North America Courier Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

136.11 Billion

USD

239.15 Billion

2025

2033

USD

136.11 Billion

USD

239.15 Billion

2025

2033

| 2026 –2033 | |

| USD 136.11 Billion | |

| USD 239.15 Billion | |

|

|

|

|

Segmentação do mercado de entregas expressas na América do Norte, por tipo (saída e entrada), modalidade de entrega (normal e expressa), tipo de cliente (B2B (Business-to-Business), B2C (Business-to-Consumer) e C2C (Consumer-to-Consumer)), destino (nacional e internacional/transfronteiriço), usuário final (comércio atacadista e varejista (e-commerce), serviços médicos, indústria, serviços (BFSI), construção, serviços públicos e setores primários) - Tendências e previsões do setor até 2033

Tamanho do mercado de entregas expressas na América do Norte

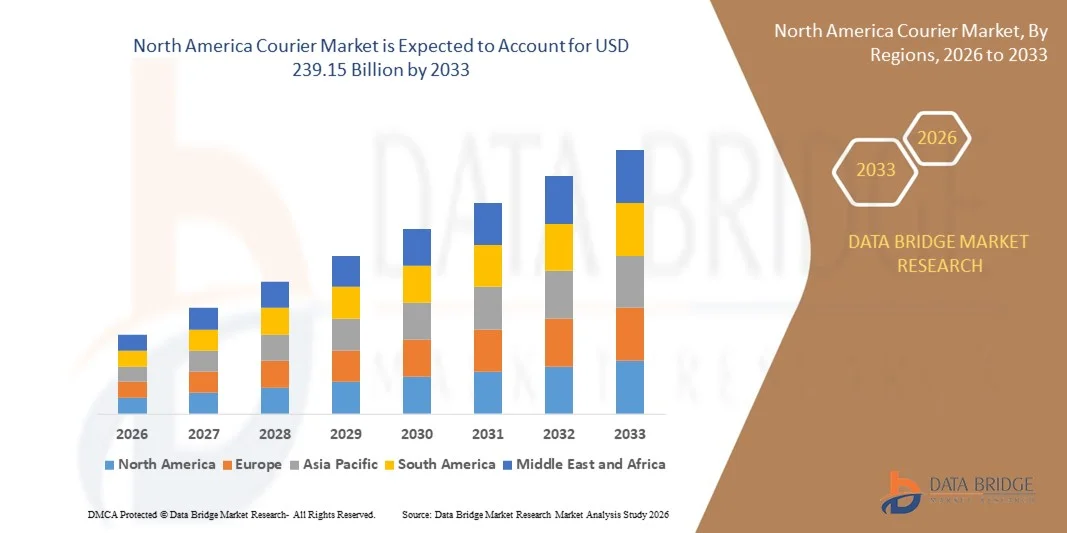

- O mercado de serviços de entrega expressa na América do Norte foi avaliado em US$ 136,11 bilhões em 2025 e deverá atingir US$ 239,15 bilhões em 2033 , com uma taxa de crescimento anual composta (CAGR) de 7,3% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela rápida expansão do comércio eletrônico e das plataformas de varejo online, o que gera maior demanda por serviços de entrega rápidos, confiáveis e com tecnologia de ponta, tanto em áreas urbanas quanto rurais.

- Além disso, as crescentes expectativas dos consumidores por entregas no mesmo dia, no dia seguinte e sem contato, juntamente com a adoção de tecnologias avançadas de rastreamento, otimização de rotas e triagem automatizada, estão consolidando os serviços de entrega expressa como componentes essenciais do comércio moderno. Esses fatores convergentes estão acelerando a adoção de soluções de entrega expressa e logística, impulsionando significativamente o crescimento do setor.

Análise do Mercado de Serviços de Entrega na América do Norte

- Os serviços de entrega expressa, que proporcionam envios rápidos e confiáveis de encomendas, documentos e mercadorias, são componentes cada vez mais vitais das operações da cadeia de suprimentos e do comércio eletrônico devido à sua eficiência, flexibilidade e integração com plataformas digitais.

- A crescente demanda por serviços de entrega expressa é impulsionada principalmente pelo crescimento do comércio eletrônico, pela urbanização acelerada, pela maior penetração de smartphones e da internet e pela preferência do consumidor por opções de entrega convenientes, porta a porta.

- Os EUA dominaram o mercado de entregas expressas em 2025, devido à alta penetração do comércio eletrônico, à infraestrutura logística bem estabelecida e à crescente demanda do consumidor por serviços de entrega rápidos e confiáveis.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de entregas expressas durante o período de previsão, devido à crescente adoção do comércio eletrônico, à urbanização acelerada e à expansão dos ecossistemas de pagamento digital e logística.

- O segmento de envios dominou o mercado com uma participação de 61,3% em 2025, devido ao alto volume de remessas enviadas por empresas, plataformas de e-commerce, fabricantes e prestadores de serviços aos clientes finais. O crescimento do varejo online, do comércio internacional e dos modelos de negócios de venda direta ao consumidor continua impulsionando o transporte de encomendas em todo o mundo. As empresas de courier focam-se fortemente na otimização da logística de envio para garantir a entrega pontual, a eficiência de custos e a satisfação do cliente.

Escopo do relatório e segmentação do mercado de entregas expressas

|

Atributos |

Principais informações de mercado para serviços de entrega |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de entregas expressas na América do Norte

Crescente tendência para serviços de entrega expressa digitalizados, de alta velocidade e impulsionados pela tecnologia.

- Uma tendência significativa no mercado de entregas expressas é a crescente adoção de soluções de entrega rápidas e baseadas em tecnologia, impulsionada pela rápida expansão do comércio eletrônico, do varejo online e pelas crescentes expectativas dos consumidores por um serviço rápido e confiável. As empresas estão investindo fortemente em plataformas digitais, automação e sistemas de rastreamento para otimizar as operações e melhorar a experiência do cliente em áreas urbanas e semiurbanas.

- Por exemplo, a DHL implementou centros de triagem automatizados e software avançado de otimização de rotas para aumentar a velocidade de entrega e reduzir as ineficiências operacionais. Essas soluções tecnológicas fortalecem a confiabilidade do serviço e permitem o monitoramento em tempo real das encomendas, desde o despacho até a entrega.

- A adoção de plataformas logísticas baseadas em IA está em ascensão, possibilitando previsões de prazos de entrega, otimização de rotas e conectividade aprimorada na última milha. Isso posiciona os serviços de entrega expressa como facilitadores essenciais para operações eficientes da cadeia de suprimentos e satisfação do cliente.

- Os setores de saúde e farmacêutico dependem cada vez mais de serviços de entrega expressa para o envio pontual de medicamentos essenciais, vacinas e amostras de laboratório. Empresas como FedEx e UPS oferecem soluções de entrega com temperatura controlada e prioridade, garantindo um transporte seguro e ágil.

- Os varejistas estão expandindo o uso de redes de entrega digitalizadas para oferecer modelos de entrega no mesmo dia e no dia seguinte, aproveitando sistemas de rastreamento, aplicativos móveis e despacho automatizado para atender à crescente demanda do consumidor. Essa tendência está acelerando a adoção de serviços de entrega integrados à tecnologia pelo mercado.

- O mercado está testemunhando um forte crescimento nos serviços internacionais de entrega expressa e logística transfronteiriça, onde plataformas digitais, automação do desembaraço aduaneiro e soluções integradas de rastreamento são cruciais. O aumento do comércio global, as compras online internacionais e a demanda por entregas internacionais rápidas reforçam a transição geral para serviços de entrega digitalizados e impulsionados pela tecnologia.

Dinâmica do mercado de entregas expressas na América do Norte

Motorista

Crescimento acelerado do comércio eletrônico e demanda crescente por entregas rápidas.

- A rápida expansão das plataformas de comércio eletrônico, o aumento da penetração das compras online e as crescentes expectativas dos consumidores por entregas pontuais estão impulsionando uma forte demanda por serviços de entrega expressa. Soluções tecnológicas, rastreamento em tempo real e opções de entrega flexíveis estão criando oportunidades para o crescimento do mercado.

- Por exemplo, a Amazon Logistics utiliza inteligência artificial sofisticada, robótica e análise preditiva para gerenciar entregas de alto volume e fornecer serviços de última milha rápidos e confiáveis. Essas capacidades permitem que a empresa atenda à crescente demanda por entregas no mesmo dia e no dia seguinte em diversas regiões.

- A crescente urbanização, o aumento do uso de smartphones e da internet e a preferência do consumidor por conveniência aceleram ainda mais a adoção de serviços de entrega expressa. Empresas de diversos setores dependem cada vez mais de redes logísticas digitalizadas para garantir entregas pontuais e eficiência operacional.

- A crescente importância da confiabilidade da cadeia de suprimentos, principalmente para bens de alto valor e perecíveis, reforça a necessidade de serviços de entrega expressa avançados. As empresas estão integrando rastreamento baseado em nuvem, triagem automatizada e otimização de rotas para manter o desempenho e a confiança do cliente.

- A expansão dos marketplaces de comércio eletrônico e dos modelos de venda direta ao consumidor está intensificando a demanda por soluções de entrega escaláveis e baseadas em tecnologia. Essa dependência contínua de serviços de entrega rápidos e confiáveis posiciona o mercado para um crescimento contínuo.

Restrição/Desafio

Altos custos operacionais e limitações de infraestrutura.

- O mercado de entregas expressas enfrenta desafios devido ao alto custo da infraestrutura, frotas de veículos, centros de triagem automatizados e investimentos em tecnologia necessários para atender à crescente demanda por entregas. Esses fatores aumentam as despesas operacionais gerais e limitam as margens de lucro dos fornecedores.

- Por exemplo, a Blue Dart e a FedEx enfrentam custos significativos associados à entrega da última milha, à automação de armazéns e à integração de sistemas de rastreamento digital. Manter a qualidade do serviço e, ao mesmo tempo, controlar os custos continua sendo um desafio operacional fundamental.

- A infraestrutura logística limitada em regiões semiurbanas e rurais cria gargalos nas entregas, impactando a velocidade e a eficiência. A expansão para essas áreas exige investimentos significativos em redes de transporte e sistemas de entrega com tecnologia de ponta.

- O aumento dos custos de combustível, a escassez de mão de obra e a flutuação das despesas de manutenção contribuem ainda mais para os desafios operacionais dos provedores de serviços de entrega expressa. Equilibrar a gestão de custos com a confiabilidade do serviço é fundamental para manter a competitividade no mercado.

- O mercado continua a enfrentar limitações na expansão de redes de entrega de alta velocidade e baseadas em tecnologia, mantendo, ao mesmo tempo, a acessibilidade e a eficiência. Esses desafios, em conjunto, exigem soluções inovadoras, parcerias e investimentos em infraestrutura para atender às crescentes expectativas dos consumidores.

Escopo do mercado de entregas expressas na América do Norte

O mercado está segmentado com base no tipo, modo de entrega, tipo de cliente, destino e usuário final .

- Por tipo

Com base no tipo, o mercado de entregas expressas é segmentado em serviços de saída e de entrada. O segmento de saída dominou o mercado com uma participação estimada em 61,3% em 2025, impulsionado pelo alto volume de remessas enviadas por empresas, plataformas de comércio eletrônico, fabricantes e prestadores de serviços para clientes finais. O crescimento do varejo online, do comércio internacional e dos modelos de negócios de venda direta ao consumidor continua a impulsionar o transporte de encomendas de saída globalmente. As empresas de entregas expressas concentram-se fortemente na otimização da logística de saída para garantir a entrega pontual, a eficiência de custos e a satisfação do cliente.

O segmento de entregas de entrada deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pelo aumento de devoluções, logística reversa, entregas de fornecedores e reposição de estoques. O crescente foco na gestão eficiente da cadeia de suprimentos e na otimização de estoques está acelerando a demanda por serviços de entrega de entrada.

- Por modalidade de entrega

Com base na modalidade de entrega, o mercado de entregas expressas é segmentado em Entrega Normal e Entrega Expressa. O segmento de Entrega Normal detinha a maior participação de mercado, com 54,8% em 2025, devido à sua relação custo-benefício e ampla utilização para remessas não urgentes nos setores de varejo, manufatura e serviços. As empresas continuam a optar pelas modalidades de entrega padrão para gerenciar os custos logísticos, garantindo, ao mesmo tempo, um serviço confiável.

Prevê-se que o segmento de Entregas Expressas registre a taxa de crescimento mais rápida durante o período de 2026 a 2033, impulsionado pela crescente demanda do consumidor por entregas no mesmo dia, no dia seguinte e com horário definido. A expansão do comércio eletrônico, da entrega de alimentos, da logística na área da saúde e dos serviços premium está impulsionando significativamente a adoção de soluções de entrega expressa.

- Por tipo de cliente

Com base no tipo de cliente, o mercado de entregas expressas é segmentado em B2B (Business-to-Business), B2C (Business-to-Consumer) e C2C (Consumer-to-Consumer). O segmento B2B dominou o mercado com uma participação de 46,5% em 2025, impulsionado pelos altos volumes de remessas nos setores de manufatura, comércio atacadista, farmacêutico, serviços financeiros e cadeias de suprimentos industriais. Serviços de entrega expressa confiáveis, programados e baseados em contratos continuam a impulsionar a forte demanda B2B.

O segmento B2C deverá apresentar o crescimento mais rápido em termos de CAGR (Taxa de Crescimento Anual Composta) entre 2026 e 2033, impulsionado pela rápida expansão do comércio eletrônico, marketplaces digitais e marcas de venda direta ao consumidor. As crescentes expectativas dos consumidores por opções de entrega rápidas, rastreáveis e flexíveis estão acelerando o crescimento dos serviços de entrega expressa B2C.

- Por destino

Com base no destino, o mercado de entregas expressas é segmentado em entregas domésticas e internacionais/transfronteiriças. O segmento doméstico representou a maior participação de mercado, com 63,9% em 2025, impulsionado pelo alto volume de encomendas dentro do país, entregas urbanas e expansão das redes nacionais de comércio eletrônico e varejo. Infraestrutura eficiente de última milha e redes locais de entregas expressas sustentam uma forte demanda doméstica.

Prevê-se que o segmento Internacional/Transfronteiriço apresente o crescimento mais rápido em termos de CAGR (Taxa de Crescimento Anual Composta) entre 2026 e 2033, impulsionado pelo aumento do comércio global, do comércio eletrônico transfronteiriço e do envio internacional de documentos e encomendas. As melhorias nos processos aduaneiros, na documentação digital e nas redes logísticas internacionais estão acelerando o crescimento do serviço de entregas expressas transfronteiriças.

- Por usuário final

Com base no usuário final, o mercado de entregas expressas é segmentado em Comércio Atacadista e Varejista (E-commerce), Entregas Médicas, Manufatura, Serviços (BFSI), Construção, Serviços Públicos e Indústrias Primárias. O segmento de Comércio Atacadista e Varejista (E-commerce) dominou o mercado com uma participação de 49,2% em 2025, impulsionado pelo enorme volume de encomendas gerado por plataformas de compras online, varejo omnichannel e marketplaces digitais. O crescimento contínuo dos gastos online do consumidor sustenta a demanda.

O segmento de entregas expressas médicas deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pela crescente demanda por entregas urgentes de produtos farmacêuticos, amostras para diagnóstico, equipamentos médicos e suprimentos para a área da saúde. O foco cada vez maior na confiabilidade e conformidade da logística na área da saúde está fortalecendo a adoção desse serviço.

Análise Regional do Mercado de Serviços de Entrega na América do Norte

- Os EUA dominaram o mercado de entregas expressas com a maior participação na receita em 2025, impulsionados pela alta penetração do comércio eletrônico, infraestrutura logística bem estabelecida e crescente demanda do consumidor por serviços de entrega rápidos e confiáveis.

- Regulamentações governamentais rigorosas sobre comércio e transporte marítimo, investimentos em centros logísticos inteligentes e redes de transporte avançadas incentivam a adoção de soluções de entrega expressa com tecnologia integrada nos EUA. A forte presença de empresas líderes nacionais e internacionais de entrega expressa, a inovação contínua em sistemas automatizados de triagem e rastreamento e as parcerias estratégicas com plataformas de comércio eletrônico reforçam ainda mais a posição de liderança do país no mercado regional.

- O crescente foco na eficiência da entrega da última milha, nas expectativas de serviço no mesmo dia e no dia seguinte e na gestão digitalizada da cadeia de suprimentos garante que os EUA mantenham sua posição dominante durante todo o período de previsão.

Análise do Mercado de Serviços de Entrega Expressa no Canadá

Prevê-se que o Canadá registre a taxa de crescimento anual composta (CAGR) mais rápida no mercado de entregas expressas da América do Norte entre 2026 e 2033, impulsionado pela crescente adoção do comércio eletrônico, pela urbanização acelerada e pela expansão dos ecossistemas de pagamento digital e logística. A demanda crescente por serviços de entrega rápidos, seguros e baseados em tecnologia está acelerando o crescimento do mercado de entregas expressas. Colaborações entre provedores de entregas expressas nacionais e empresas de logística globais, juntamente com investimentos em armazéns automatizados e softwares de otimização de rotas, aprimoram a eficiência operacional. O apoio governamental ao comércio digital, as melhorias na infraestrutura e o foco na conveniência do consumidor posicionam o Canadá como o mercado de crescimento mais rápido da região.

Análise do Mercado de Serviços de Entrega no México

Prevê-se que o mercado mexicano cresça de forma constante entre 2026 e 2033, impulsionado pela expansão do comércio eletrônico, pelo aumento do comércio transfronteiriço com os EUA e pela crescente demanda por serviços de entrega expressa e confiáveis. Iniciativas governamentais para aprimorar a infraestrutura de transporte e logística, juntamente com a adoção gradual de soluções de entrega baseadas em tecnologia, sustentam o crescimento consistente do mercado. A presença cada vez mais forte de provedores de entrega regionais e parcerias com empresas globais de logística aprimoram a confiabilidade e a cobertura dos serviços. A crescente urbanização e a preferência do consumidor por opções de entrega convenientes contribuem para a expansão constante ao longo do período previsto.

Participação de mercado de entregas expressas na América do Norte

O setor de entregas expressas é liderado principalmente por empresas consolidadas, incluindo:

- FedEx (EUA)

- Deutsche Post AG (Alemanha)

- United Parcel Service of America, Inc. (UPS) (EUA)

- SF Express (China)

- Royal Mail Group Limited (Reino Unido)

- Yamato Transport Co., Ltd. (Japão)

- Koninklijke PostNL (Holanda)

- Aramex (Emirados Árabes Unidos)

- Singapore Post Limited (Singapura)

- Sagawa Express Co., Ltd. (Japão)

- Qantas Airways Limited (Austrália)

- Allied Express (Austrália)

- Expresso Aéreo Único (Índia)

- Gati-Kintetsu Express Private Limited (Índia)

- DTDC Express Limited (Índia)

- Hermes Europe GmbH (Alemanha)

- GO! Express & Logistics (Deutschland) GmbH (Alemanha)

- GEODIS (França)

- Delhivery Pvt Ltd (Índia)

- LaserShip Inc (EUA)

Últimos desenvolvimentos no mercado de entregas expressas da América do Norte

- Em junho de 2025, a JD.com lançou seu primeiro serviço expresso internacional próprio para fortalecer sua presença logística global e competir diretamente com as principais empresas de entrega expressa. Essa iniciativa reflete a ambição da JD.com de expandir suas capacidades de entrega internacional e aprimorar o controle sobre as cadeias de suprimentos internacionais.

- Em maio de 2025, a DHL eCommerce UK fundiu-se com a Evri para criar uma rede de entregas em larga escala, responsável por mais de um bilhão de encomendas anualmente em todo o país. Essa fusão destaca a consolidação do setor, visando aprimorar a eficiência da última milha, a velocidade de entrega e a cobertura nacional.

- Em fevereiro de 2024, o Emirates Post Group, agora com a marca 7X, lançou a EMX como uma nova subsidiária focada na transformação do setor de entregas expressas, de encomendas e de pacotes nos Emirados Árabes Unidos por meio de tecnologias avançadas e soluções logísticas centradas no cliente. Essa iniciativa reforça a estratégia do grupo de modernizar os serviços de entrega expressa, de encomendas e de pacotes e fortalecer a competitividade regional.

- Em maio de 2023, a Interroll lançou sua Plataforma de Esteiras Transportadoras de Alto Desempenho, projetada especificamente para operações de entrega expressa, correio e encomendas, apresentando módulos de desvio inteligentes e recursos de triagem de alto rendimento. Esse desenvolvimento demonstra a crescente importância da automação e da eficiência em ambientes de manuseio de encomendas em larga escala.

- Em novembro de 2022, a DHL Express inaugurou um ponto de atendimento digital totalmente automatizado no Dubai Digital Park, o primeiro desse tipo no Oriente Médio e na rede global da DHL. Esse lançamento estabeleceu um novo padrão para o atendimento automatizado ao cliente e reforçou a liderança da DHL em inovação logística.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.