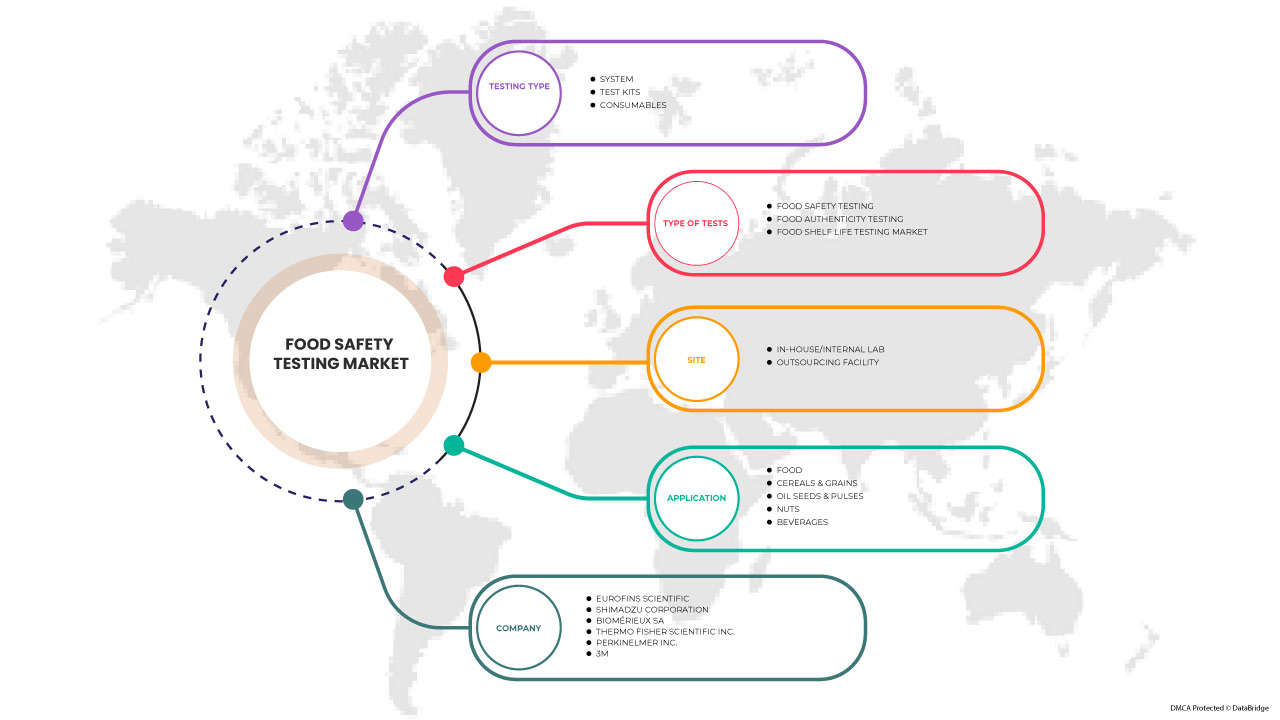

Mercado de testes de segurança alimentar da América do Norte, por tipo de teste (sistema, kits de teste, consumíveis e outros), tipo de testes (testes de segurança alimentar, por tipo de teste (sistema, kits de teste e consumíveis), tipo de testes (testes de segurança alimentar, Teste de autenticidade alimentar e teste de prazo de validade alimentar), local (laboratório interno/interno e instalação de outsourcing), aplicação (alimentos, cereais e grãos, sementes oleaginosas e leguminosas, frutos secos e bebidas) - Tendências do setor e previsão para 2030.

Análise e tamanho do mercado de testes de segurança alimentar da América do Norte

A segurança e a qualidade dos alimentos são grandes preocupações para a produção alimentar e para a indústria do retalho e da hotelaria. A qualidade e a higiene dos alimentos têm impacto na produtividade. Nos últimos anos, tanto a adulteração intencional como a não intencional tornaram-se de alta tecnologia e os laboratórios de testes podem ajudar a detetar estes adulterantes. A função mais importante dos laboratórios de testes de segurança alimentar é testar os alimentos quanto a adulterantes, agentes patogénicos, resíduos de pesticidas, contaminantes químicos como metais pesados, contaminantes microbianos, aditivos não permitidos, corantes, entre outros e antibióticos nos alimentos. Sem testes aos alimentos, os produtores e fabricantes de alimentos não podem garantir a presença de pesticidas, antibióticos, metais pesados e toxinas naturais, entre outros. Assim, é importante garantir a segurança alimentar.

A procura por testes alimentares é crescente, para os quais os fabricantes estão agora mais focados e envolvidos no lançamento de novos produtos, promoção, prémios, certificação e participação em eventos no mercado. Estas decisões estão, em última análise, a aumentar o crescimento do mercado.

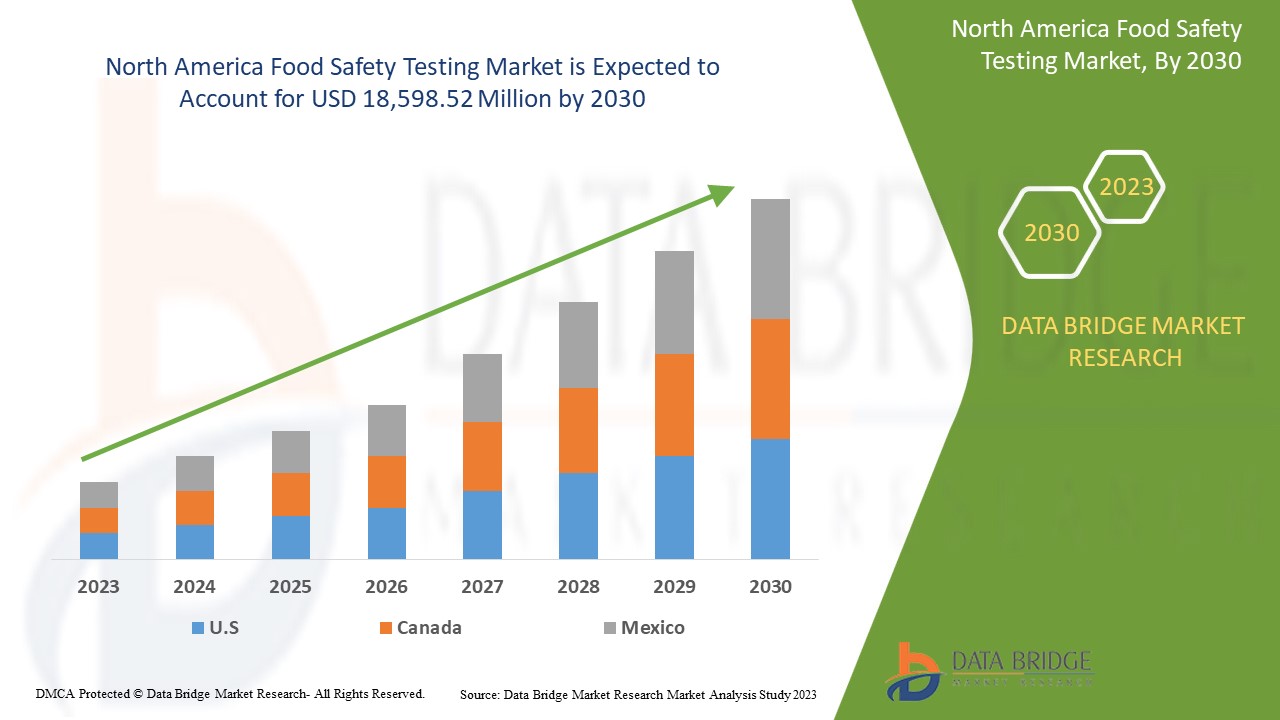

A Data Bridge Market Research analisa que o mercado norte-americano de testes de segurança alimentar deverá atingir um valor de 18.598,52 milhões de dólares até 2030, com um CAGR de 8,0% durante o período de previsão. O relatório de mercado de testes de segurança alimentar da América do Norte também abrange todos os parâmetros que afetam o mercado abrangido neste estudo de pesquisa que foram contabilizados, vistos em detalhes extensos, verificados através de pesquisa primária e analisados para obter os dados quantitativos e qualitativos finais.

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Ano histórico |

2021 (personalizável para 2020-1015) |

|

Unidades Quantitativas |

Receita em milhões de dólares |

|

Segmentos cobertos |

Por tipo de teste (sistema, kits de teste e consumíveis), tipo de testes (testes de segurança alimentar, testes de autenticidade de alimentos e testes de vida útil de alimentos), local (laboratório interno/interno e instalação de outsourcing), aplicação (alimentos, cereais e grãos , Oleaginosas e Leguminosas, Nozes e Bebidas) |

|

Países abrangidos |

EUA, Canadá e México |

|

Participantes do mercado abrangidos |

Eurofins Scientific, Shimadzu Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., FOSS, ALS, LexaGene, ROKA BIO SCIENCE, Biorex Food Diagnostics (BFD), Randox Food Diagnostics, Omega Diagnostics Group PLC, Romer Labs Division Holding GmbH, SGS Société Générale de Surveillance SA, 3M, Clear Labs, Inc., Invisible Sentinel, Ring Biotechnology Co Ltd., BIOMÉRIEUX SA, Agilent Technologies, Inc., NEOGEN Corporation, Spectro Analytical Labs Ltd. |

Definição de Mercado

O teste alimentar é a análise científica dos alimentos e do conteúdo dos alimentos. É feito para fornecer informações sobre as diversas características dos alimentos, incluindo a sua estrutura, composição e propriedades físico-químicas. Os testes de segurança alimentar incluem vários testes realizados por outros motivos, como testes de qualidade e controlo de qualidade do produto. Os testes de produtos alimentares podem ser feitos utilizando vários métodos altamente avançados para fornecer informações precisas sobre o valor nutricional e a segurança alimentar. Os métodos mais comuns de teste de produtos alimentares são os testes químicos analíticos, os testes sensoriais, os testes microbiológicos e as análises nutricionais. Os testes de produtos alimentares determinam o conteúdo de nutrientes utilizando laboratório, análise nutricional pronta a usar, software e análise nutricional online. A análise laboratorial é o método preferencial.

Os testes e análises alimentares são essenciais para a segurança alimentar, para garantir que os alimentos são seguros para consumo. Isto inclui nutrir a rede de laboratórios de análise alimentar, garantir a qualidade dos testes alimentares, investir nos recursos humanos e realizar atividades de vigilância e educação dos consumidores.

Dinâmica do mercado de testes de segurança alimentar da América do Norte

Esta secção trata da compreensão dos impulsionadores do mercado, vantagens, oportunidades, restrições e desafios. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Aumento do número de casos de doenças de origem alimentar

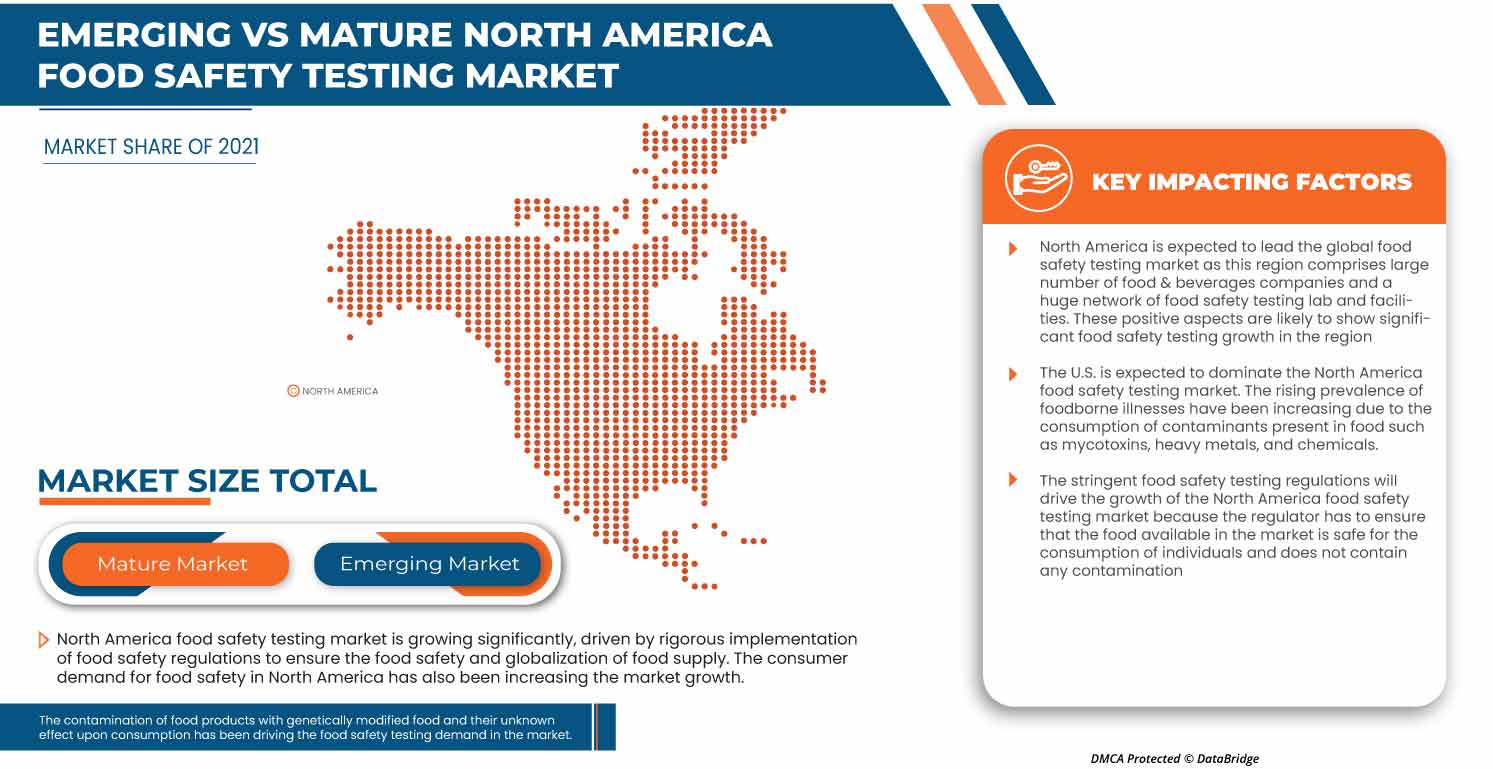

Espera-se que o número crescente de casos de doenças transmitidas por alimentos entre indivíduos de todo o mundo impulsione o mercado norte-americano de testes de segurança alimentar. O consumo de alimentos estragados, contaminados ou deteriorados com diversos microrganismos, como bactérias, fungos, parasitas, vírus e outros, é a principal causa de doenças de origem alimentar. Além disso, outros contaminantes, como micotoxinas, metais pesados e produtos químicos, também estão a levar ao aumento de casos de doenças de origem alimentar entre as pessoas. Estes casos crescentes aumentam significativamente a procura de kits, equipamentos e sistemas de testes alimentares em toda a região. A principal razão por detrás do aumento das doenças transmitidas pelos alimentos na indústria alimentar é o desconhecimento da força de trabalho, dos manipuladores e dos fabricantes de alimentos, uma vez que lhes falta conhecimento das tecnologias modernas, das boas práticas de fabrico (BPF), dos sistemas de análise de perigos e de pontos críticos de controlo (HACCP) e controlo de qualidade. A falta de conhecimento dos trabalhadores leva ao aumento da prevalência de doenças de origem alimentar.

- Aumento da consciencialização do consumidor em relação à segurança alimentar

Com o número crescente de casos de doenças de origem alimentar e problemas de intoxicação alimentar, mais consumidores estão a tomar consciência da importância de comer alimentos seguros e saudáveis. Isto levou a uma maior procura de alimentos seguros e de boa qualidade entre os indivíduos, gerando a procura de equipamentos de teste de segurança alimentar. A crescente incidência de doenças de origem alimentar levou os consumidores a introduzir mudanças vitais na sua dieta e estilo de vida, tornando-os mais preocupados com a segurança alimentar. Os consumidores estão conscientes dos seus alimentos e a segurança alimentar é a sua principal preocupação.

A segurança alimentar é importante para a saúde dos consumidores, de toda a indústria alimentar e das autoridades reguladoras. Com a crescente preocupação com a segurança alimentar entre os consumidores, o governo está também a tomar iniciativas para promover alimentos seguros junto dos consumidores.

- Aumento do número de recalls de produtos alimentares

A recolha de um produto é um pedido de um fabricante aos consumidores para devolver o produto após descobrir a presença de agentes patogénicos ou problemas de segurança no produto que possam colocar a vida do consumidor em risco. O recall do produto pode colocar o fabricante em risco de ação legal. O aumento dos casos de recolha de produtos em diferentes marcas e empresas devido à contaminação dos alimentos, seja com um agente patogénico, metais pesados ou determinados produtos químicos, está a levar a uma maior procura de equipamentos e sistemas de testes de segurança alimentar. A contaminação dos alimentos pode levar a graves problemas de saúde para os consumidores, tendo em maior conta os kits e os sistemas de segurança alimentar. Houve muitos casos de recolhas de produtos de diferentes fabricantes.

Restrições

- Falta de instalações de infraestruturas para testes de alimentos

O número crescente de recolhas de produtos, casos de contaminação alimentar, incidentes de intoxicação alimentar e a crescente sensibilização dos consumidores levaram ao aumento da procura de instalações de segurança alimentar em toda a região. No entanto, a falta de infraestruturas nos laboratórios de testes alimentares está a dificultar o crescimento do mercado de testes de segurança alimentar na América do Norte. Para obter resultados precisos para os testes alimentares, devem ser mantidas boas condições de higiene nos laboratórios, mas os laboratórios não estão bem desenvolvidos em termos de infra-estruturas, água potável, formação de pessoal, tecnologias modernas para garantia de qualidade, operações de embalagem e procedimentos de higienização padrão. Além disso, a implementação de controlos microbiológicos num programa GMP ou HACCP está basicamente fora de questão devido às condições insuficientes ou inadequadas da planta.

- Falta de conhecimento técnico nas pequenas empresas

As pequenas empresas e os fabricantes de produtos alimentares não dispõem de informação suficiente sobre os novos métodos, serviços e programas de segurança alimentar de alta tecnologia. Assim, não conseguem cumprir os requisitos específicos de segurança alimentar. Por conseguinte, a falta de competências e conhecimentos, especialmente nos países em desenvolvimento, afectará a avaliação e inspecção eficazes das operações alimentares. A experiência e o conhecimento técnico são essenciais para implementar tais procedimentos. Assim, o governo deve realizar certos programas para educar os trabalhadores, de modo a que se possam alcançar testes máximos de segurança alimentar e, assim, de segurança. A falta de experiência e de conhecimentos técnicos, especialmente nas pequenas empresas, levará a alguma contaminação grave dos produtos alimentares e das bebidas, o que resultará em doenças de origem alimentar e poderá causar problemas graves. A falta de experiência e conhecimento técnico pode prejudicar a indústria de testes de segurança alimentar. A crescente automação na indústria exige pessoas qualificadas e tecnicamente sólidas para operar as máquinas e as pequenas empresas não conseguem encontrar profissionais qualificados para o mesmo.

Oportunidades

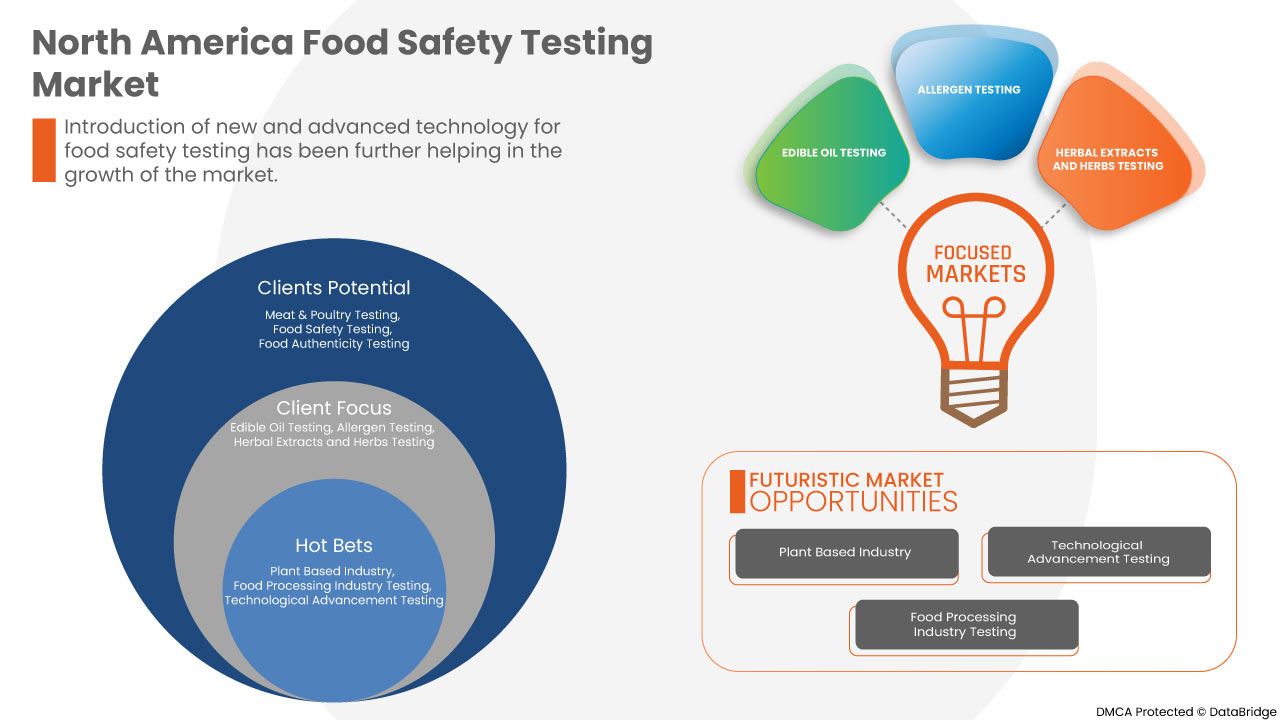

- Crescente procura e popularidade por alimentos com rótulo limpo

Os produtos alimentares com rótulo limpo contêm ingredientes alimentares que são mais naturais e menos processados. Os consumidores estão a optar por opções alimentares saudáveis e limpas para viver estilos de vida mais saudáveis, aumentando assim a procura por testes de segurança alimentar. Hoje em dia, os consumidores estão cada vez mais inclinados para alimentos com rótulos limpos, livres de conservantes ou aditivos, para continuarem um determinado estilo de vida. Além disso, a consciencialização relativamente à promoção de um ambiente sustentável através da utilização de produtos com rótulo limpo está a impulsionar o crescimento do mercado. Com a crescente procura por alimentos com rótulo limpo ou produtos alimentares com rótulo seguro, a procura por testes de segurança alimentar também está a aumentar à medida que os fabricantes oferecem produtos com rótulos alimentares seguros para garantir aos consumidores que os produtos alimentares estão livres de quaisquer agentes patogénicos nocivos, micotoxinas, metais pesados e produtos químicos.

Desafios

- Falta de um padrão uniforme de segurança de qualidade

Nos últimos anos, a procura de produtos alimentares limpos e seguros aumentou subitamente entre os consumidores, o que levou ao desenvolvimento de diferentes e novos padrões de segurança alimentar por parte dos organismos governamentais. Como resultado, o número de normas nacionais para a segurança alimentar aumentou e confundiu. Além disso, os regulamentos de segurança alimentar diferem de país para país, uma vez que os alimentos são considerados seguros para consumo num país, mas não seguros para importação para outros países. Por conseguinte, a necessidade de harmonizar os padrões de segurança alimentar está a aumentar. O aumento do número de iniciativas tomadas pelas autoridades governamentais para dar uniformidade aos padrões de segurança alimentar ajudará a enfrentar o grande desafio que se coloca ao mercado norte-americano de testes de segurança alimentar.

Desenvolvimentos recentes

- Em maio, a Biomerieux adquiriu a Specific Diagnostics, uma empresa privada que desenvolveu um teste de sensibilidade antimicrobiana. Ajudou a empresa a expandir a sua liderança a nível global

- Em abril, a FOSS anunciou o lançamento de modelos de adulteração direcionados, permitindo que as instalações de teste de leite programem instrumentos de teste para rastrear amostras de leite cru em busca de fontes conhecidas de adulteração de leite. Os novos modelos complementam um modelo existente não direcionado que permite a deteção de quaisquer anormalidades

Âmbito do mercado de testes de segurança alimentar da América do Norte

O mercado norte-americano de testes de segurança alimentar está segmentado em tipo de teste, tipo de teste, local e aplicação. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nas indústrias e fornecer aos utilizadores uma valiosa visão geral do mercado e insights de mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo de teste

- Sistema

- Kits de teste

- Consumíveis

Com base no tipo de teste, o mercado norte-americano de testes de segurança alimentar está segmentado em sistemas, kits de teste e consumíveis.

Tipo de testes

- Testes de Segurança Alimentar

- Teste de autenticidade alimentar

- Teste de vida útil dos alimentos

Com base no tipo de testes, o mercado norte-americano de testes de segurança alimentar está segmentado em testes de segurança alimentar, testes de autenticidade alimentar e testes de prazo de validade alimentar.

Local

- Laboratório interno/interno

- Instalação de outsourcing

Com base no local, o mercado de testes de segurança alimentar da América do Norte está segmentado em laboratório interno/interno e instalações de terceiros.

Aplicação

- Comida

- Cereais e Grãos

- Sementes oleaginosas e leguminosas

- Nozes

- Bebidas

Com base na aplicação, o mercado de testes de segurança alimentar da América do Norte está segmentado em alimentos, cereais e grãos, sementes oleaginosas e leguminosas, nozes e bebidas.

Análise/perspetivas regionais do mercado de testes de segurança alimentar da América do Norte

O mercado de testes de segurança alimentar da América do Norte é analisado e são fornecidos insights e tendências do tamanho do mercado por país, tipo de teste, tipo de teste, local e aplicação, conforme mencionado acima.

Alguns países abordados no relatório de mercado de testes de segurança alimentar da América do Norte são os EUA, o Canadá e o México.

Prevê-se que os EUA dominem o mercado norte-americano de testes de segurança alimentar devido ao aumento dos casos de doenças de origem alimentar.

A secção do relatório sobre países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a jusante e a montante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas norte-americanas e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas domésticas e das rotas comerciais, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Cenário competitivo e análise da quota de mercado dos testes de segurança alimentar na América do Norte

O panorama competitivo do mercado de testes de segurança alimentar da América do Norte fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produtos, largura e amplitude do produto, domínio da aplicação. Os dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado norte-americano de testes de segurança alimentar.

Alguns dos principais players que operam no mercado norte-americano de testes de segurança alimentar são a Eurofins Scientific, Shimadzu Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., FOSS, ALS, LexaGene, ROKA BIO SCIENCE, Biorex Food Diagnostics (BFD) , Randox Food Diagnostics, Omega Diagnostics Group PLC, Romer Labs Division Holding GmbH, SGS Société Générale de Surveillance SA, 3M, Clear Labs, Inc., Invisible Sentinel, Ring Biotechnology Co Ltd., BIOMÉRIEUX SA, Agilent Technologies, Inc., e NEOGEN Corporation entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FOOD SAFETY TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF FOOD SAFETY TESTING TECHNOLOGIES

4.2 EMERGING TREND ANALYSIS

4.3 GROWING FOOD ADULTERATION CASES

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 INDUSTRY TRENDS IN NORTH AMERICA FOOD SAFETY TESTING MARKET

4.5.1 INCREASING AUTOMATION IN FOOD TESTING

4.5.2 RISING TREND OF FOODBORNE PATHOGEN TESTING

4.5.3 INCREASING TREND OF ENVIRONMENTAL MONITORING

4.5.4 FOOD TESTING WITH HIGH ACCURACY AND PRECISION TECHNOLOGY

4.5.5 RISING TREND OF GMO TESTING

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 PRODUCTS/SERVICES

4.6.2 DISTRIBUTION

4.6.3 END USERS

4.7 TECHNOLOGICAL ADVANCEMENTS IN THE NORTH AMERICA FOOD SAFETY TESTING MARKET

4.8 INDUSTRY TRENDS IN NORTH AMERICA FOOD SAFETY TESTING MARKET

4.8.1 INTRODUCTION OF ROBOTICS FOR FOOD CONTAMINANT DETECTION

4.8.2 DEVELOPMENT OF BIO-SENSOR-BASED TECHNIQUES FOR PATHOGEN DETECTION

4.8.3 TECHNOLOGICAL ADVANCEMENT IN FOOD CHEMICAL AND MYCOTOXIN TESTING

4.8.4 INTRODUCTION OF DNA FINGERPRINTING TECHNIQUES

5 REGULATIONS ON NORTH AMERICA FOOD SAFETY TESTING MARKET

5.1 FOOD AND BEVERAGES SAFETY AND QUALITY REGULATIONS

5.2 FOODBORNE ILLNESS OUTBREAKS AND RELEVANT ACTIONS TAKEN BY GOVERNMENT BODIES

5.3 CHANGES IN NORTH AMERICA FOOD SAFETY REGULATIONS AND RECENTLY FORMED LAWS FOR FOOD SAFETY TESTING BY GOVERNMENT BODIES

5.4 LAWSUITS RELATED TO FOOD SAFETY TESTING

5.5 FOOD PRODUCTS WITHDRAWALS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN THE NUMBER OF FOODBORNE ILLNESS CASES

6.1.2 INCREASE IN CONSUMER AWARENESS REGARDING FOOD SAFETY

6.1.3 STRINGENT SAFETY RULES AND REGULATIONS FOR FOOD

6.1.4 RISE IN THE NUMBER OF FOOD PRODUCT RECALLS

6.2 RESTRAINTS

6.2.1 LACK OF INFRASTRUCTURE FACILITIES FOR FOOD TESTING

6.2.2 LACK OF TECHNICAL EXPERTISE IN SMALL ENTERPRISES

6.2.3 HIGH INITIAL INVESTMENT FOR INSTALLATION OF FOOD TESTING EQUIPMENT

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND AND POPULARITY FOR CLEAN-LABEL FOOD

6.3.2 INCREASE IN GOVERNMENT INITIATIVES TO MONITOR FOOD SAFETY

6.3.3 GROWING AUTOMATION IN THE FOOD TESTING INDUSTRY

6.4 CHALLENGES

6.4.1 LACK OF UNIFORM QUALITY FOOD SAFETY STANDARD

6.4.2 INCREASE IN THE NUMBER OF FALSE FOOD TESTING RESULT CASES

7 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TESTING TYPE

7.1 OVERVIEW

7.2 SYSTEM

7.2.1 HYBRIDIZATION BASED

7.2.1.1 POLYMERASE CHAIN REACTION(PCR)

7.2.1.2 MIICROARRAYS

7.2.1.3 GENE AMPLIFIERS

7.2.1.4 SEQUNCES

7.2.2 CHROMATOGRAPHY BASED

7.2.2.1 LIQUID CHROMATOGRAPHY

7.2.2.2 GAS CHROMATOGRAPHY

7.2.2.3 COLUMN CHROMATOGRAPHY

7.2.2.4 THIN LAYER CHROMATOGRAPHY

7.2.2.5 PAPER CHROMATOGRAPHY

7.2.3 SPECTROMETRY BASED

7.2.4 IMMUNOASSAY BASED

7.2.5 BIOSENSOR/BIOCHIP

7.2.6 NMR TECHNIQUE/MOLECULAR SPECTROMETRY

7.2.7 ISOTOPE METHODS

7.3 TEST KITS

7.4 CONSUMABLES

8 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY SITE

8.1 OVERVIEW

8.2 IN-HOUSE/INTERNAL LAB

8.3 OUTSOURCING FACILITY

9 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST

9.1 OVERVIEW

9.2 FOOD SAFETY TESTING

9.2.1 ALLERGEN TESTING

9.2.1.1 PEANUT & SOY

9.2.1.2 GLUTEN

9.2.1.3 MILK

9.2.1.4 EGG

9.2.1.5 TREE NUTS

9.2.1.6 SEAFOOD

9.2.1.7 OTHERS

9.2.2 PATHOGENS TESTING

9.2.2.1 SALMONELLA SPP

9.2.2.2 E. COLI

9.2.2.3 LISTERIA SPP

9.2.2.4 LISTERIA

9.2.2.5 VIBRIO SPP

9.2.2.6 CAMPYLOBACTER

9.2.2.7 OTHERS

9.2.3 HEAVY METALS TESTING

9.2.3.1 LEAD

9.2.3.2 ARSENIC

9.2.3.3 CADMIUM

9.2.3.4 MERCURY

9.2.3.5 OTHERS

9.2.4 NUTRITIONAL LABELING

9.2.5 GMO TESTING

9.2.5.1 STACKED

9.2.5.2 HERBICIDE TOLERANCE

9.2.5.3 INSECT RESISTANCE

9.2.6 PESTICIDES TESTING

9.2.6.1 INSECTICIDES

9.2.6.2 HERBICIDES

9.2.6.3 FUNGICIDES

9.2.6.4 OTHERS

9.2.7 MYCOTOXINS TESTING

9.2.7.1 AFLATOXINS

9.2.7.2 OCHRATOXINS

9.2.7.3 PATULIN

9.2.7.4 FUMONISINS

9.2.7.5 TRICHOTHECENES

9.2.7.6 DEOXYNIVALENOL

9.2.7.7 ZEARALENONE

9.2.8 ORGANIC CONTAMINANTS TESTING

9.3 FOOD SHELF LIFE TESTING

9.3.1 BY TYPE

9.3.1.1 CHEMICAL TESTS

9.3.1.2 ACIDITY LEVELS

9.3.1.3 RANCIDITY

9.3.1.3.1 PEROXIDE VALUE (PV)

9.3.1.3.2 FREE FATTY ACIDS (FFA)

9.3.1.3.3 P-ANISIDINE (P-AV)

9.3.2 ORGANOLEPTIC AND APPEARANCE

9.3.2.1 COLOUR

9.3.2.2 TEXTURE

9.3.2.3 AROMA

9.3.2.4 TASTE

9.3.2.5 PACKAGING

9.3.2.6 STRATIFICATION

9.3.3 INGREDIENT ACTIVITY

9.3.4 BROWNING

9.3.4.1 ENZYMATIC BROWNING

9.3.4.2 CHEMICAL BROWNING

9.3.5 NUTRIENT STABILITY

9.3.6 BY METHOD

9.3.6.1 REAL-TIME SHELF LIFE TESTING

9.3.6.2 ACCELERATED SHELF LIFE TESTING

9.3.7 BY PACKED FOOD CONDITION

9.3.7.1 FROZEN (-15°C TO -20°C)

9.3.7.2 REFRIGERATED (2°C TO 8°C)

9.3.7.3 AMBIENT (25°C/60%RH)

9.3.7.4 INTERMEDIATE (30°C/65%RH)

9.3.7.5 ACCELERATED (40°C/75%RH)

9.3.7.6 TROPICAL (30°C/75%RH)

9.3.7.7 OTHERS

9.4 FOOD AUTHENTICITY TESTING

9.4.1 ADULTERATION TESTS

9.4.2 ORGANIC

9.4.3 ALLERGEN TESTING

9.4.4 MEAT SPECIATION

9.4.5 GMO TESTING

9.4.6 HALAL VERIFICATION

9.4.7 KOSHER VERIFICATION

9.4.8 PROTECTED GEOGRAPHICAL INDICATION (PGI)

9.4.9 PROTECTED DENOMINATION OF ORIGIN (PDO)

9.4.10 FALSE LABELING

10 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD

10.2.1 EDIBLE OILS

10.2.1.1 EDIBLE OILS, BY TYPE

10.2.1.1.1 SUNFLOWER OIL

10.2.1.1.2 PEANUT OIL

10.2.1.1.3 SOYBEAN OIL

10.2.1.1.4 OLIVE OIL

10.2.1.1.5 COCONUT OIL

10.2.1.1.6 OTHERS

10.2.1.2 EDIBLE OILS, BY TESTING TYPE

10.2.1.2.1 FOOD SAFETY TESTING

10.2.1.2.2 FOOD AUTHENTICITY TESTING

10.2.1.2.3 FOOD SHELF LIFE TESTING

10.2.2 SPICES

10.2.2.1 SPICES, BY TESTING TYPE

10.2.2.1.1 FOOD SAFETY TESTING

10.2.2.1.2 FOOD AUTHENTICITY TESTING

10.2.2.1.3 FOOD SHELF LIFE TESTING

10.2.3 DAIRY PRODUCTS

10.2.3.1 DAIRY PRODUCTS, BY TYPE

10.2.3.1.1 CHEESE

10.2.3.1.2 PROCESSED CHEESES

10.2.3.1.3 ICE CREAM

10.2.3.1.4 YOGURT

10.2.3.1.5 MILK DESSERT

10.2.3.1.6 PUDDING

10.2.3.1.7 CUSTARD

10.2.3.1.8 CHEESE BASED DESSERTS

10.2.3.1.8.1 CHEESE CAKE

10.2.3.1.8.2 CHEESE CREAM

10.2.3.1.8.3 CHEESE PUDDING

10.2.3.1.8.4 OTHERS

10.2.3.1.9 OTHERS

10.2.3.2 DAIRY PRODUCTS, BY TESTING TYPE

10.2.3.2.1 FOOD SAFETY TESTING

10.2.3.2.2 FOOD AUTHENTICITY TESTING

10.2.3.2.3 FOOD SHELF LIFE TESTING

10.2.4 CONFECTIONARY

10.2.4.1 CONFECTIONARY, BY TYPE

10.2.4.1.1 CANDY BARS

10.2.4.1.2 JAMS AND JELLIES

10.2.4.1.3 JELLY CANDIES

10.2.4.1.4 MARMALADES

10.2.4.1.5 FRUIT JELLY DESSERT

10.2.4.1.6 MERINGUES

10.2.4.1.7 OTHERS

10.2.4.2 CONFECTIONARY, BY TESTING TYPE

10.2.4.2.1 FOOD SAFETY TESTING

10.2.4.2.2 FOOD AUTHENTICITY TESTING

10.2.4.2.3 FOOD SHELF LIFE TESTING

10.2.5 HERBAL EXTRACTS AND HERBS

10.2.5.1 HERBAL EXTRACTS AND HERBS, BY TESTING TYPE

10.2.5.1.1 FOOD SAFETY TESTING

10.2.5.1.2 FOOD AUTHENTICITY TESTING

10.2.5.1.3 FOOD SHELF LIFE TESTING

10.2.6 MEAT & POULTRY PRODUCTS

10.2.6.1 MEAT & POULTRY PRODUCTS, BY TYPE

10.2.6.1.1 CHICKEN

10.2.6.1.1.1 FROZEN

10.2.6.1.1.2 FRESH

10.2.6.1.2 PORK

10.2.6.1.2.1 FROZEN

10.2.6.1.2.2 FRESH

10.2.6.1.3 SEAFOOD

10.2.6.1.3.1 FROZEN

10.2.6.1.3.2 FRESH

10.2.6.1.4 BEEF

10.2.6.1.4.1 FROZEN

10.2.6.1.4.2 FRESH

10.2.6.1.5 LAMB

10.2.6.1.5.1 FROZEN

10.2.6.1.5.2 FRESH

10.2.6.1.6 OTHERS

10.2.6.1.6.1 FROZEN

10.2.6.1.6.2 FRESH

10.2.6.2 MEAT & POULTRY PRODUCTS, BY TESTING TYPE

10.2.6.2.1 FOOD SAFETY TESTING

10.2.6.2.2 FOOD AUTHENTICITY TESTING

10.2.6.2.3 FOOD SHELF LIFE TESTING

10.2.7 PROCESSED FOOD

10.2.7.1 PROCESSED FOOD, BY TYPE

10.2.7.1.1 CANNED FRUITS & VEGETABLES

10.2.7.1.2 JAMS, PRESERVES & MARMALADES

10.2.7.1.3 FRUIT & VEGETABLE PUREE

10.2.7.1.4 SAUCES, DRESSINGS AND CONDIMENTS

10.2.7.1.5 READY MEALS

10.2.7.1.6 PICKLES

10.2.7.1.7 SOUPS

10.2.7.2 PROCESSED FOOD, BY TESTING TYPE

10.2.7.2.1 FOOD SAFETY TESTING

10.2.7.2.2 FOOD AUTHENTICITY TESTING

10.2.7.2.3 FOOD SHELF LIFE TESTING

10.2.8 HONEY

10.2.8.1 HONEY, BY TESTING TYPE

10.2.8.1.1 FOOD SAFETY TESTING

10.2.8.1.2 FOOD AUTHENTICITY TESTING

10.2.8.1.3 FOOD SHELF LIFE TESTING

10.2.9 BABY FOOD

10.2.9.1 BABY FOOD, BY TESTING TYPE

10.2.9.1.1 FOOD SAFETY TESTING

10.2.9.1.2 FOOD AUTHENTICITY TESTING

10.2.9.1.3 FOOD SHELF LIFE TESTING

10.2.10 PLANT BASED MEAT AND POULTRY ALTERNATIVES

10.2.10.1 PLANT BASED MEAT AND POULTRY ALTERNATIVES, BY TYPE

10.2.10.1.1 BURGER & PATTIES

10.2.10.1.2 SAUSAGES

10.2.10.1.3 STRIPS & NUGGETS

10.2.10.1.4 MEATBALLS

10.2.10.1.5 TEMPEH

10.2.10.1.6 TOFU

10.2.10.1.7 SEITEN

10.2.10.1.8 OTHERS

10.2.10.2 PLANT BASED MEAT AND POULTRY ALTERNATIVES, BY TESTING TYPE

10.2.10.2.1 FOOD SAFETY TESTING

10.2.10.2.2 FOOD AUTHENTICITY TESTING

10.2.10.2.3 FOOD SHELF LIFE TESTING

10.2.11 TOBACCO

10.2.11.1 TOBACCO, BY TESTING TYPE

10.2.11.1.1 FOOD SAFETY TESTING

10.2.11.1.2 FOOD AUTHENTICITY TESTING

10.2.11.1.3 FOOD SHELF LIFE TESTING

10.2.12 CBD PRODUCTS

10.2.12.1 CBD PRODUCTS, BY TESTING TYPE

10.2.12.1.1 FOOD SAFETY TESTING

10.2.12.1.2 FOOD AUTHENTICITY TESTING

10.2.12.1.3 FOOD SHELF LIFE TESTING

10.3 CEREALS & GRAINS

10.3.1 CEREALS & GRAINS, BY TYPE

10.3.1.1 WHEAT

10.3.1.2 MAIZE

10.3.1.3 BARLEY

10.3.1.4 RICE

10.3.1.5 OAT

10.3.1.6 SORGHUM

10.3.1.7 OTHERS

10.3.2 CEREALS & GRAINS, BY TESTING TYPE

10.3.2.1 FOOD SAFETY TESTING

10.3.2.2 FOOD AUTHENTICITY TESTING

10.3.2.3 FOOD SHELF LIFE TESTING

10.4 OIL SEEDS & PULSES

10.4.1 OIL SEEDS & PULSES, BY TYPE

10.4.1.1 GRAM

10.4.1.2 PEA

10.4.1.3 LENTILS

10.4.1.4 SUNFLOWER

10.4.1.5 SOYABEAN

10.4.1.6 GROUNDNUT

10.4.1.7 SESAME

10.4.1.8 COTTON SEED

10.4.1.9 PALM

10.4.1.10 OTHERS

10.4.2 OIL SEEDS & PULSES, BY TESTING TYPE

10.4.2.1 FOOD SAFETY TESTING

10.4.2.2 FOOD AUTHENTICITY TESTING

10.4.2.3 FOOD SHELF LIFE TESTING

10.5 NUTS

10.5.1 NUTS, BY TYPE

10.5.1.1 ALMOND

10.5.1.2 WALNUT

10.5.1.3 CASHEW NUT

10.5.1.4 BRAZIL NUT

10.5.1.5 MACADAMIA NUT

10.5.1.6 OTHERS

10.5.2 NUTS, BY TESTING TYPE

10.5.2.1 FOOD SAFETY TESTING

10.5.2.2 FOOD AUTHENTICITY TESTING

10.5.2.3 FOOD SHELF LIFE TESTING

10.6 BEVERAGES

10.6.1 BEVERAGES, BY TYPE

10.6.1.1 NON-ALCOHOLIC

10.6.1.1.1 CARBONATED DRINKS

10.6.1.1.2 MINERAL WATER

10.6.1.1.3 COFFEE

10.6.1.1.4 JUICES

10.6.1.1.5 SMOOTHIES

10.6.1.1.6 TEA

10.6.1.1.7 PLANT-BASED MILK

10.6.1.1.7.1 SOY MILK

10.6.1.1.7.2 ALMOND MILK

10.6.1.1.7.3 OAT MILK

10.6.1.1.7.4 CASHEW MILK

10.6.1.1.7.5 RICE MILK

10.6.1.1.7.6 OTHERS

10.6.1.1.8 SPORTS DRINKS

10.6.1.1.9 NUTRITIONAL DRINKS

10.6.1.1.10 OTHERS

10.6.1.2 ALCOHOLIC

10.6.1.2.1 BEER

10.6.1.2.2 WINE

10.6.1.2.3 WHISKY

10.6.1.2.4 VODKA

10.6.1.2.5 TEQUILA

10.6.1.2.6 GIN

10.6.1.2.7 BRANDS

10.6.1.2.8 OTHERS

10.6.1.3 BEVERAGES, BY TESTING TYPE

10.6.1.3.1 FOOD SAFETY TESTING

10.6.1.3.2 FOOD AUTHENTICITY TESTING

10.6.1.3.3 FOOD SHELF LIFE TESTING

11 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 COMPANY LANDSCAPE: NORTH AMERICA FOOD SAFETY TESTING MARKET

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 EUROFINS SCIENTIFIC

14.1.1 COMPANY SNAPSHOT

14.1.2 RECENT FINANCIALS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 SHIMADZU CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 BIOMÉRIEUX SA

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 THERMO FISHER SCIENTIFIC INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 RECENT FINANCIALS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 PERKINELMER INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 3M

14.6.1 COMPANY SNAPSHOT

14.6.2 RECENT FINANCIALS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AGILENT TECHNOLOGIES, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 ALS

14.8.1 COMPANY SNAPSHOT

14.8.2 RECENT FINANCIALS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 BIOREX FOOD DIAGNOSTICS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 CLEAR LABS, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 FOSS

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 INVISIBLE SENTINEL

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 LEXAGENE

14.13.1 COMPANY SNAPSHOT

14.13.2 RECENT FINANCIALS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 NEOGEN CORPORATION

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 NOACK GROUP

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 OMEGA DIAGNOSTICS GROUP PLC

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 RANDOX FOOD DIAGNOSTICS

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 RING BIOTECHNOLOGY CO LTD

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 ROKA BIO SCIENCE

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 ROMER LABS DIVISION HOLDING GMBH

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA

14.21.1 COMPANY SNAPSHOT

14.21.2 RECENT FINANCIALS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENTS

14.22 SPECTRO ANALYTICAL LABS LTD.

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SYSTEM IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA SYSTEM IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA TEST KITS IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CONSUMABLES IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA IN-HOUSE IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA OUTSOURCING FACILITY IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA FOOD IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA FOOD IN FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA EDIBLE OILS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA EDIBLE OILS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CONFECTIONARY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA CONFECTIONARY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA HERBAL EXTRACTS AND HERBS PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA MEAT AND POULTRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA CHICKEN IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA BEEF IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA OTHERS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA MEAT AND POULTRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA PROCESSED FOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA PROCESSED FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA PLANT BASED MEAT AND POULTRY ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA PLANT BASED MEAT AND POULTRY ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA CEREALS, GRAINS & PULSES IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA CEREALS, GRAINS & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA CEREALS AND GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA OIL SEEDS & PULSES IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA OILSEEDS & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA OIL SEEDS AND PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA PLANT-BASED MILK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA ALCOHOLIC BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 74 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA SYSTEM IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 NORTH AMERICA PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA FOOD SHELF LIFE TESTING, IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 NORTH AMERICA ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 91 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA FOOD IN SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 99 NORTH AMERICA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 101 NORTH AMERICA MEAT & POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA CHICKEN IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 NORTH AMERICA PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 NORTH AMERICA BEEF IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 NORTH AMERICA OTHER IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA MEAT AND POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 NORTH AMERICA HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 111 NORTH AMERICA HERBAL EXTRACTS AND HERBS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 113 NORTH AMERICA BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 NORTH AMERICA EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 117 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 NORTH AMERICA PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 NORTH AMERICA CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 NORTH AMERICA OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 NORTH AMERICA ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 NORTH AMERICA NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA PLANT-BASED MILK IN NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 131 U.S. FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 132 U.S. SYSTEM IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 U.S. HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 U.S. CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 U.S. FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 136 U.S. FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 U.S. ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 U.S. PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 U.S. GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 140 U.S. MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 U.S. HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 U.S. PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 143 U.S. FOOD SHELF LIFE TESTING, IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 U.S. ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 145 U.S. RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 U.S. BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 U.S. FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 148 U.S. FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 149 U.S. FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 U.S. FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 151 U.S. FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 152 U.S. FOOD IN SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 153 U.S. DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 U.S. CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 U.S. DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 156 U.S. CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 157 U.S. CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 158 U.S. MEAT & POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 U.S. CHICKEN IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 U.S. PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 U.S. SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 162 U.S. BEEF IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 U.S. LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 U.S. OTHER IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 U.S. MEAT AND POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 U.S. HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 167 U.S. SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 168 U.S. HERBAL EXTRACTS AND HERBS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 169 U.S. TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 170 U.S. BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 171 U.S. EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 U.S. EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 173 U.S. CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 174 U.S. PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 175 U.S. PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 176 U.S. PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 U.S. PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 178 U.S. CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 179 U.S. CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 180 U.S. OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 U.S. OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 182 U.S. NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 183 U.S. NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 184 U.S. BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 U.S. ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 U.S. NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 187 U.S. PLANT-BASED MILK IN NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 U.S. BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 189 CANADA FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 190 CANADA SYSTEM IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 191 CANADA HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 CANADA CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 CANADA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 194 CANADA FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 CANADA ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 196 CANADA PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 CANADA GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 CANADA MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 CANADA HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 CANADA PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 CANADA FOOD SHELF LIFE TESTING, IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 CANADA ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 CANADA RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 CANADA BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 CANADA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 206 CANADA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 207 CANADA FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 CANADA FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 209 CANADA FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 210 CANADA FOOD IN SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 211 CANADA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 212 CANADA CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 213 CANADA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 214 CANADA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 215 CANADA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 216 CANADA MEAT & POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 217 CANADA PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 218 CANADA SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 219 CANADA LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 CANADA OTHER IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 221 CANADA MEAT AND POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 CANADA HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 223 CANADA SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 224 CANADA HERBAL EXTRACTS AND HERBS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 225 CANADA TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 226 CANADA BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 227 CANADA EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 228 CANADA CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 229 CANADA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 230 CANADA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 231 CANADA PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 CANADA PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 233 CANADA CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 CANADA CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 235 CANADA OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 CANADA OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 237 CANADA NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 CANADA NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 239 CANADA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 CANADA ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 CANADA NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 242 CANADA PLANT-BASED MILK IN NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 CANADA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 244 MEXICO FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 245 MEXICO SYSTEM IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 246 MEXICO HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 247 MEXICO CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 MEXICO FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 249 MEXICO FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 250 MEXICO ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 251 MEXICO PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 252 MEXICO GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 253 MEXICO MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 MEXICO HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 255 MEXICO PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 256 MEXICO FOOD SHELF LIFE TESTING, IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 257 MEXICO ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 258 MEXICO RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 259 MEXICO BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 260 MEXICO FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 261 MEXICO FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 262 MEXICO FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 263 MEXICO FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 264 MEXICO FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 265 MEXICO FOOD IN SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 266 MEXICO DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 267 MEXICO CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 268 MEXICO DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 269 NORTH AMERICA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 270 MEXICO CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 271 MEXICO MEAT & POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 MEXICO CHICKEN IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 MEXICO PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 MEXICO SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 275 MEXICO BEEF IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 MEXICO LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 MEXICO OTHER IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 278 MEXICO MEAT AND POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 279 MEXICO HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 280 MEXICO SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 281 MEXICO HERBAL EXTRACTS AND HERBS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 282 MEXICO TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 283 MEXICO BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 284 MEXICO EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 285 MEXICO EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 286 MEXICO CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 287 MEXICO PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 288 MEXICO PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 289 MEXICO PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 290 MEXICO PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 291 MEXICO CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 292 MEXICO CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 293 MEXICO OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 294 MEXICO OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 295 MEXICO NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 296 MEXICO NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 297 MEXICO BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 298 MEXICO ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 299 MEXICO NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 300 MEXICO PLANT-BASED MILK IN NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 301 MEXICO BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA FOOD SAFETY TESTING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FOOD SAFETY TESTING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FOOD SAFETY TESTING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FOOD SAFETY TESTING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FOOD SAFETY TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FOOD SAFETY TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FOOD SAFETY TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FOOD SAFETY TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA FOOD SAFETY TESTING MARKET: SEGMENTATION

FIGURE 10 STRINGENT RULES AND REGULATIONS REGARDING FOOD SAFETY BY DIFFERENT GOVERNMENT ORGANIZATIONS ARE EXPECTED TO DRIVE THE NORTH AMERICA FOOD SAFETY TESTING MARKET IN THE FORECAST PERIOD

FIGURE 11 TESTING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FOOD SAFETY TESTING MARKET IN 2023 & 2030

FIGURE 12 SUPPLY CHAIN OF THE NORTH AMERICA FOOD SAFETY TESTING MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FOOD SAFETY TESTING MARKET

FIGURE 14 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2022

FIGURE 15 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY SITE, 2022

FIGURE 16 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2022

FIGURE 17 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA MANGO MARKET: SNAPSHOT (2022)

FIGURE 19 NORTH AMERICA MANGO MARKET: BY COUNTRY (2022)

FIGURE 20 NORTH AMERICA MANGO MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 NORTH AMERICA MANGO MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 NORTH AMERICA MANGO MARKET: BY TESTING TYPE (2023 & 2030)

FIGURE 23 NORTH AMERICA FOOD SAFETY TESTING MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.