North America Fleet Management Market, By Offering (Solution and Services), Lease Type (On-Lease and Without Lease), Mode of Transport (Automotive, Marine, Rolling Stock, and Aircraft), Vehicle Type (Internal Combustion Engines and Electric Vehicle), Hardware (GPS Tracking Devices, Dash Cameras, Bluetooth Tracking Tags ,Data Loggers, and Others), Fleet Size (Small Fleets (1-5 Vehicles), Medium Fleets (5-20 Vehicles), and Large and Enterprise Fleets (20-50+ Vehicles), Communication Range (Short-Range Communication and Long-Range Communication), Deployment Model (On-Premise, Cloud, and Hybrid), Technology (GNSS, Cellular Systems, Electronic Data Interchange (EDI), Remote Sensing, Computational Methods and Decision-Making, RFID, and Others), Function (Monitoring Driver Behaviour, Fuel Consumption, Asset Management, ELD Complaint, Route Management, Vehicle Maintenance Updates, Delivery Schedule, Accident Prevention, Real-Time Vehicle Location, Mobile Apps, and Others), Operations (Private and Commercial), Business Type (Small Businesses and Large Businesses), End User (Automotive, Transportation & Logistics, Retail, Manufacturing, Food & Beverages, Energy & Utilities, Mining, Government, Healthcare, Agriculture, Construction, and Others) – Industry Trends and Forecast to 2030.

North America Fleet Management Market Analysis and Size

Major factors expected to boost the growth of the fleet management market in the forecast period are the rise in several industrial applications, including aerospace, steel, power, chemical, and others. Furthermore, the increased resistance to load variations is the benefit of fleet management, which is further anticipated to propel the growth of the fleet management market.

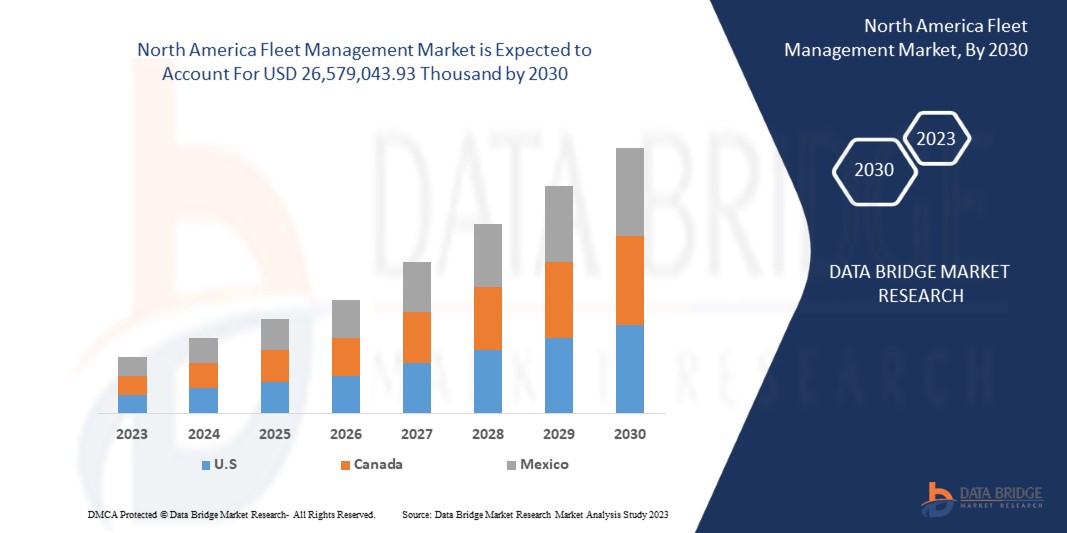

Data Bridge Market Research analyses that the North America fleet management market is expected to reach the value of USD 26,579,043.93 thousand by 2030, at a CAGR of 10.9% during the forecast period. The fleet management market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

Historic Years |

2021 (Customizable to 2015 – 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Offering (Solution and Services), Lease Type (On-Lease and Without Lease), Mode of Transport (Automotive, Marine, Rolling Stock, and Aircraft), Vehicle Type (Internal Combustion Engines and Electric Vehicle), Hardware (GPS Tracking Devices, Dash Cameras, Bluetooth Tracking Tags ,Data Loggers, and Others), Fleet Size (Small Fleets (1-5 Vehicles), Medium Fleets (5-20 Vehicles), and Large and Enterprise Fleets (20-50+ Vehicles), Communication Range (Short-Range Communication and Long-Range Communication), Deployment Model (On-Premise, Cloud, and Hybrid), Technology (GNSS, Cellular Systems, Electronic Data Interchange (EDI), Remote Sensing, Computational Methods and Decision-Making, RFID, and Others), Function (Monitoring Driver Behaviour, Fuel Consumption, Asset Management, ELD Complaint, Route Management, Vehicle Maintenance Updates, Delivery Schedule, Accident Prevention, Real-Time Vehicle Location, Mobile Apps, and Others), Operations (Private and Commercial), Business Type (Small Businesses and Large Businesses), End User (Automotive, Transportation & Logistics, Retail, Manufacturing, Food & Beverages, Energy & Utilities, Mining, Government, Healthcare, Agriculture, Construction, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

TRAXALL, Donlen LeasePlan, Enterprise Holdings, Emkay, Chevin Fleet Solutions, Deutsche Leasing AG, BERGSTROM AUTOMOTIVE, TÜV SÜD, Motive Technologies, Inc., ALD Automotive, VEL’CO, Avrios, Element Fleet Management Corp., Rarestep, Inc., OviDrive B.V., FleetCompany GmbH, Sixt Leasing (Acquired by Hyundai Capital Bank Europe GmbH) , Fleetcare Pty Ltd., Capital Lease Group, Wilmar Inc., Wheels, NEXTRAQ, LLC, Avis Budget Group, and Zeemac Vehicle Acquisition & Fleet Services among others |

Market Definition

Fleet management is the processes and practices involved in managing a company's fleet of vehicles. Fleet management includes cars, trucks, vans, and other vehicles used for business purposes. It also involves many practices, such as vehicle acquisition, maintenance, fuel management, driver management, and safety and compliance. The goal of fleet management is to optimize the use of company vehicles to improve efficiency, reduce costs, and enhance safety. Effective fleet management can help companies to increase productivity, reduce downtime, and extend the useful life of their vehicles. It can also help to improve driver behavior, reduce accidents, and ensure compliance with regulations and policies. Fleet management is used in various industries, including transportation, logistics, delivery services, and construction. Advanced technologies, such as GPS tracking and telematics, have made fleet management more effective and efficient in recent years.

North America Fleet Management Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Increase in Demand for the Logistics Due to the E-Commerce Industry

Fleet management is a practice that allows organizations to manage and coordinate delivery vehicles to achieve optimum efficiency and reduce costs. The practice of fleet management is used to monitor and record couriers and delivery personnel. It requires a system of technologies that make it easier for the fleet manager to coordinate the activities from fuel management to planning the routes- and can be easily managed using fleet management software. The expansion of the e-commerce industry has significantly impacted the logistics industry. Logistics has been considered the backbone of the e-commerce industry as it immediately affects planned operations, stockrooms, and production network organizations. They will progressively depend on re-evaluating to deal with the rising requests related to internet business portion development. Embracing this course either for the last-mile conveyance or for request satisfaction will empower them to guarantee predictable, dependable, productive, and misfire-free conveyance. Thus, this can be a great factor in managing and expanding the pressure due to the expected growth of the e-commerce business industry.

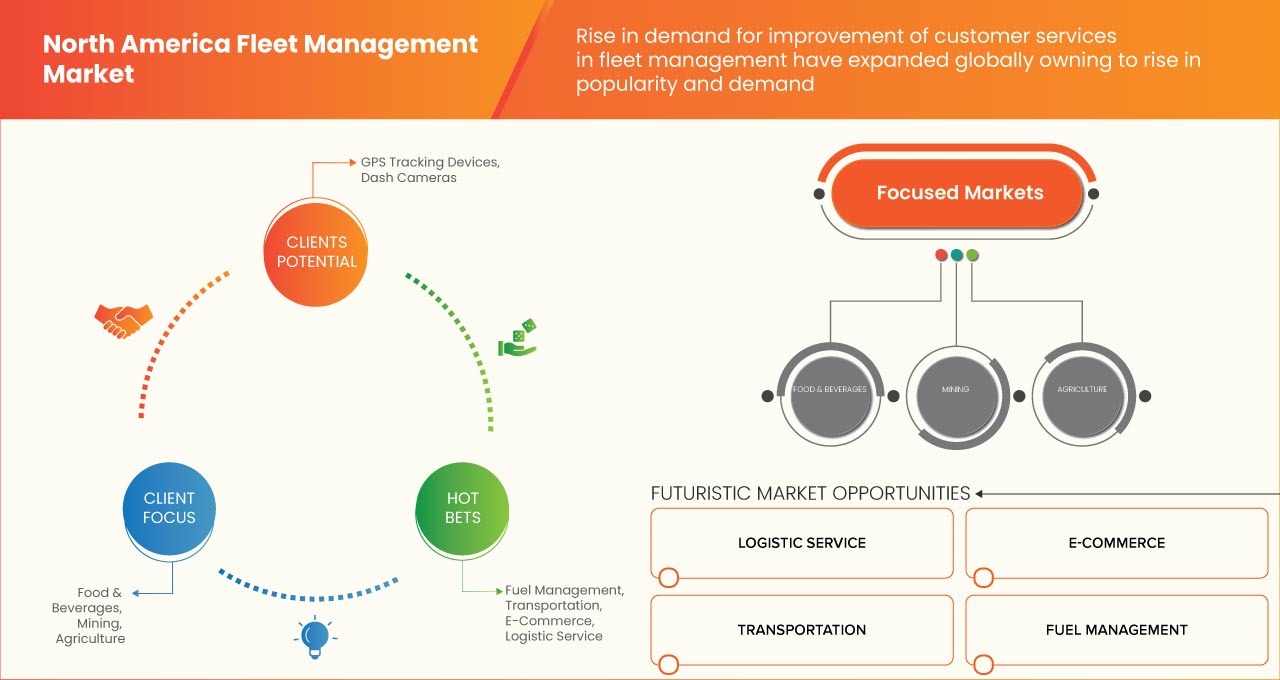

- Rise in Demand for Improvement of Customer Services

Customers nowadays are smarter and have higher expectations than ever before. Customer satisfaction and happiness are among the most important considerations for any company. Regardless of the business sector, unhappy customers won't be customers for long, so it's important to keep them happy and feel valued. This is true for logistics and fleet management as well, where the retention of customers is key to long-term success. Improving customer services and satisfaction through improved fleet management performance is a key factor expected to boost the North America fleet management market. In today's competitive market, businesses recognize the importance of customer satisfaction and use advanced technologies in fleet management solutions to optimize their operations and improve customer experiences

Opportunities

- Rise in the Demand for Utility Vehicles

Utility vehicles are vehicles designed and used for carrying goods or passengers. These vehicles include trucks, vans, buses, and similar vehicles used for commercial purposes. The utility vehicle market is a crucial component of the North America automobile industry and has witnessed significant growth over the past decades. The rise in demand for utility vehicles can be attributed to several factors, including the growth of the e-commerce industry, increasing urbanization, and the need for efficient transportation systems. As more and more businesses rely on utility vehicles for their transportation needs, the demand for fleet management services and software is also expected to increase. One of the reasons for the rise in demand for utility vehicles is the growth of the e-commerce industry. The demand for transportation services has increased with the increasing number of online shopping platforms. As a result, the use of utility vehicles has become more common, and fleet management has become more critical.

Restraints/Challenges

- Lower Efficiency in Connectivity

The logistics and transport industry has changed significantly in recent years. Concepts such as digitization, the emergence of big data, and connectivity have been introduced, and many fleets are now using early versions of these new technologies. In many cases, they are changing how fleet managers operate daily. Connectivity is one of the most important and effective concepts. This is where a fleet manager can have an overview of the entire fleet and stay in contact with drivers, trucks, and trailers through automated processes that provide actionable data from on-board devices. Through telematics devices and connected software solutions, fleet problems can be alerted to minor vehicle issues as they arise, allowing them to address issues sooner and deal with problems before breakdowns occur. This gives the flexibility to make running repairs or scheduled maintenance in advance, which enables trucks to stay on the road more often, spending more time delivering goods

- Improper Guidance for Enabling the Route

A vehicle tracking system can be defined as a part of a fleet management system, which enables the fleet operator to find out the vehicle's location throughout the vehicle's journey against time. Apart from utilizing the data generated by the vehicle tracking system for enforcing the bus schedule, this data also provides important inputs for decision-making. The system facilitates the computation of the exact distance travelled in a given time span, the computation of the speed of the bus at a given location, the analysis of the time taken by the vehicle to cover a certain distance. It becomes a very powerful tool in the case of operating agencies.

Post COVID-19 Impact on North America Fleet Management Market

COVID-19 created a negative impact on the fleet management market due to lockdown regulations and rules at manufacturing facilities.

A pandemia COVID-19 impactou o mercado de gestão de frotas de forma negativa. No entanto, a crescente adoção da gestão de frotas no setor da aviação ajudou o mercado a crescer após a pandemia. Além disso, o crescimento tem sido elevado desde a abertura do mercado após a COVID-19, e prevê-se que haja um crescimento considerável no sector.

Os fabricantes estão a tomar várias decisões estratégicas para recuperar após a COVID-19. Os participantes estão a conduzir diversas atividades de investigação e desenvolvimento para melhorar a tecnologia envolvida na gestão de frotas. Com isto, as empresas trarão tecnologias avançadas para o mercado. Além disso, as iniciativas governamentais para a utilização da tecnologia de automação levaram ao crescimento do mercado.

Desenvolvimento recente

- Em outubro de 2022, a Chevin Fleet Solutions anunciou que a Empresa tinha lançado novas aplicações, ‘FleetWave Technician’ e ‘FleetWave Driver’, para os seus produtos de software de gestão de frotas.

- Em fevereiro de 2022, a Element Fleet Management Corp. anunciou que a empresa lançou o Arc by Element, uma frota completa de veículos elétricos (EV) que oferece para ajudar os clientes a navegar e simplificar a complexa transição de veículos com motor de combustão interna (ICE) para VEs.

Âmbito do mercado de gestão de frotas da América do Norte

O mercado de gestão de frotas da América do Norte está segmentado com base na oferta, tipo de aluguer, modo de transporte, tipo de veículo, hardware, tamanho da frota, alcance de comunicação, modelo de implantação, tecnologia, funções, operações, tipo de negócio e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar os escassos segmentos de crescimento nas indústrias e fornecer aos utilizadores uma valiosa visão geral do mercado e insights de mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Oferta

- Solução

- Serviços

Com base na oferta, o mercado está segmentado em soluções e serviços.

Tipo de locação

- Em locação

- Sem locação

Com base no tipo de arrendamento, o mercado está segmentado em com arrendamento e sem arrendamento.

Meio de Transporte

- Automotivo

- Marinho

- Material circulante

- Aeronave

Com base no modo de transporte, o mercado está segmentado em automóvel, marítimo, material circulante e aeronaves.

Tipo de veículo

- Motores de Combustão Interna (ICE)

- Veículo Elétrico

Com base no tipo de veículo, o mercado está segmentado em Motores de Combustão Interna (ICE) e veículos elétricos.

Hardware

- Dispositivos de seguimento GPS

- Câmaras de painel

- Etiquetas de seguimento Bluetooth (BLE Beacons)

- Registadores de dados

- Outros

Com base no hardware, o mercado está segmentado em dispositivos de rastreamento GPS, câmaras de painel, tags de rastreamento bluetooth (beacons BLE), data loggers, entre outros.

Tamanho da Frota

- Frotas de Pequena Dimensão (1-5 Veículos)

- Frotas Médias (5-20 Veículos)

- Frotas grandes e empresariais (mais de 20 a 50 veículos)

Com base no tamanho da frota, o mercado está segmentado em frotas pequenas (1-5 veículos), frotas médias (5-20 veículos) e frotas grandes e empresariais (20-50+ veículos).

Alcance de comunicação

- Comunicação de curto alcance

- Comunicação de longo alcance

Com base no alcance da comunicação, o mercado está segmentado em comunicação de curto alcance e comunicação de longo alcance.

Modelo de implantação

- No local

- Nuvem

- Híbrido

Com base no modelo de implementação, o mercado está segmentado em local, cloud e híbrido.

Tecnologia

- GNSS

- Sistemas Celulares

- Intercâmbio Eletrónico de Dados (EDI)

- Sensoriamento Remoto

- Métodos Computacionais

- Tomando uma decisão

- RFID

- Outros

Com base na tecnologia, o mercado está segmentado em GNSS, sistemas celulares, intercâmbio eletrónico de dados (EDI), deteção remota, métodos computacionais, tomada de decisão, RFID, entre outros.

Função

- Monitorização do comportamento do motorista

- Consumo de combustível

- Gestão de ativos

- Reclamação ELD

- Gestão de rotas

- Atualizações de manutenção de veículos

- Cronograma de entrega

- Prevenção de Acidentes

- Localização de veículos em tempo real

- Aplicativos móveis

- Outros

Com base na função, o mercado está segmentado em monitorização do comportamento do condutor, consumo de combustível, gestão de ativos, reclamação ELD, gestão de rotas, atualizações de manutenção de veículos, calendário de entregas, prevenção de acidentes, localização de veículos em tempo real, aplicações móveis, entre outros.

Operações

- Privado

- Comercial

Com base nas operações, o mercado está segmentado em privado e comercial.

Tipo de negócio

- Pequenas empresas

- Grandes empresas

Com base no tipo de negócio, o mercado está segmentado em pequenas e grandes empresas.

Utilizador final

- Automotivo

- Transporte e Logística

- Retalho

- Fabricação

- Alimentos e Bebidas

- Energia e serviços públicos

- Mineração

- Governo

- Assistência médica

- Agricultura

- Construção

- Outros

Com base no utilizador final, o mercado está segmentado em automóvel, transporte e logística, retalho, manufatura, alimentos e bebidas, energia e serviços públicos, mineração, governo, saúde, agricultura, construção, entre outros. Todos os setores automóvel, transportes e logística, retalho, manufatura, alimentos e bebidas, energia e serviços públicos, mineração, governo, saúde, agricultura e construção.

Análise/perspetivas regionais do mercado de gestão de frotas da América do Norte

O mercado de gestão de frotas da América do Norte é analisado, e são fornecidos insights e tendências de tamanho de mercado por oferta, tipo de aluguer, modo de transporte, tipo de veículo, hardware, tamanho da frota, alcance de comunicação, modelo de implementação, tecnologia, funções, operações, tipo de negócio, e utilizador final como referido acima.

Os países abordados no relatório do mercado de gestão de frotas são os EUA, o Canadá e o México na América do Norte.

Os EUA são um país dominante, pois albergam muitos players gigantes no mercado de gestão de frotas.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a jusante e a montante, tendências técnicas, análise das cinco forças de Porter e estudos de caso são alguns indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas da América do Norte e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, o impacto das tarifas domésticas e as rotas comerciais, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado de gestão de frotas da América do Norte

O panorama competitivo do mercado de gestão de frotas da América do Norte fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, capacidades de produção, pontos fortes e débeis da empresa, lançamento de produto, largura e amplitude do produto. Os dados acima fornecidos estão apenas relacionados com o foco das empresas relacionado com o mercado de gestão de frotas.

Alguns dos principais players que operam no mercado norte-americano de gestão de frotas são a TRAXALL, Donlen LeasePlan, Enterprise Holdings, Emkay, Chevin Fleet Solutions, Deutsche Leasing AG, BERGSTROM AUTOMOTIVE, TÜV SÜD, Motive Technologies, Inc., ALD Automotive, VEL'CO , Avrios, Element Fleet Management Corp., Rarestep, Inc., OviDrive BV, FleetCompany GmbH, Sixt Leasing (adquirida pela Hyundai Capital Bank Europe GmbH), Fleetcare Pty Ltd., Capital Lease Group, Wilmar Inc., Wheels, NEXTRAQ, LLC , Avis Budget Group e Zeemac Vehicle Acquisition & Fleet Services, entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA FLEET MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS MODEL

4.2 REGULATORY LANDSCAPE

4.3 TOP WINNING STRATEGIES

4.4 COMPANY CAR POLICY

4.4.1 BENEFITS OF CAR POLICY CENTRALIZATION

4.4.2 CORPORATE POLICIES ON THE USAGE OF COMPANY CARS

4.5 FLEET MANAGEMENT PROFIT ALLOCATION ALONG THE VALUE CHAIN

4.6 BRAND COMPARATIVE ANALYSIS

4.6.1 TRAXALL

4.6.2 LEASEPLAN

4.6.3 ENTERPRISE HOLDINGS

4.6.4 ELEMENT FLEET MANAGEMENT

4.6.5 WHEELS

4.7 DISRUPTIVE TECHNOLOGIES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR THE LOGISTICS DUE TO THE E-COMMERCE INDUSTRY

5.1.2 RISE IN DEMAND FOR IMPROVEMENT OF CUSTOMER SERVICES

5.1.3 RAPID ADOPTION OF FUEL MANAGEMENT SYSTEMS IN FLEETS

5.1.4 INCREASE IN DEMAND FOR FULL-SERVICE LEASING

5.2 RESTRAINTS

5.2.1 LOWER EFFICIENCY IN CONNECTIVITY

5.2.2 IMPROPER GUIDANCE FOR ENABLING THE ROUTE

5.3 OPPORTUNITIES

5.3.1 RISE IN THE DEMAND FOR UTILITY VEHICLES

5.3.2 RISE IN THE TREND OF NORTH AMERICAIZATION

5.3.3 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.4 INCREASE IN DATA-DRIVEN MODELS IN MOBILITY

5.4 CHALLENGES

5.4.1 ACCUMULATION OF HUGE DATA VOLUME

5.4.2 RISE IN CYBER THREATS

6 NORTH AMERICA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE

6.1 OVERVIEW

6.2 SHORT RANGE COMMUNICATION

6.3 LONG RANGE COMMUNICATION

7 NORTH AMERICA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 ON-PREMISE

7.3 CLOUD

7.4 HYBRID

8 NORTH AMERICA FLEET MANAGEMENT MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 GNSS

8.3 CELLULAR SYSTEMS

8.4 LECTRONIC DATA INTERCHANGE (EDI)

8.5 REMOTE SENSING

8.6 COMPUTATIONAL METHOD & DECISION MAKING

8.7 RFID

8.8 OTHERS

9 NORTH AMERICA FLEET MANAGEMENT MARKET, BY FUNCTIONS

9.1 OVERVIEW

9.2 ASSET MANAGEMENT

9.3 ROUTE MANAGEMENT

9.4 FUEL CONSUMPTION

9.5 REAL TIME VEHICLE LOCATION

9.6 DELIVERY SCHEDULE

9.7 ACCIDENT PREVENTION

9.8 MOBILE APPS

9.9 MONITORING DRIVER BEHAVIOR

9.1 VEHICLE MAINTENANCE UPDATES

9.11 ELD COMPLIANCE

9.12 OTHERS

10 NORTH AMERICA FLEET MANAGEMENT MARKET, BY OPERATIONS

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 PRIVATE

11 NORTH AMERICA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE

11.1 OVERVIEW

11.2 LARGE BUSINESS

11.2.1 FLORIST & GIFT DELIVERY BUSINESS

11.2.2 CATERING & FOOD DELIVERING COMPANY

11.2.3 CLEANING SERVICE COMPANY

11.2.4 ELECTRICIAN/PLUMBING/HVAC COMPANY

11.2.5 LANDSCAPING BUSINESS

11.3 SMALL BUSINESS

11.3.1 RENTAL CAR/TRUCK COMPANY

11.3.2 MOVING COMPANY

11.3.3 TAXI COMPANY

11.3.4 DELIVERY COMPANY

11.3.5 LONG HAUL SEMI-TRUCK COMPANY

12 NORTH AMERICA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE

12.1 OVERVIEW

12.2 INTERNAL COMBUSTION ENGINE

12.3 ELECTRIC VEHICLE

13 NORTH AMERICA FLEET MANAGEMENT MARKET, BY OFFERING

13.1 OVERVIEW

13.2 SOLUTIONS

13.2.1 ETA PREDICTIONS

13.2.1.1 STREAMLINED ROUTES

13.2.1.2 DETAILED LOCATION DATA

13.2.1.3 BREAKDOWN NOTIFICATION

13.2.2 OPERATIONS MANAGEMENT

13.2.2.1 FLEET TRACKING & GEO-FENCING

13.2.2.2 ROUTING & SCHEDULING

13.2.2.3 REAL & IDLE TIME MONITORING

13.2.3 PERFORMANCE MANAGEMENT

13.2.3.1 DRIVER MANAGEMENT

13.2.3.1.1 TRACKING

13.2.3.1.2 ROADSIDE/EMERGENCY ASSISTANCE FOR DRIVERS

13.2.3.1.3 MONITORING OF MISUSE (HARD BRAKING)

13.2.3.2 FLEET MANAGEMENT & TRACKING

13.2.3.2.1 REAL TIME ROUTING

13.2.3.2.2 SPEED/IDLING REAL TIME FEEDBACK

13.2.3.2.3 ENGINE DATA VIA ON-BOARD SENSORS

13.2.4 VEHICLE MAINTENANCE & DIAGNOSTICS

13.2.5 SAFETY & COMPLIANCE MANAGEMENT

13.2.6 RISK MANAGEMENT

13.2.7 CONTRACT MANAGEMENT

13.2.7.1 FUEL MANAGEMENT

13.2.7.2 ACCIDENT MANAGEMENT

13.2.7.3 ADMINISTRATIVE COST

13.2.7.4 LONG TERM CONTRACT

13.2.7.5 SHORT TERM CONTRACT

13.3 SERVICES

13.3.1 PROFESSIONAL SERVICES

13.3.1.1 SUPPORT & MAINTENANCE

13.3.1.2 IMPLEMENTATION

13.3.1.3 CONSULTING

13.3.2 MANAGED SERVICES

14 NORTH AMERICA FLEET MANAGEMENT MARKET, BY LEASE TYPE

14.1 OVERVIEW

14.2 ON-LEASE

14.3 WITHOUT LEASE

14.3.1 OPEN ENDED

14.3.2 CLOSE ENDED

15 NORTH AMERICA FLEET MANAGEMENT MARKET, BY HARDWARE

15.1 OVERVIEW

15.2 GPS TRACKING DEVICES

15.3 DASH CAMERAS

15.4 BLUETOOTH TRACKING TAGS

15.5 DATA LOGGERS

15.6 OTHERS

16 NORTH AMERICA FLEET MANAGEMENT MARKET, BY FLEET SIZE

16.1 OVERVIEW

16.2 SMALL FLEETS (1-5 VEHICLES)

16.3 MEDIUM FLEETS (5-20 VEHICLES)

16.4 LARGE & ENTERPRISE FLEETS (20-50+ VEHICLES)

17 NORTH AMERICA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT

17.1 OVERVIEW

17.1.1 AUTOMOTIVE

17.1.2 LIGHT DUTY VEHICLE

17.1.2.1 PASSENGER CARS

17.1.2.2 VANS

17.1.3 MEDIUM & HEAVY VEHICLE

17.1.3.1 TRUCKS

17.1.3.2 TRAILERS

17.1.3.3 FORKLIFTS

17.1.3.4 SPECIALIST VEHICLES

17.1.4 MARINE

17.1.5 ROLLING STOCK

17.1.6 AIRCRAFT

18 NORTH AMERICA FLEET MANAGEMENT MARKET, BY END USER

18.1 OVERVIEW

18.2 AUTOMOTIVE

18.2.1 SOLUTIONS

18.2.1.1 ETA PREDICTIONS

18.2.1.2 OPERATIONS MANAGEMENT

18.2.1.3 PERFORMANCE MANAGEMENT

18.2.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.2.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.2.1.6 RISK MANAGEMENT

18.2.1.7 CONTRACT MANAGEMENT

18.2.2 SERVICES

18.2.2.1 PROFESSIONAL SERVICES

18.2.2.2 MANAGED SERVICES

18.3 TRANSPORTATION & LOGISTICS

18.3.1 SOLUTIONS

18.3.1.1 ETA PREDICTIONS

18.3.1.2 OPERATIONS MANAGEMENT

18.3.1.3 PERFORMANCE MANAGEMENT

18.3.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.3.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.3.1.6 RISK MANAGEMENT

18.3.1.7 CONTRACT MANAGEMENT

18.3.2 SERVICES

18.3.2.1 PROFESSIONAL SERVICES

18.3.2.2 MANAGED SERVICES

18.4 RETAIL

18.4.1 SOLUTIONS

18.4.1.1 ETA PREDICTIONS

18.4.1.2 OPERATIONS MANAGEMENT

18.4.1.3 PERFORMANCE MANAGEMENT

18.4.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.4.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.4.1.6 RISK MANAGEMENT

18.4.1.7 CONTRACT MANAGEMENT

18.4.2 SERVICES

18.4.2.1 PROFESSIONAL SERVICES

18.4.2.2 MANAGED SERVICES

18.5 MANUFACTURING

18.5.1 SOLUTIONS

18.5.1.1 ETA PREDICTIONS

18.5.1.2 OPERATIONS MANAGEMENT

18.5.1.3 PERFORMANCE MANAGEMENT

18.5.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.5.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.5.1.6 RISK MANAGEMENT

18.5.1.7 CONTRACT MANAGEMENT

18.5.2 SERVICES

18.5.2.1 PROFESSIONAL SERVICES

18.5.2.2 MANAGED SERVICES

18.6 FOOD & BEVERAGES

18.6.1 SOLUTIONS

18.6.1.1 ETA PREDICTIONS

18.6.1.2 OPERATIONS MANAGEMENT

18.6.1.3 PERFORMANCE MANAGEMENT

18.6.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.6.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.6.1.6 RISK MANAGEMENT

18.6.1.7 CONTRACT MANAGEMENT

18.6.2 SERVICES

18.6.2.1 PROFESSIONAL SERVICES

18.6.2.2 MANAGED SERVICES

18.7 ENERGY & UTILITIES

18.7.1 SOLUTIONS

18.7.1.1 ETA PREDICTIONS

18.7.1.2 OPERATIONS MANAGEMENT

18.7.1.3 PERFORMANCE MANAGEMENT

18.7.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.7.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.7.1.6 RISK MANAGEMENT

18.7.1.7 CONTRACT MANAGEMENT

18.7.2 SERVICES

18.7.2.1 PROFESSIONAL SERVICES

18.7.2.2 MANAGED SERVICES

18.8 MINING

18.8.1 SOLUTIONS

18.8.1.1 ETA PREDICTIONS

18.8.1.2 OPERATIONS MANAGEMENT

18.8.1.3 PERFORMANCE MANAGEMENT

18.8.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.8.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.8.1.6 RISK MANAGEMENT

18.8.1.7 CONTRACT MANAGEMENT

18.8.2 SERVICES

18.8.2.1 PROFESSIONAL SERVICES

18.8.2.2 MANAGED SERVICES

18.9 GOVERNMENT

18.9.1 SOLUTIONS

18.9.1.1 ETA PREDICTIONS

18.9.1.2 OPERATIONS MANAGEMENT

18.9.1.3 PERFORMANCE MANAGEMENT

18.9.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.9.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.9.1.6 RISK MANAGEMENT

18.9.1.7 CONTRACT MANAGEMENT

18.9.2 SERVICES

18.9.2.1 PROFESSIONAL SERVICES

18.9.2.2 MANAGED SERVICES

18.1 HEALTHCARE

18.10.1 SOLUTIONS

18.10.1.1 ETA PREDICTIONS

18.10.1.2 OPERATIONS MANAGEMENT

18.10.1.3 PERFORMANCE MANAGEMENT

18.10.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.10.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.10.1.6 RISK MANAGEMENT

18.10.1.7 CONTRACT MANAGEMENT

18.10.2 SERVICES

18.10.2.1 PROFESSIONAL SERVICES

18.10.2.2 MANAGED SERVICES

18.11 AGRICULTURE

18.11.1 SOLUTIONS

18.11.1.1 ETA PREDICTIONS

18.11.1.2 OPERATIONS MANAGEMENT

18.11.1.3 PERFORMANCE MANAGEMENT

18.11.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.11.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.11.1.6 RISK MANAGEMENT

18.11.1.7 CONTRACT MANAGEMENT

18.11.2 SERVICES

18.11.2.1 PROFESSIONAL SERVICES

18.11.2.2 MANAGED SERVICES

18.12 CONSTRUCTION

18.12.1 SOLUTIONS

18.12.1.1 ETA PREDICTIONS

18.12.1.2 OPERATIONS MANAGEMENT

18.12.1.3 PERFORMANCE MANAGEMENT

18.12.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.12.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.12.1.6 RISK MANAGEMENT

18.12.1.7 CONTRACT MANAGEMENT

18.12.2 SERVICES

18.12.2.1 PROFESSIONAL SERVICES

18.12.2.2 MANAGED SERVICES

18.13 OTHERS

19 NORTH AMERICA FLEET MANAGEMENT MARKET, BY REGION

19.1 NORTH AMERICA

19.1.1 U.S.

19.1.2 CANADA

19.1.3 MEXICO

20 NORTH AMERICA FLEET MANAGEMENT MARKET: COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

21 SWOT ANALYSIS

22 COMPANY PROFILE

22.1 ENTERPRISE HOLDINGS

22.1.1 COMPANY SNAPSHOT

22.1.2 COMPANY SHARE ANALYSIS

22.1.3 SOLUTION PORTFOLIO

22.1.4 RECENT DEVELOPMENTS

22.2 AVIS BUDGET GROUP

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 COMPANY SHARE ANALYSIS

22.2.4 SOLUTION PORTFOLIO

22.2.5 RECENT DEVELOPMENTS

22.3 DEUTSCHE LEASING AG

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 SOLUTION PORTFOLIO

22.3.5 RECENT DEVELOPMENT

22.4 ALD AUTOMOTIVE

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 COMPANY SHARE ANALYSIS

22.4.4 SOLUTION PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 LEASEPLAN

22.5.1 COMPANY SNAPSHOT

22.5.2 REVENUE ANALYSIS

22.5.3 COMPANY SHARE ANALYSIS

22.5.4 SOLUTION PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 AVRIOS

22.6.1 COMPANY SNAPSHOT

22.6.2 SOLUTION PORTFOLIO

22.6.3 RECENT DEVELOPMENT

22.7 BERGSTROM AUTOMOTIVE

22.7.1 COMPANY SNAPSHOT

22.7.2 SOLUTION PORTFOLIO

22.7.3 RECENT DEVELOPMENT

22.8 CAPITAL LEASE GROUP

22.8.1 COMPANY SNAPSHOT

22.8.2 SOLUTION PORTFOLIO

22.8.3 RECENT DEVELOPMENTS

22.9 CHEVIN FLEET SOLUTIONS

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENTS

22.1 DONLEN

22.10.1 COMPANY SNAPSHOT

22.10.2 SOLUTION PORTFOLIO

22.10.3 RECENT DEVELOPMENTS

22.11 ELEMENT FLEET MANAGEMENT CORP.

22.11.1 COMPANY SNAPSHOT

22.11.2 REVENUE ANALYSIS

22.11.3 SOLUTION PORTFOLIO

22.11.4 RECENT DEVELOPMENT

22.12 EMKAY

22.12.1 COMPANY SNAPSHOT

22.12.2 SOLUTION PORTFOLIO

22.12.3 RECENT DEVELOPMENT

22.13 FLEETCARE PTY LTD.

22.13.1 COMPANY SNAPSHOT

22.13.2 SOLUTION PORTFOLIO

22.13.3 RECENT DEVELOPMENT

22.14 FLEETCOMPANY GMBH

22.14.1 COMPANY SNAPSHOT

22.14.2 SOLUTION PORTFOLIO

22.14.3 RECENT DEVELOPMENTS

22.15 MOTIVE TECHNOLOGIES, INC.

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENTS

22.16 NEXTRAQ, LLC

22.16.1 COMPANY SNAPSHOT

22.16.2 SOLUTION PORTFOLIO

22.16.3 RECENT DEVELOPMENTS

22.17 OVIDRIVE B.V.

22.17.1 COMPANY SNAPSHOT

22.17.2 SOLUTION PORTFOLIO

22.17.3 RECENT DEVELOPMENTS

22.18 RARESTEP, INC.

22.18.1 COMPANY SNAPSHOT

22.18.2 SOLUTION PORTFOLIO

22.18.3 RECENT DEVELOPMENTS

22.19 SIXT LEASING

22.19.1 COMPANY SNAPSHOT

22.19.2 REVENUE ANALYSIS

22.19.3 SOLUTION PORTFOLIO

22.19.4 RECENT DEVELOPMENT

22.2 TRAXALL

22.20.1 COMPANY SNAPSHOT

22.20.2 SOLUTION PORTFOLIO

22.20.3 RECENT DEVELOPMENTS

22.21 TÜV SÜD

22.21.1 COMPANY SNAPSHOT

22.21.2 REVENUE ANALYSIS

22.21.3 SOLUTION PORTFOLIO

22.21.4 RECENT DEVELOPMENT

22.22 VELCO

22.22.1 COMPANY SNAPSHOT

22.22.2 SOLUTION PORTFOLIO

22.22.3 RECENT DEVELOPMENTS

22.23 WHEELS

22.23.1 COMPANY SNAPSHOT

22.23.2 SOLUTION PORTFOLIO

22.23.3 RECENT DEVELOPMENTS

22.24 WILMAR INC.

22.24.1 COMPANY SNAPSHOT

22.24.2 SOLUTION PORTFOLIO

22.24.3 RECENT DEVELOPMENTS

22.25 ZEEMAC VEHICLE ACQUISITION & FLEET SERVICES

22.25.1 COMPANY SNAPSHOT

22.25.2 SOLUTION PORTFOLIO

22.25.3 RECENT DEVELOPMENTS

23 QUESTIONNAIRE

24 RELATED REPORTS

Lista de Tabela

TABLE 1 VARIOUS REGULATORY STANDARDS RELATED TO FLEET MANAGEMENT

TABLE 2 NORTH AMERICA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA SHORT RANGE COMMUNICATION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA LONG RANGE COMMUNICATION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA ON-PREMISE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA CLOUD IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA HYBRID IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA GNSS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA CELLULAR SYSTEMS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA ELECTRONIC DATA INTERCHANGE (EDI) IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA REMOTE SENSING IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA COMPUTATIONAL METHOD & DECISION MAKING IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA RFID IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA OTHERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA ASSET MANAGEMENT IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA ROUTE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA FUEL CONSUMPTION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA REAL TIME VEHICLE LOCATION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA DELIVERY SCHEDULE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA ACCIDENT PREVENTION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA MOBILE APPS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA MONITORING DRIVER BEHAVIOR IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA VEHICLE MAINTENANCE UPDATES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA ELD COMPLIANCE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA OTHERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA COMMERCIAL IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA PRIVATE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA INTERNAL COMBUSTION ENGINE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA ELECTRIC VEHICLE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA ON-LEASE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA GPS TRACKING DEVICES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA DASH CAMERAS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA BLUETOOTH TRACKING TAGS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA DATA LOGGERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA OTHERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA SMALL FLEETS (1-5 VEHICLES) IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA MEDIUM FLEETS (5-20 VEHICLES) IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA LARGE & ENTERPRISE FLEETS (20-50+ VEHICLES) IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA MARINE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA ROLLING STOCK IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA AIRCRAFT STOCK IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 77 NORTH AMERICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 79 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 NORTH AMERICA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 81 NORTH AMERICA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 82 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND)

TABLE 83 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 NORTH AMERICA RETAIL IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 85 NORTH AMERICA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 86 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 NORTH AMERICA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 89 NORTH AMERICA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 90 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 NORTH AMERICA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 93 NORTH AMERICA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 94 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 NORTH AMERICA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 97 NORTH AMERICA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 98 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 NORTH AMERICA MINING IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 101 NORTH AMERICA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 102 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 NORTH AMERICA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 105 NORTH AMERICA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 106 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 NORTH AMERICA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 109 NORTH AMERICA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 110 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 NORTH AMERICA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 113 NORTH AMERICA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 114 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 NORTH AMERICA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 117 NORTH AMERICA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 118 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 NORTH AMERICA OTHERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 121 NORTH AMERICA FLEET MANAGEMENT MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 122 NORTH AMERICA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 123 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 NORTH AMERICA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 NORTH AMERICA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 NORTH AMERICA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 NORTH AMERICA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 NORTH AMERICA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 NORTH AMERICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 130 ORTH AMERICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 131 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 NORTH AMERICA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 NORTH AMERICA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 NORTH AMERICA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 NORTH AMERICA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 136 NORTH AMERICA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 137 NORTH AMERICA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 138 NORTH AMERICA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 139 NORTH AMERICA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 140 NORTH AMERICA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 141 NORTH AMERICA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 142 NORTH AMERICA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 NORTH AMERICA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 NORTH AMERICA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 NORTH AMERICA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 146 NORTH AMERICA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 147 NORTH AMERICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 NORTH AMERICA LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 NORTH AMERICA MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 NORTH AMERICA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 151 NORTH AMERICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 152 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 154 NORTH AMERICA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 155 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 156 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 NORTH AMERICA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 158 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 160 NORTH AMERICA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 161 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 162 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 NORTH AMERICA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 164 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 165 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 NORTH AMERICA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 167 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 168 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 NORTH AMERICA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 170 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 171 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 NORTH AMERICA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 173 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 174 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 175 NORTH AMERICA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 176 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 NORTH AMERICA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 179 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 180 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 NORTH AMERICA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 182 NORTH AMERICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 183 NORTH AMERICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 U.S. FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 185 U.S. SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 186 U.S. ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 187 U.S. OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 188 U.S. PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 189 U.S. DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 U.S. FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 191 U.S. CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 192 U.S. CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 193 U.S. SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 194 U.S. PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 195 U.S. FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 196 U.S. WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 197 U.S. FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 198 U.S. FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 199 U.S. FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 200 U.S. FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 201 U.S. FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 202 U.S. FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 203 U.S. FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 204 U.S. FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 205 U.S. LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 U.S. SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 207 U.S. FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 208 U.S. FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 209 U.S. AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 210 U.S. LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 211 U.S. MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 212 U.S. FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 213 U.S. AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 214 U.S. SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 215 U.S. SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 216 U.S. TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 217 U.S. SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 218 U.S. SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 219 U.S. RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 220 U.S. SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 221 U.S. SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 222 U.S. MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 223 U.S. SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 224 U.S. SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 225 U.S. FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 226 U.S. SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 227 U.S. SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 228 U.S. ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 229 U.S. SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 230 U.S. SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 231 U.S. MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 232 U.S. SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 233 U.S. SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 234 U.S. GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 235 U.S. SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 236 U.S. SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 237 U.S. HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 238 U.S. SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 239 U.S. SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 U.S. AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 241 U.S. SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 242 U.S. SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 243 U.S. CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 244 U.S. SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 245 U.S. SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 246 CANADA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 247 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 248 CANADA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 249 CANADA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 250 CANADA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 251 CANADA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 252 CANADA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 253 CANADA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 254 CANADA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 255 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 256 CANADA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 257 CANADA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 258 CANADA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 259 CANADA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 260 CANADA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 261 CANADA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 262 CANADA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 263 CANADA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 264 CANADA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 265 CANADA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 266 CANADA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 267 CANADA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 268 CANADA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 269 CANADA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 270 CANADA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 271 CANADA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 272 CANADA LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 273 CANADA MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 274 CANADA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 275 CANADA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 276 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 277 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 278 CANADA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 279 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 280 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 281 CANADA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 282 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 283 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 284 CANADA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 285 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 286 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 287 CANADA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 288 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 289 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 290 CANADA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 291 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 292 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 293 CANADA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 294 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 295 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 296 CANADA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 297 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 298 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 299 CANADA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 300 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 301 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 302 CANADA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 303 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 304 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 305 CANADA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 306 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 307 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 308 MEXICO FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 309 MEXICO SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 310 MEXICO ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 311 MEXICO OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 312 MEXICO PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 313 MEXICO DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 314 MEXICO FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 315 MEXICO CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 316 MEXICO CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 317 MEXICO SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 318 MEXICO PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 319 MEXICO FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 320 MEXICO WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 321 MEXICO FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 322 MEXICO FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 323 MEXICO FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 324 MEXICO FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 325 MEXICO FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 326 MEXICO FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 327 MEXICO FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 328 MEXICO FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 329 MEXICO LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 330 MEXICO SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 331 MEXICO FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 332 MEXICO FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 333 MEXICO AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 334 MEXICO LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 335 MEXICO MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 336 MEXICO FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 337 MEXICO AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 338 MEXICO SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 339 MEXICO SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 340 MEXICO TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 341 MEXICO SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 342 MEXICO SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 343 MEXICO RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 344 MEXICO SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 345 MEXICO SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 346 MEXICO MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 347 MEXICO SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 348 MEXICO SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 349 MEXICO FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 350 MEXICO SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 351 MEXICO SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 352 MEXICO ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 353 MEXICO SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 354 MEXICO SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 355 MEXICO MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 356 MEXICO SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 357 MEXICO SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 358 MEXICO GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 359 MEXICO SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 360 MEXICO SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 361 MEXICO HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 362 MEXICO SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 363 MEXICO SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 364 MEXICO AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 365 MEXICO SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 366 MEXICO SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 367 MEXICO CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 368 MEXICO SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 369 MEXICO SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Lista de Figura

FIGURE 1 NORTH AMERICA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FLEET MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FLEET MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FLEET MANAGEMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FLEET MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FLEET MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FLEET MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FLEET MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FLEET MANAGEMENT MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA FLEET MANAGEMENT MARKET: OFFERING TIMELINE CURVE

FIGURE 11 NORTH AMERICA FLEET MANAGEMENT MARKET: MARKET END-USE COVERAGE GRID

FIGURE 12 NORTH AMERICA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 13 RISE IN DEMAND FOR IMPROVEMENT OF CUSTOMER SERICES IS EXPECTED TO DRIVE THE NORTH AMERICA FLEET MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FLEET MANAGEMENT MARKET IN 2023 & 2030

FIGURE 15 PROFIT ALLOCATION FOR FLEET MANAGEMENT MARKET

FIGURE 16 VALUE CHAIN FOR FLEET MANAGEMENT MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA FLEET MANAGEMENT MARKET

FIGURE 18 NORTH AMERICA FLEET MANAGEMENT MARKET: BY COMMUNIATION RANGE, 2022

FIGURE 19 NORTH AMERICA FLEET MANAGEMENT MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 20 NORTH AMERICA FLEET MANAGEMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 21 NORTH AMERICA FLEET MANAGEMENT MARKET: BY FUNCTIONS, 2022

FIGURE 22 NORTH AMERICA FLEET MANAGEMENT MARKET: BY OPERATIONS, 2022

FIGURE 23 NORTH AMERICA FLEET MANAGEMENT MARKET: BY BUSINESS TYPE, 2022

FIGURE 24 NORTH AMERICA FLEET MANAGEMENT MARKET: BY VEHICLE TYPE, 2022

FIGURE 25 NORTH AMERICA FLEET MANAGEMENT MARKET: BY OFFERING, 2022

FIGURE 26 NORTH AMERICA FLEET MANAGEMENT MARKET: BY LEASE TYPE, 2022

FIGURE 27 NORTH AMERICA FLEET MANAGEMENT MARKET: BY HARDWARE, 2022

FIGURE 28 NORTH AMERICA FLEET MANAGEMENT MARKET: BY FLEET SIZE, 2022

FIGURE 29 NORTH AMERICA FLEET MANAGEMENT MARKET: BY MODE OF TRANSPORT, 2022

FIGURE 30 NORTH AMERICA FLEET MANAGEMENT MARKET: END USER, 2022

FIGURE 31 NORTH AMERICA FLEET MANAGEMENT MARKET: SNAPSHOT (2022)

FIGURE 32 NORTH AMERICA FLEET MANAGEMENT MARKET: BY COUNTRY (2022)

FIGURE 33 NORTH AMERICA FLEET MANAGEMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 34 NORTH AMERICA FLEET MANAGEMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 35 NORTH AMERICA FLEET MANAGEMENT MARKET: BY OFFERING (2023-2030)

FIGURE 36 NORTH AMERICA FLEET MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.