North America Flow Cytometry Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.40 Billion

USD

7.77 Billion

2024

2032

USD

3.40 Billion

USD

7.77 Billion

2024

2032

| 2025 –2032 | |

| USD 3.40 Billion | |

| USD 7.77 Billion | |

|

|

|

|

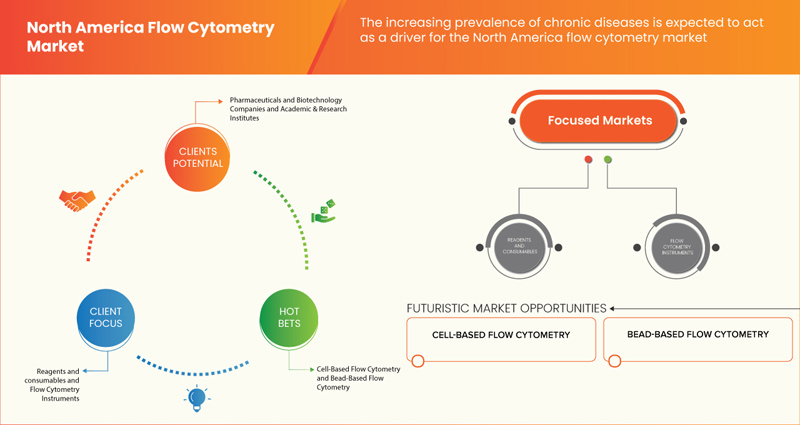

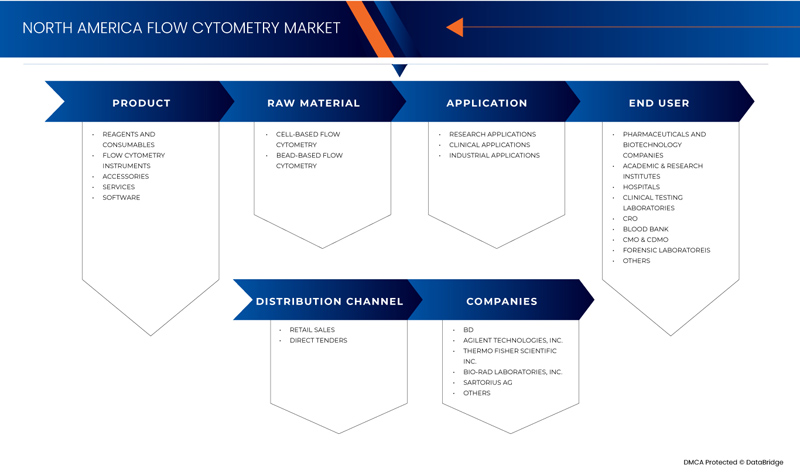

Segmentação do mercado de citometria de fluxo na América do Norte, por produto (reagentes e consumíveis, instrumentos de citometria de fluxo, acessórios, serviços e software), tecnologia (citometria de fluxo baseada em células e citometria de fluxo baseada em esferas), aplicação (aplicações de pesquisa, aplicações clínicas e aplicações industriais), usuário final (empresas farmacêuticas e de biotecnologia, institutos acadêmicos e de pesquisa, hospitais, laboratórios de testes clínicos, CRO, banco de sangue, CMO e CDMO, laboratórios forenses e outros), canal de distribuição (vendas no varejo e licitações diretas) - Tendências e previsões do setor até 2032

Análise de mercado de citometria de fluxo na América do Norte

Citometria de fluxo é uma técnica para detectar e quantificar as propriedades físicas e químicas de uma população de células ou partículas. Uma amostra contendo células ou partículas é suspensa em um fluido e injetada no equipamento do citômetro de fluxo neste processo. A citometria de fluxo é uma tecnologia bem estabelecida para identificar células em uma solução que é mais tipicamente usada para avaliar sangue periférico, medula óssea e outros fluidos corporais. As células imunes são identificadas e quantificadas usando citometria de fluxo, que também é usada para descrever malignidades hematológicas. A avaliação de células por meio desta técnica tem um papel fundamental no diagnóstico de muitas doenças crônicas. Ela analisa atividades biológicas dentro das células, apoptose, necrose, ciclo celular, membrana celular, proliferação celular e medição de DNA por célula.

As principais aplicações diagnósticas incluem processos hematológicos benignos, câncer, AIDS, deficiência imunológica, hematológicos benignos e a detecção dessas doenças usando fluorescência. Nesse processo, as células são tingidas com fluoróforos para detectar a luz emitida para produzir a intensidade pela marcação de proteínas específicas (imunofenotipagem) para diagnosticar leucemia e linfomas.

Tamanho do mercado de citometria de fluxo na América do Norte

O tamanho do mercado de citometria de fluxo na América do Norte foi avaliado em US$ 3,40 bilhões em 2024 e está projetado para atingir US$ 7,77 bilhões até 2032, com um CAGR de 10,8% durante o período previsto de 2025 a 2032. Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória.

Tendências do mercado de citometria de fluxo na América do Norte

“Aumento da adoção de capacidades de análise multiparâmetros”

Uma tendência significativa no mercado de citometria de fluxo da América do Norte é a crescente adoção de recursos de análise multiparâmetros, impulsionada por avanços na tecnologia que permitem a medição simultânea de vários marcadores celulares. Essa tendência é amplamente alimentada pela crescente demanda por caracterização celular detalhada em áreas como pesquisa sobre câncer, imunologia e medicina personalizada, onde interações celulares complexas precisam ser compreendidas. Inovações em sistemas de laser, detectores e software estão tornando possível analisar mais parâmetros com maior sensibilidade e resolução, permitindo que pesquisadores e clínicos obtenham insights mais profundos sobre processos biológicos e melhorem a precisão do diagnóstico. Essa mudança para sistemas de citometria de fluxo mais sofisticados está transformando metodologias de pesquisa e expandindo a aplicabilidade da citometria de fluxo em vários campos.

Escopo do relatório e segmentação do mercado de citometria de fluxo na América do Norte

|

Atributos |

Insights sobre o mercado de citometria de fluxo na América do Norte |

|

Segmentos abrangidos |

|

|

Região coberta |

EUA, Canadá, México, Alemanha, França, Reino Unido, Itália, Espanha, Rússia, Holanda, Suíça, Turquia, Bélgica, Áustria, Irlanda, Noruega, Polônia, Resto da Europa, Japão, China, Índia, Coreia do Sul, Austrália, Cingapura, Tailândia, Malásia, Indonésia, Vietnã, Filipinas, Resto da Ásia-Pacífico, Brasil, Argentina, Peru, Resto da América do Sul, África do Sul, Arábia Saudita, Emirados Árabes Unidos, Egito, Kuwait, Israel e Resto do Oriente Médio e África |

|

Principais participantes do mercado |

BD (EUA), Agilent Technologies, Inc. (EUA), Thermo Fisher Scientific Inc. (EUA), Bio-Rad Laboratories, Inc. (EUA), Sartorius AG (Alemanha), Bennubio Inc. (EUA), Enzo Biochem Inc. (EUA), Apogee Flow Systems Ltd. (Reino Unido), Beckman Coulter, Inc. (EUA), Coherent Corp. (EUA), Cell Signaling Technology, Inc. (EUA), Cytek Biosciences (EUA), Biomérieux. (França), Cytonome/ST LLC (EUA), entre outros |

|

Oportunidades de Mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise Porter e estrutura regulatória. |

Definição do mercado de citometria de fluxo na América do Norte

O mercado de citometria de fluxo da América do Norte se refere à indústria que abrange o desenvolvimento, produção e distribuição de equipamentos de citometria de fluxo, reagentes, software e serviços usados para analisar e classificar células e outras partículas suspensas em um fluxo de fluido. A citometria de fluxo é uma técnica poderosa que permite a medição simultânea de múltiplas características físicas e químicas de células individuais, como tamanho, complexidade e expressão de proteína. Essa tecnologia é amplamente empregada em várias aplicações, incluindo imunologia, oncologia, microbiologia e desenvolvimento de medicamentos, tornando-a uma ferramenta essencial tanto em diagnósticos clínicos quanto em ambientes de pesquisa.

Dinâmica do mercado de citometria de fluxo na América do Norte

Motoristas

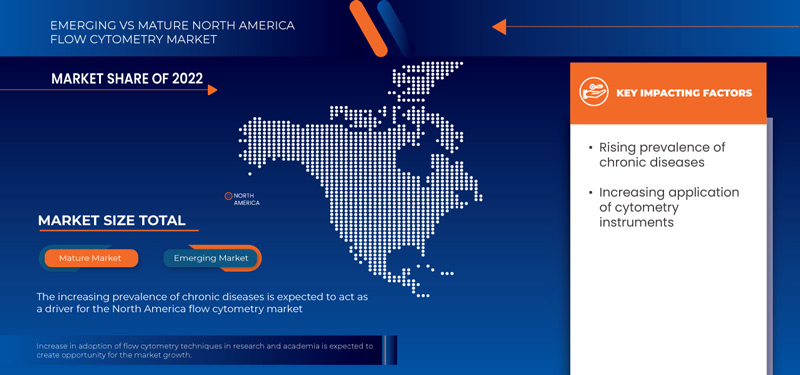

- Aumento da prevalência de doenças crônicas

Citometria de fluxo é uma técnica para detectar e quantificar as propriedades físicas e químicas de uma população de células ou partículas. Uma amostra contendo células ou partículas é suspensa em um fluido e injetada no equipamento do citômetro de fluxo neste processo. A citometria de fluxo é uma tecnologia bem estabelecida para identificar células em uma solução que é mais tipicamente usada para avaliar sangue periférico, medula óssea e outros fluidos corporais. As células imunes são identificadas e quantificadas usando citometria de fluxo, que também é usada para descrever malignidades hematológicas. A avaliação de células por meio desta técnica tem um papel fundamental no diagnóstico de muitas doenças crônicas. Ela analisa atividades biológicas dentro das células, apoptose, necrose, ciclo celular, membrana celular, proliferação celular e medição de DNA por célula.

As principais aplicações diagnósticas incluem processos hematológicos benignos, câncer, AIDS, deficiência imunológica, hematológicos benignos e a detecção dessas doenças usando fluorescência. Nesse processo, as células são tingidas com fluoróforos para detectar a luz emitida para produzir a intensidade pela marcação de proteínas específicas (imunofenotipagem) para diagnosticar leucemia e linfomas.

A crescente prevalência de doenças crônicas criou uma demanda crescente por técnicas de citometria de fluxo que podem ajudar pesquisadores e médicos a entender melhor os mecanismos subjacentes dessas doenças e desenvolver tratamentos mais eficazes.

- Aplicação crescente de instrumentos de citometria

Citometria de fluxo é uma ferramenta analítica poderosa usada para analisar e quantificar células ou partículas únicas em uma mistura heterogênea. Ela usa lasers e óptica para detectar e medir células ou partículas, como tamanho, forma e intensidade de fluorescência. Essa técnica envolve a marcação de células ou partículas com corantes fluorescentes ou anticorpos que se ligam a marcadores específicos da superfície celular ou moléculas intracelulares. As células ou partículas marcadas são então passadas por um citômetro de fluxo, que detecta e mede a fluorescência emitida por cada célula ou partícula. A citometria de fluxo é amplamente usada em muitos campos de pesquisa, incluindo imunologia, microbiologia, pesquisa com células-tronco, pesquisa sobre câncer, descoberta e desenvolvimento de medicamentos e diagnósticos clínicos. A técnica está em constante evolução com novas aplicações e melhorias de hardware e software, tornando-a uma ferramenta importante no estudo de sistemas biológicos.

Por exemplo,

- Em julho de 2023, de acordo com o artigo publicado pelo NCBI, a crescente aplicação da citometria de fluxo em diversos campos, incluindo imunofenotipagem, ensaios de viabilidade, análise do ciclo celular e identificação de células raras, impulsiona o mercado de citometria de fluxo da América do Norte. Sua capacidade de analisar células individuais em um nível de célula única e classificar populações específicas para pesquisa avançada alimenta a demanda. Essa versatilidade acelera o crescimento na pesquisa acadêmica e clínica, impulsionando a expansão do mercado.

- Em junho de 2020, de acordo com o artigo publicado pela biblioteca online Wiley, a citometria de fluxo pode ser usada para identificar e caracterizar diferentes subconjuntos de células imunes em pacientes com doenças autoimunes, como Lúpus Eritematoso Sistêmico (LES). O estudo concluiu que a citometria de fluxo pode fornecer insights valiosos sobre a patogênese dessas doenças e ajudar a desenvolver terapias mais direcionadas. Isso acelera o crescimento tanto na pesquisa acadêmica quanto na clínica, impulsionando a expansão do mercado.

Uso crescente da citometria de fluxo na descoberta de medicamentos

- As atividades de pesquisa em expansão são projetadas para impulsionar o crescimento da citometria de fluxo. Ela surgiu como a principal chave para explorar os processos de descoberta e desenvolvimento de medicamentos. Devido à sua excelente capacidade de analisar populações heterogêneas de células, a citometria de fluxo apresenta uma promessa atraente para caminhos de descoberta e desenvolvimento de medicamentos. Ela fornece insights de alta resolução sobre as informações funcionais e biológicas multiparâmetros de uma única célula. Além disso, o progresso contínuo em abordagens de citometria de fluxo, como análise multifatorial de alto rendimento, melhorias na classificação de células e detecção e resolução rápida de eventos, garante maior eficiência na descoberta e caracterização de novos medicamentos bioativos.

- Por exemplo;-

- Em março de 2024, de acordo com o artigo publicado pelo NCBI, o uso crescente da citometria de fluxo na descoberta de medicamentos, particularmente para modulação de biomarcadores em ensaios clínicos iniciais, impulsiona o mercado de citometria de fluxo da América do Norte. Sua capacidade de fornecer insights valiosos sobre a progressão de moléculas e a tradução reversa de dados de pacientes acelera as descobertas no desenvolvimento terapêutico. Essa crescente aplicação na descoberta de medicamentos impulsiona a demanda por tecnologias avançadas de citometria de fluxo nos setores de saúde e farmacêutico.

- Em novembro de 2021, de acordo com o artigo publicado pela News Medical Life Sciences, o uso crescente da citometria de fluxo na descoberta de medicamentos, desde a identificação do alvo até o desenvolvimento do lead, está impulsionando o mercado da América do Norte. Ela permite a análise de várias estruturas biomoleculares, incluindo membranas celulares, proteínas, DNA e mRNA, permitindo o direcionamento preciso no desenvolvimento de medicamentos. Essa ampla aplicabilidade na compreensão de processos biológicos complexos acelera a demanda por tecnologias de citometria de fluxo na pesquisa farmacêutica.

Oportunidades

- Aumento na adoção de técnicas de citometria de fluxo em pesquisas e na academia

A citometria de fluxo é uma técnica sofisticada para medir células individuais e outras partículas em suspensão a uma taxa de milhares de células por segundo. A citometria de fluxo foi estendida para investigações ambientais, análise de vesículas extracelulares e a capacidade de usar mais de 30 parâmetros diferentes para análises mais extensas. É mais tipicamente usada no cenário da imunologia. Os citômetros de fluxo fornecem capacidades excepcionais, dados de alta qualidade e uma plataforma fácil de usar que economiza tempo para pesquisadores durante a coleta e avaliação de dados.

O aumento da prevalência e incidência de doenças crônicas e infecciosas abriu amplas oportunidades para enorme pesquisa e desenvolvimento de novas aplicações diagnósticas e terapêuticas.

Por exemplo,

Em fevereiro de 2021, de acordo com um estudo publicado na PLOS ONE, pesquisadores usaram citometria de fluxo para analisar a resposta imune de pacientes com COVID-19. O estudo descobriu que a citometria de fluxo era uma ferramenta confiável e eficaz para caracterizar a resposta imune ao vírus, o que poderia ajudar a orientar estratégias de tratamento

Em abril de 2021, de acordo com um estudo publicado na Frontiers in Immunology, pesquisadores usaram citometria de fluxo para estudar a resposta imune à infecção pelo HIV. O estudo descobriu que a citometria de fluxo era uma ferramenta eficaz para caracterizar a resposta imune ao vírus, o que poderia levar ao desenvolvimento de novos tratamentos e vacinas

- Desenvolvimento crescente das indústrias farmacêutica e biotecnológica

Os instrumentos de citometria de fluxo se tornaram parte integrante da descoberta e desenvolvimento de medicamentos nas indústrias farmacêutica e de biotecnologia. O desenvolvimento de novos equipamentos de citometria de fluxo ajudou os pesquisadores a analisar e classificar células de forma mais rápida, precisa e eficiente, o que ajudou a acelerar o cronograma de desenvolvimento de medicamentos. Por exemplo, a Beckman Coulter, fabricante líder de equipamentos de citometria de fluxo, desenvolveu o citômetro de fluxo CytoFLEX LX com detecção rápida, sensibilidade aprimorada e tamanho reduzido. O CytoFLEX LX foi projetado para ajudar os pesquisadores a analisar populações de células raras de forma mais rápida e eficiente.

No geral, o desenvolvimento de novos dispositivos de citometria de fluxo está ajudando empresas farmacêuticas e de biotecnologia a acelerar os cronogramas de desenvolvimento de medicamentos, permitindo análises mais rápidas e precisas de populações celulares complexas. Com o aumento da população geriátrica e dos casos de doenças crônicas, o crescimento das empresas de biotecnologia e farmacêuticas também está se expandindo. Em todo o mundo, as atividades de pesquisa e desenvolvimento estão aumentando devido aos gastos com saúde pública com desempenho econômico.

Por exemplo,

- Em outubro de 2024, a Ardena anunciou uma expansão substancial de sua Bioanalítica na Holanda. Além disso, ela se concentrou em expandir suas capacidades em imunoquímica, citometria de fluxo e plataformas qPCR, aumentando sua capacidade de LC-MS/MS e adicionando novos sistemas automatizados Hamilton para aumentar a eficiência e abordar os desafios bioanalíticos em evolução

- Em abril de 2021, de acordo com dados fornecidos pelo CBO (Congressional Budget Office), o setor farmacêutico gastou US$ 83 bilhões em pesquisa e desenvolvimento. Esses custos foram incorridos para uma série de operações, incluindo a descoberta e teste de novos medicamentos, o desenvolvimento de avanços incrementais, como expansões de produtos, e testes clínicos para monitoramento de segurança e marketing

Restrições/Desafios

- Alto custo dos instrumentos de citometria de fluxo

O investimento inicial substancial necessário para instrumentos de citometria de fluxo, juntamente com os custos contínuos de reagentes, corantes e manutenção, cria barreiras financeiras, particularmente para laboratórios menores ou aqueles em ambientes com recursos limitados. Além disso, a complexidade técnica da citometria de fluxo exige pessoal qualificado para operação, com treinamento especializado necessário para utilizar adequadamente a tecnologia. Isso limita sua acessibilidade em regiões onde falta experiência, reduzindo sua taxa de adoção. Além disso, os sistemas de citometria de fluxo exigem manutenção regular, calibração e solução de problemas, o que aumenta os custos operacionais e pode resultar em tempo de inatividade, impactando ainda mais a eficiência do laboratório. Requisitos regulatórios rigorosos para aprovação desses dispositivos médicos também criam atrasos na entrada no mercado e custos adicionais de conformidade. Esses fatores coletivamente dificultam a adoção generalizada da citometria de fluxo, especialmente em mercados emergentes onde restrições financeiras, falta de profissionais treinados e processos regulatórios lentos atuam como barreiras significativas ao crescimento, restringindo, em última análise, a expansão potencial do mercado.

Por exemplo

- Em janeiro de 2024, de acordo com o artigo publicado pela Excedr, o alto custo dos instrumentos de citometria de fluxo, variando de USDUSD100.000 a USDUSD1,5 milhão, atua como uma restrição significativa para o mercado da América do Norte. Essas despesas limitam o acesso a laboratórios e instituições menores, tornando desafiador para eles adotar tecnologia avançada. Como resultado, os altos custos iniciais de investimento e manutenção dificultam o uso generalizado e retardam o crescimento do mercado, especialmente em ambientes com recursos limitados.

- Em novembro de 2023, de acordo com o artigo publicado pelo NCBI, o alto custo dos instrumentos de citometria de fluxo, variando de US$ 50.000 a US$ 750.000 ou mais, atua como uma restrição significativa no mercado da América do Norte. Este investimento financeiro substancial necessário para recursos e especificações avançados limita a acessibilidade, especialmente para laboratórios de pesquisa menores e instituições com orçamentos limitados. Consequentemente, o alto custo retarda a adoção e dificulta o crescimento do mercado, particularmente em ambientes com recursos limitados.

O investimento inicial em instrumentos e as despesas contínuas com reagentes e manutenção criam desafios financeiros para laboratórios menores e aqueles em áreas com recursos limitados. A complexidade da tecnologia também requer pessoal treinado, limitando seu uso em regiões sem experiência. Além disso, a necessidade de manutenção e calibração regulares aumenta os custos operacionais e causa tempo de inatividade potencial. Requisitos regulatórios rigorosos atrasam ainda mais a aprovação do produto e a entrada no mercado. Esses fatores limitam a adoção da citometria de fluxo, especialmente em mercados emergentes, restringindo o crescimento geral do mercado.

- Limitações da Citometria de Fluxo

A citometria de fluxo tem limitações inerentes, como sua incapacidade de analisar tecidos fixados em formalina, o que restringe seu uso em certas pesquisas e aplicações clínicas. O método é projetado para amostras frescas ou congeladas, e a fixação em formalina pode alterar a estrutura celular e a expressão do marcador, tornando-as inadequadas para análise. Além disso, a citometria de fluxo luta para capturar completamente interações celulares complexas ou vias de sinalização multicamadas. Essas restrições limitam o escopo de seu uso em vários campos e agem como uma restrição no mercado de citometria de fluxo da América do Norte, estreitando sua aplicabilidade, particularmente em ambientes clínicos e patológicos.

Por exemplo-

- Em junho de 2021, de acordo com o artigo publicado pela LearnHaem, a citometria de fluxo exige que amostras frescas sejam processadas imediatamente após a coleta, pois o armazenamento inadequado ou prolongado leva à apoptose natural, o que diminui a precisão dos resultados. Além disso, a citometria de fluxo não pode ser usada em tecidos fixados em formalina, limitando sua aplicação em certos ambientes clínicos e de pesquisa. Essas restrições atuam como uma restrição no mercado de citometria de fluxo da América do Norte, reduzindo sua versatilidade e aplicabilidade em algumas áreas.

- Em março de 2020, de acordo com o artigo publicado pelo NCBI, a citometria de fluxo enfrentou limitações devido ao desfoque óptico causado pelo alto movimento celular, o que afeta a clareza da imagem. Além disso, a detecção de objetos raros e atípicos, como Células Tumorais Circulantes (CTCs), representa um desafio, apesar de sua importância prognóstica. Esses problemas limitam a capacidade de capturar e analisar com precisão biomarcadores críticos, restringindo o crescimento e a aplicação da citometria de fluxo em certas áreas de diagnóstico e pesquisa.

A citometria de fluxo enfrenta limitações, como sua incapacidade de analisar tecidos fixados em formalina, que são comumente usados em patologia e diagnósticos clínicos. O processo requer amostras frescas ou congeladas, e o processo de fixação química altera os marcadores celulares, tornando-os incompatíveis com a análise citométrica de fluxo. Além disso, a técnica luta para capturar completamente interações celulares intrincadas ou vias de sinalização complexas. Essas limitações restringem a aplicação mais ampla da tecnologia, agindo como uma restrição no mercado de citometria de fluxo da América do Norte, reduzindo sua versatilidade em ambientes clínicos e de pesquisa.

Escopo do mercado de citometria de fluxo na América do Norte

O mercado é segmentado com base em produto, aplicação, tecnologia, canal de distribuição e usuário final. O crescimento entre esses segmentos ajudará você a analisar segmentos de crescimento escassos nas indústrias e fornecerá aos usuários uma visão geral valiosa do mercado e insights de mercado para ajudá-los a tomar decisões estratégicas para identificar as principais aplicações de mercado.

Produto

- Reagentes e consumíveis

- Tingir

- Anticorpos

- Contas

- Outros

- Instrumentos de Citometria de Fluxo

- Analisadores de células

- Por tipo

- Citômetros de fluxo de imagem

- Citômetros de fluxo sem imagem

- Por intervalo

- Analisadores de células de alto alcance

- Analisadores de células de médio alcance

- Analisadores de células de baixo alcance

- Por Modalidade

- Bancada

- Autônomo

- Por tipo

- Classificadores de células

- Por Modalidade

- Bancada

- Autônomo

- Por intervalo

- Analisadores de células de alto alcance

- Analisadores de células de médio alcance

- Analisadores de células de baixo alcance

- Por Modalidade

- Analisadores de células

- Acessórios

- Filtros

- Detectores

- Outros

- Serviços

- Programas

Tecnologia

- Citometria de fluxo baseada em células

- Instrumentos de Citometria de Fluxo

- Reagentes e consumíveis

- Acessórios

- Citometria de fluxo baseada em esferas

- Instrumentos de Citometria de Fluxo

- Reagentes e consumíveis

- Acessórios

Aplicativo

- Aplicações de Pesquisa

- Análise do ciclo celular

- Classificação/triagem de células

- Transfecção/Viabilidade Celular

- Farmacêutica e Biotecnologia

- Descoberta de Medicamentos

- Pesquisa com células-tronco

- Teste de toxicidade in vitro

- Imunologia

- Apoptose

- Contagem de células

- Outros

- Aplicações clínicas

- Hematologia

- Câncer

- Doenças de Imunodeficiência

- Transplante de Órgãos

- Outras aplicações clínicas

- Aplicações Industriais

Usuário final

- Empresas Farmacêuticas e de Biotecnologia

- Institutos Acadêmicos e de Pesquisa

- Hospitais

- Laboratórios de Testes Clínicos

- Cro

- Banco de Sangue

- Cmo e Cdmo

- Laboratório Forense

- Outros

Canal de Distribuição

- Vendas no varejo

- Desligado

- On-line

- Licitações Diretas

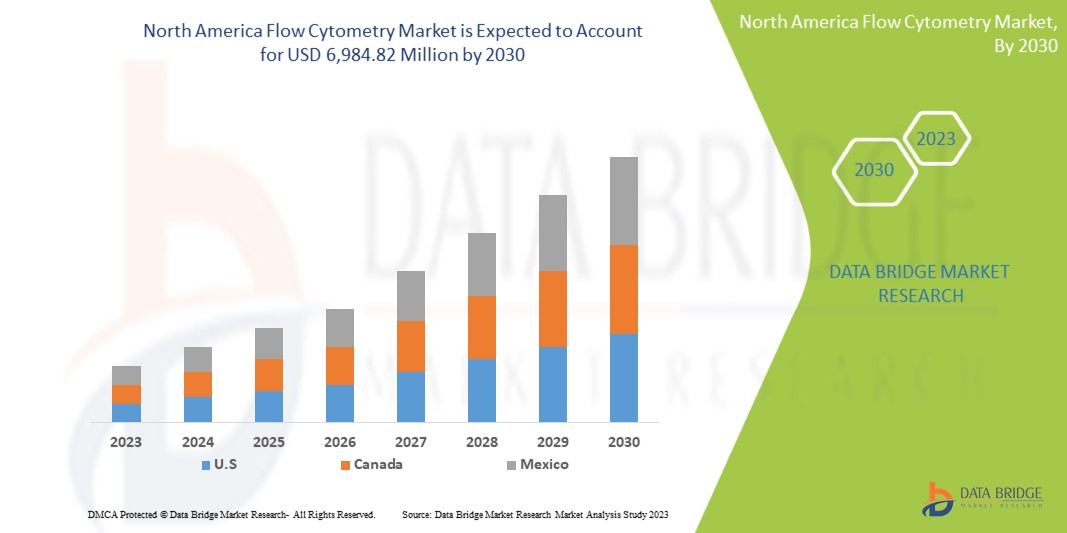

Análise regional do mercado de citometria de fluxo na América do Norte

O mercado é analisado e insights e tendências sobre o tamanho do mercado são fornecidos por país, produto, aplicação, tecnologia, canal de distribuição e usuário final, conforme referenciado acima.

Os países abrangidos pelo mercado são EUA, Canadá, México, Alemanha, França, Reino Unido, Itália, Espanha, Rússia, Holanda, Suíça, Turquia, Bélgica, Áustria, Irlanda, Noruega, Polônia, Resto da Europa, Japão, China, Índia, Coreia do Sul, Austrália, Cingapura, Tailândia, Malásia, Indonésia, Vietnã, Filipinas, Resto da Ásia-Pacífico, Brasil, Argentina, Peru, Resto da América do Sul, África do Sul, Arábia Saudita, Emirados Árabes Unidos, Egito, Kuwait, Israel e Resto do Oriente Médio e África.

Os EUA dominam o mercado de citometria de fluxo devido ao seu forte setor de pesquisa e desenvolvimento, presença de empresas líderes como BD Biosciences e Beckman Coulter, e financiamento governamental substancial. Além disso, suas indústrias avançadas de saúde e biotecnologia impulsionam o uso generalizado da citometria de fluxo em pesquisas e aplicações clínicas.

O Canadá é o país de crescimento mais rápido em citometria de fluxo devido aos seus setores de biotecnologia e farmacêutico em expansão, aumento do financiamento de pesquisa e fortes colaborações acadêmicas. O foco do país em inovação em saúde, juntamente com uma demanda crescente por ferramentas avançadas de diagnóstico, impulsiona a adoção de tecnologias de citometria de fluxo em pesquisas e aplicações clínicas.

A seção do país do relatório também fornece fatores de impacto de mercado individuais e mudanças na regulamentação no mercado doméstico que impactam as tendências atuais e futuras do mercado. Pontos de dados como análise da cadeia de valor downstream e upstream, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores usados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da América do Norte e seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer análise de previsão dos dados do país.

Participação no mercado de citometria de fluxo na América do Norte

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluídos são visão geral da empresa, finanças da empresa, receita gerada, potencial de mercado, investimento em pesquisa e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, locais e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produto, largura e amplitude do produto, domínio da aplicação. Os pontos de dados fornecidos acima são relacionados apenas ao foco das empresas em relação ao mercado.

Os líderes de mercado de citometria de fluxo na América do Norte que operam no mercado são:

- BD (EUA)

- Agilent Technologies, Inc. (EUA)

- Thermo Fisher Scientific Inc. (EUA)

- Bio-Rad Laboratories, Inc. (EUA)

- Sartorius AG (EUA)

- CytoBuoy (EUA)

- ORLFO Technologies (EUA)

- Bennubio Inc. (EUA)

- Enzo Biochem Inc. (EUA)

- Merck KGaA (EUA)

- Apogee Flow Systems Ltd. (EUA)

- Beckman Coulter, Inc. (EUA)

- Coherent Corp. (EUA)

- Laboratórios NeoGenomics (EUA)

- Sysmex Corporation (EUA)

- Luminex Corporation (EUA)

- Elabscience Bionovation Inc. (EUA)

- Miltenyi Biotec

- Takara Bio Inc. (EUA)

- Cell Signaling Technology, Inc. (EUA)

- Sony Biotechnology Inc. (EUA)

- Cytek Biosciences (EUA)

- Biomérieux (EUA).

- On-chip Biotechnologies Co., Ltd. Corporation (EUA)

- NanoCellect Biomedical (EUA)

- Stratedigm, Inc (EUA)

- Cytonome/ST LLC (EUA)

- Union Biometrica, Inc. (EUA)

Últimos desenvolvimentos no mercado de citometria de fluxo na América do Norte

- Em julho de 2024, a Agilent Technologies anunciou a aquisição da empresa canadense de serviços farmacêuticos BioVectra por USD 925 milhões. Este movimento expande as capacidades da Agilent em edição genética, especificamente na fabricação de oligonucleotídeos e peptídeos, aprimorando seu papel em terapias baseadas em RNA e tecnologias de edição genética como CRISPR-Cas

- Em junho de 2024, a Thermo Fisher comemorou o corte da fita de uma expansão de 72.500 pés quadrados em seu campus de Middleton, que servirá como um laboratório para testes farmacêuticos. O projeto criará 350 empregos nos próximos dois anos, com créditos fiscais estaduais apoiando a iniciativa

- Em novembro de 2024, a Sartorius Stedim Biotech abriu um novo Centro de Inovação em Bioprocessos em Marlborough, Massachusetts, com o objetivo de promover o desenvolvimento de terapêuticas de última geração. A instalação de 63.000 pés quadrados fornecerá otimização de processos, treinamento e suítes GMP para produção clínica a partir de 2025

- Em março de 2024, a Beckman Coulter Life Sciences lançou o CytoFLEX nano Flow Cytometer, um avanço na análise de nanopartículas que permite a detecção de até 40 nm. Este sistema aumenta a sensibilidade, oferecendo até 50% mais dados para pesquisa em vesículas extracelulares e alvos de menor abundância

- Em março de 2024, a Beckman Coulter Life Sciences recebeu a autorização 510(k) da FDA para distribuir seu Citômetro de Fluxo Clínico DxFLEX nos EUA. Isso simplifica os testes de alta complexidade com sensibilidade aprimorada e compensação automatizada, tornando a citometria de fluxo multicolorida mais acessível e eficiente para laboratórios.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA FLOW CYTOMETRY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 NORTH AMERICA FLOW CYTOMETRY MARKET: REGULATIONS

5.1 NORTH AMERICA (U.S. AND CANADA)

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES

6.1.2 INCREASING APPLICATION OF CYTOMETRY INSTRUMENTS

6.1.3 GROWING USE OF FLOW CYTOMETRY IN DRUG DISCOVERY

6.1.4 GROWING RESEARCH FUNDING

6.2 RESTRAINTS

6.2.1 HIGH COST OF FLOW CYTOMETRY INSTRUMENTS

6.2.2 LIMITATIONS OF FLOW CYTOMETRY

6.3 OPPORTUNITIES

6.3.1 INCREASE IN ADOPTION OF FLOW CYTOMETRY TECHNIQUES IN RESEARCH AND ACADEMIA

6.3.2 RISING DEVELOPMENT OF PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES

6.3.3 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 DIFFICULTY IN THE DEVELOPMENT AND VALIDATION OF FLOW CYTOMETRY ASSAYS

6.4.2 COMPLEXITIES RELATED TO REAGENT DEVELOPMENT

7 NORTH AMERICA FLOW CYTOMETRY MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 REAGENTS AND CONSUMABLES

7.2.1 DYE

7.2.2 ANTIBODIES

7.2.3 BEADS

7.2.4 OTHERS

7.3 FLOW CYTOMETRY INSTRUMENTS

7.3.1 CELL ANALYZERS

7.3.1.1 CELL ANALYZERS, BY TYPE

7.3.1.1.1 IMAGING FLOW CYTOMETERS

7.3.1.1.2 NON-IMAGING FLOW CYTOMETERS

7.3.1.2 CELL ANALYZERS, BY RANGE

7.3.1.2.1 HIGH-RANGE CELL ANALYZERS

7.3.1.2.2 MID-RANGE CELL ANALYZERS

7.3.1.2.3 LOW-RANGE CELL ANALYZERS

7.3.1.3 CELL ANALYZERS, BY MODALITY

7.3.1.3.1 BENCHTOP

7.3.1.3.2 STANDALONE

7.3.2 CELL SORTERS

7.3.2.1 BENCHTOP

7.3.2.2 STANDALONE

7.3.3 CELL SORTERS

7.3.3.1 HIGH-RANGE CELL ANALYZERS

7.3.3.2 MID-RANGE CELL ANALYZERS

7.3.3.3 LOW-RANGE CELL ANALYZERS

7.4 ACCESSORIES

7.4.1 FILTERS

7.4.2 DETECTORS

7.4.3 OTHERS

7.5 SERVICES

7.6 SOFTWARE

8 NORTH AMERICA FLOW CYTOMETRY MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 CELL-BASED FLOW CYTOMETRY

8.2.1 FLOW CYTOMETRY INSTRUMENTS

8.2.2 REAGENTS & CONSUMABLES

8.2.3 ACCESSORIES

8.3 BEAD-BASED FLOW CYTOMETRY

8.3.1 FLOW CYTOMETRY INSTRUMENTS

8.3.2 REAGENTS & CONSUMABLES

8.3.3 ACCESSORIES

9 NORTH AMERICA FLOW CYTOMETRY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESEARCH APPLICATIONS

9.2.1 CELL CYCLE ANALYSIS

9.2.2 CELL SORTING/SCREENING

9.2.3 CELL TRANSFECTION/VIABILITY

9.2.4 PHARMACEUTICAL AND BIOTECHNOLOGY

9.2.4.1 DRUG DISCOVERY

9.2.4.2 STEM CELL RESEARCH

9.2.4.3 IN VITRO TOXICITY TESTING

9.2.5 IMMUNOLOGY

9.2.6 APOPTOSIS

9.2.7 CELL COUNTING

9.2.8 OTHERS

9.3 CLINICAL APPLICATIONS

9.3.1 HAEMATOLOGY

9.3.2 CANCER

9.3.3 IMMUNODEFICIENCY DISEASES

9.3.4 ORGAN TRANSPLANTATION

9.3.5 OTHER CLINICAL APPLICATION

9.4 INDUSTRIAL APPLICATIONS

10 NORTH AMERICA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 RETAIL SALES

10.2.1 OFFLINE

10.2.2 ONLINE

10.3 DIRECT TENDERS

11 NORTH AMERICA FLOW CYTOMETRY MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICALS AND BIOTECHNOLOGY COMPANIES

11.3 ACADEMIC & RESEARCH INSTITUTES

11.4 HOSPITALS

11.5 CLINICAL TESTING LABORATORIES

11.6 CRO

11.7 BLOOD BANK

11.8 CMO & CDMO

11.9 FORENSIC LABORATORIES

11.1 OTHERS

12 NORTH AMERICA FLOW CYTOMETRY MARKET, BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA FLOW CYTOMETRY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BD

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 AGILENT TECHNOLOGIES, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 THERMO FISHER SCIENTIFIC INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 BIO-RAD LABORATORIES, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 SARTORIUS AG

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 APOGEE FLOW SYSTEMS LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BECKMAN COULTER, INC. (A SUBSIDIARY OF DANAHER CORPORATION)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 BIOMÉRIEUX

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BIOLEGEND, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BENNUBIO INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 COHERENT CORP.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 CYTONOME/ST, LLC

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 CELL SIGNALING TECHNOLOGY, INC

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 CYTEK BIOSCIENCES

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 DIASORIN S.P.A.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 ELABSCIENCE BIONOVATION INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 ENZO BIOCHEM, INC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 MILTENYI BIOTEC

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 MERCK KGAA

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 NANOCELLECT BIOMEDICAL

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 NEOGENOMICS LABORATORIES

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 ON-CHIP BIOTECHNOLOGIES CO., LTD. CORPORATION

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 ORLFO TECHNOLOGIES

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 STRATEDIGM, INC

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 SONY BIOTECHNOLOGY INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 SYSMEX ASIA PACIFIC PTE LTD (PART OF SYSMEX CORPORATION)

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENT

15.27 UNION BIOMETRICA, INC.

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 2 NORTH AMERICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 3 NORTH AMERICA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 4 NORTH AMERICA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 5 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 7 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 10 NORTH AMERICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 12 NORTH AMERICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 14 NORTH AMERICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 16 NORTH AMERICA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA CELL-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA FLOW CYTOMETRY MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 27 U.S. FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 28 U.S. REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 29 U.S. REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 30 U.S. REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 31 U.S. FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 32 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 33 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 34 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 35 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 36 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 37 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 38 U.S. CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 39 U.S. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 40 U.S. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 41 U.S. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 42 U.S. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 43 U.S. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 44 U.S. CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 45 U.S. ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 46 U.S. ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 47 U.S. ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 48 U.S. FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 49 U.S. CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 50 U.S. BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 51 U.S. FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 52 U.S. RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 53 U.S. PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 54 U.S. CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 55 U.S. FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 56 U.S. FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 57 U.S. RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 58 CANADA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 59 CANADA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 60 CANADA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 61 CANADA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 62 CANADA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 63 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 64 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 65 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 66 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 67 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 68 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 69 CANADA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 70 CANADA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 71 CANADA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 72 CANADA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 73 CANADA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 74 CANADA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 75 CANADA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 76 CANADA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 77 CANADA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 78 CANADA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 79 CANADA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 80 CANADA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 81 CANADA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 82 CANADA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 83 CANADA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 84 CANADA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 85 CANADA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 86 CANADA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 87 CANADA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 88 CANADA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 89 MEXICO FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 90 MEXICO REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 91 MEXICO REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 92 MEXICO REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 93 MEXICO FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 94 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 95 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 96 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 97 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 98 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 99 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 100 MEXICO CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 101 MEXICO CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 102 MEXICO CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 103 MEXICO CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 104 MEXICO CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 105 MEXICO CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 106 MEXICO CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 107 MEXICO ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 108 MEXICO ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 109 MEXICO ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 110 MEXICO FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 111 MEXICO CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 112 MEXICO BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 113 MEXICO FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 114 MEXICO RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 115 MEXICO PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 116 MEXICO CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 117 MEXICO FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 118 MEXICO FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 119 MEXICO RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA FLOW CYTOMETRY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FLOW CYTOMETRY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FLOW CYTOMETRY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FLOW CYTOMETRY MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FLOW CYTOMETRY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FLOW CYTOMETRY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FLOW CYTOMETRY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FLOW CYTOMETRY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA FLOW CYTOMETRY MARKET: SEGMENTATION

FIGURE 11 FIVE SEGMENTS COMPRISE THE NORTH AMERICA FLOW CYTOMETRY MARKET, BY PRODUCT

FIGURE 12 NORTH AMERICA FLOW CYTOMETRY MARKET EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING PREVALENCE OF CHRONIC DISEASES IS DRIVING THE GROWTH OF THE NORTH AMERICA FLOW CYTOMETRY MARKET FROM 2025 TO 2032

FIGURE 15 THE REAGENTS AND CONSUMABLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FLOW CYTOMETRY MARKET IN 2025 AND 2032

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FLOW CYTOMETRY MARKET

FIGURE 17 NORTH AMERICA FLOW CYTOMETRY MARKET: BY PRODUCT, 2024

FIGURE 18 NORTH AMERICA FLOW CYTOMETRY MARKET: BY PRODUCT, 2025-2032 (USD MILLION)

FIGURE 19 NORTH AMERICA FLOW CYTOMETRY MARKET: BY PRODUCT, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA FLOW CYTOMETRY MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 21 NORTH AMERICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, 2024

FIGURE 22 NORTH AMERICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, 2025-2032 (USD MILLION)

FIGURE 23 NORTH AMERICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA FLOW CYTOMETRY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 25 NORTH AMERICA FLOW CYTOMETRY MARKET: BY APPLICATION, 2024

FIGURE 26 NORTH AMERICA FLOW CYTOMETRY MARKET: BY APPLICATION, 2025-2032 (USD MILLION)

FIGURE 27 NORTH AMERICA FLOW CYTOMETRY MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA FLOW CYTOMETRY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 30 NORTH AMERICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 31 NORTH AMERICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA FLOW CYTOMETRY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 33 NORTH AMERICA FLOW CYTOMETRY MARKET: BY END USER, 2024

FIGURE 34 NORTH AMERICA FLOW CYTOMETRY MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 35 NORTH AMERICA FLOW CYTOMETRY MARKET: BY END USER, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA FLOW CYTOMETRY MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 NORTH AMERICA FLOW CYTOMETRY MARKET: SNAPSHOT

FIGURE 38 NORTH AMERICA FLOW CYTOMETRY MARKET: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.