Mercado de agentes antiaglomerantes alimentares da América do Norte, por tipo (compostos de silício, celulose microcristalina, compostos de cálcio, compostos de sódio, compostos de magnésio e outros), fonte (agentes sintéticos/artificiais e agentes naturais), categoria de produto ( não OGM e OGM) , Forma (Pó e Líquido), Aplicação (Confeitaria, Produtos de Panificação, Produtos Lácteos, Alimentos de Conveniência, Nutrição Dietética, Nutrição Desportiva , Produtos de Carne Processados, Bebidas, Sopas e Molhos, Temperos e Condimentos, Fórmula Infantil e Outros) - Tendências do Sector e Previsão para 2030.

Análise e insights do mercado de agentes antiaglomerantes alimentares da América do Norte

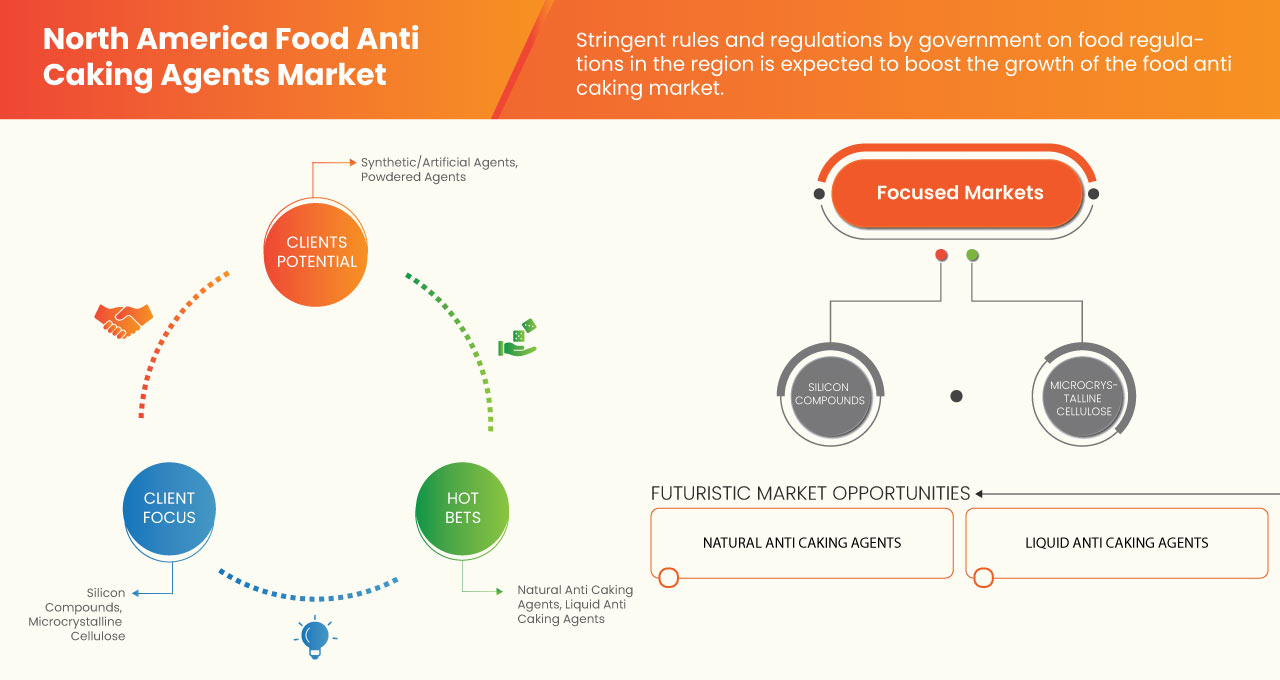

Os agentes antiaglomerantes são compostos anidros adicionados aos alimentos secos em pequenas quantidades para evitar que as partículas se aglomerem e manter o produto seco e fluido. A crescente procura de alimentos de conveniência e de artigos prontos a consumir, levando ao aumento da procura de agentes antiaglomerantes, deverá impulsionar o mercado de agentes antiaglomerantes alimentares na América do Norte. Além disso, espera-se que o aumento da procura por produtos alimentares de melhor qualidade e um prazo de validade mais alargado também impulsionem o crescimento do mercado. No entanto, regras e regulamentos rigorosos sobre agentes antiaglomerantes podem prejudicar o crescimento do mercado. O aumento das inovações nanotecnológicas nos agentes antiaglomerantes alimentares pode servir como uma oportunidade para o mercado da América do Norte. Os crescentes riscos para a saúde devido ao uso excessivo de agentes antiaglomerantes podem representar um sério desafio ao crescimento do mercado de agentes antiaglomerantes alimentares na América do Norte.

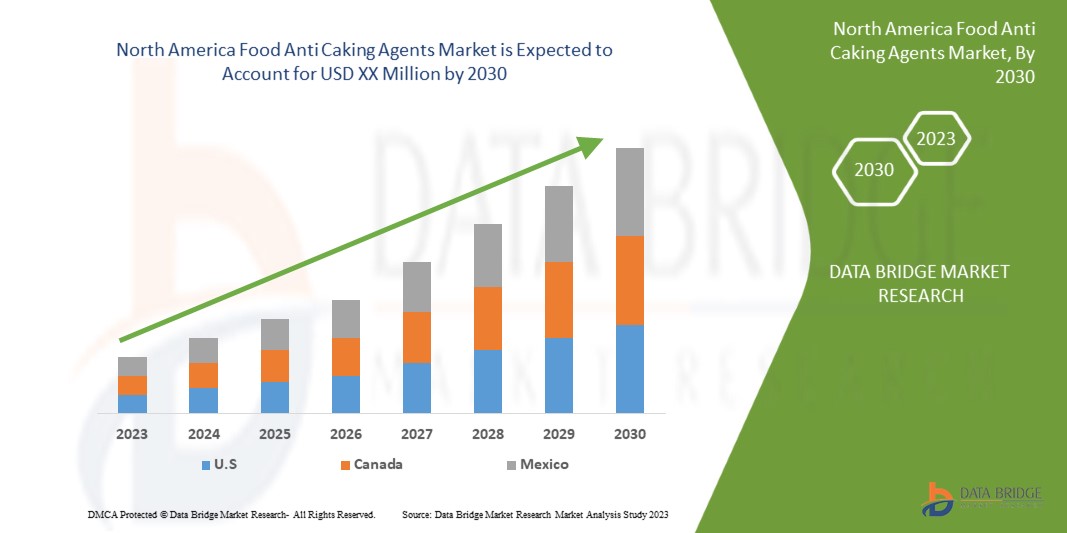

A Data Bridge Market Research analisa que o mercado norte-americano de agentes antiaglomerantes alimentares crescerá a um CAGR de 5,3% de 2023 a 2030.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (Personalizável para 2019 - 2015) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos, preço em dólares americanos |

|

Segmentos abrangidos |

Tipo (compostos de silício, celulose microcristalina , compostos de cálcio, compostos de sódio, compostos de magnésio e outros), fonte (agentes sintéticos/artificiais e agentes naturais), categoria de produto (não-OGM e OGM), forma (pó e líquido), aplicação (Confeitaria, Produtos de Panificação, Lacticínios, Alimentos de Conveniência, Nutrição Dietética, Nutrição Desportiva, Produtos de Carne Processados, Bebidas, Sopas e Molhos, Temperos e Condimentos, Fórmula Infantil e Outros) |

|

Países abrangidos |

EUA, Canadá, México |

|

Atores do mercado abrangidos |

Evonik Industries AG, PPG Industries, In, PQ, WR Grace & Co.-Conn, Solvay, Huber Engineered Materials, REMEDY LABS, Sigachi Industries, Konoshima Chemical Co., Ltd, RanQ, Fabricante de celulose - Ankit Pulps, Ltd, MUBY CHEMICALS , JELU-WERK J. Ehrler GmbH & Co. KG, Jinsha Precipitated Silica Manufacturing Co., Ltd, Astrra Chemicals, SBF Pharma, Foodchem International Corporation |

Definição de Mercado

Os agentes antiaglomerantes são aditivos utilizados em materiais em pó ou granulados, como o sal de cozinha ou os confeitaria, para evitar a formação de grumos (aglomerados) e melhorar a embalagem, o transporte, a fluidez e o consumo. Os mecanismos de aglomeração variam consoante o material. Os sólidos cristalinos aglomeram-se frequentemente devido à formação de uma ponte líquida e à subsequente fusão de microcristais. As transições vítreas e as alterações na viscosidade podem causar aglutinação de materiais amorfos. As transições de fase polimórficas também podem causar aglomeração. Alguns agentes antiaglomerantes absorvem o excesso de humidade ou partículas de revestimento com um revestimento repelente de água. O silicato de cálcio (CaSiO3), um agente antiaglomerante comum, absorve água e óleo quando adicionado a produtos como o sal de cozinha.

Dinâmica do mercado de agentes antiaglomerantes alimentares na América do Norte

Esta secção trata da compreensão dos impulsionadores, oportunidades, desafios e restrições do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

-

Aumento da procura de alimentos de conveniência e alimentos prontos a consumir

O aumento da procura de alimentos de conveniência, como alimentos embalados e prontos a consumir, é causado pelo aumento da população trabalhadora, melhorias económicas e agendas demasiado ocupadas e stressantes. Estes alimentos, que incluem artigos estáveis de prateleira, artigos refrigerados ou congelados, misturas secas sem preparação e outros, são concebidos para serem fáceis de consumir. O sector alimentar e das bebidas está a enfrentar uma procura crescente devido à crescente urbanização, à elevação do nível de vida e às mudanças nas preferências alimentares e no estilo de vida. Além disso, espera-se que o mercado dos agentes antiaglomerantes cresça significativamente em conjunto com o aumento da procura pela cozinha tradicional, uma vez que estas refeições contêm uma variedade de espessantes, como amido de milho, araruta, mandioca, ágar-ágar, gelatina e ovos.

Os agentes antiaglomerantes podem ser adicionados aos produtos alimentares para melhorar a viscosidade, textura, densidade, estabilidade e outras propriedades. Além disso, o principal ingrediente na indústria da panificação é um agente antiaglomerante. Os ingredientes para produtos de pastelaria, como bolachas (açúcar, farinha, fermento em pó, etc.) acabariam por solidificar como blocos de giz se não fossem utilizados produtos químicos antiaglomerantes. Estas substâncias secas sugam gradualmente a humidade do ar ao longo do tempo. Por causa da água, as partículas podem ligar-se.

-

Aumento da procura de produtos alimentares com melhor qualidade e maior prazo de validade

Os agentes antiaglomerantes alimentares são conservantes encontrados em alimentos em pó ou granulados que impedem que estes fluam perfeitamente para fora da embalagem, evitando que o pó ou os grânulos se agrupem ou se agarrem. Os produtos de confeitaria podem conter agentes antiaglomerantes para evitar a formação de grumos e facilitar a embalagem. Espera-se que o aumento do consumo de ingredientes alimentares como fermento em pó, leite e natas em pó, misturas para bolos e sopa instantânea em pó tenha um impacto positivo no desenvolvimento de agentes antiaglomerantes alimentares devido à sua função crítica de manter a capacidade de fluxo livre, textura, e características organoléticas adicionais, bem como uma longa vida útil.

A água, o álcool e o etanol são solventes orgânicos nos quais os compostos antiaglomerantes são solúveis. Funcionam absorvendo o excesso de humidade ou revestindo as partículas com um revestimento repelente de água, o que resulta numa maior vida útil do produto.

Oportunidade

-

Aumento das inovações nanotecnológicas em antiaglomerantes alimentares

A nanotecnologia alimentar é considerada uma fronteira tecnológica para a indústria alimentar no século XXI. A nanotecnologia é amplamente utilizada no processamento de alimentos, na rastreabilidade de embalagens e na preservação. Além disso, os avanços na nanodeteção e nos ingredientes nanoestruturados são muito promissores na indústria alimentar. Os recentes avanços tecnológicos transformaram o uso de nanopartículas (NPs) na indústria alimentar. Estes NPs são reconhecidos por terem propriedades distintas, como agentes antiaglomerantes, antibacterianos, bioterapêuticos e extensão da vida útil, que deverão impulsionar o crescimento do mercado.

A nanotecnologia no processamento de alimentos pode contribuir para sabores, texturas e sensações na boca novos ou melhorados através do processamento em nanoescala dos alimentos ou da melhoria na absorção, absorção e biodisponibilidade de nutrientes através de formulações em nanoescala. Vários aditivos alimentares são compostos por nanopartículas ou contêm uma fração nanométrica. A sílica amorfa sintética (SAS) é utilizada em muitos alimentos em pó como agente de fluxo livre e antiaglomerante e para o revestimento superficial de materiais de embalagem. É composto por agregados de partículas primárias nanométricas.

Restrição/Desafio

- Regras e regulamentos rigorosos sobre agentes antiaglomerantes

Os governos de todo o mundo estabelecem regras e regulamentos rigorosos para o uso e consumo de agentes antiaglomerantes na indústria alimentar. Os regulamentos garantem que nenhum efeito nocivo ou tóxico dos agentes antiaglomerantes alimentares está presente nos alimentos. O governo estabeleceu regulamentos específicos para o tipo e quantidade de agentes antiaglomerantes nos alimentos. O Regulamento de Segurança Alimentar e Normas (Normas de Produtos Alimentares e Aditivos Alimentares) de 2011 declara que os agentes antiaglomerantes não podem ser utilizados, a menos que sejam especificamente permitidos pelos regulamentos.

Impacto pós-COVID-19 no mercado norte-americano de agentes antiaglomerantes alimentares

A COVID-19 afetou o mercado de forma significativa. Devido ao bloqueio, o fabrico e a produção de muitas empresas pequenas e grandes foram interrompidos, a logística e a cadeia de abastecimento foram interrompidas, e a procura de agente antiaglomerante também diminuiu, influenciando o mercado. Devido à mudança em muitos mandatos e regulamentos, os fabricantes estão a conceber e a lançar novos produtos, o que pode ajudar a impulsionar o crescimento do mercado.

Desenvolvimento recente

- Em julho de 2022, a WR Grace & Co. anunciou o seu contrato de desenvolvimento e expansão da unidade de fabrico no sul do Michigan. A expansão inclui um trem de reator multiusos de 4000 galões e uma centrífuga HASTELLOY, o que aumentará a capacidade comercial do local compatível com c-GMP

Âmbito do mercado de agentes antiaglomerantes na América do Norte

O mercado norte-americano de agentes antiaglomerantes alimentares está segmentado em segmentos notáveis com base no tipo, origem, categoria de produto, forma e aplicação. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nos setores e fornecerá aos utilizadores uma visão geral valiosa do mercado e informações de mercado para tomar decisões estratégicas para identificar as principais aplicações de mercado.

Tipo

- Compostos de Silício

- Celulose microcristalina

- Compostos de Cálcio

- Compostos de Sódio

- Compostos de Magnésio

- Outros

Com base no tipo, o mercado norte-americano de agentes antiaglomerantes alimentares está segmentado em compostos de silício, celulose microcristalina, compostos de cálcio, compostos de sódio, compostos de magnésio e outros.

Fonte

- Agentes sintéticos/artificiais

- Agentes Naturais

Com base na fonte, o mercado norte-americano de agentes antiaglomerantes alimentares está segmentado em agentes sintéticos/artificiais e agentes naturais.

Categoria do produto

- Não-OGM

- OGM

Com base na categoria do produto, o mercado norte-americano de agentes antiaglomerantes alimentares está segmentado em não OGM e OGM.

Forma

- Pó

- Líquido

Com base na forma, o mercado norte-americano de agentes antiaglomerantes alimentares está segmentado em pó e líquido.

Aplicação

- Confeitaria

- Produtos de panificação

- Produtos lácteos

- Comida de conveniência

- Nutrição Dietética

- Nutrição Desportiva

- Produtos de carne processada

- Bebidas

- Sopas e Molhos

- Temperos e condimentos

- Fórmula infantil

- Outros

Com base na aplicação, o mercado norte-americano de agentes antiaglomerantes alimentares está segmentado em confeitaria, produtos de panificação, produtos lácteos, alimentos de conveniência, nutrição dietética, nutrição desportiva, produtos de carne processada, bebidas, sopas e molhos, temperos e condimentos , fórmulas infantis e outros.

Análise/Insights regionais do mercado norte-americano de agentes antiaglomerantes

Os agentes antiaglomerantes da América do Norte são analisados, e são fornecidos insights e tendências sobre o tamanho do mercado com base nas referências acima.

Os países abrangidos pelo relatório de mercado de agentes antiaglomerantes alimentares da América do Norte são os EUA, o México e o Canadá.

Espera-se que os EUA dominem o mercado norte-americano de agentes antiaglomerantes alimentares em termos de quota de mercado e receitas. Estima-se que mantenha o seu domínio durante o período previsto devido ao crescente aumento de agentes antiaglomerantes nos alimentos em vários setores da alimentação e das bebidas.

A secção regional do relatório também fornece fatores individuais que impactam o mercado e alterações nas regulamentações que impactam as tendências atuais e futuras do mercado. Pontos de dados, como vendas de produtos novos e de reposição, demografia do país, epidemiologia de doenças e tarifas de importação e exportação, são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais.

Análise do panorama competitivo e da quota de mercado dos agentes antiaglomerantes alimentares na América do Norte

O panorama competitivo do mercado norte-americano de agentes antiaglomerantes alimentares fornece detalhes sobre os concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude e abrangência do produto, e domínio da aplicação. Os pontos de dados acima referidos referem-se apenas ao foco da empresa no mercado de agentes antiaglomerantes alimentares na América do Norte.

Alguns dos principais participantes que operam no mercado norte-americano de agentes antiaglomerantes alimentares são a Evonik Industries AG, PPG Industries, In, PQ, WR Grace & Co.-Conn, Solvay, Huber Engineered Materials, REMEDY LABS, Sigachi Industries, Konoshima Chemical Co. .,Ltd, Fabricante de Celulose-Ankit Pulps, Ltd, MUBY CHEMICALS, JELU-WERK J. Ehrler GmbH & Co. KG, Jinsha Precipitated Silica Manufacturing Co., Ltd, Astrra Chemicals, SBF Pharma, Foodchem International Corporation e RanQ entre outros .

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE ANALYSIS FOR THE NORTH AMERICA ANTI CAKING AGENTS MARKET

4.2 VALUE CHAIN ANALYSIS: NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

4.3 FACTORS INFLUENCING PURCHASE DECISION OF END-USER

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6 OTHER BENEFITS OF ANTI CAKING AGENTS

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 RAW MATERIAL PROCUREMENT & MANUFACTURING

4.7.2 DISTRIBUTION

4.7.3 END USERS

4.8 TECHNOLOGICAL ADVANCEMENT IN THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

4.9 TRADE ANALYSIS

4.1 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: RAW MATERIAL SOURCING ANALYSIS

4.10.1 ABSORBENT POWDER

4.10.2 BASE LIQUID

4.10.3 FLOW AGENTS

5 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET –NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

6 PRICING INDEX (PRICE AT FOB & PRICES AT B2B)

7 PRODUCTION CAPACITY OF KEY MANUFACTURERS

8 BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS ON NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

8.2 PRODUCT VS BRAND OVERVIEW

9 REGULATORY GUIDELINES AND FRAMEWORK

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 RISING DEMAND FOR CONVENIENCE FOOD AND READY-TO-EAT FOOD ITEMS

10.1.2 RISE IN DEMAND FOR FOOD PRODUCTS WITH BETTER QUALITY AND INCREASED SHELF LIFE

10.1.3 INCREASE IN DEMAND FOR ANTI-CAKING AGENTS IN SPICES AND CONDIMENTS

10.1.4 MULTIFUNCTIONAL CHARACTERISTICS OF ANTI-CAKING AGENTS

10.2 RESTRAINTS

10.2.1 STRINGENT RULES AND REGULATIONS ON ANTI-CAKING AGENTS

10.2.2 MANUFACTURERS LIMITING USAGE OF ADDITIVES FALLING UNDER THE E-NUMBER CATEGORY

10.3 OPPORTUNITIES

10.3.1 INCREASING NANO-TECHNOLOGICAL INNOVATIONS IN FOOD ANTI-CAKING AGENTS

10.3.2 MANUFACTURERS LAUNCHING NEW AND INNOVATIVE ANTI-CAKING AGENTS

10.3.3 RISING DEMAND FOR ORGANIC ANTI-CAKING AGENTS

10.4 CHALLENGES

10.4.1 INCREASING HEALTH HAZARDS DUE TO EXCESSIVE USE OF ANTI-CAKING AGENTS

10.4.2 IMPACT OF ANTI-CAKING AGENTS ON NUTRITIVE VALUE OF FOOD ITEMS

11 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY TYPE

11.1 OVERVIEW

11.2 SILICON COMPOUNDS

11.2.1 SILICON DIOXIDE

11.2.2 CALCIUM SILICATE

11.2.3 ALUMINUM SILICATE

11.2.4 SODIUM ALUMINOSILICATE

11.2.5 POTASSIUM ALUMINUM SILICATE

11.2.6 CALCIUM ALUMINOSILICATE

11.2.7 POLYDIMETHYLSILOXANE

11.3 MICROCRYSTALLINE CELLULOSE

11.3.1 POWDERED CELLULOSE

11.3.2 TALCUM POWDER

11.4 CALCIUM COMPOUNDS

11.4.1 CALCIUM CARBONATES

11.4.2 TRI CALCIUM PHOSPHATE

11.4.3 CALCIUM FERROCYANIDE

11.4.4 CALCIUM PHOSPHATE

11.5 SODIUM COMPOUNDS

11.5.1 SODIUM BICARBONATE

11.5.2 SODIUM FERROCYANIDE

11.6 MAGNESIUM COMPOUNDS

11.6.1 MAGNESIUM CARBONATE

11.6.2 MAGNESIUM STEARATE

11.6.3 MAGNESIUM OXIDE

11.6.4 MAGNESIUM TRISILICATE

11.6.5 MAGNESIUM HYDROXIDE

11.7 OTHERS

11.7.1 ZEOLITES

11.7.2 BENTONITE

11.7.3 STEARIC ACID

11.7.4 OTHERS

12 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY SOURCE

12.1 OVERVIEW

12.2 SYNTHETIC/ARTIFICIAL AGENTS

12.3 NATURAL AGENTS

13 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY PRODUCT CATEGORY

13.1 OVERVIEW

13.2 NON GMO

13.3 GMO

14 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY FORM

14.1 OVERVIEW

14.2 POWDER

14.3 LIQUID

15 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 CONFECTIONARY

15.2.1 CONFECTIONARY, BY TYPE

15.2.1.1 CHOCOLATE

15.2.1.2 HARD & SOFT CANDY

15.2.1.3 TOFFEES

15.2.1.4 CARAMEL & NOUGATS

15.2.1.5 GUMS& JELLY

15.2.1.6 CREAM FILLINGS

15.2.1.7 OTHERS

15.3 BAKERY PRODUCTS

15.3.1 BAKERY PRODUCTS, BY TYPE

15.3.1.1 BREAD AND ROLLS

15.3.1.2 CAKES AND PASTRIES

15.3.1.3 BISCUITS

15.3.1.4 MUFFINS

15.3.1.5 COOKIES

15.3.1.6 DOUGHNUTS

15.3.1.7 OTHERS

15.4 DAIRY PRODUCTS

15.4.1 DAIRY PRODUCTS, BY TYPE

15.4.1.1 CHEESE

15.4.1.1.1 SHREDDED CHEESE

15.4.1.1.2 CUBED CHEESE

15.4.1.1.3 HIGH MOISTURE CRUMBLED CHEESE

15.4.1.2 ICE-CREAM

15.4.1.2.1 IMPULSE ICE-CREAM

15.4.1.2.2 TAKE HOME ICE-CREAM

15.4.1.3 MILK POWDER

15.4.1.4 DAIRY SPREAD

15.4.1.5 YOGURT

15.4.1.6 OTHERS

15.5 CONVENIENCE FOOD

15.5.1 CONVENIENCE FOOD, BY TYPE

15.5.1.1 PIZZA

15.5.1.2 READY TO EAT PRODUCTS

15.5.1.3 PASTA

15.5.1.4 NOODLES

15.5.1.5 SOUPS & SAUCES

15.5.1.6 SEASONINGS & DRESSINGS

15.5.1.7 NUTS

15.5.1.8 SEEDS

15.5.1.9 PREMIXES

15.5.1.10 TRAIL MIXES

15.5.1.11 OTHERS

15.6 DIETARY NUTRITION

15.7 SPORT NUTRITION

15.8 PROCESSED MEAT PRODUCTS

15.8.1 PROCESSED MEAT, BY TYPE

15.8.1.1 BEEF

15.8.1.2 PORK

15.8.1.3 POULTRY

15.8.1.4 SWINE

15.8.1.5 MUTTON

15.8.1.6 OTHERS

15.9 BEVERAGES

15.9.1 BEVERAGES, BY TYPE

15.9.1.1 RTD BEVERAGES

15.1 SOUPS AND SAUCES

15.11 SEASONINGS AND CONDIMENTS

15.12 INFANT FORMULA

15.13 OTHERS

15.13.1 OTHERS, BY TYPE

15.13.1.1 SPICES POWDERED

15.13.1.2 HERBS EXTRACTS POWDERED

16 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 EVONIK INDUSTRIES AG

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 PPG INDUSTRIES, INC.

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENT

19.3 PQ

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 W.R. GRACE & CO.-CONN

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 ALLIED BLENDING

19.5.1 COMPANY SNAPSHOT

19.5.2 COMPANY SHARE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENT

19.6 ANMOL CHEMICALS

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 ASTTRA CHEMICALS

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 BIMAL PHARMA PVT. LTD.

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 CELLULOSE MANUFACTURER- ANKIT PULPS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 FOODCHEM INTERNATIONAL CORPORATION

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 FUJI CHEMICAL INDUSTRIES CO., LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 HUBER ENGINEERED MATERIALS

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 JELU-WERK J. EHRLER GMBH & CO. KG

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 JINSHA PRECIPITATED SILICA MANUFACTURING CO., LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

19.16 KONOSHIMA CHEMICAL CO., LTD.

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENT

19.17 MUBY CHEMICALS

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENT

19.18 NB ENTREPRENEURS

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 RANQ

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENT

19.2 REGOJ CHEMICAL INDUSTRIES

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

19.21 REMEDY LABS GROUP

19.21.1 COMPANY SNAPSHOT

19.21.2 PRODUCT PORTFOLIO

19.21.3 RECENT DEVELOPMENT

19.22 SAPTHAGIRI AROMATICS

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENT

19.23 SBF PHARMA

19.23.1 COMPANY SNAPSHOT

19.23.2 PRODUCT PORTFOLIO

19.23.3 RECENT DEVELOPMENT

19.24 SIGACHI INDUSTRIES

19.24.1 COMPANY SNAPSHOT

19.24.2 REVENUE ANALYSIS

19.24.3 PRODUCT PORTFOLIO

19.24.4 RECENT DEVELOPMENT

19.25 SINTHESIS GREENCHEM PVT. LTD.

19.25.1 COMPANY SNAPSHOT

19.25.2 PRODUCT PORTFOLIO

19.25.3 RECENT DEVELOPMENT

19.26 SOLVAY

19.26.1 COMPANY SNAPSHOT

19.26.2 REVENUE ANALYSIS

19.26.3 PRODUCT PORTFOLIO

19.26.4 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA IMPORTERS OF SILICON DIOXIDE HS CODE OF PRODUCT: 28112 (UNIT US DOLLAR THOUSAND)

TABLE 2 NORTH AMERICA EXPORTERS OF SILICON DI OXIDE, HS CODE OF PRODUCT: 28112 (UNIT: US DOLLAR THOUSAND)

TABLE 3 NORTH AMERICA IMPORTERS OF CALCIUM CARBONATE, HS CODE OF PRODUCT: 283650 (UNIT US DOLLAR THOUSAND)

TABLE 4 NORTH AMERICA EXPORTERS OF CALCIUM CARBONATE, HS CODE OF PRODUCT: 283650 (UNIT US DOLLAR THOUSAND)

TABLE 5 NORTH AMERICA IMPORTERS OF CALCIUM PHOSPHATE, HS CODE OF PRODUCT: 283526 (UNIT US DOLLAR THOUSAND)

TABLE 6 NORTH AMERICA EXPORTERS OF CALCIUM PHOSPHATE, HS CODE OF PRODUCT: 283526 (UNIT US DOLLAR THOUSAND)

TABLE 7 NORTH AMERICA IMPORTERS OF SODIUM BICARBONATE, HS CODE OF PRODUCT: 283630 (UNIT US DOLLAR THOUSAND)

TABLE 8 NORTH AMERICA EXPORTERS OF SODIUM BICARBONATE, HS CODE OF PRODUCT: 283630 (UNIT US DOLLAR THOUSAND)

TABLE 9 FREE ON BOARD (FOB) OF NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

TABLE 10 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 12 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TONS)

TABLE 14 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 16 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 18 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 20 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 22 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 24 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 26 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 28 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 30 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 32 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 34 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 37 NORTH AMERICA SYNTHETIC/ARTIFICIAL AGENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA SYNTHETIC/ARTIFICIAL AGENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 39 NORTH AMERICA NATURAL AGENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA NATURAL AGENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 41 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 43 NORTH AMERICA NON-GMO IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA NON-GMO IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 45 NORTH AMERICA GMO IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA GMO IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 47 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY FORM, 2021-2030 (TON)

TABLE 49 NORTH AMERICA POWDER IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA POWDER IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 51 NORTH AMERICA LIQUID IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA LIQUID IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 53 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 55 NORTH AMERICA CONFECTIONERY IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA CONFECTIONERY IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 57 NORTH AMERICA CONFECTIONARY IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA CONFECTIONARY IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 59 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 61 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 63 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 65 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 67 NORTH AMERICA CHEESE IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA CHEESE IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 69 NORTH AMERICA ICE-CREAM IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA ICE-CREAM IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 71 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 73 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 75 NORTH AMERICA DIETARY NUTRITION IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA DIETARY NUTRITION IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 77 NORTH AMERICA SPORT NUTRITION IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA SPORT NUTRITION IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 79 NORTH AMERICA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 81 NORTH AMERICA PROCESSED MEAT IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA PROCESSED MEAT IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 83 NORTH AMERICA BEVERAGES IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA BEVERAGES IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 85 NORTH AMERICA BEVERAGES IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA BEVERAGES IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 87 NORTH AMERICA SOUPS & SAUCES IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA SOUPS & SAUCES IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 89 NORTH AMERICA SEASONING & CONDIMENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA SEASONING & CONDIMENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 91 NORTH AMERICA INFANT FORMULA IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA INFANT FORMULA IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 93 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 95 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 97 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY COUNTRY, 2021-2030 (TON)

TABLE 99 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY COUNTRY, 2021-2030 (ASP)

TABLE 100 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 102 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 103 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 105 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 106 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 108 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 109 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 111 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 113 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 115 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 117 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (ASP)

TABLE 118 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 119 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 120 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (ASP)

TABLE 121 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (TON)

TABLE 123 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (ASP)

TABLE 124 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 125 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 126 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 127 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 129 NORTH AMERICA CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 NORTH AMERICA CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 131 NORTH AMERICA ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 NORTH AMERICA ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 133 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 135 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 137 NORTH AMERICA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 NORTH AMERICA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 139 NORTH AMERICA CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 140 NORTH AMERICA CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 141 NORTH AMERICA BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 NORTH AMERICA BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 143 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 145 U.S. FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 U.S. FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 147 U.S. FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 148 U.S. CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 U.S. CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 150 U.S. CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 151 U.S. SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 U.S. SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 153 U.S. MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 U.S. MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 155 U.S. MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 U.S. MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 157 U.S. SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 U.S. SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 159 U.S. OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 U.S. OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 161 U.S. FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 162 U.S. FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 163 U.S. FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (ASP)

TABLE 164 U.S. FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 165 U.S. FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 166 U.S. FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (ASP)

TABLE 167 U.S. FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 168 U.S. FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (TON)

TABLE 169 U.S. FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (ASP)

TABLE 170 U.S. FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 171 U.S. FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 172 U.S. FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 173 U.S. DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 U.S. DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 175 U.S. CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 U.S. CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 177 U.S. ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 178 U.S. ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 179 U.S. BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 180 U.S. BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 181 U.S. CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 U.S. CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 183 U.S. PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 184 U.S. PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 185 U.S. CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 U.S. CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 187 U.S. BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 U.S. BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 189 U.S. OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 U.S. OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 191 CANADA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 CANADA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 193 CANADA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 194 CANADA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 CANADA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 196 CANADA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 197 CANADA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 CANADA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 199 CANADA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 CANADA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 201 CANADA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 CANADA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 203 CANADA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 CANADA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 205 CANADA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 CANADA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 207 CANADA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 208 CANADA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 209 CANADA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (ASP)

TABLE 210 CANADA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 211 CANADA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 212 CANADA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (ASP)

TABLE 213 CANADA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 214 CANADA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (TON)

TABLE 215 CANADA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (ASP)

TABLE 216 CANADA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 217 CANADA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 218 CANADA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 219 CANADA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 CANADA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 221 CANADA CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 CANADA CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 223 CANADA ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 CANADA ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 225 CANADA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 226 CANADA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 227 CANADA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 228 CANADA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 229 CANADA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 230 CANADA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 231 CANADA CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 CANADA CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 233 CANADA BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 CANADA BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 235 CANADA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 CANADA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 237 MEXICO FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 MEXICO FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 239 MEXICO FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 240 MEXICO CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 MEXICO CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 242 MEXICO CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 243 MEXICO SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 244 MEXICO SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 245 MEXICO MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 246 MEXICO MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 247 MEXICO MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 MEXICO MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 249 MEXICO SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 250 MEXICO SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 251 MEXICO OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 252 MEXICO OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 253 MEXICO FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 254 MEXICO FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 255 MEXICO FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (ASP)

TABLE 256 MEXICO FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 257 MEXICO FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 258 MEXICO FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (ASP)

TABLE 259 MEXICO FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 260 MEXICO FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (TON)

TABLE 261 MEXICO FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (ASP)

TABLE 262 MEXICO FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 263 MEXICO FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 264 MEXICO FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 265 MEXICO DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 266 MEXICO DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 267 MEXICO CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 268 MEXICO CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 269 MEXICO ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 270 MEXICO ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 271 MEXICO BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 MEXICO BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 273 MEXICO CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 MEXICO CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 275 MEXICO PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 MEXICO PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 277 MEXICO CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 278 MEXICO CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 279 MEXICO BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 280 MEXICO BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 281 MEXICO OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 282 MEXICO OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

Lista de Figura

FIGURE 1 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: SEGMENTATION

FIGURE 10 THE RISE IN DEMAND FOR CONVENIENCE FOOD PRODUCTS ACROSS THE GLOBE, LEADING TO THE RISE IN THE DEMAND FOR FOOD ANTI CAKING AGENTS, IS EXPECTED TO DRIVE THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE SILICON COMPOUNDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET IN 2023 AND 2030

FIGURE 12 VALUE CHAIN ANALYSIS OF THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

FIGURE 13 SUPPLY CHAIN OF NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

FIGURE 15 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY TYPE, 2022

FIGURE 16 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY SOURCE, 2022

FIGURE 17 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY PRODUCT CATEGORY, 2022

FIGURE 18 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY FORM, 2022

FIGURE 19 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY TYPE (2023-2030)

FIGURE 25 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.