North America Molecular Diagnostics Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

14.85 Billion

USD

23.49 Billion

2025

2033

USD

14.85 Billion

USD

23.49 Billion

2025

2033

| 2026 –2033 | |

| USD 14.85 Billion | |

| USD 23.49 Billion | |

|

|

|

|

Mercado de diagnóstico molecular da América do Norte, subprodutos (reagentes e kits, instrumentos e serviços e software), tecnologia (espectrometria de massa (MS), eletroforese capilar, sequenciação de última geração (NGS), chips e microarray, reação em cadeia da polimerase (PCR) baseada Métodos, Citogenética, Hibridização in situ (ISH ou FISH), Imagiologia molecular e outros), Aplicação (Oncologia, Farmacogenómica, Microbiologia, Testes pré-natais, Tipagem de tecidos, Rastreio sanguíneo, Doenças cardiovasculares, Doenças neurológicas, Doenças infeciosas e outras), Utilizador final (Hospitais, Laboratórios Clínicos e Académicos), Tendências e Previsão do Setor por País (EUA, Canadá e México) até 2028.

Análise de Mercado e Insights: Mercado de Diagnóstico Molecular da América do Norte

Análise de Mercado e Insights: Mercado de Diagnóstico Molecular da América do Norte

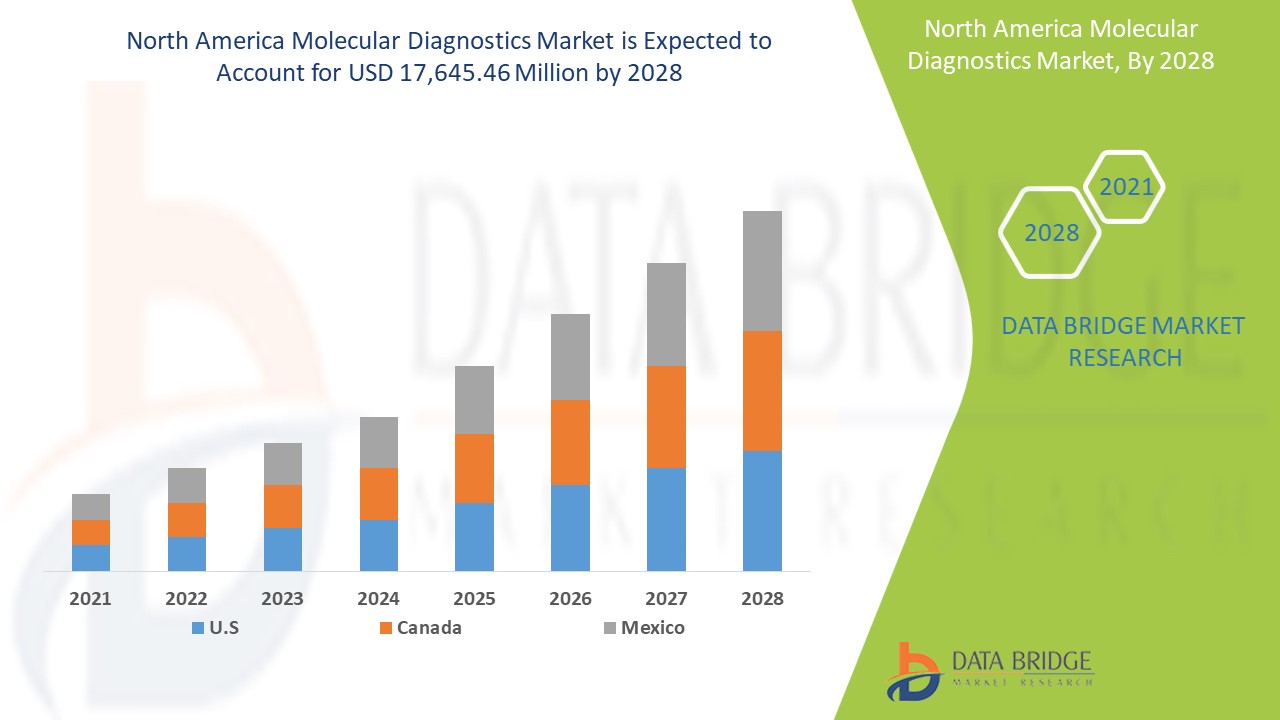

Espera-se que o mercado de diagnóstico molecular ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 5,9% no período previsto de 2021 a 2028 e deverá atingir 17.645,46 dólares até 2028. Espera-se que o aumento da prevalência de doenças infeciosas e cancro impulsione o crescimento do mercado de diagnóstico molecular.

O diagnóstico molecular identifica ou diagnostica doenças como doenças infeciosas , doenças genéticas, doenças cardiovasculares, doenças neurológicas e outras, estudando moléculas como o ADN, ARN e proteínas num tecido ou fluido. Diferentes tecnologias como PCR, espectrometria de massa, sequenciação de segunda geração, citogenética, hibridização in situ, imagiologia molecular e outras são utilizadas para diagnosticar diferentes doenças.

Espera-se que a crescente procura de ferramentas de diagnóstico molecular para diagnosticar a COVID-19 impulsione o crescimento do mercado de diagnóstico molecular. Espera-se que o elevado custo da instrumentação atue como uma grande restrição ao crescimento do mercado de diagnóstico molecular. Espera-se que o aumento da população geriátrica atue como uma oportunidade para o crescimento do mercado de diagnóstico molecular. Espera-se que a elevada concorrência entre os participantes do mercado atue como um desafio para o crescimento do mercado de diagnóstico molecular.

O relatório de mercado de diagnóstico molecular fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado nacional e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado de diagnóstico molecular, contacte a Data Bridge Market Research para obter um briefing de analista.

Âmbito e dimensão do mercado de diagnóstico molecular

Âmbito e dimensão do mercado de diagnóstico molecular

O mercado de diagnóstico molecular está segmentado com base nos produtos, tecnologia, aplicação e utilizador final. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base nos produtos, o mercado de diagnóstico molecular está segmentado em reagentes e kits, instrumentos e serviços e software . Em 2021, prevê-se que o segmento de instrumentos domine o mercado de diagnóstico molecular devido ao aumento da procura de tecnologia avançada para diagnosticar doenças como doenças infeciosas, cancro e outras.

- Com base na tecnologia, o mercado de diagnóstico molecular está segmentado em espectrometria de massa (MS) , eletroforese capilar, sequenciação de última geração (NGS), chips e microarray, métodos baseados na reação em cadeia da polimerase (PCR), citogenética, hibridização in situ (ISH). ou FISH), imagens moleculares e outros. Em 2021, prevê-se que o segmento de métodos baseados na reação em cadeia da polimerase (PCR) domine o mercado de diagnóstico molecular devido ao aumento da procura de kits de PCR para diagnosticar a COVID-19 e conter a pandemia.

- Com base na aplicação, o mercado de diagnóstico molecular está segmentado em oncologia, farmacogenómica, microbiologia , testes pré-natais, tipagem de tecidos, rastreio sanguíneo, doenças cardiovasculares, doenças neurológicas, doenças infeciosas e outras. Em 2021, prevê-se que o segmento das doenças infeciosas domine o mercado do diagnóstico molecular devido ao aumento de doenças infeciosas como a gripe, COVID-19, SIDA e outras e à maior procura de tecnologia de diagnóstico molecular altamente eficiente.

- Com base no utilizador final, o mercado de diagnóstico molecular está segmentado em hospitais , laboratórios clínicos e académicos. Em 2021, prevê-se que o segmento dos laboratórios clínicos domine o mercado do diagnóstico molecular devido ao número crescente de doentes com diversas doenças e à crescente necessidade de instrumentos de diagnóstico.

Análise ao nível do país do mercado de diagnóstico molecular da América do Norte

O mercado de diagnóstico molecular da América do Norte é analisado e são fornecidas informações sobre o tamanho do mercado por país, produtos, tecnologia, aplicação e utilizador final, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de diagnóstico molecular da América do Norte são os EUA, o Canadá e o México.

Prevê-se que o segmento de produtos na região do Canadá cresça com a maior taxa de crescimento no período previsto de 2021 a 2028, devido ao aumento da procura de instrumentos de diagnóstico para diagnosticar doentes com COVID-19 e outras doenças cardiovasculares, infeciosas e outras. O segmento de produtos nos EUA está a dominar o mercado de diagnóstico molecular da América do Norte devido ao aumento dos gastos com a saúde. O México está a liderar o crescimento do mercado de diagnóstico molecular na América do Norte, uma vez que o segmento de risco domina o país devido à crescente procura de testes no local de atendimento e medicina de precisão.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da América do Norte e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

O crescimento das atividades estratégicas dos principais participantes do mercado para aumentar a sensibilização para o diagnóstico molecular está a impulsionar o crescimento do mercado de diagnóstico molecular

O mercado de diagnóstico molecular também fornece análises de mercado detalhadas para cada país em crescimento no mercado de diagnóstico molecular. Além disso, fornece informações detalhadas sobre a estratégia dos participantes do mercado de diagnóstico molecular e a sua presença geográfica. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Análise do cenário competitivo e da quota de mercado nos diagnósticos moleculares

O panorama competitivo do mercado de diagnóstico molecular fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, largura e amplitude do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de diagnóstico molecular da América do Norte.

As principais empresas que estão a lidar com o relatório do mercado de diagnóstico molecular da América do Norte são a Abbott, Siemens Healthcare GmbH, Thermo Fisher Scientific Inc., BD, bioMérieux SA, Cepheid, Hologic, Inc., Myriad Genetics, Inc., QIAGEN , Agilent Technologies, Inc., Quidel Corporation, Beckman Coulter, Inc., Bio-Rad Laboratories, Inc., Illumina, Inc., IMMUCOR, Luminex Corporation, Meridian Bioscience, F Hoffmann-La Roche Ltd e GenMark Diagnostics, Inc., entre outros participantes nacionais. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos contratos, acordos e lançamentos são também iniciados por empresas de todo o mundo, o que está também a acelerar o mercado de diagnóstico molecular.

Por exemplo,

- Em junho de 2021, a Thermo Fisher Scientific Inc. lançou um novo produto chamado Attune CytPix, um citómetro de fluxo fluorescente que oferece imagens melhoradas e foco acústico com uma câmara de alta velocidade.

A colaboração, o lançamento de produtos, a expansão de negócios, os prémios e reconhecimentos, as joint ventures e outras estratégias dos participantes do mercado estão a aumentar a presença da empresa no mercado de diagnóstico molecular, o que também traz benefícios para o crescimento dos lucros da organização.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.