North America Iga Nephropathy Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

259.67 Million

USD

1,094.42 Million

2024

2032

USD

259.67 Million

USD

1,094.42 Million

2024

2032

| 2025 –2032 | |

| USD 259.67 Million | |

| USD 1,094.42 Million | |

|

|

|

|

Segmentação do mercado de nefropatia por IgA na América do Norte, por tipo de doença (nefropatia primária por IgA e nefropatia secundária por IgA), sintomas (hematúria, proteinúria, edema e outros), tipo (diagnóstico e tratamento), tipo de população (pediátrica e adulta), via de administração (oral, parenteral e outras), usuário final (hospitais, clínicas, assistência domiciliar e outros), canal de distribuição (venda direta, farmácia hospitalar, farmácia de varejo, farmácia online e outros) - Tendências e previsões do setor até 2032.

Tamanho do mercado de nefropatia por IgA na América do Norte

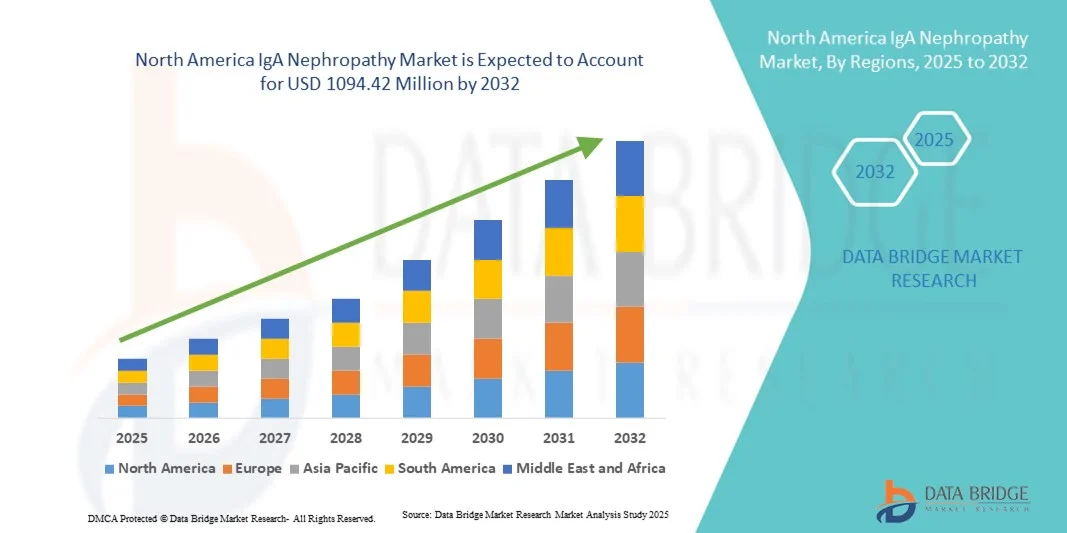

- O mercado de nefropatia por IgA na América do Norte foi avaliado em US$ 259,67 milhões em 2024 e espera-se que atinja US$ 1.094,42 milhões até 2032 , com uma taxa de crescimento anual composta (CAGR) de 19,7% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente prevalência de doenças renais em todo o mundo e pela maior conscientização sobre o diagnóstico precoce e o manejo da doença, fatores que impulsionam a demanda por tratamentos eficazes para a nefropatia por IgA (NIgA). Os avanços nas técnicas de diagnóstico, como biópsias renais e testes de biomarcadores, estão aprimorando ainda mais a detecção da doença e possibilitando intervenções oportunas.

- Além disso, o crescente foco na medicina de precisão, aliado ao desenvolvimento de novos produtos biológicos e terapias direcionadas para reduzir a proteinúria e preservar a função renal, está acelerando a adoção de soluções inovadoras para o tratamento da nefropatia por IgA. Esses fatores convergentes estão impulsionando significativamente o crescimento do setor e apoiando a transição para um atendimento renal personalizado.

Análise do mercado de nefropatia por IgA na América do Norte

- A nefropatia por IgA (NIgA), também conhecida como doença de Berger, é uma doença renal autoimune caracterizada pelo acúmulo da proteína imunoglobulina A (IgA) nos glomérulos, levando à inflamação e comprometimento da função renal. O mercado está apresentando um crescimento significativo devido à crescente prevalência de doenças renais crônicas, à maior conscientização sobre o diagnóstico precoce e aos avanços nas terapias nefrológicas.

- A crescente demanda por opções de tratamento inovadoras, incluindo terapias biológicas direcionadas e inibidores da via do complemento, está impulsionando a expansão do mercado de nefropatia por IgA. Além disso, o aumento no número de ensaios clínicos, as aprovações regulatórias favoráveis e as capacidades diagnósticas aprimoradas estão contribuindo para o crescimento geral desse setor.

- Os EUA dominaram o mercado de nefropatia por IgA, com a maior participação na receita, de 41,3% em 2024, impulsionados por uma infraestrutura de saúde bem estabelecida, alta conscientização sobre doenças renais e a presença de grandes empresas biofarmacêuticas ativamente engajadas em pesquisas na área de nefrologia.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de nefropatia por IgA, registrando uma taxa de crescimento anual composta (CAGR) de 8,9% durante o período de previsão. Esse crescimento é atribuído principalmente ao aumento dos gastos com saúde, à crescente prevalência de distúrbios renais e à expansão do acesso a soluções de tratamento inovadoras.

- O segmento de adultos dominou o mercado com a maior participação na receita, de 79,0% em 2024, visto que a maioria dos casos clinicamente significativos de nefropatia por IgA e a atividade de tratamento comercial ocorrem em populações adultas.

Escopo do relatório e segmentação do mercado de nefropatia por IgA

|

Atributos |

Nefropatia por IgA: Principais informações de mercado |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de nefropatia por IgA na América do Norte

Avanços em terapias direcionadas e baseadas no sistema complemento

- Uma tendência significativa e crescente no mercado global de nefropatia por IgA (IgAN) é a adoção cada vez maior de terapias direcionadas que se concentram em mecanismos específicos da doença, como a inibição do complemento, a modulação de células B e a regulação da imunidade da mucosa. Essa mudança de imunossupressores convencionais para tratamentos mais personalizados e baseados em mecanismos está transformando o cenário do tratamento.

- Por exemplo, em dezembro de 2023, a Novartis recebeu a aprovação da FDA para o Iptacopan (Fabhalta), o primeiro inibidor oral do fator B para nefropatia por IgA, marcando um importante marco em terapias renais direcionadas. Da mesma forma, o Tarpeyo (budesonida) da Calliditas Therapeutics ganhou forte aceitação no mercado como o primeiro medicamento aprovado que aborda a fisiopatologia subjacente da nefropatia por IgA, visando o sistema imunológico da mucosa intestinal.

- A pesquisa está cada vez mais focada na via do complemento, que desempenha um papel fundamental na progressão da nefropatia por IgA. Empresas como a Omeros Corporation (narsoplimab) e a Vera Therapeutics (atacicept) estão avançando com ensaios clínicos em estágio final, evidenciando a tendência do mercado em direção a terapias de precisão imunomoduladoras.

- A integração de diagnósticos baseados em biomarcadores e abordagens de estratificação de pacientes permite um monitoramento mais eficaz da progressão da doença e da resposta à terapia. Esse modelo de medicina de precisão melhora os resultados clínicos e reduz a exposição desnecessária a imunossupressores de amplo espectro.

- Além disso, as colaborações entre empresas farmacêuticas, empresas de biotecnologia e instituições de pesquisa estão acelerando o desenvolvimento de novos medicamentos. Por exemplo, diversos ensaios clínicos de Fase II e III nos EUA, Europa e região Ásia-Pacífico estão explorando novas terapias biológicas e baseadas em RNA com o objetivo de retardar a progressão de danos renais.

- Essa tendência em direção a opções de tratamento de precisão, direcionadas e biológicas está remodelando o mercado de nefropatia por IgA, posicionando-o como uma das áreas terapêuticas de evolução mais rápida na nefrologia.

Dinâmica do mercado de nefropatia por IgA na América do Norte

Motorista

Aumento da prevalência de doenças e crescente adoção de novas terapias.

- O aumento global na incidência de nefropatia por IgA, aliado à maior conscientização sobre doenças renais crônicas, é um dos principais impulsionadores do crescimento do mercado. A doença afeta aproximadamente 2,5 indivíduos por 100.000 anualmente, com taxas de prevalência mais elevadas em populações asiáticas.

- Por exemplo, em março de 2024, a Travere Therapeutics recebeu a aprovação da FDA para o Sparsentan, um antagonista duplo dos receptores de endotelina e angiotensina, para o tratamento da nefropatia por IgA. Esse marco demonstra uma tendência crescente em direção a terapias que reduzem a proteinúria e preservam a função renal de forma mais eficaz do que os corticosteroides tradicionais.

- Técnicas de diagnóstico aprimoradas, incluindo biomarcadores genéticos e proteicos, estão permitindo a detecção precoce e o monitoramento mais eficaz da doença, ampliando o leque de opções de tratamento.

- O financiamento público e privado para pesquisa, juntamente com parcerias para ensaios clínicos, estimularam ainda mais o desenvolvimento terapêutico na América do Norte, Europa e região Ásia-Pacífico.

- Além disso, a disponibilidade de múltiplas classes de medicamentos avançados — incluindo corticosteroides, formulações de liberação direcionada e inibidores do complemento — diversificou as opções de tratamento.

- Como resultado, espera-se que o mercado global de nefropatia por IgA cresça a uma taxa composta de crescimento anual (CAGR) de 7,2% de 2025 a 2032, impulsionado pela crescente conscientização dos pacientes, pelo aumento das aprovações de medicamentos e pelo melhor acesso aos serviços de nefrologia.

Restrição/Desafio

Altos custos de tratamento e complexidade clínica

- Apesar dos avanços promissores, os altos custos do tratamento continuam sendo uma barreira significativa para a adoção generalizada de terapias avançadas para nefropatia por IgA. Os medicamentos biológicos e inibidores do complemento recém-aprovados frequentemente custam mais de US$ 100.000 por ano , limitando o acesso em países de baixa e média renda.

- Por exemplo, embora Tarpeyo e Fabhalta ofereçam benefícios terapêuticos importantes, seus preços elevados e a cobertura limitada de reembolso representam desafios de acessibilidade tanto para pacientes quanto para sistemas de saúde.

- Além disso, a fisiopatologia complexa e heterogênea da nefropatia por IgA cria desafios na padronização das abordagens de tratamento, uma vez que a progressão da doença e a resposta à terapia variam amplamente entre os indivíduos.

- Muitos ensaios clínicos exigem longos períodos de acompanhamento para medir desfechos como a redução da proteinúria e a preservação da função renal, o que retarda o ritmo de aprovação de novos medicamentos.

- A disponibilidade limitada de centros especializados em nefrologia em regiões em desenvolvimento também dificulta o diagnóstico precoce e o tratamento consistente, restringindo ainda mais o alcance do mercado.

- Abordar esses desafios por meio de reformas de preços, programas de assistência ao paciente e esforços colaborativos de pesquisa será fundamental para sustentar o crescimento do mercado a longo prazo. Apesar dessas restrições, espera-se que a inovação contínua e o aumento do investimento em P&D impulsionem um progresso constante na melhoria dos resultados para os pacientes em todo o mundo.

Escopo do mercado de nefropatia por IgA na América do Norte

O mercado é segmentado com base no tipo de doença, sintomas, tipo de população, via de administração, usuário final e canal de distribuição.

- Por tipo de doença

Com base no tipo de doença, o mercado de nefropatia por IgA é segmentado em nefropatia primária por IgA e nefropatia secundária por IgA. O segmento de nefropatia primária por IgA dominou o mercado com a maior participação na receita, de 68,4% em 2024, refletindo sua maior prevalência e maior foco clínico em todo o mundo. A nefropatia primária por IgA representa a maioria dos casos diagnosticados, apresentando deposição mesangial característica de IgA, e impulsiona a demanda por cuidados nefrológicos especializados e desenvolvimento terapêutico direcionado. Diretrizes clínicas e registros priorizam coortes de doença primária para inclusão em ensaios clínicos, aumentando a visibilidade e a atividade de tratamento. Vias diagnósticas, incluindo biópsia renal e monitoramento da proteinúria, são aplicadas com maior frequência na nefropatia primária por IgA, levando a uma maior utilização de serviços diagnósticos e terapêuticos. A concentração de financiamento para pesquisa e a maioria dos candidatos em estágio final de desenvolvimento visam os mecanismos da doença primária, reforçando a participação de mercado. Políticas de planos de saúde e padrões de encaminhamento a especialistas também direcionam recursos para o manejo da nefropatia primária por IgA. De modo geral, a centralidade da nefropatia por IgA primária na epidemiologia, na pesquisa e na prática clínica sustenta seu papel dominante no mercado.

O segmento de Nefropatia por IgA Secundária deverá registrar a taxa de crescimento anual composta (CAGR) mais rápida, de 11,2%, entre 2025 e 2032, impulsionado pelo melhor reconhecimento das causas secundárias e pela maior triagem em populações de risco. A Nefropatia por IgA Secundária surge em associação com condições como doenças hepáticas, infecções, doenças autoimunes e certos medicamentos — contextos em que a expansão da vigilância e os modelos de cuidados integrados estão revelando pacientes anteriormente subdiagnosticados. À medida que os serviços de hepatologia, doenças infecciosas e reumatologia integram o monitoramento renal aos protocolos de cuidados crônicos, as taxas de encaminhamento para nefrologia aumentam. O desenvolvimento de protocolos de manejo personalizados e algoritmos diagnósticos mais acessíveis para as formas secundárias está acelerando a adesão ao tratamento. Além disso, terapias direcionadas, testadas em coortes mais amplas de Nefropatia por IgA, estão sendo avaliadas para indicações secundárias, o que contribui para o crescimento do mercado. A crescente colaboração entre especialidades e a inclusão mais ampla da Nefropatia por IgA Secundária nas diretrizes devem sustentar essa CAGR mais elevada.

- Por sintomas

Com base nos sintomas, o mercado de nefropatia por IgA é segmentado em hematúria, proteinúria, edema e outros. O segmento de proteinúria dominou o mercado com a maior participação na receita, de 55,1% em 2024, dada a importância central da proteinúria como marcador diagnóstico e desfecho terapêutico na nefropatia por IgA. A proteinúria persistente correlaciona-se fortemente com a progressão da doença e é a principal métrica utilizada em ensaios clínicos e diretrizes de tratamento para avaliar a eficácia. Consequentemente, terapias e ferramentas de monitoramento que reduzem a proteinúria atraem considerável atenção clínica e comercial. Nefrologistas priorizam intervenções comprovadamente eficazes na redução da proteinúria, impulsionando a demanda por opções farmacológicas, monitoramento da função renal e serviços de acompanhamento ambulatorial. O foco regulatório na redução da proteinúria como um desfecho substituto aprovável também incentivou investimentos em P&D direcionados a esse sintoma. Os modelos de reembolso frequentemente vinculam a cobertura a métricas de proteinúria, fortalecendo ainda mais sua dominância no mercado. Em resumo, a importância prognóstica e regulatória da proteinúria explica sua liderança.

Prevê-se que o segmento de hematúria apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 10,6%, entre 2025 e 2032, à medida que a melhoria dos exames de urina, os diagnósticos no local de atendimento e os programas de conscientização pública aumentam as taxas de detecção precoce. Intervenções que abordam a inflamação subjacente e previnem a hematúria macroscópica ou microscópica recorrente estão ganhando força, incentivando uma adoção mais ampla de protocolos diagnósticos em clínicas de atenção primária e nefrologia. Ensaios clínicos relatam cada vez mais a melhora da hematúria como um desfecho secundário, apoiando alegações terapêuticas mais abrangentes. Além disso, a identificação de hematúria em exames de saúde de rotina está levando a encaminhamentos mais precoces para nefrologia, expandindo a população tratada e aumentando a demanda por diagnósticos e terapias de intervenção precoce. O crescimento da telemedicina e do monitoramento remoto de exames de urina também contribui para uma adoção mais rápida do atendimento focado em hematúria.

- Por tipo

Com base no tipo, o mercado de nefropatia por IgA é segmentado em diagnóstico e tratamento. O segmento de tratamento dominou o mercado com a maior participação na receita, de 62,7% em 2024, refletindo os gastos contínuos com farmacoterapias, produtos biológicos, medicamentos de suporte e cuidados intervencionistas para pacientes com nefropatia por IgA. O tratamento abrange medicamentos (imunomoduladores, corticosteroides, agentes da via da angiotensina), formulações especializadas e regimes de suporte, como inibidores de SGLT2 e agentes redutores de proteínas; esses produtos representam a maior parte dos gastos com saúde. O crescente número de agentes modificadores da doença em desenvolvimento e diversas aprovações de alto valor ampliaram as receitas do mercado de tratamento. As atividades de comercialização — parcerias com fabricantes, marketing para especialistas e inclusão em formulários hospitalares — concentram-se em terapêuticas, aumentando ainda mais a concentração de receita. Os serviços de tratamento também incluem monitoramento de longo prazo e suporte clínico adjuvante, que adicionam fluxos de receita recorrentes. No geral, o desenvolvimento terapêutico ativo e a dependência clínica da terapia medicamentosa consolidam o domínio do tratamento.

Prevê-se que o segmento de Diagnóstico apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 12,0%, entre 2025 e 2032, devido aos avanços em biomarcadores não invasivos, ensaios multiplex e modalidades de imagem que reduzem a dependência de biópsias invasivas. O mercado está testemunhando uma rápida inovação em proteômica urinária, biomarcadores sorológicos e análises de imagem que permitem uma estratificação de doenças mais precoce e precisa. Os diagnósticos complementares, aliados a terapias direcionadas, estão acelerando a adoção de diagnósticos, à medida que os médicos utilizam cada vez mais perfis de biomarcadores para personalizar a terapia. O crescimento de plataformas de diagnóstico descentralizadas e de ponto de atendimento também melhora o acesso em ambientes comunitários, ampliando o número de pacientes. A expansão de programas de rastreamento e ferramentas de saúde digital para monitoramento remoto está impulsionando ainda mais os serviços de diagnóstico a uma taxa superior à observada historicamente.

- Por tipo de população

Com base no tipo de população, o mercado de nefropatia por IgA é segmentado em pediátrico e adulto. O segmento de adultos dominou o mercado com a maior participação na receita, de 79,0% em 2024, visto que a maioria dos casos clinicamente significativos de nefropatia por IgA e a atividade de tratamento comercial ocorrem em populações adultas. Pacientes adultos apresentam com mais frequência proteinúria progressiva e declínio da função renal, o que exige intervenção farmacológica, impulsionando a demanda por terapias, internações hospitalares e manejo a longo prazo. As populações de ensaios clínicos são predominantemente adultas, alinhando as estratégias de aprovação de medicamentos e os lançamentos no mercado para indicações em adultos. Os sistemas de saúde alocam uma parcela maior de recursos de nefrologia para o atendimento de adultos devido ao maior número absoluto de casos e à maior carga de comorbidades, reforçando a concentração de receita. As estratégias de acesso ao mercado, o reembolso por planos de saúde e os serviços especializados, portanto, têm como alvo as coortes adultas, mantendo sua participação dominante.

O segmento de Pediatria deverá registrar a taxa de crescimento anual composta (CAGR) mais rápida, de 13,5%, entre 2025 e 2032, impulsionado pelo aumento da triagem em populações pediátricas, programas de intervenção precoce e evidências crescentes de que o manejo oportuno melhora os resultados a longo prazo. Os centros de nefrologia pediátrica estão expandindo suas capacidades para testes genéticos, monitoramento de biomarcadores e regimes terapêuticos personalizados adequados para crianças. A crescente conscientização entre pediatras e as iniciativas de saúde em escolas contribuem para a detecção precoce de hematúria e proteinúria. Estudos clínicos pediátricos e formulações adequadas para crianças também estão em expansão, incentivando os fabricantes a buscarem a rotulagem pediátrica e a ampliarem seu alcance de mercado. Coletivamente, essas dinâmicas aceleram o crescimento do mercado pediátrico a um ritmo superior ao do atendimento a adultos.

- Por via administrativa

Com base na via de administração, o mercado de nefropatia por IgA é segmentado em oral, parenteral e outras. O segmento oral dominou o mercado com a maior participação na receita, de 58,2% em 2024, visto que os agentes orais (pequenas moléculas, antagonistas de receptores e muitos medicamentos de suporte) representam a forma terapêutica mais comumente prescrita, custo-efetiva e preferida pelos pacientes. Os medicamentos orais permitem o manejo ambulatorial crônico, melhoram a adesão ao tratamento e reduzem a sobrecarga dos centros de infusão; portanto, são amplamente adotados na prática nefrológica. Muitos novos agentes orais direcionados estão em desenvolvimento e diversas aprovações recentes são formulações orais, reforçando a atividade comercial e o volume de prescrições. Os sistemas de saúde e os formulários médicos priorizam as terapias orais para o manejo ambulatorial, contribuindo para maiores vendas e utilização. A conveniência e a escalabilidade da administração oral explicam a posição dominante do segmento.

Prevê-se que o segmento de terapias parenterais apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 14,1%, entre 2025 e 2032, impulsionado pela maturação e comercialização de produtos biológicos, anticorpos monoclonais e inibidores injetáveis do complemento. As terapias parenterais, embora geralmente mais caras, tratam doenças graves ou refratárias e frequentemente oferecem efeitos potentes e específicos ao mecanismo de ação, que os medicamentos orais não conseguem replicar. O número crescente de regimes administrados em clínicas ou por infusão, aliado à melhoria da infraestrutura de infusão ambulatorial e dos serviços de infusão domiciliar, está facilitando um maior acesso. As aprovações regulatórias de agentes parenterais para nefropatia por IgA e as crescentes evidências de benefício clínico duradouro são os principais fatores que impulsionam esse rápido crescimento.

- Por usuário final

Com base no usuário final, o mercado de nefropatia por IgA é segmentado em hospitais, clínicas, assistência domiciliar e outros. O segmento de hospitais dominou o mercado com a maior participação na receita, de 51,6% em 2024, devido ao papel dos hospitais no diagnóstico de casos complexos, na realização de biópsias renais, na administração de terapias parenterais e no manejo de exacerbações agudas. Centros de atendimento terciário e hospitais universitários abrigam equipes multidisciplinares e equipamentos avançados de diagnóstico por imagem, concentrando procedimentos de alto valor e consultas com especialistas em ambientes hospitalares. Os hospitais também servem como locais principais para ensaios clínicos e adoção precoce de novas terapias, impulsionando as compras institucionais e a receita. As internações para crises graves e procedimentos contribuem substancialmente para o gasto total do mercado. A infraestrutura, a força de trabalho especializada e os modelos de reembolso que favorecem o atendimento hospitalar sustentam a liderança do segmento.

O segmento de assistência domiciliar deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 15,0%, entre 2025 e 2032, impulsionado pela expansão do monitoramento remoto, serviços de infusão domiciliar e iniciativas de telenefrologia que permitem o manejo da nefropatia por IgA crônica fora do ambiente hospitalar. Os avanços em dispositivos de diagnóstico portáteis, serviços de coleta de amostras laboratoriais em domicílio e plataformas de educação do paciente estão possibilitando um acompanhamento mais rotineiro e a administração de terapias em casa. O interesse das operadoras de planos de saúde em reduzir a utilização de internações e melhorar a comodidade para o paciente apoia uma maior adoção de modelos de assistência domiciliar. O crescimento dos serviços de farmácia especializada e a entrega em domicílio de medicamentos orais e parenterais aceleram ainda mais essa mudança, sustentando o rápido crescimento do setor de assistência domiciliar.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de nefropatia por IgA é segmentado em licitação direta, farmácia hospitalar, farmácia de varejo, farmácia online e outros. O segmento de farmácia hospitalar dominou o mercado com a maior participação na receita, de 44,7% em 2024, refletindo o papel central dos hospitais no fornecimento de terapias de alto custo, biológicos parenterais e medicamentos de suporte especializados para pacientes internados e ambulatoriais. As farmácias hospitalares gerenciam as compras para unidades de nefrologia, centros de infusão e ensaios clínicos, criando volumes de compra concentrados. Os formulários institucionais e os contratos negociados favorecem os canais de farmácia hospitalar para terapias complexas, reforçando a participação na receita. A integração clínica entre médicos prescritores e serviços de farmácia hospitalar impulsiona ainda mais a utilização e o acesso imediato a novos agentes.

Prevê-se que o segmento de farmácias online apresente o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 17,8% entre 2025 e 2032, impulsionado pela crescente digitalização da aquisição de medicamentos, pela maior preferência dos pacientes pela entrega em domicílio e pelo crescimento de farmácias online especializadas que oferecem medicamentos para doenças crônicas e programas de apoio ao paciente. Os canais online melhoram o acesso a terapias orais e medicamentos de uso contínuo, oferecem serviços de assinatura e lembretes que aumentam a adesão ao tratamento e possibilitam o suporte remoto ao paciente. A crescente confiança no comércio eletrônico, a adaptação regulatória para a entrega de medicamentos prescritos e a integração com plataformas de telemedicina estão expandindo o alcance das farmácias online. A conveniência, os preços competitivos e as ferramentas de engajamento do paciente baseadas em dados, oferecidas pelos distribuidores digitais, estão acelerando a adoção por grupos de pacientes e profissionais de saúde.

Análise Regional do Mercado de Nefropatia por IgA na América do Norte

- A América do Norte dominou o mercado de nefropatia por IgA com a maior participação na receita em 2024, impulsionada pela presença de infraestrutura de saúde avançada, políticas de reembolso favoráveis e investimentos crescentes em pesquisa e desenvolvimento de doenças renais. A crescente conscientização sobre a saúde renal e a disponibilidade de opções diagnósticas e terapêuticas inovadoras contribuíram ainda mais para a liderança de mercado da região.

- A crescente adoção de terapias biológicas avançadas e imunossupressoras, juntamente com os ensaios clínicos em andamento focados em novas modalidades de tratamento, continua a fortalecer a posição da América do Norte como um centro fundamental para os avanços no tratamento da nefropatia por IgA.

- Além disso, espera-se que as iniciativas governamentais de apoio e o número crescente de programas de assistência ao paciente, com o objetivo de melhorar o acesso ao tratamento, sustentem a posição de destaque da região nos próximos anos.

Análise do Mercado de Nefropatia por IgA nos EUA

O mercado de nefropatia por IgA nos EUA dominou o mercado global, com a maior participação de receita, de 41,3% em 2024, impulsionado por uma infraestrutura de saúde bem estabelecida, alta conscientização sobre doenças renais e a presença de grandes empresas biofarmacêuticas ativamente engajadas em pesquisas nefrológicas. O robusto ecossistema de pesquisa clínica do país e o forte apoio regulatório facilitaram a aprovação e a comercialização de novos agentes terapêuticos, impulsionando assim a expansão do mercado. A crescente incidência de doenças renais crônicas e o foco cada vez maior na medicina personalizada estão impulsionando ainda mais a demanda por tratamentos avançados para nefropatia por IgA.

Análise do Mercado de Nefropatia por IgA no Canadá

O mercado canadense de nefropatia por IgA deverá ser o de crescimento mais rápido nesse segmento, registrando uma taxa de crescimento anual composta (CAGR) de 8,9% durante o período de previsão. Esse crescimento é atribuído principalmente ao aumento dos gastos com saúde, à crescente prevalência de distúrbios renais e à expansão do acesso a soluções de tratamento inovadoras. A ênfase do país no diagnóstico precoce, apoiada por programas de triagem aprimorados e maior cobertura de saúde, está fomentando uma maior adesão ao tratamento. Além disso, as colaborações contínuas entre instituições de pesquisa e empresas farmacêuticas estão promovendo a inovação clínica, posicionando o Canadá como um líder emergente no tratamento da nefropatia por IgA.

Participação de mercado da nefropatia por IgA na América do Norte

O setor de nefropatia por IgA é liderado principalmente por empresas consolidadas, incluindo:

- Travere Therapeutics (EUA)

- Calliditas Therapeutics (Suécia)

- Novartis (Suíça)

- Corporação Omeros (EUA)

- CSL Vifor (EUA)

- Ionis Pharmaceuticals (EUA)

- Bayer AG (Alemanha)

- Roche (Suíça)

- Pfizer Inc. (EUA)

- Bristol Myers Squibb (EUA)

- AbbVie Inc. (EUA)

- Merck & Co., Inc. (EUA)

- AstraZeneca (EUA)

- Regulus Therapeutics (EUA)

Últimos desenvolvimentos no mercado de nefropatia por IgA na América do Norte

- Em dezembro de 2021, a Food and Drug Administration (FDA) dos EUA concedeu aprovação acelerada ao TARPEYO (budesonida de liberação direcionada) para reduzir a proteinúria em adultos com nefropatia primária por IgA com risco de progressão rápida da doença, marcando a primeira aprovação regulatória específica para nefropatia por IgA com foco na redução da proteinúria.

- Em março de 2023, a FDA (Food and Drug Administration) dos EUA concedeu aprovação acelerada ao FILSPARI (sparsentan) da Travere Therapeutics como a primeira terapia não imunossupressora para reduzir a proteinúria em adultos com nefropatia por IgA primária com risco de progressão rápida da doença, criando uma nova e importante classe de tratamento para essa condição.

- Entre outubro e dezembro de 2023, os principais marcos regulatórios e de destaque para agentes direcionados à via do complemento avançaram: dados provisórios/em andamento da Fase 3 para o narsoplimab (Omeros) relataram fortes sinais de proteinúria e segurança no estudo ARTEMIS-IGAN, e os registros regulatórios e a atividade de revisão prioritária aumentaram em diversos programas em estágio final, ressaltando uma mudança em direção a terapias direcionadas a mecanismos específicos para a nefropatia por IgA.

- Em agosto de 2024, o Fabhalta (iptacopan) da Novartis — um inibidor oral do complemento, o primeiro da sua classe, para nefropatia por IgA — recebeu aprovação acelerada (EUA) para redução da proteinúria na nefropatia por IgA primária, com base em resultados provisórios da Fase 3 que demonstraram redução substancial da proteinúria em comparação com o placebo, ampliando as opções de tratamento com inibição do complemento para pacientes com nefropatia por IgA.

- Em setembro de 2024, a Travere Therapeutics anunciou a aprovação completa/ampliada do FILSPARI (sparsentana) pela FDA (conversão de aprovação acelerada para aprovação completa/indicação ampliada) após dados confirmatórios do estudo PROTECT demonstrarem benefício duradouro na proteinúria e na preservação da função renal, fortalecendo o posicionamento comercial e clínico da sparsentana na nefropatia por IgA.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.