North America Hydrophobic Coatings Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

96.18 Million

USD

156.80 Million

2025

2033

USD

96.18 Million

USD

156.80 Million

2025

2033

| 2026 –2033 | |

| USD 96.18 Million | |

| USD 156.80 Million | |

|

|

|

|

Segmentação do mercado de revestimentos hidrofóbicos na América do Norte, por produto (polisiloxanos, fluoropolímeros, fluoroalquilsilanos, dióxido de titânio e outros), tipo de substrato (metal, vidro, polímero, cerâmica, concreto e têxteis), camada de revestimento (camada única e multicamadas), método de aplicação (revestimento por imersão, pincel, rolo, pulverização e outros), função (anticorrosivo, antimicrobiano, anti-incrustante, anticongelante/antiumectante, autolimpante e outros), grau (grau alimentício, grau industrial e outros), canal de distribuição (offline e online), usuário final (automotivo, eletrônico, construção civil, marítimo, têxtil, saúde, aeroespacial, petróleo e gás, alimentos e bebidas e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de revestimentos hidrofóbicos na América do Norte

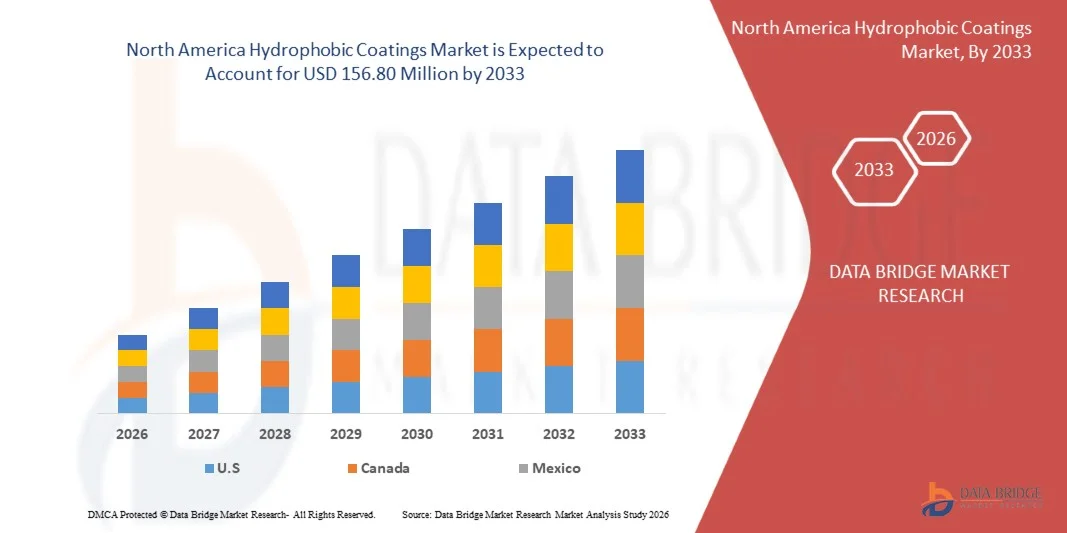

- O mercado de revestimentos hidrofóbicos na América do Norte foi avaliado em US$ 96,18 milhões em 2025 e deverá atingir US$ 156,80 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 6,3% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por revestimentos protetores em setores como o automotivo, eletrônico, da construção civil e aeroespacial, onde as superfícies exigem repelência à água, resistência à corrosão e maior durabilidade.

- Além disso, o crescente foco do consumidor e da indústria em sustentabilidade, higiene e superfícies de baixa manutenção está impulsionando a adoção de revestimentos hidrofóbicos avançados, estabelecendo-os como soluções essenciais para aplicações de alto desempenho e ecologicamente corretas. Esses fatores convergentes estão acelerando a adoção de revestimentos hidrofóbicos, impulsionando significativamente o crescimento do mercado.

Análise do mercado de revestimentos hidrofóbicos na América do Norte

- Revestimentos hidrofóbicos, que proporcionam repelência à água, autolimpeza, propriedades anticorrosivas e antimicrobianas, são cada vez mais importantes para aumentar a durabilidade, a segurança e a funcionalidade de superfícies em diversas aplicações industriais e comerciais.

- A crescente demanda por revestimentos hidrofóbicos é impulsionada principalmente pelos avanços tecnológicos em materiais de revestimento, pelas exigências cada vez maiores de conformidade regulatória e ambiental e pela necessidade crescente de tratamentos de superfície multifuncionais, de baixa manutenção e alto desempenho.

- Os EUA dominaram o mercado de revestimentos hidrofóbicos na América do Norte em 2025, devido à crescente adoção de revestimentos resistentes à corrosão e à água nos setores automotivo, eletrônico, aeroespacial e de construção.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de revestimentos hidrofóbicos da América do Norte durante o período de previsão, devido à crescente modernização industrial, à expansão da fabricação automotiva e eletrônica e à crescente adoção de revestimentos protetores multifuncionais.

- O segmento de polissiloxanos dominou o mercado com uma participação superior a 40% em 2025, devido às suas excelentes propriedades hidrorrepelentes, resistência química e adaptabilidade a diversos substratos. Esses revestimentos são amplamente utilizados em aplicações automotivas, eletrônicas e de construção civil por sua durabilidade a longo prazo e capacidade de manter a estética da superfície. Os polissiloxanos também oferecem fácil aplicação e compatibilidade com múltiplos métodos de revestimento, aumentando a eficiência operacional. Sua versatilidade na formação de camadas finas e transparentes sem alterar a aparência do substrato contribui para sua preferência no mercado. As cadeias de suprimentos consolidadas e a ampla adoção industrial do segmento reforçam ainda mais sua dominância.

Escopo do relatório e segmentação do mercado de revestimentos hidrofóbicos na América do Norte

|

Atributos |

Revestimentos hidrofóbicos: principais insights de mercado |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de revestimentos hidrofóbicos na América do Norte

“Uso crescente de revestimentos autolimpantes e multifuncionais”

- Uma tendência significativa no mercado de revestimentos hidrofóbicos da América do Norte é a crescente aplicação de revestimentos autolimpantes e multifuncionais em diversos setores, impulsionada pela necessidade de superfícies que resistam à água, poeira e contaminantes, ao mesmo tempo que melhoram a durabilidade do produto. Esses revestimentos estão aprimorando o desempenho em setores como o automotivo, eletrônico e da construção civil, reduzindo as necessidades de manutenção e prolongando a vida útil dos ativos.

- Por exemplo, empresas como a P2i e a 3M fornecem revestimentos hidrofóbicos avançados para eletrônicos de consumo e dispositivos médicos que impedem a entrada de água e a formação de incrustações na superfície. Essas soluções melhoram a vida útil dos dispositivos e a conveniência do usuário em ambientes expostos à umidade e partículas em suspensão.

- A adoção de revestimentos hidrofóbicos no setor automotivo está se acelerando, visto que os revestimentos aplicados em para-brisas, sensores e painéis da carroceria melhoram a visibilidade, a segurança e a resistência à corrosão. Isso posiciona esses revestimentos como essenciais para o desempenho dos veículos modernos e para a proteção dos passageiros.

- Na área de eletrônicos e dispositivos vestíveis, revestimentos hidrofóbicos estão sendo utilizados para proteger componentes sensíveis contra danos causados por água e suor. Essa tendência permite que os fabricantes ofereçam produtos confiáveis e duráveis que atendam às crescentes expectativas dos consumidores por dispositivos robustos.

- O setor da construção civil e de materiais de construção está incorporando cada vez mais revestimentos hidrofóbicos em superfícies de vidro, concreto e metal para evitar danos causados pela água e manchas. Isso está criando uma preferência por revestimentos que ofereçam proteção a longo prazo, mantendo o apelo estético.

- Indústrias focadas em energia e infraestrutura estão aplicando revestimentos hidrofóbicos em turbinas, dutos e painéis solares para melhorar a eficiência e reduzir os custos de manutenção. A crescente incorporação desses revestimentos está impulsionando o crescimento do mercado e os posicionando como elementos essenciais para a longevidade operacional.

Dinâmica do mercado de revestimentos hidrofóbicos na América do Norte

Motorista

“Crescente demanda por revestimentos resistentes à corrosão e à água em setores-chave”

- A crescente necessidade de superfícies resistentes à corrosão e à água em equipamentos automotivos, eletrônicos e industriais está impulsionando o mercado de revestimentos hidrofóbicos na América do Norte. Esses revestimentos protegem ativos de alto valor contra a degradação ambiental, prolongando a vida útil e reduzindo os custos de reparo.

- Por exemplo, a PPG Industries fornece revestimentos hidrofóbicos especializados para aplicações automotivas e aeroespaciais que aumentam a resistência à corrosão em condições extremas. Esses revestimentos permitem que os fabricantes ofereçam produtos mais seguros e duráveis, além de atenderem a padrões regulatórios rigorosos.

- A indústria eletrônica depende cada vez mais de revestimentos hidrofóbicos para evitar falhas causadas pela umidade em dispositivos sensíveis, como smartphones, wearables e equipamentos médicos. Essa adoção está impulsionando a inovação em nanorevestimentos e tratamentos de superfície protetores.

- Máquinas industriais e equipamentos pesados se beneficiam de revestimentos hidrofóbicos que reduzem a ferrugem e o desgaste superficial, melhorando o tempo de atividade e a produtividade dos equipamentos. Isso está impulsionando a adoção dessa tecnologia em diversos setores onde a continuidade operacional é fundamental.

- O setor de energias renováveis está utilizando revestimentos hidrofóbicos em turbinas eólicas, painéis solares e equipamentos hidrelétricos para melhorar a eficiência e minimizar danos relacionados à água. A demanda contínua por revestimentos resistentes sustenta a expansão do mercado e os posiciona como essenciais para a proteção de ativos.

Restrição/Desafio

“Alto custo e aplicação complexa de revestimentos avançados”

- O mercado de revestimentos hidrofóbicos na América do Norte enfrenta desafios devido ao alto custo das formulações avançadas e aos complexos processos de aplicação necessários para um desempenho ideal. Esses fatores limitam a adoção, principalmente em segmentos sensíveis a preços e em indústrias de pequena escala.

- Por exemplo, empresas como a P2i utilizam técnicas de deposição de vapor de precisão para aplicar nanorrevestimentos em componentes eletrônicos, o que exige equipamentos especializados e pessoal qualificado. A complexidade desses processos aumenta os custos de produção e restringe a implementação em larga escala.

- Obter uma espessura de revestimento e adesão uniformes em diversas superfícies exige um controle de processo rigoroso, o que aumenta ainda mais os custos operacionais e prolonga os prazos de produção.

- A dependência de produtos químicos de alta pureza e nanomateriais aumenta a sensibilidade da cadeia de suprimentos e afeta a estabilidade de custos, criando desafios para a manutenção de preços competitivos.

- A ampliação da produção de revestimentos hidrofóbicos para aplicações industriais e de consumo, garantindo ao mesmo tempo a consistência da qualidade, continua sendo um desafio crucial. Esses desafios, em conjunto, obrigam os fabricantes a investir em estratégias de otimização de processos e redução de custos para atender à crescente demanda, mantendo os padrões de desempenho.

Escopo do mercado de revestimentos hidrofóbicos na América do Norte

O mercado é segmentado com base no produto, tipo de substrato, camada de revestimento, método de aplicação, função, grau de qualidade, canal de distribuição e usuário final.

• Por produto

Com base no produto, o mercado de revestimentos hidrofóbicos da América do Norte é segmentado em polissiloxanos, fluoropolímeros, fluoroalquilsilanos, dióxido de titânio e outros. O segmento de polissiloxanos dominou o mercado com a maior participação na receita, superior a 40% em 2025, impulsionado por suas excelentes propriedades hidrorrepelentes, resistência química e adaptabilidade a diversos substratos. Esses revestimentos são amplamente preferidos em aplicações automotivas, eletrônicas e de construção civil devido à sua durabilidade a longo prazo e capacidade de manter a estética da superfície. Os polissiloxanos também oferecem fácil aplicação e compatibilidade com múltiplos métodos de revestimento, aumentando a eficiência operacional. Sua versatilidade na formação de camadas finas e transparentes sem alterar a aparência do substrato contribui para sua preferência no mercado. As cadeias de suprimentos estabelecidas e a ampla adoção industrial do segmento consolidam ainda mais sua dominância.

O segmento de fluoropolímeros deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente demanda em aplicações avançadas de eletrônica, aeroespacial e marítima. Por exemplo, a Chemours expandiu seu portfólio de revestimentos hidrofóbicos à base de Teflon para atender às exigências industriais por superfícies de alto desempenho e resistentes à corrosão. Os fluoropolímeros oferecem inércia química e estabilidade térmica superiores, tornando-os ideais para ambientes agressivos. Suas propriedades de baixa energia superficial permitem capacidades eficazes de anti-incrustação e autolimpeza. O aumento dos investimentos em P&D para revestimentos de fluoropolímeros de última geração também impulsiona a rápida adoção. O segmento se beneficia da crescente preferência por revestimentos protetores de alta qualidade e longa duração em diversos setores.

• Por tipo de substrato

Com base no tipo de substrato, o mercado de revestimentos hidrofóbicos da América do Norte é segmentado em metal, vidro, polímero, cerâmica, concreto e têxteis. O segmento de substrato metálico dominou o mercado em 2025, devido ao seu amplo uso nas indústrias automotiva, aeroespacial e da construção civil, que exigem superfícies resistentes à corrosão e repelentes à água. Os substratos metálicos se beneficiam de maior durabilidade e desempenho quando revestidos com camadas hidrofóbicas, prolongando o ciclo de vida de componentes críticos. Normas e regulamentações industriais também favorecem os revestimentos metálicos para aplicações de proteção. Sua compatibilidade com diversos métodos de revestimento e a capacidade de manter a integridade estrutural impulsionam a adoção contínua. A presença consolidada do segmento no setor industrial contribui para sua liderança de mercado sustentada.

O segmento de substratos de vidro deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente adoção de janelas inteligentes, painéis solares e eletrônicos de consumo. Por exemplo, a PPG Industries desenvolveu revestimentos hidrofóbicos avançados para vidros arquitetônicos, a fim de aprimorar a repelência à água e as propriedades de autolimpeza. Esses revestimentos melhoram a visibilidade e reduzem os custos de manutenção em edifícios residenciais e comerciais. Substratos de vidro revestidos com camadas hidrofóbicas também oferecem benefícios anti-incrustantes para para-brisas automotivos. O aumento da urbanização e as tendências de edifícios inteligentes impulsionam a demanda por superfícies de vidro tratadas. O segmento cresce rapidamente devido aos avanços tecnológicos e à crescente conscientização sobre soluções de eficiência energética.

• Por camada de revestimento

Com base na camada de revestimento, o mercado de revestimentos hidrofóbicos da América do Norte é segmentado em camada única e multicamadas. O segmento de camada única dominou o mercado em 2025, impulsionado pela relação custo-benefício, facilidade de aplicação e adequação para implantação industrial em larga escala. Os revestimentos de camada única são amplamente utilizados em aplicações automotivas, eletrônicas e de construção civil para proteção de superfícies sem alterar significativamente as dimensões do substrato. Sua simplicidade garante desempenho consistente e tempo de inatividade mínimo na produção. O segmento se beneficia de práticas de fabricação estabelecidas e compatibilidade com métodos de revestimento convencionais. As soluções de camada única também oferecem hidrofobicidade confiável, reduzindo o desperdício de material. Sua versatilidade em diversas aplicações contribui para a dominância do mercado.

O segmento de revestimentos multicamadas deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente demanda por revestimentos multifuncionais e de alto desempenho. Por exemplo, a AkzoNobel lançou revestimentos hidrofóbicos multicamadas para aplicações marítimas, combinando funções anticorrosivas, anti-incrustantes e autolimpantes. Os sistemas multicamadas aprimoram a durabilidade, a resistência térmica e o desempenho da superfície em ambientes desafiadores. O segmento ganha força nos setores aeroespacial, eletrônico e de máquinas industriais, onde a proteção avançada é essencial. O aumento dos investimentos em pesquisa e desenvolvimento para revestimentos multifuncionais acelera a adoção dessa tecnologia. As soluções multicamadas atendem à demanda por tratamentos de superfície sofisticados e de alta tecnologia.

• Por método de aplicação

Com base no método de aplicação, o mercado de revestimentos hidrofóbicos da América do Norte é segmentado em revestimento por imersão, pincel, rolo, pulverização e outros. O segmento de pulverização dominou o mercado em 2025, impulsionado por sua eficiência no revestimento uniforme de geometrias complexas e grandes superfícies. A pulverização oferece controle preciso sobre a espessura do revestimento e reduz o desperdício de material, tornando-a adequada para aplicações automotivas e de construção. A adoção em escala industrial e a mecanização aumentam a produtividade e garantem qualidade consistente. Os métodos de pulverização também permitem compatibilidade com múltiplos substratos e formulações de revestimento. A presença consolidada do segmento em processos comerciais e industriais contribui para sua liderança de mercado.

O segmento de revestimento por imersão deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pelo uso crescente em manufatura de pequena escala e aplicações industriais especializadas. Por exemplo, a DuPont tem utilizado técnicas de revestimento por imersão para aplicar camadas hidrofóbicas em componentes eletrônicos, aumentando a resistência à umidade. O revestimento por imersão garante cobertura uniforme e forte adesão em superfícies complexas ou com formatos irregulares. O método está ganhando popularidade nos setores têxtil, eletrônico e de saúde devido à sua precisão e eficiência. A crescente demanda por processos de revestimento econômicos e escaláveis também impulsiona esse crescimento. O revestimento por imersão facilita a criação de revestimentos multifuncionais, acelerando sua adoção.

• Por função

Com base na função, o mercado de revestimentos hidrofóbicos da América do Norte é segmentado em anticorrosivo, antimicrobiano, anti-incrustante, anti-gelo/umectante, autolimpante e outros. O segmento anticorrosivo dominou o mercado em 2025, impulsionado pelo uso industrial generalizado nos setores automotivo, naval, de petróleo e gás e de construção, que exigem proteção de longo prazo contra ferrugem e degradação. Os revestimentos anticorrosivos prolongam a vida útil dos componentes e reduzem os custos de manutenção, tornando-os essenciais em infraestrutura e máquinas industriais. Esses revestimentos são preferidos devido ao desempenho comprovado, à conformidade com as normas e à compatibilidade com diversos substratos. As soluções anticorrosivas também se integram bem com outras camadas funcionais, aprimorando a proteção geral da superfície. A relevância industrial consolidada do segmento reforça sua dominância no mercado.

O segmento de autolimpeza deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente adoção em vidros arquitetônicos, painéis solares e eletrônicos de consumo. Por exemplo, a Saint-Gobain desenvolveu revestimentos hidrofóbicos autolimpantes para fachadas de edifícios, visando reduzir a manutenção e o consumo de água. Esses revestimentos utilizam propriedades super-hidrofóbicas para repelir sujeira e contaminantes naturalmente. A rápida urbanização e as tendências de edifícios inteligentes impulsionam a demanda por superfícies de baixa manutenção. O segmento também se beneficia da crescente conscientização sobre sustentabilidade e eficiência no uso de recursos. Os avanços tecnológicos em nanorrevestimentos aceleram ainda mais o crescimento do mercado.

• Por série

Com base na classificação, o mercado de revestimentos hidrofóbicos da América do Norte é segmentado em grau alimentício, grau industrial e outros. O segmento de grau industrial dominou o mercado em 2025, impulsionado por extensas aplicações nas indústrias automotiva, aeroespacial, de construção e eletrônica, que exigem revestimentos protetores de alto desempenho. Os revestimentos hidrofóbicos de grau industrial oferecem durabilidade, estabilidade térmica e resistência química em condições operacionais severas. Esses revestimentos são amplamente preferidos devido à conformidade com os padrões industriais e aos benefícios operacionais de longo prazo. A forte presença do segmento em polos de manufatura e cadeias de suprimentos robustas sustentam a continuidade de sua dominância. Os revestimentos de grau industrial também permitem a integração com camadas multifuncionais, aumentando sua utilidade.

O segmento de produtos para uso alimentar deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente demanda da indústria de alimentos e bebidas por superfícies higiênicas e repelentes à água. Por exemplo, a PPG desenvolveu revestimentos hidrofóbicos para uso alimentar que previnem o crescimento bacteriano e facilitam a limpeza em equipamentos de processamento. Esses revestimentos atendem às normas de segurança e garantem a qualidade do produto. A crescente conscientização sobre o controle de contaminação e os padrões de higiene no processamento de alimentos impulsiona a adoção dessa tecnologia. O segmento cresce à medida que os fabricantes se concentram cada vez mais em eficiência e segurança. Os revestimentos para uso alimentar também aumentam a vida útil dos equipamentos, minimizando os esforços de limpeza.

• Por canal de distribuição

Com base no canal de distribuição, o mercado de revestimentos hidrofóbicos na América do Norte é segmentado em offline e online. O segmento offline dominou o mercado em 2025, impulsionado por cadeias de suprimentos estabelecidas, práticas de compras industriais e disponibilidade de suporte técnico para produtos de revestimento. Compradores industriais geralmente preferem canais offline para pedidos em grande quantidade, consultoria e soluções personalizadas. A distribuição offline permite a avaliação prática do produto e garante a conformidade com os padrões de qualidade. O segmento se beneficia de fortes relações entre fabricantes, distribuidores e usuários finais nos setores automotivo, aeroespacial e de construção. Os canais offline continuam sendo uma via principal para revestimentos hidrofóbicos devido à confiança e acessibilidade.

Espera-se que o segmento online apresente a taxa de crescimento mais rápida de 2026 a 2033, impulsionado pela crescente adoção do comércio eletrônico, marketplaces B2B e plataformas de compras digitais. Por exemplo, o Alibaba facilitou a venda online de revestimentos hidrofóbicos especiais para aplicações industriais e de pequena escala. Os canais online oferecem conveniência, maior alcance e informações comparativas sobre os produtos para os compradores. O aumento da digitalização e das compras remotas impulsiona a adoção entre PMEs e compradores globais. O segmento cresce à medida que os fabricantes expandem sua visibilidade online e suas iniciativas de venda direta ao consumidor. A distribuição online permite uma penetração de mercado mais rápida e acesso a aplicações de nicho.

• Por usuário final

Com base no usuário final, o mercado de revestimentos hidrofóbicos na América do Norte é segmentado em automotivo, eletrônico, construção civil, náutico, têxtil, saúde, aeroespacial, petróleo e gás, alimentos e bebidas, e outros. O segmento automotivo dominou o mercado em 2025, impulsionado pela crescente demanda por revestimentos protetores em veículos para aumentar a resistência à corrosão, a repelência à água e a durabilidade da superfície. Os revestimentos hidrofóbicos melhoram a estética dos veículos, reduzem a manutenção e apoiam práticas de fabricação sustentáveis. As montadoras de veículos integram cada vez mais revestimentos aos processos de produção de componentes de alto valor agregado. A base industrial consolidada do segmento e sua adoção em veículos de passageiros, comerciais e elétricos reforçam sua dominância. A forte preferência do consumidor por veículos de baixa manutenção também contribui para o crescimento do segmento.

O segmento de eletrônicos deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente adoção de smartphones, wearables e eletrônicos industriais que exigem superfícies resistentes à umidade e autolimpantes. Por exemplo, a Samsung incorporou revestimentos hidrofóbicos em dispositivos móveis para aumentar a resistência à água e a confiabilidade. O segmento se beneficia das tendências de miniaturização, da adoção da IoT (Internet das Coisas) e de componentes eletrônicos de alto valor que exigem durabilidade a longo prazo. A crescente conscientização do consumidor sobre a proteção de dispositivos impulsiona a rápida adoção. Os revestimentos eletrônicos também contribuem para dispositivos com baixo consumo de energia e que não necessitam de manutenção. O segmento cresce à medida que os fabricantes priorizam a inovação e a diferenciação de produtos.

Análise Regional do Mercado de Revestimentos Hidrofóbicos na América do Norte

- Os EUA dominaram o mercado de revestimentos hidrofóbicos na América do Norte, com a maior participação na receita em 2025, impulsionados pela crescente adoção de revestimentos resistentes à corrosão e à água nos setores automotivo, eletrônico, aeroespacial e de construção.

- A crescente aplicação de revestimentos multifuncionais e autolimpantes, a modernização industrial em expansão e a rápida adoção em projetos de infraestrutura e manufatura de alto valor agregado sustentam a demanda contínua do mercado em aplicações comerciais, residenciais e industriais.

- A forte presença de empresas como PPG Industries, Sherwin-Williams e AkzoNobel, os investimentos contínuos em P&D para nanorrevestimentos avançados e as parcerias estratégicas com OEMs reforçam a posição de liderança dos EUA no mercado regional. Espera-se que o crescente foco em durabilidade, eficiência operacional e iniciativas de sustentabilidade mantenha o papel dominante do país durante o período de previsão.

Análise do Mercado de Revestimentos Hidrofóbicos no Canadá e na América do Norte

Prevê-se que o Canadá registre a taxa de crescimento anual composta (CAGR) mais rápida no mercado de revestimentos hidrofóbicos da América do Norte entre 2026 e 2033, impulsionado pela crescente modernização industrial, expansão da fabricação automotiva e eletrônica e pela adoção cada vez maior de revestimentos protetores multifuncionais. Por exemplo, empresas como Sherwin-Williams e Axalta fornecem revestimentos hidrofóbicos avançados para equipamentos industriais, materiais de construção e componentes automotivos, enquanto a crescente demanda por revestimentos resistentes à corrosão e à água em condições climáticas adversas acelera o crescimento do mercado. A expansão das cadeias de suprimentos industriais, a integração com plataformas de manufatura inteligente e as altas taxas de adoção de tecnologia aumentam a acessibilidade aos produtos, e o foco crescente em revestimentos sustentáveis e proteção de superfície de alto desempenho posiciona o Canadá como o mercado de crescimento mais rápido da região.

Análise do Mercado de Revestimentos Hidrofóbicos no México e na América do Norte

Prevê-se que o mercado mexicano de revestimentos hidrofóbicos cresça de forma constante entre 2026 e 2033, impulsionado pelo aumento da construção industrial e comercial, pela expansão dos setores automotivo e eletrônico e pela crescente conscientização sobre a importância dos revestimentos protetores. Empresas como a PPG Industries e a AkzoNobel fortalecem a oferta interna por meio da localização de tecnologia, da customização de produtos e de parcerias com fabricantes industriais, enquanto a urbanização, a expansão industrial e o investimento estrangeiro em projetos de infraestrutura sustentam a adoção consistente de revestimentos hidrofóbicos. O alinhamento com os padrões de desempenho norte-americanos, o aumento da aplicação em ambientes úmidos e propensos à corrosão e a adoção gradual em polos industriais emergentes contribuem para o crescimento estável do mercado ao longo do período previsto.

Participação de mercado de revestimentos hidrofóbicos na América do Norte

O setor de revestimentos hidrofóbicos é liderado principalmente por empresas consolidadas, incluindo:

- Nanofilme (EUA)

- BASF SE (Alemanha)

- AccuCoat Inc. (EUA)

- NeverWet, LLC (EUA)

- Arkema (França)

- COTEC GmbH (Alemanha)

- P2i Ltda. (Reino Unido)

- PPG Industries, Inc. (EUA)

- 3M (EUA)

- Artekya Teknoloji (Turquia)

- A empresa Sherwin-Williams (EUA)

- Laboratório Avançado de Nanotecnologia (EUA)

- AkzoNobel NV (Países Baixos)

- Aculon Inc. (EUA)

- UltraTech International, Inc. (EUA)

- Nukote Coating Systems International (EUA)

- Cytonix, LLC (EUA)

Novidades no mercado de revestimentos hidrofóbicos na América do Norte

- Em junho de 2024, a NEI Corporation lançou o NANOMYTE AM-100EC, um revestimento antimicrobiano de última geração projetado para oferecer proteção superior contra microrganismos nocivos. Este produto inovador oferece funcionalidade antimicrobiana e facilidade de limpeza, tornando-o altamente adequado para aplicações em saúde, processamento de alimentos e ambientes de higiene pública. O revestimento AM-100EC foi projetado para suportar protocolos de limpeza rigorosos, mantendo sua eficácia, atendendo à crescente demanda do mercado por superfícies seguras e com foco em higiene. O lançamento fortalece a posição da NEI no mercado de revestimentos hidrofóbicos da América do Norte, expandindo a oferta de revestimentos antimicrobianos e multifuncionais, refletindo a crescente ênfase na segurança pública e na conformidade regulatória.

- Em março de 2024, a Mitsui Chemicals, Inc., em colaboração com a empresa alemã CADIS Engineering GmbH, lançou uma impressora digital projetada para aprimorar displays automotivos com revestimento hidrofóbico avançado, por meio de sua subsidiária COTEC GmbH. Essa inovação facilita a deposição precisa de revestimentos hidrofóbicos em superfícies eletrônicas automotivas, melhorando a repelência à água, a resistência à incrustação e a durabilidade. Espera-se que o desenvolvimento acelere a adoção de revestimentos hidrofóbicos na eletrônica automotiva, um segmento em rápido crescimento, possibilitando aplicações mais eficientes e de alto desempenho. Também reforça a tendência de mercado de integração de revestimentos avançados com a manufatura digital e tecnologias de veículos inteligentes.

- Em fevereiro de 2024, o Instituto Leibniz de Ciência e Tecnologia de Plasma (INP) em Greifswald, Alemanha, desenvolveu um novo método para produzir revestimentos de polímero organossilício ultra-hidrofóbicos. Essa abordagem oferece uma alternativa ecologicamente correta aos compostos per e polifluorados (PFAS), amplamente utilizados, mas sujeitos a crescente escrutínio regulatório. Ao reduzir a dependência de PFAS, essa inovação aborda as preocupações com a sustentabilidade no mercado de revestimentos hidrofóbicos da América do Norte, promovendo soluções mais seguras e ecologicamente conscientes. O desenvolvimento impulsiona o crescimento do mercado em setores que priorizam revestimentos ecológicos e posiciona os polímeros organossilícios como uma solução essencial de alto desempenho e em conformidade com as regulamentações.

- Em julho de 2023, a BASF Automotive OEM Coatings alcançou a utilização de 100% de energia renovável em todas as suas unidades na China, um passo significativo rumo à transformação da empresa para emissões líquidas zero. Utilizando uma combinação de Compras Diretas de Energia Renovável (RDPP), certificados internacionais de energia renovável e outras estratégias, a iniciativa projeta reduzir as emissões de carbono em aproximadamente 19.000 toneladas até o final de 2023. Esse marco reforça o compromisso da BASF com a sustentabilidade e está em sintonia com o mercado de revestimentos hidrofóbicos da América do Norte, destacando a crescente expectativa por soluções ambientalmente responsáveis e de baixo carbono. A iniciativa fortalece o posicionamento competitivo da BASF, alinhando sua oferta de produtos às tendências globais de sustentabilidade.

- Em setembro de 2022, a BASF Coatings inaugurou um centro de pesquisa de última geração para revestimento por imersão eletroforética em Münster-Hiltrup, Alemanha, com foco no aprimoramento de tecnologias de revestimento hidrofóbico. A instalação prioriza a segurança, a eficiência e a simulação de processos específicos para cada cliente, impulsionando a tecnologia de revestimento eletroforético CathoGuard 800 da empresa. Reconhecida por proteger superfícies automotivas contra corrosão com baixo teor de solventes e redução de efluentes, essa inovação oferece alto desempenho e benefícios ambientais. O centro de pesquisa reforça a liderança da BASF no mercado de revestimentos hidrofóbicos automotivos, possibilitando o desenvolvimento de soluções avançadas e ecologicamente corretas que atendem aos padrões da indústria em constante evolução e às expectativas dos clientes.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.