North America Forestry Equipment Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.09 Billion

USD

4.74 Billion

2025

2033

USD

3.09 Billion

USD

4.74 Billion

2025

2033

| 2026 –2033 | |

| USD 3.09 Billion | |

| USD 4.74 Billion | |

|

|

|

|

Segmentação do mercado de equipamentos florestais na América do Norte, por tipo (equipamentos de abate, equipamentos de extração, equipamentos de processamento no local, equipamentos de corte e carregamento e outros equipamentos), produto (desgalhadores, colhedoras-processadoras, trituradores de tocos, trituradores florestais, guinchos florestais, forwarders, carregadores de toras, colhedoras florestais, skidder, caminhões para transporte de madeira, picadores para energia e outros), fonte de energia (gasolina, bateria, elétrica com fio, sem fio e outras), material (metal, plástico, madeira, plásticos reciclados, resina sintética e outros), tipo de floresta (natural, artificial, plantações florestais), tipo de sistema (sistemas de árvore inteira, sistemas de madeira curta e sistemas de comprimento total da árvore), técnica (abate de árvores, desbaste e desgalheamento, descascamento, extração, fabricação de toras/corte transversal, escalonamento, classificação e empilhamento, carregamento e outras), canal de distribuição (distribuidores terceirizados, vendas B2B/diretas, comércio eletrônico, marca própria). Sites da Web, Lojas Especializadas e Outros) - Tendências e Previsões do Setor até 2033

Qual é o tamanho e a taxa de crescimento do mercado de equipamentos florestais na América do Norte?

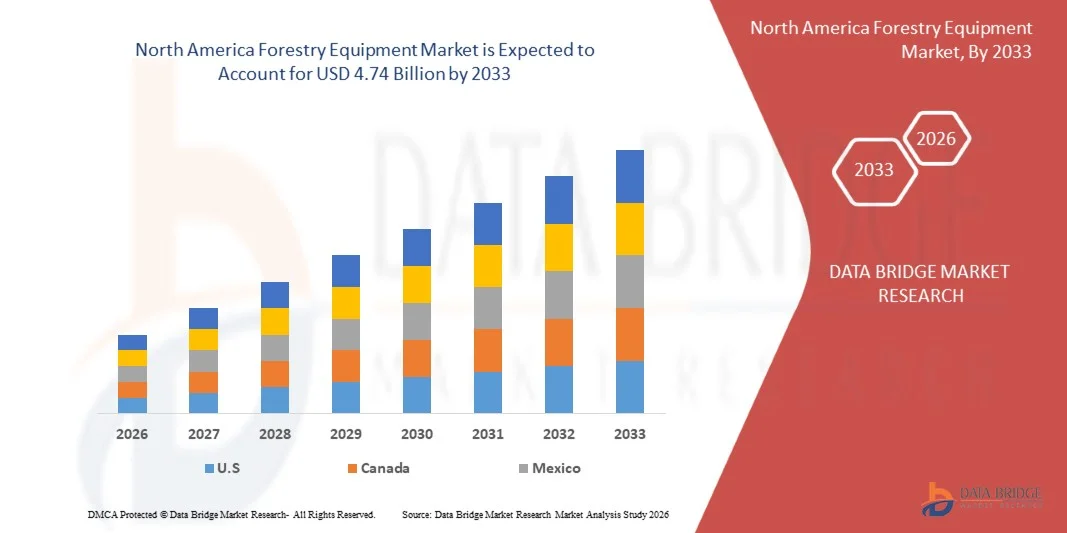

- O mercado de equipamentos florestais na América do Norte foi avaliado em US$ 3,09 bilhões em 2025 e deverá atingir US$ 4,74 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 5,5% durante o período de previsão.

- A elevada produção de madeira em tora exige equipamentos florestais para corte, processamento, elevação e carregamento, impulsionando assim o crescimento do mercado de equipamentos florestais.

- O elevado custo da colheita deve-se principalmente ao investimento inicial na aquisição das máquinas. Essas máquinas são veículos pesados e exigem altos custos de manutenção. O aumento do custo total de produção, portanto, limita o crescimento do mercado de equipamentos florestais.

Quais são os principais destaques do mercado de equipamentos florestais?

- Os avanços tecnológicos em equipamentos florestais têm levado a uma melhoria da produtividade nas instalações florestais. Isso contribuiu para o aumento da produtividade e a redução de custos, o que representa uma importante oportunidade para o crescimento do mercado de equipamentos florestais.

- O aumento de custos devido a vazamentos em sistemas hidráulicos representa um grande desafio para as empresas e, consequentemente, um obstáculo significativo para o crescimento do mercado de equipamentos florestais.

- Os EUA dominaram o mercado de equipamentos florestais da América do Norte, com uma participação de 36,2% na receita em 2025, impulsionados pela ampla adoção de soluções mecanizadas para o setor florestal, tecnologias avançadas de colheita de madeira e expansão de plantações comerciais em todo o país.

- Prevê-se que o Canadá e a Suécia registem a taxa de crescimento anual composta (CAGR) mais rápida, de 9,9%, entre 2026 e 2033, impulsionada pela mecanização das operações de exploração florestal, pela adoção de equipamentos de alta precisão e por programas governamentais de silvicultura sustentável.

- O segmento de equipamentos de abate dominou o mercado com uma participação de receita de 53,69% em 2025, impulsionado pela crescente demanda por colheita de árvores precisa e eficiente em florestas naturais e plantadas.

Escopo do relatório e segmentação do mercado de equipamentos florestais

|

Atributos |

Principais informações sobre o mercado de equipamentos florestais |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de equipamentos florestais?

“ Crescente demanda por equipamentos florestais sustentáveis e de alto desempenho ”

- O mercado de equipamentos florestais está testemunhando uma tendência importante de crescente adoção de máquinas ecológicas, energeticamente eficientes e tecnologicamente avançadas. Essa tendência é impulsionada pela crescente conscientização global sobre práticas florestais sustentáveis, eficiência operacional e conformidade ambiental, especialmente na América do Norte.

- Por exemplo, empresas como a Komatsu Forest e a Waratah estão desenvolvendo colheitadeiras e forwarders energeticamente eficientes, equipados com motores híbridos e telemática, para reduzir o consumo de combustível e as emissões de carbono.

- A crescente demanda por máquinas que melhoram a produtividade operacional, a precisão e a segurança está acelerando a adoção.

- Os fabricantes estão integrando automação avançada, monitoramento habilitado para IoT e tecnologias de assistência ao operador em equipamentos florestais para melhorar o desempenho.

- O aumento dos investimentos em pesquisa e desenvolvimento de materiais leves, componentes duráveis e sistemas hidráulicos de precisão está impulsionando a inovação de produtos.

- À medida que os operadores florestais priorizam a sustentabilidade, a segurança e a eficiência, espera-se que os equipamentos florestais modernos continuem a ser fundamentais para a modernização do setor.

Quais são os principais fatores que impulsionam o mercado de equipamentos florestais?

- A crescente ênfase global na exploração madeireira sustentável, na redução do desmatamento e no cumprimento das normas ambientais é um dos principais motores de crescimento.

- Por exemplo, em 2025, a Komatsu Forest e a CRANAB AB lançaram colheitadeiras e forwarders inteligentes equipados com telemática avançada para otimizar o consumo de combustível e reduzir as emissões.

- A crescente demanda por máquinas multifuncionais e de alta produtividade está impulsionando a adoção em toda a América do Norte.

- Os avanços tecnológicos em automação, colheita assistida por GPS e braços robóticos estão permitindo que os fabricantes produzam equipamentos mais precisos e eficientes.

- A crescente integração de máquinas com sistemas de monitoramento em tempo real, manutenção preditiva e gestão de frotas impulsiona ainda mais a expansão do mercado.

- Com investimentos contínuos em P&D, design sustentável e inovações focadas no operador, espera-se que o mercado de equipamentos florestais mantenha um forte ritmo de crescimento nos próximos anos.

Que fator está a dificultar o crescimento do mercado de equipamentos florestais?

- O elevado investimento de capital necessário para máquinas florestais avançadas limita a sua adoção, especialmente entre os pequenos operadores.

- Por exemplo, durante o período de 2024–2025, as flutuações nos custos de sistemas hidráulicos, componentes telemáticos e motores híbridos afetaram os volumes de produção e aquisição.

- A conformidade com as normas regulamentares relativas a emissões, segurança e sustentabilidade florestal aumenta a complexidade operacional e os custos.

- A falta de conhecimento e treinamento sobre máquinas florestais avançadas em mercados emergentes dificulta a adoção, principalmente de equipamentos tecnologicamente sofisticados.

- A concorrência de máquinas usadas ou recondicionadas e de importações de baixo custo cria pressão sobre os preços e afeta a penetração no mercado.

- Para superar esses desafios, os fabricantes estão investindo em produção com custos eficientes, programas de treinamento para operadores, opções de financiamento e design sustentável para garantir a oferta de equipamentos florestais de alta qualidade e ambientalmente responsáveis.

Como está segmentado o mercado de equipamentos florestais?

O mercado é segmentado com base no tipo, produto, fonte de energia, material, tipo de floresta, tipo de sistema, técnica e canal de distribuição .

• Por tipo

Com base no tipo, o mercado de equipamentos florestais é segmentado em equipamentos de abate, equipamentos de extração, equipamentos de processamento no local, equipamentos de corte e carregamento e outros equipamentos. O segmento de equipamentos de abate dominou o mercado com uma participação de receita de 53,69% em 2025, impulsionado pela crescente demanda por colheita de árvores precisa e eficiente em florestas naturais e plantadas. Essas máquinas, incluindo colhedoras-processadoras e motosserras, aumentam a velocidade operacional, a segurança e a produtividade.

Prevê-se que o segmento de equipamentos de extração apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionado pela crescente adoção de forwarders, skidders e guinchos de cabo que otimizam o transporte de madeira e reduzem a necessidade de mão de obra. A inovação contínua em automação, sistemas hidráulicos e telemática também contribui para a expansão do mercado.

• Por produto

Com base no produto, o mercado é segmentado em Desgalhadores, Colhedoras-processadoras, Destocadores, Trituradores, Pátios de Toras, Forwarders, Carregadores de Toras, Colheitadeiras, Skidder, Caminhões para Transporte de Madeira, Picadores para Energia e Outros. O segmento de Colheitadeiras dominou o mercado com uma participação de 46,5% da receita em 2025, devido à alta adoção em operações florestais de grande escala na América do Norte e no Caribe.

Prevê-se que o setor de picadores de madeira para energia apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionado pela crescente demanda por energia de biomassa e fontes de combustível renováveis. A mecanização avançada e os modelos de alta capacidade estão permitindo o processamento eficiente da madeira e a redução do impacto ambiental.

• Por fonte de energia

Com base na fonte de energia, o mercado é segmentado em Gasolina, Bateria, Elétrica com Fio, Sem Fio e Outras. O segmento de Gasolina dominou com 55,2% da receita em 2025, visto que os motores de combustão interna oferecem confiabilidade, alto torque e longas horas de operação para trabalhos florestais pesados.

Prevê-se que as máquinas elétricas e movidas a bateria apresentem o crescimento anual composto mais rápido entre 2026 e 2033, impulsionadas por inovações em sistemas híbridos e totalmente elétricos que reduzem as emissões de carbono, a poluição sonora e os custos de manutenção, especialmente em florestas ecologicamente sensíveis.

• Por material

Com base no material, o mercado é segmentado em Metal, Plástico, Madeira, Plásticos Reciclados, Resina Sintética e Outros. O segmento de Metal dominou com uma participação de 42,1% da receita em 2025, devido à durabilidade, alta resistência e longa vida útil dos componentes de aço e liga em máquinas florestais pesadas.

Prevê-se que os plásticos reciclados apresentem o crescimento mais rápido em termos de taxa composta de crescimento anual (CAGR) entre 2026 e 2033, impulsionados por iniciativas de sustentabilidade e pela integração de compósitos poliméricos leves e de alto desempenho em cabines de proteção, coberturas e componentes não estruturais.

• Por tipo de floresta

Com base no tipo de floresta, o mercado é segmentado em Florestas Naturais, Florestas Manufaturadas e Plantações Florestais. As florestas naturais dominaram o mercado com 53,6% da receita em 2025, por serem responsáveis pela maior extração de madeira em todo o mundo.

Prevê-se que as plantações de árvores apresentem o crescimento anual composto mais rápido durante o período de 2026 a 2033, impulsionadas por iniciativas governamentais para o manejo florestal sustentável, pelo aumento de projetos de reflorestamento e pela expansão da área de plantações comerciais para as indústrias de papel, celulose e madeira.

• Por tipo de sistema

Com base no tipo de sistema, o mercado é segmentado em Sistemas de Árvore Inteira, Sistemas de Madeira Curta e Sistemas de Comprimento Total da Árvore. O segmento de Sistemas de Madeira Curta dominou com 50,8% da receita em 2025, devido à facilidade de manuseio, menor quebra de toras e compatibilidade com equipamentos mecanizados de extração.

Prevê-se que os sistemas Full-Tree apresentem o crescimento anual composto mais rápido entre 2026 e 2033, impulsionados pela sua eficiência em operações de grande escala e pela integração com unidades modernas de trituração e processamento de biomassa.

• Por técnica

Com base na técnica, o mercado é segmentado em Abate de Árvores, Desbaste e Desgalhe, Descascamento, Extração, Fabricação de Toras/Corte Transversal, Escala, Classificação e Empilhamento, Carregamento e Outros. O Abate de Árvores dominou o segmento com 37,7% da receita em 2025, devido ao papel crucial do abate na produtividade geral.

Prevê-se que as técnicas de carregamento e triagem apresentem o crescimento anual composto mais rápido durante o período de 2026 a 2033, impulsionadas pela automação, robótica e soluções telemáticas para um manuseio e processamento de madeira mais rápidos, seguros e precisos.

• Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em Distribuidores Terceirizados, Vendas B2B/Diretas, Comércio Eletrônico, Sites de Marcas, Lojas Especializadas e Outros. O segmento de Vendas B2B/Diretas dominou com 57,5% da receita em 2025, visto que os fabricantes fornecem máquinas diretamente para grandes operadores florestais, garantindo personalização, suporte pós-venda e treinamento.

Prevê-se que o comércio eletrônico e as plataformas online apresentem o crescimento anual composto mais rápido entre 2026 e 2033, especialmente para operadores de pequena escala e aquisição de peças de reposição, impulsionados pela digitalização, entregas mais rápidas e serviços de suporte remoto.

Qual região detém a maior participação no mercado de equipamentos florestais?

- Os EUA dominaram o mercado de equipamentos florestais da América do Norte, com uma participação de 36,2% na receita em 2025, impulsionados pela ampla adoção de soluções mecanizadas para o setor florestal, tecnologias avançadas de colheita de madeira e expansão de plantações comerciais em todo o país.

- Incentivos governamentais para o manejo florestal sustentável, investimentos em pesquisa e desenvolvimento e a crescente demanda por madeira, celulose e produtos de biomassa impulsionam a liderança regional. Os principais atores do setor estão aproveitando inovações em corte automatizado, forwarders e máquinas de processamento para aumentar a produtividade e a eficiência operacional.

- A crescente urbanização, a demanda industrial e o foco em práticas florestais ecológicas e de precisão contribuem para uma maior adoção.

Análise do Mercado de Equipamentos Florestais no Canadá

Prevê-se que o Canadá e a Suécia registem a taxa de crescimento anual composta (CAGR) mais rápida, de 9,9%, entre 2026 e 2033, impulsionada pela mecanização das operações de exploração florestal, pela adoção de equipamentos de alta precisão e por programas governamentais de silvicultura sustentável. Os operadores utilizam colheitadeiras, tratores florestais e carregadeiras modernas para melhorar a produtividade e manter a conformidade ambiental. A expansão das plantações comerciais e o foco em práticas ecologicamente corretas impulsionam o crescimento do mercado a longo prazo.

Quais são as principais empresas no mercado de equipamentos florestais?

O setor de equipamentos florestais é liderado principalmente por empresas consolidadas, incluindo:

- Floresta de Komatsu (Japão)

- Waratah (Finlândia)

- CRANAB AB (Suécia)

- Rotobec (Canadá)

- Log Max AB (Suécia)

- Konrad Forsttechnik GmbH (Alemanha)

- Penz crane GmbH (Áustria)

- INDÚSTRIAS GUERRA, SA (Espanha)

- Palmse Mehaanikakoda (Estônia)

- Southstar Equipment (EUA)

- JSC AMKODOR, holding gestora (Bielorrússia)

- SP Maskiner (Suécia)

Quais são os desenvolvimentos recentes no mercado de equipamentos florestais na América do Norte?

- Em maio de 2025, a Forico, uma empresa florestal líder na Tasmânia, implantou câmeras de detecção de incêndios florestais com inteligência artificial em suas plantações, permitindo a triangulação em tempo real das características do fogo para alerta precoce e resposta rápida, aumentando a resiliência ao fogo e estabelecendo um padrão para a gestão digital de riscos no setor florestal.

- Em fevereiro de 2025, pesquisadores apresentaram um sistema baseado em aprendizado por reforço para manipulação autônoma de guindastes em operações florestais. O modelo de IA foi treinado em ambientes simulados para identificar e agarrar toras de madeira com 96% de precisão, representando um avanço significativo em automação, redução de mão de obra e segurança operacional em áreas florestais remotas.

- Em junho de 2023, a Volvo Construction Equipment (Volvo CE) anunciou o lançamento de sua nova Unidade de Negócios Compacta, estabelecendo uma divisão dedicada às suas máquinas e soluções compactas para impulsionar o crescimento e a rentabilidade, fortalecendo sua posição no crescente segmento de equipamentos compactos.

- Em maio de 2023, a Caterpillar lançou a MH3050, uma nova manipuladora de materiais projetada para desempenho superior, confiabilidade e conforto premium na cabine, apresentando um sistema eletro-hidráulico avançado para otimizar a eficiência energética e os tempos de ciclo, ampliando ainda mais a oferta de manipuladoras de materiais da Caterpillar para aplicações industriais e aumentando o potencial de lucro.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.