North America Eggs Market, By Product Type (Shell Egg, Processed Eggs), Source (Plant Based Egg, Animal Based Egg), Category (Conventional and Organic), Packaging Type (Trays, Boxes & Carton, Cans, Bottles, Pouches, Others), Specialty (Gluten Free, Low Cholesterol, High Protein, and Others), End User (Retail/Household, Food Service Sector), Distribution Channel (Store Based Retailer and Non-Store Based Retailer (Online)), Country (U.S, Canada, Mexico) Industry Trends and Forecast to 2028

Market Analysis and Insights: North America Eggs Market

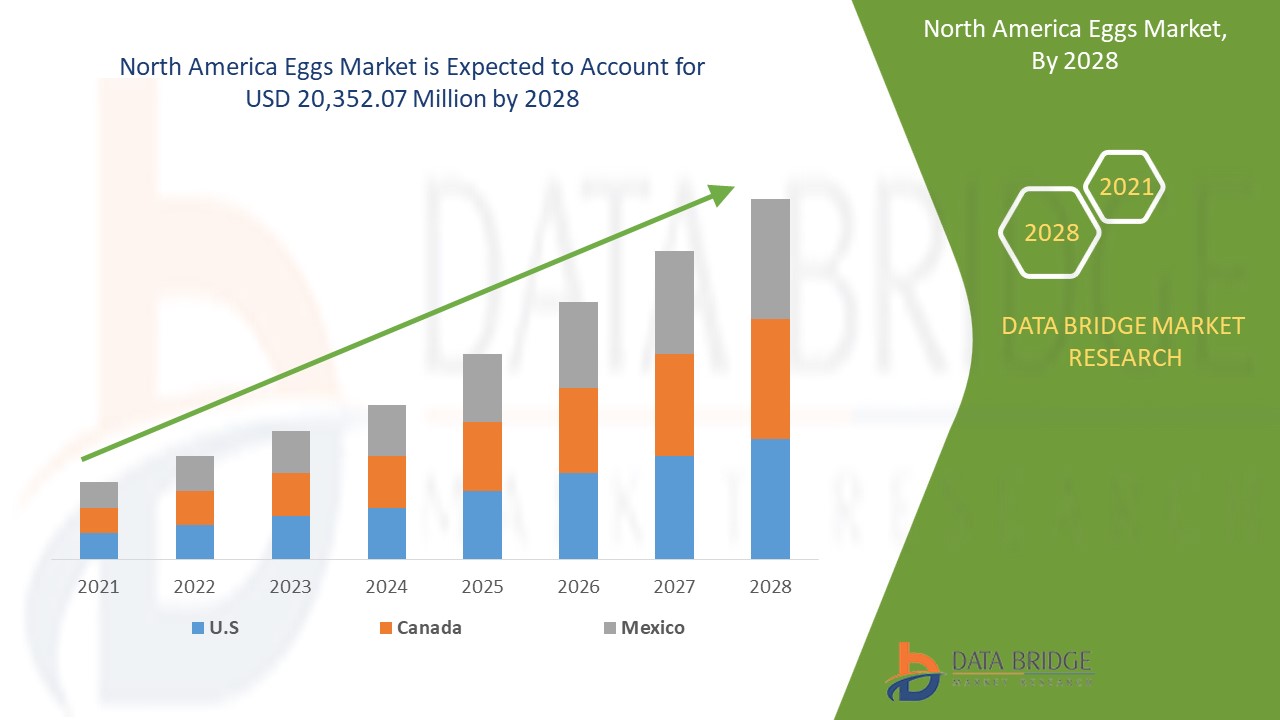

Eggs market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with the CAGR of 5.2% in the forecast period of 2021 to 2028 and expected to reach USD 20,352.07 million by 2028. Increasing number of food chains and restaurants is a driving factor for the market growth.

Egg is a good source of protein and a very energy-dense with nutrients. Nowadays, people are becoming more aware of the health benefits of protein-rich foods which are expected to boost their demand in the market. Egg has several applications and usage in various foodservice sectors. Thus, the high nutrient content of these eggs is attracting health-conscious consumers towards healthy protein option.

Increasing number of health conscious consumers and increasing vegan population are is expected to drive the market’s growth. Also, the growth of fast food and restaurant chains and increasing digitalization in egg supply is expected to drive the market’s growth. However, the risk of disease transfer from animal egg sources, food allergens associated with conventional eggs may restrain the market growth. The opportunity for growth in the market is increasing automation in poultry and processing industry. Some factors that challenge the market growth are high investment cost in poultry business.

This eggs market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographical expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Eggs Market Scope and Market Size

Eggs market is segmented on basis of product type, source, category, packaging type, specialty, end user and distribution channel. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

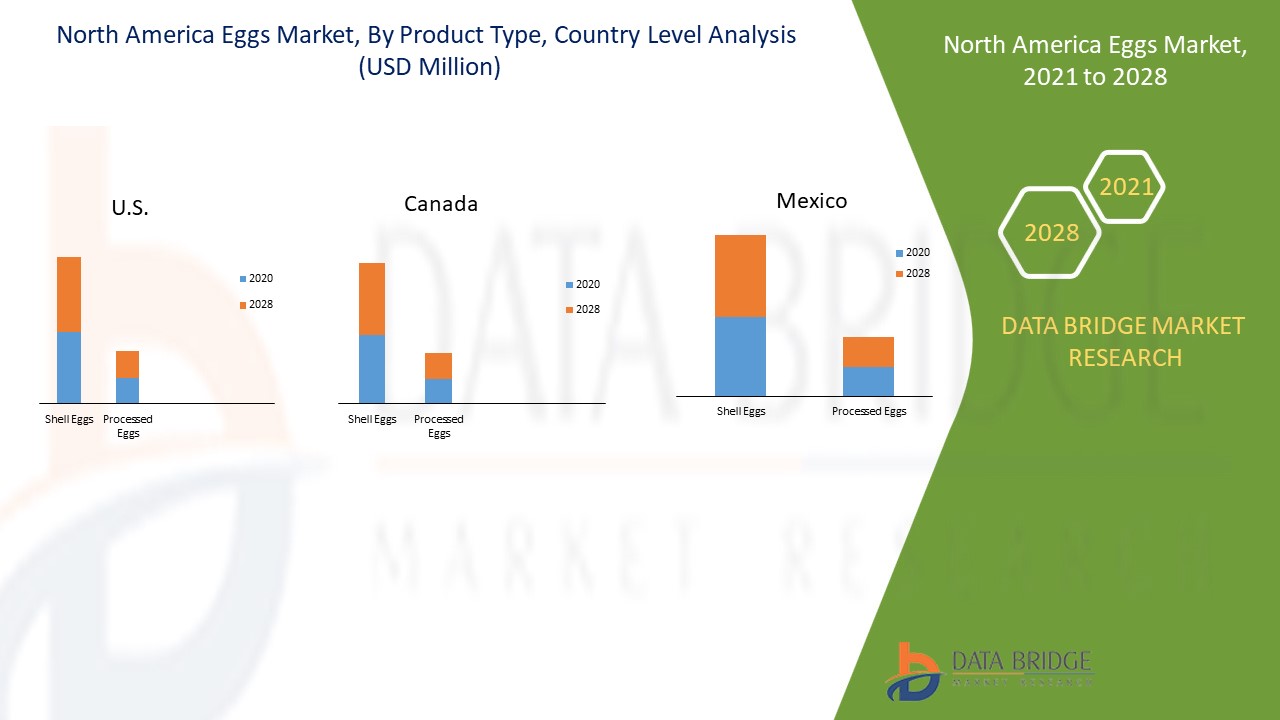

- On the basis of product type, the North America eggs market is segmented into shell egg, processed eggs. In 2021, the shell egg segment is expected to dominate the egg market due to various popularity and usages of shells eggs in the market.

- On the basis of source, the North America eggs market is segmented into plant based egg, animal based egg. In 2021, the animal based egg segment is expected to dominate the egg market due to the greater content of protein in the animal eggs.

- On the basis of category, the North America eggs market is segmented into conventional and organic. In 2021, the conventional segment is expected to dominate the egg market due to the cheaper price of conventional eggs.

- On the basis of packaging type, the North America eggs market is segmented into trays, boxes & carton, cans, bottles, pouches, others. In 2021, the trays segment is expected to dominate the egg market due as it prevents the eggs from breaking easily.

- On the basis of specialty, the North America eggs market is segmented into gluten free, low cholesterol, high protein and others. In 2021, the high protein segment is expected to dominate the egg market due to the consumer willingness to buy high protein foods such as eggs.

- On the basis of end user, the North America eggs market is segmented into retail/household, food service sector. In 2021, the retail/household segment is expected to dominate the egg market due to the growing application in the retail segment.

- On the basis of distribution channel, the North America eggs market is segmented into store based retailer and non-store based retailer (online). In 2021, the store based retailer segment is expected to dominate the plant-based egg market due to the convenience offered.

Eggs Market Country Level Analysis

Eggs Market Country Level Analysis

Eggs market is analysed and market size information is provided by type, source, category, packaging type, specialty, end user and distribution channel as referenced above.

The countries covered in eggs market report are U.S, Canada, and Mexico.

U.S. dominates the North America eggs market due to growth of fast food and restaurant chain in the region.

The shell eggs segment is dominating in all the regions due to its growing usage and applications of shells eggs. U.S. is expected to dominate because of growing vegan population, Canada is dominating due to growing fast food restaurant chains, and Mexico is dominating due to growing trend of high protein diet in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising Consumption of Eggs in the Laboratories for New Experiments

Eggs market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in eggs and changes in regulatory scenarios with their support for the eggs market. The data is available for historic period 2011 to 2019.

Competitive Landscape and Eggs Market Share Analysis

Eggs market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to eggs market.

The major players covered in the report are Rose Acre Farms, Cal-Maine Foods, Inc. Charoen Pokphand Foods PCL, Versova, Rembrandt Foods, Hillandale Farms, Michael Foods, Inc. , Bachoco, Daybreak Foods, Inc., Calvary Egg., Sparboe, Mantiqueira Group, Herbruck's Poultry Ranch, Inc, Eat Just, Inc., Vegg, Bob’s Red Mill Natural Foods, , Nabati, and Atlantic Natural Foods among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many collaborations are also initiated by the companies worldwide which are also accelerating the growth of eggs market.

For instance,

- In December 2020, Rose Acre Farms collaborated with Benson Hill, a food tech company unlocking nature’s genetic diversity with its leading food innovation engine. This collaboration has helped the company to expand processing capacity and build out supply chain infrastructure

Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for eggs through expanded range of size.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of North America eggs MARKET

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- MULTIVARIATE MODELLING

- product type LIFELINE CURVE

- DBMR MARKET POSITION GRID

- vendor share analysis

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- PROMOTIONAL ACTIVITIES

- SHOPPING BEHAVIOR AND DYNAMICS/FACTORS INFLUENCING THE PURCHASE

- GROWING HEALTH BENEFIT

- PRICING OF EGG

- GROWING CONSUMERS INTEREST IN PLANT-BASED DIETS

- supply chain analysis

- RAW MATERIAL PROCUREMENT

- PROCESSING AND PACKING

- MARKETING AND DISTRIBUTION

- END USERS

- regulatory framework, labelling and claims- North America eggs market

- market overview

- Drivers

- Increasing number of health conscious consumers

- Increasing vegan population to drive market growth

- Growth of fast food and restaurant chains

- Increasing digitalization in egg supply

- RESTRAINTs

- Risk of disease transfer from animal egg sources

- food allergens associated with conventional eggs

- OPPORTUNITies

- Increasing automation in poultry and processing industry

- STRATERGIC COLLABORATIONs, ACQUiSITIOns, AND EXPANSIONs FROM KEY PLAYERS

- Rise in demand for organic ingredients

- CHALLENGES

- Disruption in supply chain and trade due to COVID 19

- HIGH INVESTMENT COST IN POULTRY BUSINESS

- COVID-19 IMPACT ON NORTH AMERICA EGGS MARKET

- AFTERMATH OF COVID-19

- IMPACT ON SUPPLY CHAIN

- IMPACT ON DEMAND

- STRATEGIC INITIATIVES BY GOVERNMENT ANDF MANUFACTURERS

- IMPACT ON PRICE

- CONCLUSION

- North America eggs market, by product Type

- overview

- Shell Eggs

- CAGED

- WHITE EGGS

- BROWN EGGS

- CAGED-FREE

- WHITE EGGS

- BROWN EGGS

- Processed Eggs

- Eggs Powder

- EGG WHITE

- WHOLE EGG

- EGG YOLK

- LIQUID EGGS

- EGG WHITE

- WHOLE EGG

- EGG YOLK

- FROZEN EGGS

- EGG WHITE

- WHOLE EGG

- EGG YOLK

- DRIED EGGS

- EGG WHITE

- WHOLE EGG

- EGG YOLK

- SPECIALTY EGGS

- EGG WHITE

- WHOLE EGG

- EGG YOLK

- OTHERS

- NORTH AMERICA EGGS MARKET, BY END-USER

- overview

- REtail/household

- food service sector

- hotels

- restaurants

- RESTAURANTS, BY TYPE

- INDEPENDENT RESTAURANT

- CHAIN RESTAURANT

- RESTAURANTS, BY SERVICE CATEGORY

- QUICK SERVICE RESTAURANTS

- FULL SERVICE RESTAURANTS

- CATERING

- CAfe

- BARS AND CLUBS

- others

- North America eggs market, by source

- overview

- Animal Based Eggs

- CHICKEN

- DUCK

- OTHERS

- Plant Based Eggs

- MUNG BEANS

- GARBANZO BEANS

- PEA

- SOY FLOUR

- STARCH

- ALGAL FLOUR

- CHIA SEEDS

- WHEAT FLOUR

- OTHERS

- North America eggs market, by category

- overview

- Conventional

- organic

- North America eggs market, by packaging type

- overview

- Trays

- Boxes & Carton

- Bottles

- Pouches

- Cans

- Others

- North America eggs market, by specialty

- overview

- High Protein

- Low Cholesterol

- Gluten Free

- Others

- North America eggs market, by distribution channel

- overview

- Store Based Retailer

- SUPERMARKETS/HYPERMARKETS

- CONVENIENCE STORES

- GROCERY STORES

- BRICK & MOTOR STORES

- OTHER DISTRIBUTION CHANNEL

- Non-Store Based Retailer (Online)

- north america Eggs market, BY country

- north america

- North America

- U.S.

- Canada

- Mexico

- North America Eggs market: COMPANY landscape

- company share analysis: North America

- Swot analysis

- Company profile

- cal-maine foods, inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- COMPANY SHARE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- rose acre farms

- COMPANY SNAPSHOT

- COMPANY SHARE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- CHAROEN POKPHAND FOODS PCL

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- COMPANY SHARE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- versova

- COMPANY SNAPSHOT

- COMPANY SHARE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- hillandale farms

- COMPANY SNAPSHOT

- COMPANY SHARE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- agroholding avangard

- COMPANY snapshot

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ATLANTIC NATURAL FOODS

- COMPANY SNAPSHOT

- product portfolio

- RECENT DEVELOPMENTs

- bachoco

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- bob’s red mill natural foods

- COMPANY SNAPSHOT

- product portfolio

- RECENT DEVELOPMENT

- calvary egg

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- daybreak foods, inc

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- EAT JUST, INC.

- COMPANY SNAPSHOT

- product portfolio

- RECENT DEVELOPMENTs

- herbruck’s poultry ranch, inc

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- michael foods, inc

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- NABATI

- COMPANY SNAPSHOT

- product portfolio

- RECENT DEVELOPMENTs

- rembrandt foods

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- sparboe

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- VEGG

- COMPANY SNAPSHOT

- product portfolio

- RECENT DEVELOPMENT

- questionnaire

- RELATED REPORTS

Lista de Tabela

TABLE 1 The regulatory framework, labelling information for eggs as well as processed eggs:

TABLE 2 North America eggs Market, by Product Type, 2019-2028 (USD million)

TABLE 3 north america shell Eggs in Eggs Market, By Type, 2019-2028 (USD Million)

TABLE 4 north america caged in Eggs Market, By Type, 2019-2028 (USD Million)

TABLE 5 North America caged free in Eggs Market, By Type, 2019-2028 (USD Million)

TABLE 6 North America processed Eggs in Eggs Market, By Type, 2019-2028 (USD Million)

TABLE 7 North America eggs powder in Eggs Market, By Type, 2019-2028 (USD Million)

TABLE 8 North America liquid eggs in Eggs Market, By Type, 2019-2028 (USD Million)

TABLE 9 North America frozen eggs in Eggs Market, By Type, 2019-2028 (USD Million)

TABLE 10 North America dried eggs in Eggs Market, By Type, 2019-2028 (USD Million)

TABLE 11 North America specialty eggs in Eggs Market, By Type, 2019-2028 (USD Million)

TABLE 12 North America eggs market, By End User, 2019-2028 (USD Million)

TABLE 13 North America food service sector in eggs market, By type, 2019-2028 (USD Million)

TABLE 14 NORTH AMERICA restaurants in eggs market, By type, 2019-2028 (USD Million)

TABLE 15 NORTH AMERICA restaurants in eggs market, By SERVICE CATEGORY, 2019-2028 (USD Million)

TABLE 16 North America eggs market, by SOURCE, 2019-2028 (USD million)

TABLE 17 North America Animal Based Eggs in Eggs Market, By sOURCE, 2019-2028 (USD Million)

TABLE 18 The nutritional content of plant based egg is mentioned in the table below

TABLE 19 North America Plant Based Eggs in Eggs Market, By Source, 2019-2028 (USD Million)

TABLE 20 North America Eggs Market, By Category, 2019-2028 (USD Million)

TABLE 21 North America Eggs Market, By Packaging type, 2019-2028 (USD Million)

TABLE 22 North America Eggs Market, By Specialty, 2019-2028 (USD Million)

TABLE 23 North America eggs market, by DISTRIBUTION Channel, 2019-2028 (USD million)

TABLE 24 North America store based retailer in Eggs Market, By Type, 2019-2028 (USD Million)

TABLE 25 NORTH AMERICA EGG market, By COUNTRY, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA eggs market, By product type, 2019-2028 (USD million)

TABLE 27 NORTH AMERICA shell eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 28 NORTH AMERICA caged in eggs market, By type, 2019-2028 (USD million)

TABLE 29 NORTH AMERICA caged-free in eggs market, By type, 2019-2028 (USD million)

TABLE 30 NORTH AMERICA processed eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 31 NORTH AMERICA powder eggs in eggs market, By Type, 2019-2028 (USD million)

TABLE 32 NORTH AMERICA liquid eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 33 NORTH AMERICA frozen egg in eggs market, By type, 2019-2028 (USD million)

TABLE 34 NORTH AMERICA dried eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 35 NORTH AMERICA specialty eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 36 NORTH AMERICA eggs market, By Source, 2019-2028 (USD million)

TABLE 37 NORTH AMERICA plant-based eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 38 NORTH AMERICA animal based eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 39 NORTH AMERICA eggs market, By Category, 2019-2028 (USD million)

TABLE 40 NORTH AMERICA eggs market, By PACKAGING Type, 2019-2028 (USD million)

TABLE 41 NORTH AMERICA eggs market, By specialty, 2019-2028 (USD million)

TABLE 42 NORTH AMERICA eggs market, By End User, 2019-2028 (USD million)

TABLE 43 NORTH AMERICA food service sector in eggs market, By type, 2019-2028 (USD million)

TABLE 44 NORTH AMERICA restaurants in eggs market, By type, 2019-2028 (USD million)

TABLE 45 NORTH AMERICA restaurants in eggs market, By service category, 2019-2028 (USD million)

TABLE 46 NORTH AMERICA eggs market, By distribution channel, 2019-2028 (USD million)

TABLE 47 NORTH AMERICA store based retailers in eggs market, By type, 2019-2028 (USD million)

TABLE 48 U.S. eggs market, By product type, 2019-2028 (USD million)

TABLE 49 U.S. shell eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 50 U.S. caged in eggs market, By type, 2019-2028 (USD million)

TABLE 51 U.S. caged-free in eggs market, By type, 2019-2028 (USD million)

TABLE 52 U.S. processed eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 53 U.S. powder eggs in eggs market, By Type, 2019-2028 (USD million)

TABLE 54 U.S. liquid eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 55 U.S. frozen egg in eggs market, By type, 2019-2028 (USD million)

TABLE 56 U.S. dried eggs IN EGGS market, By type, 2019-2028 (USD million)

TABLE 57 U.S. specialty eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 58 U.S. eggs market, By Source, 2019-2028 (USD million)

TABLE 59 U.S. plant-based eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 60 U.S. animal based eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 61 U.S. eggs market, By Category, 2019-2028 (USD million)

TABLE 62 U.S. eggs market, By PACKAGING TYPE, 2019-2028 (USD million)

TABLE 63 U.S. eggs market, By specialty, 2019-2028 (USD million)

TABLE 64 U.S. eggs market, By End User, 2019-2028 (USD million)

TABLE 65 U.S. food service sector in eggs market, By type, 2019-2028 (USD million)

TABLE 66 U.S. restaurants in eggs market, By type, 2019-2028 (USD million)

TABLE 67 U.S. restaurants in eggs market, By service category, 2019-2028 (USD million)

TABLE 68 U.S. eggs market, By distribution channel, 2019-2028 (USD million)

TABLE 69 U.S. store based retailers in eggs market, By type, 2019-2028 (USD million)

TABLE 70 Canada eggs market, By product type, 2019-2028 (USD MILLION)

TABLE 71 Canada shell eggs in eggs market, By type, 2019-2028 (USD MILLION)

TABLE 72 Canada caged in eggs market, By type, 2019-2028 (USD million)

TABLE 73 Canada caged-free in eggs market, By type, 2019-2028 (USD million)

TABLE 74 Canada processed eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 75 Canada powder eggs in eggs market, By Type, 2019-2028 (USD million)

TABLE 76 Canada liquid eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 77 Canada frozen egg in eggs market, By type, 2019-2028 (USD million)

TABLE 78 Canada dried eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 79 Canada specialty eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 80 Canada eggs market, By Source, 2019-2028 (USD million)

TABLE 81 Canada plant-based eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 82 Canada animal based eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 83 Canada eggs market, By Category, 2019-2028 (USD million)

TABLE 84 Canada eggs market, By PACKAGING TYPE, 2019-2028 (USD million)

TABLE 85 Canada eggs market, By specialty, 2019-2028 (USD million)

TABLE 86 Canada eggs market, By End User, 2019-2028 (USD million)

TABLE 87 Canada food service sector in eggs market, By type, 2019-2028 (USD million)

TABLE 88 Canada restaurants in eggs market, By type, 2019-2028 (USD million)

TABLE 89 Canada restaurants in eggs market, By service category, 2019-2028 (USD million)

TABLE 90 Canada eggs market, By distribution channel, 2019-2028 (USD million)

TABLE 91 Canada store based retailers in eggs market, By type, 2019-2028 (USD million)

TABLE 92 Mexico eggs market, By product type, 2019-2028 (USD million)

TABLE 93 Mexico shell eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 94 Mexico caged in eggs market, By type, 2019-2028 (USD million)

TABLE 95 Mexico caged-free in eggs market, By type, 2019-2028 (USD million)

TABLE 96 Mexico processed eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 97 Mexico powder eggs in eggs market, By Type, 2019-2028 (USD million)

TABLE 98 Mexico liquid eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 99 Mexico frozen egg in eggs market, By type, 2019-2028 (USD million)

TABLE 100 Mexico dried eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 101 Mexico specialty eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 102 Mexico eggs market, By Source, 2019-2028 (USD million)

TABLE 103 Mexico plant-based eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 104 Mexico animal based eggs in eggs market, By type, 2019-2028 (USD million)

TABLE 105 Mexico eggs market, By Category, 2019-2028 (USD million)

TABLE 106 Mexico eggs market, By PACKAGING TYPE, 2019-2028 (USD million)

TABLE 107 Mexico eggs market, By specialty, 2019-2028 (USD million)

TABLE 108 Mexico eggs market, By End User, 2019-2028 (USD million)

TABLE 109 Mexico food service sector in eggs market, By type, 2019-2028 (USD million)

TABLE 110 Mexico restaurants in eggs market, By type, 2019-2028 (USD million)

TABLE 111 Mexico restaurants in eggs market, By service category, 2019-2028 (USD million)

TABLE 112 Mexico eggs market, By distribution channel, 2019-2028 (USD million)

TABLE 113 Mexico store based retailers in eggs market, By type, 2019-2028 (USD million)

Lista de Figura

FIGURE 1 North America eggs MARKET: segmentation

FIGURE 2 North America eggs MARKET: data triangulation

FIGURE 3 North America eggs MARKET: DROC ANALYSIS

FIGURE 4 North America eggs MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 North America eggs MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 North America eggs MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 North America eggs MARKET: SEGMENTATION

FIGURE 10 Increasing number of health-conscious consumers and vegan population are expected to drive North America Eggs market in the forecast period of 2021 to 2028

FIGURE 11 shell egg segment is expected to account for the largest share of the North America eggs MARKET in 2021 & 2028

FIGURE 12 Value chain of North America EGGS Market

FIGURE 13 supply chain analysis- North America EggS Market

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA EGG MARKET

FIGURE 15 North America eggs Market, By PRODUCT TYPE, 2020

FIGURE 16 North America eggs market, By End User, 2020

FIGURE 17 NORTH AMERICA Eggs market, BY SOURCE, 2020

FIGURE 18 North America Eggs Market, By Category, 2020

FIGURE 19 North America Eggs Market, By Packaging type, 2020

FIGURE 20 North America Eggs Market, By Specialty, 2020

FIGURE 21 NORTH AMERICA Eggs market, BY DISTRIBUTION Channel, 2020

FIGURE 22 NORTH AMERICA EGG market: SNAPSHOT (2020)

FIGURE 23 NORTH AMERICA EGG market: BY COUNTRY (2020)

FIGURE 24 NORTH AMERICA EGG market: BY COUNTRY (2021 & 2028)

FIGURE 25 NORTH AMERICA EGG market: BY COUNTRY (2020 & 2028)

FIGURE 26 NORTH AMERICA EGG market: BY PRODUCT TYPE (2021 & 2028)

FIGURE 27 North America Eggs market: company share 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.