North America Dehydrated Onion Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

41.96 Million

USD

68.93 Million

2025

2033

USD

41.96 Million

USD

68.93 Million

2025

2033

| 2026 –2033 | |

| USD 41.96 Million | |

| USD 68.93 Million | |

|

|

|

|

Segmentação do mercado de cebola desidratada na América do Norte por formato (inteira, em pó, granulada, fatiada, em pedaços, em cubos, picada, em flocos, em anéis, em cubos, cortada transversalmente, em pedaços, em pasta e outras), embalagem (sacos/embalagens, latas, caixas assépticas e potes reutilizáveis), tipo de cultivo (orgânica e convencional), variedade (cebola branca, cebola roxa, cebola rosa e híbrida), tecnologia (secagem a vácuo, secagem ao ar, secagem por aspersão, secagem por micro-ondas, liofilização, secagem em tambor, frita e outras), canal de distribuição (B2B e B2C), usuário final (doméstico, processamento de alimentos, serviços de alimentação e industrial), aplicação (culinária, sopas, molhos, molhos para salada, salgadinhos e alimentos prontos, produtos de panificação, bebidas, produtos farmacêuticos, suplementos alimentares, cuidados pessoais e cosméticos, produtos cárneos e de aves e outros) - Tendências e previsões do setor. 2033

Tamanho do mercado de cebola desidratada na América do Norte

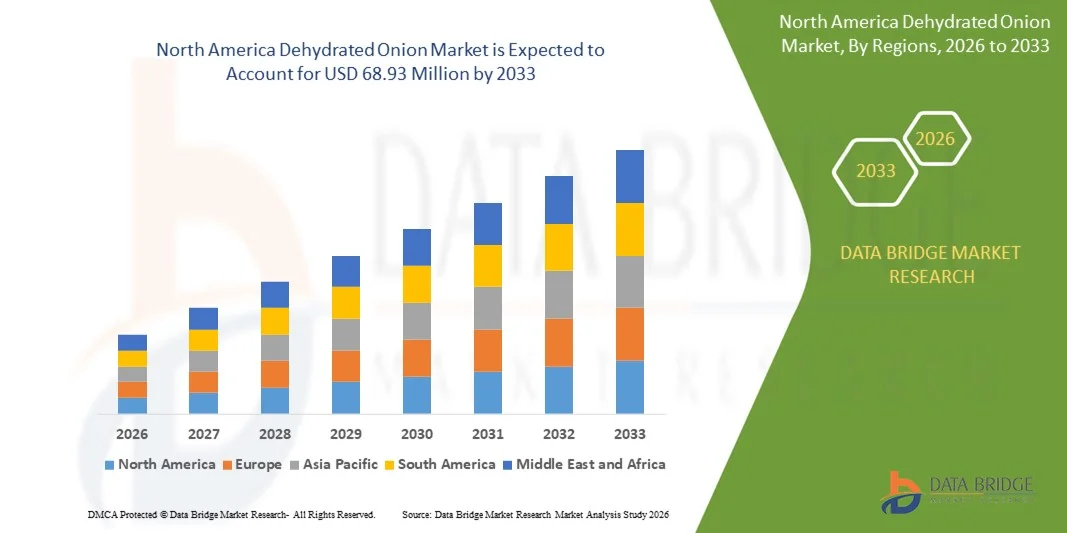

- O mercado de cebola desidratada na América do Norte foi avaliado em US$ 41,96 milhões em 2025 e espera-se que alcance US$ 68,93 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 6,4% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por ingredientes alimentícios com longa vida útil e pela adoção cada vez maior de alimentos processados e práticos, tanto no consumo doméstico quanto comercial. A urbanização crescente e a mudança nos padrões alimentares estão incentivando fabricantes de alimentos e fornecedores de serviços de alimentação a utilizarem cebolas desidratadas, que oferecem sabor consistente, tempo de preparo reduzido e disponibilidade durante todo o ano.

- Além disso, a crescente ênfase na eficiência de custos, na redução do desperdício de alimentos e na simplificação do armazenamento e transporte está posicionando a cebola desidratada como uma alternativa preferencial à cebola fresca. Esses fatores combinados estão acelerando sua adoção em todo o processamento de alimentos, serviços de alimentação e aplicações industriais, apoiando, assim, a expansão sustentada do mercado.

Análise do Mercado de Cebola Desidratada na América do Norte

- Cebolas desidratadas, produzidas por meio de diversas tecnologias de secagem para remover a umidade, mantendo o sabor e as propriedades funcionais, são ingredientes cada vez mais essenciais em alimentos processados, refeições prontas e preparações culinárias, devido à sua longa vida útil e praticidade.

- A crescente demanda por cebolas desidratadas é impulsionada principalmente pelo crescimento da indústria global de processamento de alimentos, pela expansão das redes de restaurantes de serviço rápido e pela crescente preferência do consumidor por soluções práticas de preparo de alimentos que ofereçam qualidade consistente e menor necessidade de manipulação.

- Os EUA dominaram o mercado de cebola desidratada em 2025, devido à sua indústria de processamento de alimentos bem estabelecida, extensa infraestrutura de cozinhas industriais e alta demanda por ingredientes práticos nos setores de alimentos comerciais e embalados.

- Prevê-se que o México seja o país com o crescimento mais rápido no mercado de cebola desidratada durante o período de previsão, devido ao aumento da produção industrial de alimentos, à expansão dos estabelecimentos de alimentação fora do lar e à crescente demanda por ingredientes culinários práticos e com longa vida útil.

- O segmento de cebola em pó dominou o mercado com uma participação de cerca de 40% em 2025, devido ao seu amplo uso nas indústrias de processamento de alimentos, em função da textura uniforme, longa vida útil e facilidade de mistura em preparações secas. A cebola em pó desidratada é amplamente utilizada em sopas, molhos, temperos e produtos prontos para consumo, onde a consistência e a dispersão do sabor são cruciais. Seus menores custos de armazenamento e transporte reforçam ainda mais a sua adoção entre os fabricantes de grande escala.

Escopo do relatório e segmentação do mercado de cebola desidratada

|

Atributos |

Principais informações de mercado sobre cebola desidratada |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de cebola desidratada na América do Norte

Aumento do uso de cebolas desidratadas em serviços de alimentação e na culinária industrial.

- Uma tendência significativa no mercado de cebola desidratada é a crescente adoção desse produto em serviços de alimentação, cozinhas industriais e na fabricação de alimentos embalados, impulsionada pela necessidade cada vez maior de ingredientes práticos, que economizam tempo e mantêm o sabor consistente. Essa tendência está elevando a cebola desidratada a um patamar essencial na produção de alimentos processados, refeições prontas, molhos e misturas de temperos.

- Por exemplo, a Daksh Foods Pvt. Ltd. e a Earth Expo Company fornecem uma gama de cebolas desidratadas em pó e flocos para restaurantes e grandes fabricantes de alimentos na Índia, garantindo sabor uniforme e maior durabilidade entre lotes. Esses produtos aumentam a eficiência operacional nas cozinhas, ao mesmo tempo que asseguram qualidade consistente na produção em massa de alimentos.

- A demanda por cebolas desidratadas está aumentando ainda mais em serviços de alimentação institucionais e cozinhas industriais, onde o armazenamento em grande escala, a vida útil prolongada e o manuseio reduzido são essenciais. Esse posicionamento está impulsionando o crescimento, já que chefs e processadores de alimentos preferem cada vez mais as cebolas desidratadas às alternativas frescas, tanto pela confiabilidade quanto pela relação custo-benefício.

- Empresas globais de processamento de alimentos estão integrando cebolas desidratadas em refeições prontas, molhos e formulações de snacks para manter a estabilidade do sabor e reduzir os riscos de deterioração. Essa incorporação está fortalecendo a presença do mercado de alimentos embalados, criando maior dependência de produtos padronizados de cebola desidratada.

- Em economias emergentes, cozinhas industriais e pequenas processadoras de alimentos estão adotando cebolas desidratadas para simplificar o gerenciamento de estoque e garantir um tempero consistente em toda a linha de produção. O crescente foco em praticidade e eficiência da mão de obra está impulsionando a adoção de produtos de cebola desidratada pelo mercado.

- O mercado está testemunhando uma utilização crescente de cebolas desidratadas em sopas, molhos, temperos para salada e salgadinhos industrializados, onde sabor uniforme e longa vida útil são essenciais. Isso está consolidando a cebola desidratada como um ingrediente preferido em diversas aplicações culinárias e segmentos de processamento industrial.

Dinâmica do mercado de cebola desidratada na América do Norte

Motorista

Crescente necessidade de maior prazo de validade e redução do desperdício de alimentos.

- O mercado de cebola desidratada é impulsionado principalmente pela crescente demanda por maior prazo de validade em produtos alimentícios e pela necessidade de reduzir perdas pós-colheita e desperdício de alimentos. A cebola desidratada oferece uma solução econômica para preservar o sabor, o aroma e o valor nutricional por períodos prolongados, o que é vital tanto para cozinhas comerciais quanto para fabricantes de alimentos embalados.

- Por exemplo, a Jain Irrigation Systems Ltd. oferece produtos avançados de cebola desidratada que mantêm a qualidade por vários meses, permitindo que processadores e distribuidores de alimentos otimizem o estoque e reduzam o desperdício. Essas soluções são particularmente valiosas em regiões com limitações na cadeia de suprimentos, ajudando os fabricantes a manter a disponibilidade consistente do produto.

- A crescente conscientização sobre a sustentabilidade alimentar e o armazenamento eficiente está incentivando os setores de serviços de alimentação e industriais a adotarem cebolas desidratadas para minimizar o desperdício, garantindo, ao mesmo tempo, a consistência da qualidade do produto. A possibilidade de armazenar e utilizar essas cebolas sem reposição frequente contribui diretamente para a redução de custos operacionais e a eficiência no uso de recursos.

- Os fabricantes têm preferido cada vez mais as cebolas desidratadas para produção em larga escala devido à sua longa vida útil, perfis de sabor previsíveis e requisitos mínimos de armazenamento, o que reduz os desafios logísticos e da cadeia de suprimentos. Essa previsibilidade é crucial para manter a padronização em alimentos processados e aplicações culinárias.

- O setor de processamento industrial de alimentos em expansão, particularmente em mercados emergentes, está adotando cebolas desidratadas para atender à crescente demanda do consumidor por alimentos embalados e soluções de refeições prontas para o preparo. Essa tendência está fortalecendo ainda mais o mercado, à medida que as cebolas desidratadas se tornam essenciais para manter a consistência do produto em larga escala.

Restrição/Desafio

Degradação da qualidade durante a secagem e o armazenamento.

- O mercado de cebola desidratada enfrenta desafios relacionados à manutenção do sabor, cor, aroma e valor nutricional durante a secagem, o armazenamento e o transporte. Métodos de secagem inadequados, calor excessivo ou armazenamento prolongado podem levar a perdas significativas de qualidade, reduzindo o apelo do produto e limitando sua adoção em aplicações de alimentos premium.

- Por exemplo, a Green Rootz e a Harmony House Foods, Inc. destacaram os desafios na preservação da pungência e da cor naturais das cebolas durante a secagem por aspersão e o armazenamento a granel, o que pode afetar a aceitação do consumidor e o sabor do produto final. Garantir a qualidade consistente em grandes lotes exige tecnologias sofisticadas de secagem e embalagem.

- Variações no teor de umidade e a exposição ao oxigênio ou à umidade durante o armazenamento agravam ainda mais a degradação, representando desafios logísticos tanto para a distribuição nacional quanto internacional. Essas questões exigem um rigoroso controle de qualidade e soluções avançadas de embalagem para prolongar a vida útil do produto sem comprometer o sabor.

- O mercado é limitado pelo alto custo de tecnologias de secagem otimizadas, como a secagem a vácuo ou a liofilização, necessárias para preservar sabores e nutrientes delicados. Embora esses métodos melhorem a retenção da qualidade, eles aumentam os custos de produção, limitando a adoção em larga escala por pequenos e médios produtores.

- Os fabricantes precisam equilibrar a eficiência operacional com a necessidade de manter a qualidade superior do produto, o que continua sendo um desafio crucial para o mercado de cebola desidratada. Superar esses obstáculos é essencial para sustentar o crescimento e atender à crescente demanda dos segmentos industrial e de serviços de alimentação.

Escopo do mercado de cebola desidratada na América do Norte

O mercado é segmentado com base em forma, embalagem, natureza, variedade, tecnologia, canal de distribuição, usuário final e aplicação.

- Por formulário

Com base na forma, o mercado de cebola desidratada é segmentado em inteira, em pó, granulada, em fatias, em pedaços, em cubos, picada, em flocos, em anéis, em cubos pequenos, em tiras, em pedaços grandes, em pasta e outras. O segmento de cebola em pó dominou o mercado com a maior participação, em torno de 40% em 2025, impulsionado por seu amplo uso nas indústrias de processamento de alimentos devido à textura uniforme, longa vida útil e facilidade de mistura em preparações secas. A cebola desidratada em pó é amplamente preferida em sopas, molhos, misturas de temperos e produtos prontos para consumo, onde a consistência e a dispersão do sabor são essenciais. Seus menores custos de armazenamento e transporte reforçam ainda mais a adoção entre os fabricantes de grande escala.

Espera-se que o segmento de flocos apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente demanda do setor de serviços de alimentação e aplicações culinárias premium. Os flocos de cebola mantêm o apelo visual, o aroma e a textura mais próximos da cebola fresca, tornando-os ideais para pratos gourmet, refeições instantâneas e coberturas. A crescente preferência do consumidor por ingredientes minimamente processados também contribui para o aumento da demanda por formatos em flocos.

- Por embalagem

Com base na embalagem, o mercado de cebola desidratada é segmentado em sacos/bolsas, latas, caixas assépticas e potes reutilizáveis. Sacos e bolsas representaram a maior participação de mercado em 2025, devido à sua relação custo-benefício, leveza e adequação para transporte a granel em cadeias de suprimentos B2B. As embalagens flexíveis oferecem resistência à umidade e maior estabilidade de prateleira, o que é essencial para produtos desidratados. Processadores e distribuidores de alimentos preferem esse formato pela facilidade de manuseio e redução dos custos logísticos.

Prevê-se que os frascos reutilizáveis registem a taxa de crescimento mais rápida durante o período de previsão, impulsionados pelo aumento das vendas no varejo e pela inclinação do consumidor por embalagens sustentáveis e reutilizáveis. Esses frascos aumentam a visibilidade do produto, a conveniência e a percepção de qualidade, principalmente em canais de varejo urbanos e premium. O aumento do consumo doméstico de ingredientes desidratados acelera ainda mais essa tendência.

- Por natureza

Com base na natureza, o mercado é segmentado em cebolas desidratadas orgânicas e convencionais. O segmento convencional dominou o mercado em 2025, impulsionado pela maior disponibilidade, menores custos de produção e forte penetração na indústria alimentícia em larga escala. As cebolas desidratadas convencionais continuam sendo a opção preferida para aplicações em grande volume em snacks, molhos e alimentos processados devido à estabilidade de preços. Cadeias de suprimentos estabelecidas também garantem qualidade consistente e escalabilidade.

Prevê-se que o segmento de produtos orgânicos cresça no ritmo mais acelerado entre 2026 e 2033, impulsionado pela crescente conscientização do consumidor em relação a alimentos com rótulos limpos e livres de químicos. A demanda crescente de consumidores preocupados com a saúde e de marcas de alimentos premium sustenta esse crescimento. A expansão da área cultivada com produtos orgânicos e as iniciativas de certificação fortalecem ainda mais as perspectivas de longo prazo.

- Por Variedade

Com base na variedade, o mercado de cebola desidratada é segmentado em cebola branca, cebola roxa, cebola rosa e híbrida. A cebola branca detinha a maior participação na receita de mercado em 2025, impulsionada por seu sabor suave, alta estabilidade de pungência após a desidratação e amplo uso em alimentos processados. Seu perfil de sabor consistente a torna adequada para diversas aplicações culinárias e industriais. Os fabricantes de alimentos preferem a cebola branca para formulações padronizadas.

Espera-se que as cebolas híbridas apresentem a taxa de crescimento mais rápida durante o período de previsão, impulsionadas pelo aumento da produtividade, tamanho uniforme dos bulbos e maior eficiência na desidratação. Essas variedades oferecem melhor estabilidade de armazenamento e retenção de sabor, atraindo processadores focados em eficiência operacional. Os avanços na tecnologia de sementes promovem ainda mais a sua adoção.

- Por meio da tecnologia

Com base na tecnologia, o mercado é segmentado em secagem a vácuo, secagem ao ar, secagem por aspersão, secagem por micro-ondas, liofilização, secagem em tambor rotativo, fritura e outros. A secagem ao ar dominou o mercado em 2025, devido à sua relação custo-benefício e aplicabilidade em larga escala em regiões desenvolvidas e em desenvolvimento. Esse método permite a produção em grande volume, mantendo características aceitáveis de sabor e textura. Seu baixo investimento inicial o torna amplamente acessível.

Prevê-se que a liofilização seja a tecnologia de crescimento mais rápido entre 2026 e 2033, impulsionada pela sua capacidade superior de preservar o aroma, a cor e o valor nutricional. Aplicações premium nos setores alimentício e farmacêutico têm favorecido cada vez mais as cebolas liofilizadas para formulações de alta qualidade. A crescente demanda por produtos desidratados premium e de valor agregado acelera a adoção dessa tecnologia.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de cebola desidratada é segmentado em B2B e B2C. O segmento B2B dominou o mercado em 2025, impulsionado pela forte demanda de processadores de alimentos, fabricantes de snacks e operadores de serviços de alimentação. Compras em grande volume, contratos de longo prazo e requisitos consistentes de volume contribuem para a manutenção dessa dominância. A cebola desidratada é um ingrediente essencial em diversas categorias de alimentos industriais.

O segmento B2C deverá crescer à taxa mais rápida durante o período de previsão, impulsionado pelo aumento do consumo doméstico e pela expansão das plataformas de varejo online e organizado. Os consumidores estão adotando cada vez mais cebolas desidratadas pela praticidade no preparo de alimentos e pela maior vida útil do produto. Embalagens e marcas aprimoradas contribuem ainda mais para a penetração no varejo.

- Por usuário final

Com base no usuário final, o mercado é segmentado em doméstico, processamento de alimentos, serviços de alimentação e industrial. O segmento de processamento de alimentos representou a maior participação de mercado em 2025, impulsionado pelo uso extensivo em molhos, temperos, salgadinhos e refeições prontas. A cebola desidratada oferece consistência, tempo de preparo reduzido e disponibilidade durante todo o ano, tornando-se essencial para os processadores. A alta demanda garante um consumo constante.

Prevê-se que o segmento de serviços de alimentação apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pela rápida expansão de restaurantes de serviço rápido e cozinhas virtuais. A cebola desidratada proporciona eficiência operacional e reduz o desperdício em cozinhas comerciais. A crescente urbanização e a tendência de comer fora reforçam essa trajetória de crescimento.

- Por meio de aplicação

Com base na aplicação, o mercado de cebola desidratada é segmentado em culinária, sopas, molhos, temperos para salada, salgadinhos e alimentos prontos para consumo, produtos de panificação, bebidas, produtos farmacêuticos, suplementos alimentares, cuidados pessoais e cosméticos, produtos cárneos e de aves, e outros. Sopas e molhos dominaram o mercado em 2025, impulsionados pela demanda consistente de fabricantes de alimentos embalados e prontos para consumo. A cebola desidratada intensifica o sabor e garante maior estabilidade em formulações líquidas e semissólidas. A facilidade de reidratação também contribui para seu uso extensivo.

Prevê-se que os suplementos alimentares e os produtos farmacêuticos registem a taxa de crescimento mais rápida durante o período de previsão, impulsionados pelo aumento da utilização de compostos bioativos à base de cebola. O crescente interesse em ingredientes naturais para aplicações relacionadas à imunidade e ao bem-estar alimenta essa tendência. A pesquisa contínua sobre ingredientes alimentares funcionais fortalece a demanda a longo prazo.

Análise Regional do Mercado de Cebola Desidratada na América do Norte

- Os EUA dominaram o mercado de cebola desidratada, com a maior participação na receita em 2025, impulsionados por sua indústria de processamento de alimentos bem estabelecida, extensa infraestrutura de cozinhas industriais e alta demanda por ingredientes práticos nos setores de alimentos comerciais e embalados.

- Regulamentações rigorosas aplicadas por agências como a FDA (Administração de Alimentos e Medicamentos dos EUA), juntamente com investimentos contínuos em segurança alimentar, controle de qualidade e tecnologias avançadas de secagem, incentivam a adoção generalizada de produtos de cebola desidratada em restaurantes, serviços de catering e fabricantes industriais de alimentos.

- O crescente foco em cebolas em pó, flocos e fatias padronizadas, com sabor estável e longa vida útil, aliado ao aumento do uso em refeições prontas para o preparo, molhos, salgadinhos e alimentos processados, garante que os EUA mantenham sua posição dominante durante todo o período de previsão. Fornecedores líderes nacionais e internacionais, como a Harmony House Foods, Inc. e a Jain Irrigation Systems Ltd., reforçam ainda mais a posição de liderança do país no mercado regional.

Análise do Mercado de Cebola Desidratada no Canadá

Prevê-se que o Canadá registre um crescimento constante no mercado de cebola desidratada da América do Norte entre 2026 e 2033, impulsionado pela expansão de cozinhas industriais, pelo aumento da produção de alimentos embalados e pela crescente adoção de cebolas desidratadas em serviços de alimentação e aplicações culinárias. O uso crescente de cebolas em pó e flocos de alta qualidade e com longa vida útil por processadores de alimentos urbanos está acelerando o crescimento do mercado. Por exemplo, as colaborações entre distribuidores canadenses de ingredientes alimentícios e fornecedores globais estão melhorando a disponibilidade e a consistência dos produtos para cozinhas industriais e comerciais. As iniciativas governamentais que promovem a segurança alimentar, combinadas com o foco crescente na eficiência operacional e na redução do desperdício de alimentos, posicionam o Canadá como um mercado em constante crescimento na região.

Análise do Mercado de Cebola Desidratada no México

Prevê-se que o México registre a taxa de crescimento anual composta (CAGR) mais rápida no mercado de cebola desidratada da América do Norte entre 2026 e 2033, impulsionado pelo aumento da produção industrial de alimentos, pela expansão dos estabelecimentos de alimentação fora do lar e pela crescente demanda por ingredientes culinários convenientes e com longa vida útil. O crescimento de pequenas e médias empresas de processamento de alimentos e restaurantes que adotam cebolas desidratadas para obter sabor consistente e facilidade de armazenamento está acelerando a penetração no mercado. Parcerias entre fornecedores regionais, como a Daksh Foods Pvt. Ltd., a Earth Expo Company e distribuidores locais, juntamente com investimentos em tecnologias modernas de secagem e embalagem, estão aprimorando a acessibilidade do produto. Iniciativas governamentais de apoio à modernização do processamento de alimentos, aliadas à crescente urbanização e à preferência cada vez maior do consumidor por refeições processadas e prontas para o preparo, garantem a ascensão do México como o mercado de crescimento mais rápido da região.

Participação de mercado da cebola desidratada na América do Norte

O setor de cebola desidratada é liderado principalmente por empresas consolidadas, incluindo:

- Daksh Foods Pvt. Ltd. (Índia)

- Empresa Earth Expo (Índia)

- Raízes Verdes (Índia)

- Harmony House Foods, Inc. (EUA)

- Jain Irrigation Systems Ltd (Índia)

- INGREDIENTES ALIMENTARES JIYAN (Índia)

- Desidratação Natural (Índia)

- Grupo Olam (Singapura)

- Real Dehydrates Pvt Ltd (Índia)

- Silva Internacional (EUA)

- Fazendas Van Drunen (EUA)

- BKDehy Alimentos (Índia)

- Rocky Mountain Spice Company (EUA)

- Viji Foods (Índia)

- Qingdao UnisonEco Food Technology Co., Ltd. (China)

- Murtuza Foods Pvt Ltd (Índia)

- Adegermex (México)

- Alimentos liofilizados (Alemanha)

Novidades no mercado de cebola desidratada na América do Norte

- Em janeiro de 2024, a S4S Technologies, uma startup de agroprocessamento descentralizada com sede na Índia, deu continuidade à sua missão de reduzir o desperdício de alimentos no campo, implementando secadores solares de condução para pequenos agricultores. Esses secadores prolongam a vida útil de produtos como cebolas sem o uso de produtos químicos ou conservantes, permitindo o armazenamento e o processamento durante todo o ano. A S4S também compra o produto desidratado dos agricultores e o fornece para empresas de processamento de alimentos, criando uma cadeia de suprimentos circular que aumenta a renda dos agricultores e reduz as perdas pós-colheita. Esse modelo colaborativo apoia a agricultura sustentável e empodera microempreendedoras lideradas por mulheres em áreas rurais da Índia.

- Em março de 2023, o governo da Índia anunciou planos para irradiar cebolas após a colheita, utilizando radiação gama, a fim de reduzir a deterioração e prolongar a vida útil. A iniciativa, liderada pelo Centro de Pesquisa Atômica Bhabha (BARC), tem como alvo as cebolas da safra de inverno (rabi), mais adequadas para armazenamento a longo prazo. Ao tratar as cebolas com radiação ionizante antes de armazená-las em câmaras frigoríficas, o governo pretende reduzir as perdas pós-colheita de 25% para cerca de 10-12%. Essa medida estabiliza o fornecimento e os preços da cebola e também apoia indiretamente o mercado de cebola desidratada, garantindo uma base de matéria-prima mais consistente.

- Em março de 2023, a Universidade Estadual de Pangasinan (PSU) e o Centro de Inovação Alimentar do Departamento de Ciência e Tecnologia (DOST-FIC) das Filipinas lançaram tecnologias inovadoras de fabricação de cebola em pó e pasta de camarão ("bagoong") utilizando técnicas de secagem por aspersão. Essas soluções visam aumentar a vida útil, reduzir o teor de sódio e facilitar o transporte, abordando desafios comuns nas embalagens e no armazenamento tradicionais. A cebola em pó, derivada de chalotas e variedades de cebola roxa, oferece uma alternativa econômica durante os períodos de pico da colheita. Essa iniciativa reflete o compromisso da região com a inovação alimentar e apoia o crescente mercado de condimentos desidratados.

- Em outubro de 2021, a Olam Food Ingredients (OFI) firmou parceria com a Agri-Neo, inovadora em segurança alimentar, para lançar as primeiras cebolas desidratadas pasteurizadas organicamente do setor. A colaboração combina a liderança global da OFI na produção de cebolas desidratadas com a tecnologia Neo-Pure™ da Agri-Neo — um sistema de pasteurização não térmica, certificado como orgânico, que elimina patógenos como Salmonella e E. coli sem o uso de radiação. Essa inovação aprimora a segurança alimentar tanto para ingredientes convencionais quanto orgânicos, preservando o sabor, a cor e o aroma. A parceria reflete o compromisso da OFI em fornecer ingredientes rastreáveis e de alta qualidade e marca um marco na inovação do processamento de alimentos orgânicos.

- Em janeiro de 2021, a Anuha Food Products Pvt. Ltd., uma startup indiana, lançou uma linha de produtos prontos para cozinhar sob sua marca sem glúten, Zilli's. A linha inclui flocos de cebola desidratada, dentes de alho, gengibre, tamarindo, cebola roxa em pó e rolinhos de frutas — desenvolvidos para simplificar o preparo de alimentos, preservando o valor nutricional. Com validade de 12 a 18 meses, esses produtos atendem aos consumidores preocupados com a saúde, que buscam praticidade e armazenamento a longo prazo. Apoiada pela Atal Innovation Mission e pelo programa Startup India, a Zilli's reflete uma tendência crescente no setor alimentício da Índia.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.