North America Hot Fill Packaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

16.00 Billion

USD

21.56 Billion

2025

2033

USD

16.00 Billion

USD

21.56 Billion

2025

2033

| 2026 –2033 | |

| USD 16.00 Billion | |

| USD 21.56 Billion | |

|

|

|

|

Mercado de embalagens de enchimento a quente da América do Norte, por tipo de produto (garrafas, frascos, recipientes, sacos, latas, tampas e fechos e outros), tipo de material (tereftalato de polietileno (PET), vidro, polipropileno e outros) , camada de embalagem (primária, Secundária e terciária), capacidade (até 12 onças, 13 onças - 32 onças, 33 onças - 64 onças, acima de 64 onças. Em 2021, 13 onças - 32 onças), tipo de máquina (manual e automática), utilizador final ( Molhos e pastas, sumos de fruta, sumos de vegetais, geleias, maionese, água aromatizada, bebidas prontas a beber, sopas, produtos lácteos, néctares e outros), canal de distribuição (off-line e on- line), país (Brasil, Argentina e resto da América do Norte ) Tendências e previsões do setor até 2028.

Análise de mercado e insights: Mercado de embalagens de enchimento a quente da América do Norte

Análise de mercado e insights: Mercado de embalagens de enchimento a quente da América do Norte

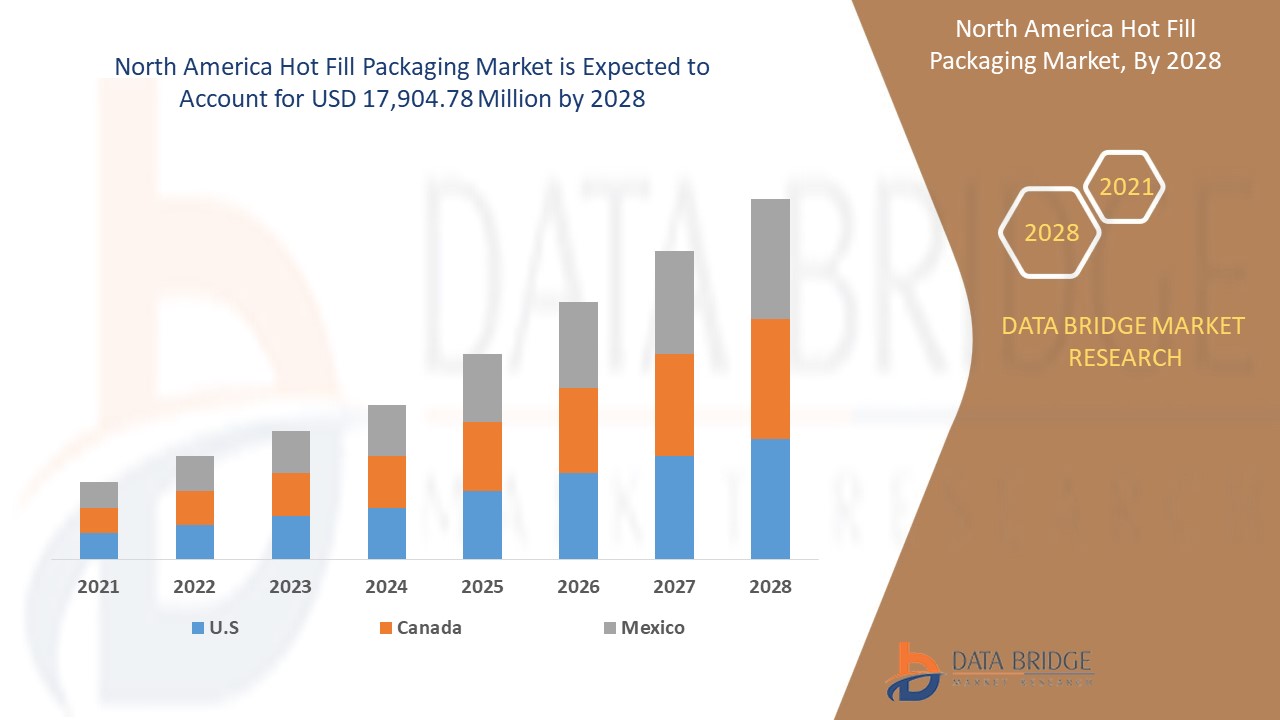

Espera-se que o mercado norte-americano de embalagens de enchimento a quente ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 3,8% no período previsto de 2021 a 2028 e prevê-se que atinja os 17.904,78 milhões de dólares até 2028.

A embalagem de enchimento a quente é adequada para a embalagem de bebidas não carbonatadas , água e refrigerantes e oferece uma vida útil aproximada de 6 a 12 meses, dependendo das camadas de barreira utilizadas. O estireno foi destilado pela primeira vez a partir de uma árvore de bálsamo em 1831, mas os primeiros produtos eram facilmente quebradiços. A Alemanha refinou o processo em 1933 e, na década de 1950, a espuma estava disponível em todo o mundo. No entanto, o fabrico de vidro começou em 7000 como um desdobramento da cerâmica. Foi industrializado pela primeira vez no Egito em 1500 a.C. Feito de materiais básicos que eram abundantes, todos os ingredientes eram derretidos e moldados enquanto estavam quentes. Desde esta descoberta inicial, o processo de mistura e os ingredientes mudaram muito pouco, mas as técnicas de moldagem progrediram drasticamente.

Por exemplo,

- Em abril de 2019, a Amcor plc lançou uma nova embalagem reciclável para reduzir a pegada de carbono de uma embalagem até 64%. Este lançamento de produto ajudou a empresa a aumentar o portfólio de produtos e a aumentar as suas vendas

O relatório do mercado de embalagens de enchimento a quente da América do Norte fornece detalhes sobre a quota de mercado, novos desenvolvimentos e impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos, geografias expansões e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado de embalagens de enchimento a quente, contacte a Data Bridge Market Research para obter um briefing de analista.

Âmbito e dimensão do mercado de embalagens de enchimento a quente na América do Norte

Âmbito e dimensão do mercado de embalagens de enchimento a quente na América do Norte

O mercado norte-americano de embalagens de enchimento a quente está segmentado em sete segmentos com base no tipo de produto, tipo de material, camada de embalagem, capacidade, tipo de máquina, utilizador final e canal de distribuição.

O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no tipo de produto, o mercado de embalagens de enchimento a quente está segmentado em garrafas, frascos, recipientes, bolsas, latas, tampas, fechos e outros. Em 2021, espera-se que o segmento das garrafas domine o mercado devido ao seu tamanho e formato convenientes.

- Com base no tipo de material, o mercado de embalagens de enchimento a quente está segmentado em polietileno tereftalato (PET), vidro, polipropileno e outros. Em 2021, prevê-se que o segmento do polietileno tereftalato (PET) domine o mercado, uma vez que é um dos materiais de embalagem mais acessíveis para alimentos e bebidas.

- Com base na camada de embalagem, o mercado de embalagens de enchimento a quente está segmentado em primária, secundária e terciária. Em 2021, prevê-se que o segmento primário domine o mercado, uma vez que a principal é a camada de embalagem que contacta diretamente com o produto.

- Com base na capacidade, o mercado de embalagens de enchimento a quente está segmentado até 12 oz, 13 oz-32 oz, 33 oz-64 oz, acima de 64 oz. Em 2021, prevê-se que o segmento de 13 oz-32 oz domine o mercado devido à inclinação dos consumidores jovens e adultos em relação a este tamanho de embalagem.

- Com base no tipo de máquina, o mercado de embalagens de enchimento a quente está segmentado em manual e automático. Em 2021, espera-se que o segmento automático domine o mercado, uma vez que poupa tempo e permite a produção em massa.

- Com base no utilizador final, o mercado de embalagens de enchimento a quente está segmentado em molhos e pastas, sumos de fruta, sumos de vegetais, geleias, maionese, água aromatizada, bebidas prontas a beber, sopas, produtos lácteos, néctares e outros. Em 2021, prevê-se que o segmento dos sumos de fruta domine o mercado devido ao crescente consumo de sumos de fruta no mercado.

- Com base no canal de distribuição, o mercado de embalagens de enchimento a quente está segmentado em offline e online. Em 2021, prevê-se que o segmento offline domine o mercado devido ao vasto alcance dos canais offline no mercado.

Análise do mercado de embalagens de enchimento a quente a nível de país na América do Norte

O mercado norte-americano de embalagens de enchimento a quente é analisado e são fornecidas informações sobre o tamanho do mercado por país, tipo de produto, tipo de material, camada de embalagem, capacidade, tipo de máquina, utilizador final e canal de distribuição, conforme acima referenciado.

- Com base na geografia, o mercado norte-americano de embalagens de enchimento a quente está segmentado nos EUA, Canadá e México. Em 2021, prevê-se que os EUA dominem o mercado devido à elevada procura de uma variedade de bebidas, molhos e pastas.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da América do Norte e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

O crescimento das atividades estratégicas dos principais participantes do mercado para aumentar a sensibilização para as embalagens de enchimento a quente está a impulsionar o crescimento do mercado de embalagens de enchimento a quente

O mercado de embalagens de enchimento a quente também fornece análises de mercado detalhadas para o crescimento de cada país num mercado específico. Além disso, fornece informações detalhadas sobre a estratégia dos participantes do mercado e a sua presença geográfica. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Análise do panorama competitivo e da quota de mercado de embalagens de enchimento a quente na América do Norte

O panorama competitivo do mercado norte-americano de embalagens de enchimento a quente fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, aprovações de produto, patentes, amplitude e amplitude do produto, domínio da aplicação , curva de salvação da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado norte-americano de embalagens de enchimento a quente.

Alguns dos principais participantes que operam no mercado de embalagens de enchimento a quente são a United States Plastic Corporation, Berry Global Inc. (2020), Imperial Packaging, DS Smith (2020), Smurfit Kappa (2020), RESILUX NV (2020), MJS Packaging, Gualapack SpA, LOG Plastic Products Company Ltd., Klöckner Pentaplast, Kaufman Container, Pipeline Packaging, Amcor plc (2020), Graham Packaging Company e Borealis AG (2020), entre outros participantes nacionais. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos desenvolvimentos são também iniciados por empresas de todo o mundo, o que está também a acelerar o mercado de embalagens de enchimento a quente na América do Norte.

Por exemplo,

- Em julho de 2021, a Graham Packaging Company obteve os direitos de patente para o método de moldagem por sopro de um recipiente de plástico. Isto ajudou a empresa a aumentar o portfólio de produtos, aumentando assim as vendas e a receita

A colaboração, o lançamento de produtos, a expansão de negócios, prémios e reconhecimentos, joint ventures e outras estratégias do participante do mercado estão a aumentar a presença da empresa no mercado norte-americano de embalagens de enchimento a quente, o que também traz benefícios para o crescimento do lucro da organização.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.