North America Polyglycerol Esters Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

143.32 Million

USD

171.79 Million

2024

2032

USD

143.32 Million

USD

171.79 Million

2024

2032

| 2025 –2032 | |

| USD 143.32 Million | |

| USD 171.79 Million | |

|

|

|

|

Segmentação do mercado de ésteres de poliglicerol na América do Norte, por grau (grau alimentício, grau farmacêutico e grau industrial), forma (espessantes, solubilizantes, agentes de espalhamento, aditivos, sólidos cerosos e ingredientes inertes), valor de hidroxila (50 a 150, 30 a 49, menos de 30 e mais de 150), cor (amarelo claro, âmbar, bege claro e marrom), aplicação (alimentos, cuidados pessoais, produtos farmacêuticos, surfactantes e detergentes e outros) - Tendências do setor e previsão até 2032

Tamanho do mercado de ésteres de poliglicerol na América do Norte

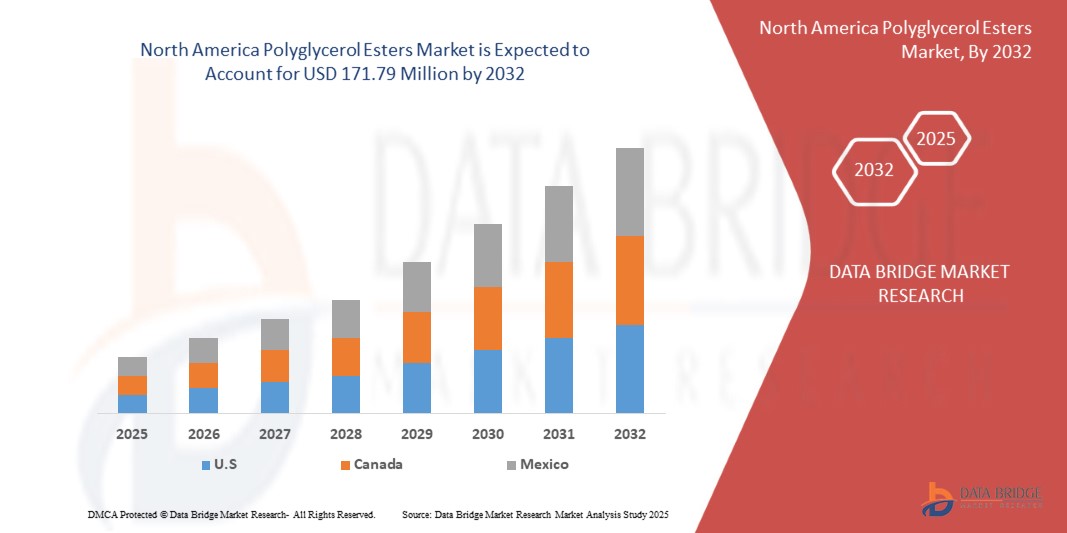

- O tamanho do mercado de ésteres de poliglicerol da América do Norte foi avaliado em US$ 143,32 milhões em 2024 e deve atingir US$ 171,79 milhões até 2032 , com um CAGR de 2,29% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente adoção de ésteres de poliglicerol como emulsificantes naturais e multifuncionais em aplicações alimentícias, de cuidados pessoais e farmacêuticas. A crescente preferência do consumidor por ingredientes sustentáveis, de rótulo limpo e derivados de plantas está incentivando os fabricantes a substituir aditivos sintéticos por EGPs, fortalecendo assim sua penetração no mercado global.

- Além disso, a crescente demanda por emulsificantes de alto desempenho que melhoram a textura, a estabilidade e a vida útil de alimentos processados, bebidas, cosméticos e formulações de medicamentos está acelerando a adoção de ésteres de poliglicerol. Esses fatores convergentes estão impulsionando a ampla adoção e impulsionando significativamente o crescimento geral do mercado.

Análise do mercado de ésteres de poliglicerol na América do Norte

- Ésteres de poliglicerol são emulsificantes não iônicos derivados de ácidos graxos naturais e poliglicerol, oferecendo aplicações como solubilizantes, espessantes, agentes de espalhamento e estabilizantes em diversos setores. São amplamente utilizados em panificação, laticínios, confeitaria, cosméticos e produtos farmacêuticos, devido à sua versatilidade, segurança e compatibilidade com as tendências de produtos sustentáveis.

- A crescente demanda por ésteres de poliglicerol é impulsionada principalmente pelo crescimento do consumo de alimentos processados, pelo foco crescente em formulações de rótulos limpos e pela crescente conscientização do consumidor sobre ingredientes multifuncionais e ecologicamente corretos. Seu amplo escopo de aplicação e sua capacidade de atender às expectativas regulatórias e dos consumidores os tornam um componente essencial nas indústrias de alimentos e cuidados pessoais em constante evolução.

- Os EUA dominaram o mercado de ésteres de poliglicerol da América do Norte em 2024, devido à forte demanda da indústria de processamento de alimentos, especialmente em aplicações de panificação, confeitaria, laticínios e bebidas.

- Espera-se que o Canadá seja o país com crescimento mais rápido no mercado de ésteres de poliglicerol da América do Norte durante o período previsto devido à crescente demanda por emulsificantes naturais em alimentos processados, bebidas e produtos de higiene pessoal.

- O segmento de grau alimentício dominou o mercado, com uma participação de mercado de 53,1% em 2024, devido à sua ampla aplicação em produtos de panificação, confeitaria, laticínios e bebidas como emulsificante e estabilizante. Os processadores de alimentos preferem o PGE de grau alimentício devido à sua capacidade de melhorar a textura, prolongar a vida útil e aprimorar a consistência do produto sem comprometer a segurança. A crescente demanda dos consumidores por emulsificantes de rótulo limpo e derivados de plantas também fortaleceu a posição dos PGEs de grau alimentício nos mercados globais, especialmente na produção de alimentos embalados.

Escopo do Relatório e Segmentação do Mercado de Ésteres de Poliglicerol na América do Norte

|

Atributos |

Principais insights de mercado sobre ésteres de poliglicerol na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de ésteres de poliglicerol na América do Norte

Aumento da demanda por emulsificantes alimentares

- A crescente demanda por emulsificantes alimentares está impulsionando uma expansão significativa no mercado de ésteres de poliglicerol na América do Norte, visto que esses compostos são cada vez mais utilizados para melhorar a estabilidade, a textura e a vida útil de alimentos processados. Com o aumento do consumo global de alimentos embalados e de conveniência, os fabricantes estão recorrendo aos EGPs como emulsificantes multifuncionais que melhoram a qualidade do produto e a satisfação do consumidor.

- Por exemplo, a Palsgaard A/S expandiu seu portfólio de ésteres de poliglicerol para os segmentos de panificação e confeitaria, permitindo um desempenho consistente do produto em aplicações como bolos, sorvetes e chocolates. Da mesma forma, a BASF desenvolve ingredientes à base de EGP com foco na regulação da cristalização de gordura, na melhoria da aeração e na estabilidade da textura em margarinas e substitutos lácteos.

- Os ésteres de poliglicerol são altamente valorizados no processamento de alimentos devido à sua capacidade de estabilizar misturas de óleo em água, melhorar a dispersão do sabor e manter a estabilidade na prateleira em condições variáveis de armazenamento. A crescente penetração de alimentos de conveniência em economias emergentes e as mudanças no estilo de vida dos consumidores estão impulsionando diretamente a demanda por esses emulsificantes de grau alimentício.

- A busca por ingredientes com rótulos limpos também está influenciando a tendência, já que os ésteres de poliglicerol são amplamente reconhecidos como aditivos seguros e versáteis. Os fabricantes estão cada vez mais substituindo emulsificantes sintéticos por EGPs para atender às preferências dos consumidores por componentes alimentares naturais, seguros e sustentáveis.

- Além disso, o crescimento de produtos de panificação premium, alternativas alimentares à base de plantas e sobremesas congeladas reforça ainda mais a importância de emulsificantes confiáveis. Os EGPs garantem a consistência na produção industrial de alimentos e também apoiam a inovação em novas formulações de produtos voltadas para consumidores preocupados com a saúde.

- Em última análise, a crescente demanda por emulsificantes alimentícios nas categorias de alimentos processados e embalados posiciona os ésteres de poliglicerol como um importante impulsionador de crescimento. Espera-se que essa tendência continue, à medida que as expectativas dos consumidores por qualidade, segurança e praticidade reforçam a dependência global de soluções avançadas em emulsificantes.

Dinâmica do mercado de ésteres de poliglicerol na América do Norte

Motorista

Expansão da Indústria Farmacêutica

- A rápida expansão da indústria farmacêutica está influenciando positivamente a demanda por ésteres de poliglicerol, visto que eles estão sendo cada vez mais utilizados em formulações e sistemas de liberação de medicamentos. Suas propriedades como solubilizantes, dispersantes e emulsificantes tornam os PGEs altamente úteis na estabilização de compostos farmacêuticos e no aumento da biodisponibilidade.

- Por exemplo, a Croda International oferece PGEs especiais projetados para uso em sistemas de administração oral de medicamentos, auxiliando na solubilização de ingredientes farmacêuticos ativos (IFAs) pouco solúveis. Isso permitiu que os fabricantes farmacêuticos utilizassem PGEs para desenvolver formulações aprimoradas que atendem aos requisitos de eficácia e estabilidade.

- O aumento global na produção de medicamentos genéricos e biológicos está impulsionando ainda mais a demanda, visto que os PGEs fornecem suporte crítico na estabilização de moléculas sensíveis. Sua compatibilidade com uma ampla gama de excipientes farmacêuticos os torna adaptáveis a diversas formas farmacêuticas, incluindo comprimidos, cápsulas, pomadas e xaropes.

- Além disso, o foco da indústria em formulações de medicamentos centradas no paciente está reforçando o papel dos PGEs. Propriedades aprimoradas de mascaramento de sabor, estabilidade aprimorada e perfis farmacológicos seguros os tornam ingredientes confiáveis para o desenvolvimento terapêutico, especialmente em formulações pediátricas e geriátricas.

- Em conclusão, a expansão do setor farmacêutico está garantindo uma demanda sustentada por ésteres de poliglicerol. Sua versatilidade em diferentes sistemas de administração de fármacos e estabilidade de formulação os posiciona como excipientes indispensáveis que continuarão a desempenhar um papel central na inovação farmacêutica e no crescimento da indústria.

Restrição/Desafio

Questões de conformidade regulatória e aprovação

- Um dos maiores desafios no mercado de ésteres de poliglicerol da América do Norte reside na complexidade dos procedimentos de conformidade e aprovação regulatória em diferentes regiões. Como os EGPs são utilizados tanto em aplicações alimentícias quanto farmacêuticas, eles estão sujeitos a avaliações rigorosas por órgãos reguladores para garantir que os padrões de segurança e qualidade sejam atendidos de forma consistente.

- Por exemplo, as empresas que introduzem EGP na UE devem cumprir as avaliações e os requisitos de rotulagem da Autoridade Europeia para a Segurança Alimentar (EFSA), enquanto nos EUA, a FDA impõe a conformidade por meio do status GRAS (Geralmente Reconhecido como Seguro). Esses padrões divergentes aumentam a complexidade e retardam as estratégias de lançamento no mercado dos fabricantes.

- O processo de obtenção de aprovações para novas aplicações, especialmente em produtos farmacêuticos ou nutrição infantil, consome muitos recursos e tempo. Testes, documentação e verificações de conformidade extensivos criam obstáculos, especialmente para empresas menores que carecem de experiência regulatória e recursos financeiros.

- Além disso, as revisões periódicas das diretrizes regulatórias e o aumento do escrutínio do consumidor em relação aos aditivos alimentares aumentam a incerteza no planejamento de negócios. Os fabricantes são obrigados a se adaptar continuamente às estruturas de conformidade em evolução, mantendo, ao mesmo tempo, a transparência na obtenção e aplicação dos ingredientes.

- Como resultado, questões de conformidade e aprovação regulatórias continuam sendo uma restrição estrutural ao mercado de ésteres de poliglicerol na América do Norte. Superar esses desafios exigirá colaboração consistente com os reguladores, gestão proativa de riscos e investimento em práticas sustentáveis de P&D para garantir a segurança dos produtos e, ao mesmo tempo, atender às demandas de crescimento do mercado.

Escopo do mercado de ésteres de poliglicerol na América do Norte

O mercado é segmentado com base em grau, forma, valor de hidroxila, cor e aplicação.

• Por Grau

Com base na classificação, o mercado de ésteres de poliglicerol da América do Norte é segmentado em grau alimentício, grau farmacêutico e grau industrial. O segmento de grau alimentício dominou a maior fatia de mercado, com 53,1% da receita em 2024, impulsionado por sua ampla aplicação em produtos de panificação, confeitaria, laticínios e bebidas como emulsificante e estabilizante. Processadores de alimentos preferem o PGE de grau alimentício devido à sua capacidade de melhorar a textura, prolongar a vida útil e aprimorar a consistência do produto sem comprometer a segurança. A crescente demanda do consumidor por emulsificantes de rótulo limpo e derivados de plantas também fortaleceu a posição dos PGEs de grau alimentício nos mercados globais, especialmente na produção de alimentos embalados.

Prevê-se que o segmento de grau farmacêutico apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pelo seu uso crescente como solubilizante, intensificador de biodisponibilidade e agente estabilizante em formulações de medicamentos. Os crescentes investimentos em novos sistemas de liberação de medicamentos e o foco crescente em excipientes que atendem aos padrões regulatórios estão impulsionando a demanda. A mudança da indústria farmacêutica para excipientes mais seguros, biocompatíveis e multifuncionais posiciona a PGE de grau farmacêutico como um facilitador fundamental em formulações de cápsulas, pomadas e medicamentos de liberação controlada.

• Por Formulário

Com base na forma, o mercado é segmentado em espessantes, solubilizantes, agentes de espalhamento, aditivos, sólidos cerosos e ingredientes inertes. O segmento de solubilizantes foi responsável pela maior participação na receita em 2024, impulsionado por sua alta adoção em formulações de alimentos, bebidas e cuidados pessoais para melhorar a solubilidade e a dispersão de compostos hidrofóbicos. Os PGEs de grau solubilizante são particularmente importantes em bebidas, molhos, cremes e loções, onde a consistência uniforme é essencial, e a demanda está alinhada à crescente preferência por emulsificantes naturais e estáveis.

O segmento de agentes de espalhamento deverá crescer com a CAGR mais rápida entre 2025 e 2032, impulsionado pelo seu uso crescente em cosméticos, cuidados com a pele e aplicações farmacêuticas tópicas. Os PGEs como agentes de espalhamento melhoram as propriedades sensoriais, a sensação na pele e a absorção do produto, tornando-os atraentes para formuladores de cremes e loções de alto desempenho. O crescimento é ainda impulsionado pela crescente demanda do consumidor por ingredientes multifuncionais para cuidados pessoais que ofereçam eficácia e segurança, apoiando uma adoção mais ampla em produtos premium de beleza e dermatologia.

• Por valor de hidroxila

Com base no valor de hidroxila, o mercado é segmentado em 50 a 150, 30 a 49, menos de 30 e mais de 150. O segmento com valor de hidroxila de 50 a 150 dominou a participação de mercado em 2024, devido às suas propriedades de emulsificação balanceadas, adequadas para processamento de alimentos, estabilização de laticínios e formulações para cuidados pessoais. Essa linha oferece versatilidade em desempenho, tornando-se a escolha preferida para fabricantes que buscam estabilidade funcional e custo-benefício.

Espera-se que o segmento com valor de hidroxila inferior a 30 registre o crescimento mais rápido entre 2025 e 2032, impulsionado por seu uso em formulações especiais de alta qualidade, onde a emulsificação suave e a estabilidade são cruciais. Este segmento encontra aplicação crescente em produtos farmacêuticos, cosméticos premium e produtos alimentícios de nicho, onde a emulsificação controlada e a estabilização suave aprimoram a qualidade do produto. A crescente demanda por emulsificantes especializados em categorias de produtos premium e voltados para a saúde está acelerando a adoção desta linha.

• Por cor

Com base na cor, o mercado de ésteres de poliglicerol da América do Norte é segmentado em amarelo-claro, âmbar, bege-claro e marrom. O segmento amarelo-claro dominou a participação de mercado em 2024, sendo amplamente preferido em aplicações alimentícias e de cuidados pessoais devido à sua aparência limpa e adequada para produtos que exigem mínimo impacto visual. Os fabricantes preferem PGEs amarelo-claros para formulações de panificação, laticínios e cosméticos, onde clareza, estética e apelo ao consumidor são importantes.

A previsão é de que o segmento âmbar apresente o crescimento mais rápido entre 2025 e 2032, devido à sua adequação a aplicações industriais e especializadas, incluindo surfactantes e detergentes. Os PGEs de cor âmbar oferecem maior tolerância a variações de processamento e desempenho consistente em formulações onde a uniformidade da cor é menos crítica. A crescente demanda por surfactantes de origem biológica e aditivos industriais reforça ainda mais a expansão dessa categoria.

• Por aplicação

Com base na aplicação, o mercado é segmentado em alimentos, cuidados pessoais, produtos farmacêuticos, surfactantes e detergentes, entre outros. O segmento alimentício dominou a maior fatia da receita em 2024, impulsionado pelo aumento do consumo de alimentos processados e de conveniência que exigem emulsificantes eficientes. Os EGPs melhoram a maciez dos produtos de panificação, a cremosidade dos laticínios e a estabilidade das bebidas, tornando-os indispensáveis na fabricação de alimentos em larga escala. A tendência por aditivos alimentares naturais, derivados de plantas, também reforçou o domínio dos EGPs neste setor.

O segmento de cuidados pessoais deverá crescer com a CAGR mais rápida entre 2025 e 2032, impulsionado pela crescente demanda do consumidor por ingredientes naturais e multifuncionais em cuidados com a pele, cabelos e cosméticos. Os EGPs atuam como emulsificantes, hidratantes e agentes de espalhamento eficazes, proporcionando benefícios sensoriais e estabilidade a cremes, loções e protetores solares. O movimento de rótulos limpos, aliado ao crescimento de produtos de beleza orgânicos, está criando novas oportunidades para EGPs no setor de cuidados pessoais.

Análise regional do mercado de ésteres de poliglicerol na América do Norte

- Os EUA dominaram o mercado de ésteres de poliglicerol da América do Norte com a maior participação na receita em 2024, impulsionados pela forte demanda da indústria de processamento de alimentos, especialmente em aplicações de panificação, confeitaria, laticínios e bebidas.

- O mercado maduro de alimentos embalados e de conveniência do país, aliado à alta preferência do consumidor por emulsificantes naturais e de rótulos limpos, impulsionou a adoção. Investimentos robustos em inovação alimentar, aliados ao apoio regulatório para aditivos seguros e sustentáveis, estão reforçando o domínio dos EGPs no mercado americano.

- A presença de fabricantes consolidados, atividades avançadas de P&D e ampla aplicação em cuidados pessoais e produtos farmacêuticos contribuem ainda mais para a liderança do segmento

Visão geral do mercado de ésteres de poliglicerol na América do Norte e Canadá

A projeção é que o Canadá registre o CAGR mais rápido no mercado norte-americano entre 2025 e 2032, impulsionado pela crescente demanda por emulsificantes naturais em alimentos processados, bebidas e produtos de higiene pessoal. A crescente conscientização do consumidor sobre ingredientes de origem vegetal e benéficos à saúde está impulsionando a adoção nos setores de alimentos e cosméticos. A expansão da produção nacional de alimentos, aliada a uma crescente mudança para excipientes sustentáveis e multifuncionais em produtos farmacêuticos, fortalece as perspectivas de crescimento. O mercado canadense também conta com um ambiente regulatório favorável a aditivos de origem biológica e seguros.

Visão geral do mercado de ésteres de poliglicerol na América do Norte e no México

Espera-se que o México testemunhe um crescimento constante entre 2025 e 2032, impulsionado pela crescente urbanização, mudanças nas preferências alimentares e aumento da demanda por alimentos e bebidas embalados. O crescimento nos setores de panificação, confeitaria e laticínios está gerando uma demanda consistente por EGPs como emulsificantes e estabilizantes. A expansão dos mercados de cosméticos e cuidados pessoais também está contribuindo para a adoção, especialmente em produtos acessíveis para a pele e os cabelos. Colaborações entre produtores locais de alimentos e fornecedores internacionais estão aumentando a disponibilidade dos produtos, apoiando uma maior penetração no mercado em todo o país.

Participação no mercado de ésteres de poliglicerol na América do Norte

A indústria de ésteres de poliglicerol é liderada principalmente por empresas bem estabelecidas, incluindo:

- Taiyo Kagaku Co., Ltd. (Japão)

- Olean NV (Bélgica)

- Evonik Industries AG (Alemanha)

- Lonza (Suíça)

- NIHON EMULSION Co., Ltd. (Japão)

- BASF SE (Alemanha)

- Henan Chemsino Industry Co., Ltd (China)

- ABITEC (EUA)

- Foodchem International Corporation (China)

Últimos desenvolvimentos no mercado de ésteres de poliglicerol da América do Norte

- Em agosto de 2024, a Foodchem, líder no setor de ingredientes alimentícios, anunciou sua participação na FISA 2024, em São Paulo, Brasil, apresentando soluções inovadoras em ingredientes alimentícios no estande D-95. Este compromisso fortalece a presença global da Foodchem, aumentando a visibilidade da marca na América Latina e apoiando sua estratégia de expandir o alcance de clientes em mercados emergentes. Espera-se que o evento impulsione a demanda por ésteres de poliglicerol em aplicações de alimentos e bebidas, promovendo seu papel como emulsificantes naturais e multifuncionais.

- Em março de 2024, a Lonza concluiu a aquisição da unidade de produtos biológicos da Roche, a Genentech, em Vacaville, Califórnia, por US$ 1,2 bilhão, com um investimento adicional de US$ 500 milhões planejado para modernização das instalações. Essa expansão aumenta significativamente a capacidade de produção da Lonza, permitindo que a empresa atenda à crescente demanda por ingredientes de origem biológica e excipientes farmacêuticos, incluindo ésteres de poliglicerol. A aquisição posiciona a Lonza para atender às crescentes necessidades das indústrias farmacêutica e de cuidados pessoais, reforçando seu papel no fornecimento de ingredientes especiais sustentáveis e de alta qualidade.

- Em novembro de 2023, a Palsgaard anunciou um investimento estratégico para expandir sua capacidade de produção de emulsificantes na Dinamarca, com operações em escala previstas para 2025. A expansão beneficia diretamente o mercado de ésteres de poliglicerol da América do Norte, garantindo maior disponibilidade de fornecimento para fabricantes globais de alimentos que buscam soluções de emulsificação natural. Ao ampliar sua base de produção, a Palsgaard atende à crescente demanda por emulsificantes de rótulo limpo e derivados de plantas, fortalecendo assim sua posição como fornecedora-chave nas indústrias de alimentos e cuidados pessoais.

- Em outubro de 2023, a BASF apresentou suas mais recentes soluções para cuidados com a casa, limpeza I&I e cuidados pessoais no Congresso SEPAWA em Berlim, como parte de sua Iniciativa de Produtos Químicos para Cuidados Care 360° – Soluções para uma Vida Sustentável. A iniciativa integra sustentabilidade, digitalização e inovação ao desenvolvimento de produtos, destacando o compromisso da BASF com soluções químicas ambientalmente responsáveis. Isso apoia diretamente a adoção de ésteres de poliglicerol em formulações sustentáveis, alinhando-se às tendências globais de consumo por ingredientes ecologicamente corretos e multifuncionais.

- Em setembro de 2023, a Croda International revelou novos avanços em seu portfólio de ingredientes de origem biológica na in-cosmetics Latin America, com ênfase em emulsificantes multifuncionais para aplicações em cuidados pessoais. A apresentação destacou a versatilidade dos ésteres de poliglicerol no aprimoramento da textura, estabilidade e benefícios sensoriais de formulações cosméticas. Ao expandir sua oferta de produtos na América Latina, a Croda fortalece sua presença no mercado regional e atende à crescente demanda por ingredientes naturais e sustentáveis em beleza e cuidados pessoais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.