North America Digital Experience Platform Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

10,132.67 Million

USD

38,606.79 Million

2021

2029

USD

10,132.67 Million

USD

38,606.79 Million

2021

2029

| 2022 –2029 | |

| USD 10,132.67 Million | |

| USD 38,606.79 Million | |

|

|

|

|

North America Digital Experience Platform Market, By Component (Platform, Services), Deployment Model (Cloud, On Premises), Organization Size (Small & Medium Enterprise, Large Enterprise), Application (Business to Customer, Business to Business), Vertical (Retail, BFSI, Travel & Hospitality, IT & Telecom, Healthcare, Manufacturing, Media and Entertainment, Education), – Industry Trends and Forecast to 2029

Market Analysis and Size

The advancement of content management software and its combination with various technologies such as IoT, virtual reality, and enhanced graphics is assisting enterprises to provide lively experiences to customers. Sectors such as BFSI have incorporated DXPs in order to provide personalised banking experiences to its customers via its official application, portals, and websites, making banking easier.

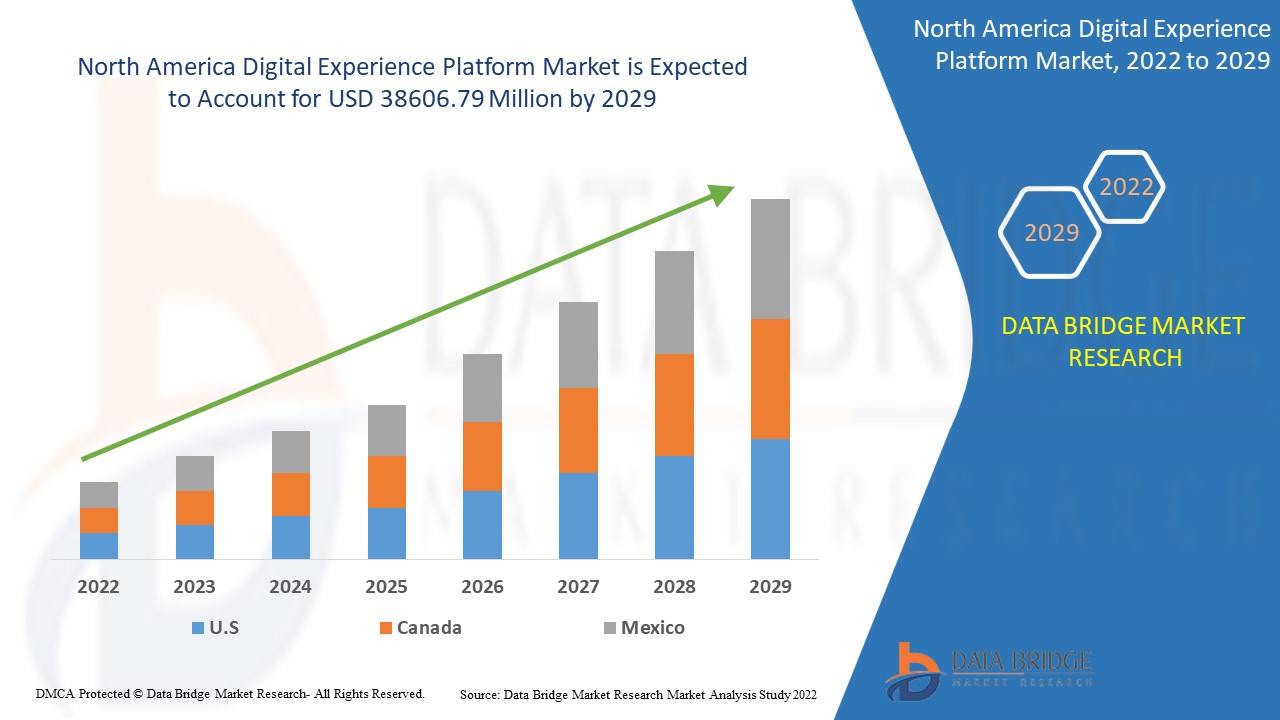

Data Bridge Market Research analyses that the digital experience platform market was valued at USD 10,132.67 million in 2021 and is expected to reach the value of USD 38606.79 million by 2029, at a CAGR of 18.2% during the forecast period of 2022 to 2029.

Market Definition

A digital experience platform (DXP) is a well-integrated and cohesive set of technologies that enables the creation, management, delivery, and optimization of contextualised digital experiences across multi experience customer journeys. A DXP can provide optimal digital experiences to a wide range of constituents, including consumers, partners, employees, citizens, and students, as well as help ensure continuity throughout the entire customer lifetime journey. It provides presentation orchestration, which connects capabilities from various applications to create seamless digital experiences. Through API-based integrations with adjacent technologies, a DXP becomes a part of a digital business ecosystem.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Platform, Services), Deployment Model (Cloud, On Premises), Organization Size (Small & Medium Enterprise, Large Enterprise), Application (Business to Customer, Business to Business), Vertical (Retail, BFSI, Travel & Hospitality, IT & Telecom, Healthcare, Manufacturing, Media and Entertainment, Education) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Xandr Inc.(U.S), Verizon (U.S), Kayzen (China), NextRoll, Inc. (U.S), Google (U.S), Adobe (U.S), Magnite, Inc (U.S), MediaMath (U.S), IPONWEB Limited (U.S), VOYAGE GROUP (Japan), Integral Ad Science Inc.(Denmark), The Trade Desk (U.S), Connexity (U.S), Centro, Incorporated (U.S), RhythmOne, LLC (U.S) |

|

Opportunities |

|

Digital Experience Platform Market Dynamics

Drivers

- Increased cloud based solution across various enterprises

One of the major factors driving the growth of the digital experience platform market is the increased deployment of cloud-based solutions across various enterprises. Increased company initiatives to deliver personalised, optimised, and integrated user engagement and experience across multiple marketing channels, as well as increased demand for platforms to understand customers' immediate needs, are driving market growth.

- Rising adoption of digital experience platforms to reach customer base across multiple levels

The increased adoption of digital experience platforms (DXPs) by marketers for the purpose of seamlessly reaching customers across multiple digital devices and promoting cross-selling and upselling, as well as high usage due to accurate data obtained through DXP used for marketing and customer engagement, all have an impact on the market. Furthermore, use to reduce customer churn rate, rise in demand for big data analytics, urbanisation and digitization, and preference for Omni channel approach all have a positive impact on the digital experience platform market. Furthermore, the rise in demand for personalised experiences for each customer in real time, as well as the implementation of advanced technologies such as AI, data analytics, and cloud computing, will provide profitable opportunities to market participants during the forecast period.

Opportunity

The widespread use of self-service and interactive kiosks for financial services such as internet banking and mobile banking is expected to drive the adoption of digital experience platforms by banks, financial institutions, and non-banking financial companies (NBFCs). As the digital experience platform eliminates siloed systems, many organisations have begun to deploy DXP to improve their customer interaction and engagement strategies in order to compete with market leaders.

Restraints

On the other hand, the difficulties in integrating omni-channel-generated data, as well as concerns about unclear ROI data are expected to stymie market growth. Integration issues with various software are expected to pose a challenge to the digital experience platform market during the forecast period.

This digital experience platform market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the digital experience platform market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Digital Experience Platform Market

There was an unavoidable surge in the field of digital platforms and technologies during the Covid-19 pandemic years. These steps paved the way for new work and life models, providing a significant impetus for the digitization of all business operations. During the lockdown period, the majority of market players in every field focused on improving their digital platform experience for their customers. Massive investment in DXP content management by online service providers created new opportunities for the development and growth of the digital experience platform market size. However, because the success of any customer engagement service is dependent on the availability of products or services, Covid-19 did have some negative effects on commerce experience management platforms.

Recent Development

- Adobe collaborated with ServiceNow, a leading cloud computing company, to develop an industry-first solution for integrating digital experience data with customer data. Customers would benefit from seamless digital workflows and personalised CXs across all touchpoints.

- Oracle partnered with TWINSET, an Italian clothing brand, in March 2019 to provide the company with Oracle Retail's modern Point-of-Service (POS) technology. This technology would help to improve customer experience at TWINSET stores by providing all transactional details to in-store staff, allowing them to recommend necessary styling and information about the latest merchandise, among other things.

- SAP acquired Qualtrics International, one of the world's pioneers of experience management software, in January 2019. This acquisition would aid SAP in accelerating CX solutions by combining experience and operational data.

North America Digital Experience Platform Market Scope

The digital experience platform market is segmented on the basis of component, deployment model, organization size, application and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Platform

- Services

Product Type

- Customer Identity Management Software

- Transaction Monitoring Software

- Currency Transaction Reporting Software

- Compliance Management Software

- Others

Organization size

- Large Organization

- Small & Medium Organization

Deployment

- On-premise

- Cloud

Application

- Business to Customer

- Business to Business

Vertical

- Retail

- BFSI

- Travel & Hospitality

- IT & Telecom

- Healthcare

- Manufacturing

- Media and Entertainment

- Education

Digital Experience Platform Market Regional Analysis/Insights

The digital experience platform market is analysed and market size insights and trends are provided by country, component, deployment model, organization size, application and vertical as referenced above.

The countries covered in the digital experience platform market report are U.S., Canada and Mexico.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Digital Experience Platform Market Share Analysis

The digital experience platform market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to digital experience platform market.

Some of the major players operating in the digital experience platform market are:

- Xandr Inc.(U.S)

- Verizon (U.S)

- Kayzen (China)

- NextRoll, Inc. (U.S)

- Google (U.S)

- Adobe (U.S)

- Magnite, Inc (U.S)

- MediaMath (U.S)

- IPONWEB Limited (U.S)

- VOYAGE GROUP (Japan)

- Integral Ad Science Inc.(Denmark)

- The Trade Desk (U.S)

- Connexity (U.S).

- Centro, Incorporated (U.S)

- RhythmOne, LLC (U.S)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 COMPONENT TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY OPERATING SYSTEMS

5 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: IMPACT ANALYSIS OF COVID-19

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING GROWTH IN DIGITALIZATION

6.1.2 RICH EXPERIENCE WITH TOUCHPOINT OPTIMIZATION

6.1.3 INCREASED CUSTOMER RETENTION THROUGH DXP

6.1.4 GROWTH IN CLOUD TECHNOLOGY AND IOT BASED DEVICES

6.1.5 GROWTH IN BIG DATA ANALYTICS

6.2 RESTRAINTS

6.2.1 LACK OF KNOWLEDGE REGARDING DIGITAL EXPERIENCE PLATFORM

6.2.2 ISSUE WITH CYBER SECURITY

6.2.3 MULTILINGUAL CONTENT AVAILABLE NORTH AMERICALY

6.3 OPPORTUNITIES

6.3.1 INCREASING GROWTH IN ARTIFICIAL INTELLIGENCE TECHNOLOGY

6.3.2 GROWTH IN E-COMMERCE TRANSFORMING THE RETAIL MARKET

6.3.3 IMPLEMENTING BUSINESS INTELLIGENCE IN DXP

6.4 CHALLENGES

6.4.1 COMPLICATIONS INVOLVED IN INTEGRATION OF DIFFERENT PLATFORMS INVOLVED

6.4.2 TRACKING CROSS CHANNEL USER BEHAVIOUR

7 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 PLATFORM

7.3 SERVICES

7.3.1 PROFESSIONAL SERVICES

7.3.2 MANAGED SERVICES

8 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL

8.1 OVERVIEW

8.2 ON PREMISES

8.3 CLOUD

9 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISE

9.3 SMALL & MEDIUM ENTERPRISE

10 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BUSINESS TO CUSTOMER

10.2.1 ON PREMISES

10.2.2 CLOUD

10.3 BUSINESS TO BUSINESS

10.3.1 ON PREMISES

10.3.2 CLOUD

10.4 OTHERS

11 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 RETAIL

11.2.1 PLATFORM

11.2.2 SERVICES

11.3 BFSI

11.3.1 PLATFORM

11.3.2 SERVICES

11.4 IT & TELECOM

11.4.1 PLATFORM

11.4.2 SERVICES

11.5 TRAVEL & HOSPITALITY

11.5.1 PLATFORM

11.5.2 SERVICES

11.6 MEDIA AND ENTERTAINMENT

11.6.1 PLATFORM

11.6.2 SERVICES

11.7 EDUCATION

11.7.1 PLATFORM

11.7.2 SERVICES

11.8 HEALTHCARE

11.8.1 PLATFORM

11.8.2 SERVICES

11.9 MANUFACTURING

11.9.1 PLATFORM

11.9.2 SERVICES

11.1 OTHERS

12 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY GEOGRAPHY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: SWOT ANALYSIS

15 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: DBMR ANALYSIS

16 COMPANY PROFILE

16.1 ADOBE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SAP SE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANLYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 ORACLE

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SALESFORCE.COM, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 ACCENTURE

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SERVICE PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACQUIA, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BLOOMREACH INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CENSHARE AG

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT & SERVICE PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 CROWNPEAK TECHNOLOGY, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 EPISERVER

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 HCL TECHNOLOGIES LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 INFOSYS LIMITED

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 SERVICE PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 JAHIA SOLUTIONS GROUP SA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 KENTICO SOFTWARE

16.14.1 COMPANY SNAPSHOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 LIFERAY INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 OPEN TEXT CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT & SOLUTION PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SDL PLC

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 SOFTWARE PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 SITECORE

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 SQUIZ

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 WIPRO LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 SERVICE PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

LIST OF TABLES

TABLE 1 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: DIGITAL EXPERIENCE PLATFORM REVIEW BASED ON CUSTOMER FEEDBACK

TABLE 2 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 3 NORTH AMERICA PLATFORM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 6 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 7 NORTH AMERICA ON PREMISES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 8 NORTH AMERICA CLOUD IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 10 NORTH AMERICA LARGE ENTERPRISE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 NORTH AMERICA SMALL & MEDIUM ENTERPRISE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 NORTH AMERICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 15 NORTH AMERICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 27 NORTH AMERICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 29 NORTH AMERICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 NORTH AMERICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 34 NORTH AMERICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 36 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 37 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 38 NORTH AMERICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 40 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 41 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 42 NORTH AMERICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 43 NORTH AMERICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 44 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 45 NORTH AMERICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 46 NORTH AMERICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 47 NORTH AMERICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 48 NORTH AMERICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 49 NORTH AMERICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 50 NORTH AMERICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 51 NORTH AMERICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 52 NORTH AMERICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 53 U.S. DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 54 U.S. SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 55 U.S. DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 56 U.S. DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 57 U.S. DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 58 U.S. BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 59 U.S. BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 60 U.S. DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 61 U.S. RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 62 U.S. BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 63 U.S. IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 64 U.S. TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 65 U.S. MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 66 U.S. EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 67 U.S. HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 68 U.S. MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 69 CANADA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 70 CANADA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 71 CANADA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 72 CANADA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 73 CANADA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 74 CANADA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 75 CANADA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 76 CANADA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 77 CANADA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 78 CANADA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 79 CANADA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 80 CANADA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 81 CANADA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 82 CANADA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 83 CANADA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 84 CANADA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 85 MEXICO DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 86 MEXICO SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 87 MEXICO DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 88 MEXICO DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 89 MEXICO DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 90 MEXICO BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 91 MEXICO BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 92 MEXICO DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 93 MEXICO RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 94 MEXICO BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 95 MEXICO IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 96 MEXICO TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 97 MEXICO MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 98 MEXICO EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 99 MEXICO HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 100 MEXICO MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

Lista de Figura

LIST OF FIGURES

FIGURE 1 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: MULTIVARIATE MODELING

FIGURE 11 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: SEGMENTATION

FIGURE 12 INCREASED CUSTOMER RETENTION THROUGH DXP IS EXPECTED TO DRIVE NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 13 PLATFORM IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET IN 2020 & 2027

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE AND FASTEST GROWING IN THE NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 15 NORTH AMERICA IS THE FASTEST GROWING MARKET FOR DIGITAL EXPERIENCE PLATFORM MANUFACTURERS IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET

FIGURE 17 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COMPONENT, 2019

FIGURE 18 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY DEPLOYMENT MODEL, 2019

FIGURE 19 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY ORGANISATION SIZE, 2019

FIGURE 20 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY APPLICATION, 2019

FIGURE 21 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY VERTICAL, 2019

FIGURE 22 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: SNAPSHOT (2019)

FIGURE 23 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COUNTRY (2019)

FIGURE 24 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COUNTRY (2020 & 2027)

FIGURE 25 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COUNTRY (2019 & 2027)

FIGURE 26 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COMPONENT (2020-2027)

FIGURE 27 NORTH AMERICA DIGITAL EXPERIENCE PLATFORM MARKET: COMPANY SHARE 2019 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.