North America E Commerce Packaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

18.98 Billion

USD

37.53 Billion

2025

2033

USD

18.98 Billion

USD

37.53 Billion

2025

2033

| 2026 –2033 | |

| USD 18.98 Billion | |

| USD 37.53 Billion | |

|

|

|

|

Mercado de Embalagens para E-commerce na América do Norte: Segmentação por Embalagem (Caixas de Papelão Ondulado, Sacolas, Envelopes, Etiquetas, Embalagens de Proteção, Caixas para Paletes, Fitas Adesivas, Embalagens Postais, Filme Termoencolhível), por Material (Plásticos à Base de Fibra, Plásticos com Conteúdo Reciclado e Pós-Consumo, Materiais de Base Biológica, Plásticos Convencionais, Outros), por Usuário Final (Vestuário e Acessórios, Eletrônicos e Elétricos, Têxteis, Artigos para o Lar, Cuidados Pessoais, Alimentos e Bebidas, Produtos Farmacêuticos, Automotivo, Produtos de Metal Fabricados, Produtos Químicos, Agricultura, Móveis, Madeira e Produtos de Madeira, Couro e Artigos de Couro, Materiais de Construção, Produtos de Tabaco, Outros), por Canal de Distribuição (direto, indireto) - Tendências e Previsões do Setor até 2033

Tamanho do mercado de embalagens para comércio eletrônico na América do Norte

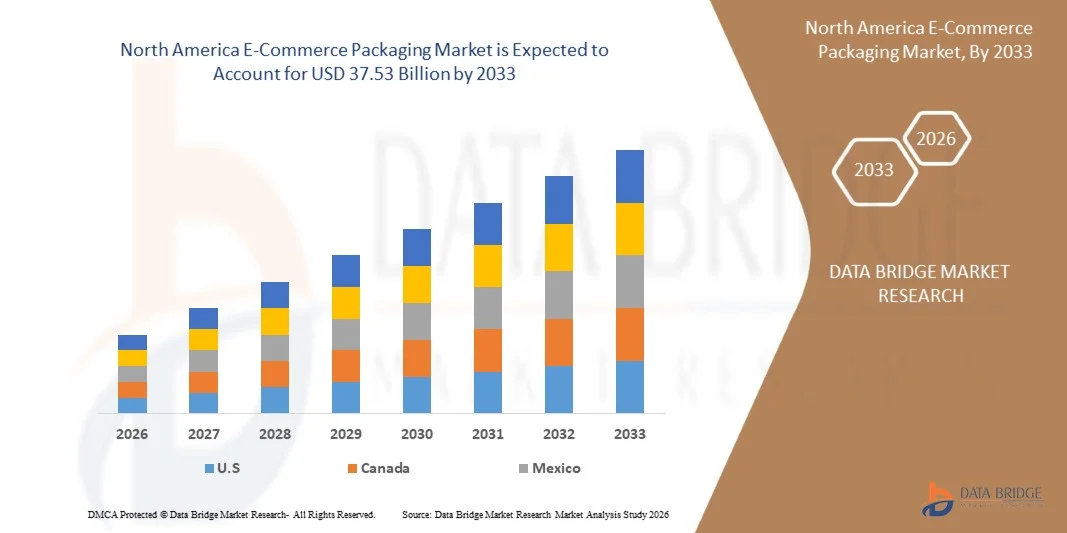

- O mercado de embalagens para comércio eletrônico na América do Norte foi avaliado em US$ 18,98 bilhões em 2025 e espera-se que atinja US$ 37,53 bilhões até 2033.

- Durante o período de previsão de 2026 a 2033, o mercado deverá crescer a uma taxa composta de crescimento anual (CAGR) de 8,9%, impulsionado principalmente pelo aumento do envolvimento do consumidor em atividades recreativas, sociais e familiares, o que expandiu significativamente a demanda por jogos de tabuleiro educativos e de estratégia — categorias-chave que frequentemente dependem de formatos de embalagem especializados, duráveis e esteticamente atraentes.

- Além disso, a expansão da infraestrutura de manufatura e transporte da América do Norte, combinada com o aumento do volume de comércio nos mercados doméstico e internacional, está acelerando a adoção de soluções avançadas de embalagem. A forte ênfase da região em logística moderna, iniciativas de sustentabilidade e conveniência para o consumidor também contribui para o crescimento consistente do mercado.

Análise do mercado de embalagens para comércio eletrônico na América do Norte

- O mercado de embalagens para e-commerce na América do Norte está crescendo rapidamente, à medida que as marcas integram tecnologias avançadas para melhorar a eficiência, a sustentabilidade e o engajamento do consumidor. Embora a automação seja tradicionalmente associada à logística e às operações portuárias, tendências semelhantes — como digitalização, análises baseadas em IA, mecanismos automatizados de empilhamento e gestão inteligente de estoque — estão moldando cada vez mais as operações de embalagem em diversos setores, incluindo produtos químicos, alimentos e bebidas, produtos farmacêuticos, agricultura, construção, mineração, resíduos e reciclagem e bens de consumo.

- Essas tecnologias estão fortalecendo a cadeia de suprimentos da região, reduzindo processos manuais, acelerando prazos de entrega, otimizando o espaço de armazenamento e dando suporte a extensas redes de varejo online. Guindastes de empilhamento automatizados (ASCs), sistemas guiados por inteligência artificial e ferramentas avançadas de monitoramento permitem o armazenamento otimizado, a redução do tempo de manuseio e a visibilidade contínua dos níveis de estoque, ajudando fabricantes, distribuidores e plataformas de e-commerce a manter a consistência do fornecimento e reduzir os custos operacionais.

- A adoção de plataformas de distribuição inteligentes e o planejamento preditivo da demanda estão aprimorando ainda mais os ciclos de reposição, principalmente durante períodos de pico de vendas, lançamentos de novos produtos e eventos promocionais.

- Prevê-se que os EUA dominem o mercado de embalagens para comércio eletrônico na América do Norte, com a maior participação de receita, de 75,23% em 2026, impulsionados por investimentos significativos em automação logística, infraestrutura digital e iniciativas de resiliência da cadeia de suprimentos. Grandes portos, como Los Angeles, Long Beach e Nova York/Nova Jersey, já implementaram sistemas automatizados de movimentação de cargas (ASCs), veículos guiados automaticamente (AGVs) e sistemas operacionais de terminal (TOS) avançados para melhorar o fluxo de mercadorias e reduzir o congestionamento, enquanto operadores importantes como APM Terminals, SSA Marine e DP World continuam a modernizar seus equipamentos e operações de movimentação.

- Prevê-se que o México seja a região de crescimento mais rápido no mercado de embalagens para comércio eletrônico da América do Norte durante o período de previsão, com uma taxa de crescimento anual composta (CAGR) de 9,6%, impulsionada pelo aumento do comércio de contêineres, pela modernização dos centros logísticos e pela adoção de rastreamento de estoque com inteligência artificial, veículos autônomos e guindastes controlados remotamente.

- Em 2026, espera-se que o segmento de caixas de papelão ondulado domine o mercado com uma participação de 36,63%, visto que essas soluções de embalagem oferecem um equilíbrio ideal entre preço acessível, durabilidade, escalabilidade e flexibilidade operacional. Sua capacidade de atender à alta demanda do comércio eletrônico, mantendo a eficiência de custos, as torna a escolha preferida de fabricantes, distribuidores e empresas de entrega de última milha em toda a região.

Escopo do relatório e segmentação do mercado de embalagens para comércio eletrônico na América do Norte

|

Atributos |

Principais informações sobre o mercado de embalagens para comércio eletrônico na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de embalagens para comércio eletrônico na América do Norte

“Adoção de automação e dimensionamento adequado de sistemas em logística”

- A adoção da automação e de sistemas de dimensionamento adequado na logística de distribuição emergiu como uma oportunidade significativa para o mercado global de embalagens para e-commerce na América do Norte. À medida que o volume de pedidos aumenta e a diversidade de SKUs cresce, os processos manuais de embalagem e distribuição tornam-se mais caros, lentos e propensos a erros. A automação por meio de robótica, sistemas de separação e embalagem orientados por IA e máquinas de embalagem com dimensionamento adequado oferece maior eficiência, menor dependência de mão de obra, produção consistente e uso otimizado de materiais, fatores que se alinham estreitamente com a demanda do e-commerce e as metas de sustentabilidade. Essa mudança posiciona a automação de embalagens como uma alavanca de valor agregado para as empresas reduzirem custos logísticos, melhorarem a velocidade de distribuição e possibilitarem um crescimento escalável.

- Em janeiro de 2025, a Smart-Robotics.io informou que, até 2025, estima-se que quatro milhões de robôs de armazém serão instalados em 50.000 armazéns em todo o mundo, com a penetração da automação prevista para subir de 18% no final de 2021 para 26% em 2027.

- Em setembro de 2024, um comunicado de imprensa observou que o mercado global de automação de embalagens (abrangendo sistemas automatizados de embalagem, selagem e rotulagem) deveria crescer de US$ 64,70 bilhões em 2022 para US$ 136,47 bilhões em 2032.

- Em julho de 2025, um blog sobre automação de armazéns no eShipz citou que a automação nas operações de armazém pode reduzir os custos em até 30% e aumentar a produtividade em mais de 40%, tornando a automação uma necessidade estratégica em mercados dinâmicos e de alto volume, como a Índia.

- A crescente adoção de automação e sistemas de dimensionamento adequado no atendimento de pedidos de e-commerce está criando uma oportunidade estrutural para fornecedores de embalagens e provedores de tecnologia. A automação reduz o custo por embalagem, acelera a produção, melhora a precisão e suporta a escalabilidade. À medida que os centros de distribuição investem em robótica e tecnologia de dimensionamento adequado, a demanda por linhas de embalagem automatizadas, sistemas de embalagem modulares e soluções de embalagem inteligentes deverá aumentar substancialmente, impulsionando o crescimento e a inovação no mercado global de embalagens para e-commerce na América do Norte.

Dinâmica do mercado de embalagens para comércio eletrônico na América do Norte

Motorista

“Penetração regional da internet e de smartphones em mercados emergentes”

- O aumento regional da penetração da internet e dos smartphones em mercados emergentes tem se destacado como um fator-chave para o crescimento do mercado global de embalagens para e-commerce na América do Norte. À medida que mais consumidores obtêm acesso confiável à internet móvel — e os smartphones se tornam a principal porta de entrada para compras online — a penetração do varejo online se expande rapidamente, gerando maior demanda por embalagens em diversas regiões geográficas. Essa penetração digital impulsiona maiores volumes de remessas de pequenos pacotes, ciclos de pedidos frequentes e um comércio internacional ampliado, o que aumenta a necessidade de soluções de embalagem variadas e escaláveis, alinhadas aos requisitos de logística do e-commerce.

- Em outubro de 2023, a União Internacional de Telecomunicações (UIT) informou que 78% da população mundial com 10 anos ou mais possuía um telefone celular, uma porcentagem 11 pontos percentuais superior à penetração global do uso da internet.

- Em outubro de 2024, o relatório da GSMA sobre o Estado da Conectividade Móvel à Internet indicou que 4,6 bilhões de pessoas — aproximadamente 57% da população mundial — estavam usando a internet móvel em dispositivos pessoais, apontando para uma aceleração da penetração digital em regiões emergentes.

- Em julho de 2025, o relatório Global Findex Digital Connectivity Tracker do Banco Mundial revelou que, em países de baixa e média renda, a adoção de smartphones e o uso de pagamentos digitais aumentaram consideravelmente, refletindo capacidades mais amplas de comércio digital e possibilitando o crescimento do comércio eletrônico fora das regiões de alta renda.

- Em outubro de 2025, estimativas globais indicavam que aproximadamente 6,04 bilhões de pessoas — cerca de 73% da população mundial — utilizavam a internet, o que evidencia a crescente base de consumidores digitais que sustenta a demanda por embalagens para comércio eletrônico.

- A crescente penetração da internet e dos smartphones nos mercados emergentes está expandindo a base de clientes potenciais para o varejo online, impulsionando assim uma maior demanda por embalagens para e-commerce. Com a ampliação da inclusão digital, os fornecedores de embalagens podem antecipar um crescimento sustentado do volume e a diversificação dos formatos de embalagem, reforçando a expansão do volume de embalagens como uma alavanca estrutural de crescimento para o mercado global de embalagens para e-commerce na América do Norte.

Restrição/Desafio

“ Regulamentação de Resíduos de Embalagens e Custos de Conformidade”

- As regulamentações sobre resíduos de embalagens e os custos de conformidade emergiram como um fator restritivo significativo para o mercado global de embalagens para e-commerce na América do Norte. À medida que os órgãos reguladores em todo o mundo endurecem as regras sobre design de embalagens, composição de materiais, reciclabilidade e responsabilidade pelo descarte, as empresas de e-commerce enfrentam pressões crescentes, desde a reformulação de embalagens para atender a novos padrões, o aumento do uso de materiais reciclados, a redução do espaço vazio e a extensão da responsabilidade do produtor (RPE). Esses encargos regulatórios aumentam os custos de conformidade, complicam as remessas internacionais e podem forçar as empresas a reestruturar suas cadeias de suprimentos ou repassar os custos aos consumidores. Para um mercado impulsionado por velocidade, conveniência e frete de baixo custo, leis mais rigorosas sobre resíduos de embalagens podem prejudicar o crescimento ou limitar a expansão das margens de lucro.

- Em dezembro de 2024, o Ministério do Meio Ambiente da Índia apresentou uma minuta das Regras de Proteção Ambiental (Responsabilidade Estendida do Produtor para Embalagens) de 2024, que, uma vez implementadas a partir de abril de 2026, exigirão que produtores, importadores e proprietários de marcas gerenciem todo o ciclo de vida das embalagens.

- Em abril de 2024, o Parlamento Europeu chegou a um acordo provisório para adotar regras mais rigorosas para embalagens, incluindo metas para reduzir o desperdício de embalagens em 5% até 2030 (10% até 2035, 15% até 2040), proibições de muitos formatos de embalagens plásticas descartáveis e a exigência de que todas as embalagens sejam recicláveis.

- Em março de 2024, o Conselho da União Europeia e o Parlamento Europeu chegaram a um acordo provisório para reformular a regulamentação das embalagens e dos resíduos de embalagens, reforçando os padrões de design, reciclabilidade e rotulagem para todas as embalagens, incluindo as de comércio eletrônico.

- Em dezembro de 2024, o Conselho adotou formalmente o novo Regulamento de Embalagens e Resíduos de Embalagens 2025/40 (PPWR), estabelecendo metas vinculativas de reutilização e conteúdo reciclado, restringindo os plásticos de uso único e exigindo a minimização do peso/volume das embalagens.

- Em 11 de fevereiro de 2025, o Regulamento sobre Embalagens e Produtos de Consumo (PPWR) entrou em vigor, estabelecendo assim um quadro jurídico harmonizado em toda a UE para todas as embalagens colocadas no mercado, incluindo as embalagens de comércio eletrónico, e sinalizando uma mudança em direção a encargos de conformidade com a economia circular para os retalhistas online.

- As regulamentações sobre resíduos de embalagens foram reforçadas nas principais economias, aumentando os requisitos obrigatórios de reciclabilidade, reutilização, relatórios e redução de materiais. Essas medidas elevam os custos de conformidade para os produtores de embalagens de e-commerce por meio de padrões de design mais rigorosos, obrigações de rastreabilidade, mandatos de conteúdo reciclado e maior responsabilidade do produtor. À medida que os limites regulatórios aumentam, as empresas enfrentam maiores despesas operacionais, de auditoria e de redesenho, reduzindo as margens de lucro e dificultando a entrada no mercado para fornecedores menores. Consequentemente, espera-se que o aumento das exigências de conformidade atue como uma restrição estrutural no mercado global de embalagens de e-commerce da América do Norte, aumentando os custos e limitando a flexibilidade na seleção de materiais e formatos.

Escopo do mercado de embalagens para comércio eletrônico na América do Norte

O mercado global de embalagens para comércio eletrônico na América do Norte está segmentado em quatro categorias com base na embalagem, no material, no usuário final e no canal de distribuição.

- Por embalagem

Com base na embalagem, o mercado de embalagens para e-commerce na América do Norte é segmentado em caixas de papelão ondulado, sacolas, envelopes, etiquetas, embalagens de proteção, caixas para paletes, fitas adesivas, embalagens postais e filme termoencolhível. Em 2026, espera-se que o segmento de caixas de papelão ondulado domine o mercado com uma participação de 36,63%, impulsionado pelo aumento do volume de compras online, pela crescente demanda por embalagens duráveis e econômicas e pela rápida expansão das redes de varejo omnichannel. As caixas de papelão ondulado continuam sendo a opção preferida devido à sua alta resistência, reciclabilidade, flexibilidade de personalização e adequação a uma ampla gama de produtos — de eletrônicos e artigos domésticos a vestuário, cosméticos e itens essenciais de consumo. Além disso, o crescimento de modelos de e-commerce baseados em assinatura, o aprimoramento das tecnologias de impressão e as crescentes exigências de sustentabilidade estão reforçando a liderança do segmento.

O segmento de caixas de papelão ondulado é o que apresenta o crescimento mais rápido no mercado de embalagens para e-commerce da América do Norte, com uma taxa de crescimento anual composta (CAGR) de 9,5%, impulsionado pelo aumento nas remessas de encomendas, pela crescente adoção de soluções de embalagens sustentáveis e leves e pelas crescentes expectativas dos consumidores por entregas seguras e sem danos. A expansão dos centros de distribuição, os avanços em sistemas automatizados de fabricação de caixas e a mudança para embalagens com o tamanho adequado estão acelerando ainda mais a demanda. Além disso, a maior ênfase em materiais recicláveis, as exigências por embalagens ecológicas e a crescente presença de grandes players de e-commerce nos EUA, Canadá e México devem fortalecer a dominância das embalagens de papelão ondulado nos próximos anos.

- Por material

Com base no material, o mercado de embalagens para e-commerce na América do Norte é segmentado em plásticos à base de fibras, plásticos com conteúdo reciclado e plásticos reciclados pós-consumo (PCR), materiais de base biológica, plásticos convencionais (plásticos virgens) e outros. Em 2026, espera-se que o segmento de materiais à base de fibras domine o mercado com uma participação de 50,22%, impulsionado pela forte demanda por soluções de embalagens sustentáveis, recicláveis e leves nas principais categorias de e-commerce. A mudança para embalagens ecológicas, a crescente conscientização ambiental entre os consumidores e a implementação de regulamentações de sustentabilidade mais rigorosas nos EUA e no Canadá estão acelerando a adoção de materiais à base de fibras. Além disso, a expansão da produção de embalagens de papelão ondulado, os avanços nas tecnologias de resistência e redução de peso do papel e a crescente preferência por embalagens sem plástico entre marcas e varejistas reforçam ainda mais a liderança do segmento.

O segmento de materiais de base biológica é o que apresenta o crescimento mais rápido no mercado de embalagens para e-commerce da América do Norte, com uma taxa de crescimento anual composta (CAGR) de 9,8%, impulsionado pelo aumento dos investimentos em embalagens biodegradáveis e compostáveis, pelo fortalecimento dos compromissos corporativos com a sustentabilidade e pela preferência do consumidor por alternativas de baixo impacto ambiental. Envelopes, filmes, materiais de amortecimento e soluções de fibra moldada de base biológica estão ganhando espaço à medida que as empresas buscam reduzir suas emissões de carbono e atingir metas ESG (ambientais, sociais e de governança). Além disso, inovações em polímeros de origem vegetal, iniciativas verdes apoiadas pelo governo e a rápida expansão de marcas ecologicamente conscientes que vendem diretamente ao consumidor estão acelerando a adoção dessa tecnologia em toda a região.

- Por canal de distribuição

Com base no canal de distribuição, o mercado global de embalagens para e-commerce na América do Norte é segmentado em canais diretos e indiretos. Em 2026, espera-se que o segmento direto domine o mercado com 68,61% de participação, impulsionado pelos fortes volumes de compras de grandes empresas de e-commerce, provedores de logística terceirizada (3PL) e grandes organizações varejistas que preferem comprar materiais de embalagem diretamente dos fabricantes. Os canais diretos oferecem benefícios como preços por atacado, soluções de embalagem personalizadas, prazos de entrega mais rápidos e parcerias de longo prazo com fornecedores, que são cada vez mais preferidos por operadores de e-commerce de alto volume. Além disso, a crescente tendência de cadeias de suprimentos verticalmente integradas, compras de embalagens por assinatura e linhas de embalagem automatizadas fortalece ainda mais o domínio do canal de distribuição direto.

O segmento de vendas diretas é o que apresenta o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 9,1% no mercado de embalagens para e-commerce na América do Norte. Esse crescimento é impulsionado pela crescente preferência de empresas de e-commerce, centros de distribuição e provedores de logística terceirizada (3PL) por adquirir materiais de embalagem diretamente dos fabricantes, visando maior custo-benefício, qualidade consistente e confiabilidade no fornecimento. A compra direta permite que grandes compradores garantam pedidos em grande volume, se beneficiem de preços negociados, acessem soluções de embalagem personalizadas e otimizem a gestão de estoque — vantagens cruciais em um mercado onde o volume de pedidos e a frequência de envios continuam a aumentar.

- Por usuário final

Com base no usuário final, o mercado global de embalagens para e-commerce na América do Norte é segmentado em vestuário e acessórios (excluindo artigos de couro), eletrônicos e eletrodomésticos, têxteis, artigos para o lar, cuidados pessoais, alimentos e bebidas, produtos farmacêuticos, automotivo, produtos de metal fabricados, produtos químicos, agricultura, móveis, madeira e produtos de madeira (excluindo móveis), couro e artigos de couro, materiais de construção, produtos de tabaco e outros. Em 2026, espera-se que o segmento de Vestuário e Acessórios (exceto artigos de couro) domine o mercado com 14,51% de participação, impulsionado pelo rápido crescimento do varejo de moda online, marcas de fast-fashion e empresas de vestuário D2C. A crescente preferência do consumidor por devoluções convenientes, assinaturas de moda personalizadas e lançamentos de produtos sazonais está impulsionando a demanda por soluções de embalagens duráveis e leves. O crescimento do comércio social, as promoções de vestuário lideradas por influenciadores e os ciclos de envio de alto volume reforçam ainda mais a liderança do segmento no setor global de embalagens para e-commerce.

O segmento de Eletrônicos e Elétricos é o que apresenta o crescimento mais rápido no mercado de embalagens para e-commerce da América do Norte, com uma taxa composta de crescimento anual (CAGR) de 10,0%. Esse crescimento é impulsionado pelo aumento das vendas online de eletrônicos de consumo, dispositivos inteligentes, produtos de automação residencial e pequenos eletrodomésticos. Como esses itens exigem embalagens protetoras, resistentes a impactos e invioláveis, a demanda por materiais especializados, como envelopes de proteção, inserções de fibra moldada, caixas de papelão ondulado e embalagens multicamadas, continua a crescer. Além disso, a rápida inovação de produtos, as frequentes atualizações de dispositivos e a crescente adoção de plataformas de e-commerce para eletrônicos de alto valor agregado — combinadas com a expansão de marketplaces de eletrônicos recondicionados — estão acelerando a necessidade de soluções de embalagem avançadas e sustentáveis em toda a região.

Análise Regional do Mercado de Embalagens para E-commerce na América do Norte

- Prevê-se que os EUA dominem o mercado de embalagens para comércio eletrônico na América do Norte, com a maior participação de receita, de 75,23% em 2026. Esse crescimento é impulsionado pelo ecossistema de varejo e comércio eletrônico altamente consolidado do país, pelo forte poder de compra do consumidor e pela presença de grandes varejistas online, provedores de logística e fabricantes de embalagens. As operações em larga escala de empresas como Amazon, Walmart, Target, UPS e FedEx geram uma demanda substancial por caixas de papelão ondulado, envelopes, embalagens de proteção e materiais sustentáveis. Além disso, os EUA continuam investindo fortemente em automação, otimização de armazéns, digitalização da cadeia de suprimentos e embalagens ecologicamente responsáveis, solidificando ainda mais sua posição dominante na região.

- Prevê-se que o México seja a região de crescimento mais rápido no mercado de embalagens para e-commerce da América do Norte durante o período de previsão, com uma taxa de crescimento anual composta (CAGR) de 9,6%, impulsionada pela rápida expansão da penetração do e-commerce, pelo aumento do comércio transfronteiriço, pela crescente adoção de sistemas de pagamento digital e pela melhoria da infraestrutura de entrega de última milha. Investimentos em centros logísticos modernos, instalações de produção de embalagens e iniciativas governamentais que apoiam a competitividade da indústria manufatureira aceleram ainda mais o desenvolvimento do mercado. Além disso, o crescimento de pequenas e médias empresas (PMEs) e marcas D2C no México está contribuindo para o aumento do consumo de envelopes flexíveis, caixas de papelão ondulado e embalagens de proteção.

- De forma geral, a crescente adoção do varejo digital, o crescimento do comércio eletrônico transfronteiriço, a inovação de produtos voltada para a sustentabilidade e os investimentos contínuos em tecnologias de logística e distribuição estão, em conjunto, fortalecendo o mercado de embalagens para comércio eletrônico na América do Norte, abrangendo os EUA, o México e o Canadá.

Análise do mercado de embalagens para e-commerce no Canadá e na América do Norte

O mercado de embalagens para e-commerce no Canadá e na América do Norte ocupa uma posição significativa no setor norte-americano, impulsionado pela crescente penetração do varejo online, pela forte preferência do consumidor por embalagens sustentáveis e pelos investimentos cada vez maiores em infraestrutura avançada de logística e distribuição. As rigorosas regulamentações ambientais do país e a crescente ênfase na reciclagem e nas práticas de economia circular estão acelerando a adoção de soluções de embalagens ecológicas e à base de fibras. Além disso, a rápida expansão do e-commerce nacional e internacional, o crescimento de marcas baseadas em assinaturas e a presença cada vez maior de varejistas globais impulsionaram a demanda por caixas de papelão ondulado, embalagens protetoras e envelopes leves. O crescimento constante da capacidade de armazenagem do Canadá, as melhorias nas redes de entrega de última milha e a contínua transformação digital no varejo estão fortalecendo ainda mais seu papel como um importante contribuinte para o mercado de embalagens para e-commerce na América do Norte.

Análise do mercado de embalagens para e-commerce no México e na América do Norte

O mercado de embalagens para e-commerce no México e na América do Norte deverá crescer de forma constante, impulsionado pela rápida expansão das compras online, pelo aumento da penetração da internet e de smartphones e pela ascensão de plataformas de e-commerce nacionais e internacionais. A crescente participação de PMEs e marcas D2C no varejo online está impulsionando a demanda por formatos de embalagem com boa relação custo-benefício, como envelopes flexíveis, caixas de papelão ondulado e embalagens de proteção. Além disso, investimentos significativos na modernização da logística — incluindo armazéns automatizados, redes de transporte aprimoradas e capacidades de entrega de última milha otimizadas — estão fortalecendo o ecossistema de e-commerce do país. Iniciativas governamentais de apoio para promover a competitividade da indústria, juntamente com as crescentes expectativas dos consumidores por entregas mais rápidas e embalagens seguras, contribuem ainda mais para a trajetória de crescimento sustentado do mercado.

Os principais líderes de mercado que atuam no setor são:

- Companhia Internacional de Papel (EUA)

- Amcor PLC (Suíça)

- DS Smith PLC (Reino Unido)

- Smurfit WestRock (EUA)

- Packaging Corporation of America (PCA) (EUA)

- Mondi PLC (Reino Unido)

- Klabin SA (Brasil)

- Oji Holdings Corporation (Japão)

- Sealed Air Corporation (EUA)

- Nine Dragons Paper Holdings Ltd. (Hong Kong)

- Empresa 3M (EUA)

- Avery Dennison Corporation (EUA)

- Green Bay Packaging Inc. (EUA)

- Cosmo Films (Índia)

- Georgia-Pacific LLC (EUA)

- Ranpak Holdings Corp. (EUA)

- Boxon Group AB (Suécia)

- Stora Enso (Finlândia)

- Pratt Industries (EUA)

- Prem Industries India Limited (Índia)

- Pregis LLC (EUA)

- Packtek (Índia)

- Packman Packaging Private Limited (Índia)

- Packhelp (Polônia)

- IPG (EUA)

- Grupo Filmar (Polônia)

- BCE (EUA)

- Ecom Packaging (Índia)

- Embalagem Blue Box (EUA)

- Altpac (Índia)

Novidades em embalagens para comércio eletrônico na América do Norte

- Em julho de 2022, a Packhelp lançou a “etiquetagem de carbono” para seus produtos de embalagem, permitindo que os clientes visualizem a pegada de carbono estimada de seus pedidos. Isso está alinhado com a crescente demanda por embalagens sustentáveis no e-commerce. A Packhelp continua se posicionando como um marketplace de embalagens personalizadas com baixas quantidades mínimas de pedido, o que permanece atrativo para vendedores de e-commerce, startups e pequenas marcas D2C que precisam de embalagens personalizadas, mas não fazem pedidos em grandes volumes.

- Em abril de 2025, a Pratt Industries, Inc. anunciou um compromisso de investir US$ 5 bilhões em reciclagem nos EUA, infraestrutura de energia limpa e empregos na indústria, apoiando um amplo esforço de reindustrialização.

- Em setembro de 2025, a Pregis inaugurou um novo centro de conversão de papel de 477.000 pés quadrados (aproximadamente 44.300 m²) em Elgin, Illinois. A unidade criará mais de 500 empregos na área de manufatura e terá capacidade para produzir mais de 1 bilhão de soluções de embalagens de papel recicláveis por ano.

- Em agosto de 2025, a Ranpak Holdings Corp. anunciou uma expansão significativa de sua parceria com o Walmart. De acordo com os termos deste acordo estratégico, o Walmart instalará diversos sistemas Ranpak AutoFill em seus cinco Centros de Distribuição de Próxima Geração, otimizando o processo de logística, reduzindo o desperdício de embalagens e simplificando o trabalho dos funcionários.

- Em setembro de 2025, a Sealed Air Corporation avançará em sua estratégia de se tornar uma solução completa para operações de logística com o lançamento da AUTOBAG 850HB Hybrid Samgging Machine, um novo sistema automatizado de ensacamento projetado para operar tanto com embalagens de polietileno quanto de papel.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 COMPANY EVALUATION QUADRANT

4.3 PATENT ANALYSIS

4.3.1 PATENT FILING DISTRIBUTION BY COUNTRY

4.3.2 KEY APPLICANTS (TOP INNOVATORS)

4.3.3 TECHNOLOGY SEGMENTATION BY IPC CODES

4.3.4 PATENT TREND OVER TIME (2016–2025)

4.4 PRICING ANALYSIS

4.5 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.6 BRAND OUTLOOK

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.1.1 Packaging waste volumes and landfill pressure

4.7.1.2 Plastic pollution & microplastics

4.7.1.3 Deforestation and pulp supply stress

4.7.1.4 Greenhouse gas (GHG) emissions across the lifecycle

4.7.1.5 Water and chemical pollution

4.7.1.6 Supply chain vulnerability to extreme weather

4.7.1.7 Regulatory and consumer pressure

4.7.2 INDUSTRY RESPONSE

4.7.2.1 Material substitution and lightweighting

4.7.2.2 Design for recycling & circularity

4.7.2.3 Adoption of recycled and bio-based feedstocks

4.7.2.4 Investment in recycling & recovery partnerships

4.7.2.5 Supply-chain optimization & right-sizing

4.7.2.6 Process & energy efficiency at converters

4.7.2.7 Certification & eco-labeling

4.7.2.8 Innovation in protective solutions

4.7.3 GOVERNMENT’S ROLE

4.7.3.1 Regulation & mandates

4.7.3.2 Standards, labelling & transparency

4.7.3.3 Fiscal instruments & incentives

4.7.3.4 Infrastructure investment

4.7.3.5 Public procurement leadership

4.7.3.6 R&D & standards support

4.7.4 ANALYST RECOMMENDATIONS

4.8 CONSUMER BUYING BEHAVIOR

4.8.1 DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY PACKAGING

4.8.2 PREFERENCE FOR SECURE AND DAMAGE-RESISTANT PACKAGING

4.8.3 RISING IMPORTANCE OF CONVENIENCE AND EASE OF UNBOXING

4.8.4 INFLUENCE OF AESTHETIC APPEAL AND BRAND IDENTITY

4.8.5 INCREASING CONSUMER NEED FOR TRANSPARENCY AND INFORMATION

4.8.6 SHIFT TOWARD PERSONALIZED PACKAGING EXPERIENCES

4.8.7 CONCERNS ABOUT PACKAGING WASTE AND RECYCLING CONVENIENCE

4.8.8 WILLINGNESS TO PAY FOR PREMIUM PACKAGING IN CERTAIN CATEGORIES

4.8.9 CONCLUSION

4.9 COST ANALYSIS BREAKDOWN

4.9.1 TOP-LEVEL COST BUCKETS

4.9.1.1 Raw Materials

4.9.1.2 Manufacturing & Converting

4.9.1.3 Protective Inserts & Cushioning

4.9.1.4 Labour & Fulfilment Handling

4.9.1.5 Packaging Design / Customization / Printing

4.9.1.6 Logistics & Dimensional Weight Impact

4.9.1.7 Returns & Reverse Logistics

4.9.1.8 Sustainability Premium & Compliance Costs

4.9.1.9 Overheads & CAPEX Amortization

4.9.1.10 Supplier Margin / Distributor Markup

4.9.2 TYPICAL COST SHARES

4.9.2.1 Raw Materials + Converting: 50-65% of Total Packaging Cost

4.9.2.2 Labour & Fulfilment Handling: 10-20%

4.9.2.3 Protective Inserts & Void Fill: 5-15%

4.9.2.4 Design / Printing / Customization: 3-10%

4.9.2.5 Sustainability Premium / Compliance: 5-15%

4.9.2.6 Packaging as % of Fulfilment Cost: 15-20%

4.1 INDUSTRY ECOSYSTEM ANALYSIS

4.10.1 PROMINENT COMPANIES

4.10.2 SMALL & MEDIUM-SIZED COMPANIES

4.10.3 END USERS

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 17.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 PROFIT MARGIN OUTLOOK AND SCENARIO ASSESSMENT

4.12.1 INTRODUCTION

4.12.2 EXPECTED MARGIN PERFORMANCE (BASE CASE)

4.12.3 MARGIN UPSIDE POTENTIAL (FAVOURABLE MARKET ENVIRONMENT)

4.12.4 MARGIN COMPRESSION RISKS (ADVERSE MARKET CONDITIONS)

4.12.5 EXPOSURE TO RAW MATERIAL PRICE VOLATILITY

4.12.6 MARGIN VARIATION BY PRODUCT CATEGORY

4.12.7 INFLUENCE OF SCALE AND AUTOMATION ON COST EFFICIENCY

4.12.8 SENSITIVITY TO DEMAND CYCLICALITY AND PRICING DYNAMICS

4.12.9 FINANCIAL IMPACT OF SUSTAINABILITY REQUIREMENTS

4.12.10 COMPETITIVE INTENSITY AND ITS EFFECT ON MARGIN STRUCTURE

4.12.11 STRATEGIC MARGIN ENHANCEMENT OPPORTUNITIES

4.12.12 CONCLUSION

4.13 RAW MATERIAL COVERAGE

4.13.1 PAPER AND PAPERBOARD: THE DOMINANT RAW MATERIAL

4.13.2 PLASTICS: FLEXIBLE, PROTECTIVE, AND LIGHTWEIGHT

4.13.3 BIODEGRADABLE AND COMPOSTABLE MATERIALS

4.13.4 MOLDED FIBER AND PULP-BASED MATERIALS

4.13.5 FOAMS AND CUSHIONING MATERIALS

4.13.6 ADHESIVES, COATINGS, AND INKS

4.13.7 EMERGING RAW MATERIALS FOR SMARTER PACKAGING

4.13.8 CONCLUSION

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 OVERVIEW

4.14.2 LOGISTIC COST SCENARIO

4.14.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.15 TECHNOLOGICAL ADVANCEMENTS

4.15.1 SMART PACKAGING AND IOT INTEGRATION

4.15.2 AUTOMATION AND ROBOTICS IN FULFILMENT CENTRES

4.15.3 RIGHT-SIZING AND ON-DEMAND PACKAGING TECHNOLOGIES

4.15.4 SUSTAINABLE AND ADVANCED MATERIAL INNOVATIONS

4.15.5 ARTIFICIAL INTELLIGENCE AND DATA-DRIVEN DESIGN

4.15.6 ANTI-COUNTERFEIT AND SECURITY TECHNOLOGIES

4.15.7 ENHANCED CUSTOMIZATION AND DIGITAL PRINTING

4.15.8 CONCLUSION

4.16 VALUE CHAIN ANALYSIS

4.16.1 OVERVIEW

4.16.2 RAW MATERIAL SUPPLY

4.16.3 COMPONENT MANUFACTURING AND PROCESSING

4.16.4 EQUIPMENT & TECHNOLOGY PROVIDERS

4.16.5 DISTRIBUTION AND LOGISTICS

4.16.6 END-USERS

4.16.7 CONCLUSION

4.17 VENDOR SELECTION CRITERIA

4.17.1 PRODUCT QUALITY, DURABILITY, AND COMPLIANCE

4.17.2 SUSTAINABILITY AND ENVIRONMENTAL CERTIFICATIONS

4.17.3 TECHNOLOGICAL CAPABILITIES AND INNOVATION

4.17.4 CUSTOMIZATION, BRANDING, AND CONSUMER EXPERIENCE

4.17.5 COST EFFICIENCY AND TOTAL COST OF OWNERSHIP (TCO)

4.17.6 SUPPLY CHAIN STRENGTH AND NORTH AMERICA REACH

4.17.7 CERTIFICATIONS, SAFETY STANDARDS, AND INDUSTRY EXPERTISE

4.17.8 AFTER-SALES SUPPORT AND TECHNICAL ASSISTANCE

4.17.9 CONCLUSION

5 TARIFFS AND IMPACT ANALYSIS

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZs/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 REGIONAL INTERNET & SMARTPHONE PENETRATION IN EMERGING MARKETS

7.1.2 RISING CONSUMER EXPECTATIONS FOR PRODUCT PROTECTION AND DELIVERY EXPERIENCE

7.1.3 RAPID GROWTH OF ONLINE RETAIL AND FULFILLMENT NETWORKS

7.1.4 SUSTAINABILITY SHIFT TOWARD RECYCLABLE AND FIBER-BASED FORMATS

7.2 RESTRAINS

7.2.1 VOLATILITY IN RAW MATERIAL PRICES (PAPER, RESINS, ADHESIVES)

7.2.2 PACKAGING WASTE REGULATIONS AND COMPLIANCE COSTS

7.3 OPPORTUNITY

7.3.1 ADOPTION OF AUTOMATION AND RIGHT-SIZING SYSTEMS IN FULFILLMENT

7.3.2 PREMIUMIZATION VIA DIGITAL PRINTING AND BRAND PERSONALIZATION

7.4 CHALLENGES

7.4.1 BALANCING PROTECTION WITH MATERIAL REDUCTION TARGETS

7.4.2 REVERSE LOGISTICS AND RETURNS PACKAGING OPTIMIZATION

8 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING.

8.1 OVERVIEW

8.2 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

8.2.1 CORRUGATED BOXES

8.2.2 BAGS

8.2.3 MAILER

8.2.4 LABELS

8.2.5 PROTECTIVE PACKAGING

8.2.6 PALLET BOXES

8.2.7 TAPES

8.2.8 POSTAL PACKAGING

8.2.9 SHRINK FILM

8.3 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

8.3.1 CORRUGATED BOXES

8.3.2 BAGS

8.3.3 MAILER

8.3.4 LABELS

8.3.5 PROTECTIVE PACKAGING

8.3.6 PALLET BOXES

8.3.7 TAPES

8.3.8 POSTAL PACKAGING

8.3.9 SHRINK FILM

8.4 NORTH AMERICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.4.1 ASIA-PACIFIC

8.4.2 NORTH AMERICA

8.4.3 EUROPE

8.4.4 SOUTH AMERICA

8.4.5 MIDDLE EAST & AFRICA

8.5 NORTH AMERICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.5.1 ASIA-PACIFIC

8.5.2 NORTH AMERICA

8.5.3 EUROPE

8.5.4 SOUTH AMERICA

8.5.5 MIDDLE EAST & AFRICA

8.6 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 POLYTHENE BAGS

8.6.2 COURIER BAGS

8.6.3 WOVEN SACK BAGS

8.6.4 FOAM BAGS

8.6.5 TEMPER PROOF BAGS

8.6.6 LOCK BAGS

8.6.7 OTHERS

8.7 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.7.1 POLYTHENE BAGS

8.7.2 COURIER BAGS

8.7.3 WOVEN SACK BAGS

8.7.4 FOAM BAGS

8.7.5 TEMPER PROOF BAGS

8.7.6 LOCK BAGS

8.7.7 OTHERS

8.8 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.8.1 ASIA-PACIFIC

8.8.2 NORTH AMERICA

8.8.3 EUROPE

8.8.4 SOUTH AMERICA

8.8.5 MIDDLE EAST & AFRICA

8.9 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.9.1 ASIA-PACIFIC

8.9.2 NORTH AMERICA

8.9.3 EUROPE

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 NORTH AMERICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.10.1 ASIA-PACIFIC

8.10.2 NORTH AMERICA

8.10.3 EUROPE

8.10.4 SOUTH AMERICA

8.10.5 MIDDLE EAST & AFRICA

8.11 NORTH AMERICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.11.1 ASIA-PACIFIC

8.11.2 NORTH AMERICA

8.11.3 EUROPE

8.11.4 SOUTH AMERICA

8.11.5 MIDDLE EAST & AFRICA

8.12 NORTH AMERICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.12.1 ASIA-PACIFIC

8.12.2 NORTH AMERICA

8.12.3 EUROPE

8.12.4 SOUTH AMERICA

8.12.5 MIDDLE EAST & AFRICA

8.13 NORTH AMERICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.13.1 ASIA-PACIFIC

8.13.2 NORTH AMERICA

8.13.3 EUROPE

8.13.4 SOUTH AMERICA

8.13.5 MIDDLE EAST & AFRICA

8.14 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.14.1 SELF-ADHESIVE BOPP TAPES

8.14.2 PRINTED TAPES

8.14.3 REINFORCED PAPER TAPES

8.14.4 PVC PACKING TAPES

8.14.5 PACKAGING SEALING ADHESIVE TAPES

8.14.6 RESEALABLE BAG SEALING TAPES

8.14.7 OTHERS

8.15 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.15.1 SELF-ADHESIVE BOPP TAPES

8.15.2 PRINTED TAPES

8.15.3 REINFORCED PAPER TAPES

8.15.4 PVC PACKING TAPES

8.15.5 PACKAGING SEALING ADHESIVE TAPES

8.15.6 RESEALABLE BAG SEALING TAPES

8.15.7 OTHERS

8.16 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.16.1 ASIA-PACIFIC

8.16.2 NORTH AMERICA

8.16.3 EUROPE

8.16.4 SOUTH AMERICA

8.16.5 MIDDLE EAST & AFRICA

8.17 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.17.1 ASIA-PACIFIC

8.17.2 NORTH AMERICA

8.17.3 EUROPE

8.17.4 SOUTH AMERICA

8.17.5 MIDDLE EAST & AFRICA

8.18 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.18.1 AIR BUBBLE ROLLS

8.18.2 CORRUGATED ROLLS

8.18.3 OTHERS

8.19 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

8.19.1 AIR BUBBLE ROLLS

8.19.2 CORRUGATED ROLLS

8.19.3 OTHERS

8.2 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.20.1 ASIA-PACIFIC

8.20.2 NORTH AMERICA

8.20.3 EUROPE

8.20.4 SOUTH AMERICA

8.20.5 MIDDLE EAST & AFRICA

8.21 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.21.1 ASIA-PACIFIC

8.21.2 NORTH AMERICA

8.21.3 EUROPE

8.21.4 SOUTH AMERICA

8.21.5 MIDDLE EAST & AFRICA

8.22 NORTH AMERICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.22.1 ASIA-PACIFIC

8.22.2 NORTH AMERICA

8.22.3 EUROPE

8.22.4 SOUTH AMERICA

8.22.5 MIDDLE EAST & AFRICA

8.23 NORTH AMERICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.23.1 ASIA-PACIFIC

8.23.2 NORTH AMERICA

8.23.3 EUROPE

8.23.4 SOUTH AMERICA

8.23.5 MIDDLE EAST & AFRICA

8.24 NORTH AMERICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.24.1 ASIA-PACIFIC

8.24.2 NORTH AMERICA

8.24.3 EUROPE

8.24.4 SOUTH AMERICA

8.24.5 MIDDLE EAST & AFRICA

8.25 NORTH AMERICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.25.1 ASIA-PACIFIC

8.25.2 NORTH AMERICA

8.25.3 EUROPE

8.25.4 SOUTH AMERICA

8.25.5 MIDDLE EAST & AFRICA

8.26 NORTH AMERICA SHRINK FILM IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.26.1 ASIA-PACIFIC

8.26.2 NORTH AMERICA

8.26.3 EUROPE

8.26.4 SOUTH AMERICA

8.26.5 MIDDLE EAST & AFRICA

8.27 NORTH AMERICA SHRINK FILMING E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.27.1 ASIA-PACIFIC

8.27.2 NORTH AMERICA

8.27.3 EUROPE

8.27.4 SOUTH AMERICA

8.27.5 MIDDLE EAST & AFRICA

9 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY MATERIAL.

9.1 OVERVIEW

9.2 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

9.2.1 FIBER-BASED

9.2.2 RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS

9.2.3 BIO-BASED MATERIALS

9.2.4 CONVENTIONAL PLASTICS (VIRGIN PLASTICS)

9.2.5 OTHERS

9.3 NORTH AMERICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 CORRUGATED BOARD

9.3.2 PAPER & PAPERBOARD

9.4 NORTH AMERICA CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 SINGLE WALL

9.4.2 DOUBLE WALL

9.4.3 SINGLE FACE

9.4.4 TRIPLE WALL

9.4.5 OTHERS

9.5 NORTH AMERICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 NORTH AMERICA

9.5.3 EUROPE

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST & AFRICA

9.6 NORTH AMERICA RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.6.1 ASIA-PACIFIC

9.6.2 NORTH AMERICA

9.6.3 EUROPE

9.6.4 SOUTH AMERICA

9.6.5 MIDDLE EAST & AFRICA

9.7 NORTH AMERICA BIO-BASED MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 NORTH AMERICA

9.7.3 EUROPE

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 NORTH AMERICA CONVENTIONAL PLASTICS (VIRGIN PLASTICS) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.8.1 ASIA-PACIFIC

9.8.2 NORTH AMERICA

9.8.3 EUROPE

9.8.4 SOUTH AMERICA

9.8.5 MIDDLE EAST & AFRICA

9.9 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.9.1 ASIA-PACIFIC

9.9.2 NORTH AMERICA

9.9.3 EUROPE

9.9.4 SOUTH AMERICA

9.9.5 MIDDLE EAST & AFRICA

10 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY END-USER.

10.1 OVERVIEW

10.2 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

10.2.1 APPARELS AND ACCESSORIES (EX. LEATHER BASED) (0001)

10.2.2 ELECTRONICS & ELECTRICAL (2500)

10.2.3 TEXTILE (0001)

10.2.4 HOUSEHOLD (2000,0001)

10.2.5 PERSONAL CARE (2000,0001)

10.2.6 FOOD AND BEVERAGES (1000,1100)

10.2.7 PHARMACEUTICALS (2100)

10.2.8 AUTOMOTIVE (4600)

10.2.9 FABRICATED METAL PRODUCTS (2500)

10.2.10 CHEMICAL PRODUCTS (2000)

10.2.11 AGRICULTURE (0100)

10.2.12 FURNITURE (0001)

10.2.13 WOOD AND WOOD PRODUCTS (EX. FURNITURE) (0001)

10.2.14 LEATHER AND LEATHER GOODS (0001)

10.2.15 CONSTRUCTION MATERIALS (2000,0001)

10.2.16 TOBACCO PRODUCTS (0001)

10.3 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.3.1 RETAIL

10.3.2 WHOLESALE

10.4 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.4.1 CORRUGATED BOXES

10.4.2 BAGS

10.4.3 MAILER

10.4.4 LABELS

10.4.5 PROTECTIVE PACKAGING

10.4.6 PALLET BOXES

10.4.7 TAPES

10.4.8 POSTAL PACKAGING

10.4.9 SHRINK FILM

10.5 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 ASIA-PACIFIC

10.5.2 NORTH AMERICA

10.5.3 EUROPE

10.5.4 SOUTH AMERICA

10.5.5 MIDDLE EAST & AFRICA

10.6 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.6.1 RETAIL

10.6.2 WHOLESALE

10.7 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.7.1 CORRUGATED BOXES

10.7.2 BAGS

10.7.3 MAILER

10.7.4 LABELS

10.7.5 PROTECTIVE PACKAGING

10.7.6 PALLET BOXES

10.7.7 TAPES

10.7.8 POSTAL PACKAGING

10.7.9 SHRINK FILM

10.8 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.8.1 COMPUTERS, ELECTRONIC AND OPTICAL PRODUCTS

10.8.2 ELECTRICAL EQUIPMENT

10.8.3 OTHERS

10.9 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 NORTH AMERICA

10.9.3 EUROPE

10.9.4 SOUTH AMERICA

10.9.5 MIDDLE EAST & AFRICA

10.1 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.10.1 RETAIL

10.10.2 WHOLESALE

10.11 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.11.1 CORRUGATED BOXES

10.11.2 BAGS

10.11.3 MAILER

10.11.4 LABELS

10.11.5 PROTECTIVE PACKAGING

10.11.6 PALLET BOXES

10.11.7 TAPES

10.11.8 POSTAL PACKAGING

10.11.9 SHRINK FILM

10.12 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 NORTH AMERICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.13.1 RETAIL

10.13.2 WHOLESALE

10.14 NORTH AMERICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.14.1 CORRUGATED BOXES

10.14.2 BAGS

10.14.3 MAILER

10.14.4 LABELS

10.14.5 PROTECTIVE PACKAGING

10.14.6 PALLET BOXES

10.14.7 TAPES

10.14.8 POSTAL PACKAGING

10.14.9 SHRINK FILM

10.15 NORTH AMERICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.15.1 ASIA-PACIFIC

10.15.2 NORTH AMERICA

10.15.3 EUROPE

10.15.4 SOUTH AMERICA

10.15.5 MIDDLE EAST & AFRICA

10.16 NORTH AMERICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.16.1 RETAIL

10.16.2 WHOLESALE

10.17 NORTH AMERICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.17.1 CORRUGATED BOXES

10.17.2 BAGS

10.17.3 MAILER

10.17.4 LABELS

10.17.5 PROTECTIVE PACKAGING

10.17.6 PALLET BOXES

10.17.7 TAPES

10.17.8 POSTAL PACKAGING

10.17.9 SHRINK FILM

10.18 NORTH AMERICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.18.1 ASIA-PACIFIC

10.18.2 NORTH AMERICA

10.18.3 EUROPE

10.18.4 SOUTH AMERICA

10.18.5 MIDDLE EAST & AFRICA

10.19 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.19.1 RETAIL

10.19.2 WHOLESALE

10.2 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.20.1 CORRUGATED BOXES

10.20.2 BAGS

10.20.3 MAILER

10.20.4 LABELS

10.20.5 PROTECTIVE PACKAGING

10.20.6 PALLET BOXES

10.20.7 TAPES

10.20.8 POSTAL PACKAGING

10.20.9 SHRINK FILM

10.21 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.21.1 FOOD

10.21.2 BEVERAGES

10.22 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.22.1 ASIA-PACIFIC

10.22.2 NORTH AMERICA

10.22.3 EUROPE

10.22.4 SOUTH AMERICA

10.22.5 MIDDLE EAST & AFRICA

10.23 NORTH AMERICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.23.1 RETAIL

10.23.2 WHOLESALE

10.24 NORTH AMERICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.24.1 CORRUGATED BOXES

10.24.2 BAGS

10.24.3 MAILER

10.24.4 LABELS

10.24.5 PROTECTIVE PACKAGING

10.24.6 PALLET BOXES

10.24.7 TAPES

10.24.8 POSTAL PACKAGING

10.24.9 SHRINK FILM

10.25 NORTH AMERICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.25.1 ASIA-PACIFIC

10.25.2 NORTH AMERICA

10.25.3 EUROPE

10.25.4 SOUTH AMERICA

10.25.5 MIDDLE EAST & AFRICA

10.26 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.26.1 RETAIL

10.26.2 WHOLESALE

10.27 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.27.1 CORRUGATED BOXES

10.27.2 BAGS

10.27.3 MAILER

10.27.4 LABELS

10.27.5 PROTECTIVE PACKAGING

10.27.6 PALLET BOXES

10.27.7 TAPES

10.27.8 POSTAL PACKAGING

10.27.9 SHRINK FILM

10.28 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY COMMODITY TYPE, 2018-2033 (USD THOUSAND)

10.28.1 SPARE PARTS

10.28.2 VEHICLE MODIFICATION PARTS

10.29 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.29.1 ASIA-PACIFIC

10.29.2 NORTH AMERICA

10.29.3 EUROPE

10.29.4 SOUTH AMERICA

10.29.5 MIDDLE EAST & AFRICA

10.3 NORTH AMERICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.30.1 RETAIL

10.30.2 WHOLESALE

10.31 NORTH AMERICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.32 ASIA-PACIFIC

10.32.1 NORTH AMERICA

10.32.2 EUROPE

10.32.3 SOUTH AMERICA

10.32.4 MIDDLE EAST & AFRICA

10.33 NORTH AMERICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.33.1 RETAIL

10.33.2 WHOLESALE

10.34 NORTH AMERICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.34.1 ASIA-PACIFIC

10.34.2 NORTH AMERICA

10.34.3 EUROPE

10.34.4 SOUTH AMERICA

10.34.5 MIDDLE EAST & AFRICA

10.35 NORTH AMERICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.35.1 RETAIL

10.35.2 WHOLESALE

10.36 NORTH AMERICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.36.1 FERTILIZERS

10.36.2 FISHING AND AQUACULTURE PRODUCTS

10.36.3 PLANTS

10.36.4 SEEDS

10.36.5 OTHERS

10.37 NORTH AMERICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.37.1 ASIA-PACIFIC

10.37.2 NORTH AMERICA

10.37.3 EUROPE

10.37.4 SOUTH AMERICA

10.37.5 MIDDLE EAST & AFRICA

10.38 NORTH AMERICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.38.1 RETAIL

10.38.2 WHOLESALE

10.39 NORTH AMERICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.39.1 ASIA-PACIFIC

10.39.2 NORTH AMERICA

10.39.3 EUROPE

10.39.4 SOUTH AMERICA

10.39.5 MIDDLE EAST & AFRICA

10.4 NORTH AMERICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.40.1 RETAIL

10.40.2 WHOLESALE

10.41 NORTH AMERICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.41.1 ASIA-PACIFIC

10.41.2 NORTH AMERICA

10.41.3 EUROPE

10.41.4 SOUTH AMERICA

10.41.5 MIDDLE EAST & AFRICA

10.42 NORTH AMERICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.42.1 RETAIL

10.42.2 WHOLESALE

10.43 NORTH AMERICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.43.1 ASIA-PACIFIC

10.43.2 NORTH AMERICA

10.43.3 EUROPE

10.43.4 SOUTH AMERICA

10.43.5 MIDDLE EAST & AFRICA

10.44 NORTH AMERICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.44.1 RETAIL

10.44.2 WHOLESALE

10.45 NORTH AMERICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.45.1 ASIA-PACIFIC

10.45.2 NORTH AMERICA

10.45.3 EUROPE

10.45.4 SOUTH AMERICA

10.45.5 MIDDLE EAST & AFRICA

10.46 NORTH AMERICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.46.1 RETAIL

10.46.2 WHOLESALE

10.47 NORTH AMERICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.47.1 ASIA-PACIFIC

10.47.2 NORTH AMERICA

10.47.3 EUROPE

10.47.4 SOUTH AMERICA

10.47.5 MIDDLE EAST & AFRICA

10.48 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.48.1 CORRUGATED BOXES

10.48.2 BAGS

10.48.3 MAILER

10.48.4 LABELS

10.48.5 PROTECTIVE PACKAGING

10.48.6 PALLET BOXES

10.48.7 TAPES

10.48.8 POSTAL PACKAGING

10.48.9 SHRINK FILM

10.49 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.49.1 ASIA-PACIFIC

10.49.2 NORTH AMERICA

10.49.3 EUROPE

10.49.4 SOUTH AMERICA

10.49.5 MIDDLE EAST & AFRICA

11 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL.

11.1 OVERVIEW

11.2 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

11.2.1 DIRECT

11.2.2 INDIRECT

11.3 NORTH AMERICA DIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 COMPANY OWNED WEBSITES

11.3.2 FIELD AGENTS

11.3.3 DIRECT CONTRACTS

11.4 NORTH AMERICA INDIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.4.1 DISTRIBUTORS / WHOLESALERS

11.4.2 VALUE-ADDED RESELLERS (VARS)

11.4.3 THIRD-PARTY ONLINE MARKETPLACES

11.5 NORTH AMERICA DIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 NORTH AMERICA

11.5.3 EUROPE

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST & AFRICA

11.6 NORTH AMERICA INDIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.6.1 ASIA-PACIFIC

11.6.2 NORTH AMERICA

11.6.3 EUROPE

11.6.4 SOUTH AMERICA

11.6.5 MIDDLE EAST & AFRICA

12 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY GEOGRAPHY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA E-COMMERCE PACKAGING MARKET: COMPANY LANDSCAPE

13.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 MANUFACTURERS COMPANY PROFILE

15.1 INTERNATIONAL PAPER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 AMCOR PLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DS SMITH

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SMURFIT WESTROCK

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 PACKAGING CORPORATION OF AMERICA.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 3M

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ALTPAC

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AVERY DENNISON CORPORATION

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BLUE BOX PACKAGING

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BOXON AB

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVEOPMENT

15.11 COSMO FILMS

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 ECOM PACKAGING

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 ECB

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 FILMAR GROUP

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 GEORGIA-PACIFIC LLC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 GREEN BAY PACKAGING INC

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 IPG

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 KLABIN S.A

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MONDI

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 NINE DRAGONS WORLDWIDE (CHINA) INVESTMENT GROUP CO., LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 OJI HOLDINGS CORPORATION.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 PACKHELP

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 PACKMAN PACKAGING PRIVATE LIMITED.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 PACKTEK

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 PRATT INDUSTRIES INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 PREGIS LLC

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 PREM INDUSTRIES INDIA LIMITED

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENT

15.28 RANPAK

15.28.1 COMPANY SNAPSHOT

15.28.2 REVENUE ANALYSIS

15.28.3 PRODUCT PORTFOLIO

15.28.4 RECENT DEVELOPMENT

15.29 SEALED AIR

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENT

15.3 STORA ENSO

15.30.1 COMPANY SNAPSHOT

15.30.2 REVENUE ANALYSIS

15.30.3 PRODUCT PORTFOLIO

15.30.4 RECENT DEVELOPMENT

16 DISTRIBUTOR COMPANY PROFILE

16.1 BUNZL PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 MACFARLANE PACKAGING (A SUBSIDIARY COMPANY OF MACFARLANE GROUP PLC)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 RAJAPACK LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 ULINE

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 VERITIV OPERATING COMPANY

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 BRAND COMPARATIVE ANALYSIS

TABLE 3 CONSUMER PREFERENCE MATRIX

TABLE 4 REGULATORY COVERAGE

TABLE 5 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 6 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

TABLE 7 NORTH AMERICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 NORTH AMERICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 9 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 11 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 13 NORTH AMERICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 NORTH AMERICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 15 NORTH AMERICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 NORTH AMERICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 17 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 19 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 21 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

TABLE 23 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 25 NORTH AMERICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 NORTH AMERICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 27 NORTH AMERICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 NORTH AMERICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 29 NORTH AMERICA SHRINK FILM IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 30 NORTH AMERICA SHRINK FILMING E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 31 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 32 NORTH AMERICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 NORTH AMERICA CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 NORTH AMERICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 NORTH AMERICA RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 NORTH AMERICA BIO-BASED MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 NORTH AMERICA CONVENTIONAL PLASTICS (VIRGIN PLASTICS) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 40 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 42 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 45 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 49 NORTH AMERICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 NORTH AMERICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 NORTH AMERICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 52 NORTH AMERICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 NORTH AMERICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 NORTH AMERICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 55 NORTH AMERICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 58 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 NORTH AMERICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 NORTH AMERICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 NORTH AMERICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 62 NORTH AMERICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 63 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 65 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY COMMODITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 NORTH AMERICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 67 NORTH AMERICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 NORTH AMERICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 69 NORTH AMERICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 NORTH AMERICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 71 NORTH AMERICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 NORTH AMERICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 NORTH AMERICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 NORTH AMERICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 NORTH AMERICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 76 NORTH AMERICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 NORTH AMERICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 78 NORTH AMERICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 NORTH AMERICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 80 NORTH AMERICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 NORTH AMERICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 NORTH AMERICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 NORTH AMERICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 84 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 86 NORTH AMERICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 87 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 88 NORTH AMERICA DIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 NORTH AMERICA INDIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 NORTH AMERICA DIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 91 NORTH AMERICA INDIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 92 NORTH AMERICA

TABLE 93 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 94 NORTH AMERICA

TABLE 95 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2018-2033 (THOUSAND UNITS)

TABLE 96 THOUSAND

TABLE 97 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 98 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

TABLE 99 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 NORTH AMERICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 101 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 NORTH AMERICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 103 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 NORTH AMERICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

TABLE 105 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 106 NORTH AMERICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 NORTH AMERICA CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 NORTH AMERICA E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 109 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 NORTH AMERICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 111 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 113 NORTH AMERICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)