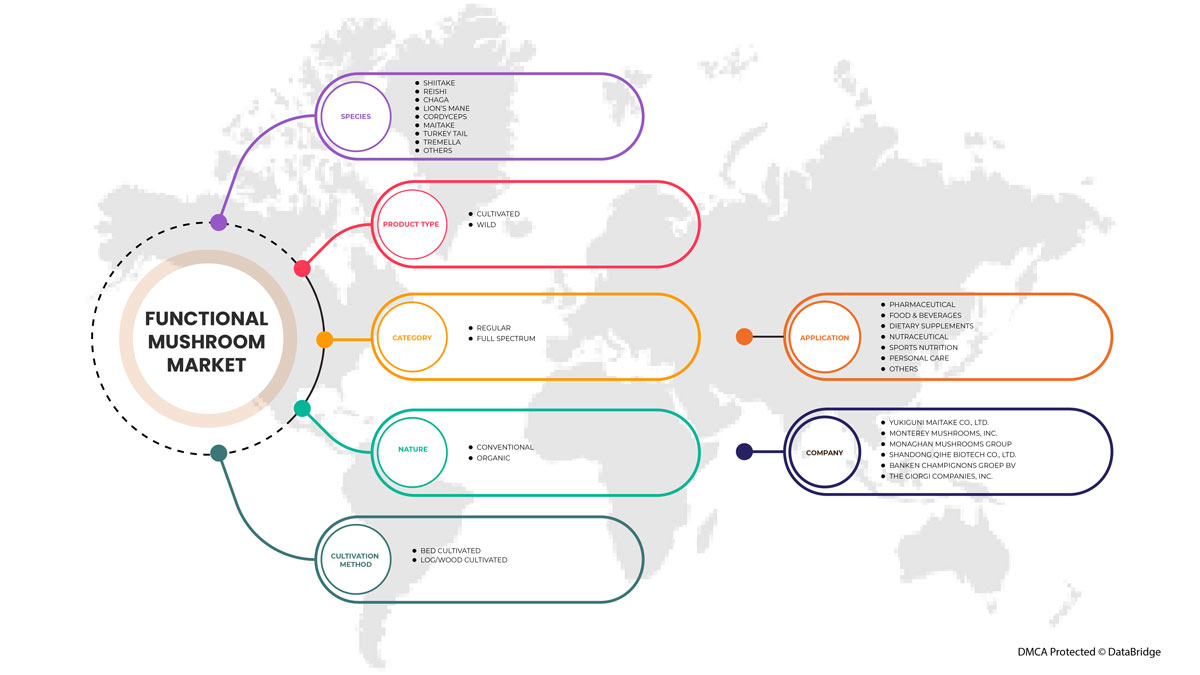

North America Functional Mushroom Market, By Species (Shiitake, Reishi, Chaga, Lion's Mane, Cordyceps, Maitake, Turkey Tail, Tremella, Others), Product Type (Cultivated, Wild), Category (Regular, Full Spectrum), Nature (Conventional, Organic), Cultivation Method (Bed Cultivated, Log/Wood Cultivated), Application (Pharmaceutical, Food & Beverages, Dietary Supplements, Nutraceutical, Sports Nutrition, Personal Care, Others) Industry Trends and Forecast to 2029

North America Functional Mushroom Market Analysis and Insights

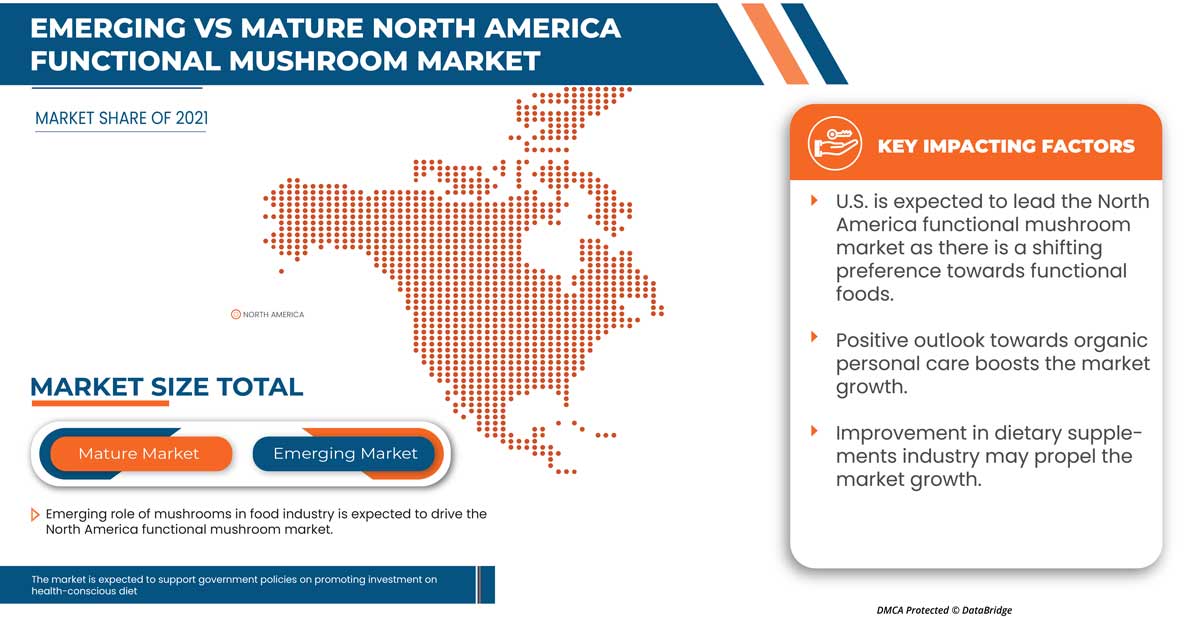

The North America functional mushroom market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.2% in the forecast period of 2022 to 2029 and is expected to reach USD 174,100.93 thousand by 2029. The major factor driving the growth of the North America functional mushroom market is shifting preference towards functional foods, positive outlook towards organic personal care, improvement in the dietary supplements industry, increasing acceptability of mushroom for medicinal properties, and the emerging role of mushrooms in the food industry. The rising alternatives for proteins may hamper the market growth.

The North America functional mushroom market provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousands |

|

Segments Covered |

By Species (Shiitake, Reishi, Chaga, Lion's Mane, Cordyceps, Maitake, Turkey Tail, Tremella, Others), Product Type (Cultivated, Wild), Category (Regular, Full Spectrum), Nature (Conventional, Organic), Cultivation Method (Bed Cultivated, Log/Wood Cultivated), Application (Pharmaceutical, Food & Beverages, Dietary Supplements, Nutraceutical, Sports Nutrition, Personal Care, Others). |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Monterey Mushrooms, Inc., Monaghan Mushrooms Group, Shandong Qihe Biotech Co., Ltd., The Giorgi Companies, Inc., Nammex, Shogun Maitake, Rain Forest Mushrooms, Mushroom King Farm, Farming Fungi, LLC, among others. |

Market Definition

Functional mushrooms are packed with antioxidants and nutritional value, with many health claims. These mushrooms have been widely used due to their medicinal properties and superfood benefits. Functional mushrooms help to strengthen immune systems and are also used as a dietary option that is low in calories and high in protein which is great for those lacking protein in their diet, in addition to providing multiple vitamins and essential minerals. The most widely used mushrooms for medicinal purposes are shiitake and reishi, among others.

Shiitake

The demand for shiitake is increasing in the functional mushroom market as it has a rich, savory taste and diverse health benefits. Compounds in shiitake may help fight cancer, boost immunity, and support heart health.

Reishi

The demand for reishi is increasing in the functional mushroom market owing to its medicinal properties. It can also be used in coffee and cocoa to enhance taste and health.

North America Functional Mushroom Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Shift in consumer preference toward functional foods

Functional foods have a specific set of added nutrients such as fiber, probiotics, prebiotics, minerals, and others—also, these types of food help overcome nutritional deficiencies. Functional foods are also useful in decreasing the risk of chronic diseases. Growing health concerns due to a rapidly changing lifestyle, especially in urban areas, are increasing consumers' preference for healthy and functional foods to a great extent. In addition, in the COVID-19 situation, consumers are looking for such functional food ingredients which help to increase their immunity level, so such a scenario positively impacts increasing preference for functional mushrooms.

- Positive outlook towards organic personal care

Functional mushroom has their specific benefits, and all functional mushrooms work to balance energy levels, strengthen immune function, smooth digestion, and enhance the skin's natural glow. Mushrooms are loaded with polyphenols, polysaccharides, beta-glucans, and antioxidant properties. Together and separately, all these compounds help support the immune system. Mushrooms also deliver a slew of dietary fiber, aiding in healthy digestion and increasing beneficial gut bacteria in the digestive system. As for skin-enhancing benefits, functional mushrooms have an overflowing amount of antioxidant properties. Glowing skin is also the result of whole-body health. Any dysfunction in the immune system or digestion will show up in the skin first. Supporting whole-body well-being with functional mushrooms often results in a smooth complexion. Mushroom ingredients find their way into skincare and supplements as the consumer quest for wellness endures. Beauty and wellness companies are increasingly tapping different types of mushrooms, including reishi, lion's mane, turkey tail, and Chaga, among others.

- Increase in acceptability of mushroom for medicinal properties

Mushrooms are a recognized component of the human diet, with versatile medicinal properties. Some mushrooms are popular worldwide for their nutritional and therapeutic properties. Mushrooms have long been valued as high medicinal and nutritional food by many societies worldwide. Mushrooms are consumed as a medicine in Asian countries, and much research works have been done on medicinal aspects. A large variety of mushrooms have been utilized traditionally in many different cultures for the maintenance of health and the prevention and treatment of diseases through their immunomodulatory and antineoplastic properties. In the last decade, the interest in mushrooms' pharmaceutical potential has increased rapidly, and it has been suggested that many mushrooms are like mini-pharmaceutical factories producing compounds with miraculous biological properties.

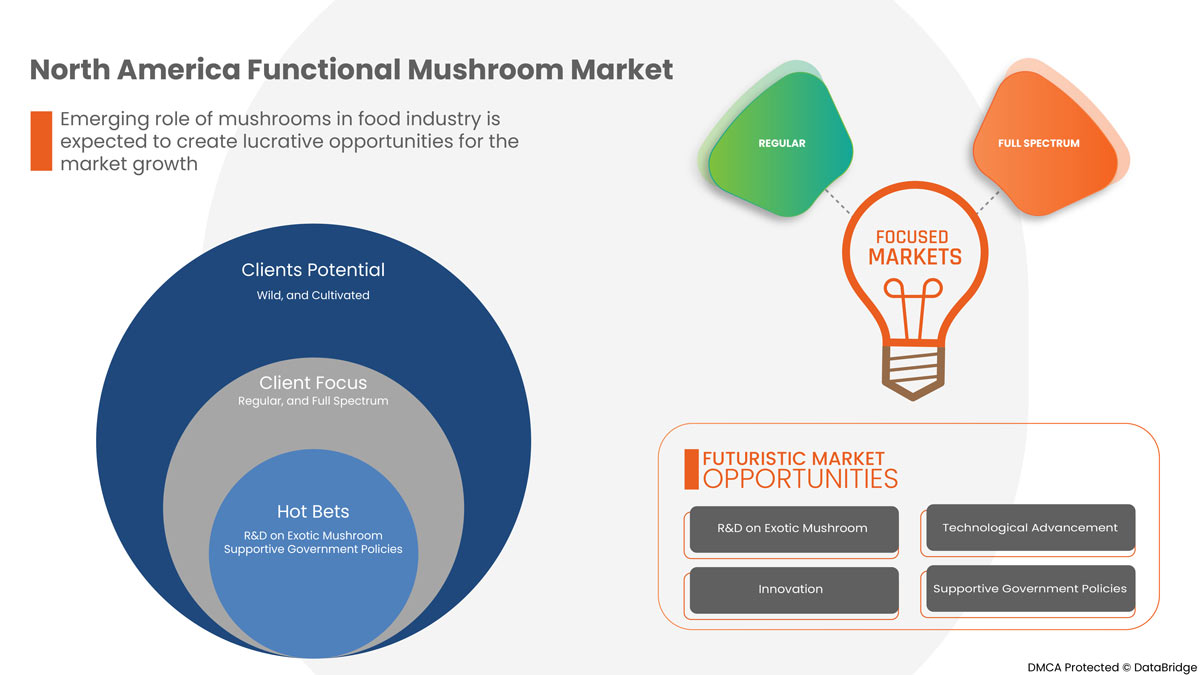

- Emerging role of mushrooms in the food industry

Consumers are increasingly interested in nutritious, safe, and healthy muscle food products with reduced salt and fat that benefit their well-being. Hence, food processors are constantly searching for natural bioactive ingredients that offer health benefits beyond their nutritional values without affecting the quality of the products. Mushrooms are considered next-generation healthy food components. Owing to their low-fat content, high-quality proteins, dietary fiber, and the presence of nutraceuticals, they are ideally preferred in the formulation of low-caloric functional foods. There is a growing trend to fortify muscle food with mushrooms to harness their goodness in terms of nutritional, bioactive, and therapeutic values. The incorporation of mushrooms in muscle foods assumes significance. Consumers favorably accept it because its fibrous structure mimics the texture of meat analogs, offering a unique taste and umami flavor.

Opportunities

- Increasing R&D spending on exotic mushroom variants

The demand for exotic varieties of mushrooms has been growing, driven by the increasing trend of eating healthy and natural food. Oyster mushrooms, enoki, and shiitake are a few examples of popular exotic mushrooms. The demand for exotic mushrooms has increased considerably over the past years. They can be canned, dried, or packed in frozen forms, including their usage in the food industry in mushroom pickles and sauces.

- Technological advancement and innovations on functional mushroom

Technological developments in the mushroom industry have witnessed increasing production capacities, innovations in cultivation technologies, improvements in final mushroom goods, and utilization of mushrooms' natural qualities for environmental benefits. The growing technologies used worldwide for mushroom species are increasing in food, processing, and pharmacological industries owing to the rapid development of mushroom farming.

- Supportive government policies on promoting investment in health conscious diet

Consuming a healthy diet throughout the life course helps to prevent malnutrition in all its forms, as well as a range of non-communicable diseases (NCDs) and conditions. However, increased production of processed foods, rapid urbanization, and changing lifestyles have shifted dietary patterns. People are now consuming more foods high in energy, fats, free sugars, and salt/sodium, and many people do not eat enough fruit, vegetables, and other dietary fiber, such as whole grains. Investment by governments, the private sector, and other relevant stakeholders should support training for food producers, handlers, and processors to implement national, scientific, and evidence-based risk-based measures that can provide safe food while retaining its nutrient content.

Restraints/Challenges

- Strong market reach of other protein substitutes

The rise in the availability of protein substitutes is majorly driven by factors such as growing urbanization, innovation in food technology, high nutritional value, and a rise in environmental sustainability with the production and consumption of alternative protein.

- High product prices

Medicinal mushrooms are becoming more popular daily as researchers unravel new psilocybin benefits. These benefits are drawing more consumers to mushroom-related products. The rising demand for mushroom-related products is surging the prices to a higher rate due to everyday rising North America demand. The high cost of functional mushroom products is rising due to its high cost of production since mushrooms for the retail market are hand-picked. Picker training courses have contributed enormously to labor costs. Harvesting costs alone account for over 30% of the cost of production. The requirement of the modern cold storage facility and well-equipped processing units also cost extra, leading to rising end-product prices.

- Implementation of strict regulation for the commercialization of functional mushroom products

The U.S. has one of the most stringent and progressive regulations on consumer safety, so when it comes to keeping both its citizens and those around the world who purchase American-made food at their healthiest, food is the most scrutinized. Food Safety Magazine named the U.S. the world's best food safety regulations and practices, right behind Canada.

Recent Developments

- In May 2021, Monaghan Group announced its partnership with Melissa Hemsley. The partnership will encourage more people to create vegetarian dishes and will be amplified through PR, social media, and digital activity. With this development company can increase its customer base.

- In October 2017, Monterey Mushrooms, Inc. announced the launch of its new product line, Let's Blend finely diced mushrooms, to make the cooking experience much easier. Let's blend works well with ground beef, chicken, lamb, pork, and turkey. With this development company can enhance its product portfolio.

North America Functional Mushroom Market Scope

The North America functional mushroom market is categorized based on species, product type, category, nature, cultivation method, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Species

- Shiitake

- Reishi

- Chaga

- Lion's Mane

- Cordyceps

- Maitake

- Turkey Tail

- Tremella

- Others

Based on species, the North America functional mushroom market is classified into shiitake, reishi, chaga, lion's mane, cordyceps, maitake, turkey tail, tremella, and others.

Product Type

- Cultivated

- Wild

Based on product type, the North America functional mushroom market is classified into cultivated and wild.

Category

- Regular

- Full Spectrum

Based on the category, the North America functional mushroom market is classified into regular, and full spectrum.

Nature

- Conventional

- Organic

Based on nature, the North America functional mushroom market is segmented into conventional, and organic.

Cultivation Method

- Bed Cultivated

- Log/Wood Cultivated

Based on cultivation method, the North America functional mushroom market is segmented into bed cultivated, and log/wood cultivated.

Application

- Pharmaceutical

- Food & Beverages

- Dietary Supplements

- Nutraceutical

- Sports Nutrition

- Personal Care

- Others

Based on application, the North America functional mushroom market is segmented into pharmaceutical, food & beverages, dietary supplements, nutraceutical, sports nutrition, personal care, and others.

North America Functional Mushroom Market Regional Analysis/Insights

The North America functional mushroom market is segmented by country, species, product type, category, nature, cultivation method, and application.

Some countries in the North America functional mushroom market are the U.S., Canada, and Mexico. The U.S. is expected to dominate the North America functional mushroom market in terms of market share and revenue because of the increasing sales and profit of the players operating in the market.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Functional Mushroom Market Share Analysis

The North America functional mushroom market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the North America functional mushroom market.

Some of the prominent participants operating in the North America functional mushroom market are Monterey Mushrooms, Inc., Monaghan Mushrooms Group, Shandong Qihe Biotech Co., Ltd., The Giorgi Companies, Inc., Nammex, Shogun Maitake, Rain Forest Mushrooms, Mushroom King Farm, Farming Fungi, LLC, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, North America Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS OF FUNCTIONAL MUSHROOM SPECIES

4.2 FULL SPECTRUM FUNCTIONAL MUSHROOM CULTIVATION METHODS, NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

4.3 MARKETING STRATEGIES ADOPTED BY KEY MARKET PLAYERS OF THE NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

4.4 PRICING ANALYSIS, NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

4.5 SUPPLY CHAIN ANALYSIS, NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

4.6 CHINA PERSPECTIVE

4.6.1 CHINA REGULATORY SCENARIO

4.6.2 RESEARCH AND DEVELOPMENT

4.6.3 OVERVIEW: CONTRACT PARTNERSHIPS AMONG FARMERS

5 REGULATIONS AND LABELLING CLAIMS FOR NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

6 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, REGIONAL SUMMARY

6.1 OVERVIEW

6.2 NORTH AMERICA

6.3 EUROPE

6.4 ASIA-PACIFIC

6.5 SOUTH AMERICA

6.6 MIDDLE EAST AND AFRICA (MEA)

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 SHIFT IN CONSUMER PREFERENCE TOWARD FUNCTIONAL FOODS

7.1.2 POSITIVE OUTLOOK TOWARDS ORGANIC PERSONAL CARE

7.1.3 IMPROVEMENT IN THE DIETARY SUPPLEMENTS INDUSTRY

7.1.4 INCREASE IN ACCEPTABILITY OF MUSHROOM FOR MEDICINAL PROPERTIES

7.1.5 EMERGING ROLE OF MUSHROOMS IN THE FOOD INDUSTRY

7.2 RESTRAINTS

7.2.1 STRONG MARKET REACH OF OTHER PROTEIN SUBSTITUTES

7.2.2 HIGH PRODUCT PRICES

7.3 OPPORTUNITIES

7.3.1 INCREASING R&D SPENDING ON EXOTIC MUSHROOM VARIANTS

7.3.2 TECHNOLOGICAL ADVANCEMENT AND INNOVATIONS ON FUNCTIONAL MUSHROOM

7.3.3 SUPPORTIVE GOVERNMENT POLICIES ON PROMOTING INVESTMENT IN HEALTH-CONSCIOUS DIET

7.4 CHALLENGE

7.4.1 IMPLEMENTATION OF STRICT REGULATION FOR COMMERCIALIZATION OF FUNCTIONAL MUSHROOM PRODUCTS

8 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY SPECIES

8.1 OVERVIEW

9 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

10 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY CATEGORY

10.1 OVERVIEW

11 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY NATURE

11.1 OVERVIEW

12 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY CULTIVATION METHOD

12.1 OVERVIEW

13 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY APPLICATION

14 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY REGION

14.1 NORTH AMERICA

15 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.1.1 PARTNERSHIP & ACQUISITION

15.1.2 EXPANSIONS

15.1.3 NEW PRODUCT DEVELOPMENTS

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 YUKIGUNI MAITAKE CO., LTD.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT UPDATE

17.2 MONTEREY MUSHROOMS, INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATE

17.3 MONAGHAN MUSHROOMS GROUP

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT UPDATE

17.4 SHANDONG QIHE BIOTECHNOLOGY CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATE

17.5 BANKEN CHAMPIGNONS GROEP BV

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATE

17.6 BIOBRITTE AGRO SOLUTIONS PVT LTD

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT UPDATES

17.7 FARMING FUNGI, LLC

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT UPDATE

17.8 LIANFENG (SUIZHOU) FOOD CO., LTD

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATE

17.9 MAESYFFIN MUSHROOMS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT UPDATE

17.1 MUSHROOM KING FARM

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT UPDATE

17.11 NAMMEX

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATE

17.12 OJAS FARMS

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT UPDATES

17.13 RAIN FOREST MUSHROOMS

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATE

17.14 SHOGUN MAITAKE

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT UPDATE

17.15 SMITHY MUSHROOMS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT UPDATE

17.16 THE GIORGIO COMPANIES, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATE

17.17 VLD FOOD PRODUCTS PVT. LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT UPDATE

17.18 WULING (FUZHOU) BIOTECHNOLOGY CO., LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT UPDATE

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Figura

FIGURE 1 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: SEGMENTATION

FIGURE 13 INCREASING ACCEPTABILITY OF MUSHROOM FOR MEDICINAL PROPERTIES IS DRIVING THE NORTH AMERICA FUNCTIONAL MUSHROOM MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 SHIITAKE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FUNCTIONAL MUSHROOM MARKET IN 2022 & 2029

FIGURE 15 MUSHROOM FARMING STEPS

FIGURE 16 MARKETING STRATEGIES ADOPTED BY MARKET PLAYERS

FIGURE 17 DATA ON THE SPECIFIC SALES PRICES AT DIFFERENT QUANTITIES FOR FULL SPECTRUM MUSHROOM PRODUCTS IN THE 8 PRIMARY SPECIES ACROSS THE GLOBE:

FIGURE 18 SUPPLY CHAIN ANALYSIS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF NORTH AMERICA FUNCTIONAL MUSHROOM MARKET

FIGURE 20 HEART DISEASE DEATH RATE, U.S. (2009-2016)

FIGURE 21 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY SPECIES

FIGURE 22 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY PRODUCT TYPE, 2020

FIGURE 23 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY CATEGORY, 2020

FIGURE 24 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET, BY NATURE

FIGURE 25 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY CULTIVATION METHOD, 2021

FIGURE 26 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: BY SPECIES (2022-2029)

FIGURE 32 NORTH AMERICA FUNCTIONAL MUSHROOM MARKET: COMPANY SHARE 2021, (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.