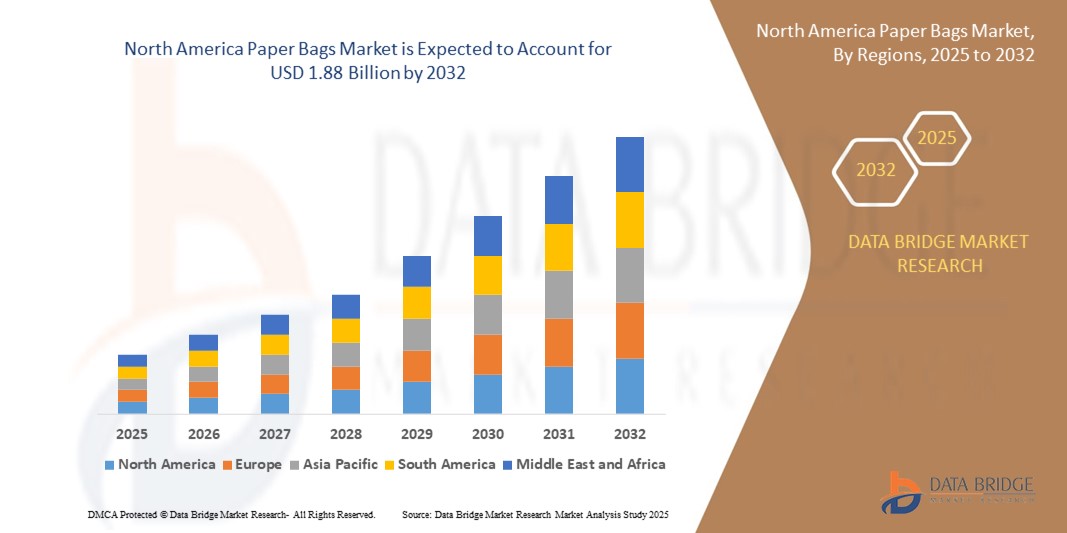

North America Paper Bags Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.23 Billion

USD

1.88 Billion

2024

2032

USD

1.23 Billion

USD

1.88 Billion

2024

2032

| 2025 –2032 | |

| USD 1.23 Billion | |

| USD 1.88 Billion | |

|

|

|

|

Segmentação do mercado de sacolas de papel na América do Norte, por produtos (sacolas de papel planas, sacos de papel com múltiplas paredes, boca aberta, válvula colada, sacolas de papel com trava, sacolas estilo autoabertura (SOS), bolsa vertical e outros), uso (uso único e reutilizável), capacidade (menos de 1 kg, 1 kg a 5 kg, 5 kg a 10 kg e mais de 10 kg), tamanho (tamanho pequeno, tamanho médio, tamanho grande e tamanho extragrande), vedação e alça (vedação a quente, alça de comprimento de mão, Ziplock, alça torcida, alça plana e outros), formato (retângulo, quadrado, circular e outros), canal de distribuição (lojas de conveniência, supermercados/hipermercados, lojas especializadas, comércio eletrônico e outros), usuário final (alimentos e bebidas, ração animal, produtos cosméticos, agricultura, construção, produtos farmacêuticos, produtos químicos e outros) - tendências do setor e Previsão para 2032

Tamanho do mercado de sacolas de papel

- O tamanho do mercado de sacolas de papel da América do Norte foi avaliado em US$ 1,23 bilhão em 2024 e deve atingir US$ 1,88 bilhão até 2032 , com um CAGR de 5,5% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela mudança em direção a soluções de embalagens sustentáveis e pela crescente pressão regulatória para reduzir o plástico de uso único, levando à maior adoção de sacolas de papel nos setores de varejo, serviços de alimentação e indústria.

- Além disso, a crescente conscientização dos consumidores em relação ao impacto ambiental, aliada à crescente demanda por alternativas biodegradáveis e recicláveis, está posicionando as sacolas de papel como a escolha preferida tanto por marcas quanto por consumidores. Esses fatores convergentes estão acelerando a transição do plástico para o papel, impulsionando significativamente o crescimento do setor.

Análise de mercado de sacolas de papel

- Sacolas de papel são soluções de embalagem ecológicas feitas de papel kraft ou reciclado, amplamente utilizadas para transportar mantimentos, alimentos, vestuário e outros bens de consumo. Estão disponíveis em diversos tipos, tamanhos e formatos de lacre, atendendo aos setores de varejo, serviços de alimentação, farmacêutico e construção civil.

- A crescente demanda por sacolas de papel é impulsionada principalmente pelas proibições governamentais ao plástico, pelas metas de sustentabilidade definidas pelas empresas e pelo uso crescente de sacolas de papel como ferramenta de marca em ambientes de varejo premium e ecologicamente corretos.

- Os EUA dominaram o mercado de sacolas de papel, com uma participação de 83,10% em 2024, devido ao aumento das restrições regulatórias ao uso de plástico e à crescente adoção de embalagens sustentáveis nos setores de varejo, serviços de alimentação e supermercados. A crescente demanda por alternativas recicláveis e biodegradáveis e a maior conscientização ambiental do consumidor posicionaram os EUA como líder regional.

- Espera-se que o Canadá seja a região de crescimento mais rápido no mercado de sacolas de papel durante o período previsto devido às políticas nacionais de redução de plástico e à forte mudança do consumidor em direção a embalagens ecologicamente corretas.

- O segmento de uso único dominou o mercado, com uma participação de mercado de 64,2% em 2024, devido aos rigorosos requisitos de higiene nas indústrias farmacêutica e alimentícia. A ênfase regulatória no controle de contaminação e na conveniência no descarte de embalagens levou à ampla adoção de sacolas de papel descartáveis. Elas também são econômicas para operações de alto volume, especialmente em ambientes de ritmo acelerado, como os setores de varejo e alimentos e bebidas.

Escopo do Relatório e Segmentação do Mercado de Sacolas de Papel

|

Atributos |

Principais insights do mercado de sacolas de papel |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências de mercado de sacolas de papel

“Adoção crescente de materiais biodegradáveis”

- O mercado de sacolas de papel está experimentando um crescimento robusto, à medida que empresas e consumidores priorizam cada vez mais embalagens ecológicas, com a adoção de materiais biodegradáveis e recicláveis se tornando uma tendência definidora

- Por exemplo, empresas como a International Paper Company, Mondi Group, Smurfit Kappa e WestRock estão introduzindo sacolas de papel inovadoras feitas de papel kraft de origem sustentável, bioplásticos e revestimentos compostáveis para atender à demanda regulatória e do consumidor por soluções de embalagens sustentáveis.

- O setor de alimentos e bebidas, juntamente com o varejo e o comércio eletrônico, está mudando rapidamente para sacolas de papel para retirada, compras de supermercado e entrega, impulsionado pelas proibições de plásticos descartáveis e pela necessidade de embalagens alinhadas com iniciativas verdes.

- Materiais avançados — como papel kraft mais fino e resistente e revestimentos resistentes à umidade — estão aumentando a durabilidade e a versatilidade das sacolas de papel, apoiando seu uso em uma gama mais ampla de produtos, incluindo produtos perecíveis e a granel.

- A marca e a personalização estão em ascensão, com varejistas e restaurantes de serviço rápido aproveitando sacolas de papel impressas personalizadas para promover a sustentabilidade e melhorar a experiência do consumidor

- Em conclusão, a convergência do crescimento do comércio eletrônico, ação regulatória e iniciativas de sustentabilidade está posicionando as sacolas de papel como um componente crítico no futuro das embalagens e logística da Ásia-Pacífico, com líderes de mercado investindo em novas tecnologias e expandindo linhas de produtos ecologicamente corretos.

Dinâmica do mercado de sacolas de papel

Motorista

“ Mudança para alternativas ecológicas ao plástico ”

- O crescente movimento global para reduzir o desperdício de plástico é o principal impulsionador do mercado de sacolas de papel da Ásia-Pacífico, com proibições legislativas e preferências do consumidor acelerando a mudança para opções biodegradáveis e recicláveis

- Por exemplo, empresas como a International Paper Company, Mondi Group, Smurfit Kappa e WestRock estão aumentando a produção de sacolas de papel para grandes varejistas e prestadores de serviços de alimentação na China, Índia, Austrália e Sudeste Asiático, que estão substituindo sacolas plásticas para cumprir com os regulamentos e atingir as metas de sustentabilidade.

- O aumento do comércio eletrônico e do envio direto ao consumidor está alimentando a demanda por sacolas de papel leves, protetoras e econômicas em diversos setores

- A conveniência, a capacidade de impressão e os benefícios ambientais percebidos dos sacos de papel fazem deles uma escolha preferida tanto para grandes empresas quanto para pequenas empresas que buscam aprimorar suas credenciais verdes.

- O aumento do investimento em infraestrutura de reciclagem e o desenvolvimento de papel de origem local com certificação FSC estão apoiando ainda mais a mudança para soluções de embalagem à base de papel

Restrição/Desafio

“Altos custos de produção e restrições de matéria-prima”

- A produção de sacos de papel é mais cara do que as alternativas de plástico devido aos maiores requisitos de matéria-prima, energia e água, o que pode limitar a adoção em mercados sensíveis a custos

- Por exemplo, o preço médio de importação de sacos e sacolas de papel na Ásia-Pacífico atingiu US$ 2.778 por tonelada em 2018, com países como o Japão pagando até US$ 3.754 por tonelada, destacando a significativa variabilidade de preços e as pressões de custos em toda a região.

- Sacolas de papel geralmente oferecem menor durabilidade, especialmente em condições úmidas ou de uso intenso, tornando-as menos adequadas para o transporte de líquidos, produtos congelados ou itens volumosos. A flutuação dos preços e do fornecimento de matérias-primas, como celulose e papel reciclado, bem como a necessidade de práticas florestais sustentáveis, podem impactar a estabilidade de custos e a confiabilidade da cadeia de suprimentos.

- A infraestrutura limitada de reciclagem e os sistemas de coleta inconsistentes em algumas regiões da Ásia-Pacífico dificultam a circularidade dos sacos de papel, especialmente aqueles com construção de materiais mistos.

- As preocupações ambientais relacionadas com a desflorestação e a pegada de carbono da produção de papel persistem, especialmente em regiões carentes de reciclagem avançada ou de gestão florestal sustentável.

Escopo de mercado de sacolas de papel

O mercado é segmentado com base no tipo de produto, uso, capacidade, tamanho, vedação e manuseio, formato, canal de distribuição e usuário final.

- Por produtos

Com base nos produtos, o mercado de medicamentos antivirais é segmentado em Sacos de Papel Planos, Sacos de Papel Multicamadas, Sacos de Papel com Boca Aberta, Sacos de Papel com Válvula Colada, Sacos de Papel com Trava, Sacos de Abertura Automática (SOS), Sacos Stand Up Pouch e outros. O segmento de Sacos de Papel Planos dominou a maior fatia de mercado em 2024, impulsionado por seu perfil ecológico, preço acessível e ampla utilização em embalagens de itens leves, como produtos de panificação e farmacêuticos. Esses sacos são especialmente indicados para aplicações de uso único, onde a biodegradabilidade e o impacto ambiental mínimo são fatores críticos de compra. Sua fácil personalização e compatibilidade com tecnologias de impressão aprimoram ainda mais a marca e a visibilidade do produto para os usuários finais.

O segmento de Stand-Up Pouch deverá apresentar a maior taxa de crescimento entre 2025 e 2032, devido à crescente demanda por embalagens flexíveis, resseláveis e com economia de espaço. Essas embalagens oferecem maior prazo de validade e proteção contra contaminação, tornando-as ideais para produtos farmacêuticos e cosméticos. Seu apelo estético, praticidade e adaptabilidade a conteúdos secos e líquidos também estão acelerando sua adoção nos canais de varejo e e-commerce.

- Por uso

Com base na utilização, o mercado é categorizado em Uso Único e Reutilizável. O segmento de Uso Único representou a maior fatia de mercado, 64,2% em 2024, impulsionado por rigorosos requisitos de higiene nas indústrias farmacêutica e alimentícia. A ênfase regulatória no controle de contaminação e na conveniência no descarte de embalagens levou à ampla adoção de sacolas de papel descartáveis. Elas também são econômicas para operações de alto volume, especialmente em ambientes de ritmo acelerado, como os setores de varejo e alimentos e bebidas.

Espera-se que o segmento de Reutilizáveis cresça com a CAGR mais rápida entre 2025 e 2032, impulsionado por iniciativas crescentes de sustentabilidade e pela preferência do consumidor por soluções de embalagem ambientalmente responsáveis. Essas sacolas são cada vez mais utilizadas por marcas premium e supermercados para promover hábitos de consumo ecoconscientes, mantendo a durabilidade e o apelo visual.

- Por Capacidade

Com base na capacidade, o mercado é segmentado em menos de 1 kg, 1 kg a 5 kg, 5 kg a 10 kg e mais de 10 kg. O segmento de 1 kg a 5 kg liderou o mercado em 2024, devido à sua versatilidade em uma ampla gama de indústrias de uso final, incluindo alimentos, produtos farmacêuticos e ração animal. Essa faixa de capacidade é ideal para o manuseio de itens perecíveis e não perecíveis, sem comprometer a conveniência ou a eficiência do armazenamento.

O segmento de mais de 10 kg deverá registrar o maior crescimento durante o período previsto, impulsionado pelo aumento das aplicações industriais na agricultura, construção e produtos químicos. Essas sacolas oferecem integridade estrutural robusta, custo-benefício para transporte a granel e compatibilidade com sistemas automatizados de enchimento e manuseio.

- Por tamanho

Com base no tamanho, o mercado é segmentado em Tamanho Pequeno, Tamanho Médio, Tamanho Grande e Tamanho Extra Grande. O segmento de Tamanho Médio deteve a maior participação de mercado em 2024, impulsionado por seu equilíbrio ideal entre capacidade, portabilidade e conveniência de uso. Esse segmento de tamanho encontra tração significativa nos setores de varejo, serviços de alimentação e farmacêutico, onde embalagens compactas, porém funcionais, são essenciais.

O segmento de tamanho extragrande deverá crescer ao ritmo mais acelerado entre 2025 e 2032, impulsionado pelos crescentes requisitos de manuseio de grandes volumes e pela demanda por alternativas sustentáveis aos sacos plásticos. Essas sacolas são cada vez mais utilizadas nos setores de construção e agricultura, onde são necessárias embalagens de alto volume, duráveis e resistentes às intempéries.

- Por selagem e manuseio

Com base na vedação e na alça, o mercado é segmentado em selagem térmica, alça longa, Ziplock, alça torcida, alça plana e outros. O segmento de selagem térmica dominou o mercado em 2024 devido à sua superior resistência de vedação, propriedades invioláveis e ampla adoção em embalagens farmacêuticas e alimentícias. A selagem térmica garante a integridade do produto, prolongando a vida útil e minimizando vazamentos e deterioração.

Espera-se que o segmento Ziplock testemunhe o crescimento mais rápido, já que a funcionalidade reselável se torna uma demanda fundamental dos consumidores por conveniência e reutilização. A integração de recursos ziplock com materiais biodegradáveis também está ganhando força, especialmente em embalagens de varejo urbano e premium.

- Por Forma

Com base no formato, o mercado é dividido em retangular, quadrado, circular e outros. O segmento retangular conquistou a maior fatia em 2024, favorecido por seus benefícios práticos de armazenamento, empilhamento e adequação para impressão e etiquetagem. Sacolas retangulares são amplamente utilizadas em setores como farmacêutico e cosmético, onde a presença nas prateleiras e a eficiência operacional são importantes.

O segmento Circular deverá registrar o maior crescimento durante o período previsto, devido à crescente demanda por embalagens inovadoras e diferenciadas em categorias de produtos premium e de nicho. As sacolas circulares oferecem exclusividade visual e são frequentemente adotadas por marcas que buscam diferenciação no consumidor.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em lojas de conveniência, supermercados/hipermercados, lojas especializadas, e-commerce e outros. O segmento de supermercados/hipermercados manteve a participação dominante em 2024, impulsionado pelas tendências de compra a granel e pela visibilidade direta de produtos embalados. Essas lojas atuam como pontos-chave de compra de sacolas de papel reutilizáveis e de marca, especialmente em centros urbanos.

A previsão é de que o comércio eletrônico apresente o crescimento mais rápido entre 2025 e 2032, devido ao aumento das compras online e dos modelos de entrega em domicílio. À medida que a embalagem se torna um ponto de contato fundamental com a marca, os varejistas eletrônicos estão migrando cada vez mais para soluções em papel, visando a sustentabilidade e o apelo estético.

- Por usuário final

Com base no usuário final, o mercado é segmentado em Alimentos e Bebidas, Ração Animal, Produtos Cosméticos, Agricultura, Construção, Farmacêuticos, Químicos e Outros. O segmento de Alimentos e Bebidas liderou o mercado em 2024, devido ao alto volume de consumo, aos padrões de higiene e à rápida transição para embalagens biodegradáveis. Essas sacolas proporcionam armazenamento seguro, estabilidade térmica e rotulagem clara do produto.

O segmento Farmacêutico deverá crescer em ritmo mais acelerado entre 2025 e 2032, devido ao aumento das exigências regulatórias para embalagens secundárias sustentáveis, proteção estéril e rastreabilidade. A crescente demanda por sacolas de papel com propriedades de barreira aprimoradas e recursos à prova de violação está impulsionando ainda mais a expansão do segmento.

Análise regional do mercado de sacolas de papel

- Os EUA dominaram o mercado de sacolas de papel, com a maior participação na receita, de 83,10% em 2024, impulsionados pelo aumento das restrições regulatórias ao uso de plástico e pela crescente adoção de embalagens sustentáveis nos setores de varejo, serviços de alimentação e supermercados. A crescente demanda por alternativas recicláveis e biodegradáveis e a maior conscientização ambiental do consumidor posicionaram os EUA como líder regional.

- A ampla presença de grandes fabricantes de sacolas de papel, aliada a uma sólida infraestrutura de varejo e iniciativas de sustentabilidade corporativa, continua a impulsionar a demanda por produtos. Além disso, o apoio das proibições locais e federais de plásticos descartáveis está acelerando a transição para soluções de embalagem à base de papel.

- O mercado dos EUA também se beneficia da crescente inovação em design, resistência e reutilização de sacolas de papel, consolidando ainda mais seu domínio no cenário de embalagens sustentáveis da América do Norte.

Visão geral do mercado de sacolas de papel no Canadá

A projeção é que o Canadá registre o CAGR mais rápido no mercado de sacolas de papel da América do Norte entre 2025 e 2032, impulsionado por políticas nacionais de redução de plástico e uma forte mudança do consumidor em direção a embalagens ecologicamente corretas. A crescente preferência por sacolas de papel reutilizáveis e de alta qualidade, especialmente em serviços de alimentação e varejo, está impulsionando a demanda. O apoio governamental a alternativas de embalagens verdes e os crescentes investimentos em capacidade de produção nacional estão impulsionando ainda mais o mercado.

Visão geral do mercado de sacolas de papel no México

Espera-se que o mercado mexicano de sacolas de papel apresente crescimento constante entre 2025 e 2032, impulsionado pelo crescimento do varejo, pela expansão das operações de foodservice e pela crescente pressão para reduzir o desperdício de plástico. A crescente conscientização ambiental, juntamente com os desenvolvimentos regulatórios e os laços comerciais regionais, estão incentivando os fabricantes locais a expandir a produção de sacolas de papel para atender à demanda doméstica e voltada para a exportação.

Participação no mercado de sacolas de papel

O setor de sacolas de papel é liderado principalmente por empresas bem estabelecidas, incluindo:

- WestRock Company (EUA)

- Smurfit Kappa (Irlanda)

- International Paper (EUA)

- Grupo Inteplast (EUA)

- PAPIER-METTLER KG (Alemanha)

- PackagingPro (Austrália)

- JINAN XINSHUNYUAN EMBALAGEM CO., LTD (China)

- Mondi (Reino Unido)

- Thai Showa Paxxs Co., Ltd. (Tailândia)

- Conitex Sonoco (EUA)

Últimos desenvolvimentos no mercado de sacolas de papel da América do Norte

- Em julho de 2025, o EP Group lançou uma campanha direcionada incentivando os varejistas de moda a atualizarem suas ofertas de sacolas de papel, sinalizando um impulso em direção a soluções de embalagem de maior qualidade e mais sustentáveis no setor de vestuário. Espera-se que essa iniciativa influencie os padrões de embalagem do varejo e impulsione a demanda por sacolas de papel premium e alinhadas à marca.

- Em junho de 2025, a Mondi lançou o re/cycle PaperPlus Bag Advanced, uma solução de alto desempenho desenvolvida especialmente para produtos sensíveis à umidade, com conteúdo plástico reduzido. Essa inovação reforça a tendência de embalagens híbridas à base de papel e reforça a posição da Mondi nos segmentos de embalagens industriais e de e-commerce, priorizando funcionalidade e sustentabilidade.

- Em junho de 2024, o lançamento do SolmixBag pela Mondi na Espanha, em parceria com a Cemex, marcou um avanço significativo na área de embalagens para materiais de construção. Ao criar uma embalagem que se dissolve durante o processo de mistura do cimento, a Mondi contribui para a eficiência operacional e a sustentabilidade no setor da construção, incentivando a adoção mais ampla de soluções ecológicas e redutoras de resíduos pela indústria.

- Em outubro de 2024, a Coles lançou uma sacola de papel lavável com preço de US$ 15, capaz de carregar até 20 kg e resistir à lavagem na máquina. Essa inovação reflete a crescente mudança do consumidor em direção a embalagens duráveis e reutilizáveis, reforçando o abandono do plástico de uso único pelo setor varejista e ampliando as oportunidades para fabricantes de sacolas de papel de longa duração.

- Em novembro de 2024, a Primark lançou sacolas de papel para presentes de fim de ano com um design de listras vermelhas que permite a reutilização como papel de presente. Essa abordagem criativa para embalagens de uso duplo aumenta o engajamento do cliente e também apoia metas de sustentabilidade, reforçando as sacolas de papel como uma solução de varejo versátil e ambientalmente responsável.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.