North America Meat Poultry And Seafood Processing Equipment Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

5.57 Billion

USD

8.36 Billion

2024

2032

USD

5.57 Billion

USD

8.36 Billion

2024

2032

| 2025 –2032 | |

| USD 5.57 Billion | |

| USD 8.36 Billion | |

|

|

|

|

Segmentação do mercado de equipamentos para processamento de carnes, aves e frutos do mar na América do Norte, por tipo de equipamento (equipamentos de porcionamento, fritura, filtragem, revestimento, cozimento, defumação, abate, refrigeração, processamento de alta pressão, massagem e outros), processo (redução de tamanho, aumento de tamanho, homogeneização, mistura e outros), modo de operação (automático, semiautomático e manual), aplicação (processado fresco, cozido cru, pré-cozido, fermentado cru, carne seca, curado, congelado e outros), função (corte, mistura, amaciamento, enchimento, marinada, fatiamento, moagem, defumação, abate e depenagem, desossa e remoção da pele, evisceração, evisceração, filetagem e outros), tipo de produto processado (carne, aves e frutos do mar) - Tendências e previsões do setor até 2032.

Qual é o tamanho e a taxa de crescimento do mercado de equipamentos para processamento de carne, aves e frutos do mar na América do Norte?

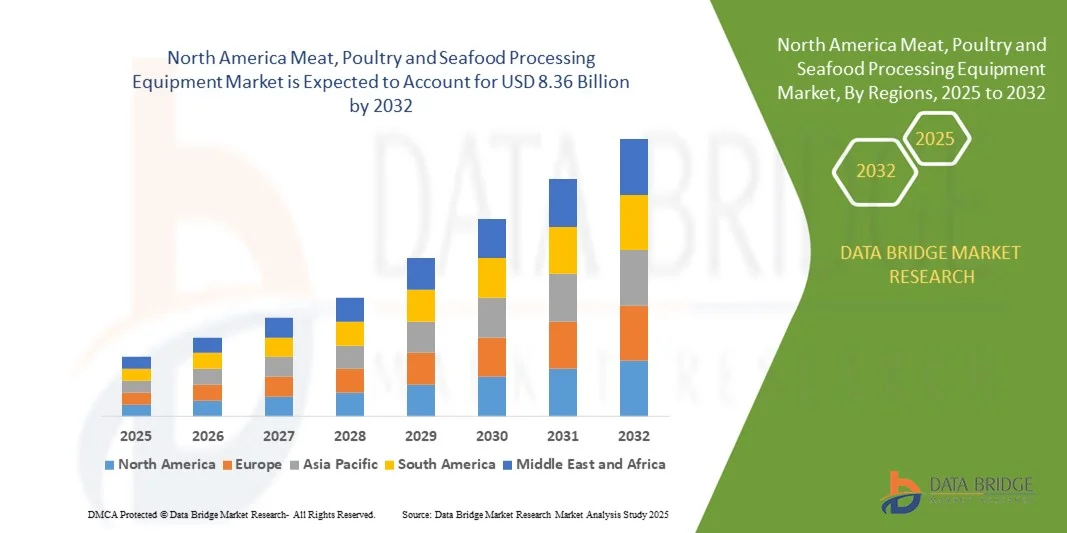

- O mercado de equipamentos para processamento de carne, aves e frutos do mar na América do Norte foi avaliado em US$ 5,57 bilhões em 2024 e deverá atingir US$ 8,36 bilhões até 2032 , com uma taxa de crescimento anual composta (CAGR) de 5,2% durante o período de previsão.

- O aumento do consumo de carnes, aves e frutos do mar processados, juntamente com o crescente número de redes de fast food e restaurantes no mercado, impulsiona a demanda por carnes processadas e outros produtos de melhor qualidade. Além disso, os avanços tecnológicos no mercado de equipamentos, especialmente para carnes, aves e frutos do mar, têm contribuído para o aumento do valor de mercado atual.

- Os fatores que restringem o crescimento do mercado são o alto investimento de capital e a lenta substituição de equipamentos devido à sua longa vida útil.

Quais são os principais destaques do mercado de equipamentos para processamento de carne, aves e frutos do mar?

- A crescente automação na indústria de processamento de alimentos pode representar a melhor oportunidade para o mercado de equipamentos de processamento de carne, aves e frutos do mar.

- O alto custo das máquinas, a infraestrutura precária nos países em desenvolvimento e o uso excessivo de água durante o processamento e a limpeza das tubulações podem representar uma ameaça para o mercado.

- Em 2025, os EUA dominaram o mercado de equipamentos para processamento de carne, aves e frutos do mar na América do Norte, detendo a maior participação de mercado, com 42,6%, impulsionados pela rápida industrialização, alta adoção de automação e investimentos crescentes em tecnologias avançadas de processamento de alimentos.

- Prevê-se que o mercado canadense de equipamentos para processamento de carne, aves e frutos do mar apresente a taxa de crescimento mais rápida, de 11,2%, impulsionado pela crescente demanda por produtos processados e congelados de carne, aves e frutos do mar, juntamente com iniciativas governamentais para modernizar o setor de processamento de alimentos.

- O segmento de Equipamentos de Corte e Porcionamento dominou o mercado em 2025, com uma participação de 42,8%, impulsionado pela crescente demanda por fatiamento de precisão, controle de porções e aparagem automatizada em grandes fábricas de processamento de carne e frutos do mar.

Escopo do relatório e segmentação do mercado de equipamentos para processamento de carne, aves e frutos do mar.

|

Atributos |

Equipamentos para Processamento de Carne, Aves e Frutos do Mar: Principais Análises de Mercado |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de equipamentos para processamento de carne, aves e frutos do mar?

Automação e Tecnologias de Processamento Sustentável

- Uma das principais tendências que moldam o mercado de equipamentos para processamento de carnes, aves e frutos do mar é a rápida adoção de automação e sistemas de processamento sustentáveis, projetados para melhorar a eficiência, reduzir o desperdício e aumentar a segurança alimentar. A crescente ênfase em operações com eficiência energética e design higiênico está impulsionando os fabricantes em direção a inovações ecologicamente conscientes.

- As empresas estão integrando cada vez mais robótica, inspeção baseada em IA e sistemas de monitoramento habilitados para IoT para otimizar os processos de desossa, corte e embalagem, garantindo precisão e reduzindo erros humanos.

- Além disso, o uso de tecnologias de economia de água e redução de resíduos está ganhando força, à medida que as empresas de processamento buscam atender às normas de sustentabilidade e reduzir os custos operacionais.

- Um exemplo notável é o da GEA Group Aktiengesellschaft (Alemanha), que introduziu sua Linha de Processamento Sustentável, integrando automação inteligente, resfriamento eficiente e sistemas de recuperação de resíduos para otimizar a produção de carne e frutos do mar.

- Essa mudança em direção a soluções inteligentes, ecológicas e que economizam energia está transformando o setor, incentivando investimentos em equipamentos de última geração que equilibram produtividade, segurança e sustentabilidade.

Quais são os principais fatores que impulsionam o mercado de equipamentos para processamento de carne, aves e frutos do mar?

- O aumento do consumo global de alimentos ricos em proteínas e a crescente demanda por carnes e frutos do mar processados são os principais fatores que impulsionam o mercado. Os consumidores buscam opções de alimentos convenientes, seguras e processadas higienicamente, o que impulsiona a modernização dos equipamentos.

- Por exemplo, em 2025, a Marel (Islândia) expandiu sua linha de produtos com sistemas automatizados de porcionamento e fatiamento que aumentam a precisão do rendimento e a consistência do produto no processamento de aves e frutos do mar.

- O setor também se beneficia de investimentos governamentais em regulamentações de segurança alimentar e infraestrutura de exportação, fomentando a demanda por máquinas de processamento avançadas.

- Além disso, o crescimento dos produtos prontos para consumo (RTE) e congelados acelerou a modernização dos equipamentos para melhorar as capacidades de embalagem, refrigeração e armazenamento.

- Inovações como sistemas de triagem baseados em IA, transportadores higiênicos e tecnologias de selagem a vácuo estão aprimorando ainda mais a qualidade do produto, prolongando a vida útil e impulsionando a expansão do mercado em todos os segmentos industriais e comerciais.

Qual fator está dificultando o crescimento do mercado de equipamentos para processamento de carne, aves e frutos do mar?

- Os elevados custos de investimento inicial e de manutenção continuam sendo os principais desafios que limitam a adoção, principalmente entre as pequenas e médias empresas de processamento. Equipamentos como desossadores automáticos e máquinas de enchimento a vácuo exigem um investimento inicial significativo.

- Por exemplo, em 2025, o aumento dos preços do aço inoxidável e dos componentes eletrônicos elevou os custos de fabricação de equipamentos para empresas importantes como a BAADER (Alemanha) e a JBT Corporation (EUA), afetando as margens de lucro.

- Além disso, os complexos requisitos de limpeza e higienização podem prolongar o tempo de inatividade, afetando a eficiência da produção.

- As regulamentações ambientais e energéticas também desafiam as empresas a atualizarem continuamente seus sistemas para reduzir as emissões e o consumo de água.

- Apesar dessas barreiras, empresas como a GEA Group Aktiengesellschaft e a Key Technology (EUA) estão abordando essas questões por meio de projetos modulares, energeticamente eficientes e fáceis de limpar. Equilibrar custo, conformidade e sustentabilidade continua sendo vital para garantir o crescimento e a competitividade a longo prazo no mercado.

Como está segmentado o mercado de equipamentos para processamento de carne, aves e frutos do mar?

O mercado de equipamentos para processamento de carne, aves e frutos do mar é segmentado com base no tipo de equipamento, processo, modo de operação, aplicação, função e tipo de produto processado.

- Por tipo de equipamento

Com base no tipo de equipamento, o mercado é segmentado em Equipamentos de Porcionamento, Equipamentos de Fritura, Equipamentos de Filtragem, Equipamentos de Revestimento, Equipamentos de Cozimento, Equipamentos de Defumação, Equipamentos de Abate/Desmembramento, Equipamentos de Refrigeração, Equipamentos de Processamento de Alta Pressão (HPP), Equipamentos de Massagem e Outros. O segmento de Equipamentos de Corte e Porcionamento dominou o mercado em 2025, com uma participação de 42,8%, impulsionado pela crescente demanda por fatiamento de precisão, controle de porções e aparagem automatizada em grandes plantas de processamento de carne e frutos do mar. Esses sistemas aumentam a eficiência, minimizam o desperdício e mantêm a qualidade consistente do produto.

Prevê-se que o segmento de equipamentos de processamento de alta pressão (HPP) registre a taxa de crescimento anual composta (CAGR) mais rápida de 2026 a 2033, impulsionado pela crescente adoção de tecnologias de conservação não térmicas para melhorar a vida útil e garantir produtos de carne e frutos do mar livres de patógenos, sem comprometer o valor nutricional ou a textura.

- Por processo

Com base no processo, o mercado de equipamentos para processamento de carnes, aves e frutos do mar é classificado em redução de tamanho, aumento de tamanho, homogeneização, mistura e outros. O segmento de redução de tamanho dominou o mercado em 2025, com uma participação de 49,5%, visto que a moagem, o corte e o trituramento são etapas iniciais cruciais no processamento de carnes, permitindo uma textura consistente e uniformidade do produto para linguiças, hambúrgueres e produtos à base de frutos do mar. A eficiência dos modernos sistemas de redução de tamanho ajuda a otimizar a produção e a qualidade.

Prevê-se que o segmento de Mistura apresente a taxa de crescimento anual composta (CAGR) mais rápida entre 2026 e 2033, impulsionado pela crescente demanda por formulações de carnes misturadas, marinadas e frutos do mar processados. Misturadores a vácuo e de pás avançados estão sendo cada vez mais adotados para distribuição uniforme dos ingredientes, consistência de sabor e maior estabilidade do produto.

- Por modo de operação

Com base no modo de operação, o mercado é segmentado em Automático, Semiautomático e Manual. O segmento Automático dominou o mercado em 2025, com uma participação de 56,7%, impulsionado pela crescente adoção da automação para reduzir custos de mão de obra, aumentar a eficiência da produção e garantir a conformidade com as normas de higiene. Os sistemas automatizados integram robótica, sensores e software para executar tarefas complexas, como desossa e embalagem, com precisão.

Prevê-se que o segmento de sistemas semiautomáticos registre a taxa de crescimento anual composta (CAGR) mais rápida entre 2026 e 2033, à medida que as pequenas e médias empresas de processamento buscam equilibrar os benefícios da automação com a acessibilidade. Os sistemas semiautomáticos oferecem flexibilidade, menor complexidade operacional e adaptabilidade a diferentes escalas de produção.

- Por meio de aplicação

Com base na aplicação, o mercado de equipamentos para processamento de carnes, aves e frutos do mar é segmentado em: Produtos Frescos Processados, Produtos Crus Cozidos, Produtos Pré-cozidos, Produtos Crus Fermentados, Carne Seca, Produtos Curados, Produtos Congelados e Outros. O segmento de Produtos Frescos Processados detinha a maior participação de mercado, com 51,2% em 2025, devido ao alto consumo de produtos de carne e frutos do mar minimamente processados, como linguiças, nuggets e hambúrgueres, que exigem máquinas avançadas de corte, mistura e revestimento. A demanda é impulsionada pela preferência do consumidor por refeições frescas e prontas para o preparo.

O segmento de congelados deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pela crescente popularidade de frutos do mar congelados e refeições prontas em todo o mundo. Os avanços nas tecnologias de congelamento e na logística da cadeia de frio estão possibilitando maior prazo de validade e preservação da textura e do sabor.

- Por função

Com base na função, o mercado é categorizado em Corte, Mistura, Amaciamento, Enchimento, Marinada, Fatiamento, Moagem, Defumação, Abate e Despenagem, Desossa e Pele, Evisceração, Evisceração, Filetagem e Outros. O segmento de Corte e Fatiamento dominou o mercado em 2025, com uma participação de 46,4%, por representar uma função essencial em praticamente todas as operações de processamento de carnes e frutos do mar. A demanda por sistemas de corte e fatiamento de precisão é impulsionada pela necessidade de obter espessura uniforme, reduzir o desperdício e manter a integridade do produto.

Prevê-se que o segmento de Desossa e Pele apresente a taxa de crescimento anual composta (CAGR) mais rápida de 2026 a 2033, impulsionado pela necessidade de sistemas de alta eficiência que minimizem o trabalho manual, melhorem o rendimento e aprimorem a higiene, especialmente em linhas de processamento de aves e peixes.

- Por tipo de produto processado

Com base no tipo de produto processado, o mercado é segmentado em Carnes, Aves e Frutos do Mar. O segmento de Carnes dominou o mercado em 2025, com uma participação de 54,9%, atribuído ao crescente consumo de produtos cárneos processados, como linguiças, bacon e presunto, especialmente na América do Norte. As linhas de processamento de carne exigem sistemas sofisticados de moagem, cura e embalagem para garantir segurança e qualidade.

O segmento de frutos do mar deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pela crescente demanda global por peixes, camarões e mariscos processados. O aumento das exportações de frutos do mar, aliado aos avanços tecnológicos em filetagem e congelamento, está impulsionando a automação e a expansão da capacidade das instalações de processamento de frutos do mar em todo o mundo.

Qual região detém a maior participação no mercado de equipamentos para processamento de carne, aves e frutos do mar?

- Em 2025, os EUA dominaram o mercado de equipamentos para processamento de carne, aves e frutos do mar na América do Norte, detendo a maior participação de mercado, com 42,6%, impulsionados pela rápida industrialização, alta adoção de automação e investimentos crescentes em tecnologias avançadas de processamento de alimentos.

- A sólida base industrial do país, aliada ao foco regulatório em segurança alimentar e padrões de qualidade, sustenta a ampla produção e utilização de equipamentos modernos para processamento de carnes, aves e frutos do mar. Empresas líderes nacionais e internacionais estão investindo em sistemas energeticamente eficientes, automatizados e rastreáveis, impulsionando o mercado.

- De modo geral, a liderança dos EUA em inovação, infraestrutura e adoção tecnológica os posicionou como o país dominante no mercado de equipamentos para processamento de carne, aves e frutos do mar na América do Norte.

Análise do Mercado de Equipamentos para Processamento de Carnes, Aves e Frutos do Mar no Canadá

Prevê-se que o mercado canadense de equipamentos para processamento de carne, aves e frutos do mar apresente a taxa de crescimento mais rápida, de 11,2%, impulsionado pela crescente demanda por produtos processados e congelados de carne, aves e frutos do mar, juntamente com iniciativas governamentais para modernizar o setor de processamento de alimentos. Os fabricantes canadenses estão investindo cada vez mais em soluções automatizadas de corte, desossa, marinada e embalagem para melhorar a eficiência operacional e manter a conformidade com as normas de segurança alimentar. Medidas de sustentabilidade, incluindo refrigeração com eficiência energética e redução do consumo de água, contribuem ainda mais para o crescimento. O foco do Canadá em inovação, automação e garantia de qualidade o posiciona como um importante motor de crescimento na região da América do Norte.

Análise do Mercado de Equipamentos para Processamento de Carnes, Aves e Frutos do Mar no México

O mercado mexicano de equipamentos para processamento de carnes, aves e frutos do mar está em constante expansão, impulsionado pelo aumento do consumo interno de produtos proteicos processados e pela crescente demanda de exportação para os EUA e outros países da América Latina. Os fabricantes mexicanos estão adotando equipamentos modernos de abate, fatiamento, embalagem e porcionamento para atender aos padrões de higiene e aumentar a produtividade. Os incentivos governamentais que apoiam a modernização das plantas de processamento, juntamente com o crescente investimento em infraestrutura de cadeia de frio, aceleram ainda mais a adoção pelo mercado. Com sua localização estratégica, mão de obra qualificada e base industrial em expansão, o México desempenha um papel importante no fortalecimento do mercado de equipamentos para processamento de carnes, aves e frutos do mar na América do Norte.

Quais são as principais empresas no mercado de equipamentos para processamento de carne, aves e frutos do mar?

O setor de equipamentos para processamento de carne, aves e frutos do mar é liderado principalmente por empresas consolidadas, incluindo:

- Equipamientos Cárnicos, SL (Espanha)

- BRAHER INTERNACIONAL, SA (Espanha)

- RZPO (Polônia)

- Minerva Omega Group srl (Itália)

- Grupo GEA Aktiengesellschaft (Alemanha)

- RISCO SpA (Itália)

- PSS SVIDNÍK, como (Eslováquia)

- Metalbud (Polônia)

- BAADER (Alemanha)

- JBT Corporation (EUA)

- Marel (Islândia)

- Tecnologia chave (EUA)

- Illinois Tool Works Inc. (EUA)

- A Middleby Corporation (EUA)

- (EUA)

- BIZERBA (Alemanha)

Quais são os desenvolvimentos recentes no mercado de equipamentos para processamento de carne, aves e frutos do mar na América do Norte?

- Em fevereiro de 2025, a JBT Marel firmou uma aliança estratégica com a Ace Aquatec, nomeando a empresa como sua fornecedora preferencial de soluções de atordoamento de peixes para máquinas de processamento de alimentos. Essa colaboração fortalece a posição da JBT Marel no processamento sustentável de frutos do mar e expande seu portfólio de máquinas inovadoras.

- Em janeiro de 2025, a JBT, com sede nos EUA, adquiriu a Marel integralmente, formando a nova entidade JBT Marel Corporation. Essa fusão cria uma poderosa líder global em tecnologia de processamento de alimentos, aprimorando a eficiência e a inovação em diversos setores alimentícios.

- Em novembro de 2024, a Fortifi Food Processing Solutions anunciou a aquisição da propriedade intelectual, dos relacionamentos com clientes, de estoques selecionados e de ativos fixos da JWE-BANSS GmbH (Alemanha), uma importante fabricante de sistemas de processamento de proteínas. Essa aquisição reforça a expertise da Fortifi no processamento de carnes e fortalece sua presença no mercado norte-americano.

- Em julho de 2024, a Ross Industries lançou a AMS 400 Membrane Skinner, uma solução personalizada para processadores de carne artesanais e de médio porte, visando melhorar a eficiência operacional e a qualidade do produto final. Este lançamento reflete o foco da Ross Industries em atender às crescentes necessidades de automação de produtores de alimentos de pequeno e médio porte.

- Em março de 2024, a Fortifi Food Processing Solutions foi oficialmente lançada como uma plataforma global unificada de marcas de processamento de alimentos e automação, operando em cinco continentes. Essa criação representa um passo estratégico para oferecer soluções integradas nos setores de processamento de proteínas, laticínios, frutas e vegetais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.