North America Organic Solar Cell (OPV) Market, By Type (Bilayer Membrane Heterojunction, Schottky Type, and Others), Material (Polymer and Small Molecules), Application (BIPV & Architecture, Consumer Electronics, Wearable Devices, Automotive, Military & Device, and Others), Physical Size (More Than 140*100 MM Square, and Less Than 140*100 MM Square), End User (Commercial, Industrial, Residential, and Others), Industry Trends and Forecast to 2030.

North America Organic Solar Cell (OPV) Market Analysis and Size

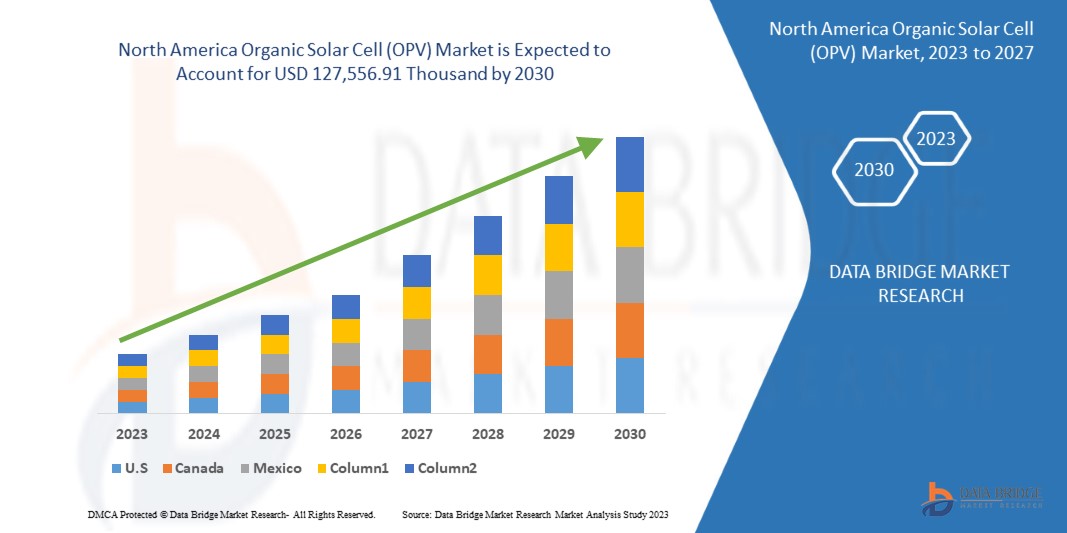

The North America organic solar cell (OPV) market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 10.3% in the forecast period of 2023 to 2030 and is expected to reach USD 127,556.91 thousand by 2030. The major factor driving the growth of the Organic solar cell (OPV) market is the rising popularity of organic solar cell (OPV) products among the organic solar cell and growing awareness regarding the properties of the organic solar cell (OPV) products.

Organic solar cells (OSCs), which are categorized as third-generation solar cells using organic polymer material as the light-absorbing layer, are one of the newest photovoltaic (PV) technologies. Organic photovoltaic (OPV) solar cells seek to offer a low-energy-production and earth-abundant photovoltaic (PV) solution.

The North America organic solar cell (OPV) market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Type (Bilayer Membrane Heterojunction, Schottky Type, and Others), Material (Polymer, and Small Molecules), Application (BIPV & Architecture, Consumer Electronics, Wearable Devices, Automotive, Military & Device, and Others), Physical Size (More Than 140*100 Mm Square, and Less Than 140*100 Mm Square), End User (Commercial, Industrial, Residential, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Eni SpA, TOSHIBA CORPORATION, ARMOR, Tokyo Chemicals Industry Co. Ltd, Merck KGaA, Alfa Aesar, Thermo Fisher Scientific, Heliatek, Solarmer Energy Inc., SUNEW, Epishine, Lumtec, Borun New Material Technology Co., Ltd, Novaled GmbH, Ningbo Polycrown Solar Tech Co, Ltd, SHIFENG TECHNOLOGY CO., LTD., Solaris Chem Inc., MORESCO Corporation, NanoFlex Power Corporation e Flask, entre outros |

Definição de Mercado

As células solares orgânicas ou fotovoltaicas orgânicas referem-se a dispositivos fotovoltaicos multicamadas feitos com compostos orgânicos, convertendo a energia solar em eletricidade. Uma célula solar orgânica é fabricada utilizando material à base de carbono e eletrónica orgânica em vez de silício como semicondutor. As células orgânicas podem também ser referidas como células solares de plástico ou células solares de polímero; em comparação com as células solares de silício cristalino, as células solares orgânicas são constituídas por compostos que podem ser dissolvidos em tinta e impressos em plásticos. Isto confere às células solares orgânicas o atributo de flexibilidade, leveza e fácil incorporação em locais ou estruturas, entre outros.

A tecnologia das células solares orgânicas ainda está em desenvolvimento. A eficiência de conversão de energia da célula solar orgânica não corresponde à eficiência alcançada pelas células solares de silício inorgânico. Mas os OPV apresentam uma vasta gama de potenciais aplicações e poderá não demorar muito até que se tornem a tecnologia habitualmente utilizada. Os OPV são fáceis de fabricar em comparação com as células solares inorgânicas, são baratos de produzir e fisicamente versáteis. O princípio de funcionamento das células solares orgânicas é semelhante ao das células solares de silício monocristalino e policristalino. Geram eletricidade através do efeito fotovoltaico em três etapas simples, tais como:

- Os eletrões são libertados do material polimérico semicondutor quando a luz é absorvida

- O fluxo dos eletrões soltos constitui uma corrente elétrica

- A corrente é captada e transferida para os fios

A versatilidade do OPV pode ser atribuída à diversidade de materiais orgânicos desenhados e sintetizados para o absorvedor, aceitador e interfaces. As células solares orgânicas encontram aplicações em painéis automóveis, painéis de cobertura, energia fotovoltaica integrada em edifícios (BIPV), eletrónica de consumo e outros.

Dinâmica do mercado de células solares orgânicas (OPV) da América do Norte

Esta secção trata da compreensão dos impulsionadores do mercado, das oportunidades, das restrições e dos desafios. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Aumentar a consciencialização sobre o uso de energia renovável para a geração de energia

O crescimento contínuo da população e o crescente florescimento do sector industrial, juntamente com o crescimento no desenvolvimento de infra-estruturas, que está a levar a um aumento significativo na procura de electricidade na América do Norte. Os países estão a investir fortemente em recursos de produção de energia através da instalação de novas centrais eléctricas para satisfazer a procura de energia para um desenvolvimento sem entraves. Isto levou ao aumento da poluição e dos riscos ambientais. À medida que o foco está a mudar para a conservação do clima, há um aumento na adoção de fontes de energia renováveis para a geração de energia e o aproveitamento da energia solar para a eletricidade é uma das tecnologias líderes na América do Norte.

- Aumento da procura pela construção de produtos fotovoltaicos integrados (BIPV)

A energia fotovoltaica integrada em edifícios (BIPV) refere-se a materiais que são utilizados na construção para substituir os materiais de construção convencionais em telhados, claraboias e fachadas, entre outros. Com o BIPV, os edifícios possuem uma camada exterior da estrutura que também gera eletricidade para uso local ou exportação para a rede. As aplicações BIPV são frequentemente para edifícios comerciais e industriais. A utilização de OPVs apresenta vantagens significativas em relação às células solares de silício, pois resultam na redução de custos. São leves, flexíveis e visivelmente transparentes. Isto resultou no crescimento da adoção de energia fotovoltaica orgânica como material em aplicações BIPV.

A energia fotovoltaica orgânica é fina e flexível e pode ser integrada nas laterais dos edifícios, substituindo as janelas de vidro convencionais; este oferece uma grande área disponível para a absorção de energia solar. As claraboias OPC são integradas através de células solares orgânicas ultrafinas, que permitem a penetração da luz do dia e, ao mesmo tempo, geram eletricidade.

Oportunidades

- Aumentar as aplicações em projetos e gadgets DIY

Os últimos anos testemunharam uma extensa investigação no desenvolvimento de células solares orgânicas para aumentar a eficiência e tornar as células solares orgânicas mais flexíveis e finas. Os resultados alcançados são de louvar. Os investigadores conseguem atingir uma eficiência de conversão de energia (PCE) superior a 10%. Os desenvolvimentos recentes levaram ao avanço na natureza flexível, à estabilidade da flexão mecânica e à boa conformabilidade. Isto levou a aplicações de células solares orgânicas em aplicações como a geração de energia em eletrónica vestível e pequenos projetos.

Existe uma procura crescente no mercado por futuros dispositivos eletrónicos portáteis e wearable, como smartwatches ou sensores biométricos, que utilizem recursos de geração de energia leves, flexíveis e eficientes. Isto abriu oportunidades interessantes para as células solares orgânicas como recursos de fornecimento de energia da próxima geração devido às suas propriedades desejáveis. Como resultado, muitas atividades de investigação para desenvolver células solares orgânicas para aumentar o seu PCE e flexibilidade são realizadas na América do Norte.

- Aumentar o foco do governo nas alterações climáticas

O aquecimento da América do Norte, impulsionado pela emissão de gases com efeito de estufa induzida pelo homem e pelas alterações e alterações nos padrões climáticos devido às constantes alterações do ecossistema, está a resultar em alterações climáticas aceleradas em todas as regiões da América do Norte. Não está a abrandar e tem um impacto imenso no bem-estar humano e na pobreza em todo o mundo. Segundo o Banco Mundial, as alterações climáticas podem empurrar até 132 milhões de pessoas para a pobreza. Há um movimento em todo o mundo, e os principais governos estão a perceber e a agir no sentido de adoptar e combater medidas para evitar maiores danos ao ecossistema mundial.

Restrições/Desafios

- Maior custo de configuração dos sistemas OPV

Tem havido um forte foco na aceleração da adoção de sistemas elétricos solares, como os sistemas fotovoltaicos orgânicos, para o desenvolvimento de sistemas fotovoltaicos integrados em edifícios. Mas, apesar destes esforços, a inculcação do design BIPV (construção fotovoltaica integrada) no design do edifício é menor em comparação com os edifícios com sistemas de células solares orgânicas montados em rack. Isto aumenta o custo de integração da pré-implementação do projeto. Isto revela-se um fator de restrição significativo para o mercado.

Embora a adopção de energias renováveis seja encorajada e esteja, portanto, a aumentar com o foco crescente nas alterações climáticas, os adoptantes solares são vistos como distorcidos na maioria das regiões do globo. Esta assimetria é atribuída ao rendimento da população.

- Taxas de baixa eficiência das células solares orgânicas

A eficiência de conversão de energia numa célula solar refere-se à fracção da energia luminosa que a célula é capaz de converter em electricidade. Existe uma oportunidade crescente para a adoção de células solares orgânicas, uma vez que proporcionam flexibilidade e podem adaptar-se a qualquer superfície, como o tejadilho de um automóvel ou o exterior de dispositivos eletrónicos vestíveis. O principal desafio que tem impedido a comercialização da tecnologia é a eficiência de conversão de energia relativamente baixa em comparação com a eficiência proporcionada pelas células solares de silício inorgânico.

Desenvolvimento recente

- Em janeiro de 2023, a Novaled GmbH foi anunciada que ganhou o prémio "Prémio de Excelência em Saúde Corporativa" em 2022. Isto ajudará a empresa a ser melhor reconhecida entre os concorrentes.

Âmbito do mercado das células solares orgânicas da América do Norte (OPV)

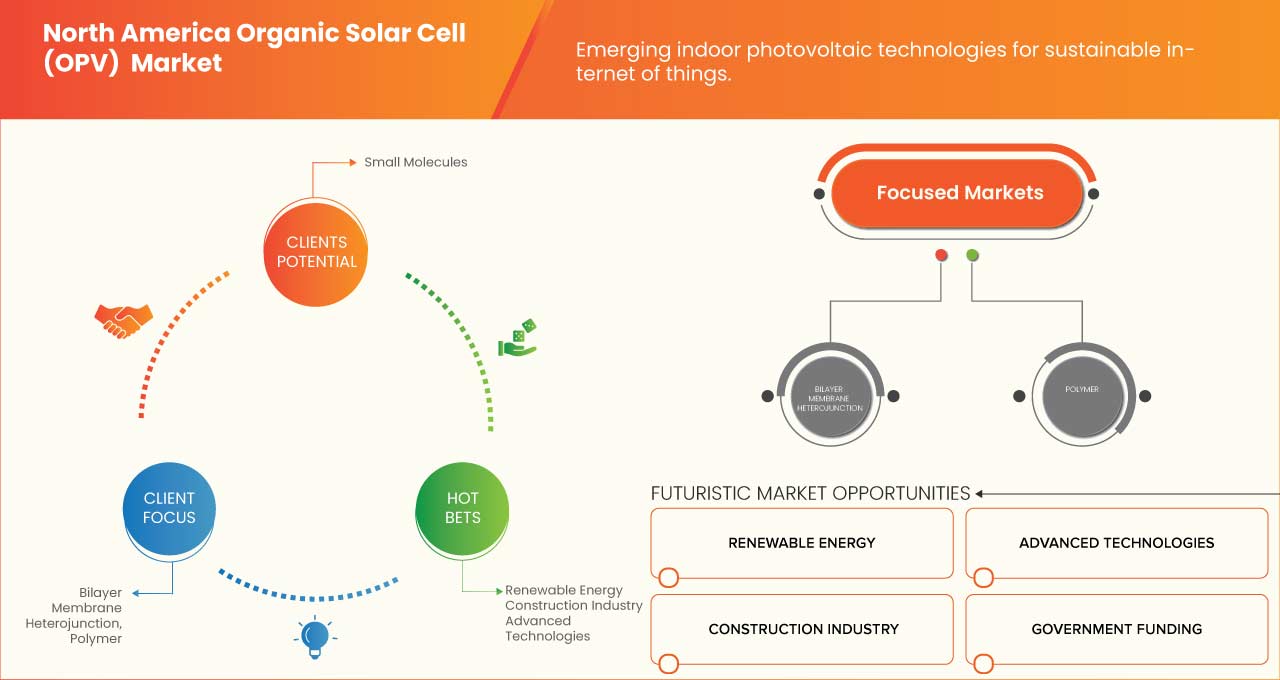

O mercado norte-americano de células solares orgânicas (OPV) é categorizado com base no tipo, material, aplicação, tamanho físico e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nas indústrias e a fornecer aos utilizadores uma valiosa visão geral do mercado e insights de mercado para tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo

- Heterojunção de membrana bicamada

- Tipo Schottky

- Outros

Com base no tipo, o mercado norte-americano de células solares orgânicas (OPV) está classificado em três segmentos Heterojunção de Membrana Bicamada, Tipo Schottky, entre outros.

Material

- Polímero

- Moléculas Pequenas

Com base no material, o mercado norte-americano de células solares orgânicas (OPV) é classificado em dois segmentos: Polímeros e Pequenas Moléculas.

Aplicação

- BIPV e Arquitetura

- Eletrónicos de consumo

- Dispositivos vestíveis

- Automotivo

- Militar e dispositivos

- Outros

Com base na aplicação, o mercado norte-americano de células solares orgânicas (OPV) está classificado em seis segmentos: bipv e arquitetura, eletrónica de consumo, dispositivos wearable, automóvel, militar e dispositivos, entre outros.

Tamanho Físico

- Mais de 140*100 mm quadrados

- Menos de 140*100 mm quadrados

Com base no tamanho físico, o mercado norte-americano de células solares orgânicas (OPV) está classificado em dois segmentos com mais de 140*100 MM quadrados e menos de 140*100 MM quadrados.

Utilizador final

- Comercial

- Industrial

- residencial

- Outros

Com base no utilizador final, o mercado norte-americano de células solares orgânicas (OPV) está classificado em quatro segmentos: comercial, industrial, residencial, entre outros.

Análise/perspetivas regionais do mercado de células solares orgânicas da América do Norte (OPV)

O mercado norte-americano de células solares orgânicas (OPV) está segmentado com base no tipo, material, aplicação, tamanho físico e utilizador final.

Os países do mercado norte-americano de células solares orgânicas (OPV) são os EUA, o Canadá e o México. Os EUA estão a dominar o mercado norte-americano de células solares orgânicas (OPV) em termos de quota de mercado e receitas de mercado devido à crescente consciencialização das propriedades dos produtos de células solares orgânicas (OPV) nesta região.

A secção do relatório sobre países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. A análise da cadeia de valor a jusante e a montante dos pontos de dados, as tendências técnicas, a análise das cinco forças de Porter e os estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas da América do Norte e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, o impacto das tarifas domésticas e as rotas comerciais, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Cenário competitivo e análise da quota de mercado das células solares orgânicas (OPV) da América do Norte

O panorama competitivo do mercado norte-americano de células solares orgânicas (OPV) fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produtos, aprovações de produtos, patentes, largura e amplitude do produto, domínio de aplicação, curva de segurança da tecnologia. Os dados fornecidos acima estão apenas relacionados com o foco das empresas relacionado com o mercado norte-americano de células solares orgânicas (OPV).

Alguns dos participantes proeminentes que operam no mercado norte-americano de células solares orgânicas (OPV) são a Eni SpA, TOSHIBA CORPORATION, ARMOR, Tokyo Chemicals Industry Co. Ltd, Merck KGaA, Alfa Aesar, Thermo Fisher Scientific, Heliatek, Solarmer Energy Inc ., SUNEW, Epishine, Lumtec, Borun New Material Technology Co., Ltd, Novaled GmbH, Ningbo Polycrown Solar Tech Co, Ltd, SHIFENG TECHNOLOGY CO., LTD., Solaris Chem Inc., MORESCO Corporation, NanoFlex Power Corporation e Flask, entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING AWARENESS TOWARDS THE USE OF RENEWABLE ENERGY FOR POWER GENERATION

5.1.2 SURGE IN DEMAND FOR BUILDING INTEGRATED PHOTOVOLTAIC PRODUCTS (BIPV)

5.1.3 GOVERNMENT INITIATIVES AND TAX BENEFITS FOR THE APPLICATION OF ALTERNATE ENERGY RESOURCE

5.1.4 ADVANTAGES OF OPVS OVER SILICON SOLAR CELLS AND SIMPLICITY IN THE MANUFACTURING PROCESS

5.1.5 INCREASING SOLAR ADOPTION IN RESIDENTIAL AREAS

5.2 RESTRAINTS

5.2.1 HIGHER SETUP COST OF OPV SYSTEMS

5.2.2 CUSTOM TARIFFS OVER SOLAR PANELS AND SOLAR CELLS BY MULTIPLE GOVERNMENTS

5.3 OPPORTUNITIES

5.3.1 INCREASING APPLICATIONS IN DIY PROJECTS AND GADGETS

5.3.2 INCREASING GOVERNMENT FOCUS ON CLIMATE CHANGE

5.3.3 INCREASING FOCUS ON THE DEVELOPMENT OF TANDEM ORGANIC CELLS

5.3.4 EMERGING INDOOR PHOTOVOLTAIC TECHNOLOGIES FOR SUSTAINABLE INTERNET OF THINGS

5.4 CHALLENGES

5.4.1 LOW-EFFICIENCY RATES OF ORGANIC SOLAR CELLS

5.4.2 STABILITY PROBLEMS IN ORGANIC SOLAR CELL

6 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE

6.1 OVERVIEW

6.2 BILAYER MEMBRANE HETEROJUNCTION

6.3 SCHOTTKY TYPE

6.4 OTHERS

7 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 POLYMER

7.3 SMALL MOLECULES

8 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BIPV & ARCHITECTURE

8.3 CONSUMER ELECTRONICS

8.4 WEARABLE DEVICES

8.5 AUTOMOTIVE

8.6 MILITARY & DEVICE

8.7 OTHERS

9 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE

9.1 OVERVIEW

9.2 MORE THAN 140*100 MM SQUARE

9.3 LESS THAN 140*100 MM SQUARE

10 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER

10.1 OVERVIEW

10.2 COMMERCIAL

10.2.1 COMMERCIAL, BY COMMERCIAL TYPE

10.2.1.1 PUBLIC INSTITUTIONS

10.2.1.2 GOVERNMENT AGENCIES

10.2.1.3 RESEARCH INSTITUTIONS

10.2.1.4 OTHERS

10.2.2 COMMERCIAL, BY TYPE

10.2.2.1 BILAYER MEMBRANE HETEROJUNCTION

10.2.2.2 SCHOTTKY TYPE

10.2.2.3 OTHERS

10.3 INDUSTRIAL

10.3.1 INDUSTRIAL, BY TYPE

10.3.1.1 BILAYER MEMBRANE HETEROJUNCTION

10.3.1.2 SCHOTTKY TYPE

10.3.1.3 OTHERS

10.4 RESIDENTIAL

10.4.1 RESIDENTIAL, BY TYPE

10.4.1.1 BILAYER MEMBRANE HETEROJUNCTION

10.4.1.2 SCHOTTKY TYPE

10.4.1.3 OTHERS

10.5 OTHERS

11 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 BUSINESS ACQUISITION & EXPANSION

12.3 COLLABORATION & PARTNERSHIP

12.4 ACQUISITION

12.5 AGREEMENT & CERTIFICATION

12.6 RECOGNITION & PRODUCT LAUNCH

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ENI SPA (2022)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 TOSHIBA CORPORATION (2022)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 ARMOR

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 TOKYO CHEMICAL INDUSTRY CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 MERCK KGAA (2022)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ALFA AESAR, THERMO FISHER SCIENTIFIC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BORUN NEW MATERIAL TECHNOLOGY CO., LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 EPISHINE

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 FLASK

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HELIATEK

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 LUMTEC

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MORESCO CORPORATION (2022)

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 NANOFLEX POWER CORPORATION (2022)

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NINGBO POLYCROWN SOLAR TECH CO, LTD

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 NOVALED GMBH

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SHIFENG TECHNOLOGY CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SOLARIS CHEM INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 SOLARMER ORGANIC OPTOELECTRONICS TECHNOLOGY (BEIJING) CO., LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SUNEW

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 IMPORT DATA ON PHOTOSENSITIVE SEMICONDUCTOR DEVICES, INCL. PHOTOVOLTAIC CELLS, WHETHER OR NOT ASSEMBLED IN ...; HS CODE – 854140 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PHOTOSENSITIVE SEMICONDUCTOR DEVICES, INCL. PHOTOVOLTAIC CELLS, WHETHER OR NOT ASSEMBLED IN ...; HS CODE – 854140 (USD THOUSAND)

TABLE 3 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA BILAYER MEMBRANE HETEROJUNCTION IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION , 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA SCHOTTKY TYPE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA POLYMER IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA SMALL MOLECULES IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA BIPV & ARCHITECTURE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA CONSUMER ELECTRONICS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA WEARABLE DEVICES IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA AUTOMOTIVE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA MILITARY & DEVICE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE , 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA MORE THAN 140*100 MM SQUARE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA LESS THAN 140*100 MM SQUARE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 41 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 43 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 44 U.S. COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 U.S. COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 U.S. RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 50 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 51 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 52 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 53 CANADA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 CANADA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 CANADA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 59 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 61 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 62 MEXICO COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 MEXICO COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 MEXICO INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 MEXICO RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Lista de Figura

FIGURE 1 NORTH AMERICA ORGANIC SOLAR CELL MARKET

FIGURE 2 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: SEGMENTATION

FIGURE 14 INCREASING AWARENESS TOWARDS THE USE OF RENEWABLE ENERGY FOR POWER GENERATION IS EXPECTED TO DRIVE THE NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET IN THE FORECAST PERIOD

FIGURE 15 2 WHEEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET IN 2023 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET

FIGURE 17 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2022

FIGURE 18 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2022

FIGURE 19 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2022

FIGURE 21 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2022

FIGURE 22 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: BY SNAPSHOT (2022)

FIGURE 23 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: BY COUNTRY (2022)

FIGURE 24 EUROPE ORGANIC SOLAR CELL (OPV) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: BY TYPE (2023-2030)

FIGURE 27 NORTH AMERICA HEAVY METALS TESTING MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.