North America Internet Of Medical Things Iomt Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

62.50 Billion

USD

310.77 Billion

2025

2033

USD

62.50 Billion

USD

310.77 Billion

2025

2033

| 2026 –2033 | |

| USD 62.50 Billion | |

| USD 310.77 Billion | |

|

|

|

|

Segmentação do mercado de Internet das Coisas Médicas (IoMT) na América do Norte por componente (hardware, software e serviços), plataforma (gerenciamento de dispositivos, gerenciamento de aplicativos e gerenciamento em nuvem), modo de entrega de serviço (local e em nuvem), dispositivos de conectividade (com fio e sem fio), aplicação (dispositivos corporais, profissionais de saúde, dispositivos médicos para uso doméstico, comunidade e outros) e usuário final (hospitais, clínicas, institutos de pesquisa e instituições acadêmicas, assistência domiciliar e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de Internet das Coisas Médicas (IoMT) na América do Norte

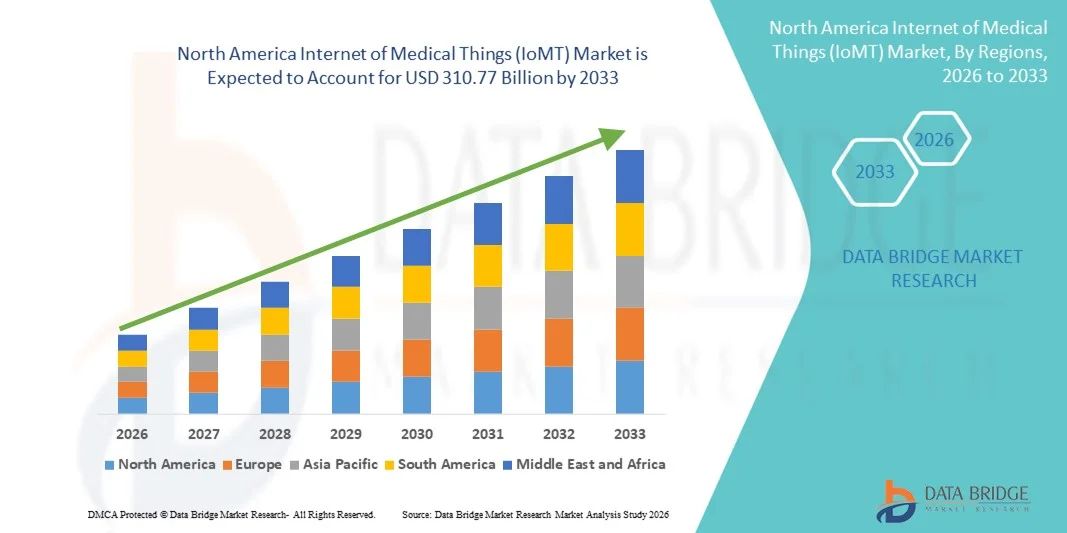

- O mercado de Internet das Coisas Médicas (IoMT) na América do Norte foi avaliado em US$ 62,50 bilhões em 2025 e deverá atingir US$ 310,77 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 22,2% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente adoção de dispositivos médicos conectados, soluções de telessaúde e sistemas de monitoramento remoto de pacientes , que estão cada vez mais integrados às redes hospitalares e aos serviços de saúde domiciliar.

- Além disso, a crescente demanda por dados de pacientes em tempo real, maior eficiência operacional e melhores resultados na área da saúde está posicionando as soluções de IoMT como componentes essenciais do ecossistema de saúde digital. Esses fatores estão acelerando a implementação de dispositivos de IoMT em hospitais, clínicas e ambientes de atendimento domiciliar, impulsionando significativamente o crescimento do mercado.

Análise do mercado de Internet das Coisas Médicas (IoMT) na América do Norte

- Os dispositivos da Internet das Coisas Médicas (IoMT), incluindo dispositivos médicos conectados, monitores de saúde vestíveis e sistemas de monitoramento remoto de pacientes, são cada vez mais essenciais na área da saúde moderna devido à sua capacidade de fornecer dados de pacientes em tempo real, viabilizar serviços de telemedicina e integrar-se perfeitamente à infraestrutura de TI hospitalar.

- A crescente adoção da IoMT é impulsionada principalmente pela demanda por melhores resultados para os pacientes, eficiência operacional e recursos de assistência médica remota, juntamente com os crescentes investimentos em tecnologias de saúde digital por hospitais e prestadores de serviços de saúde.

- Os Estados Unidos dominaram o mercado de Internet das Coisas Médicas (IoMT) da América do Norte, com a maior participação de receita, de 86,2% em 2025, impulsionados por uma infraestrutura de saúde avançada, altos investimentos em TI na área da saúde e a presença de importantes players do mercado.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de Internet das Coisas Médicas (IoMT) da América do Norte durante o período de previsão, devido à crescente adoção de dispositivos corporais e dispositivos médicos para uso doméstico, juntamente com iniciativas governamentais para expandir a infraestrutura digital de saúde e programas de monitoramento remoto de pacientes.

- O segmento de hardware dominou o mercado de Internet das Coisas Médicas (IoMT) na América do Norte, com uma participação de 45,2% em 2025, impulsionado pela crescente implantação de sensores médicos, monitores vestíveis e dispositivos de diagnóstico conectados em hospitais e ambientes de atendimento domiciliar.

Escopo do relatório e segmentação do mercado de Internet das Coisas Médicas (IoMT) na América do Norte

|

Atributos |

Principais insights de mercado sobre a Internet das Coisas Médicas (IoMT) na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais players, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de Internet das Coisas Médicas (IoMT) na América do Norte

Atendimento aprimorado ao paciente por meio de dispositivos conectados e integração com a nuvem.

- Uma tendência significativa e crescente no mercado de Internet das Coisas Médicas (IoMT) na América do Norte é a integração cada vez maior de dispositivos médicos conectados com plataformas em nuvem e sistemas de TI para a área da saúde, melhorando significativamente o monitoramento do paciente e a coordenação do cuidado.

- Por exemplo, os monitores de glicose vestíveis agora sincronizam perfeitamente com aplicativos baseados em nuvem, permitindo que os profissionais de saúde acompanhem os níveis de açúcar no sangue dos pacientes em tempo real e ajustem os planos de tratamento remotamente.

- A integração da IA em dispositivos IoMT permite análises preditivas para a detecção precoce de anomalias, recomendações de saúde personalizadas e alertas inteligentes com base na atividade do paciente. Por exemplo, alguns monitores cardíacos vestíveis utilizam IA para detectar arritmias e notificar os médicos automaticamente.

- A integração perfeita de dispositivos IoMT com registros eletrônicos de saúde (EHRs) e plataformas de telessaúde facilita o gerenciamento centralizado de pacientes, permitindo que os médicos monitorem vários pacientes a partir de um único painel e coordenem intervenções com mais eficiência.

- Essa tendência em direção a dispositivos médicos mais inteligentes, orientados por dados e interconectados está remodelando as expectativas para a saúde digital. Consequentemente, empresas como a Philips e a Medtronic estão desenvolvendo dispositivos IoMT com inteligência artificial que integram gerenciamento em nuvem, análise preditiva e recursos de monitoramento remoto.

- A demanda por dispositivos IoMT com recursos avançados de IA e nuvem está crescendo rapidamente em hospitais e ambientes de atendimento domiciliar, à medida que os profissionais de saúde priorizam cada vez mais a segurança do paciente, a conveniência e a eficiência do atendimento remoto.

- A telessaúde e os aplicativos de saúde móvel (mHealth) estão utilizando cada vez mais dispositivos da Internet das Coisas Médicas (IoMT) para o engajamento contínuo do paciente, melhorando a adesão aos planos de tratamento e reduzindo as visitas ao hospital. Por exemplo, monitores de pressão arterial vestíveis podem transmitir dados diretamente para aplicativos de saúde móvel para monitoramento e feedback em tempo real.

Dinâmica do mercado de Internet das Coisas Médicas (IoMT) na América do Norte

Motorista

Aumento da demanda devido a doenças crônicas e monitoramento remoto de pacientes.

- A crescente prevalência de doenças crônicas e o envelhecimento da população, juntamente com a adoção de soluções de monitoramento remoto de pacientes, são fatores significativos para o crescimento do mercado de Internet das Coisas Médicas (IoMT) na América do Norte.

- Por exemplo, em abril de 2025, a Dexcom anunciou um sistema de monitoramento contínuo de glicose (CGM) atualizado com integração em nuvem para melhorar o controle do diabetes por meio do acesso a dados em tempo real por médicos e pacientes.

- Os dispositivos IoMT permitem o monitoramento contínuo dos sinais vitais, a detecção precoce da deterioração da saúde e a intervenção oportuna, oferecendo uma vantagem significativa em relação ao atendimento hospitalar convencional.

- Além disso, iniciativas governamentais que promovem a adoção da telessaúde e políticas de reembolso para dispositivos de monitoramento remoto estão apoiando a ampla implantação de soluções de IoMT (Internet das Coisas Médicas).

- A conveniência do monitoramento remoto, alertas em tempo real e insights baseados em dados para cuidados personalizados é um fator chave que impulsiona a adoção tanto em hospitais quanto no setor de assistência domiciliar.

- A crescente disponibilidade de dispositivos IoMT fáceis de usar e a tendência para modelos de atendimento centrados no paciente contribuem ainda mais para o crescimento sustentado do mercado.

- O aumento dos investimentos de capital de risco e de empresas de tecnologia da saúde está acelerando o desenvolvimento e a implementação de dispositivos inovadores de IoMT (Internet das Coisas Médicas). Por exemplo, empresas como a Withings e a iRhythm estão expandindo seus portfólios de produtos com soluções de monitoramento baseadas em nuvem.

- A integração de análises preditivas baseadas em IA em plataformas de IoMT está aprimorando o gerenciamento de doenças crônicas, permitindo que os profissionais de saúde ajustem os tratamentos de forma proativa. Por exemplo, dispositivos vestíveis com IA podem prever eventos de insuficiência cardíaca antes que ocorram, reduzindo as internações hospitalares.

Restrição/Desafio

Preocupações com a privacidade dos dados e altos custos de implementação

- As preocupações com a privacidade dos dados e as vulnerabilidades de cibersegurança dos dispositivos médicos conectados representam um desafio significativo para a adoção mais ampla das soluções da Internet das Coisas Médicas (IoMT).

- Por exemplo, relatos de acesso não autorizado a dados de pacientes em sistemas de monitoramento remoto deixaram alguns hospitais cautelosos quanto à implementação generalizada de dispositivos conectados.

- Abordar essas preocupações com privacidade e segurança por meio de criptografia robusta, protocolos de autenticação seguros e conformidade com as regulamentações da HIPAA é crucial para construir confiança entre profissionais de saúde e pacientes.

- Além disso, o custo relativamente alto de dispositivos avançados de IoMT, plataformas de software e infraestrutura em nuvem pode dificultar a adoção, principalmente para pequenas clínicas e prestadores de cuidados domiciliares com orçamentos limitados.

- Embora os preços de monitores e sensores vestíveis básicos estejam diminuindo gradualmente, recursos premium, como análises baseadas em IA ou monitoramento contínuo de múltiplos parâmetros, geralmente têm um preço mais elevado, o que limita sua adoção.

- Superar esses desafios por meio de maior segurança cibernética, conformidade regulatória e desenvolvimento de soluções de IoMT com boa relação custo-benefício será vital para o crescimento sustentado do mercado de IoMT na América do Norte.

- A baixa alfabetização digital entre profissionais de saúde e pacientes pode retardar a adoção, exigindo programas de treinamento e infraestrutura de suporte. Por exemplo, pacientes idosos podem precisar de orientação para usar dispositivos de monitoramento vestíveis de forma eficaz.

- Os desafios de integração entre os sistemas legados de TI hospitalares e as novas plataformas de IoMT podem restringir a implementação. Por exemplo, alguns hospitais enfrentam dificuldades para conectar sistemas EHR mais antigos com dispositivos de monitoramento remoto baseados em nuvem.

Escopo do mercado de Internet das Coisas Médicas (IoMT) na América do Norte

O mercado é segmentado com base em componentes, plataforma, modo de prestação de serviços, dispositivos de conectividade , aplicação e usuário final.

- Por componente

Com base nos componentes, o mercado de IoMT na América do Norte é segmentado em hardware, software e serviços. O segmento de hardware dominou o mercado com a maior participação na receita, de 45,2% em 2025, impulsionado pela ampla implantação de sensores médicos, monitores vestíveis e dispositivos de diagnóstico conectados em hospitais e ambientes de atendimento domiciliar. A adoção de hardware é impulsionada pela crescente necessidade de monitoramento preciso e contínuo de sinais vitais, gerenciamento de doenças crônicas e atendimento remoto ao paciente. Os profissionais de saúde priorizam dispositivos de IoMT de alta qualidade que possam capturar e transmitir dados do paciente de forma confiável e em tempo real. Além disso, os componentes de hardware geralmente formam a base para soluções de IoMT mais abrangentes, incluindo a integração com plataformas de software e sistemas de gerenciamento em nuvem. O número crescente de hospitais e serviços de atendimento domiciliar habilitados para IoMT nos EUA reforçou o domínio desse segmento.

Prevê-se que o segmento de software apresente o crescimento mais rápido durante o período de previsão, com uma taxa de crescimento anual composta (CAGR) de 19,8% de 2026 a 2033. As soluções de software para a Internet das Coisas Médicas (IoMT), incluindo plataformas de gerenciamento de dispositivos, aplicativos de análise e ferramentas de monitoramento com inteligência artificial, estão cada vez mais em demanda para processar e interpretar grandes volumes de dados de pacientes. O aumento na adoção da telemedicina e de soluções de saúde baseadas em nuvem está acelerando a implantação de sistemas de IoMT orientados por software. O software também possibilita insights preditivos na área da saúde, diagnósticos remotos e automação de fluxos de trabalho, que são essenciais para os provedores de saúde modernos. O aumento do investimento em análises baseadas em inteligência artificial e aprendizado de máquina está impulsionando ainda mais o crescimento do segmento de software.

- Por plataforma

Com base na plataforma, o mercado de IoMT na América do Norte é segmentado em gerenciamento de dispositivos, gerenciamento de aplicativos e gerenciamento em nuvem. O segmento de gerenciamento em nuvem dominou o mercado em 2025 devido à sua capacidade de armazenar, gerenciar e analisar grandes volumes de dados de pacientes com segurança. As plataformas em nuvem permitem que os profissionais de saúde acessem remotamente informações de pacientes, integrem múltiplos dispositivos e garantam interoperabilidade perfeita entre hospitais e serviços de assistência domiciliar. A escalabilidade e a flexibilidade oferecidas pelos sistemas de gerenciamento em nuvem os tornam ideais para lidar com diversos dispositivos de IoMT, permitindo monitoramento em tempo real e análises preditivas. As plataformas em nuvem também simplificam atualizações, conformidade com segurança e integração com sistemas de registro eletrônico de saúde (EHR). Hospitais e provedores de assistência domiciliar estão adotando cada vez mais soluções em nuvem para o gerenciamento centralizado de dados de pacientes.

O segmento de Gerenciamento de Dispositivos deverá apresentar o crescimento mais rápido entre 2026 e 2033. As plataformas de gerenciamento de dispositivos facilitam o monitoramento, a configuração e a manutenção de diversos dispositivos da Internet das Coisas Médicas (IoMT), garantindo desempenho e segurança ideais. Com o número crescente de dispositivos médicos conectados em hospitais, clínicas e atendimento domiciliar, as soluções de gerenciamento de dispositivos são essenciais para a interoperabilidade e o controle em tempo real. Essas plataformas também oferecem ferramentas para solução de problemas remota, atualizações de firmware e monitoramento de conformidade. A crescente adoção de ecossistemas de saúde conectados e a necessidade de uma administração eficiente de dispositivos estão impulsionando a expansão desse segmento.

- Por Modalidade de Prestação de Serviços

Com base na prestação de serviços, o mercado de IoMT na América do Norte é segmentado em soluções locais (on-premise) e em nuvem. O segmento de nuvem dominou em 2025 devido à crescente preferência por soluções de saúde escaláveis, acessíveis remotamente e com boa relação custo-benefício. As plataformas de IoMT baseadas em nuvem permitem que os provedores de saúde acessem dados de pacientes de vários locais, ofereçam suporte a consultas de telemedicina e integrem análises para tomada de decisões em tempo real. A flexibilidade para gerenciar diversos dispositivos conectados remotamente torna a entrega em nuvem ideal para hospitais e provedores de assistência domiciliar. Além disso, os sistemas em nuvem reduzem os custos iniciais de infraestrutura de TI e oferecem recursos de implantação rápida. Os provedores de saúde nos EUA e no Canadá dependem cada vez mais de serviços baseados em nuvem para monitoramento de pacientes e eficiência operacional.

O segmento On-Premise deverá apresentar o crescimento mais rápido durante o período de previsão, impulsionado por hospitais e institutos de pesquisa que exigem maior controle sobre dados sensíveis de pacientes. As soluções On-Premise oferecem segurança aprimorada e conformidade com regulamentações rigorosas da área da saúde, como a HIPAA. Elas são preferidas por grandes hospitais e clínicas com equipes de TI internas capazes de gerenciar a infraestrutura. A capacidade de integrar sistemas legados, personalizar softwares e manter o controle total sobre os dados está impulsionando a adoção em unidades de terapia intensiva e instalações médicas especializadas. A implantação On-Premise também resolve os desafios de latência e conectividade, o que é essencial para determinadas aplicações de alta complexidade.

- Por meio de dispositivos de conectividade

Com base na conectividade, o mercado de IoMT na América do Norte é segmentado em com fio e sem fio. O segmento sem fio dominou o mercado em 2025 devido à crescente adoção de dispositivos vestíveis, sensores sem fio e sistemas de monitoramento remoto de pacientes que exigem mobilidade e flexibilidade. A conectividade sem fio permite a transmissão de dados vitais em tempo real, reduz a complexidade da instalação e suporta a integração com aplicativos móveis e em nuvem. Hospitais e serviços de assistência domiciliar preferem soluções sem fio pela facilidade de implantação e conforto do paciente. A proliferação de Wi-Fi, Bluetooth e outras tecnologias sem fio de curto alcance fortalece ainda mais esse segmento. Os dispositivos IoMT sem fio também facilitam o monitoramento contínuo de pacientes sem restringir seus movimentos.

O segmento de conexões com fio deverá apresentar o crescimento mais rápido durante o período de previsão, impulsionado por dispositivos e equipamentos médicos especializados em ambientes de terapia intensiva que exigem alta confiabilidade e conectividade estável. Dispositivos com fio garantem perda mínima de dados, fornecimento de energia consistente e interferência reduzida, tornando-os ideais para monitoramento intensivo em hospitais. Os profissionais de saúde priorizam soluções com fio em salas de cirurgia, unidades de terapia intensiva e laboratórios de diagnóstico, onde o fluxo ininterrupto de dados é crucial. O segmento também é beneficiado pelas constantes atualizações de infraestrutura em hospitais modernos.

- Por meio de aplicação

Com base na aplicação, o mercado de IoMT na América do Norte é segmentado em dispositivos corporais, provedores de saúde, dispositivos médicos para uso doméstico, comunidade e outros. O segmento de provedores de saúde dominou em 2025, impulsionado pela adoção de soluções de IoMT em hospitais, clínicas e centros de diagnóstico. Dispositivos médicos conectados permitem que os profissionais de saúde monitorem os sinais vitais dos pacientes, acompanhem os resultados dos tratamentos e otimizem as operações com eficiência. Os hospitais utilizam plataformas de IoMT para análises em tempo real, alertas preditivos e integração com registros eletrônicos de saúde. A necessidade de maior segurança do paciente, automação do fluxo de trabalho e prestação de cuidados com melhor custo-benefício reforça a dominância desse segmento. Os dispositivos de IoMT também aprimoram a tomada de decisões clínicas e reduzem erros manuais nos fluxos de trabalho da área da saúde.

O segmento de dispositivos corporais deverá apresentar o crescimento mais rápido durante o período de previsão, impulsionado pela crescente adoção de monitores de saúde vestíveis, adesivos inteligentes e rastreadores de atividades físicas. Esses dispositivos permitem o monitoramento contínuo da frequência cardíaca, pressão arterial, níveis de glicose e outros parâmetros críticos de saúde fora do ambiente clínico. A crescente tendência de monitoramento remoto de pacientes, gerenciamento de doenças crônicas e cuidados preventivos de saúde está acelerando a implementação de dispositivos corporais. Além disso, a preferência dos pacientes por soluções de monitoramento convenientes e não invasivas contribui para uma forte demanda. Análises avançadas de IA e integração com a nuvem aprimoram ainda mais a funcionalidade desses dispositivos.

- Por usuário final

Com base no usuário final, o mercado de IoMT na América do Norte é segmentado em hospitais, clínicas, institutos de pesquisa e instituições acadêmicas, assistência domiciliar e outros. O segmento de hospitais dominou em 2025 devido à implantação em larga escala de dispositivos IoMT para monitoramento de pacientes internados, aplicações cirúrgicas e gerenciamento de cuidados intensivos. Os hospitais necessitam de dispositivos conectados para monitorar vários pacientes simultaneamente, otimizar operações e garantir a conformidade com os padrões de saúde. A adoção é impulsionada pelo aumento do volume de pacientes, pela demanda por análises em tempo real e pela integração com os sistemas de TI hospitalares. Os principais hospitais nos EUA e no Canadá estão entre os primeiros a adotar soluções de IoMT com inteligência artificial para aumentar a eficiência e a segurança do paciente. Os dispositivos IoMT também aprimoram os recursos de telemedicina e consulta remota.

O segmento de cuidados domiciliares deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente preferência por cuidados de saúde em casa, gestão de doenças crônicas e soluções de monitoramento remoto. Os usuários de cuidados domiciliares se beneficiam de dispositivos vestíveis, sistemas de monitoramento conectados e plataformas em nuvem para gerenciar suas condições de saúde de forma prática. Esse crescimento é sustentado por iniciativas governamentais de telessaúde, maior conscientização dos pacientes e avanços tecnológicos em dispositivos portáteis da Internet das Coisas Médicas (IoMT). As soluções de cuidados domiciliares reduzem as visitas ao hospital, diminuem os custos com saúde e proporcionam monitoramento contínuo para idosos e pacientes crônicos.

Análise Regional do Mercado de Internet das Coisas Médicas (IoMT) na América do Norte

- Os Estados Unidos dominaram o mercado de Internet das Coisas Médicas (IoMT) da América do Norte, com a maior participação de receita, de 86,2% em 2025, impulsionados por uma infraestrutura de saúde avançada, altos investimentos em TI na área da saúde e a presença de importantes players do mercado.

- Os profissionais de saúde e os pacientes da região valorizam cada vez mais o monitoramento em tempo real, a análise preditiva e os recursos de atendimento remoto oferecidos pelas soluções da IoMT, o que melhora os resultados do tratamento e a eficiência operacional.

- Essa ampla adoção é ainda mais impulsionada por políticas governamentais favoráveis, estruturas de reembolso para telessaúde e monitoramento remoto, e um ecossistema robusto de hospitais, clínicas e provedores de assistência domiciliar, estabelecendo os dispositivos da IoMT como ferramentas essenciais na prestação de cuidados de saúde modernos.

Análise do Mercado de Internet das Coisas Médicas (IoMT) nos EUA

Os EUA detiveram a maior fatia de receita, com 86,2%, no mercado de Internet das Coisas Médicas (IoMT) da América do Norte em 2025, impulsionados pela rápida adoção de dispositivos médicos conectados e soluções de monitoramento remoto de pacientes. Os profissionais de saúde priorizam cada vez mais o monitoramento de pacientes em tempo real, a análise preditiva e os serviços de telemedicina para melhorar os resultados clínicos e a eficiência operacional. A crescente demanda por diagnósticos habilitados por IA e plataformas de IoMT integradas à nuvem impulsiona ainda mais o mercado. Além disso, políticas governamentais favoráveis, estruturas de reembolso e investimentos robustos em infraestrutura de saúde digital contribuem significativamente para a expansão do mercado. A ampla presença de grandes fornecedores de soluções de IoMT e startups inovadoras garante o desenvolvimento e a implementação contínuos de soluções avançadas de monitoramento e análise.

Análise do Mercado de Internet das Coisas Médicas (IoMT) no Canadá

O Canadá está testemunhando um crescimento constante no mercado de Internet das Coisas Médicas (IoMT) da América do Norte, impulsionado pela crescente adoção de dispositivos de monitoramento remoto de pacientes e sensores médicos corporais. Instituições de saúde estão enfatizando a medicina preventiva, o gerenciamento de doenças crônicas e a integração de dispositivos IoMT com registros eletrônicos de saúde (EHRs) para aprimorar o atendimento ao paciente. O apoio do governo canadense a iniciativas de telessaúde e saúde digital incentiva o uso de plataformas IoMT baseadas em nuvem. Além disso, a demanda por soluções de assistência domiciliar e dispositivos de monitoramento vestíveis está aumentando devido ao envelhecimento da população e ao foco crescente na prestação de cuidados de saúde centrados no paciente. A integração de soluções IoMT em hospitais e clínicas, combinada com os avanços tecnológicos, está acelerando a penetração no mercado em todo o país.

Análise do Mercado de Internet das Coisas Médicas (IoMT) no México

O México está emergindo como um mercado em crescimento no setor de Internet das Coisas Médicas (IoMT) da América do Norte, impulsionado pela crescente conscientização sobre tecnologias digitais na área da saúde e pelo aumento dos investimentos em infraestrutura de saúde. Hospitais e clínicas estão adotando gradualmente dispositivos de IoMT para monitorar sinais vitais de pacientes, gerenciar doenças crônicas e aprimorar fluxos de trabalho operacionais. Iniciativas governamentais que promovem a telemedicina e soluções de saúde móvel estão impulsionando a adoção de plataformas de IoMT baseadas em nuvem. Além disso, a crescente prevalência de doenças crônicas e a demanda cada vez maior por serviços de saúde remotos estão incentivando os profissionais de saúde a integrar dispositivos médicos conectados à rotina de atendimento. A crescente colaboração com fornecedores de soluções de IoMT e empresas de tecnologia está fortalecendo ainda mais o potencial de crescimento do mercado.

Participação de mercado da Internet das Coisas Médicas (IoMT) na América do Norte

O setor de Internet das Coisas Médicas (IoMT) na América do Norte é liderado principalmente por empresas consolidadas, incluindo:

- Medtronic (Irlanda)

- GE HealthCare (EUA)

- Koninklijke Philips NV (Holanda)

- Cisco Systems, Inc. (EUA)

- IBM Corporation (EUA)

- Honeywell International Inc. (EUA)

- Lenovo Group Ltd. (Hong Kong)

- Boston Scientific Corporation (EUA)

- Siemens Healthineers AG (Alemanha)

- BIOTRONIK SE & Co. KG (Alemanha)

- Grupo Unison Healthcare (Taiwan)

- Cadi Scientific (Singapura)

- imedtac Co., Ltd (Taiwan)

- Meril Life Sciences (Índia)

- Omron Healthcare Co., Ltd (Japão)

- Corporação Terumo (Japão)

- NIHON KOHDEN CORPORATION (Japão)

- Lepu Medical Technology Co., Ltd (China)

- Accuster Technologies Pvt Ltd (Índia)

- iHealth Labs, Inc. (EUA)

Quais são os desenvolvimentos recentes no mercado de Internet das Coisas Médicas (IoMT) na América do Norte?

- Em junho de 2025, a Philips anunciou uma parceria plurianual ampliada com a Medtronic para expandir o acesso a soluções avançadas de monitoramento de pacientes no mercado de saúde da América do Norte. A parceria integra os sistemas de monitoramento da Philips às tecnologias da Medtronic para simplificar a aquisição e dar suporte ao uso clínico na linha de frente, reforçando a infraestrutura de atendimento ao paciente habilitada pela Internet das Coisas Médicas (IoMT).

- Em abril de 2025, a Medtronic anunciou que submeteu pedidos 510(k) à FDA (Food and Drug Administration) dos EUA para uma bomba de insulina interoperável que se integraria a sistemas de monitoramento contínuo de glicose (MCG), um desenvolvimento fundamental em soluções de gerenciamento de diabetes habilitadas pela IoMT (Internet das Coisas Médicas) que poderia aprimorar a conectividade e o monitoramento remoto do paciente.

- Em fevereiro de 2025, a Etiometry obteve sua décima aprovação 510(k) da FDA para uma plataforma avançada de dados para cuidados intensivos que agrega dados contínuos de múltiplos dispositivos IoMT à beira do leito em um painel de controle unificado para médicos. Essa aprovação aprimora o monitoramento remoto e a análise em tempo real para pacientes críticos em unidades de terapia intensiva nos EUA, marcando um marco em soluções de dados IoMT interoperáveis.

- Em janeiro de 2025, a Food and Drug Administration (FDA) dos EUA identificou sérias vulnerabilidades de cibersegurança em certos dispositivos de monitoramento de pacientes conectados à Internet das Coisas Médicas (IoMT) usados em hospitais e em cuidados domiciliares. A FDA alertou que esses dispositivos poderiam ser acessados ou manipulados remotamente, comprometendo potencialmente tanto o funcionamento do dispositivo quanto os dados sensíveis do paciente, o que levou as instituições de saúde a tomarem medidas de mitigação para proteger as redes de IoMT.

- Em março de 2024, a Food and Drug Administration (FDA) dos EUA aprovou o primeiro monitor contínuo de glicose (MCG) de venda livre, o sistema Dexcom Stelo Glucose Biosensor, permitindo que consumidores adultos comprassem e utilizassem um dispositivo IoMT conectado sem receita médica. Essa aprovação representou um avanço importante, tornando o monitoramento contínuo e em tempo real da saúde acessível diretamente aos consumidores, proporcionando uma compreensão mais ampla do bem-estar e do tratamento de doenças crônicas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.