INDUCTIVE IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 81 U.S. CAPACITIVE IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 82 U.S. PHOTOELECTRIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 83 U.S. MAGNETIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 84 U.S. ULTRASONIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 85 U.S. PROXIMITY SENSOR MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 86 U.S. PROXIMITY SENSOR MARKET, BY SENSING RANGE, 2019-2028 (USD MILLION)

TABLE 87 U.S. PROXIMITY SENSOR MARKET, BY CHANNEL TYPE, 2019-2028 (USD MILLION)

TABLE 88 U.S. PROXIMITY SENSOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 89 U.S. ROLLER COASTERS IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 90 U.S. PARKING SENSOR SYSTEMS PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 91 U.S. MOBILE DEVICES IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 92 U.S. CONVEYOR SYSTEMS IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 93 U.S. PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 94 U.S. PROXIMITY SENSOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 95 U.S. CONSTRUCTION IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 96 U.S. ENERGY IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 97 CANADA PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 98 CANADA INDUCTIVE IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 99 CANADA CAPACITIVE IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 100 CANADA PHOTOELECTRIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 101 CANADA MAGNETIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 102 CANADA ULTRASONIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 103 CANADA PROXIMITY SENSOR MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 104 CANADA PROXIMITY SENSOR MARKET, BY SENSING RANGE, 2019-2028 (USD MILLION)

TABLE 105 CANADA PROXIMITY SENSOR MARKET, BY CHANNEL TYPE, 2019-2028 (USD MILLION)

TABLE 106 CANADA PROXIMITY SENSOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 107 CANADA ROLLER COASTERS IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 108 CANADA PARKING SENSOR SYSTEMS PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 109 CANADA MOBILE DEVICES IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 110 CANADA CONVEYOR SYSTEMS IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 111 CANADA PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 112 CANADA PROXIMITY SENSOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 113 CANADA CONSTRUCTION IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 114 CANADA ENERGY IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 115 MEXICO PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 116 MEXICO INDUCTIVE IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 117 MEXICO CAPACITIVE IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 118 MEXICO PHOTOELECTRIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 119 MEXICO MAGNETIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 120 MEXICO ULTRASONIC IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 121 MEXICO PROXIMITY SENSOR MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 122 MEXICO PROXIMITY SENSOR MARKET, BY SENSING RANGE, 2019-2028 (USD MILLION)

TABLE 123 MEXICO PROXIMITY SENSOR MARKET, BY CHANNEL TYPE, 2019-2028 (USD MILLION)

TABLE 124 MEXICO PROXIMITY SENSOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 125 MEXICO ROLLER COASTERS IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 126 MEXICO PARKING SENSOR SYSTEMS PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 127 MEXICO MOBILE DEVICES IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 128 MEXICO CONVEYOR SYSTEMS IN PROXIMITY SENSOR MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 129 MEXICO PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 130 MEXICO PROXIMITY SENSOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 131 MEXICO CONSTRUCTION IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 132 MEXICO ENERGY IN PROXIMITY SENSOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

Lista de Figura

LIST OF FIGURES

FIGURE 1 NORTH AMERICA PROXIMITY SENSOR MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PROXIMITY SENSOR MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PROXIMITY SENSOR MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PROXIMITY SENSOR MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PROXIMITY SENSOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PROXIMITY SENSOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PROXIMITY SENSOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PROXIMITY SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PROXIMITY SENSOR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA PROXIMITY SENSOR MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND OF NON-CONTACT SENSING TECHNOLOGY IS EXPECTED TO DRIVE NORTH AMERICA PROXIMITY SENSOR MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 INDUCTIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA PROXIMITY SENSOR MARKET IN 2021 & 2028

FIGURE 1. DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA PROXIMITY SENSOR MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA PROXIMITY SENSOR MARKET

FIGURE 14 NUMBER OF SMARTPHONE USERS WORLDWIDE FROM 2016 TO 2020

FIGURE 15 NORTH AMERICA PROXIMITY SENSOR MARKET: BY TECHNOLOGY, 2020

FIGURE 16 NORTH AMERICA PROXIMITY SENSOR MARKET: BY PRODUCT, 2020

FIGURE 17 NORTH AMERICA PROXIMITY SENSOR MARKET: BY SENSING RANGE, 2020

FIGURE 18 NORTH AMERICA PROXIMITY SENSOR MARKET: BY CHANNEL TYPE, 2020

FIGURE 19 NORTH AMERICA PROXIMITY SENSOR MARKET: BY APPLICATION, 2020

FIGURE 20 NORTH AMERICA PROXIMITY SENSOR MARKET: BY TYPE, 2020

FIGURE 21 NORTH AMERICA PROXIMITY SENSOR MARKET: BY END-USER, 2020

FIGURE 22 NORTH AMERICA PROXIMITY SENSOR MARKET: SNAPSHOT (2020)

FIGURE 23 NORTH AMERICA PROXIMITY SENSOR MARKET: BY COUNTRY (2020)

FIGURE 24 NORTH AMERICA PROXIMITY SENSOR MARKET: BY COUNTRY (2019-2028)

FIGURE 25 NORTH AMERICA PROXIMITY SENSOR MARKET: BY COUNTRY (2019-2028)

FIGURE 26 NORTH AMERICA PROXIMITY SENSOR MARKET: BY TYPE (2021-2028)

FIGURE 27 NORTH AMERICA PROXIMITY SENSOR MARKET: COMPANY SHARE 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.