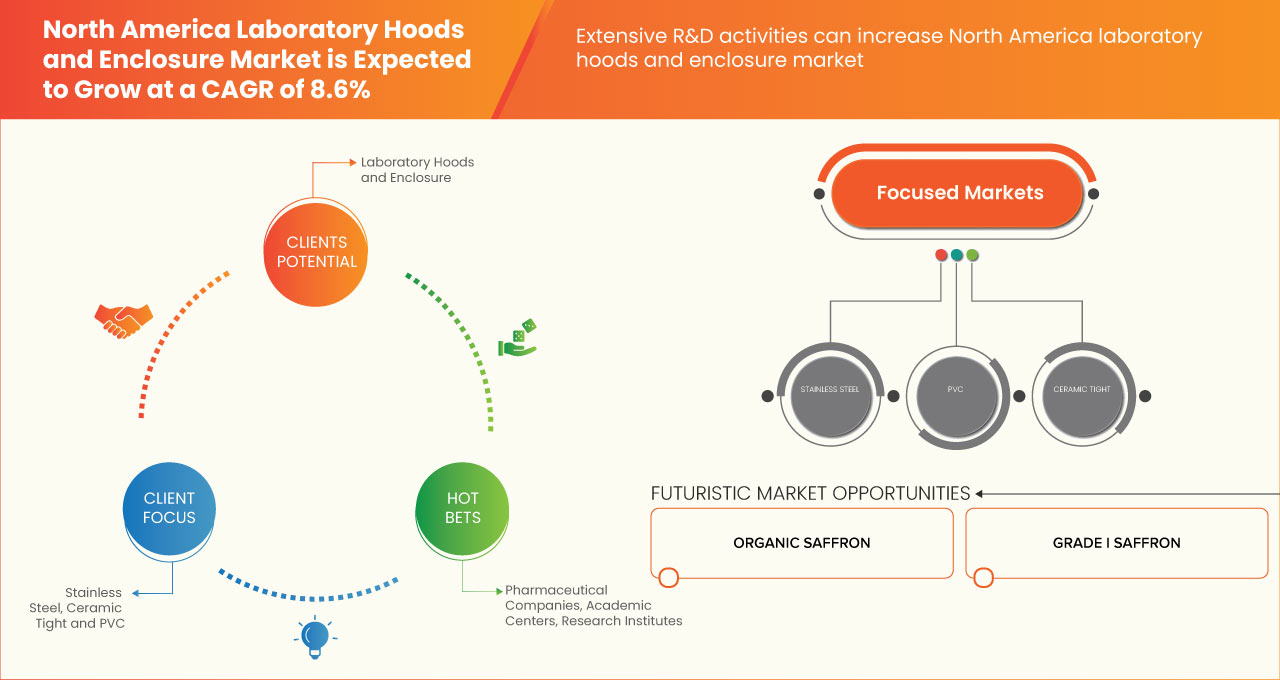

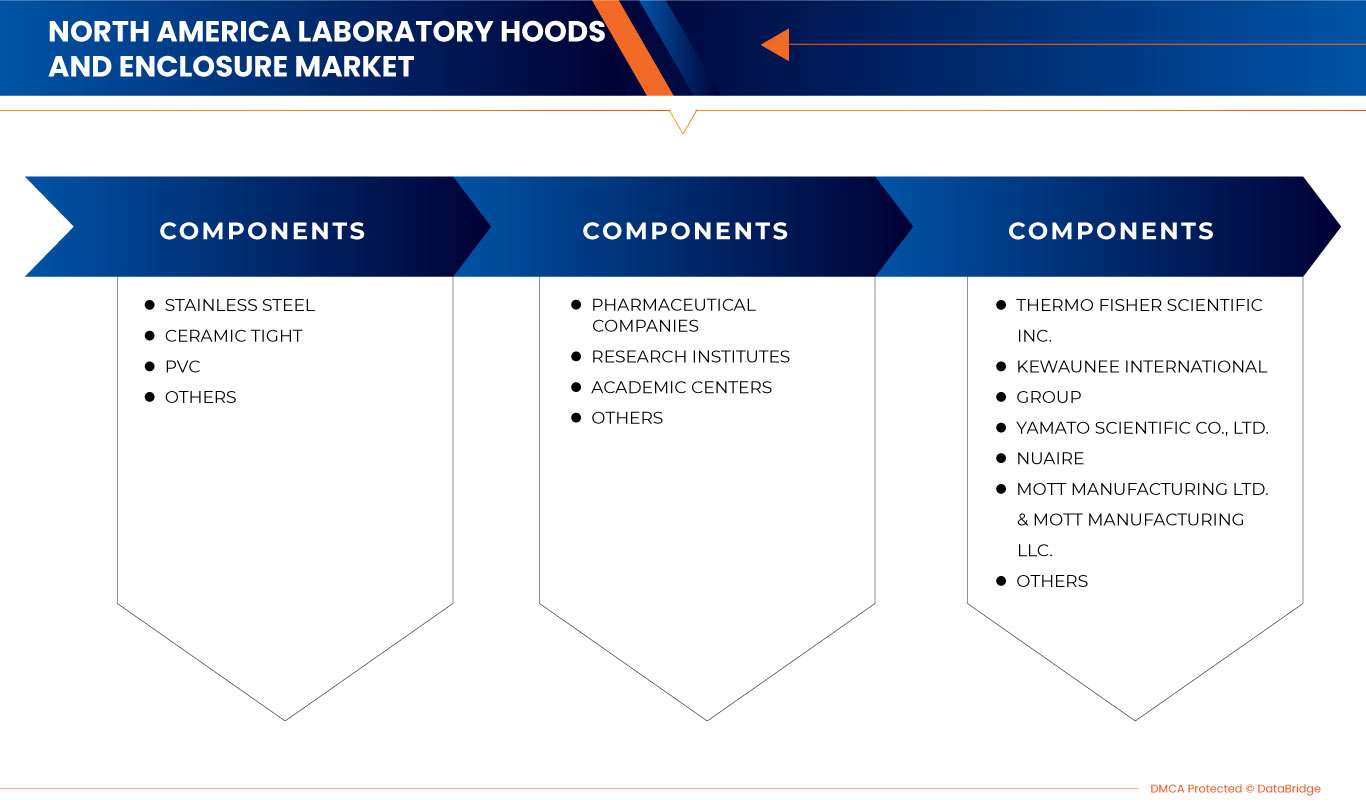

North America Laboratory Hoods and Enclosure Market, By Materials (Stainless Steel, Ceramic Tight, PVC, and Others), End User (Pharmaceutical Companies, Research Institutes, Academic Centers, and Others) - Industry Trends and Forecast to 2030.

North America Laboratory Hoods and Enclosure Market Analysis and Insights

Laboratory hoods and enclosure market deals in products such as fume hoods, Ventilated Balance Enclosures (VBEs), biological safety cabinets for the protection of personnel, environment, and products from hazardous chemical fumes or vapors while experimentation and other research activities. These products are in great demand due to rising awareness among people toward biosafety and biosecurity. Moreover, the increasing prevalence of infectious diseases worldwide has further propelled the demand for laboratory hoods and enclosures. The increasing prevalence of LAIs is likely to fuel the growth of the laboratory hoods and enclosure market to prevent spreading infections while performing research and development a sample preparation across the globe. The key market players are investing extensively in the research & development to launch new products and services, which acts as an opportunity for the growth of the market. However, the high cost of laboratory hoods and enclosure and environmental side effects and limitations associated with the use of laboratory hoods and enclosures act as restraint for its growth in the market.

Rising prevalence of infectious diseases demands the advanced laboratory hoods and enclosures, thus acts as drivers for the laboratory hoods and enclosure market growth.

The laboratory hoods and enclosure market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 8.6% in the forecast period of 2023 to 2030 and is expected to reach USD 804.00 million by 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2020-2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Materials (Stainless Steel, Ceramic Tight, PVC, and Others), End User (Pharmaceutical Companies, Research Institutes, Academic Centers, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Thermo Fisher Scientific Inc., Kewaunee International Group, Yamato Scientific co., ltd., Nuaire, Mott Manufacturing Ltd. & Mott Manufacturing LLC., Labconco, Shimadzu Rika Corporation, AirClean Systems, Inc., Royston Group | Hamilton Lab Solutions, Sheldon Laboratory Systems, Terra Universal. Inc., Bigneat Ltd., Flow Sciences, Inc, Air Science USA LLC., WALDNER Holding SE & Co. KG, Sentry Air Systems, Inc., Liberty Industries, Cleatech, LLC., LOC SCIENTIFIC, and Esco Micro Pte. Ltd. |

Market Definition of North America Laboratory Hoods and Enclosure Market

Fume hoods are ventilated enclosures that remove hazardous chemical fumes, particulates, and volatile vapors from the laboratory, providing personnel protection and prevent them from inhalation or absorption of hazardous chemicals and from other health problems. The fume hood limits exposure to hazardous or noxious fumes, vapors, or dusts by safely removing these substances from the immediate working environment. It also serves to protect the sample from external environment. Biological safety cabinets (or biosafety cabinets) utilize HEPA filters to provide environmental, personnel and/or product protection. They capture the impure fumes and recirculate or exhaust filtered air to protect environment as well as personnel while doing sample preparation and experimentation. A ventilated enclosure is any site-fabricated chemical hood designed primarily for containing processes, such as scale-up or pilot plant equipment. Ventilated balance enclosures used in laboratories to weigh toxic particulates. These devices are installed with different specifications for face velocity than the standard laboratory chemical hood and are well suited for locating sensitive balances that might be disturbed if placed in a laboratory chemical hood.

North America Laboratory Hoods and Enclosure Market Dynamics

DRIVERS

RISE IN INFECTIOUS DISEASES WORLDWIDE

Increasing cases of infectious diseases are the leading cause of death worldwide, especially in low-income countries. Infectious diseases affected by organisms, such as viruses, parasites, fungi, and bacteria, are directly or indirectly passed from one person to another.

Clinical laboratories utilize different methods to perform analysis through a range of tests and assays required for diagnosis and monitoring of infectious diseases.

Increasing infectious diseases enhance the demand for clinical laboratories. Clinical laboratories provide different types of services for diagnosis and treatment of patients due to infectious diseases, including blood count, immunology and allergy testing, and urinalysis among others.

Different strains of microorganisms cause infectious diseases. These are viruses, protozoa, fungi, and bacteria. All these organisms are microscopic in size. The cause of disease in humans is viruses and bacteria; parasite which causes malaria is an example of a protozoan.

Diseases that are related to the viruses are HIV/AIDS, Ebola, MERS; the clinical laboratory used Immunofluorescence technique to diagnose different types of viruses from the human body tissue. Laboratories play an important role in diagnosing infectious diseases by using infectious disease testing technique, transplant diagnostic testing, or any other kind of clinical test. Rising infectious diseases worldwide are leading to upsurge in the number of laboratories across the globe, which is driving the growth of the global laboratory hoods and enclosure market.

RISING THYROID CANCER DIAGNOSTIC TESTS

Advancements help in extending the scope of development of new methods for diagnosing diseases in the clinical laboratory. The research and development team is involved in producing more advanced innovations in the service to improve the clinical diagnostic methods. In the U.S., more than 4,000 different methods of diagnostic tests are available, and they are done nearby to 7,000 million times each year.

Technological advancements in clinical diagnostic methods have made diagnostic tests easier to use and more accurate and have led to more precise and more timely reports. They have also managed to the point of care tests, which enable faster decision-making by medical practitioners.

Advances in the laboratory will impact the infection control programs, which have been made primarily in three major areas: identifying and detecting various infectious disease pathogens, genotyping methods, and antibiotic susceptibility testing. Due to implementation of advanced clinical diagnostic methods, clinical laboratory are in greater capabilities to provide support in the infection control programs.

RESTRAINT

LACK OF SKILLED AND CERTIFIED PROFESSIONALS

The requirement of skilled and certified professionals is a big restraint for clinical laboratories. laboratory hoods and enclosure demand is increased due to the high growth in the number of people aged 65 or older who need a routine diagnostic test for their health, but the less number of skilled professionals present in the laboratory center is hampering the growth of the market.

The method and laboratory procedure have advantages, but there are certain gaps in standardization, equalization, and knowledge. Technicians are facing technical training gaps related to problems to adopt advanced methods safely to perform procedures efficiently. There is a need for highly skilled professionals in the clinical laboratory for method development, validation, operation, and troubleshooting activities.

The laboratory is a dynamic component in today’s complex healthcare system, providing patients with essential information for the diagnosis, prevention, treatment, and management of their disease and health. The main factors that impact the shortages of skilled and certified professionals are changes in the practice of clinical laboratory science due to advancement in technology and the retirement of the aging skilled and certified professionals.

The requirement of trained staff is a big issue for clinical laboratories, due to which the lack of skilled and certified professionals acts as restraints for the growth of the global laboratory hoods and enclosure market.

OPPORTUNITY

EMERGENCE OF COVID-19

Coronavirus disease (COVID-19) is an infectious disease caused by a newly discovered SARS-CoV-2. The people affected with COVID-19 virus experience mild to moderate respiratory illness and recover without requiring special treatment. But coronavirus (COVID-19) spread is expanding across the world from last few months and the number patient population is hugely boomed up.

As COVID-19 is an infectious disease, its spread is endless; moreover, there is no specific and approved treatment for the COVID-19. Owing to this, various health organizations and government bodies are approaching guidelines to control its spread as well as recommending treatment that is concentrating on managing symptoms or complications that is developed by the virus.

Owing to outbreak of COVID-19, the demand for laboratory hoods and enclosure is increasing due to escalating research activities for developing medicines and other biopharmaceuticals, which provide utmost safety from the chemical hazards as well as other Laboratory acquired infections (LAI) while performing experiments in the laboratory. Thus it is estimated that global laboratory hoods and enclosure market is anticipated to boom up in the forecast period.

CHALLENGE

EMERGING REGULATORY STANDARDS AND LAWS

A fume hood is a ventilated enclosure that usually vents separately from the building’s Heating, Ventilation and Air Conditioning (HVAC) system and not recirculated into the building. Whenever working with toxic compounds or compounds with a boiling point below 120°C, fume hoods and enclosure should be used. They must be used when the materials used will exceed exposure limits in the laboratory. There are various regulatory standards and laws set by different organizations to provide permissible exposure limits in order to protect from laboratory hazards.

There are various government agencies that oversee biosafety at Western, such as the Public Health Agency of Canada (PHAC) and the Canadian Food Inspection Agency (CFIA). PHAC publishes the Canadian Biosafety Standard which replaced the laboratory Biosafety and Guidelines and the CFIA’s Containment Standards for Veterinary Facilities.

These guidelines while working in laboratory must be taken into consideration that are one of the most challenging tasks for the players. In addition, they restrict new players from entering the market as these guidelines take a good amount of capital, which is very difficult to maintain for mid and low level players, hampering the growth and acting as a challenge for global laboratory hoods and enclosure market.

Recent Developments

- In February 2022, Yamato Scientific Co., ltd. announced the new products catalog release. The new product catalog was designed to provide an overview of the product to the customer; this will help the company to generate revenue of the company

- In May 2021, Labconco Launched Newly Updated Axiom Biosafety Cabinets with Exclusive Features. This product launch has created persistent revenue flow for the company

North America Laboratory Hoods and Enclosure Market

North America laboratory hoods and enclosure market is segmented into materials and end user. The growth amongst these segments will help you analyse major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

By Materials

- Stainless Steel

- Ceramic Tight

- PVC

- Others

On the basis of materials, the North America laboratory hoods and enclosure market is segmented into stainless steel, ceramic tight, PVC, and others.

By End User

- Pharmaceutical Companies

- Research Institutes

- Academic Centers

- Others

On the basis of end user, the North America laboratory hoods and enclosure market is segmented into pharmaceutical companies, research institutes, academic centers, and others.

Laboratory Hoods and Enclosure Market Regional Analysis/Insights

The laboratory hoods and enclosure market is segmented into seven notable segments which are based on materials and end user.

The countries covered in this market report U.S., Canada, Mexico.

U.S. is expected to dominate the market due to the technological advancements in clinical diagnostic methods which have made diagnostic tests easier to use and more accurate.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Laboratory Hoods and Enclosure Market Share Analysis

North America laboratory hoods and enclosure market competitive landscape provides details of a competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the laboratory hoods and enclosure market.

Some of the major players operating in the North America laboratory hoods and enclosure market are Thermo Fisher Scientific Inc., Kewaunee International Group, Yamato Scientific co., ltd., Nuaire, Mott Manufacturing Ltd. & Mott Manufacturing LLC., Labconco, Shimadzu Rika Corporation, AirClean Systems, Inc., Royston Group | Hamilton Lab Solutions, Sheldon Laboratory Systems, Terra Universal. Inc., Bigneat Ltd., Flow Sciences, Inc, Air Science USA LLC., WALDNER Holding SE & Co. KG, Sentry Air Systems, Inc., Liberty Industries, Cleatech, LLC., LOC SCIENTIFIC, and Esco Micro Pte. Ltd. among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of NORTH AMERICA LABORATORY HOODS AND ENCLOSURE MARKET

- Currency and pricing

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- MULTIVARIATE MODELLING

- product LIFELINE CURVE

- DBMR MARKET POSITION GRID

- MARKET end user COVERAGE GRID

- secondary sourcEs

- assumptions

- Pestel's Model_Laboratory Hoods and Enclosure Market

- EXECUTIVE SUMMARY

- Regulations

- Market Overview

- DRIVERS

- RISe in INFECTIOUS DISEASES WORLDWIDE

- ADVANCEMENTs IN CLINICAL DIAGNOSTIC METHODS

- RisE IN Demand for Early and Accurate Disease Diagnosis

- RISE IN PREFERENCE FOR PREVENTIVE HEALTH CHECK-UPS

- INCREASE IN AWARENESS ABOUT DIAGNOSIS AND TREATMENT OF THE DISEASE

- RESTRAINTS

- LACK OF SKILLED AND CERTIFIED PROFESSIONALS

- High cost of Laboratory fume hoods and enclosure

- OPPRTUNITIES

- Emergence of COVID-19

- STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

- RISING AWARENESS OF BIOSAFETY

- Challenges

- EMERGING REGULATORY STANDARDS AND LAWS

- EXPERTISE IN OPERATION

- Impact of COVID 19 Pandemic on the north America Laboratory Hoods and Enclosure Market

- Price Impact

- Impact on Supply Chain

- IMPACT ON DEMAND

- Strategic Decisions by Manufacturers

- CONCLUSION

- north america LABORATORY HOODS AND ENCLOSURE MARKET, BY Product

- overview

- Hoods

- Biological Safety Cabinets

- LAMINAR FLOW CABINETS

- enclosures

- VENTILATED BALANCE ENCLOSURES (VBES)

- OTHERS

- North America LABORATORY HOODS AND ENCLOSURE MARKET, BY Modularity

- overview

- benchtop

- PORTABLE

- North America LABORATORY HOODS AND ENCLOSURE MARKET, BY Material

- overview

- stainless steel

- PVC

- others

- North America LABORATORY HOODS AND ENCLOSURE MARKET, BY End User

- overview

- Pharmaceutical Companies

- RESEARCH INSTITUTES

- Academic Centers

- others

- NORTH AMERICA LABORATORY HOODS AND ENCLOSURE MARKET, by REGION

- overview

- U.S.

- canada

- mexico

- north america Laboratory Hoods and Enclosure Market: COMPANY landscape

- company share analysis: North America

- swot analysis

- company profile

- THERMO FISHER SCIENTIFIC INC.

- COMPANY SNAPSHot

- REVENUE ANALYSIS

- product Portfolio

- RECENT DEVELOPMENTs

- Kewaunee International Group

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- nuiare

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- Terra Universal, Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Air Science USA LLC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Yamato Scientific co., ltd.

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- Sentry Air Systems, Inc.

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- AirClean Systems, Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Labconco

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Bigneat Ltd.

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- Esco Micro Pte. Ltd.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Flow Science Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Köttermann GmbH

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- LOC SCIENTIFIC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Mott Manufacturing Ltd. & Mott Manufacturing LLC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Royston Group | Hamilton Lab Solutions

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- Sheldon Laboratory Systems

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- WALDNER Holding GmbH & Co. KG

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- questionnaire

- related reports

Lista de Tabela

TABLE 1 Number of coronavirus (COVID-19) tests performed in the most impacted countries worldwide as of July 27, 2021

TABLE 2 According to the National Laboratory Sales data, cost of hoods are mentioned below,

TABLE 3 North America LABORATORY HOODS AND ENCLOSURE Market, By Product, 2019-2028 (USD MILLION)

TABLE 4 North America hoods in laboratory hoods and enclosure Market, By Product, 2019-2028 (USD MILLION)

TABLE 5 North America LABORATORY HOODS AND ENCLOSURE Market, By Modularity, 2019-2028 (USD MILLION)

TABLE 6 North America LABORATORY HOODS AND ENCLOSURE Market, By Material, 2019-2028 (USD MILLION)

TABLE 7 North America LABORATORY HOODS AND ENCLOSURE Market, By End User, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA LABORATORY HOODS AND ENCLOSURE Market, By COUNTRY, 2019-2028 (USD Million)

TABLE 9 U.S. LABORATORY HOODS AND ENCLOSURE Market, By PRODUCT, 2019-2028 (USD Million)

TABLE 10 U.S. Hoods in Laboratory Hoods and Enclosure Market, By Product, 2019-2028 (USD Million)

TABLE 11 U.S. Laboratory Hoods and Enclosure Market, By Modularity, 2019-2028 (USD Million)

TABLE 12 U.S. Laboratory Hoods and Enclosure Market, By Material, 2019-2028 (USD Million)

TABLE 13 U.S. Laboratory Hoods and Enclosure Market, By End User, 2019-2028 (USD Million)

TABLE 14 Canada Laboratory Hoods and Enclosure Market, By Product, 2019-2028 (USD Million)

TABLE 15 Canada Hoods in Laboratory Hoods and Enclosure Market, By Product, 2019-2028 (USD Million)

TABLE 16 Canada Laboratory Hoods and Enclosure Market, By Modularity, 2019-2028 (USD Million)

TABLE 17 Canada Laboratory Hoods and Enclosure Market, By Material, 2019-2028 (USD Million)

TABLE 18 Canada Laboratory Hoods and Enclosure Market, By End User, 2019-2028 (USD Million)

TABLE 19 mexico LABORATORY HOODS AND ENCLOSURE Market, By PRODUCT, 2019-2028 (USD Million)

TABLE 20 Mexico Hoods in Laboratory Hoods and Enclosure Market, By Product, 2019-2028 (USD Million)

TABLE 21 Mexico Laboratory Hoods and Enclosure Market, By Modularity, 2019-2028 (USD Million)

TABLE 22 Mexico Laboratory Hoods and Enclosure Market, By Material, 2019-2028 (USD Million)

TABLE 23 Mexico Laboratory Hoods and Enclosure Market, By End User, 2019-2028 (USD Million)

Lista de Figura

FIGURE 1 NORTH AMERICA LABORATORY HOODS AND ENCLOSURE MARKET: segmentation

FIGURE 2 NORTH AMERICA laboratory hoods and enclosure MARKET: data triangulation

FIGURE 3 NORTH AMERICA laboratory hoods and enclosure MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA laboratory hoods and enclosure MARKET: north america vs country MARKET ANALYSIS

FIGURE 5 NORTH AMERICA laboratory hoods and enclosure MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA laboratory hoods and enclosure MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA laboratory hoods and enclosure MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA laboratory hoods and enclosure MARKET: MARKET end user COVERAGE GRID

FIGURE 9 NORTH AMERICA laboratory hoods and enclosure MARKET: SEGMENTATION

FIGURE 10 growing prevalence of infectious diseases is expected to drive the NORTH AMERICA laboratory hoods and enclosure MARKET in the forecast period of 2021 to 2028

FIGURE 11 HOODS SEGMENT is expected to account for the largest share of the NORTH AMERICA laboratory hoods and enclosure MARKET in 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF North America Laboratory Hoods and Enclosure Market

FIGURE 13 BIOSAFETY CONCEPT AND LEVELS OF BIOSAFETY WITH THEIR RISK INTENSITY

FIGURE 14 NCRST PUBLIC AWARENESS STRATEGY

FIGURE 15 NORTH AMERICA LABORATORY HOODS AND ENCLOSURE MARKET: BY Product, 2020

FIGURE 16 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY Product, 2021-2028 (USD MILLION)

FIGURE 17 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY Product, CAGR (2021-2028)

FIGURE 18 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY Product, LIFELINE CURVE

FIGURE 19 North America LABORATORY HOODS AND ENCLOSURE MARKET : BY Modularity, 2020

FIGURE 20 North America LABORATORY HOODS AND ENCLOSURE MARKET : BY Modularity, 2021-2028 (USD MILLION)

FIGURE 21 North America LABORATORY HOODS AND ENCLOSURE MARKET : BY Modularity, CAGR (2021-2028)

FIGURE 22 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY Modularity, LIFELINE CURVE

FIGURE 23 North America LABORATORY HOODS AND ENCLOSURE MARKET : BY material, 2020

FIGURE 24 North America LABORATORY HOODS AND ENCLOSURE MARKET : BY material, 2021-2028 (USD MILLION)

FIGURE 25 North America LABORATORY HOODS AND ENCLOSURE MARKET : BY material, CAGR (2021-2028)

FIGURE 26 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY material, LIFELINE CURVE

FIGURE 27 NORTH AMERICA LABORATORY HOODS AND ENCLOSURE MARKET: BY End User, 2020

FIGURE 28 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY End User, 2021-2028 (USD MILLION)

FIGURE 29 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY End User, CAGR (2021-2028)

FIGURE 30 North America LABORATORY HOODS AND ENCLOSURE MARKET: BY End User, LIFELINE CURVE

FIGURE 31 NORTH AMERICA laboratory hoods and enclosure MARKET: SNAPSHOT (2020)

FIGURE 32 NORTH AMERICA laboratory hoods and enclosure MARKET: BY COUNTRY (2020)

FIGURE 33 NORTH AMERICA laboratory hoods and enclosure MARKET: BY COUNTRY (2021 & 2028)

FIGURE 34 NORTH AMERICA laboratory hoods and enclosure MARKET: BY COUNTRY (2020 & 2028)

FIGURE 35 NORTH AMERICA laboratory hoods and enclosure MARKET: BY PRODUCT (2021-2028)

FIGURE 36 North America Laboratory Hoods and Enclosure Market: company share 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.