North America Nut Oil Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

22.55 Billion

USD

41.46 Billion

2025

2033

USD

22.55 Billion

USD

41.46 Billion

2025

2033

| 2026 –2033 | |

| USD 22.55 Billion | |

| USD 41.46 Billion | |

|

|

|

|

Segmentação do mercado de óleos de nozes na América do Norte, por categoria (orgânico e convencional), tipo de produto (óleo de amêndoa, óleo de castanha-do-pará, óleo de caju, óleo de castanha-do-pará, óleo de avelã, óleo de noz-pecã, óleo de macadâmia, óleo de noz-pecã, óleo de pinhão, óleo de pistache, óleo de noz, óleo de amendoim, óleo de argan, óleo de marula, óleo de mongongo e outros), uso final (indústrias de processamento de alimentos, indústrias de cuidados pessoais e cosméticos, consumo direto, aromaterapia, tintas e vernizes e outros), canal de distribuição (direto e indireto) - Tendências e previsões do setor até 2033.

Tamanho do mercado de óleo de nozes na América do Norte

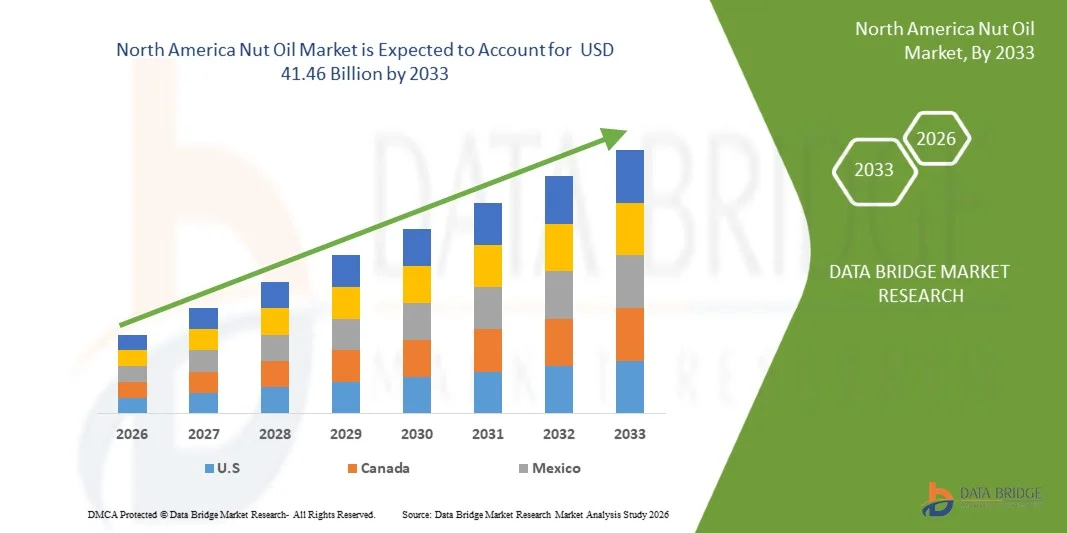

- O mercado de óleo de nozes na América do Norte foi avaliado em US$ 22,55 bilhões em 2025 e espera-se que alcance US$ 41,46 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 7,30% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente preferência do consumidor por óleos naturais e vegetais para cozinhar e cuidar da pele.

- A crescente conscientização sobre os benefícios dos óleos de nozes para a saúde, como a melhora da saúde cardiovascular e suas propriedades antioxidantes, está em alta.

Análise do Mercado de Óleo de Nozes na América do Norte

- O mercado está testemunhando uma mudança em direção aos óleos de nozes orgânicos e prensados a frio devido ao seu perfil nutricional superior e processamento mínimo.

- Os fabricantes estão focando na inovação de produtos e lançando misturas e óleos de nozes aromatizados para atrair consumidores preocupados com a saúde.

- Os EUA dominaram o mercado de óleos vegetais, detendo a maior participação na receita em 2025, devido ao seu ecossistema avançado de processamento de alimentos, à alta conscientização do consumidor sobre óleos funcionais e ricos em nutrientes e à forte presença de fabricantes líderes.

- Prevê-se que o Canadá registre a maior taxa de crescimento anual composta (CAGR) no mercado de óleos de nozes da América do Norte, devido à crescente preocupação com a saúde, à demanda cada vez maior por óleos orgânicos e prensados a frio e à crescente disponibilidade de óleos de nozes especiais por meio de canais de distribuição tanto no varejo quanto online.

- O segmento convencional detinha a maior participação na receita de mercado em 2025, impulsionado por sua maior disponibilidade, preço mais baixo e forte utilização em aplicações de processamento de alimentos e cuidados pessoais. Os óleos vegetais convencionais continuam a dominar as prateleiras dos principais varejistas devido às cadeias de suprimentos estabelecidas e à maior aceitação por parte dos consumidores.

Escopo do relatório e segmentação do mercado de óleo de nozes na América do Norte

|

Atributos |

Principais informações sobre o mercado de óleo de nozes na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de óleo de nozes na América do Norte

“A ascensão dos óleos prensados a frio e ricos em nutrientes no mercado de óleos de nozes”

- A crescente preferência dos consumidores por óleos vegetais prensados a frio está remodelando o mercado, oferecendo produtos minimamente processados e ricos em nutrientes. Esses óleos retêm um teor mais elevado de antioxidantes e vitaminas, atendendo à crescente demanda por ingredientes naturais e funcionais. A tendência é especialmente forte entre os consumidores que adotam um estilo de vida focado em saúde preventiva e produtos com rótulos limpos.

- A crescente demanda por óleos comestíveis premium em regiões urbanas e semiurbanas está acelerando a adoção dos óleos de amêndoa, noz, avelã e macadâmia. Esses óleos são cada vez mais utilizados na culinária gourmet, em alimentos funcionais e em dietas especiais devido ao seu sabor superior e perfil nutricional. Sua presença crescente nos canais de varejo e comércio eletrônico está impulsionando ainda mais o consumo doméstico.

- A acessibilidade e a maior disponibilidade da tecnologia de extração por prensagem a frio estão permitindo que pequenos fabricantes entrem no mercado, impulsionando o crescimento da produção local. Essas tecnologias proporcionam maior eficiência de extração, menor complexidade operacional e rendimentos de melhor qualidade. Como resultado, unidades de processamento em nível comunitário estão ganhando força em economias emergentes.

- Por exemplo, em 2023, muitos pequenos processadores de óleo relataram aumento nas vendas de óleos vegetais prensados a frio após a adoção de máquinas de extração compactas. Essas tecnologias melhoraram a pureza e a consistência, impulsionando a competitividade dos produtores locais e apoiando a geração de empregos em comunidades rurais.

- Embora a demanda por óleos vegetais prensados a frio esteja aumentando, o crescimento sustentado do mercado depende da educação do consumidor, da padronização da qualidade e de preços competitivos. Os fabricantes precisam construir um posicionamento sólido baseado em valores, com ênfase na pureza, rastreabilidade e fornecimento autêntico. Alinhar as ofertas com as tendências de saúde, sustentabilidade e estilo de vida premium será essencial para o sucesso a longo prazo.

Dinâmica do mercado de óleo de nozes na América do Norte

Motorista

“A crescente demanda por óleos funcionais e ricos em nutrientes”

- A crescente preocupação com a saúde e o bem-estar está impulsionando os consumidores em direção a óleos ricos em nutrientes que oferecem benefícios para a saúde do coração, ação anti-inflamatória e nutrição da pele. Óleos como o de noz e o de amêndoa contêm ácidos graxos ômega, antioxidantes e vitaminas que contribuem para o bem-estar integral. Essa mudança reflete uma tendência mais ampla do consumidor em direção a produtos alimentícios com benefícios funcionais comprovados cientificamente.

- Os consumidores estão cada vez mais conscientes das vantagens funcionais dos óleos vegetais para aplicações culinárias e de cuidados pessoais. A versatilidade desses óleos permite seu uso em saladas, preparações gourmet, séruns para a pele e cosméticos naturais. A preferência por ingredientes de origem vegetal e livres de químicos continua a impulsionar uma adoção mais forte em diversos setores.

- Iniciativas da indústria, como rotulagem limpa, fornecimento transparente e certificações orgânicas, estão aumentando a confiança dos consumidores. Além disso, marcas premium estão destacando a rastreabilidade do campo à garrafa para fortalecer a autenticidade e a diferenciação do produto. Essas iniciativas estão alinhadas à demanda global por óleos minimamente processados que atendam às expectativas de sustentabilidade e pureza.

- Por exemplo, em 2022, diversos fabricantes de alimentos reformularam suas linhas de produtos premium para incluir óleos de nozes prensados a frio, fortalecendo a demanda geral do mercado. Essa mudança impulsionou a premiumização dos produtos e ajudou as marcas a atenderem consumidores preocupados com a saúde, incentivando os fornecedores a aumentarem a produção de óleos de nozes de alta qualidade.

- Embora a conscientização do consumidor seja um forte impulsionador de crescimento, o mercado exige inovação contínua de produtos, branding eficaz e estratégias de preços competitivas para manter o ritmo de crescimento a longo prazo. As empresas devem investir em embalagens premium, marketing direcionado e atributos diferenciados para os produtos. A pesquisa e o desenvolvimento contínuos em tecnologias de extração e formulação darão ainda mais suporte à expansão do mercado.

Restrição/Desafio

“Altos custos de produção e disponibilidade limitada de matéria-prima”

- O alto custo do cultivo de nozes e o baixo rendimento de óleo de nozes como a macadâmia e a avelã contribuem para o aumento dos custos de produção. Esses desafios resultam em preços de varejo premium, restringindo o acesso para consumidores sensíveis ao preço. Além disso, os produtores enfrentam custos crescentes de insumos relacionados à mão de obra, irrigação e manejo do pomar.

- Em muitas regiões produtoras de nozes, a infraestrutura de processamento limitada e os sistemas inadequados de manuseio pós-colheita reduzem a eficiência da produção. Os pequenos produtores frequentemente não possuem maquinário moderno e o treinamento técnico necessário para garantir uma produção consistente. Essas lacunas levam a variações de qualidade que afetam a credibilidade da marca e a competitividade no mercado.

- Restrições na cadeia de suprimentos, como disponibilidade sazonal e flutuações na produção de nozes induzidas pelo clima, criam volatilidade no fornecimento de matéria-prima. Condições climáticas instáveis afetam os ciclos de floração e a estabilidade da produção, interrompendo o planejamento da produção. Essa volatilidade também leva a frequentes oscilações de preços, afetando tanto fabricantes quanto distribuidores.

- Por exemplo, em 2023, vários produtores de óleo de nozes enfrentaram escassez de oferta devido à disponibilidade inconsistente de matéria-prima, relacionada a condições climáticas adversas. A redução nos volumes de colheita criou desafios de aquisição para os processadores, impactando a produção, as redes de distribuição e os compromissos de exportação.

- Embora os avanços tecnológicos estejam gradualmente melhorando a eficiência da extração, solucionar a escassez de matéria-prima e os custos de produção continua sendo essencial. Investimentos em agricultura resiliente às mudanças climáticas, cadeias de suprimentos integradas e capacidades de processamento aprimoradas são necessários para a estabilidade futura. Práticas de cultivo sustentáveis desempenharão um papel fundamental para garantir o crescimento a longo prazo do mercado de óleo de nozes.

Escopo do mercado de óleo de nozes na América do Norte

O mercado é segmentado com base em categoria, tipo de produto, uso final e canal de distribuição.

• Por categoria

Com base na categoria, o mercado de óleos de nozes na América do Norte é segmentado em orgânico e convencional. O segmento convencional detinha a maior participação na receita de mercado em 2025, impulsionado por sua maior disponibilidade, preço mais baixo e uso expressivo em aplicações de processamento de alimentos e cuidados pessoais. Os óleos de nozes convencionais continuam a dominar as prateleiras dos principais varejistas devido às cadeias de suprimentos estabelecidas e à maior aceitação do consumidor.

Espera-se que o segmento de produtos orgânicos apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente preferência do consumidor por produtos com rótulos limpos, livres de químicos e de origem sustentável. Os óleos de nozes orgânicos atraem compradores preocupados com a saúde, que buscam pureza natural e valor nutricional superior. A crescente adoção em cuidados com a pele, aromaterapia e culinária sofisticada está impulsionando significativamente a expansão do segmento.

• Por tipo de produto

Com base no tipo de produto, o mercado de óleos de nozes na América do Norte é segmentado em óleo de amêndoa, óleo de castanha-do-pará, óleo de caju, óleo de castanha-do-pará, óleo de avelã, óleo de noz-pecã, óleo de macadâmia, óleo de noz-pecã, óleo de pinhão, óleo de pistache, óleo de noz, óleo de amendoim, óleo de argan, óleo de marula, óleo de mongongo e outros. Os óleos de amêndoa e de noz detiveram a maior participação na receita de mercado em 2025, impulsionados por sua ampla aplicação na preparação de alimentos, cuidados com a pele e formulações de bem-estar. Seu forte perfil nutricional e a familiaridade consolidada com o consumidor sustentam uma demanda consistente em diversos setores.

Prevê-se que os óleos de macadâmia, argan e marula apresentem o crescimento mais rápido entre 2026 e 2033, impulsionados pelo crescente interesse em óleos premium, exóticos e ricos em nutrientes. Esses óleos são cada vez mais utilizados em produtos de cuidados pessoais de alto valor agregado, cosméticos de luxo e misturas terapêuticas devido às suas propriedades emolientes superiores. A crescente adoção em alimentos especiais e produtos de beleza naturais está amplificando ainda mais esse crescimento.

• Por uso final

Com base no uso final, o mercado de óleos de nozes na América do Norte é segmentado em Indústrias de Processamento de Alimentos, Indústrias de Cuidados Pessoais e Cosméticos, Consumo Direto, Aromaterapia, Tintas e Vernizes e Outros. O segmento de indústrias de processamento de alimentos detinha a maior participação na receita de mercado em 2025, impulsionado pela forte utilização de óleos de nozes em panificação, confeitaria, alimentos funcionais e formulações gourmet. Seu sabor rico, antioxidantes naturais e apelo nutricional sustentam a ampla integração na indústria alimentícia.

O segmento de cuidados pessoais e cosméticos deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente demanda por emolientes naturais, hidratantes à base de plantas e ingredientes ricos em nutrientes em formulações para cuidados com a pele e o cabelo. Óleos de nozes, como amêndoa, argan e macadâmia, são altamente valorizados por suas propriedades hidratantes, anti-inflamatórias e restauradoras. As crescentes tendências de bem-estar e os lançamentos de cosméticos premium continuam a impulsionar o crescimento do segmento.

• Por canal de distribuição

Com base no canal de distribuição, o mercado de óleos de nozes na América do Norte é segmentado em direto e indireto. O segmento indireto detinha a maior participação na receita de mercado em 2025, impulsionado pela ampla presença de supermercados, lojas especializadas e plataformas de comércio eletrônico que oferecem diversas variedades de óleos de nozes. A grande visibilidade do produto e as promoções lideradas pelos varejistas também contribuem para um forte alcance do consumidor.

Espera-se que o segmento de vendas diretas apresente a taxa de crescimento mais rápida de 2026 a 2033, impulsionado pela crescente adoção de lojas online próprias de marcas, modelos "do produtor ao consumidor" e canais de venda direta. A distribuição direta permite que os fabricantes ofereçam produtos mais frescos, pureza garantida e preços competitivos. A crescente preferência dos consumidores por produtos autênticos, rastreáveis e com origem verificada está impulsionando a expansão desse segmento.

Análise Regional do Mercado de Óleo de Nozes na América do Norte

- Os EUA dominaram o mercado de óleos vegetais, detendo a maior participação na receita em 2025, devido ao seu ecossistema avançado de processamento de alimentos, à alta conscientização do consumidor sobre óleos funcionais e ricos em nutrientes e à forte presença de fabricantes líderes.

- O uso crescente de óleos de nozes em alimentos voltados para a saúde, formulações de cuidados pessoais e produtos de aromaterapia continua a impulsionar a demanda do mercado.

- Uma rede de varejo bem estabelecida e a crescente preferência por óleos naturais premium reforçam ainda mais sua liderança.

Análise do Mercado de Óleo de Nozes no Canadá

Prevê-se que o Canadá registre a taxa de crescimento mais rápida entre 2026 e 2033, impulsionado pela crescente conscientização do consumidor sobre os benefícios para a saúde dos óleos à base de nozes. A popularidade crescente de óleos naturais, orgânicos e prensados a frio está incentivando os fabricantes a expandirem sua oferta de produtos nos segmentos de alimentos, cuidados com a pele e aromaterapia. O crescimento da produção artesanal e em pequenos lotes, aliado às tendências de rótulos limpos, está moldando ainda mais as preferências do consumidor. Além disso, a expansão dos canais de varejo e online está tornando os óleos de nozes especiais mais acessíveis, acelerando o crescimento geral do mercado.

Participação de mercado de óleo de nozes na América do Norte

A indústria de óleo de nozes na América do Norte é liderada principalmente por empresas consolidadas, incluindo:

- ADM – Archer Daniels Midland (EUA)

- Bunge Limited (EUA)

- Cargill, Incorporated (EUA)

- La Tourangelle, Inc. (EUA)

- Spectrum Organics – Parte do Hain Celestial Group (EUA)

- Nutiva, Inc. (EUA)

- NOW Health Group / NOW Foods (EUA)

- Caloy Company LP (EUA)

- Richardson International Limited (Canadá)

- Ventura Foods (EUA)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.