North America Disinfectant Wipes Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.92 Billion

USD

6.02 Billion

2024

2032

USD

3.92 Billion

USD

6.02 Billion

2024

2032

| 2025 –2032 | |

| USD 3.92 Billion | |

| USD 6.02 Billion | |

|

|

|

|

Segmentação do mercado de lenços desinfetantes na América do Norte, por tipo de produto (compostos de cloro, amônio quaternário, agentes oxidantes, fenol, álcool, compostos de iodo, aldeídos, gluconato de clorexidina e outros), usabilidade (descartável e não descartável), embalagem (desmontável, em lata e outros), tipo de material (lenços de fibra têxtil, lenços de fibra virgem, lenços de fibra avançada e outros), níveis de desinfecção (alto, intermediário e baixo), sabor (lavanda e jasmim, limão, cítrico, coco e outros), tipo (bactericida, virucida, esporicida, tuberculocida, fungicida e germicida), uso final (saúde, comercial, cozinha industrial, indústria de transporte, indústria óptica, indústria eletrônica e de computadores e outros), canal de distribuição (licitações diretas e vendas no varejo) - Tendências do setor e previsão até 2032

Tamanho do mercado de lenços desinfetantes

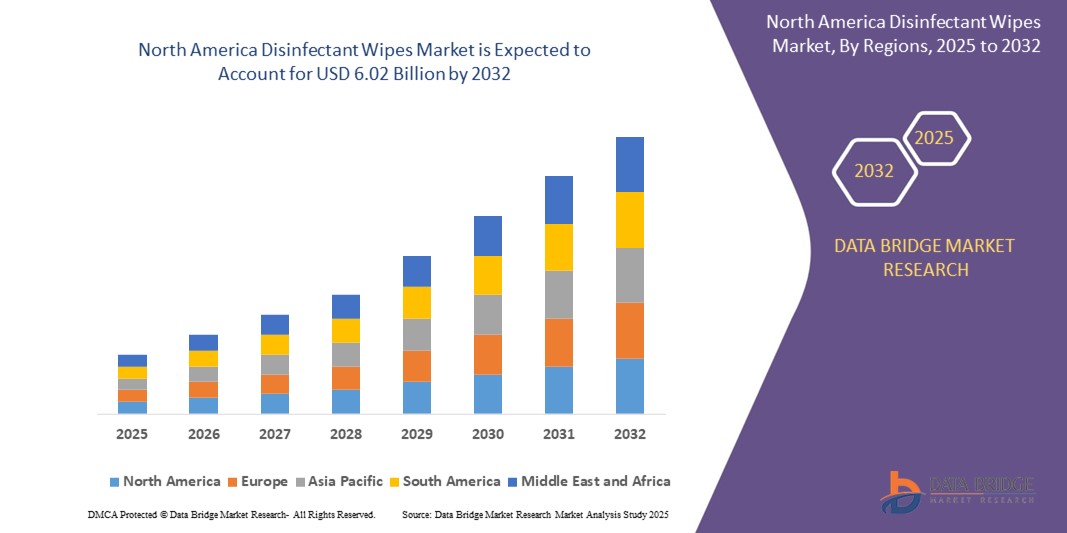

- O tamanho do mercado de lenços desinfetantes da América do Norte foi avaliado em US$ 3,92 bilhões em 2024 e deve atingir US$ 6,02 bilhões até 2032 , com um CAGR de 5,5% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela maior conscientização sobre higiene pós-COVID-19 e pela crescente adoção de lenços desinfetantes em ambientes de saúde, comerciais e residenciais como uma solução conveniente e eficaz para o controle de infecções em nível de superfície.

- Além disso, a crescente demanda dos consumidores por produtos de desinfecção prontos para uso, portáteis e seguros para a pele está consolidando os lenços desinfetantes como uma alternativa preferencial aos desinfetantes líquidos e sprays. Esses fatores convergentes estão acelerando o uso de lenços desinfetantes em ambientes de alto contato, impulsionando significativamente o crescimento do setor.

Análise de mercado de lenços umedecidos desinfetantes

- Lenços umedecidos desinfetantes são lenços umedecidos com agentes antimicrobianos, projetados para eliminar bactérias, vírus e fungos de superfícies duras e macias. Eles oferecem uma limpeza rápida e sem resíduos e são amplamente utilizados em instalações de saúde, residências, escolas, escritórios e transporte público.

- A crescente demanda por lenços desinfetantes é impulsionada principalmente pelo aumento dos protocolos de prevenção de infecções, pela crescente inclinação do consumidor por métodos de limpeza higiênicos e convenientes e pela expansão de opções de produtos ecológicos e biodegradáveis no mercado.

- Os EUA dominaram o mercado de lenços desinfetantes, com uma participação de 30,58% em 2024, devido à forte demanda em aplicações de limpeza para a área da saúde, residências e comércio. A ampla adoção de lenços desinfetantes em hospitais, escritórios, escolas e residências, juntamente com a maior conscientização sobre higiene pós-pandemia, consolidou os EUA como líder regional.

- Espera-se que o Canadá seja a região de crescimento mais rápido no mercado de lenços desinfetantes durante o período previsto devido à crescente demanda em saúde, creches e instalações públicas.

- O segmento de álcool dominou o mercado, com uma participação de mercado de 42,5% em 2024, devido à sua ação rápida, facilidade de evaporação e eficácia contra uma ampla gama de patógenos. Lenços umedecidos à base de álcool são amplamente preferidos em ambientes médicos, de consumo e de consultórios devido à sua conveniência, propriedades não residuais e conformidade com as práticas de controle de infecção em ambientes de alto contato.

Escopo do Relatório e Segmentação do Mercado de Lenços Desinfetantes

|

Atributos |

Principais insights do mercado de lenços desinfetantes |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de lenços desinfetantes

“Aumentar a conscientização sobre higiene”

- Uma tendência significativa e crescente no mercado de lenços desinfetantes é a maior conscientização sobre higiene e prevenção de infecções entre consumidores e empresas, especialmente após a pandemia de COVID-19

- Por exemplo, a procura por lenços desinfetantes aumentou em ambientes de saúde, comerciais e residenciais, com hospitais, clínicas, escritórios e residências contando com esses produtos para uma limpeza rápida e eficaz de superfícies, a fim de minimizar o risco de infecções e contaminação cruzada.

- A introdução de lenços desinfetantes biodegradáveis e ecológicos está ganhando força, à medida que consumidores e organizações buscam alternativas sustentáveis que reduzam o impacto ambiental sem comprometer a eficácia.

- Grandes cidades e regiões densamente povoadas estão testemunhando uma adoção crescente de lenços desinfetantes, impulsionada por campanhas de saúde pública e pela necessidade de manter a limpeza em áreas de alto tráfego, como transporte público, escolas e lojas de varejo.

- O mercado também está presenciando inovação em formulações de produtos, embalagens e canais de distribuição, com os fabricantes se concentrando na conveniência, portabilidade e conformidade com os padrões regulatórios em evolução para atender às diversas necessidades do usuário final.

- As empresas estão investindo em iniciativas de marketing e educação para reforçar a importância da desinfecção regular, apoiando ainda mais o crescimento contínuo e a aceitação generalizada de lenços desinfetantes em vários setores

Dinâmica do mercado de lenços desinfetantes

Motorista

“Uso crescente de lenços desinfetantes para aplicações comerciais”

- O uso crescente de lenços desinfetantes em aplicações comerciais é um importante impulsionador do crescimento do mercado, pois as empresas priorizam a higiene para proteger funcionários, clientes e a continuidade operacional.

- Por exemplo, indústrias como a de saúde, hotelaria, serviços de alimentação e transportes estão a adotar lenços desinfetantes para a limpeza de rotina de superfícies de alto contacto, equipamentos e áreas comuns, para cumprir com as rigorosas normas de saúde e segurança.

- O aumento de infecções hospitalares e a necessidade de medidas rigorosas de controle de infecções em instalações médicas levaram ao uso generalizado de lenços desinfetantes em unidades cirúrgicas, quartos de pacientes e áreas de espera públicas.

- Varejistas, academias e prédios de escritórios estão cada vez mais fornecendo lenços desinfetantes para uso de clientes e funcionários, reforçando a confiança do público em espaços compartilhados e apoiando a recuperação dos negócios pós-pandemia.

- A conveniência, a rapidez e a eficácia comprovada dos lenços desinfetantes os tornam ferramentas indispensáveis para protocolos de limpeza comercial, gerando uma demanda sustentada em vários setores.

- À medida que o setor comercial continua a crescer e a evoluir, espera-se que a integração de lenços desinfetantes nos procedimentos operacionais padrão continue a ser um impulsionador fundamental do mercado.

Restrição/Desafio

“Efeitos colaterais do uso de lenços desinfetantes”

- Os potenciais efeitos colaterais associados ao uso frequente de lenços desinfetantes representam um desafio significativo para o mercado, pois preocupações com irritação da pele, reações alérgicas e problemas respiratórios podem desencorajar alguns usuários

- Por exemplo, os agentes químicos presentes em certos toalhetes desinfetantes, como os compostos de amónio quaternário e os álcoois, podem causar secura, dermatite ou sensibilização com a exposição repetida, especialmente entre os profissionais de saúde e os funcionários de limpeza que utilizam estes produtos extensivamente.

- O uso impróprio ou excessivo de lenços desinfetantes também pode levar ao acúmulo de resíduos químicos nas superfícies, o que pode representar riscos à saúde, especialmente em ambientes sensíveis, como creches ou áreas de preparação de alimentos.

- A crescente conscientização do consumidor sobre esses riscos, juntamente com o escrutínio regulatório dos ingredientes químicos, está levando os fabricantes a desenvolver formulações mais seguras, amigáveis à pele e hipoalergênicas para atender às preocupações dos usuários.

- O desafio de equilibrar a desinfecção eficaz com a segurança e o conforto do usuário está impulsionando a pesquisa contínua e a inovação de produtos no mercado, à medida que as empresas buscam manter a eficácia e, ao mesmo tempo, minimizar os efeitos adversos.

Escopo de mercado de lenços desinfetantes

O mercado é segmentado com base no tipo de produto, usabilidade, embalagem, tipo de material, níveis de desinfecção, sabor, tipo, uso final e canal de distribuição.

- Por tipo de produto

Com base no tipo de produto, o mercado de lenços desinfetantes é segmentado em compostos de cloro, amônio quaternário, agentes oxidantes, fenol, álcool, compostos de iodo, aldeídos, gluconato de clorexidina e outros. O segmento de álcool representou a maior fatia da receita, 42,5% em 2024, devido à sua ação rápida, facilidade de evaporação e eficácia contra uma ampla gama de patógenos. Lenços umedecidos à base de álcool são amplamente preferidos em ambientes médicos, de consumo e de escritórios devido à sua conveniência, propriedades não residuais e conformidade com as práticas de controle de infecção em ambientes de alto contato.

O segmento de amônio quaternário deverá registrar a maior taxa de crescimento entre 2025 e 2032, impulsionado por sua atividade antimicrobiana de amplo espectro, compatibilidade com uma ampla gama de superfícies e odor mínimo. Este composto é amplamente utilizado em desinfetantes de nível hospitalar, onde a eficácia e a segurança das superfícies são essenciais. Além disso, a crescente adoção em produtos de limpeza residenciais e comerciais está sustentando o domínio do segmento.

- Por usabilidade

Com base na usabilidade, o mercado se divide em lenços desinfetantes descartáveis e não descartáveis. O segmento de descartáveis liderou o mercado em 2024, impulsionado por sua natureza higiênica de uso único, que minimiza a contaminação cruzada e atende aos padrões de controle de infecção. O uso crescente em instalações de saúde e espaços públicos também está acelerando a demanda por variantes descartáveis.

Prevê-se que o segmento de não descartáveis apresente o CAGR mais rápido durante o período previsto, impulsionado pelas crescentes preocupações ambientais e pelo crescente desenvolvimento de lenços desinfetantes reutilizáveis. Estes produtos estão ganhando força, especialmente entre consumidores e empresas ecoconscientes que buscam soluções de saneamento sustentáveis.

- Por embalagem

Com base na embalagem, o mercado é segmentado em embalagens planas, canister e outras. O segmento de canister dominou o mercado em 2024 devido à sua conveniência, durabilidade e adequação para uso em ambientes de saúde, academias e escritórios. Os canisters oferecem maior prazo de validade e permitem fácil dispensação, tornando-os o formato preferido para uso a granel.

Espera-se que o segmento de embalagens planas cresça em ritmo acelerado até 2032, já que seu design compacto e portátil atrai consumidores em movimento. Esse tipo de embalagem é especialmente popular em casos de cuidados pessoais e viagens, onde a facilidade de transporte e descarte é priorizada.

- Por tipo de material

Com base no tipo de material, o mercado é segmentado em lenços umedecidos de fibra têxtil, lenços umedecidos de fibra virgem, lenços umedecidos de fibra avançada e outros. O segmento de lenços umedecidos de fibra virgem conquistou a maior fatia em 2024 devido à sua alta absorção, resistência e pureza, fatores essenciais para uma eficácia de desinfecção consistente. Esses lenços são frequentemente usados em ambientes críticos de saúde, onde a garantia de qualidade é fundamental.

Projeta-se que lenços umedecidos de fibra avançada apresentem o maior CAGR entre 2025 e 2032, impulsionados por inovações em materiais multicamadas e com nanotecnologia que melhoram as taxas de eliminação de micróbios, a durabilidade e a compatibilidade com diversas formulações de desinfetantes. Esses lenços são cada vez mais adotados em ambientes de alto risco, como UTIs e laboratórios farmacêuticos.

- Por Níveis de Desinfecção

Com base nos níveis de desinfecção, o mercado é categorizado em alto, intermediário e baixo. O segmento de desinfecção de alto nível obteve a maior fatia da receita em 2024, impulsionado pelo aumento da demanda em ambientes de terapia intensiva, como salas de cirurgia, enfermarias de isolamento e laboratórios. Esses lenços umedecidos são essenciais para eliminar patógenos resistentes, incluindo esporos e vírus, garantindo um controle rigoroso de infecções.

Espera-se que o segmento de desinfecção de nível intermediário cresça ao ritmo mais acelerado entre 2025 e 2032, devido à sua versatilidade e custo-benefício em instalações de saúde, comerciais e educacionais. Esses lenços alcançam um equilíbrio entre eficácia e compatibilidade com superfícies, tornando-os adequados para a limpeza de rotina de áreas de alto contato.

- Por Sabor

Com base no sabor, o mercado é segmentado em lavanda e jasmim, limão, cítricos, coco e outros. O segmento de limão liderou o mercado em 2024, favorecido por seu aroma fresco e forte associação do consumidor com limpeza. Lenços umedecidos com sabor de limão são amplamente utilizados em ambientes residenciais e comerciais devido ao seu amplo apelo e capacidade de neutralizar odores.

Espera-se que lavanda e jasmim apresentem o crescimento mais rápido durante o período previsto, impulsionados pela crescente preferência do consumidor por fragrâncias calmantes e aromaterapêuticas. Essa tendência é especialmente proeminente em segmentos voltados para o estilo de vida, como academias, salões de beleza e cuidados pessoais, onde a experiência sensorial agrega valor aos produtos de higiene.

- Por tipo

Com base no tipo, o mercado de lenços desinfetantes é segmentado em bactericidas, virucidas, esporicidas, tuberculocidas, fungicidas e germicidas. O segmento bactericida dominou a participação de mercado em 2024 devido à sua aplicação universal nas rotinas de limpeza diária e desinfecção de superfícies. Lenços desinfetantes bactericidas são essenciais para o controle de infecções associadas à assistência à saúde (IRAS) comuns e são amplamente aceitos em ambientes residenciais e institucionais.

A projeção é de que o segmento virucida cresça com a CAGR mais rápida entre 2025 e 2032, impulsionado pela maior conscientização após surtos virais globais e pela ênfase em protocolos antivirais de desinfecção de superfícies. A demanda por lenços umedecidos virucidas também está crescendo em transportes e instalações públicas, onde os riscos de infecção são altos e uma ação rápida é necessária.

- Por uso final

Com base no uso final, o mercado é segmentado em saúde, comércio, cozinha industrial, indústria de transportes, indústria óptica, indústria eletrônica e de computadores, entre outros. O segmento de saúde deteve a maior fatia da receita em 2024, impulsionado por rígidas regulamentações de controle de infecção e demanda consistente em hospitais, clínicas e centros de diagnóstico. Esses ambientes exigem desinfecção frequente e eficaz das superfícies para manter a higiene e prevenir a contaminação cruzada.

Espera-se que o setor de transportes registre a maior taxa de crescimento durante o período previsto, com investimentos crescentes em manutenção de higiene em companhias aéreas, ferrovias e sistemas de transporte público. As expectativas dos consumidores em relação à limpeza e segurança após a pandemia continuam a impulsionar a adoção de lenços desinfetantes para superfícies de alto contato em ambientes de viagem.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é dividido em licitações diretas e vendas no varejo. O segmento de licitações diretas conquistou a maior fatia de mercado em 2024, apoiado por compras em grandes quantidades de hospitais, órgãos governamentais e compradores corporativos que buscam suprimentos padronizados para prevenção de infecções. Esses contratos garantem cadeias de suprimentos estáveis e, frequentemente, são respaldados por relacionamentos de longo prazo com os fornecedores.

A previsão é de que o segmento de vendas no varejo cresça com a CAGR mais rápida entre 2025 e 2032, impulsionado pela crescente conscientização do consumidor e pela demanda por produtos de higienização doméstica. A disponibilidade de lenços desinfetantes em supermercados, farmácias, plataformas de e-commerce e lojas de conveniência os torna altamente acessíveis aos consumidores finais.

Análise regional do mercado de lenços umedecidos desinfetantes

- Os EUA dominaram o mercado de lenços desinfetantes, com a maior participação na receita, de 30,58% em 2024, impulsionados pela forte demanda em aplicações de limpeza para a área da saúde, residências e comércio. A ampla adoção de lenços desinfetantes em hospitais, escritórios, escolas e residências, juntamente com a maior conscientização sobre higiene pós-pandemia, consolidou os EUA como líder regional.

- A crescente preferência por produtos de higienização práticos e prontos para uso, especialmente em ambientes de alto contato, está impulsionando a expansão contínua do mercado. A ênfase regulatória no controle de infecções e a presença de marcas consolidadas que oferecem formulações antimicrobianas avançadas impulsionam ainda mais a penetração dos produtos.

- A forte presença de fabricantes importantes, canais de distribuição de varejo bem desenvolvidos e inovações contínuas em formulações de lenços umedecidos biodegradáveis e seguros para a pele reforçam os EUA como o mercado dominante de lenços desinfetantes na América do Norte.

Visão geral do mercado de lenços umedecidos desinfetantes no Canadá

A projeção é que o Canadá registre o CAGR mais rápido no mercado de lenços desinfetantes da América do Norte entre 2025 e 2032, impulsionado pela crescente demanda nos setores de saúde, creches e instalações públicas. A crescente conscientização sobre higiene pessoal, prevenção de infecções e uso de produtos ecologicamente corretos está impulsionando o crescimento do mercado. Regulamentações governamentais favoráveis e a mudança para soluções de desinfecção sustentáveis e produzidas localmente estão impulsionando ainda mais o mercado canadense.

Visão geral do mercado de lenços umedecidos desinfetantes no México

Espera-se que o mercado mexicano de lenços desinfetantes apresente crescimento constante entre 2025 e 2032, impulsionado pela expansão da infraestrutura de saúde, pela conscientização do consumidor e pelo uso crescente de lenços desinfetantes nos setores industrial e de hospitalidade. O crescimento também é impulsionado pela expansão da capacidade de produção nacional e pelo papel estratégico do México nas exportações regionais e nas cadeias de suprimentos transfronteiriças.

Participação no mercado de lenços umedecidos desinfetantes

O setor de lenços desinfetantes é liderado principalmente por empresas bem estabelecidas, incluindo:

- GOJO Industries, Inc. (EUA)

- PDI, Inc. (EUA)

- Ecolab (EUA)

- Reckitt Benckiser Group PLC (Reino Unido)

- KCWW (Kimberly-Clark Worldwide, Inc.) (EUA)

- Parker Laboratories, Inc. (EUA)

- Dreumex (Holanda)

- Seventh Generation Inc. (EUA)

- STERIS plc (Irlanda)

- SC Johnson & Son Inc. (EUA)

- The Claire Manufacturing Company (EUA)

- Schülke & Mayr GmbH (Alemanha)

Últimos desenvolvimentos no mercado de lenços desinfetantes na América do Norte

- Em março de 2024, a Ecolab, empresa conhecida por seus esforços de sustentabilidade e produtos para água, higiene e prevenção de infecções, foi reconhecida como uma das Empresas Mais Éticas do Mundo pela Ethisphere, uma organização respeitada que define padrões éticos de negócios. Este é o 18º ano consecutivo em que a Ecolab recebe o prêmio desde seu lançamento em 2007. Isso fortalecerá a credibilidade da empresa no mercado.

- Em fevereiro de 2022, a Reckitt Benckiser Group plc, conhecida por marcas como Lysol e Dettol, e a Diversey Holdings, Ltd., empresa líder em soluções de higiene e limpeza, firmaram uma parceria de distribuição. Essa parceria visa tornar soluções de higiene confiáveis mais amplamente disponíveis para empresas, garantindo a segurança de funcionários, clientes e consumidores, prevenindo a propagação de germes causadores de doenças.

- Em junho de 2020, a Reckitt Benckiser Group plc. anunciou que sua marca Lysol iniciou o Programa Escolas Saudáveis para alcançar alunos em idade escolar nas áreas mais afetadas pela COVID-19 nos EUA, a fim de prevenir a disseminação da pandemia. Essa iniciativa da empresa aumentou sua credibilidade no mercado.

- Em novembro de 2020, a SC Johnson anunciou que foi reconhecida como Membro do Ano da Rede Hygieia da ISSA 2020 pelos recursos e esforços oferecidos pela empresa para promover a carreira de mulheres no setor de limpeza. Esse reconhecimento à empresa aumentou sua credibilidade no mercado.

- Em maio de 2022, a GOJO Industries, Inc., conhecida por seus produtos PURELL, lançou os Lenços Desinfetantes de Superfícies PURELL Healthcare, expandindo sua linha de soluções para higiene de superfícies. Esses lenços oferecem alta eficácia na eliminação de germes e proporcionam tranquilidade aos usuários, combinando desempenho potente com tranquilidade. Isso ampliou o portfólio de produtos e contribuiu para a receita total da empresa.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.