North America Medical Automation Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

35.34 Billion

USD

75.75 Billion

2025

2033

USD

35.34 Billion

USD

75.75 Billion

2025

2033

| 2026 –2033 | |

| USD 35.34 Billion | |

| USD 75.75 Billion | |

|

|

|

|

Segmentação do Mercado de Automação Médica na América do Norte, por Componente (Equipamentos, Software e Serviços), Tipo (Formulação e Dispensação Automatizadas de Prescrições, Avaliação e Monitoramento Automatizados da Saúde, Imagem e Análise de Imagens Automatizadas, Logística Automatizada na Área da Saúde, Rastreamento de Recursos e Pessoal, Robótica Médica e Dispositivos Cirúrgicos Assistidos por Computador, Procedimentos Terapêuticos (Não Cirúrgicos) Automatizados e Testes e Análises Laboratoriais Automatizados), Aplicação (Diagnóstico e Monitoramento, Terapêutica, Automação de Laboratórios e Farmácias, Logística e Treinamento Médico e Outros), Conectividade (Com e Sem Fio), Usuário Final (Hospitais, Centros de Diagnóstico, Farmácias, Laboratórios e Institutos de Pesquisa, Assistência Domiciliar, Clínicas Especializadas, Centros Cirúrgicos Ambulatoriais (CCAs) e Outros), Canal de Distribuição (Licitação Direta, Vendas no Varejo, Vendas Online e Outros) - Tendências e Previsões do Setor até 2033

Tamanho do mercado de automação médica na América do Norte

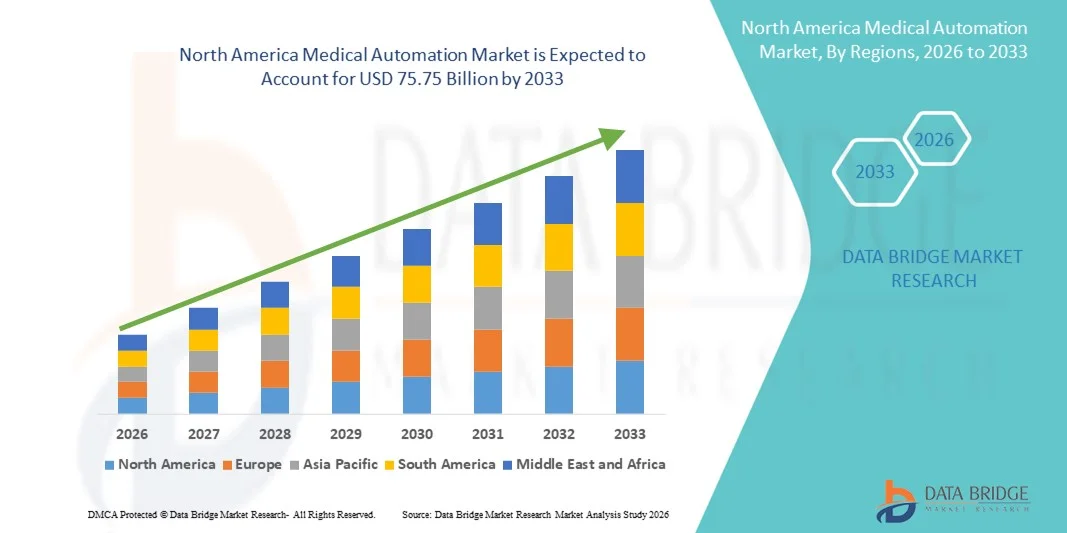

- O mercado de automação médica na América do Norte foi avaliado em US$ 35,34 bilhões em 2025 e espera-se que alcance US$ 75,75 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 10,00% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela rápida adoção de sistemas avançados de TI na área da saúde, robótica e inteligência artificial em hospitais e laboratórios de diagnóstico, o que leva a uma maior automação dos fluxos de trabalho clínicos, administrativos e operacionais, tanto em ambientes hospitalares quanto ambulatoriais.

- Além disso, a crescente demanda por maior eficiência operacional, redução de erros humanos, contenção de custos e maior segurança do paciente está consolidando a automação médica como um componente essencial da prestação de cuidados de saúde modernos. Esses fatores convergentes estão acelerando a adoção de soluções de automação médica, impulsionando significativamente o crescimento do setor.

Análise do Mercado de Automação Médica na América do Norte

- A automação médica, que engloba robótica, software baseado em IA, diagnósticos automatizados e soluções de fluxo de trabalho digital, está se tornando cada vez mais essencial em hospitais, laboratórios e clínicas ambulatoriais, à medida que os profissionais de saúde buscam melhorar a eficiência operacional, a precisão clínica e a segurança do paciente.

- A crescente demanda por automação médica é impulsionada principalmente pelo aumento do número de pacientes, pela pressão cada vez maior para reduzir custos operacionais, pela escassez de profissionais de saúde qualificados e pela rápida adoção de tecnologias digitais , inteligência artificial e robótica em processos clínicos e administrativos.

- Os EUA dominaram o mercado de automação médica na América do Norte, com a maior participação de receita, de aproximadamente 38,6% em 2025. Esse desempenho foi impulsionado por uma infraestrutura de saúde bem estabelecida, pela adoção precoce de soluções avançadas de automação na área da saúde, pela ampla implementação de diagnósticos baseados em inteligência artificial, cirurgia robótica e automação hospitalar, além de fortes investimentos de empresas líderes em tecnologia médica.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de automação médica durante o período de previsão, com uma robusta taxa de crescimento anual composta (CAGR) de 11,8%, impulsionada pela crescente modernização das instalações de saúde, fortes iniciativas governamentais de apoio à digitalização da saúde, crescente adoção da robótica médica e investimentos crescentes em soluções para hospitais inteligentes por parte de empresas nacionais e internacionais.

- O segmento Wired dominou o mercado com uma participação de receita de quase 58,2% em 2025, principalmente devido à sua confiabilidade superior, transmissão de dados estável e desempenho de baixa latência em ambientes críticos de saúde.

Escopo do relatório e segmentação do mercado de automação médica

|

Atributos |

Principais informações sobre o mercado de automação médica |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

• Siemens Healthineers (Alemanha) |

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de automação médica na América do Norte

Adoção crescente de fluxos de trabalho clínicos e laboratoriais automatizados

- Uma tendência significativa e crescente no mercado global de automação médica é a ampla adoção de sistemas automatizados em hospitais, laboratórios de diagnóstico, fábricas farmacêuticas e centros de atendimento ambulatorial para melhorar a eficiência, a precisão e a segurança do paciente.

- Por exemplo, em 2024, a Siemens Healthineers expandiu a implantação de suas plataformas de automação laboratorial na América do Norte e na região Ásia-Pacífico, oferecendo suporte a diagnósticos de alto rendimento e fluxos de trabalho de testes padronizados em escala global.

- As soluções de automação médica são cada vez mais utilizadas para otimizar tarefas clínicas e administrativas repetitivas, como preparação de amostras, dispensação de medicamentos, monitoramento de pacientes e gerenciamento de dados, reduzindo significativamente a intervenção manual e as taxas de erro.

- A crescente demanda global por diagnósticos mais rápidos, resultados clínicos consistentes e testes em grande volume está acelerando a adoção da automação em mercados de saúde desenvolvidos e emergentes.

- Os avanços em robótica, plataformas de software integradas e sistemas com sensores estão permitindo uma coordenação perfeita entre diferentes funções na área da saúde, melhorando a continuidade do fluxo de trabalho em ambientes de atendimento complexos.

- Essa mudança em direção a sistemas de saúde automatizados, escaláveis e interoperáveis está transformando fundamentalmente os modelos globais de prestação de serviços de saúde e fortalecendo o papel da automação médica em todo o mundo.

Dinâmica do mercado de automação médica na América do Norte

Motorista

Crescente demanda global por serviços de saúde e requisitos de eficiência operacional

- O aumento da carga global de doenças crônicas, o envelhecimento da população e o crescente número de pacientes são os principais fatores que impulsionam o crescimento do mercado global de Automação Médica.

- Por exemplo, em abril de 2025, a Fresenius Medical Care anunciou a implementação global de soluções automatizadas de gestão e monitorização de tratamentos em suas clínicas de diálise em diversas regiões, com o objetivo de melhorar a consistência do atendimento e a eficiência operacional.

- Os prestadores de serviços de saúde em todo o mundo estão adotando cada vez mais tecnologias de automação para lidar com a escassez de mão de obra, reduzir custos operacionais e aumentar a consistência nos processos clínicos.

- A expansão de laboratórios centralizados, centros de fabricação farmacêutica e instalações de atendimento ambulatorial em regiões como Ásia-Pacífico, América Latina e Oriente Médio está impulsionando ainda mais a demanda por sistemas médicos automatizados.

- Além disso, as iniciativas globais de modernização da saúde e os investimentos em infraestrutura digital e automatizada estão acelerando a integração de soluções de automação em ambientes de saúde públicos e privados.

- Esses fatores, em conjunto, criam um forte impulso para o crescimento sustentado do mercado global de Automação Médica durante o período de previsão.

Restrição/Desafio

Altos custos de capital e complexidade de implementação

- O elevado investimento inicial exigido para sistemas avançados de automação médica continua a ser um grande desafio para os prestadores de cuidados de saúde, particularmente em regiões com recursos limitados e sensíveis aos custos.

- Por exemplo, em 2024, vários hospitais em mercados emergentes na Ásia e na América Latina adiaram projetos de automação laboratorial em larga escala devido a limitações de financiamento e desafios relacionados à infraestrutura, evidenciando barreiras à adoção relacionadas a custos.

- A complexidade da integração de sistemas, incluindo a compatibilidade com a infraestrutura legada existente e os sistemas de informação hospitalares, pode prolongar os prazos de implementação e aumentar os custos totais de propriedade.

- Além disso, desafios como a necessidade de treinamento da equipe, a reformulação do fluxo de trabalho e as interrupções operacionais temporárias durante a implementação podem retardar ainda mais a adoção.

- A variabilidade regulatória entre países e regiões pode complicar a implementação de soluções de automação padronizadas, aumentando os custos relacionados à conformidade.

- Superar essas limitações por meio de projetos de sistemas escaláveis, modelos de financiamento flexíveis e estratégias de implementação com suporte do fornecedor será essencial para o crescimento a longo prazo do mercado global de Automação Médica.

Escopo do mercado de automação médica na América do Norte

O mercado é segmentado com base em componente, tipo, aplicação, conectividade, usuário final e canal de distribuição.

- Por componente

Com base nos componentes, o mercado de Automação Médica é segmentado em Equipamentos, Software e Serviços. O segmento de Equipamentos dominou a maior participação na receita de mercado, com cerca de 46,1% em 2025, impulsionado pela ampla implantação de sistemas de hardware automatizados em hospitais, laboratórios de diagnóstico e clínicas especializadas. Equipamentos como sistemas de imagem automatizados, plataformas cirúrgicas robóticas, unidades de dispensação automatizadas e robôs de laboratório formam a espinha dorsal da infraestrutura de automação médica. Os hospitais continuam priorizando o investimento em equipamentos de automação para reduzir erros clínicos, aumentar a precisão dos procedimentos e gerenciar o crescente volume de pacientes. A forte demanda de hospitais terciários e centros médicos acadêmicos sustenta essa dominância. As soluções em equipamentos também se beneficiam de ciclos de substituição mais longos e alto valor de aquisição inicial. A integração de sensores com inteligência artificial, robótica e controladores inteligentes aumenta ainda mais a adoção. Mercados desenvolvidos como os EUA, Alemanha, Japão e França lideram a implantação de equipamentos. As atualizações e expansões contínuas das instalações com automação mantêm a liderança em receita.

O segmento de Software deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 22,4%, entre 2026 e 2033, devido à rápida digitalização dos fluxos de trabalho na área da saúde e à crescente dependência da automação orientada por dados. As plataformas de software permitem o controle centralizado, o monitoramento em tempo real, a manutenção preditiva e o suporte à decisão baseado em IA em sistemas automatizados. A crescente adoção de soluções baseadas em nuvem, algoritmos de IA e softwares interoperáveis integrados a registros eletrônicos de saúde acelera o crescimento. Os provedores de serviços de saúde estão cada vez mais implementando softwares de automação para otimizar a utilização de equipamentos e reduzir custos operacionais. Os modelos de assinatura e SaaS impulsionam ainda mais a adoção. A expansão da telemedicina e do diagnóstico remoto também alimenta a demanda. As economias emergentes estão investindo fortemente em softwares de automação devido aos menores custos iniciais em comparação com o hardware. A ênfase regulatória na rastreabilidade e na conformidade também contribui para o crescimento do setor de software.

- Por tipo

Com base no tipo, o mercado é segmentado em Formulação e Dispensação Automatizadas de Prescrições, Avaliação e Monitoramento Automatizados da Saúde, Imagem e Análise de Imagens Automatizadas, Logística Automatizada na Área da Saúde, Rastreamento de Recursos e Pessoal, Robótica Médica e Dispositivos Cirúrgicos Assistidos por Computador, Procedimentos Terapêuticos (Não Cirúrgicos) Automatizados e Testes e Análises Laboratoriais Automatizados. O segmento de Imagem e Análise de Imagens Automatizadas dominou a maior participação de mercado em receita, com aproximadamente 35,6% em 2025, impulsionado pela crescente demanda por imagens diagnósticas rápidas, precisas e de alto volume. A automação melhora a eficiência do fluxo de trabalho em departamentos de radiologia e minimiza a variabilidade diagnóstica. Ferramentas de imagem com inteligência artificial auxiliam os médicos na detecção precoce de doenças e na tomada de decisões clínicas. A alta utilização em oncologia, cardiologia e neurologia fortalece a adoção. Grandes redes de diagnóstico e hospitais dependem fortemente da imagem automatizada para gerenciar o crescente volume de exames. As aprovações regulatórias de soluções de imagem baseadas em IA reforçam ainda mais a dominância. A integração com PACS e sistemas de TI hospitalares agrega valor. Regiões desenvolvidas predominam na adoção devido à infraestrutura avançada.

O segmento de Robótica Médica e Dispositivos Cirúrgicos Assistidos por Computador deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 24,1%, entre 2026 e 2033, impulsionado pela crescente preferência por cirurgias minimamente invasivas e de precisão. Os sistemas robóticos melhoram a precisão cirúrgica, reduzem a perda de sangue e diminuem o tempo de internação hospitalar. O aumento dos programas de treinamento de cirurgiões e a expansão das indicações em ortopedia, urologia, ginecologia e neurocirurgia apoiam a adoção dessa tecnologia. Avanços tecnológicos, como navegação assistida por inteligência artificial e funções autônomas, aceleram o crescimento. Hospitais investem em robótica para diferenciar seus serviços e melhorar os resultados. A expansão nos mercados da Ásia-Pacífico e do Oriente Médio impulsiona ainda mais a CAGR. Tendências favoráveis de reembolso e a demanda dos pacientes por cuidados avançados reforçam o ritmo de crescimento.

- Por meio de aplicação

Com base na aplicação, o mercado é segmentado em Diagnóstico e Monitoramento, Terapêutica, Automação Laboratorial e Farmacêutica, Logística Médica e Treinamento, e Outros. O segmento de Diagnóstico e Monitoramento representou a maior participação na receita de mercado, com cerca de 41,3% em 2025, impulsionado pela crescente prevalência de doenças crônicas e pela necessidade de monitoramento contínuo do paciente. Sistemas de diagnóstico automatizados aumentam a precisão e reduzem o tempo de resposta. Soluções de monitoramento remoto ganharam forte adoção após a pandemia. Hospitais implantam cada vez mais diagnósticos automatizados para gerenciar o alto fluxo de pacientes. A integração com dispositivos vestíveis e plataformas de IoT fortalece ainda mais a dominância do mercado. Iniciativas governamentais de apoio ao diagnóstico digital também contribuem para esse cenário. A automação diagnóstica permanece fundamental para as estratégias de saúde preventiva.

Prevê-se que o segmento de Automação Laboratorial e Farmacêutica registre a taxa de crescimento anual composta (CAGR) mais rápida, de 23,0%, entre 2026 e 2033, impulsionado pelo aumento do volume de testes e pela demanda por dispensação de medicamentos sem erros. A automação melhora a produtividade laboratorial, reduz os riscos de contaminação e garante a conformidade com as normas regulatórias. A automação farmacêutica minimiza erros de medicação e aprimora o controle de estoque. A alta adoção em farmácias hospitalares e laboratórios centralizados sustenta o crescimento. A expansão de instalações ambulatoriais e de atendimento externo aumenta a demanda. A crescente ênfase na medicina personalizada acelera ainda mais a adoção.

- Por meio da conectividade

Com base na conectividade, o mercado é segmentado em redes com fio e sem fio. O segmento com fio dominou o mercado com uma participação de receita de quase 58,2% em 2025, principalmente devido à sua confiabilidade superior, transmissão de dados estável e desempenho de baixa latência em ambientes críticos de saúde. A conectividade com fio é amplamente preferida para sistemas de automação usados em salas de cirurgia, unidades de terapia intensiva (UTIs), diagnóstico por imagem e automação laboratorial, onde o desempenho ininterrupto é essencial. Os hospitais dependem de redes com fio para garantir o tempo de atividade consistente do sistema e minimizar os riscos de segurança cibernética associados à transferência de dados sem fio. A infraestrutura hospitalar existente é amplamente projetada em torno da conectividade com fio, reduzindo custos adicionais de investimento. Os sistemas com fio também suportam altas cargas de dados geradas por sistemas de imagem e robótica. Os requisitos de conformidade regulatória e proteção de dados favorecem ainda mais as soluções com fio. Grandes instalações de saúde priorizam a automação com fio para aplicações de missão crítica. A durabilidade a longo prazo e o desempenho previsível contribuem para a manutenção da dominância.

O segmento de tecnologia sem fio deverá apresentar o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 21,2% entre 2026 e 2033, impulsionado pela rápida expansão de dispositivos médicos habilitados para IoT e soluções de monitoramento remoto de pacientes. A conectividade sem fio proporciona maior flexibilidade e mobilidade tanto para profissionais de saúde quanto para pacientes. A crescente adoção da telemedicina e do atendimento domiciliar impulsiona fortemente a implantação da automação sem fio. Os sistemas sem fio reduzem a complexidade de instalação e permitem a expansão em escala em diversas instalações. O crescimento de centros cirúrgicos ambulatoriais e clínicas externas acelera ainda mais a adoção. Os avanços na tecnologia 5G melhoram significativamente a largura de banda, a velocidade e a confiabilidade. A conectividade sem fio também é fundamental para dispositivos vestíveis e sensores inteligentes. Economias emergentes adotam cada vez mais sistemas sem fio devido aos menores requisitos de infraestrutura. A inovação contínua fortalece as perspectivas de crescimento a longo prazo.

- Por usuário final

Com base no usuário final, o mercado é segmentado em Hospitais, Centros de Diagnóstico, Farmácias, Laboratórios e Institutos de Pesquisa, Assistência Domiciliar, Clínicas Especializadas, Centros Cirúrgicos Ambulatoriais (CCAs) e Outros. O segmento de Hospitais dominou o mercado com uma participação de receita de aproximadamente 49,4% em 2025, impulsionado pela ampla implementação de automação em diversos departamentos. Os hospitais investem fortemente em diagnósticos automatizados, cirurgia robótica, automação de farmácia e sistemas de monitoramento de pacientes para melhorar a eficiência e os resultados clínicos. O grande volume de pacientes exige fluxos de trabalho otimizados e redução de erros humanos. Os hospitais também se beneficiam de orçamentos de capital mais robustos e do acesso a financiamento público ou privado. A integração da automação com os sistemas de informação hospitalares fortalece ainda mais a adoção. Hospitais universitários e terciários são os primeiros a adotar tecnologias avançadas de automação. A pressão regulatória para melhorar a qualidade do atendimento apoia o investimento contínuo. Os hospitais também priorizam a automação para lidar com a escassez de mão de obra. O planejamento de infraestrutura a longo prazo sustenta a liderança de mercado.

Prevê-se que o segmento de cuidados domiciliares apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 22,6%, entre 2026 e 2033, impulsionado pela crescente tendência para a prestação de cuidados de saúde descentralizados e centrados no paciente. O aumento da população idosa e a crescente prevalência de doenças crônicas impulsionam significativamente a demanda por soluções de automação residencial. Dispositivos de monitoramento automatizados permitem o acompanhamento contínuo das condições de saúde do paciente. O diagnóstico remoto e a integração da telemedicina aumentam a acessibilidade aos cuidados. A automação em cuidados domiciliares reduz as reinternações hospitalares e os custos gerais com saúde. Os avanços tecnológicos resultaram em dispositivos de automação compactos, fáceis de usar e portáteis. A crescente preferência dos pacientes por tratamentos em casa também contribui para o crescimento. A expansão da conectividade sem fio aumenta a viabilidade. Políticas de reembolso favoráveis em regiões desenvolvidas aceleram a adoção. Os mercados emergentes também demonstram um forte potencial de crescimento para a automação em cuidados domiciliares.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em Licitação Direta, Vendas no Varejo, Vendas Online e Outros. O segmento de Licitação Direta detinha a maior participação na receita, com cerca de 53,7% em 2025, impulsionado por contratos de aquisição em larga escala com hospitais, sistemas de saúde governamentais e instituições públicas. As licitações diretas permitem a compra em grande volume de equipamentos e sistemas de automação de alto valor. Esse canal garante a implantação padronizada e a conformidade com os requisitos regulatórios. Governos e grandes redes hospitalares preferem as licitações diretas pela transparência e custo-benefício. Contratos de serviço e manutenção de longo prazo fortalecem ainda mais esse canal. A licitação direta também viabiliza a personalização e a integração de sistemas. Ela permanece dominante para soluções de automação que exigem alto investimento de capital. Os investimentos em saúde pública sustentam fortemente a demanda.

O segmento de Vendas Online deverá registrar a taxa de crescimento anual composta (CAGR) mais rápida, de 21,8%, entre 2026 e 2033, impulsionado pela crescente digitalização dos processos de compras. Clínicas de pequeno porte, farmácias e prestadores de serviços de assistência domiciliar preferem cada vez mais plataformas online para a compra de dispositivos de automação. As vendas online oferecem maior transparência de preços e maior disponibilidade de produtos. A facilidade de compra e os prazos de entrega mais rápidos aumentam a adoção. O crescimento de plataformas de e-commerce especializadas em dispositivos médicos sustenta a expansão. Softwares baseados em assinatura e ferramentas de automação modulares são ideais para distribuição online. A crescente penetração da internet em mercados emergentes acelera ainda mais o crescimento. Os canais online também permitem o engajamento direto entre fabricante e cliente. A inovação contínua da plataforma garante a escalabilidade a longo prazo.

Análise Regional do Mercado de Automação Médica na América do Norte

- Prevê-se que o mercado de automação médica na América do Norte cresça a uma taxa composta de crescimento anual (CAGR) substancial durante o período de previsão, impulsionado principalmente pela crescente pressão para melhorar a eficiência dos cuidados de saúde, reduzir os custos operacionais e lidar com a escassez de mão de obra em hospitais e centros de diagnóstico.

- A sólida estrutura regulatória da região, que apoia a adoção da saúde digital, aliada aos crescentes investimentos em sistemas laboratoriais automatizados, cirurgia robótica e fluxos de trabalho clínicos com inteligência artificial, está acelerando o crescimento do mercado. Os prestadores de serviços de saúde na América do Norte estão adotando cada vez mais soluções de automação médica para aumentar a segurança do paciente, melhorar a precisão dos diagnósticos e otimizar as operações hospitalares.

- O crescimento está sendo observado em instalações de saúde públicas e privadas, com tecnologias de automação sendo integradas tanto em hospitais recém-construídos quanto em iniciativas de modernização da infraestrutura de saúde existente.

Panorama do Mercado de Automação Médica nos EUA:

O mercado de automação médica nos EUA dominou o mercado da América do Norte com a maior participação de receita, de aproximadamente 38,6% em 2025. Esse crescimento foi impulsionado por uma infraestrutura de saúde bem estabelecida, pela adoção precoce de soluções avançadas de automação na área da saúde, pela ampla implementação de diagnósticos com inteligência artificial, cirurgia robótica e automação hospitalar, além de fortes investimentos de empresas líderes em tecnologia médica. O país continua a testemunhar uma rápida adoção de robótica médica, sistemas laboratoriais automatizados e fluxos de trabalho clínicos orientados por IA, fortalecendo o crescimento geral do mercado.

O mercado canadense de automação médica

deverá ser o de crescimento mais rápido na América do Norte durante o período de previsão, com uma taxa de crescimento anual composta (CAGR) robusta de 11,8%, impulsionada pela crescente modernização das instalações de saúde, fortes iniciativas governamentais de apoio à digitalização da saúde, crescente adoção da robótica médica e investimentos cada vez maiores em soluções para hospitais inteligentes por empresas nacionais e internacionais. Tanto hospitais recém-construídos quanto os já existentes estão integrando cada vez mais soluções de automação para melhorar o atendimento ao paciente, a eficiência operacional e os resultados clínicos.

Participação de mercado de automação médica na América do Norte

O setor de Automação Médica é liderado principalmente por empresas consolidadas, incluindo:

• Siemens Healthineers (Alemanha)

• GE Healthcare (EUA)

• Philips Healthcare (Países Baixos)

• Abbott (EUA)

• Roche Diagnostics (Suíça)

• Medtronic (Irlanda)

• BD (EUA)

• Stryker Corporation (EUA)

• Boston Scientific (EUA)

• Olympus Corporation (Japão)

• Intuitive Surgical (EUA)

• Danaher Corporation (EUA)

• Thermo Fisher Scientific (EUA)

• Agilent Technologies (EUA)

• Johnson & Johnson (EUA)

• Fresenius Medical Care (Alemanha)

• Smith & Nephew (Reino Unido)

• Getinge AB (Suécia)

• Zimmer Biomet (EUA)

• Omnicell (EUA)

Últimos desenvolvimentos no mercado de automação médica na América do Norte

- Em março de 2025, o Hospital Prashanth, na Índia, inaugurou o Instituto de Cirurgia Robótica, juntamente com um sistema robótico cirúrgico dedicado para realizar cirurgias minimamente invasivas, marcando uma expansão significativa da automação médica na prática clínica no Sul da Ásia. O hospital destacou os benefícios do robô na redução do tempo de recuperação, da perda de sangue e da invasividade do procedimento, ao mesmo tempo que oferece suporte a cirurgias gerais, urologia e ginecologia — um marco para a adoção da automação na região.

- Em abril de 2025, a IMA Automation anunciou o lançamento de sua divisão IMA Med-Tech, focada em linhas automatizadas de montagem e embalagem especificamente para dispositivos médicos, como injetores, inaladores, plataformas de diagnóstico e produtos vestíveis para a área da saúde. Essa iniciativa reflete o impulso mais amplo para a automação nos processos de fabricação e montagem de dispositivos em toda a cadeia de suprimentos da área da saúde.

- Em março de 2025, a UiPath anunciou um acordo global de consultoria com um importante fornecedor de registros médicos eletrônicos (RME) para acelerar os serviços de automação para organizações de saúde em 16 países, facilitando uma integração mais fluida entre RMEs e fluxos de trabalho automatizados e expandindo a presença de ferramentas de automação em processos clínicos e administrativos.

- Em outubro de 2024, a Microsoft lançou um conjunto de novas ferramentas de IA e automação para a área da saúde, com foco em modelos de imagem médica, documentação clínica automatizada e auxílio no fluxo de trabalho de enfermagem, visando reduzir a carga administrativa e aprimorar a prestação de cuidados por meio da automação inteligente.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.