North America Point Of Care Poc Drug Abuse Testing Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

585.51 Million

USD

851.98 Million

2024

2032

USD

585.51 Million

USD

851.98 Million

2024

2032

| 2025 –2032 | |

| USD 585.51 Million | |

| USD 851.98 Million | |

|

|

|

|

Segmentação do mercado de testes de abuso de drogas no ponto de atendimento (POC) na América do Norte, por tipo de droga (anfetaminas, opiáceos, canabinoides, cocaína, barbitúricos, benzodiazepínicos, metadona, fenciclidina, antidepressivos tricíclicos e outros), produtos (dispositivos, consumíveis e acessórios), prescrição (testes sem receita e testes com receita), tipo de amostra (urina, saliva, sangue, cabelo, hálito e outros), tipo de teste (testes aleatórios, testes pós-incidente e testes de abstinência), aplicação (triagem médica, triagem no local de trabalho, aplicação da lei e justiça criminal, gerenciamento da dor, tratamento e reabilitação de abuso de substâncias, testes de drogas parentais ou domiciliares, testes esportivos e atléticos, triagem de drogas em escolas e instituições educacionais e outros), usuário final (instalações de saúde, empregadores, institutos governamentais e outros), canal de distribuição (licitação direta, Vendas no Varejo e Outros) - Tendências e Previsões do Setor até 2032

Tamanho do mercado de testes de abuso de drogas no ponto de atendimento (POC) na América do Norte

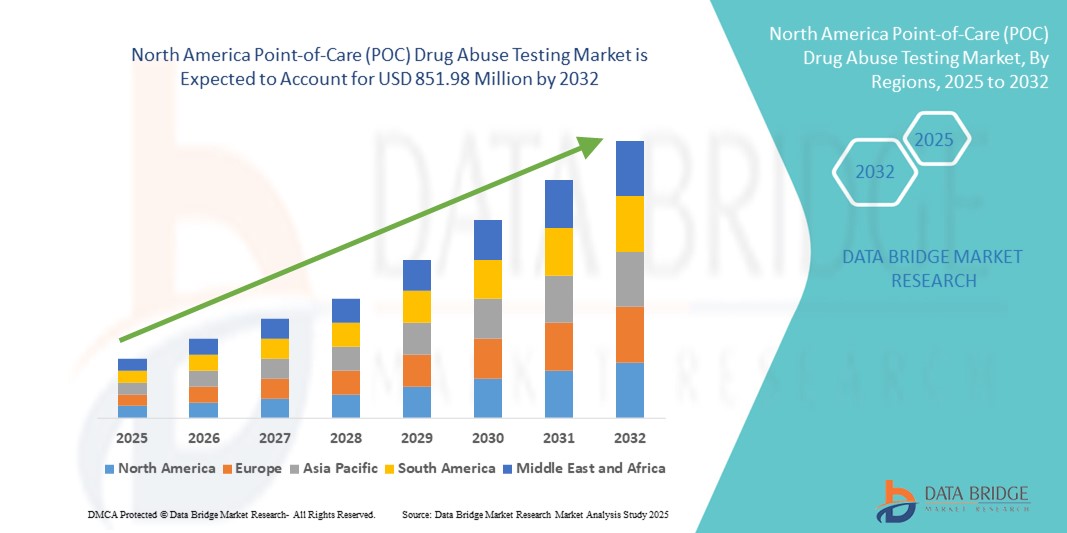

- O tamanho do mercado de testes de abuso de drogas no ponto de atendimento (POC) da América do Norte foi avaliado em US$ 585,51 milhões em 2024 e deve atingir US$ 851,98 milhões até 2032 , com um CAGR de 4,80% durante o período previsto.

- O crescimento do mercado é impulsionado principalmente pelo aumento das taxas de abuso de substâncias na região, o que gera uma demanda maior por métodos de testes rápidos e no local de trabalho em ambientes policiais, locais de trabalho e clínicos.

- Além disso, a mudança para a assistência médica descentralizada e a crescente disponibilidade de tecnologias de diagnóstico portáteis reforçam a relevância dos testes de drogas em locais de atendimento como uma solução de triagem de primeira linha. Essas dinâmicas combinadas estão acelerando a penetração no mercado e expandindo a adoção de plataformas inovadoras de testes de drogas em toda a América do Norte.

Análise de mercado de testes de abuso de drogas no ponto de atendimento (POC) na América do Norte

- Os testes de abuso de drogas POC, que permitem a detecção imediata de substâncias ilícitas no local de atendimento ou próximo a ele, tornaram-se uma ferramenta essencial nos sistemas de saúde, conformidade no local de trabalho e jurídicos devido à sua rápida execução, facilidade de uso e eliminação da dependência de laboratório.

- A procura do mercado é em grande parte alimentada pela crescente incidência do abuso de drogas, particularmente opioides e drogas sintéticas, juntamente com políticas mais rigorosas no local de trabalho e iniciativas de saúde pública destinadas à detecção e intervenção precoces.

- Os EUA dominaram o mercado de testes de abuso de drogas no ponto de atendimento (POC) da América do Norte com a maior participação na receita de 84,4% em 2024, apoiados por forte apoio governamental, ampla adoção nos setores de saúde e justiça criminal e a presença de empresas líderes em diagnósticos que promovem tecnologias POC conectadas e habilitadas por IA.

- Espera-se que o Canadá seja o país com crescimento mais rápido no mercado de testes de abuso de drogas no local de atendimento (POC) durante o período previsto, impulsionado pela crescente conscientização pública, descentralização da assistência médica e adoção crescente de ferramentas de triagem portáteis em ambientes de emergência e saúde comunitária.

- O segmento de urina dominou o mercado de testes de abuso de drogas no ponto de atendimento (POC) da América do Norte, com uma participação de mercado de 49,8% em 2024, devido à sua ampla gama de detecção de substâncias, baixo custo e confiabilidade estabelecida para uso em diversos ambientes de triagem.

Escopo do relatório e segmentação do mercado de testes de abuso de drogas no ponto de atendimento (POC) na América do Norte

|

Atributos |

Principais insights de mercado sobre testes de abuso de drogas no ponto de atendimento (POC) na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de testes de abuso de drogas no ponto de atendimento (POC) na América do Norte

Avanço das tecnologias de testes digitais e conectados

- Uma tendência significativa e crescente no mercado de testes de abuso de drogas POC na América do Norte é a integração de conectividade digital inteligente e tecnologias habilitadas para dispositivos móveis em plataformas de testes de drogas, permitindo transmissão de dados contínua, compartilhamento de resultados em tempo real e tomada de decisão clínica aprimorada.

- Por exemplo, o Sistema de Teste Móvel SoToxa da Abbott foi projetado para uso policial, oferecendo testes de drogas rápidos e confiáveis na estrada com captura digital dos resultados. Da mesma forma, a Thermo Fisher Scientific continua aprimorando seu portfólio de testes rápidos com recursos conectados à nuvem para fluxos de trabalho simplificados na área da saúde.

- A adoção de soluções POC conectadas permite que provedores de saúde, empregadores e agências de segurança pública armazenem e transmitam com segurança os resultados dos testes por meio de plataformas integradas, melhorando a eficiência e apoiando o atendimento coordenado ou as respostas de segurança.

- Análises avançadas de dados e ferramentas assistidas por IA também estão sendo exploradas para melhorar a precisão dos resultados, identificar padrões de uso e apoiar o monitoramento populacional das tendências de abuso de drogas. Esses recursos são particularmente úteis em programas de saúde pública e iniciativas de triagem em larga escala.

- A crescente demanda por dispositivos inteligentes, portáteis e interoperáveis que possam interagir com prontuários eletrônicos de saúde (PEP) e aplicativos móveis está moldando o futuro dos testes POC na América do Norte. Essas tecnologias apoiam a testagem descentralizada e oferecem soluções escaláveis e centradas no paciente.

- Essa tendência em direção à digitalização e à integração inteligente está redefinindo as expectativas de velocidade, precisão e usabilidade em ferramentas de triagem de abuso de drogas, impulsionando a indústria em direção à inovação em soluções de cuidados conectados.

Dinâmica do mercado de testes de abuso de drogas no ponto de atendimento (POC) na América do Norte

Motorista

Aumento da demanda devido à crise dos opioides e aos requisitos regulatórios de testes

- A crescente epidemia de opioides e o uso crescente de drogas sintéticas ampliaram a urgência de detecção e intervenção precoces, impulsionando significativamente a adoção de testes de abuso de drogas POC em toda a América do Norte.

- Por exemplo, agências federais dos EUA, como o Departamento de Transportes e a OSHA, exigem exames frequentes de drogas em indústrias como transporte, construção e saúde, alimentando a demanda por tecnologias de testes rápidos e confiáveis no local.

- A disponibilidade de dispositivos de teste POC compactos, móveis e fáceis de usar capacitou programas de saúde pública, instalações correcionais, equipes de emergência e centros de reabilitação a expandir as capacidades de triagem além dos ambientes laboratoriais tradicionais.

- Além disso, o aumento das campanhas de conscientização pública e o financiamento das autoridades de saúde aceleraram a implantação de testes de drogas POC em iniciativas de saúde comunitária, escolas e locais de trabalho.

- A capacidade de obter resultados precisos e em tempo real com infraestrutura mínima tornou o teste POC uma solução preferencial para tomada de decisão imediata em ambientes clínicos e não clínicos, reforçando sua crescente importância na luta contra o abuso de substâncias.

Restrição/Desafio

Preocupações com a precisão e obstáculos à conformidade regulatória

- Apesar da crescente adoção, as preocupações com a precisão e a sensibilidade de certos testes rápidos de drogas POC continuam sendo um desafio fundamental, especialmente em aplicações clínicas e forenses de alto risco, onde a precisão é crítica.

- Por exemplo, fatores ambientais, coleta inadequada de amostras ou variabilidade na qualidade dos testes podem levar a falsos positivos ou negativos, gerando ceticismo entre clínicos e profissionais jurídicos.

- Além disso, os fabricantes devem navegar por estruturas regulatórias complexas, como a aprovação 510(k) da FDA nos EUA e os requisitos de licenciamento da Health Canada, o que pode atrasar a entrada no mercado e limitar a disponibilidade do produto.

- A integração de componentes digitais também levanta preocupações sobre a privacidade dos dados e a conformidade com os regulamentos de dados de saúde, como o HIPAA, exigindo investimento em sistemas seguros e treinamento de pessoal.

- A superação desses desafios exigirá que os fabricantes aprimorem os processos de validação de testes, ofereçam educação aos clínicos, invistam em medidas robustas de segurança cibernética e desenvolvam plataformas de teste mais padronizadas, precisas e compatíveis para manter a confiança do usuário e garantir o crescimento sustentado do mercado.

Escopo de mercado de testes de abuso de drogas no ponto de atendimento (POC) na América do Norte

O mercado é segmentado com base no tipo de medicamento, produtos, tipo de prescrição, tipo de amostra, tipo de teste, aplicação, usuário final e canal de distribuição.

- Por tipo de medicamento

Com base no tipo de droga, o mercado de testes de abuso de drogas no local de atendimento (POC) na América do Norte é segmentado em anfetaminas, opiáceos, canabinoides, cocaína, barbitúricos, benzodiazepínicos, metadona, fenciclidina, antidepressivos tricíclicos e outros. O segmento de opiáceos dominou o mercado, com a maior participação na receita em 2024, principalmente devido à atual crise de opioides nos Estados Unidos e Canadá, impulsionando a demanda por ferramentas de detecção rápida e no local em atendimentos de emergência, segurança no trabalho e aplicação da lei. O uso indevido generalizado de opioides sintéticos, como o fentanil, reforçou ainda mais a necessidade crítica de triagem rápida de opiáceos em diversos cenários.

Prevê-se que o segmento de canabinoides apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente legalização da cannabis para uso medicinal e recreativo. Essa mudança regulatória levou a um aumento nos requisitos de triagem em locais de trabalho, estradas e escolas, impulsionando a adoção de testes POC específicos para canabinoides.

- Por produtos

Com base nos produtos, o mercado de testes de abuso de drogas no local de atendimento (POC) da América do Norte é segmentado em dispositivos, consumíveis e acessórios. O segmento de dispositivos deteve a maior fatia da receita de mercado em 2024, impulsionado pela ampla implantação de analisadores portáteis e de mesa em ambientes clínicos e não clínicos. Esses dispositivos oferecem portabilidade, resultados rápidos e conectividade digital, tornando-os essenciais em aplicações com prazos apertados, como serviços de emergência e justiça criminal.

Espera-se que o segmento de consumíveis e acessórios apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela necessidade recorrente de tiras de teste, kits de reagentes e ferramentas de coleta de amostras. A expansão dos programas de triagem de rotina nos setores de saúde e corporativo continua a impulsionar a demanda por componentes de teste de uso único.

- Por tipo de prescrição

Com base no tipo de prescrição, o mercado de testes de abuso de drogas no local de atendimento (POC) na América do Norte é segmentado em testes sem receita e testes com receita médica. O segmento de testes sem receita médica dominou o mercado em 2024, impulsionado pela crescente preferência do consumidor por kits de teste de drogas autoadministrados para uso pessoal, parental ou doméstico. Este segmento se beneficia da ampla disponibilidade no varejo e da crescente conscientização pública sobre o monitoramento do abuso de substâncias.

O segmento de testes baseados em prescrição deverá crescer de forma constante ao longo do período previsto devido ao seu uso em aplicações clínicas regulamentadas, particularmente em programas de gerenciamento de dor e reabilitação, onde a documentação formal e a precisão são essenciais.

- Por tipo de amostra

Com base no tipo de amostra, o mercado de testes de abuso de drogas no local de atendimento (POC) na América do Norte é segmentado em urina, saliva, sangue, cabelo, hálito e outros. O segmento de urina deteve a maior participação de mercado, com 49,8% de receita em 2024, devido à sua relação custo-benefício, longa janela de detecção e aceitação regulatória na maioria dos programas formais de triagem. A urina continua sendo o padrão ouro para a triagem inicial de abuso de drogas em ambientes de saúde e correcionais.

Espera-se que o segmento de saliva testemunhe a maior taxa de crescimento entre 2025 e 2032, apoiado por sua coleta não invasiva, facilidade de uso e adequação para detecção de drogas em tempo real, especialmente em cenários de testes em estradas e locais de trabalho.

- Por tipo de teste

Com base no tipo de teste, o mercado de testes de abuso de drogas no local de atendimento (POC) na América do Norte é segmentado em testes aleatórios, testes pós-incidente e testes de abstinência. O segmento de testes aleatórios dominou o mercado, com a maior participação na receita em 2024, sendo utilizado principalmente por empregadores, órgãos de segurança pública e centros de reabilitação para manter a conformidade e a segurança. Os testes aleatórios são amplamente considerados um impedimento eficaz contra o abuso de substâncias em ambientes de alto risco.

Espera-se que o segmento de testes de abstinência cresça no ritmo mais rápido durante o período previsto, especialmente em programas de monitoramento pós-reabilitação e liberdade condicional, onde a validação contínua sem drogas é necessária para dar suporte à recuperação e à reintegração.

- Por aplicação

Com base na aplicação, o mercado de testes de abuso de drogas no local de atendimento (POC) na América do Norte é segmentado em triagem médica, triagem no local de trabalho, aplicação da lei e justiça criminal, gerenciamento da dor, tratamento e reabilitação para abuso de substâncias, testes de drogas para pais ou em casa, testes esportivos e atléticos, triagem de drogas em escolas e instituições educacionais, entre outros. O segmento de aplicação da lei e justiça criminal dominou o mercado em 2024, impulsionado pela exigência de testes de drogas obrigatórios para detentos, pessoas em liberdade condicional e indivíduos em programas pré-julgamento.

Espera-se que o segmento de testes de drogas realizados pelos pais ou em casa testemunhe a maior taxa de crescimento, impulsionado pela crescente acessibilidade de kits fáceis de usar, pela crescente preocupação entre os pais e por uma mudança social em direção ao monitoramento proativo da saúde em casa.

- Por usuário final

Com base no usuário final, o mercado de testes de abuso de drogas no ponto de atendimento (POC) na América do Norte é segmentado em unidades de saúde, empregadores, institutos governamentais e outros. O segmento de unidades de saúde deteve a maior fatia da receita de mercado em 2024, impulsionado pela ampla utilização em departamentos de emergência, clínicas ambulatoriais e centros de tratamento de dependência. Essas unidades exigem resultados rápidos e confiáveis para subsidiar intervenções clínicas oportunas.

O segmento de empregadores deverá crescer na taxa mais rápida durante o período previsto, impulsionado pelos padrões de conformidade regulatória e uma ênfase crescente na manutenção de um ambiente de trabalho livre de drogas em setores como transporte, logística, construção e manufatura.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de testes de abuso de drogas no ponto de atendimento (POC) na América do Norte é segmentado em licitação direta, vendas no varejo e outros. O segmento de licitação direta dominou o mercado em 2024, devido à aquisição em larga escala de dispositivos e kits de teste por órgãos governamentais, unidades prisionais e instituições de saúde. Esse canal garante eficiência de custos e alinhamento regulatório em ambientes de alto volume.

Espera-se que o segmento de vendas no varejo testemunhe um forte crescimento entre 2025 e 2032, apoiado pela crescente adoção pelos consumidores de kits de teste de drogas para uso doméstico, disponíveis em farmácias, plataformas de comércio eletrônico e lojas especializadas em saúde.

Análise regional do mercado de testes de abuso de drogas no ponto de atendimento (POC) na América do Norte

- Os EUA dominaram o mercado de testes de abuso de drogas no ponto de atendimento (POC) da América do Norte com a maior participação na receita de 84,4% em 2024, apoiados por forte apoio governamental, ampla adoção nos setores de saúde e justiça criminal e a presença de empresas líderes em diagnósticos que promovem tecnologias POC conectadas e habilitadas por IA.

- Os consumidores e instituições dos EUA priorizam soluções rápidas de testes de drogas no local por sua precisão, velocidade e capacidade de apoiar a tomada de decisões imediatas em cenários clínicos, legais e ocupacionais.

- Essa forte liderança de mercado é ainda mais reforçada pela infraestrutura avançada de saúde, altos volumes de testes e inovação contínua por empresas de diagnóstico sediadas nos EUA, estabelecendo o país como o centro central para adoção e desenvolvimento de testes de abuso de drogas POC em toda a região.

Visão do mercado de testes de abuso de drogas para pessoas com deficiência nos EUA

O mercado de testes de abuso de drogas no local de atendimento (POC) dos EUA capturou a maior fatia da receita, de 85,3%, em 2024, na América do Norte, impulsionado pelas altas taxas de dependência de drogas no país, por uma estrutura regulatória robusta que exige exames regulares e pela forte presença de empresas líderes em diagnósticos. A crescente ênfase na vigilância de opioides, combinada com a expansão de aplicações em locais de trabalho, clínicas de tratamento da dor e órgãos de segurança pública, está impulsionando o crescimento. A adoção de kits de teste rápidos e fáceis de usar, tanto para uso profissional quanto doméstico, com o apoio das aprovações da FDA e cobertura de reembolso, tornou os EUA um líder global neste setor.

Visão geral do mercado de testes de abuso de drogas para pessoas com deficiência no Canadá

O mercado canadense de testes de abuso de drogas no local de atendimento (POC) deverá apresentar um crescimento significativo durante o período previsto, impulsionado pelas crescentes preocupações com o uso indevido de fentanil e opioides, pelo aumento dos investimentos em infraestrutura de saúde e por medidas governamentais proativas para a segurança pública. A integração de testes POC em atenção primária, resposta a emergências e instituições correcionais está ganhando força, impulsionada pela necessidade de triagem imediata e confiável. O crescente foco do Canadá em programas de redução de danos e intervenção comunitária está promovendo ainda mais o uso de soluções portáteis de teste no local, tanto em ambientes urbanos quanto rurais.

Visão geral do mercado de testes de abuso de drogas para pessoas de cor no México

Espera-se que o mercado mexicano de testes de abuso de drogas no local de atendimento (POC) cresça de forma constante durante o período previsto, impulsionado pelo aumento das taxas de tráfico de drogas e abuso de substâncias, bem como pela crescente adoção de protocolos de teste de drogas em ambientes de trabalho e de aplicação da lei. Campanhas antidrogas lideradas pelo governo e a expansão das iniciativas de saúde estão melhorando o acesso a tecnologias de triagem rápida, especialmente em regiões de alto risco. A demanda também está aumentando em clínicas privadas, escolas e instituições correcionais, enquanto a disponibilidade de kits de teste acessíveis e fáceis de usar está contribuindo para uma adoção mais ampla em todo o país.

Participação no mercado de testes de abuso de drogas no ponto de atendimento (POC) na América do Norte

O setor de testes de abuso de drogas no local de atendimento (POC) da América do Norte é liderado principalmente por empresas bem estabelecidas, incluindo:

- Abbott (EUA)

- Thermo Fisher Scientific Inc. (EUA)

- F. Hoffmann-La Roche Ltd (Suíça)

- Siemens Healthineers AG (Alemanha)

- Bio-Rad Laboratories, Inc. (EUA)

- Drägerwerk AG & Co. KGaA (Alemanha)

- Alfa Scientific Designs, Inc. (EUA)

- OraSure Technologies, Inc. (EUA)

- Securetec Detektions-Systeme AG (Alemanha)

- MP Biomedicals, LLC (EUA)

- Danaher Corporation (EUA)

- Randox Laboratories Ltd. (Reino Unido)

- Omega Diagnostics Group PLC (Reino Unido)

- T&D Diagnostics Canada, Inc. (Canadá)

- Nova Biomedical Corporation (EUA)

- Lifeloc Technologies, Inc. (EUA)

- Biosure (Reino Unido) Ltd (Reino Unido)

- Premier Biotech, Inc. (EUA)

- Alcolizer Technology Pty Ltd (Austrália)

- Neogen Corporation (EUA)

Quais são os desenvolvimentos recentes no mercado de testes de abuso de drogas no ponto de atendimento (POC) na América do Norte?

- Em abril de 2024, a Abbott Laboratories expandiu sua capacidade de testes de drogas em locais de atendimento (POC) com o lançamento do Sistema de Teste Móvel SoToxa em diversos departamentos de segurança pública dos EUA. Este dispositivo portátil permite a triagem de drogas na beira da estrada usando fluido oral e fornece resultados rápidos e confiáveis para diversas classes de drogas. A iniciativa reforça a segurança pública ao possibilitar a avaliação de comprometimento por drogas em tempo real e reflete o compromisso contínuo da Abbott com a inovação em soluções de testes de drogas forenses e no local de trabalho.

- Em março de 2024, a Thermo Fisher Scientific Inc. anunciou uma parceria com diversas agências de saúde pública no Canadá para fornecer kits de teste rápido de drogas por imunoensaio para programas de emergência e de extensão comunitária. A colaboração visa combater o aumento do uso de opioides, fornecendo soluções de triagem instantâneas e implementáveis em campo, permitindo intervenção precoce e reduzindo os riscos de overdose. Esta parceria destaca o papel da Thermo Fisher no apoio a estratégias de redução de danos por meio de diagnósticos POC acessíveis.

- Em março de 2024, a OraSure Technologies, Inc. lançou uma versão aprimorada do seu teste de drogas em fluidos orais IntelliSwab, desenvolvido especialmente para ambientes clínicos e laborais na América do Norte. O produto atualizado oferece sensibilidade aprimorada e uma janela de detecção estendida para as principais classes de drogas, incluindo opioides, anfetaminas e THC. Este lançamento reforça o foco da OraSure em fornecer soluções precisas e fáceis de usar que atendam à crescente demanda por testes rápidos e presenciais em ambientes de saúde e ocupacionais.

- Em fevereiro de 2024, a Alfa Scientific Designs, Inc. lançou uma nova linha de copos multipainéis para teste de drogas em urina POC no mercado americano, com designs invioláveis e testes de validade integrados para evitar adulteração de amostras. Esses dispositivos, aprovados pela FDA, destinam-se ao uso em diagnósticos clínicos, centros de reabilitação e instalações correcionais. O aprimoramento do produto atende à necessidade do mercado por soluções de teste seguras e econômicas que garantam a conformidade com os padrões regulatórios.

- Em janeiro de 2024, a Drägerwerk AG & Co. KGaA anunciou uma expansão significativa de seu portfólio de testes de drogas POC na América do Norte com a introdução do Dräger DrugTest 5000 em departamentos de polícia e unidades de fiscalização de trânsito selecionados nos EUA. Este analisador avançado, baseado em saliva, permite a triagem rápida e não invasiva de múltiplas substâncias com alta precisão. A implantação reflete o crescente interesse por alternativas sem urina e apoia as autoridades policiais em seus esforços para coibir a direção sob efeito de álcool.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.