North America Greenhouse And Controlled Environment Grow Lights For Agricultural Crops Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.24 Billion

USD

5.75 Billion

2024

2032

USD

2.24 Billion

USD

5.75 Billion

2024

2032

| 2025 –2032 | |

| USD 2.24 Billion | |

| USD 5.75 Billion | |

|

|

|

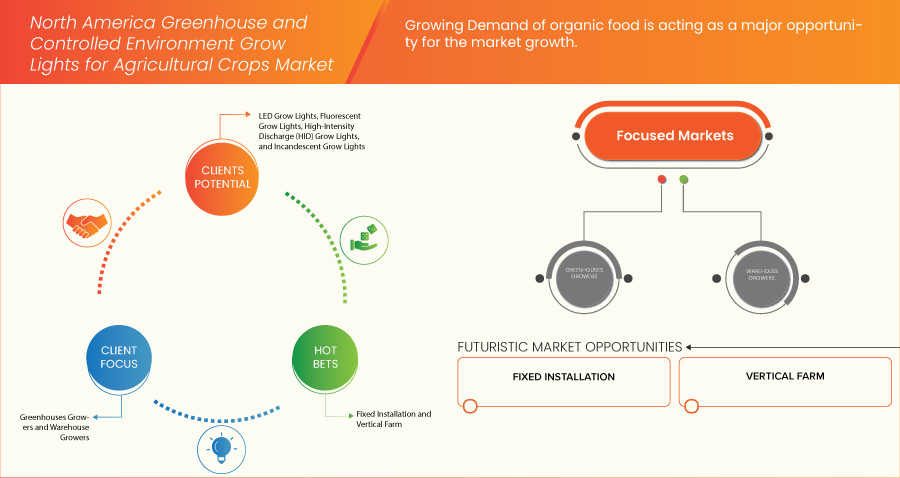

North America Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Segmentation, By Type (LED Grow Lights, Fluorescent Grow Lights, High-Intensity Discharge (HID) Grow Lights, and Incandescent Grow Lights), Application (Vegetables, Fruits, Flowers, Herbs, Trees, and Others), System Type (Green Houses and Vertical Farm), Installation Type (Fixed Installation and Portable Installation), Spectrum (Broad and Narrow), Light Spectrum (Dual Spectrum Red Light Spectrum (600–700 NM), Blue Light Spectrum (400–500 NM), Far-Red Light Spectrum (700–850 NM), Green Light Spectrum (500–600 NM), and UV Light Spectrum (100–400 NM)), Distribution Channel (Online, E-Commerce, Company Website, Retail, Wholesale, Offline, and Others), End User (Greenhouses Growers, Warehouse Growers, Residential Growers, Livestock Applications, Research and Academic Institutions, and Others) - Industry Trends and Forecast to 2031.

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Analysis

North America greenhouse and controlled environment grow lights for agricultural crops market has evolved significantly over the past few decades. Initially, traditional lighting methods, such as incandescent and fluorescent bulbs, were widely used, but these proved less efficient for plant growth. The introduction of High-Intensity Discharge (HID) lighting in the 1990s marked a turning point, offering better energy efficiency and light output. In the early 2000s, LED technology began to emerge, revolutionizing the market with its energy savings and customizable light spectrums. As urban farming and sustainable practices gained popularity, demand for advanced grow lights surged. Government initiatives and funding for research in agriculture further propelled market growth.

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Size

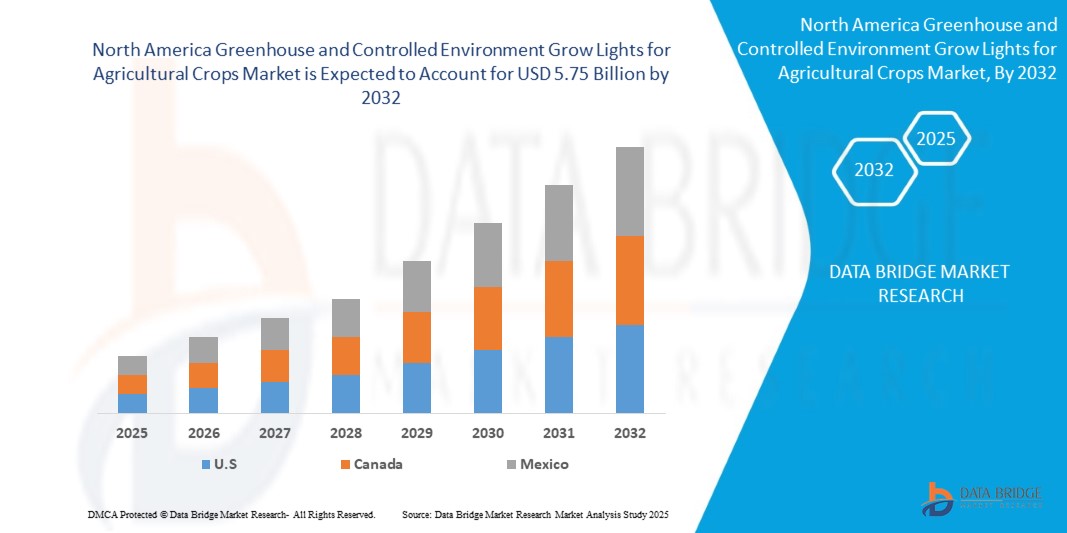

North America greenhouse and controlled environment grow lights for agricultural crops market is expected to reach USD 5.11 billion by 2031 from USD 2.01 billion in 2023, growing with a CAGR of 12.5% in the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Trends

Increasing Demand for Energy-Efficient Lighting Solutions

The growing demand for energy-efficient and sustainable lighting solutions is a key trend driving the greenhouse and controlled environment grow lights for agricultural crops market. Advanced grow lights play a critical role in enabling optimal plant growth in environments where natural sunlight is limited or inconsistent. This trend is especially prevalent in industries such as indoor farming, horticulture, and urban agriculture, where controlled environments are essential for ensuring year-round crop production.

Report Scope for Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Segmentation

|

Attributes |

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S, Canada, and Mexico |

|

Key Market Players |

Signify Holding (Netherlands), Heliospectra (Sweden), AMS-OSRAM AG (Austria), Cree LED (U.S.), Hydrofarm (U.S.), SunPlus LED (China), SAVANT TECHNOLOGIES LLC (U.S.), Hyperion Grow Lights (Subsidiary of Midstream Ltd.) (U.K.), MechaTronix Horticulture Lighting (Netherlands), GrowPackage.com (Canada), California Lightworks (U.S.), Valoya (Finland) and Grower's Choice (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Definição do mercado de luzes de cultivo em estufa e ambiente controlado para culturas agrícolas

O mercado de luzes para cultivo em estufas e ambientes controlados na América do Norte refere-se ao setor focado em soluções de iluminação concebidas para culturas agrícolas cultivadas em ambientes controlados, como estufas e quintas interiores. Estas luzes simulam a luz solar natural, melhorando o crescimento das plantas, a fotossíntese e a produtividade. Isto inclui tecnologias como LED, fluorescentes e luzes de descarga de alta intensidade. Este mercado é impulsionado pela crescente procura de práticas agrícolas sustentáveis, agricultura urbana e produção agrícola durante todo o ano. Abrange também diversas aplicações, desde a agricultura comercial à investigação e desenvolvimento em horticultura.

Dinâmica do mercado de luzes de cultivo em estufa e ambiente controlado para culturas agrícolas

Motoristas

- Desenvolvimento rápido da tecnologia de iluminação LED

O rápido desenvolvimento da tecnologia de iluminação LED é um factor-chave para o sector das estufas e ambientes controlados na América do Norte, bem como para o cultivo de luzes para o mercado das culturas agrícolas. A tecnologia LED avançou significativamente nos últimos anos, oferecendo maior eficiência energética, maior vida útil e melhor qualidade de luz em comparação com as opções de iluminação tradicionais. Os LED modernos podem ser ajustados para emitir espectros de luz específicos que otimizam o crescimento das plantas, melhoram a fotossíntese e aumentam a produtividade. Esta personalização permite um controlo mais preciso sobre as condições de cultivo, o que é crucial para maximizar a produtividade em ambientes controlados.

Por exemplo,

Em junho de 2024, de acordo com o produtor 2 produtor, a Philips GreenPower LED toplighting force 2.0, lançada pela Signify, exemplifica o rápido desenvolvimento da tecnologia LED com uma saída de luz até 5.150 µmol/s e uma eficácia de 3,9 µmol/ J. Dispõe de controlo dinâmico de cor multicanal e lente Quadro Beam avançada para uma uniformidade de luz superior, melhorando o rendimento das culturas e a eficiência energética. A opção de controlo sem fios ou com fios sublinha ainda mais a sua inovação na otimização de sistemas de iluminação de estufas.

- Aumento da preferência do consumidor por produtos frescos

O mercado norte-americano de luzes de cultivo em estufas e ambientes controlados para culturas agrícolas é um factor significativo que está a aumentar a preferência dos consumidores por produtos frescos. À medida que os consumidores se tornam mais preocupados com a saúde e exigem produtos de maior qualidade, de origem local e frescos durante todo o ano, os produtores são obrigados a adaptar as suas operações para satisfazer estas preferências. As estufas e os ambientes controlados oferecem a capacidade de produzir legumes, frutas e ervas frescas, independentemente das restrições sazonais ou limitações geográficas. Esta crescente procura de produtos frescos e de alta qualidade levou a maiores investimentos em tecnologias de cultivo avançadas, incluindo sistemas de iluminação especializados para apoiar a produção contínua e óptima das culturas.

Por exemplo,

- Em 2022, de acordo com a Signify Holding, a iluminação de teto linear Philips GreenPower LED apresenta rápidos avanços na tecnologia LED com uma eficácia até 3,5 μmol/J e uma uniformidade de luz precisa. Esta tecnologia garante uma distribuição ideal da luz vertical e horizontal, melhorando o crescimento e o rendimento das culturas em estufa. A flexibilidade para diminuir e ajustar os níveis de luz realça ainda mais o progresso na iluminação LED para a agricultura. Foi desenvolvido um módulo especial para a América do Norte (EUA e Canadá) para cumprir a norma UL/CSA.

Oportunidades

- Crescente procura por alimentos biológicos

As vendas de alimentos biológicos estão a apresentar um forte crescimento devido à crescente consciencialização dos consumidores sobre a saúde, a sustentabilidade ambiental e os efeitos nocivos dos produtos químicos sintéticos utilizados na agricultura convencional. Como resultado, a agricultura biológica está a tornar-se uma opção mais atrativa e sustentável para muitos produtores agrícolas, o que impacta diretamente a procura por soluções avançadas de iluminação de cultivo. Os alimentos biológicos vendidos aos consumidores representaram 56% da fatia nos supermercados tradicionais, grandes armazéns e hipermercados .

Por exemplo,

- Em julho de 2024, conforme relatado pelo Departamento de Agricultura dos EUA, o Censo Agrícola de 2022 revelou que a Califórnia liderava o país em produtos agrícolas biológicos vendidos pelas explorações agrícolas. As vendas orgânicas foram fortemente concentradas ao longo da Costa Oeste, com a Califórnia a gerar mais de 3,7 mil milhões de dólares em vendas orgânicas, representando quase 40% do total de vendas orgânicas do país. Isto fortaleceu o domínio da Califórnia no setor biológico .

Restrição/Desafio

- Exigência de custo inicial inicial

A exigência de um custo inicial elevado é uma restrição significativa para as luzes de cultivo em estufas e ambientes controlados da América do Norte para o mercado das culturas agrícolas. Os sistemas avançados de iluminação de cultivo, especialmente LEDs de alta qualidade e configurações sofisticadas, exigem frequentemente investimentos de capital substanciais. Este custo inicial inclui não só o preço das luzes em si, mas também a instalação, a integração com sistemas existentes e modificações de infraestruturas potencialmente necessárias. Para os pequenos ou novos produtores, estes custos podem ser proibitivos, limitando a sua capacidade de adoptar tais tecnologias e dificultando a expansão do mercado .

Além disso, o encargo financeiro de investir em sistemas de iluminação avançados pode impedir os potenciais compradores de mudar para métodos de cultivo tradicionais. Os produtores podem hesitar em comprometer-se com gastos iniciais elevados sem um retorno claro e imediato do investimento. Embora as luzes de cultivo LED ofereçam poupanças a longo prazo através da redução do consumo de energia e de menores custos de manutenção, os benefícios financeiros tardios nem sempre correspondem às restrições orçamentais de curto prazo enfrentadas por muitas empresas agrícolas, particularmente em tempos de incerteza económica .

Por exemplo,

A exigência de um custo inicial elevado para produtos de estufa para a agricultura em ambiente controlado (CEA) é substancial, com componentes-chave como a Tenda para Eventos ClearSpan a custar 7.085 dólares e o Banco de Estufa Móvel a custar 1.315 dólares. O equipamento essencial adicional aumenta ainda mais o fardo financeiro, destacando o investimento significativo necessário para configurar um sistema CEA. Este elevado custo inicial pode desencorajar potenciais adotantes e ter impacto na expansão do mercado, apesar dos benefícios a longo prazo.

Este relatório de mercado fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado das categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado, contacte a Data Bridge Market Research para obter um briefing de analista.

Âmbito do mercado de luzes de cultivo em estufa e ambiente controlado para culturas agrícolas

O mercado de luzes de cultivo em estufas e ambientes controlados para culturas agrícolas na América do Norte está dividido em oito segmentos notáveis, que se baseiam no tipo, aplicação, tipo de sistema, tipo de instalação, espectro, espectro de luz, canal de distribuição e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo

- Luzes de cultivo LED

- Luzes fluorescentes para cultivo

- T5 Luz Fluorescente

- Lâmpadas fluorescentes compactas (CFLS)

- Outros

- Luzes de cultivo de descarga de alta intensidade (Hid)

- Lâmpada de sódio de alta pressão (HPS)

- Lâmpada de iodetos metálicos (MH)

- Lâmpadas de iodetos metálicos cerâmicos

- Lâmpadas de conversão e balastros comutáveis

- Lâmpadas combinadas MH e HPS

- Luzes de cultivo incandescentes

Aplicação

- Vegetais

- Frutas

- Flores

- Ervas

- Árvores

Tipo de sistema

- Casas Verdes

- Estufa de alta tecnologia

- Casa Verde Tradicional

- Fazenda Vertical

- Hidrofônico

- Aquafónico

- Aeropónico

- Sistema de cultivo baseado no solo

Tipo de instalação

- Instalação fixa

- Instalação portátil

Espectro

- Abrangente

- Estreito

Espectro de luz

- Espectro de luz vermelha de espectro duplo (600–700 Nm)

- Espectro de luz azul (400–500 Nm)

- Espectro de luz vermelha distante (700–850 Nm)

- Espectro de luz verde (500–600 Nm)

- Espectro de luz UV (100–400 Nm)

Canal de Distribuição

- Online

- Comércio eletrónico

- Site da empresa

- Retalho

- Atacado

- Desligado

Utilizador final

- Produtores de Estufas

- Luzes LED para cultivo

- Luzes fluorescentes para cultivo

- T5 Luz Fluorescente

- Lâmpadas fluorescentes compactas (CFLS)

- Outros

- Luzes de cultivo de descarga de alta intensidade (HID)

- Lâmpada de sódio de alta pressão (HPS)

- Lâmpada de halogéneo metálico (MH)

- Lâmpadas de iodetos metálicos cerâmicos

- Lâmpadas de conversão e balastros comutáveis

- Lâmpadas combinadas MH e HPS

- Luzes de cultivo incandescentes

- Produtores de Armazéns

- Luzes LED para cultivo

- Luzes fluorescentes para cultivo

- T5 Luz Fluorescente

- Lâmpadas fluorescentes compactas (CFLS)

- Outros

- Luzes de cultivo de descarga de alta intensidade (HID)

- Lâmpada de sódio de alta pressão (HPS)

- Lâmpada de halogéneo metálico (MH)

- Lâmpadas de iodetos metálicos cerâmicos

- Lâmpadas de conversão e balastros comutáveis

- Lâmpadas combinadas MH e HPS

- Luzes de cultivo incandescentes

- Produtores residenciais

- Luzes LED para cultivo

- Luzes fluorescentes para cultivo

- T5 Luz Fluorescente

- Lâmpadas fluorescentes compactas (CFLS)

- Outros

- Luzes de cultivo de descarga de alta intensidade (HID)

- Lâmpada de sódio de alta pressão (HPS)

- Lâmpada de halogéneo metálico (MH)

- Lâmpadas de iodetos metálicos cerâmicos

- Lâmpadas de conversão e balastros comutáveis

- Lâmpadas combinadas MH e HPS

- Luzes de cultivo incandescentes

- Instituição de Investigação e Académica

- Luzes LED para cultivo

- Luzes fluorescentes para cultivo

- T5 Luz Fluorescente

- Lâmpadas fluorescentes compactas (CFLS)

- Outros

- Luzes de cultivo de descarga de alta intensidade (HID)

- Lâmpada de sódio de alta pressão (HPS)

- Lâmpada de halogéneo metálico (MH)

- Lâmpadas de iodetos metálicos cerâmicos

- Lâmpadas de conversão e balastros comutáveis

- Lâmpadas combinadas MH e HPS

- Luzes de cultivo incandescentes

- Aplicações pecuárias

- Luzes LED para cultivo

- Luzes fluorescentes para cultivo

- T5 Luz Fluorescente

- Lâmpadas fluorescentes compactas (CFLS)

- Outros

- Luzes de cultivo de descarga de alta intensidade (HID)

- Lâmpada de sódio de alta pressão (HPS)

- Lâmpada de halogéneo metálico (MH)

- Lâmpadas de iodetos metálicos cerâmicos

- Lâmpadas de conversão e balastros comutáveis

- Lâmpadas combinadas MH e HPS

- Luzes de cultivo incandescentes

- Outros

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, application, system type, installation type, spectrum, light spectrum, distribution channel, and end user.

The countries covered in North America greenhouse and controlled environment grow lights for agricultural crops market report as U.S., Canada, and Mexico.

U.S. is expected to dominate the greenhouse and controlled environment grow lights for agricultural crops market due to its advanced agricultural technology infrastructure and significant investments in innovative farming practices, alongside the presence of key market players.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down- stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of U.S brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market Leaders Operating in the Market are:

- Signify Holding (Netherlands)

- Heliospectra (Sweden)

- AMS-OSRAM AG (Austria)

- Cree LED (U.S.)

- Hydrofarm (U.S.)

- SunPlus LED (China)

- SAVANT TECHNOLOGIES LLC (U.S.)

- Hyperion Grow Lights (Subsidiary of Midstream Ltd.) (U.K.)

- MechaTronix Horticulture Lighting (Netherlands)

- GrowPackage.com (Canada)

- California Lightworks (U.S.)

- Valoya (Finland)

- Grower's Choice (U.S.)

Latest Developments in Greenhouse and Controlled Environment Grow Lights for Agricultural Crops Market

- Em agosto de 2024, a ams-OSRAM AG estabeleceu um Centro de Desenvolvimento da China (CDC) para impulsionar o crescimento empresarial regional e a inovação tecnológica. Parte da unidade CMOS, Sensores e ASIC (CSA), o CDC concentrou-se no marketing de produtos, na engenharia de soluções de sistemas, na engenharia de aplicações e na inovação na cadeia de abastecimento. Esta iniciativa teve como objetivo alavancar o mercado dinâmico da China para melhorar as experiências tecnológicas quotidianas e explorar oportunidades na tecnologia de tempo de voo, aplicações de laser azul e soluções de projeção a laser.

- Em maio de 2024, a ams-OSRAM AG recebeu três prémios no Prémio Alemão de Inovação 2024. A OSRAM TRUCKSTAR LED H7 venceu na categoria “Excelência em Business to Business: Tecnologias Automóveis” pelo seu elevado brilho e baixo brilho. A OSRAM NIGHT BREAKER LED W5W foi reconhecida na categoria “Excelência em Negócios para o Consumidor: Iluminação” pela sua luz brilhante e com baixo consumo de energia. O OSRAM TYREinflate 4000 recebeu uma Menção Especial em “Excelência em Negócios para o Consumidor: Artigos de Viagem, Desporto e Outdoor” pela sua versatilidade no enchimento de pneus e carregamento de dispositivos

- Em julho de 2022, a Midstream Ltd. adquiriu a Hyperion Grow Lights para impulsionar o seu setor de horticultura. O acordo aumentou o apoio aos produtores de estufas, integrou as operações da Hyperion na rede da Midstream e expandiu o fabrico da nova série Hyperion Pro

- Em fevereiro de 2023, as luzes de cultivo LED Phantom PHOTOBIO TX e PHOTOBIO T da Hydrofarm oferecem designs finos e de alta eficiência com espectro S4 para uma saúde ideal das plantas. Ideais para estufas e ambientes interiores, estas luzes de ponta apresentam uma dissipação de calor avançada e um sombreamento mínimo, melhorando a produtividade e a qualidade das culturas de forma sustentável

- A MechaTronix Horticulture Lighting lançou os novos COOLSTACK Dynamic Growlights, utilizando LEDs Osram OSCONIQ P3737 e óptica redesenhada para culturas de alta tensão. Esta inovação alcançou uma eficácia ultra-elevada de mais de 3,8 µmol por joule, melhorando a propagação e a profundidade da luz. A empresa reforçou o seu compromisso de maximizar os rendimentos e a eficiência para os produtores do setor das estufas

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.