North America Epigenetics Diagnostic Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.29 Billion

USD

10.82 Billion

2024

2032

USD

3.29 Billion

USD

10.82 Billion

2024

2032

| 2025 –2032 | |

| USD 3.29 Billion | |

| USD 10.82 Billion | |

|

|

|

|

Segmentação do mercado de diagnóstico epigenético da América do Norte, por produto ( reagentes , kits, instrumentos e consumíveis, ferramentas de bioinformática e enzimas), tecnologia (metilação de DNA, metilação de histona, estruturas de cromatina, acetilação de histona, modificação de RNA não codificante grande e microRNA), tipo de terapia (inibidores de histona desacetilase (HDAC), inibidores de DNA metiltransferase (DNMT) e outros), aplicação ( oncologia , doenças cardiovasculares, doenças metabólicas , imunologia, doenças inflamatórias, doenças infecciosas e outras), usuário final (institutos acadêmicos e de pesquisa, empresas farmacêuticas e de biotecnologia , organizações de pesquisa contratadas (CROs) e outras), canal de distribuição (licitação direta e vendas no varejo), tendências do setor e previsão até 2032

Tamanho do mercado de diagnóstico epigenético na América do Norte

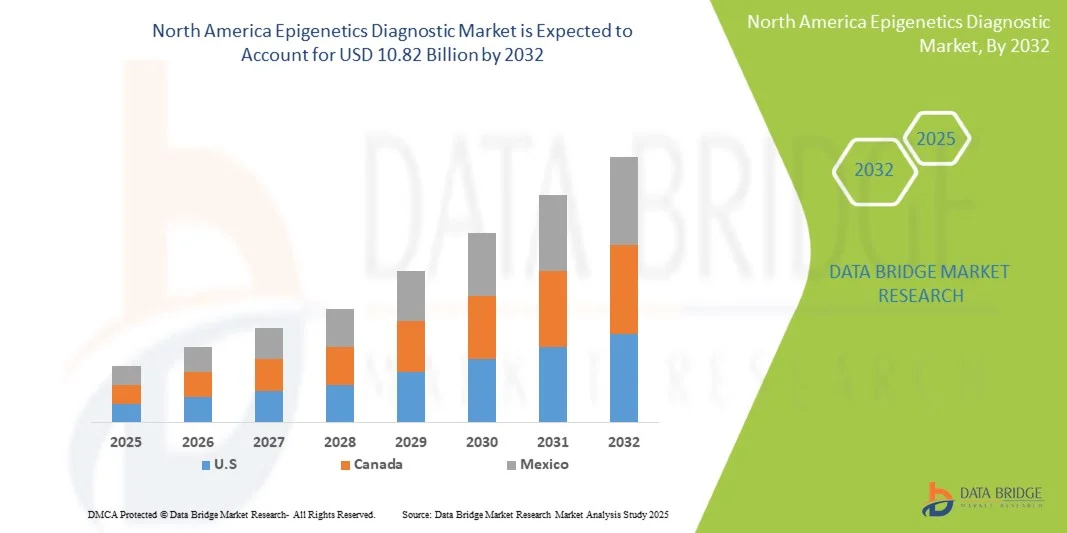

- O tamanho do mercado de diagnóstico epigenético da América do Norte foi avaliado em US$ 3,29 bilhões em 2024 e deve atingir US$ 10,82 bilhões até 2032 , com um CAGR de 16,00% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente adoção de técnicas avançadas de biologia molecular e pela integração de tecnologias de sequenciamento de última geração (NGS), que estão aumentando a precisão e a eficiência dos diagnósticos epigenéticos em pesquisas e aplicações clínicas.

- Além disso, a crescente demanda por detecção precoce de doenças, medicina personalizada e diagnósticos baseados em biomarcadores está impulsionando a adoção de soluções de Diagnóstico Epigenético. Esses fatores convergentes estão acelerando a adoção de soluções de Diagnóstico Epigenético, impulsionando significativamente o crescimento do setor.

Análise de mercado de diagnóstico epigenético na América do Norte

- O mercado de diagnóstico epigenético da América do Norte envolve o uso de marcadores e ensaios epigenéticos para detectar, monitorar e gerenciar doenças como câncer, distúrbios cardiovasculares e condições neurológicas, oferecendo soluções de diagnóstico minimamente invasivas, precisas e personalizadas.

- A crescente demanda por soluções de diagnóstico epigenético é alimentada principalmente pela crescente prevalência de doenças crônicas, pela crescente adoção da medicina de precisão e pela crescente conscientização sobre a detecção precoce de doenças entre profissionais de saúde e pacientes.

- Os EUA dominaram o mercado de diagnóstico epigenético da América do Norte, com a maior participação na receita, de 87,3% em 2024, apoiados por infraestrutura avançada de saúde, alta adoção de tecnologias de diagnóstico molecular e investimentos substanciais em pesquisa clínica e instalações de diagnóstico. O país apresentou crescimento notável devido ao aumento da prevalência de câncer e doenças crônicas, à crescente demanda por detecção precoce e às inovações em plataformas de testes epigenéticos de alto rendimento.

- Espera-se que o Canadá seja o país com crescimento mais rápido no mercado de diagnóstico epigenético da América do Norte durante o período previsto, atribuído ao aumento dos investimentos em infraestrutura de saúde, à crescente conscientização sobre medicina de precisão, à crescente prevalência de doenças relacionadas ao estilo de vida e à expansão de iniciativas de pesquisa médica.

- O segmento de oncologia dominou o mercado de diagnóstico epigenético da América do Norte com 46,3% de participação na receita em 2024. O aumento da prevalência do câncer, o aumento das iniciativas de detecção precoce e a adoção de biomarcadores epigenéticos alimentam esse domínio.

Escopo do relatório e segmentação do mercado de diagnóstico epigenético na América do Norte

|

Atributos |

Principais insights de mercado de diagnóstico epigenético da América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de diagnóstico epigenético na América do Norte

“ Avanços impulsionados pela IA e maior precisão diagnóstica em epigenética ”

- Uma tendência significativa e crescente no mercado de diagnóstico epigenético da América do Norte é a integração de inteligência artificial (IA) e algoritmos de aprendizado de máquina para aprimorar a identificação de biomarcadores e a análise preditiva. Essa integração está melhorando a precisão do diagnóstico, o monitoramento de doenças e o planejamento personalizado do tratamento.

- Empresas líderes estão aproveitando a IA para analisar padrões de metilação de DNA, modificações de histonas e acessibilidade de cromatina, permitindo a detecção precoce de doenças complexas, como câncer e distúrbios cardiovasculares.

- Plataformas baseadas em IA facilitam a interpretação rápida de grandes conjuntos de dados genômicos, reduzindo o tempo de análise e fornecendo insights mais acionáveis para os médicos

- A integração com sistemas baseados em nuvem permite o gerenciamento centralizado de dados epigenéticos do paciente, possibilitando consultas remotas, pesquisas colaborativas e relatórios em tempo real em instituições de saúde.

- Os algoritmos de IA podem aprender continuamente com novos dados, melhorando a precisão preditiva ao longo do tempo e apoiando o monitoramento longitudinal do paciente quanto à progressão da doença e à resposta terapêutica.

- Além disso, a IA ajuda a priorizar populações de pacientes de alto risco, sugerindo estratégias de teste otimizadas, reduzindo testes desnecessários e aumentando a eficiência geral do fluxo de trabalho.

- Empresas como Guardant Health, EpigenDx e Exact Sciences estão desenvolvendo ativamente ensaios epigenéticos habilitados para IA para aplicações clínicas e de pesquisa, com foco na detecção precoce e na medicina personalizada.

- A tendência para diagnósticos mais precisos, preditivos e baseados em dados está a reformular as expectativas entre prestadores de cuidados de saúde, institutos de investigação e pagadores

- A crescente colaboração entre desenvolvedores de IA e provedores de saúde está acelerando a adoção de diagnósticos epigenéticos baseados em IA na prática clínica

- A integração da IA também permite ferramentas de relatórios e visualização contínuas, auxiliando os médicos a interpretar dados epigenéticos complexos de forma eficiente.

Dinâmica do mercado de diagnóstico epigenético na América do Norte

Motorista

“Crescente demanda por detecção precoce, medicina de precisão e assistência médica personalizada”

- A crescente incidência de câncer, distúrbios metabólicos, doenças neurológicas e condições cardiovasculares está impulsionando a demanda por diagnósticos epigenéticos precisos

- A detecção precoce de doenças por meio de biomarcadores epigenéticos permite uma intervenção oportuna, melhorando significativamente os resultados dos pacientes e as taxas de sobrevivência

- As iniciativas de medicina personalizada estão incentivando os profissionais de saúde a adotar testes epigenéticos para adaptar as terapias com base em perfis epigenéticos individuais

- O financiamento governamental e os investimentos privados em pesquisa genômica e de medicina de precisão estão apoiando o desenvolvimento de novos ensaios epigenéticos

- Hospitais, clínicas especializadas e instituições de pesquisa estão cada vez mais incorporando diagnósticos epigenéticos em fluxos de trabalho clínicos padrão para avaliação e monitoramento de risco de doenças

- Os avanços nos métodos de testes não invasivos, como biópsias líquidas, estão expandindo a aplicação do diagnóstico epigenético no atendimento de rotina ao paciente.

- Campanhas de conscientização e educação entre médicos sobre a utilidade clínica dos biomarcadores epigenéticos estão impulsionando a adoção pelo mercado

- A capacidade de prever a resposta do paciente às terapias e monitorar a recorrência da doença aumenta a atratividade do diagnóstico epigenético

- A integração com plataformas de IA e aprendizado de máquina proporciona maior precisão diagnóstica, o que é cada vez mais valorizado pelos provedores de saúde

- A expansão de programas de pesquisa colaborativa entre instituições acadêmicas e empresas de biotecnologia está acelerando ainda mais as inovações tecnológicas e o crescimento do mercado

Restrição/Desafio

“ Alto custo, barreiras regulatórias e preocupações com a privacidade de dados ”

- O alto custo dos testes avançados de diagnóstico epigenético continua sendo uma grande barreira, especialmente em regiões em desenvolvimento ou em unidades de saúde menores

- Os requisitos laboratoriais complexos e a necessidade de pessoal altamente qualificado restringem a adoção generalizada

- Os processos de aprovação regulatória para novos ensaios epigenéticos podem ser demorados, atrasando o lançamento do produto e a disponibilidade no mercado

- A variabilidade nas políticas de reembolso entre países cria incertezas para os prestadores de cuidados de saúde e para os pacientes

- Preocupações éticas e de privacidade relacionadas ao tratamento de dados genômicos e epigenéticos podem limitar a disposição do paciente em se submeter a testes

- A integração de plataformas baseadas em IA requer infraestrutura de TI significativa e medidas de segurança de dados, o que representa desafios adicionais de investimento

- A falta de padronização nos procedimentos de testes epigenéticos e nos bancos de dados de referência pode afetar a confiabilidade dos resultados

- O crescimento do mercado pode ser prejudicado pela conscientização limitada entre os médicos sobre a utilidade clínica e a interpretação de dados epigenéticos complexos

- A necessidade de atualizações contínuas de software e validação de algoritmos de IA aumenta os custos operacionais dos laboratórios

- Superar esses desafios requer colaboração entre autoridades reguladoras, provedores de saúde e participantes do setor para garantir soluções de diagnóstico padronizadas, econômicas e seguras.

Escopo do mercado de diagnóstico epigenético na América do Norte

O mercado de diagnóstico epigenético da América do Norte é segmentado com base no produto, tecnologia, tipo de terapia, aplicação, usuário final e canal de distribuição.

• Por produto

Com base no produto, o mercado de diagnóstico epigenético da América do Norte é segmentado em reagentes, kits, instrumentos e consumíveis, e ferramentas de bioinformática e enzimas. O segmento de reagentes dominou a maior fatia de receita de mercado, com 42,8% em 2024. Isso é impulsionado por seu papel essencial na preparação, detecção e análise de amostras em estudos epigenéticos. Os reagentes são altamente confiáveis, compatíveis com múltiplas plataformas de ensaio e fornecem resultados reprodutíveis, tornando-os indispensáveis tanto em pesquisa quanto em diagnóstico clínico. A crescente adoção da medicina de precisão e do diagnóstico baseado em biomarcadores impulsiona ainda mais a demanda. Pesquisas acadêmicas e empresas farmacêuticas dependem fortemente de reagentes de alta qualidade para alcançar resultados consistentes. Além disso, reagentes especializados para metilação de DNA, modificações de histonas e análise de RNA fortalecem sua posição no mercado. O segmento se beneficia da inovação contínua na formulação de reagentes e da melhoria do prazo de validade. O crescente investimento em pesquisa epigenética globalmente apoia o crescimento do mercado. Os reagentes também facilitam a automação em laboratórios de alto rendimento. A pandemia de COVID-19 destacou a importância de reagentes de diagnóstico rápidos e precisos, aumentando a conscientização e a adoção. Colaborações estratégicas entre fabricantes de reagentes e institutos de pesquisa continuam a expandir a disponibilidade. De modo geral, os reagentes continuam sendo a espinha dorsal dos fluxos de trabalho de diagnóstico epigenético.

O segmento de instrumentos e consumíveis deverá apresentar o CAGR mais rápido, de 20,3%, entre 2025 e 2032. Esse crescimento é impulsionado pela crescente demanda por plataformas de diagnóstico epigenético de alto rendimento, automatizadas e precisas. Instrumentos como sequenciadores de última geração e máquinas de PCR em tempo real aumentam a precisão e a reprodutibilidade dos ensaios. O segmento se beneficia das tendências em direção a dispositivos miniaturizados e portáteis, adequados para laboratórios descentralizados. Consumíveis como pontas, placas e tubos são essenciais para a confiabilidade e a eficiência dos ensaios. A crescente adoção em hospitais, institutos de pesquisa e empresas de biotecnologia impulsiona a demanda por volume. A automação avançada reduz o erro humano e o tempo de processamento. O aumento dos investimentos em medicina personalizada e terapias direcionadas impulsiona ainda mais a adoção. Novos lançamentos de instrumentos com soluções de software integradas atraem usuários finais que buscam fluxos de trabalho simplificados. O desenvolvimento contínuo em consumíveis específicos para ensaios melhora o desempenho. As crescentes colaborações entre fabricantes de instrumentos e provedores de bioinformática também expandem a penetração de mercado. Aplicações emergentes em oncologia, pesquisa cardiovascular e metabólica impulsionam ainda mais o crescimento.

• Por Tecnologia

Com base na tecnologia, o mercado de diagnóstico epigenético da América do Norte é segmentado em metilação de DNA, metilação de histonas, estruturas de cromatina, acetilação de histonas e modificação de RNA e microRNA não codificantes de grande porte. O segmento de metilação de DNA dominou, com uma participação de receita de 44,5% em 2024, por ser um biomarcador essencial em câncer, doenças cardiovasculares e metabólicas. Sua ampla adoção decorre de ensaios reprodutíveis e de baixo custo, além de utilidade clínica validada. A metilação de DNA é crucial para a detecção e o prognóstico precoce de doenças, auxiliando na tomada de decisões clínicas. Tanto laboratórios de pesquisa quanto empresas de diagnóstico utilizam extensivamente o perfil de metilação de DNA. Suas aplicações em medicina de precisão e monitoramento de terapia epigenética aumentam a demanda. Kits e plataformas de ensaio consolidados oferecem confiabilidade e facilidade de uso. As aprovações regulatórias para testes diagnósticos baseados em biomarcadores de metilação de DNA fortalecem ainda mais sua posição no mercado. Pesquisas acadêmicas e farmacêuticas investem continuamente em estudos de metilação, sustentando a demanda. Os métodos de detecção de metilação de DNA são compatíveis com sistemas de alto rendimento. A integração com ferramentas de bioinformática permite insights mais profundos sobre a regulação epigenética. O crescimento do segmento é apoiado pelo aumento do financiamento público e privado em pesquisa epigenética.

Espera-se que o segmento de metilação de histonas testemunhe o CAGR mais rápido de 19,6% de 2025 a 2032. O crescimento é impulsionado por seu papel na compreensão da progressão da doença e na identificação de alvos terapêuticos. O perfil de metilação de histonas é cada vez mais adotado em pesquisas sobre oncologia e doenças inflamatórias. Técnicas avançadas de detecção, incluindo ChIP-seq, aumentam a sensibilidade e a precisão. A demanda está aumentando nos setores acadêmico e farmacêutico. Novos kits e instrumentos de ensaio que visam modificações de histonas estão sendo lançados. Pesquisas em remodelação da cromatina e desenvolvimento de terapia epigenética impulsionam a adoção. Plataformas automatizadas e de alto rendimento melhoram a escalabilidade e a eficiência. Iniciativas globais para pesquisa epigenética apoiam a expansão. Organizações de pesquisa contratadas estão cada vez mais terceirizando estudos de metilação de histonas. A integração com biologia computacional e bioinformática fortalece as capacidades analíticas. A metilação de histonas está se tornando essencial em aplicações de medicina personalizada.

• Por tipo de terapia

Com base no tipo de terapia, o mercado de diagnóstico epigenético da América do Norte é segmentado em inibidores de histona desacetilase (HDAC), inibidores de DNA metiltransferase (DNMT) e outros. O segmento de inibidores de HDAC dominou o mercado, com uma participação de 40,2% na receita em 2024. Eles são amplamente utilizados no tratamento do câncer e em pesquisas clínicas devido à sua capacidade de modular a expressão gênica epigeneticamente. Os inibidores de HDAC possuem pipelines clínicos bem estabelecidos, tornando-os altamente adotados em hospitais e estudos farmacêuticos. Sua relevância terapêutica em tumores hematológicos e sólidos impulsiona a demanda. O segmento se beneficia da P&D contínua em terapias combinadas. Aprovações regulatórias para múltiplos inibidores de HDAC fornecem credibilidade de mercado. Pesquisas acadêmicas que exploram as vias de HDAC sustentam o uso consistente. Empresas farmacêuticas investem na descoberta de medicamentos baseados em inibidores de HDAC. Os inibidores de HDAC são aplicados em pesquisas sobre doenças inflamatórias e metabólicas. Processos de fabricação estabelecidos e a reprodutibilidade dos compostos fortalecem a adoção. A atividade de ensaios clínicos globalmente apoia o crescimento constante do mercado. A inovação contínua em formulações de HDAC garante o domínio do segmento.

O segmento de inibidores de DNMT deverá registrar o CAGR mais rápido, de 18,9%, de 2025 a 2032. O crescimento é impulsionado pelo aumento da pesquisa em terapia epigenética e medicina personalizada. Os inibidores de DNMT têm como alvo os padrões de metilação do DNA ligados ao câncer e outras doenças crônicas. O aumento dos ensaios clínicos que exploram inibidores de DNMT expande a adoção. Laboratórios acadêmicos e farmacêuticos implementam cada vez mais estudos com inibidores de DNMT. A pesquisa em terapia combinada amplia seu escopo de aplicação. Mercados emergentes estão investindo na acessibilidade de inibidores de DNMT. Avanços tecnológicos em formulação e administração melhoram a eficácia. A conscientização sobre alvos epigenéticos em doenças cardiovasculares e metabólicas impulsiona ainda mais o crescimento. A expansão contínua do pipeline por empresas farmacêuticas apoia o impulso do mercado. Os inibidores de DNMT são cada vez mais incorporados em iniciativas de medicina de precisão. A adoção é ainda mais reforçada pelo crescente financiamento governamental e privado.

• Por aplicação

Com base na aplicação, o mercado de diagnóstico epigenético da América do Norte é segmentado em oncologia, doenças cardiovasculares, doenças metabólicas, imunologia, doenças inflamatórias, doenças infecciosas e outras. O segmento de oncologia dominou o mercado, com participação de 46,3% na receita em 2024. O aumento da prevalência de câncer, o aumento das iniciativas de detecção precoce e a adoção de biomarcadores epigenéticos impulsionam esse domínio. As aplicações em oncologia dependem fortemente da metilação do DNA, modificações de histonas e perfilamento de RNA não codificante. A utilidade clínica no prognóstico, na seleção de terapias e no monitoramento do tratamento impulsiona a demanda. Hospitais e institutos de pesquisa adotam extensivamente o diagnóstico epigenético com foco em oncologia. Empresas comerciais desenvolvem kits e instrumentos específicos para oncologia. O financiamento para a pesquisa do câncer apoia o crescimento contínuo. A integração com plataformas de alto rendimento permite a triagem eficiente de grandes coortes de pacientes. Ferramentas avançadas de bioinformática aprimoram insights acionáveis. Iniciativas governamentais que promovem o rastreamento do câncer impulsionam ainda mais a adoção. Colaborações entre empresas de diagnóstico e centros de oncologia fortalecem a presença no mercado.

Espera-se que o segmento de doenças cardiovasculares testemunhe o CAGR mais rápido de 19,2% de 2025 a 2032. O crescimento é impulsionado por pesquisas emergentes que ligam mecanismos epigenéticos a doenças cardíacas. A adoção de ferramentas de diagnóstico epigenético para detecção precoce e estratificação de risco está aumentando. Hospitais e laboratórios de pesquisa estão investindo em perfis de biomarcadores. Ensaios de metilação de DNA e modificação de histonas são aplicados em pesquisas cardiovasculares. Avanços tecnológicos em plataformas de detecção aumentam a precisão e o rendimento. A crescente prevalência de doenças cardiovasculares em todo o mundo impulsiona o potencial de mercado. Estudos acadêmicos e P&D farmacêutico contribuem para o aumento da adoção. A integração com programas de medicina personalizada acelera o crescimento. O investimento em infraestrutura de diagnóstico apoia a acessibilidade. Campanhas de conscientização e diretrizes clínicas incorporando epigenética impulsionam ainda mais a demanda.

• Por Usuário Final

Com base no usuário final, o mercado de diagnóstico epigenético da América do Norte é segmentado em institutos acadêmicos e de pesquisa, empresas farmacêuticas e de biotecnologia, organizações de pesquisa contratadas (CROs) e outros. O segmento de institutos acadêmicos e de pesquisa foi responsável pela maior participação de mercado na receita, de 43,7% em 2024. As instituições realizam extensas pesquisas em epigenética, com foco na descoberta de biomarcadores, mecanismos de doenças e desenvolvimento terapêutico. A disponibilidade de bolsas e financiamento para pesquisa fortalece a adoção. Altos investimentos em infraestrutura de biologia molecular dão suporte a ensaios sofisticados. A colaboração com empresas farmacêuticas garante acesso a reagentes, kits e instrumentos. A produção de pesquisas impulsiona a inovação em diagnósticos epigenéticos. A integração com plataformas de bioinformática melhora a análise e a reprodutibilidade. O treinamento de pessoal qualificado garante a utilização ideal das ferramentas. Iniciativas globais de pesquisa em oncologia, doenças cardiovasculares e metabólicas sustentam o domínio do segmento. Publicações revisadas por pares e atividades de patentes sustentam a demanda de longo prazo. A expansão contínua dos programas de pesquisa impulsiona o consumo de reagentes e instrumentos.

Espera-se que o segmento de empresas farmacêuticas e de biotecnologia testemunhe o CAGR mais rápido, de 18,5%, de 2025 a 2032. As empresas se concentram na descoberta de medicamentos, no desenvolvimento de terapias epigenéticas e em ensaios clínicos. O aumento do investimento em medicina de precisão acelera a adoção. As parcerias com CROs aumentam a escalabilidade e a expertise. A demanda por reagentes, instrumentos e ferramentas de bioinformática de alta qualidade está aumentando. Tecnologias avançadas permitem melhor triagem de compostos e avaliação de eficácia. Os pipelines de P&D farmacêutico em oncologia e distúrbios metabólicos impulsionam o crescimento do mercado. Aplicações emergentes em imunologia e doenças infecciosas apoiam a expansão. Colaborações estratégicas com institutos acadêmicos facilitam a transferência de conhecimento. Aprovações regulatórias de novos diagnósticos impulsionam a adoção. A competição global incentiva a inovação contínua.

• Por Canal de Distribuição

Com base no canal de distribuição, o mercado de diagnóstico epigenético da América do Norte é segmentado em licitação direta e vendas no varejo. O segmento de licitação direta dominou o mercado em 2024, respondendo pela maior fatia da receita, com aproximadamente 48,5%. Essa dominância se deve principalmente à preferência de hospitais, instituições acadêmicas e grandes organizações de pesquisa em adquirir instrumentos e reagentes diagnósticos de alto valor diretamente de fabricantes ou distribuidores autorizados. A licitação direta garante confiabilidade, benefícios na compra em grandes quantidades e melhor suporte pós-venda, o que é crucial para ferramentas sofisticadas de diagnóstico epigenético. Usuários finais em larga escala frequentemente preferem esse canal, pois permite negociar contratos personalizados, receber treinamento técnico e garantir o fornecimento ininterrupto para pesquisas críticas e aplicações clínicas. Além disso, a licitação direta oferece a vantagem de acesso a produtos premium, tecnologias avançadas e serviços de manutenção abrangentes, essenciais para diagnósticos precisos. O segmento se beneficia de acordos de longo prazo com os principais fabricantes, garantindo qualidade consistente do produto e conformidade regulatória. Além disso, a licitação direta facilita uma melhor integração de instrumentos, reagentes e ferramentas de bioinformática, o que é crucial para fluxos de trabalho simplificados em laboratórios de pesquisa e clínicos. O alto valor agregado dos produtos, incluindo instrumentos, kits e softwares de bioinformática, torna a licitação direta o canal preferido entre compradores institucionais. Além disso, os fabricantes frequentemente oferecem soluções personalizadas e suporte técnico pós-instalação por meio desse canal, aumentando a fidelidade do cliente e a recorrência de compras.

Espera-se que o segmento de vendas no varejo testemunhe o CAGR mais rápido, de 18,3%, de 2025 a 2032. Esse crescimento é impulsionado pela crescente acessibilidade de kits de diagnóstico epigenético, reagentes e consumíveis para laboratórios menores, clínicas especializadas e pesquisadores individuais. Os canais de varejo oferecem conveniência e ciclos de aquisição mais rápidos, permitindo que usuários finais menores adotem tecnologias de ponta sem se envolver em processos de licitação complexos. A expansão de plataformas de comércio eletrônico e marketplaces online acelerou ainda mais a adoção das vendas no varejo, permitindo que pesquisadores e laboratórios clínicos comprem instrumentos, consumíveis e ferramentas de bioinformática diretamente com prazo de entrega mínimo. Além disso, a tendência crescente de medicina personalizada e a demanda por kits de teste domiciliares ou descentralizados contribuem para a crescente adoção dos canais de vendas no varejo. Os canais de varejo também facilitam uma penetração mais ampla no mercado semiurbano e regional, onde a licitação direta pode ser menos acessível. Os fabricantes estão cada vez mais oferecendo soluções combinadas e pacotes promocionais por meio do varejo, aumentando a acessibilidade e a adoção. Estratégias de marketing, como descontos para compradores de primeira viagem e opções de pagamento flexíveis, estão impulsionando a adoção no varejo. O segmento também se beneficia de iniciativas de conscientização e treinamento crescentes para clientes do varejo, incentivando o uso de diagnósticos epigenéticos avançados. Além disso, os canais de vendas no varejo ajudam a criar visibilidade da marca, expandindo o alcance para novos usuários finais e permitindo uma coleta mais rápida de feedback para aprimoramento do produto.

Análise regional do mercado de diagnóstico epigenético na América do Norte

- Os EUA dominaram o mercado de diagnóstico epigenético da América do Norte, com a maior participação na receita, de 87,3% em 2024, apoiados por infraestrutura avançada de saúde, alta adoção de tecnologias de diagnóstico molecular e investimentos substanciais em pesquisa clínica e instalações de diagnóstico. O país apresentou crescimento notável devido ao aumento da prevalência de câncer e doenças crônicas, à crescente demanda por detecção precoce e às inovações em plataformas de testes epigenéticos de alto rendimento.

- Espera-se que o Canadá seja o país com crescimento mais rápido no mercado de diagnóstico epigenético da América do Norte durante o período previsto, atribuído ao aumento dos investimentos em infraestrutura de saúde, à crescente conscientização sobre medicina de precisão, à crescente prevalência de doenças relacionadas ao estilo de vida e à expansão de iniciativas de pesquisa médica.

- Fortes investimentos em pesquisa clínica, instalações de diagnóstico e medicina de precisão estão apoiando o crescimento do mercado

Visão do mercado de diagnóstico epigenético da América do Norte nos EUA

O mercado de diagnóstico epigenético da América do Norte nos EUA capturou a maior fatia da receita, de 87,3%, em 2024, na América do Norte, impulsionado pelo aumento da prevalência de câncer e outras doenças crônicas, pela crescente demanda por detecção precoce e pelas inovações em plataformas de testes epigenéticos de alto rendimento. A expansão dos laboratórios de diagnóstico, a crescente conscientização sobre a medicina personalizada entre os profissionais de saúde e as iniciativas governamentais para apoiar ferramentas avançadas de diagnóstico estão impulsionando ainda mais o crescimento do mercado.

Visão do mercado de diagnóstico epigenético da América do Norte no Canadá

Espera-se que o mercado de diagnóstico epigenético canadense e norte-americano seja o de crescimento mais rápido no período previsto, devido ao aumento dos investimentos em infraestrutura de saúde, à crescente conscientização sobre medicina de precisão e à expansão das iniciativas de pesquisa médica. O foco do país em melhorar o acesso a serviços avançados de diagnóstico, aliado à colaboração entre o governo e o setor privado, está impulsionando a adoção de tecnologias de diagnóstico epigenético.

Participação no mercado de diagnóstico epigenético na América do Norte

O setor de diagnóstico epigenético é liderado principalmente por empresas bem estabelecidas, incluindo:

- PerkinElmer (EUA)

- Diagenode (Bélgica)

- F. Hoffman-La Roche Ltd (Suíça)

- EpiCypher (EUA)

- Promega Corporation (EUA)

- QIAGEN (Alemanha)

- PacBio (EUA)

- Epigenomics AG (Alemanha)

- Biologia de Reação (EUA)

- Bio-Rad Laboratories, Inc. (EUA)

- Agilent Technologies, Inc. (EUA)

- Merck KGaA (Alemanha)

- Illumina, Inc. (EUA)

- ACTIVEMOTIF (EUA)

- Thermo Fisher Scientific, Inc. (EUA)

- EpiGentek Group Inc. (EUA)

- Enzo Life Sciences, Inc. (EUA)

- Epizyme, Inc. (EUA)

Últimos desenvolvimentos no mercado de diagnóstico epigenético da América do Norte

- Em maio de 2025, uma equipe de pesquisa colaborativa de importantes instituições acadêmicas dos EUA publicou um estudo inovador apresentando um modelo de classificação de metilação de DNA capaz de prever a origem de órgãos e locais de doenças a partir de DNA livre de células (cfDNA). Este modelo, utilizando aprendizado de máquina e conjuntos de dados de metilação harmonizados, demonstrou alta precisão na distinção de perfis de metilação específicos de tecidos, oferecendo potencial significativo para diagnósticos não invasivos em oncologia e doenças inflamatórias.

- Em julho de 2024, a Food and Drug Administration (FDA) dos EUA aprovou um novo teste de biomarcador epigenético para a detecção precoce do câncer colorretal. Desenvolvido por uma empresa de biotecnologia sediada na Califórnia, este teste analisa os padrões de metilação do DNA em amostras de sangue, proporcionando uma opção de triagem minimamente invasiva que melhora o diagnóstico precoce e os resultados do tratamento.

- Em março de 2023, uma empresa farmacêutica sediada nos EUA anunciou o início de um ensaio clínico de Fase II para um medicamento epigenético direcionado às enzimas DNA metiltransferase. O ensaio visa avaliar a eficácia dessa nova abordagem terapêutica no tratamento de pacientes com tumores sólidos avançados, marcando um passo significativo rumo à integração de terapias epigenéticas em regimes de tratamento do câncer.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.