Mercado de diagnóstico de cancro gástrico na América do Norte, por tipo de produto (instrumentos, reagentes e consumíveis, serviços), tipo de diagnóstico (teste confirmatório, testes de rastreio de cancro gástrico/exame físico), faixa etária (adulto, pediátrico e geriátrico), tipo de doença (intestinal Ou Adenocarcinoma Difuso, Tumor Carcinoide, Tumor Estromal Gastrointestinal (GIST), Linfoma Gástrico e Outros), Estádio (Estágio 0, Estádio I, Estádio II, Estádio III), Sexo (Masculino e Feminino), Tipo de Amostra (Sangue, Tecido, Urina , e fezes), utilizadores finais (laboratórios de diagnóstico, hospitais, institutos de investigação do cancro, clínicas especializadas em oncologia e outros), canal de distribuição (licitações directas e vendas a retalho) - tendências do setor e previsões até 2030.

Análise e insights do mercado de diagnósticos de cancro gástrico na América do Norte

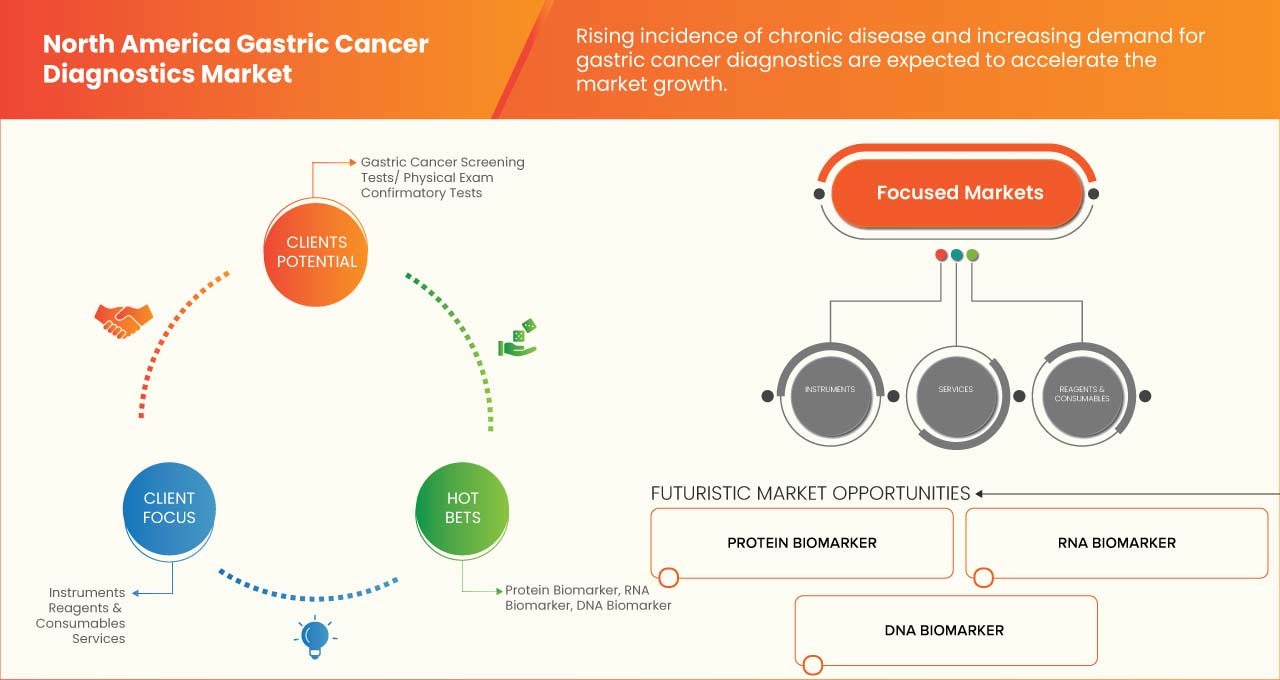

O aumento da população geriátrica na América do Norte está a impulsionar o crescimento da indústria de diagnóstico do cancro gástrico. A prevalência de tumores gastrointestinais e linfomas também aumentou a procura de diagnósticos de cancro gástrico. A principal restrição do mercado é a necessidade de reduzir os elevados preços associados aos testes de diagnóstico de cancro para que até os países em desenvolvimento possam beneficiar dos mesmos.

Um grande número de participantes no mercado está a oferecer produtos de diagnóstico do cancro gástrico com inovações que abrem caminho para o crescimento do mercado de diagnóstico do cancro gástrico na América do Norte.

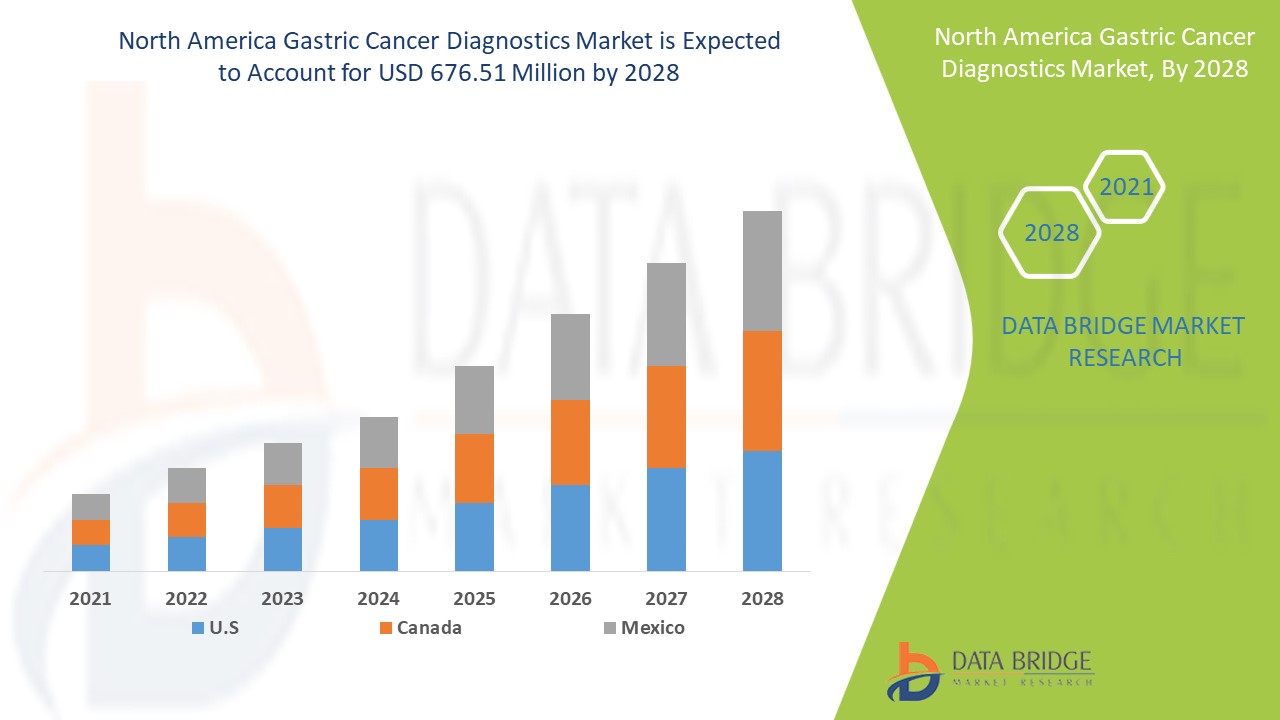

A Data Bridge Market Research analisa que o mercado de diagnóstico do cancro gástrico na América do Norte deverá atingir o valor de 843,49 milhões de dólares até 2030, com um CAGR de 8,5% durante o período previsto. Os reagentes e consumíveis representam o maior segmento de tipo de produto no mercado devido à crescente procura de kits e reagentes, e o aumento dos gastos com a saúde acelerou a procura de dispositivos médicos inteligentes.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (Personalizável para 2015-2020) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos, volumes em unidades, preços em dólares americanos |

|

Segmentos abrangidos |

Por tipo de produto (instrumentos, reagentes e consumíveis, serviços), tipo de diagnóstico (teste confirmatório, testes de rastreio do cancro gástrico/exame físico), grupo etário (adulto, pediátrico e geriátrico), tipo de doença (adenocarcinoma intestinal ou difuso , tumor carcinoide, Tumor estromal gastrointestinal (GIST), linfoma gástrico e outros), estádio (estádio 0, estádio I, estádio II, estádio III), sexo (masculino e feminino), tipo de amostra (sangue, tecido, urina e fezes ), utilizadores finais (Laboratórios de Diagnóstico, Hospitais, Institutos de Investigação do Cancro, Clínicas de Especialidades Oncológicas e Outros), Canal de Distribuição (Licitações Diretas e Vendas a Retalho) |

|

Países abrangidos |

EUA, Canadá e México |

|

Atores do mercado abrangidos |

BIOMÉRIEUX, Myriad Genetics, Inc., ACON Laboratories, Inc., Teco Diagnostics, Vela Diagnostics, Abbott, AdvaCare Pharma, MiRXES Pte Ltd., Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, General Electric, Agilent Technologies, Inc., Biohit Oyj, BIOCEPT, INC., FOUNDATION MEDICINE, INC., DiaSorin SpA, Paragon Genomics, Inc., QIAGEN e entre outros |

Definição de Mercado

O cancro do estômago é um tipo de cancro que começa no estômago e que se espalha por todo o corpo. O estômago é uma bolsa muscular que se encontra imediatamente abaixo das costelas, na parte superior do abdómen. O estômago absorve e retém os alimentos que ingerimos antes de os quebrar e digerir. O cancro do estômago, vulgarmente chamado de cancro gástrico, pode ocorrer em qualquer parte do estômago. O cancro do estômago desenvolve-se na maior parte do estômago na maioria das partes do mundo (corpo do estômago). Vários testes de diagnóstico utilizados para diagnosticar o cancro incluem testes de pré-triagem, biópsia, biomarcadores, exames de imagem, tomografias por emissão de positrões (PET/CT) e ecografia, entre outros.

O cancro é causado pela proliferação celular descontrolada e anormal que tem a capacidade de se espalhar e invadir outras partes do corpo. As alterações no gene fazem com que uma única célula ou algumas células se expandam e se repliquem, que é quando o cancro começa. Isto pode levar ao crescimento de um tumor, que é uma massa anormal de tecido. A criação de células cancerígenas no revestimento do estômago é conhecida como cancro gástrico ou cancro do estômago. A dieta e os distúrbios estomacais são fatores de risco para o cancro gástrico.

Dinâmica do mercado de diagnósticos de cancro gástrico na América do Norte

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Aumento da incidência de tumores gastrointestinais, linfoma e adenocarcinoma

De acordo com um relatório publicado na Clinical Medicine, o cancro gástrico é o quinto cancro mais comum e a quarta principal causa de morte por cancro no mundo em 2020. Em 2020, estima-se que 1,1 milhões de casos (720.000 homens e 370.000 mulheres) de cancro gástrico foram diagnosticados em todo o mundo. O cancro gástrico é responsável por cerca de 1 em cada 12 mortes oncológicas. Todos os anos, são diagnosticados cerca de um milhão de novos casos de cancro do estômago em todo o mundo.

Prevê-se que a incidência do cancro gástrico aumente devido ao envelhecimento e ao aumento populacional, ao estilo de vida e às alterações socioeconómicas. Variações marcantes na raça, normas socioculturais, comportamentos e tendências alimentares refletem-se na carga e distribuição do cancro nas diferentes regiões do mundo.

Assim sendo, espera-se que a crescente incidência de cancro em todo o mundo acelere a procura por diagnósticos de cancro gástrico. Assim, espera-se que o aumento das taxas de incidência de tumores gastrointestinais, linfoma e adenocarcinoma impulsione o crescimento do mercado de diagnóstico do cancro gástrico na América do Norte.

- Aumento do consumo de álcool e aumento do tabagismo

Evidências epidemiológicas, clínicas e laboratoriais apontam para uma relação comportamental entre o tabagismo e o consumo de álcool. O uso combinado de cigarros e álcool traz preocupações de saúde para além das causadas pelo tabagismo isoladamente e, por isso, representa um grave problema de saúde pública que merece mais investigação.

Uma reação química em cadeia ocorre sempre que um fumador inala um cigarro aceso, produzindo dezenas de produtos químicos perigosos. O fumo do cigarro contém substâncias que são inaladas pelos lábios, pela língua e pela boca, pela garganta e pelos pulmões, produzindo inflamação e expondo estas partes do corpo a substâncias químicas causadoras de cancro.

Assim, espera-se que o aumento do consumo de álcool e o aumento do tabagismo impulsionem o crescimento do mercado do cancro gástrico na América do Norte.

Oportunidade

-

Aumento da adoção de sistemas automatizados

O cancro é uma doença sistémica e de rede. Isto indica que, numa célula cancerígena, certos genes relacionados com a rede deixam de funcionar corretamente. Interações complexas em tais redes genéticas devem ser abordadas no tratamento do cancro. Os algoritmos de inteligência artificial (IA), em particular, têm evoluído rapidamente, o que se reflete no progresso da oncologia.

A aprendizagem automática e as redes neuronais estão a tornar-se cada vez mais importantes na oncologia de precisão e na medicina sistémica. A combinação de dados de imagem com dados clínicos e moleculares abre um mundo de possibilidades. A radiogenómica, por exemplo, é um novo campo focado no processamento de dados multidimensionais. Ela também pode beneficiar dos avanços da IA.

Desta forma, a crescente adoção de sistemas automatizados atua como uma oportunidade para o crescimento deste mercado.

Restrição/Desafio

- Falta de apoio financeiro suficiente das apólices de seguro de saúde

Para atingir os seus objectivos, os sistemas de saúde necessitam de recursos financeiros. Os recursos humanos, os cuidados hospitalares e os medicamentos são os aspetos mais dispendiosos da maioria dos sistemas de saúde. Na maioria dos países tropicais, os cuidados de saúde são financiados por uma combinação de despesas governamentais, privadas (principalmente do próprio bolso) e ajuda internacional.

O financiamento da saúde continua a ser uma preocupação fundamental para os países de baixo e médio-baixo rendimento. Muitos países de rendimento médio-alto da América Latina, África e Ásia conseguiram estabelecer acordos de financiamento dos cuidados de saúde que abrangem grandes segmentos das suas populações. Estas medidas permitem o acesso a cuidados de saúde e, ao mesmo tempo, protegem os indivíduos de dívidas catastróficas contraídas em resultado desse acesso. As finanças, por outro lado, são um grande obstáculo à prestação de cuidados de saúde nos países de baixo rendimento (a maior parte dos quais se encontra na África Subsariana).

Desta forma, a falta de apoio financeiro suficiente das apólices de seguro de saúde atua como uma restrição ao crescimento do mercado.

Desenvolvimentos recentes

- Em outubro de 2022, a General Electric Company colaborou com vários institutos de investigação, como os Hospitais da Universidade de Cambridge, a Sophia Genetics e, anteriormente, com a Optellum, para utilizar dados de imagem em colaboração com a inteligência artificial. Isto ajudará a reduzir o tempo de diagnóstico de vários tipos de cancro e a prestar cuidados personalizados aos doentes. Isto ajudou a empresa a alargar os seus horizontes no diagnóstico do cancro

- Em março de 2020, a Thermo Fisher Scientific Inc. anunciou que iria adquirir a QIAGEN, uma empresa holandesa de diagnóstico molecular e saúde. Esta aquisição por parte da empresa aumentará o seu portfólio de produtos no mercado, resultando num aumento de receitas no futuro

Âmbito do mercado de diagnóstico de cancro gástrico na América do Norte

O mercado de diagnóstico do cancro gástrico da América do Norte está segmentado em nove segmentos notáveis com base no tipo de produto, tipo de diagnóstico, faixa etária, tipo, fase, género, amostra, utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

TIPO DE PRODUTO

- Instrumentos

- Reagentes e consumíveis

- Serviços

Com base no tipo de produto, o mercado está segmentado em instrumentos, reagentes e consumíveis e serviços.

TIPO DE DIAGNÓSTICO

- Teste confirmatório

- Testes de rastreio de cancro gástrico/exame físico

Com base no tipo de diagnóstico, o mercado está segmentado em testes de rastreio do cancro gástrico/exame físico e testes confirmatórios.

FAIXA ETÁRIA

- Adulto

- Pediátrico

- Geriatria

Com base na faixa etária, o mercado está segmentado em adulto, pediátrico e geriátrico.

TIPO

- Adenocarcinoma intestinal ou difuso

- Tumor carcinoide

- Tumor estromal gastrointestinal (GIST)

- Linfoma gástrico

- Outros

Com base no tipo, o mercado está segmentado em adenocarcinoma intestinal ou difuso, tumor carcinoide, tumor estromal gastrointestinal (GIST), linfoma gástrico e outros.

FASE

- Estágio 0

- Estágio I

- Estágio II

- Estágio III

Com base no estágio, o mercado está segmentado em estágio 0, estágio I, estágio II e estágio III.

GÉNERO

- Macho

- Fêmea

Com base no género, o mercado está segmentado em masculino e feminino.

TIPO DE AMOSTRA

- Sangue

- Lenço

- Urina

- Banco

Com base no tipo de amostra, o mercado está segmentado em sangue, tecido, urina e fezes.

UTILIZADOR FINAL

- Laboratórios de Diagnóstico

- Hospitais

- Institutos de Investigação do Cancro

- Clínicas de Especialidades Oncológicas

- Outros

Com base nos utilizadores finais, o mercado está segmentado em laboratórios de diagnóstico, hospitais, institutos de investigação do cancro, clínicas especializadas em oncologia e outros.

CANAL DE DISTRIBUIÇÃO

- Licitações Diretas

- Vendas no retalho

Com base no canal de distribuição, o mercado está segmentado em licitação direta e vendas a retalho.

Análise/Insights Regionais do Mercado de Diagnósticos do Cancro Gástrico na América do Norte

O mercado de diagnóstico do cancro gástrico na América do Norte está segmentado em nove segmentos notáveis com base no tipo de produto, tipo de diagnóstico, faixa etária, tipo de doença, estádio, género, amostra, utilizador final e canal de distribuição.

Os países abrangidos neste relatório de mercado são os EUA, o Canadá e o México.

Espera-se que os EUA dominem devido ao aumento do avanço tecnológico no setor da saúde.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade das marcas norte-americanas e os seus desafios enfrentados devido à grande ou escassa concorrência das marcas locais e nacionais, e o impacto dos canais de vendas são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado nos diagnósticos de cancro gástrico

O panorama competitivo do mercado de diagnóstico do cancro gástrico na América do Norte fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em I&D, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, aprovações de produtos, amplitude e amplitude do produto, domínio da aplicação e tipo de produto curva da linha de vida. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de diagnóstico de cancro gástrico na América do Norte.

Alguns dos principais participantes que operam no mercado de diagnóstico do cancro gástrico na América do Norte são a BIOMÉRIEUX, Myriad Genetics, Inc., ACON Laboratories, Inc., Teco Diagnostics, Vela Diagnostics, Abbott, AdvaCare Pharma, MiRXES Pte Ltd., Thermo Fisher Scientific Inc. , F. Hoffmann-La Roche Ltd, General Electric, Agilent Technologies, Inc., Biohit Oyj, BIOCEPT, INC., FOUNDATION MEDICINE, INC., DiaSorin SpA, Paragon Genomics, Inc., QIAGEN e entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET END COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL'S MODEL

4.2 PORTER'S 5 FORCES

4.3 EPIDEMIOLOGY

4.4 BRAND ANALYSIS

4.5 ROLE OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML): NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET

4.6 INDUSTRY INSIGHTS:

5 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, REGULATORY

5.1 NORTH AMERICA

5.1.1 REGULATORY SCENARIO IN THE U.S

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN INCIDENCE OF GASTROINTESTINAL TUMOURS, LYMPHOMA, AND ADENOCARCINOMA

6.1.2 RISE IN ALCOHOL CONSUMPTION AND SURGE IN SMOKING

6.1.3 INCREASE IN THE GERIATRIC POPULATION

6.1.4 RECENT ADVANCEMENTS IN GASTRIC CANCER DIAGNOSTICS PRODUCTS

6.2 RESTRAINTS

6.2.1 HIGH COST OF GASTRIC CANCER DIAGNOSTIC TEST

6.2.2 LACK OF SUFFICIENT FINANCIAL SUPPORT FROM HEALTH INSURANCE POLICIES

6.3 OPPORTUNITIES

6.3.1 RISE IN THE ADOPTION OF AUTOMATED SYSTEMS

6.3.2 INCREASED RESEARCH AND DEVELOPMENT ON CANCER DIAGNOSTICS PRODUCTS

6.3.3 STRATEGIC INITIATIVES BY EMERGING PLAYERS

6.4 CHALLENGES

6.4.1 STRINGENT REGULATIONS AND POLICIES FOR APPROVING THE COMPLICATED NATURE OF RADIATION DEVICES

6.4.2 LIMITATIONS OF RADIATION TESTS

7 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 REAGENTS & CONSUMABLES

7.2.1 KITS

7.2.1.1 DNA POLYMERASE KITS

7.2.1.2 PCR KITS

7.2.1.3 NUCLEIC ACID ISOLATION KITS

7.2.1.4 OTHERS

7.2.2 REAGENTS

7.2.2.1 ASSAYS

7.2.2.2 BUFFERS

7.2.2.3 PRIMERS

7.2.2.4 OTHERS

7.3 INSTRUMENTS

7.4 SERVICES

8 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE

8.1 OVERVIEW

8.2 CONFIRMATORY TEST

8.2.1 IMAGING TESTS

8.2.1.1 PET SCAN/CT SCAN

8.2.1.2 CT SCAN

8.2.1.3 ULTRASOUND

8.2.1.4 MRI

8.2.1.5 X-RAY

8.2.2 BIOMARKER

8.2.2.1 DNA BIOMARKER

8.2.2.2 RNA BIOMARKER

8.2.2.3 PROTEIN BIOMARKER

8.2.3 BIOPSY

8.3 GASTRIC CANCER SCREENING TESTS/PHYSICAL EXAM

9 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY AGE GROUP

9.1 OVERVIEW

9.2 GERIATRICS

9.3 ADULT

9.4 PEDIATRIC

10 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY DISEASE TYPE

10.1 OVERVIEW

10.2 INTESTINAL OR DIFFUSE ADENOCARCINOMA

10.3 CARCINOID TUMOR

10.4 GASTROINTESTINAL STROMAL TUMOR

10.5 GASTRIC LYMPHOMA

10.6 OTHERS

11 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE

11.1 OVERVIEW

11.2 STAGE I

11.2.1 STAGE IA

11.2.2 STAGE IB

11.3 STAGE II

11.3.1 STAGE IIA

11.3.2 STAGE IIB

11.4 STAGE III

11.4.1 STAGE IIIA

11.4.2 STAGE IIIB

11.4.3 STAGE IIIC

11.5 STAGE 0

12 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY GENDER

12.1 OVERVIEW

12.2 MALE

12.3 FEMALE

13 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY SAMPLE TYPE

13.1 OVERVIEW

13.2 STOOL

13.3 TISSUE

13.4 BLOOD

13.5 URINE

14 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 DIAGNOSTIC LABORATORIES

14.4 CANCER RESEARCH INSTITUTES

14.5 ONCOLOGY SPECIALTY CLINICS

14.6 OTHERS

15 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDERS

15.3 RETAIL SALES

16 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 F. HOFFMANN-LA ROCHE LTD

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 GENERAL ELECTRIC

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENT

19.3 ABBOTT

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 QIAGEN

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENT

19.5 MYRIAD GENETICS, INC.

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 ACON LABORATORIES, INC.

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 ADVACARE PHARMA

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 AGILENT TECHNOLOGIES, INC.

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENTS

19.9 BIOMÉRIEUX

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT DEVELOPMENT

19.1 BIOCEPT, INC.

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENT

19.11 BIOHIT OYJ

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENT

19.12 DIASORIN S.P.A

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENT

19.13 ENDOFOTONICS PTE LTD

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENT

19.14 FOUNDATION MEDICINE, INC.

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

19.15 FUJIREBIO (AN H.U. GROUP COMPANY)

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENT

19.16 MIRXES PTE LTD.

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 PARAGON GENOMICS, INC.

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 TECO DIAGNOSTICS

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 THERMO FISHER SCIENTIFIC INC.

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENTS

19.2 VELA DIAGNOSTICS

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tabela

TABLE 1 APPROVED COMPANION DIAGNOSTIC DEVICE

TABLE 2 THE BELOW-MENTIONED LIST SHOWS THE COST OF PET SCAN FOR CANCER DIAGNOSIS IN DIFFERENT REGIONS ACROSS THE GLOBE-

TABLE 3 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA REAGENTS & CONSUMABLES IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA REAGENT AND CONSUMABLES IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA KITS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA REAGENTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA INSTRUMENTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA SERVICES IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA CONFIRMATORY TEST IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA CONFIRMATORY TEST IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA IMAGING TESTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA BIOMARKER IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA GASTRIC CANCER SCREENING TESTS/PHYSICAL EXAM IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA GERIATRICS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA ADULT IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA PEDIATRIC IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA INTESTINAL OR DIFFUSE ADENOCARCINOMA IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA CARCINOID TUMOR IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA GASTROINTESTINAL STROMAL TUMOR IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA GASTRIC LYMPHOMA IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA STAGE I IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA STAGE I IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA STAGE II IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA STAGE II IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA STAGE III IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA STAGE III IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA STAGE 0 IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA MALE IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA FEMALE IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA STOOL IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA TISSUE IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA BLOOD IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA URINE IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA HOSPITALS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA DIAGNOSTIC LABORATORIES IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA CANCER RESEARCH INSTITUTES IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA ONCOLOGY SPECIALTY CLINICS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA OTHERS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA DIRECT TENDERS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA RETAIL SALES IN GASTRIC CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA REAGENTS & CONSUMABLES IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA KITS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA REAGENTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA CONFIRMATORY TESTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA IMAGING TESTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA BIOMARKER IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA STAGE I IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA STAGE II IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA STAGE III IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 70 U.S. GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 71 U.S. REAGENTS & CONSUMABLES IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 72 U.S. KITS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 73 U.S. REAGENTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 74 U.S. GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 75 U.S. CONFIRMATORY TESTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 76 U.S. IMAGING TESTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 77 U.S. BIOMARKER IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 78 U.S. GASTRIC CANCER DIAGNOSTICS MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 79 U.S. GASTRIC CANCER DIAGNOSTICS MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 80 U.S. GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 81 U.S. STAGE I IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 82 U.S. STAGE II IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 83 U.S. STAGE III IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 84 U.S. GASTRIC CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 85 U.S. GASTRIC CANCER DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2021-2030 (USD MILLION)

TABLE 86 U.S. GASTRIC CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 87 U.S. GASTRIC CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 88 CANADA GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 89 CANADA REAGENTS & CONSUMABLES IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 90 CANADA KITS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 91 CANADA REAGENTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 92 CANADA GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 93 CANADA CONFIRMATORY TESTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 94 CANADA IMAGING TESTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 95 CANADA BIOMARKER IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 96 CANADA GASTRIC CANCER DIAGNOSTICS MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 97 CANADA GASTRIC CANCER DIAGNOSTICS MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 98 CANADA GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 99 CANADA STAGE I IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 100 CANADA STAGE II IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 101 CANADA STAGE III IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 102 CANADA GASTRIC CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 103 CANADA GASTRIC CANCER DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2021-2030 (USD MILLION)

TABLE 104 CANADA GASTRIC CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 105 CANADA GASTRIC CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 106 MEXICO GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 107 MEXICO REAGENTS & CONSUMABLES IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 108 MEXICO KITS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 109 MEXICO REAGENTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 110 MEXICO GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 111 MEXICO CONFIRMATORY TESTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 112 MEXICO IMAGING TESTS IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 113 MEXICO BIOMARKER IN GASTRIC CANCER DIAGNOSTICS MARKET, BY DIAGNOSTIC TYPE, 2021-2030 (USD MILLION)

TABLE 114 MEXICO GASTRIC CANCER DIAGNOSTICS MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 115 MEXICO GASTRIC CANCER DIAGNOSTICS MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 116 MEXICO GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 117 MEXICO STAGE I IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 118 MEXICO STAGE II IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 119 MEXICO STAGE III IN GASTRIC CANCER DIAGNOSTICS MARKET, BY STAGE, 2021-2030 (USD MILLION)

TABLE 120 MEXICO GASTRIC CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 121 MEXICO GASTRIC CANCER DIAGNOSTICS MARKET, BY SAMPLE TYPE, 2021-2030 (USD MILLION)

TABLE 122 MEXICO GASTRIC CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 123 MEXICO GASTRIC CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: MARKET END COVERAGE GRID

FIGURE 11 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 12 INCREASE IN THE INCIDENCE OF GASTROINTESTINAL TUMORS, LYMPHOMA, AND ADENOCARCINOMA IS EXPECTED TO DRIVE THE NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 REAGENTS AND CONSUMABLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET IN 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES, OF THE NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET

FIGURE 15 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2022

FIGURE 16 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 17 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 18 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY DIAGNOSTIC TYPE, 2022

FIGURE 20 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY DIAGNOSTIC TYPE, 2023-2030 (USD MILLION)

FIGURE 21 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY DIAGNOSTIC TYPE, CAGR (2023-2030)

FIGURE 22 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY DIAGNOSTIC TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY AGE GROUP, 2022

FIGURE 24 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY AGE GROUP, 2023-2030 (USD MILLION)

FIGURE 25 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY AGE GROUP, CAGR (2023-2030)

FIGURE 26 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 27 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY DISEASE TYPE, 2022

FIGURE 28 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY DISEASE TYPE, 2023-2030 (USD MILLION)

FIGURE 29 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY DISEASE TYPE, CAGR (2023-2030)

FIGURE 30 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY DISEASE TYPE, LIFELINE CURVE

FIGURE 31 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY STAGE, 2022

FIGURE 32 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY STAGE, 2023-2030 (USD MILLION)

FIGURE 33 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY STAGE, CAGR (2023-2030)

FIGURE 34 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY STAGE, LIFELINE CURVE

FIGURE 35 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY GENDER, 2022

FIGURE 36 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY GENDER, 2023-2030 (USD MILLION)

FIGURE 37 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY GENDER, CAGR (2023-2030)

FIGURE 38 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 39 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY SAMPLE TYPE, 2022

FIGURE 40 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY SAMPLE TYPE, 2023-2030 (USD MILLION)

FIGURE 41 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY SAMPLE TYPE, CAGR (2023-2030)

FIGURE 42 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY SAMPLE TYPE, LIFELINE CURVE

FIGURE 43 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY END USER, 2022

FIGURE 44 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 45 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 46 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 47 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 48 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 49 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 50 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 51 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: SNAPSHOT (2022)

FIGURE 52 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022)

FIGURE 53 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 54 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 55 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 56 NORTH AMERICA GASTRIC CANCER DIAGNOSTICS MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.