North America Menstrual Cramps Treatment Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.39 Billion

USD

4.21 Billion

2024

2032

USD

2.39 Billion

USD

4.21 Billion

2024

2032

| 2025 –2032 | |

| USD 2.39 Billion | |

| USD 4.21 Billion | |

|

|

|

|

Segmentação do mercado de tratamento de cólicas menstruais na América do Norte, por tipo (dismenorreia primária, dismenorreia secundária), tipo de tratamento (medicação, terapia, cirurgia, outros), modo de prescrição (sem receita, prescrição), via de administração (oral, parenteral, implantes, outros), usuário final (hospitais, centros especializados, centros cirúrgicos ambulatoriais, outros), canal de distribuição (farmácias, vendas no varejo, licitação direta, outros), país (EUA, Canadá, México), tendências e previsões do setor até 2032

Tamanho do mercado de tratamento de cólicas menstruais

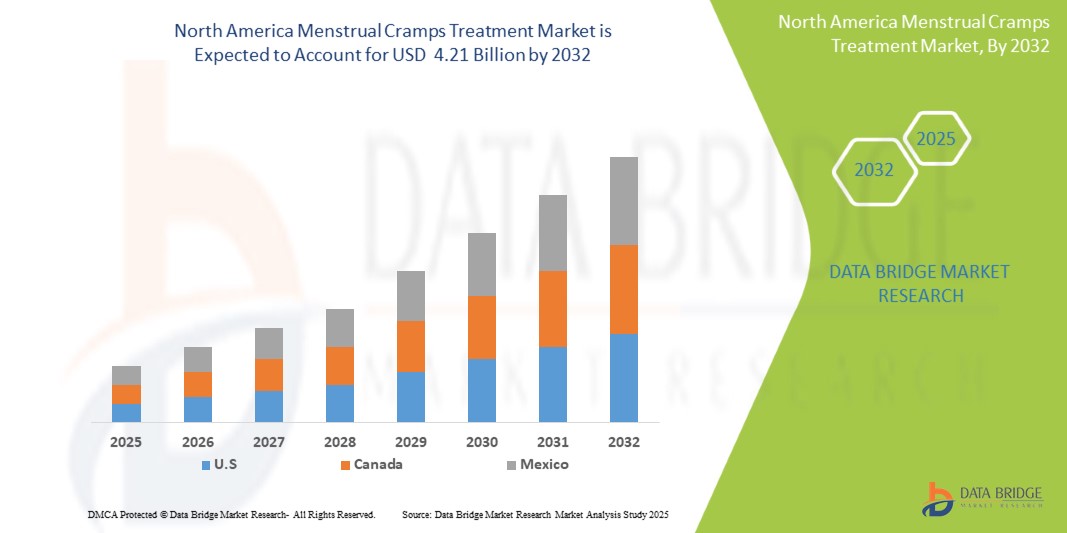

- O tamanho do mercado de tratamento de cólicas menstruais da América do Norte foi avaliado em US$ 2,39 bilhões em 2024 e deve atingir US$ 4,21 bilhões até 2032 , com um CAGR de 7,6% durante o período previsto.

- O crescimento do mercado de tratamento para cólicas menstruais na América do Norte é amplamente impulsionado pela crescente prevalência de dismenorreia e pela conscientização crescente sobre a saúde menstrual, levando a uma maior demanda por opções de tratamento eficazes em toda a região.

- Além disso, a crescente demanda dos consumidores por soluções seguras, eficientes e prontamente disponíveis para o alívio da dor menstrual está consolidando diversas modalidades de tratamento, incluindo medicamentos de venda livre e métodos não farmacológicos avançados, como a escolha moderna. Esses fatores convergentes estão acelerando a adoção de soluções para o tratamento da cólica menstrual, impulsionando significativamente o crescimento do setor.

Análise de Mercado para Tratamento de Cólicas Menstruais

- Os tratamentos para cólicas menstruais, que oferecem alívio da dor e do desconforto associados à menstruação, são componentes cada vez mais vitais do gerenciamento da saúde feminina na América do Norte devido à sua eficácia comprovada, diversas opções de administração e uma ênfase crescente no atendimento personalizado.

- A crescente demanda por tratamentos para cólicas menstruais nos EUA, Canadá e México é motivada principalmente pela alta prevalência de dismenorreia, pela crescente conscientização sobre a saúde menstrual e pela forte preferência por soluções eficazes e convenientes para o alívio da dor.

- Os Estados Unidos detêm uma fatia significativa do mercado de tratamento de cólicas menstruais na América do Norte, respondendo por 75% da receita regional, apoiada por altos gastos com saúde, ampla cobertura de seguro e ampla disponibilidade de medicamentos com e sem receita (OTC).

- O Canadá e o México também estão experimentando um crescimento constante, impulsionado pela expansão do acesso aos serviços de saúde, pelo aumento das campanhas de educação do consumidor sobre a saúde da mulher e por uma crescente população feminina em busca de opções de tratamento confiáveis.

- Espera-se que o segmento de medicamentos — especialmente os anti-inflamatórios não esteroidais (AINEs) — domine o mercado de tratamento de cólicas menstruais na América do Norte, representando 60% da participação total de mercado, impulsionado por sua reputação estabelecida de eficácia, acessibilidade e ampla disponibilidade como terapia de primeira linha para dismenorreia.

Escopo do Relatório e Segmentação do Mercado de Tratamento de Cólicas Menstruais

|

Atributos |

Insights sobre o mercado de chaves de fechadura inteligente |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências de mercado para tratamento de cólicas menstruais

“ Gestão personalizada da dor por meio de soluções de saúde digital com tecnologia de IA ”

- Uma tendência significativa e crescente no mercado de tratamento de cólicas menstruais na América do Norte é a integração cada vez maior com plataformas de inteligência artificial (IA) e saúde digital. Essa fusão de tecnologias está aumentando significativamente a conveniência e o controle do usuário sobre suas estratégias de gerenciamento da dor.

- Por exemplo, aplicativos de monitoramento menstrual com tecnologia de IA, como Flo e Clue, integram-se perfeitamente aos sintomas relatados pelas usuárias e aos dados históricos do ciclo menstrual, permitindo prever períodos menstruais, ovulação e janelas férteis com maior precisão, e frequentemente oferecendo insights personalizados para o gerenciamento do desconforto associado. Da mesma forma, dispositivos vestíveis que utilizam tecnologias como TENS (Estimulação Elétrica Nervosa Transcutânea) ou terapia de calor estão se integrando a aplicativos inteligentes para oferecer programas personalizáveis de alívio da dor.

- A integração de IA no tratamento de cólicas menstruais permite recursos como o aprendizado dos padrões de dor da usuária para sugerir o momento ideal para o tratamento e fornecer alertas mais inteligentes com base na gravidade dos sintomas. Por exemplo, algumas terapias digitais utilizam IA para aprimorar as recomendações de alívio da dor ao longo do tempo e podem enviar alertas inteligentes caso padrões de dor incomuns ou intensos sejam detectados. Além disso, as plataformas de saúde digital oferecem às usuárias a facilidade de monitorar sintomas, a ingestão de medicamentos e fatores de estilo de vida, permitindo que elas entendam e gerenciem melhor sua jornada individual de saúde menstrual.

- A integração perfeita de soluções baseadas em IA com ecossistemas de saúde digital mais amplos facilita o controle centralizado sobre vários aspectos do bem-estar menstrual. Por meio de uma única interface, as usuárias podem gerenciar suas estratégias de alívio da dor, além de monitorar o humor, os níveis de atividade e outros dados de saúde, criando uma abordagem unificada e automatizada para o gerenciamento da saúde menstrual.

- Essa tendência em direção a sistemas de gerenciamento da dor mais inteligentes, intuitivos e interconectados está remodelando fundamentalmente as expectativas das usuárias em relação ao alívio do desconforto menstrual. Consequentemente, as empresas estão desenvolvendo soluções de saúde digital habilitadas por IA, com recursos como recomendações personalizadas automáticas para alívio da dor com base nos sintomas relatados e integração com outros aplicativos de bem-estar.

- A demanda por tratamentos para cólicas menstruais que ofereçam integração perfeita de IA e saúde digital está crescendo rapidamente no mercado da América do Norte, à medida que os consumidores priorizam cada vez mais conveniência, atendimento personalizado e funcionalidades abrangentes de autogerenciamento.

Dinâmica do mercado de tratamento para cólicas menstruais

Motorista

“ Necessidade crescente devido à crescente prevalência de dismenorreia e à maior conscientização sobre saúde ”

- A prevalência crescente de cólicas menstruais (dismenorreia) entre mulheres, aliada à conscientização crescente e à discussão aberta sobre a saúde menstrual, é um fator significativo para o aumento da demanda por tratamentos eficazes para cólicas menstruais.

- Por exemplo, nos últimos anos, empresas introduziram soluções não farmacológicas inovadoras, como dispositivos vestíveis de terapia térmica ou unidades TENS, com o objetivo de proporcionar alívio prático e sem medicamentos para a dor. Espera-se que tais avanços, realizados por empresas importantes, impulsionem o crescimento do setor de tratamento de cólicas menstruais no período previsto.

- À medida que as pessoas se tornam mais conscientes do impacto da dor menstrual em suas vidas diárias e buscam melhores opções de alívio e tratamento, os tratamentos modernos oferecem recursos avançados, como alívio direcionado da dor, abordagens personalizadas e efeitos colaterais reduzidos, fornecendo uma alternativa ou complemento atraente aos métodos tradicionais.

- Além disso, a crescente popularidade de abordagens de saúde holística e o desejo por bem-estar abrangente estão tornando os tratamentos para cólicas menstruais um componente integral dessas estratégias de saúde mais amplas, oferecendo integração perfeita com modificações no estilo de vida e práticas de autocuidado.

- A conveniência de medicamentos de venda livre prontamente disponíveis, a acessibilidade a diversas opções terapêuticas e a capacidade de controlar os sintomas por meio de aplicativos de saúde digitais de fácil utilização são fatores-chave que impulsionam a adoção de tratamentos para cólicas menstruais. A tendência à autogestão e a crescente disponibilidade de diversas opções de tratamento contribuem ainda mais para o crescimento do mercado.

Restrição/Desafio

“ Preocupações com os efeitos colaterais e o estigma associados aos tratamentos ”

- As preocupações em torno dos potenciais efeitos colaterais dos tratamentos farmacêuticos e o estigma social associado aos problemas de saúde menstrual representam um desafio significativo para uma penetração mais ampla no mercado. Como os tratamentos para cólicas menstruais frequentemente envolvem medicamentos ou terapias, eles podem estar associados a reações adversas ou à relutância em buscar ajuda devido a questões de privacidade, gerando ansiedade entre potenciais consumidores quanto à segurança e adequação dessas opções.

- Por exemplo, a conscientização pública sobre os potenciais efeitos colaterais de certos medicamentos, ou a percepção de invasividade de algumas terapias, fez com que alguns consumidores hesitassem em adotar soluções de tratamento convencionais.

- Abordar essas preocupações por meio de pesquisas robustas, comunicação clara dos benefícios versus riscos e desenvolvimento de terapias mais direcionadas é crucial para construir a confiança do consumidor. As empresas enfatizam seus rigorosos ensaios clínicos e programas de suporte ao paciente para tranquilizar potenciais compradores. Além disso, o custo relativamente alto de alguns regimes de tratamento avançados ou de longo prazo, ou políticas de reembolso insuficientes, podem ser uma barreira à adoção por consumidores sensíveis a preço, especialmente para aqueles que buscam atendimento especializado. Embora analgésicos básicos de venda livre sejam acessíveis, recursos premium, como dispositivos vestíveis avançados ou planos de terapia personalizados, geralmente têm um preço mais alto.

- Embora o acesso a vários tratamentos esteja melhorando, a percepção do fardo do gerenciamento contínuo ou a preferência por alternativas não farmacológicas ainda podem dificultar a adoção generalizada, especialmente para aqueles que buscam abordagens mais naturais ou menos invasivas.

- Superar esses desafios por meio de melhor educação do paciente, informações transparentes sobre os resultados do tratamento e o desenvolvimento de opções terapêuticas mais acessíveis e de menor custo será vital para o crescimento sustentado do mercado.

Escopo de mercado para tratamento de cólicas menstruais

O mercado é segmentado com base no tipo, tipo de tratamento, modo de prescrição, via de administração, usuário final e canal de distribuição.

Por tipo

Com base no tipo, o mercado de tratamento para cólicas menstruais na América do Norte é segmentado em dismenorreia primária e dismenorreia secundária. Espera-se que o segmento de dismenorreia primária detenha a maior participação de mercado, de 68%, em 2025, impulsionado pela alta prevalência entre mulheres adolescentes e jovens adultas. O aumento das campanhas de conscientização e a melhoria do acesso a medicamentos de venda livre contribuem para a demanda por tratamentos eficazes para a dor menstrual primária. A projeção é de que esse segmento se expanda a uma taxa composta de crescimento anual (CAGR) de 6,5% entre 2025 e 2032.

Por Tipo de Tratamento

Com base no tipo de tratamento, o mercado é segmentado em medicamentos, terapias, cirurgias e outros. O segmento de medicamentos, particularmente os Anti-inflamatórios Não Esteroidais (AINEs), foi responsável pela maior fatia da receita de mercado em 2025, refletindo seu papel consolidado como terapia de primeira linha, acessibilidade e ampla disponibilidade. Espera-se que o segmento de terapias, incluindo a termoterapia e a estimulação elétrica nervosa transcutânea (TENS), apresente o CAGR mais rápido entre 2025 e 2032, impulsionado pelo crescente interesse do consumidor por soluções não farmacológicas para o controle da dor.

Por modalidade de prescrição

: Por modalidade de prescrição, o mercado se divide em tratamentos de venda livre (OTC) e com receita médica. O segmento de OTC domina o mercado, impulsionado pelo uso generalizado de AINEs e analgésicos sem receita médica e pela forte penetração em farmácias de varejo. O segmento de prescrição médica também está em expansão, impulsionado pela demanda por terapias hormonais e tratamentos direcionados para dismenorreia secundária.

Por via de administração

: Com base na via de administração, o mercado inclui oral, parenteral, implantes e outros. O segmento oral deteve a maior participação na receita em 2025, devido à facilidade de uso, rápido início de ação e familiaridade do consumidor com analgésicos orais. Espera-se que o segmento de implantes cresça de forma constante, à medida que os dispositivos intrauterinos hormonais ganham popularidade para o tratamento a longo prazo da dismenorreia.

Por usuário final

Por usuário final, o mercado é segmentado em hospitais, centros de especialidades, centros cirúrgicos ambulatoriais e outros. Os hospitais foram responsáveis pela maior fatia da receita, refletindo o alto volume de consultas e tratamentos administrados por meio de serviços ambulatoriais e de internação. A projeção é de que os centros de especialidades cresçam rapidamente, impulsionados pelo papel crescente das clínicas de ginecologia no fornecimento de planos de tratamento personalizados e procedimentos minimamente invasivos.

Por Canal de Distribuição

O segmento de canais de distribuição inclui farmácias, vendas no varejo, licitações diretas e outros. As farmácias continuam sendo o principal canal de distribuição, apoiadas pela forte venda de medicamentos sem receita e pelo atendimento de receitas. As vendas no varejo, incluindo plataformas de e-commerce, estão apresentando um crescimento robusto devido à preferência do consumidor por acesso conveniente e entrega em domicílio.

Análise regional do mercado de tratamento de cólicas menstruais

- Espera-se que a América do Norte detenha uma fatia significativa do mercado de tratamento para cólicas menstruais, impulsionada pela alta prevalência de dismenorreia entre a população feminina e por uma infraestrutura de saúde bem estabelecida. Os Estados Unidos são o principal contribuinte para esse mercado, apoiados pela crescente conscientização, forte cobertura de seguros e uma ampla gama de tratamentos com e sem receita médica. Canadá e México também estão testemunhando um crescimento constante devido à melhoria do acesso aos serviços de saúde da mulher e ao aumento da educação sobre cuidados menstruais.

- Os consumidores da região valorizam muito o alívio eficaz da dor, a conveniência e a possibilidade de escolher entre diversas opções de tratamento, incluindo terapias não farmacológicas e medicamentos avançados. Há uma aceitação crescente da busca proativa por soluções médicas para o desconforto menstrual, ainda mais incentivada por campanhas de conscientização e iniciativas direcionadas que posicionam a saúde menstrual como um aspecto essencial do bem-estar geral.

- Essa ampla adoção é ainda apoiada por altos gastos com saúde, uma população engajada em tecnologia e a crescente popularidade dos canais de comércio eletrônico e farmácias de varejo, estabelecendo o gerenciamento abrangente da dor menstrual como uma abordagem preferencial nos países da América do Norte.

Visão Geral do Mercado de Tratamento de Cólicas Menstruais nos EUA:

Os EUA são o mercado dominante na América do Norte para o tratamento de cólicas menstruais, respondendo pela maior fatia da receita, de 75%. O crescimento é impulsionado pela alta conscientização sobre a saúde menstrual, ampla disponibilidade de tratamentos com e sem receita médica e forte cobertura de planos de saúde. Os consumidores priorizam cada vez mais soluções eficazes para o alívio da dor, incluindo opções farmacêuticas e não farmacológicas, apoiadas por fortes redes de farmácias de varejo e plataformas de comércio eletrônico em expansão. Iniciativas de saúde pública, programas de bem-estar apoiados por empregadores e a integração da saúde menstrual em políticas mais amplas de saúde da mulher impulsionam ainda mais a demanda do mercado.

Visão Geral do Mercado de Tratamento de Cólicas Menstruais no Canadá:

O Canadá ocupa uma posição significativa no mercado de tratamento de cólicas menstruais na América do Norte, impulsionado pelo crescimento dos investimentos em saúde, pela cobertura universal de saúde e pela crescente conscientização pública sobre a saúde menstrual. Há um foco crescente no acesso equitativo a produtos menstruais e à educação, o que indiretamente apoia a demanda por soluções para o controle da dor. O mercado se beneficia de uma combinação de medicamentos tradicionais, terapias alternativas e do crescente interesse por opções holísticas e sustentáveis para o alívio da dor menstrual.

Visão Geral do Mercado de Tratamento para Cólicas Menstruais no México:

O mercado de tratamento para cólicas menstruais no México está em constante crescimento, impulsionado pela expansão da infraestrutura de saúde, pela crescente conscientização sobre problemas de saúde menstrual e pelos esforços para reduzir o estigma em torno da busca por tratamento para dores menstruais. Os consumidores estão recorrendo cada vez mais a soluções farmacêuticas e não medicamentosas, à medida que o acesso aos serviços de saúde melhora. Iniciativas governamentais e não governamentais que promovem a saúde da mulher e a higiene menstrual contribuem ainda mais para a expansão do mercado, juntamente com o crescimento da urbanização e da renda disponível.

Participação no mercado de tratamento de cólicas menstruais

O setor de fechaduras inteligentes é liderado principalmente por empresas bem estabelecidas, incluindo:

- Bayer AG (Leverkusen, Alemanha)

- GlaxoSmithKline plc (Londres, Reino Unido)

- Pfizer Inc. (Nova York, EUA)

- Teva Pharmaceuticals USA, Inc. (Parsippany, Nova Jersey, EUA)

- Color Seven Co., Ltd. (Seul, Coreia do Sul)

- Beurer GmbH (Ulm, Alemanha)

- Mylan NV (Canonsburg, Pensilvânia, EUA)

- Boehringer Ingelheim International GmbH (Ingelheim am Rhein, Alemanha)

- PMS4PMS, LLC (informações da sede não estão prontamente disponíveis)

- Sanofi (Paris, França)

- Nobelpharma Co., Ltd. (Informações da sede não disponíveis prontamente)

- ObsEva (Genebra, Suíça)

- Myovant Sciences Ltd. (Basileia, Suíça)

- AbbVie Inc. (Norte de Chicago, Illinois, EUA)

- BioElectronics Corporation (Frederick, Maryland, EUA)

- LIVIA (informações da sede não estão prontamente disponíveis)

- Alvogen (Pine Brook, Nova Jersey, EUA)

- Cumberland Pharmaceuticals Inc. (Nashville, Tennessee, EUA)

- Lupin Pharmaceuticals, Inc. (Baltimore, Maryland, EUA)

- Janssen Pharmaceuticals, Inc. (Titusville, Nova Jersey, EUA)

- Sun Pharmaceutical Industries Ltd. (Mumbai, Índia)

Últimos desenvolvimentos no mercado de tratamento de cólicas menstruais na América do Norte

- Em março de 2025, a Samphire Neuroscience, pioneira em neurotecnologia, lançou oficialmente o Nettle™, seu dispositivo cerebral com certificação CE, projetado para aliviar os sintomas mentais e físicos associados à menstruação. Esta iniciativa reforça a dedicação da empresa em fornecer soluções inovadoras e não farmacológicas para o alívio da dor, adaptadas à crescente demanda na América do Norte por tratamentos alternativos e tecnológicos para a saúde menstrual. Ao alavancar sua expertise em estimulação transcraniana por corrente contínua (ETCC), a Samphire Neuroscience não está apenas abordando o desconforto, mas também reforçando sua posição no mercado de femtech e terapias digitais em rápida expansão.

- Em 2024, a Bayer AG manteve estrategicamente seu foco no avanço dos tratamentos para dor pélvica associada à endometriose, uma causa significativa de dismenorreia secundária na América do Norte. Esse compromisso contínuo, exemplificado pela pesquisa e comercialização contínuas de produtos como Visanne, reforça a dedicação da empresa em fornecer soluções médicas eficazes e personalizadas para condições complexas de dor ginecológica. Ao alavancar sua ampla capacidade de P&D e sua sólida experiência farmacêutica, a Bayer AG não está apenas abordando a dor crônica, mas também reforçando sua posição dominante no setor de saúde da mulher, em rápida evolução.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.