North America Copper Busbar Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.64 Billion

USD

7.46 Billion

2024

2032

USD

4.64 Billion

USD

7.46 Billion

2024

2032

| 2025 –2032 | |

| USD 4.64 Billion | |

| USD 7.46 Billion | |

|

|

|

|

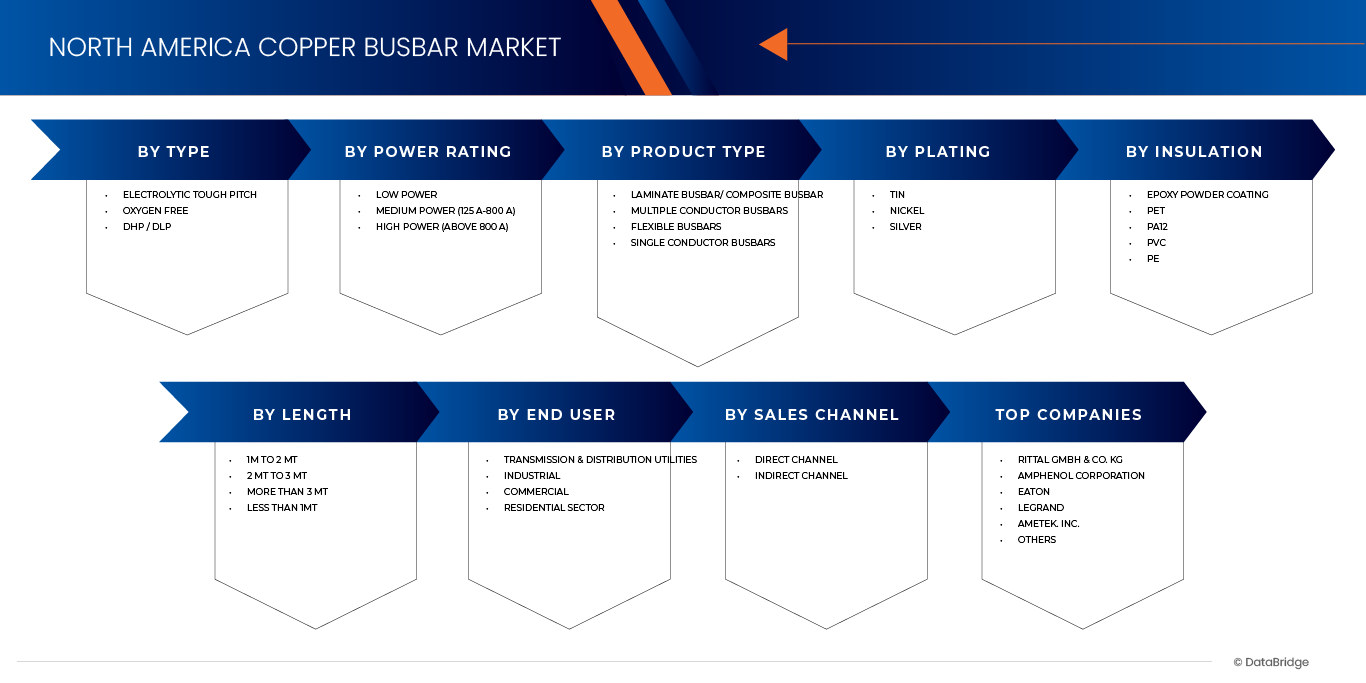

Segmentação do mercado de barramentos de cobre na América do Norte, por tipo (eletrolítico de alta resistência, livre de oxigênio e DHP/DLP), potência nominal (baixa potência, potência média (125 A a 800 A) e alta potência (acima de 800 A)), tipo de produto (barramento laminado/barramento composto, barramentos com múltiplos condutores, barramentos flexíveis e barramentos com um único condutor), revestimento (estanho, níquel e prata), isolamento (revestimento em pó epóxi, PET, PA12, PVC, PE), comprimento (1 m a 2 m, 2 m a 3 m, mais de 3 m, menos de 1 m), usuário final (empresas de transmissão e distribuição, setor industrial, comercial e residencial), canal de vendas (canal direto e canal indireto) - Tendências e previsões do setor até 2032.

Tamanho do mercado de barramentos de cobre na América do Norte

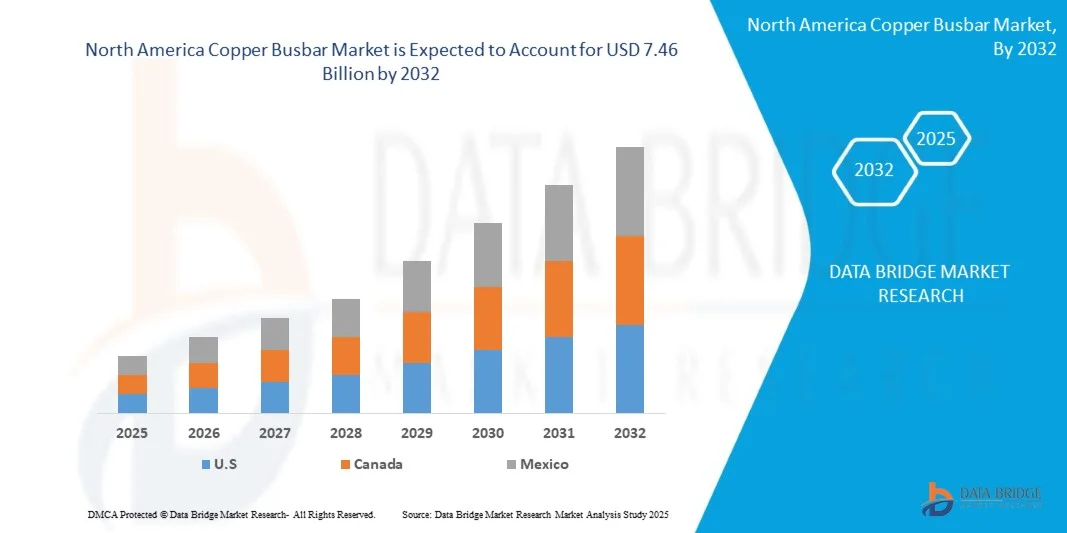

- Prevê-se que o mercado de barramentos de cobre na América do Norte atinja US$ 7,46 bilhões em 2032, partindo de US$ 4,64 bilhões em 2024, crescendo a uma taxa composta de crescimento anual (CAGR) de 6,3% no período de previsão de 2025 a 2032.

- O mercado de barramentos de cobre na América do Norte está experimentando um crescimento significativo, impulsionado pela crescente demanda por distribuição de energia eficiente em diversos setores, incluindo concessionárias de transmissão e distribuição, aplicações industriais, comerciais e residenciais.

Análise do mercado de barramentos de cobre na América do Norte

- O foco da região na modernização da infraestrutura elétrica obsoleta e na transição para fontes de energia renováveis está impulsionando ainda mais o mercado. A adoção de tecnologias avançadas, como redes inteligentes e sistemas de eficiência energética, também contribui para a crescente necessidade de soluções de barramento confiáveis e de alto desempenho, reforçando a posição dominante do cobre devido à sua condutividade elétrica superior e propriedades de gerenciamento térmico.

- O aumento do foco na eficiência energética, com preferência por barramentos em vez de cabos, deverá impulsionar o crescimento geral do mercado. A flutuação nos preços das matérias-primas, especialmente do cobre, deverá restringir o mercado de barramentos de cobre na América do Norte.

- Prevê-se que os EUA sejam o país dominante e de crescimento mais rápido no mercado de barramentos de cobre da América do Norte, detendo a maior participação de mercado, de 72,48%, em 2025, devido à presença de importantes indústrias de uso final, à modernização contínua da infraestrutura, ao aumento da demanda por integração de energia renovável e aos fortes investimentos em redes de transmissão e distribuição de energia.

- Com base no tipo, o mercado de barramentos de cobre na América do Norte é segmentado em cobre eletrolítico de alta resistência, cobre isento de oxigênio e cobre DHP/DLP. Em 2025, espera-se que o segmento de cobre eletrolítico de alta resistência domine o mercado com uma participação de 50,28%, devido à sua condutividade elétrica superior e custo-benefício em comparação com os segmentos de cobre isento de oxigênio e DHP/DLP, tornando-o ideal para aplicações de distribuição de energia de alta eficiência. Além disso, sua ampla disponibilidade e adequação para aplicações industriais padrão impulsionam ainda mais sua demanda.

- Com base no canal de vendas, o mercado de barramentos de cobre na América do Norte é segmentado em canal direto e canal indireto. Em 2025, espera-se que o canal direto domine o mercado, pois permite que os fabricantes forneçam barramentos de cobre diretamente aos usuários finais, oferecendo maior controle sobre preços, personalização e relacionamento com o cliente. Essa abordagem simplificada reduz os intermediários, resultando em maior eficiência de custos e prazos de entrega mais rápidos.

Escopo do relatório e segmentação do mercado de barramentos de cobre na América do Norte

|

Atributos |

Principais informações sobre o mercado de barramentos de cobre na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, produção e capacidade das empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas das tendências de preços e análises de déficits na cadeia de suprimentos e demanda. |

Tendências do mercado de barramentos de cobre na América do Norte

“Forte mudança em direção à modernização e atualização da infraestrutura de distribuição de energia”

- A crescente integração de fontes de energia renováveis, como a solar e a eólica, exige sistemas de rede flexíveis e resilientes para gerenciar o fornecimento intermitente de energia.

- A expansão dos Recursos Energéticos Distribuídos (REDs) e a eletrificação das indústrias exigem fluxo de energia bidirecional e atualizações para redes inteligentes.

- O investimento em armazenamento de energia e baterias de grande escala para a rede elétrica contribui para o equilíbrio entre oferta e demanda, possibilitando a integração de energias renováveis.

- Os esforços concentram-se no fortalecimento da resiliência da rede elétrica contra condições climáticas extremas, ameaças cibernéticas e equipamentos obsoletos.

- A modernização prioriza a flexibilidade da demanda, a otimização da rede e a troca de energia para garantir um fornecimento de energia acessível, confiável e sustentável.

Dinâmica do mercado de barramentos de cobre na América do Norte

Motoristas

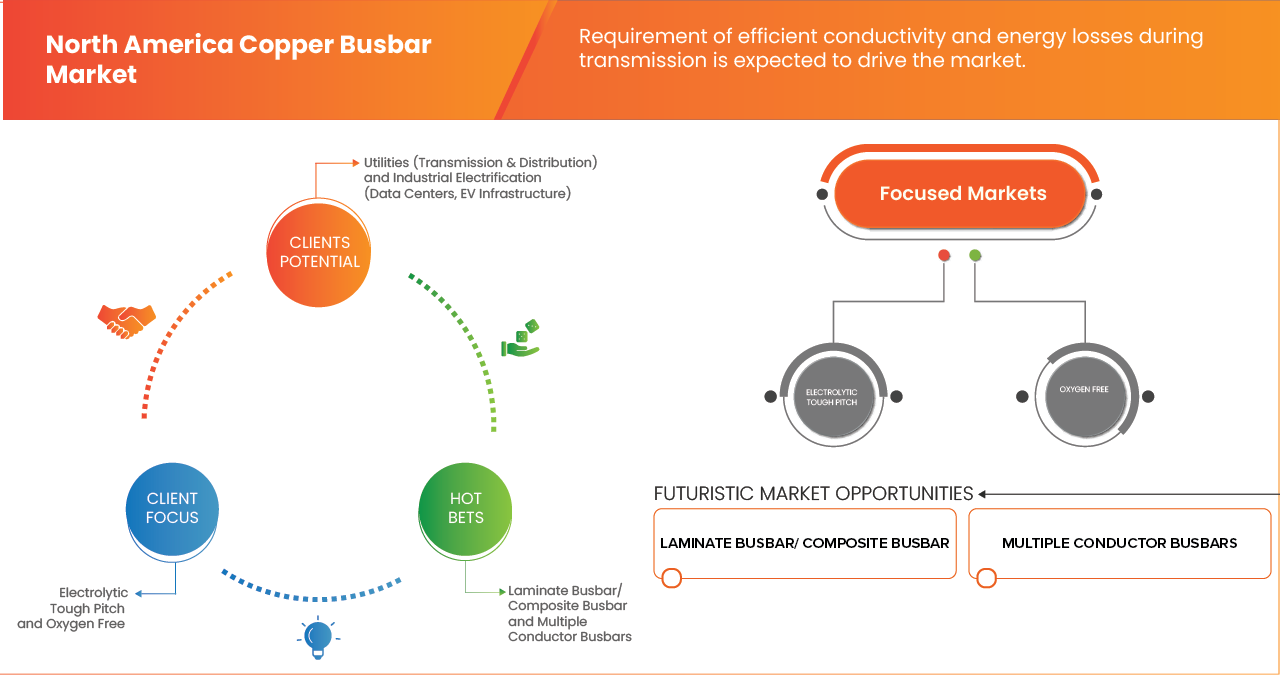

“Requisitos de condutividade eficiente e perdas de energia durante a transmissão”

- Há uma ampla utilização de aplicações de energia que dependem de barramentos para fornecer interfaces críticas entre os módulos de potência. Isso se mantém verdadeiro mesmo com a evolução dos setores de energia, motores, indústria e automotivo nas últimas décadas. Os módulos de potência usados para inversão ou conversão precisam se tornar mais eficientes à medida que as indústrias avançam rumo à eletrificação nos transportes, mobilidade e energias renováveis. O barramento de energia para entrada e saída do circuito inversor torna-se um elemento crítico que deve ser incorporado ao projeto geral do sistema para maximizar a eficiência.

- As barras de cobre são utilizadas em instalações elétricas para distribuir energia de um ponto de alimentação para diversos circuitos de saída. Elas podem ser usadas em uma variedade de configurações, desde colunas verticais, que levam corrente a cada andar de um edifício de vários andares, até barras utilizadas inteiramente dentro de um painel de distribuição ou em um processo industrial. A distribuição de energia baseada em sistemas de barras de cobre é utilizada em larga escala e tem sido cada vez mais aceita devido à sua flexibilidade, segurança e capacidade de reduzir os custos gerais de projeto e integração em sistemas industriais. Além disso, a globalização levou os engenheiros de controle industrial a escolherem técnicas de projeto, componentes elétricos e métodos de integração industrial em todo o mundo, baseados em sistemas de barras cada vez mais complexos.

- Os módulos de potência usados para inversão ou conversão precisam se tornar mais eficientes à medida que as indústrias avançam rumo à eletrificação nos setores de transporte, mobilidade e energia renovável. O fluxo de energia para dentro e para fora do circuito inversor torna-se um elemento crítico que deve ser incorporado ao projeto geral do sistema para maximizar a eficiência.

- Por exemplo, em janeiro de 2025, o Ministério de Recursos Naturais do Canadá publicou um comentário atualizado sobre o papel estratégico do cobre na eletrificação e na infraestrutura de energia limpa, observando que a transição energética deverá aumentar a demanda por cobre devido ao seu papel essencial nas redes elétricas e nos equipamentos associados.

- A condutividade eficiente e a minimização das perdas de energia durante a transmissão de energia são requisitos críticos, visto que as indústrias estão cada vez mais adotando a eletrificação nos setores de transporte, mobilidade e energias renováveis. As barras de cobre desempenham um papel fundamental na garantia de uma distribuição de energia confiável, devido à sua alta condutividade, flexibilidade, segurança e custo-benefício em sistemas industriais e comerciais. A crescente complexidade dos projetos de barras, impulsionada pela globalização e pela integração industrial avançada, ressalta sua importância estratégica.

Oportunidades

Adoção crescente da tecnologia de redes inteligentes

- A crescente adoção da tecnologia de redes inteligentes representa uma oportunidade de crescimento significativa para o mercado de barramentos de cobre na América do Norte. As redes inteligentes integram tecnologias avançadas de informação e comunicação em toda a geração, distribuição e consumo de eletricidade, otimizando a eficiência, reduzindo os impactos ambientais e aumentando a confiabilidade geral. O uso de barramentos de cobre nesses sistemas é essencial devido à condutividade elétrica superior, durabilidade e resistência à corrosão do cobre, tornando-o ideal para suportar altas correntes em redes de distribuição de energia.

- Componentes essenciais de redes inteligentes, como Infraestrutura Avançada de Medição (AMI), Resposta à Demanda (DR) e Veículos Elétricos Híbridos Plug-in (PHEV), dependem fortemente de barramentos de cobre de alto desempenho para uma transmissão de energia eficiente. Os sistemas AMI, que permitem a comunicação em tempo real entre consumidores e concessionárias, se beneficiam da confiabilidade do cobre para garantir um fluxo de energia consistente. À medida que as cidades inteligentes e as iniciativas de economia de energia se expandem, o papel dos barramentos de cobre no suporte a essas redes torna-se cada vez mais crucial.

- Por exemplo, em agosto de 2024, conforme relatado pela Synergy BV, o setor de energia dos EUA passou por uma grande transformação, impulsionada por metas de descarbonização e investimentos em energia renovável e modernização da rede. A energia solar em escala de utilidade pública, a energia eólica, o armazenamento em baterias e os recursos de energia distribuída atrás do medidor, como painéis solares em telhados e armazenamento residencial, expandiram-se. Espera-se que essa mudança impulsione a demanda por barramentos de cobre, essenciais para a distribuição eficiente de energia em sistemas de energia renovável.

- Com o incentivo à redução das emissões de gases de efeito estufa e à adoção de fontes de energia mais limpas, como eólica, solar e hidrelétrica, a tecnologia de redes inteligentes continuará a crescer. Esse crescimento impulsiona a demanda por barramentos de cobre em infraestrutura, apoiando não apenas a conservação de energia, mas também a futura eletrificação dos sistemas de transporte e aquecimento. Consequentemente, a crescente adoção de redes inteligentes deverá criar mais oportunidades no mercado de barramentos de cobre na América do Norte.

Restrições/ Desafios

Disponibilidade de produtos baratos e de baixa qualidade

- A crescente concorrência e a rigidez do mercado têm atraído muitos fabricantes e empresas que atuam no setor de barramentos de cobre. Muitos fabricantes têm desempenhado um papel importante no desenvolvimento desses produtos. Como resultado, houve uma constante degradação na qualidade do material. Os fabricantes estão produzindo produtos de baixa qualidade com menor necessidade de matéria-prima básica. As empresas estão investindo pesadamente na fabricação de produtos com materiais de baixa qualidade e matérias-primas baratas, o que reduziu a oferta geral e, consequentemente, o custo de produção.

- Por exemplo, em julho de 2025, um artigo publicado no Supply Chain Connect afirmou que comentários do setor sobre a cadeia de suprimentos apontavam que as equipes de compras continuavam a se deparar com componentes falsificados ou de baixa qualidade, declarando que “peças falsificadas e conformes continuam a inundar o mercado”.

- A crescente disponibilidade de barras de cobre baratas e de baixa qualidade tornou-se um desafio significativo para o mercado. A intensa concorrência e a entrada de inúmeros fabricantes levaram a uma queda nos padrões de qualidade dos produtos, já que algumas empresas priorizam a redução de custos em detrimento da qualidade, utilizando matérias-primas inferiores e processos de produção simplificados.

Escopo do mercado de barramentos de cobre na América do Norte

O mercado de barramentos de cobre na América do Norte é segmentado em oito segmentos principais com base no tipo, potência nominal, tipo de produto, revestimento, isolamento, comprimento, usuário final e canal de vendas.

• Por tipo

Com base no tipo, o mercado de barramentos de cobre na América do Norte é segmentado em cobre eletrolítico de alta resistência, cobre isento de oxigênio e cobre DHP/DLP. Em 2025, espera-se que o segmento de cobre eletrolítico de alta resistência domine o mercado de barramentos de cobre na América do Norte, com uma participação de 50,28%, devido à sua condutividade elétrica superior, durabilidade e custo-benefício.

O segmento de cobre eletrolítico de alta resistência no mercado de barramentos de cobre da América do Norte deverá crescer a uma taxa composta de crescimento anual (CAGR) de 6,6% no período de previsão de 2025 a 2032, devido à expansão da infraestrutura de redes inteligentes e energias renováveis.

• Por classificação de potência

Com base na potência nominal, o mercado de barramentos de cobre na América do Norte é segmentado em baixa potência, média potência (125 A a 800 A) e alta potência (acima de 800 A). Em 2025, espera-se que o segmento de baixa potência domine o mercado de barramentos de cobre na América do Norte, com uma participação de 47,60%, devido à sua capacidade de oferecer vantagens como menor necessidade de espaço e instalação mais fácil em comparação com os sistemas de fiação tradicionais.

O segmento de baixa potência do mercado de barramentos de cobre na América do Norte deverá crescer a uma taxa composta de crescimento anual (CAGR) de 6,6% no período de previsão de 2025 a 2032, devido à crescente demanda por soluções de distribuição de energia eficientes e compactas em aplicações residenciais, comerciais e industriais leves.

• Por tipo de produto

Com base no tipo de produto, o mercado de barramentos de cobre na América do Norte é segmentado em barramentos laminados/compósitos, barramentos com múltiplos condutores, barramentos flexíveis e barramentos com um único condutor. Em 2025, espera-se que o segmento de barramentos laminados/compósitos domine o mercado de barramentos de cobre na América do Norte, com uma participação de 48,90%, devido às suas vantagens superiores em relação aos barramentos tradicionais. Os barramentos laminados oferecem atributos de desempenho aprimorados, como excelente resistência à corrosão, alta tolerância à temperatura e condutividade elétrica excepcional, o que os torna altamente confiáveis e eficientes para distribuição de energia.

O segmento de barramentos laminados/compósitos no mercado de barramentos de cobre da América do Norte deverá crescer a uma taxa composta de crescimento anual (CAGR) de 6,6% no período de previsão de 2025 a 2032, devido às suas vantagens em eficiência energética, design leve e desempenho térmico e elétrico superior.

• Por revestimento

Com base no revestimento, o mercado de barramentos de cobre na América do Norte é segmentado em estanho, níquel e prata. Em 2025, espera-se que o segmento de estanho domine o mercado de barramentos de cobre na América do Norte, com uma participação de 47,24%, devido à sua capacidade de oferecer excelente resistência à corrosão e aumentar a condutividade superficial dos barramentos de cobre.

O segmento de estanho no mercado de barramentos de cobre da América do Norte deverá crescer a uma taxa composta de crescimento anual (CAGR) de 6,7% no período de previsão de 2025 a 2032, devido à sua excelente combinação de resistência à corrosão, condutividade elétrica e estabilidade térmica.

• Por isolamento

Com base no isolamento, o mercado de barramentos de cobre na América do Norte é segmentado em revestimento em pó epóxi, PET, PA12, PVC e PE. Em 2025, espera-se que o segmento de revestimento em pó epóxi domine o mercado de barramentos de cobre na América do Norte, com uma participação de 40,80%, devido à crescente adoção de sistemas de energia renovável, ao aumento da automação industrial e à expansão da infraestrutura para veículos elétricos.

O segmento de revestimento em pó epóxi no mercado de barramentos de cobre na América do Norte deverá crescer a uma taxa composta de crescimento anual (CAGR) de 6,8% no período de previsão de 2025 a 2032, devido à crescente demanda por isolamento elétrico superior, resistência à corrosão e resistência mecânica que os revestimentos em pó epóxi proporcionam aos barramentos de cobre.

• Por comprimento

Com base no comprimento, o mercado de barramentos de cobre na América do Norte é segmentado em menos de 1 m, de 1 m a 2 m, de 2 m a 3 m e mais de 3 m. Em 2025, espera-se que o segmento de 1 m a 2 m domine o mercado de barramentos de cobre na América do Norte, com uma participação de 42,52%, devido ao seu equilíbrio ideal entre tamanho, capacidade e versatilidade.

O segmento de 1m a 2m do mercado de barramentos de cobre na América do Norte deverá crescer a uma taxa composta de crescimento anual (CAGR) de 6,9% no período de previsão de 2025 a 2032, devido à crescente demanda por barramentos de cobre padronizados e versáteis que se adaptem a uma ampla gama de aplicações industriais e comerciais.

• Pelo usuário final

Com base no usuário final, o mercado de barramentos de cobre na América do Norte é segmentado em concessionárias de transmissão e distribuição, indústria, comércio e setor residencial. Em 2025, espera-se que o segmento de concessionárias de transmissão e distribuição domine o mercado de barramentos de cobre na América do Norte, com uma participação de 40,48%, devido ao seu papel fundamental na modernização e expansão da infraestrutura da rede elétrica.

O segmento de serviços públicos de transmissão e distribuição no mercado de barramentos de cobre na América do Norte deverá crescer a uma taxa composta de crescimento anual (CAGR) de 6,9% no período de previsão de 2025 a 2032, devido à crescente adoção de fontes de energia renováveis, como a energia eólica e solar.

- Por canal de vendas

Com base no canal de vendas, o mercado de barramentos de cobre na América do Norte é segmentado em canal direto e canal indireto. Em 2025, espera-se que o segmento de canal direto domine o mercado de barramentos de cobre na América do Norte, com uma participação de 74,30%, devido à redução de intermediários, à otimização da eficiência de custos, à melhoria da confiabilidade da cadeia de suprimentos e à garantia de entregas pontuais.

O segmento de revestimento direto de canais no mercado de barramentos de cobre da América do Norte deverá crescer a uma taxa composta de crescimento anual (CAGR) de 6,3% no período de previsão de 2025 a 2032, devido à sua eficiência e conveniência na distribuição de barramentos de cobre revestidos diretamente dos fabricantes ou fornecedores para os usuários finais.

Análise Regional do Mercado de Barramentos de Cobre na América do Norte

- O mercado de barramentos de cobre na América do Norte é composto pelos Estados Unidos, Canadá e México. Os Estados Unidos são o país com o crescimento mais expressivo nesse mercado.

- A necessidade de condutividade eficiente e de minimização das perdas de energia durante a transmissão, as vantagens operacionais e de custo das barras de cobre, o foco crescente na eficiência energética com preferência por barras em detrimento de cabos, e a demanda crescente por eletricidade nos setores residencial, comercial e industrial estão impulsionando o crescimento do mercado.

Análise do Mercado de Barramentos de Cobre nos EUA e na América do Norte

Prevê-se que o mercado nos EUA cresça a uma taxa composta de crescimento anual (CAGR) substancial de 6,6%. A procura por barramentos de cobre nos EUA está a aumentar principalmente devido à crescente necessidade de sistemas de distribuição de energia eficientes, seguros e compactos em vários setores, incluindo aplicações comerciais, industriais e de serviços públicos.

Análise do Mercado de Barramentos de Cobre no Canadá e na América do Norte

Prevê-se que o mercado no Canadá cresça a uma taxa composta de crescimento anual (CAGR) substancial de 5,5%. A procura por barramentos de cobre no Canadá está a aumentar devido a vários fatores-chave. Principalmente, o crescente foco em projetos de energias renováveis, incluindo parques solares e eólicos, exige sistemas de distribuição de energia eficientes e fiáveis, nos quais os barramentos de cobre são essenciais devido à sua condutividade e durabilidade superiores.

Análise do Mercado de Barramentos de Cobre México-América do Norte

Prevê-se que o mercado no México cresça a uma taxa composta de crescimento anual (CAGR) substancial de 5,0%. A procura por barramentos de cobre no México está a aumentar principalmente devido à crescente necessidade de sistemas de distribuição de energia elétrica fiáveis e eficientes em vários setores, como o industrial, o comercial e o residencial.

Participação de mercado de barramentos de cobre na América do Norte

O mercado de barramentos de cobre na América do Norte é liderado principalmente por empresas consolidadas, incluindo:

- Elementos Americanos (EUA)

- FPS América (EUA)

- Watteredge LLC (EUA)

- Zhejiang RHI Electric Co., Ltd (China)

- Fanshun Machinery (China)

- Hubbell (EUA)

- (EUA)

- CAPLINQ Corporation (Países Baixos)

- Siemens (Alemanha)

- Mersen Property (França)

- ABB (Suíça)

- EG Electronics (EUA)

- Legrand (França)

- Eaton (EUA)

- AMETEK, Inc. (EUA)

- Ennovi Holdings Pte. Ltd. (Interplex Holdings) (Singapura)

- Schneider Electric (França)

- Rogers Corporation (EUA)

- Rittal GmbH & Co. KG (Alemanha)

- Amphenol Corporation (EUA)

- MOLEX LLC (EUA)

Últimos desenvolvimentos no mercado de barramentos de cobre na América do Norte

- Em março de 2022, a Amphenol Corporation anunciou o lançamento de um conector de barramento de 3,00 mm de alta potência e baixa resistência. O conector é utilizado em um sistema de guia integrado. Ele garante resistência de contato ultrabaixa e eficiência energética geral aprimorada. Isso ajudará a empresa a expandir seu portfólio de produtos com soluções aprimoradas para os clientes.

- Em agosto de 2025, a Amphenol Corporation anunciou um acordo definitivo para adquirir a Trexon por aproximadamente US$ 1 bilhão em dinheiro, visando fornecer soluções adicionais de alta tecnologia aos clientes.

- Em maio de 2025, a Lenze e a Rittal firmaram uma parceria tecnológica para trabalharem juntas na definição do futuro da distribuição de energia e da tecnologia de acionamento. A combinação da plataforma RiLineX, o novo padrão para sistemas de barramento, com os inversores compactos líderes de mercado da Lenze fornece a base para essa parceria.

- Em fevereiro de 2022, a Rittal GmbH & Co. KG foi premiada pelos leitores da LANline como "Fornecedor do Ano de 2021". Esta foi a quinta vez que a empresa recebeu o prêmio, que visa promover seu portfólio de produtos para impulsionar as vendas no mercado de barramentos de cobre.

- Em agosto de 2025, a Amphenol Corporation anunciou um acordo definitivo para adquirir a Trexon por aproximadamente US$ 1 bilhão em dinheiro, visando fornecer soluções adicionais de alta tecnologia aos clientes.

- Em maio de 2025, a Eaton anunciou a expansão de suas instalações em Orchard Park, Nova York, para atender à crescente demanda por soluções de sistemas de missão aeroespacial fabricadas no local. O investimento de US$ 18,5 milhões aumentará significativamente a capacidade de produção para atender à crescente demanda de clientes dos setores militar, aeroespacial comercial e espacial.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA COPPER BUSBAR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCE ANALYSIS

4.2 REGULATORY FRAMEWORK

4.3 VALUE CHAIN ANALYSIS

4.4 COMPANY COMPARATIVE ANALYSIS

4.5 IMPORT-EXPORT DATA

4.6 PATENT ANALYSIS

4.7 TECHNOLOGICAL TRENDS

4.8 IMPORT-EXPORT DATA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 REQUIREMENT OF EFFICIENT CONDUCTIVITY AND ENERGY LOSSES DURING TRANSMISSION

5.1.2 COST & OPERATIONAL ADVANTAGES OF COPPER BUSBARS

5.1.3 INCREASING FOCUS ON ENERGY EFFICIENCY WITH PREFERENCE FOR BUSBARS OVER CABLES

5.1.4 RISING DEMAND FOR ELECTRICITY ACROSS RESIDENTIAL, COMMERCIAL, AND INDUSTRIAL SECTOR

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF CHEAP AND LOW QUALITY PRODUCTS

5.2.2 FLUCTUATION IN RAW MATERIAL PRICES

5.3 OPPORTUNITY

5.3.1 RISING ADOPTION OF SMART GRID TECHNOLOGY

5.3.2 GROWTH IN SWITCHGEAR AND ENERGY & POWER MARKET

5.3.3 GROWING ADOPTION OF BUSBARS IN ELECTRIC VEHICLES

5.4 CHALLENGES

5.4.1 HIGH COST INVOLVED IN THE MANUFACTURING SETUP

5.4.2 AVAILABILITY OF ALTERNATIVE MATERIALS, SUCH AS ALUMINUM

6 NORTH AMERICA COPPER BUSBAR MARKET, BY TYPE

6.1 OVERVIEW

6.2 ELECTROLYTIC TOUGH PITCH

6.3 OXYGEN FREE

6.4 DHP / DLP

7 NORTH AMERICA COPPER BUSBAR MARKET, BY POWER RATING

7.1 OVERVIEW

7.2 LOW POWER

7.2.1 LOW POWER, BY TYPE

7.2.1.1 40 TO 60 AMP

7.2.1.2 60 AMP TO 100 AMP

7.2.1.3 100 AMP TO 125 AMP

7.2.1.4 LESS THAN 40 AMP

7.2.2 LOW POWER, BY END USER

7.2.2.1 TRANSMISSION & DISTRIBUTION UTILITIES

7.2.2.2 INDUSTRIAL

7.2.2.3 COMMERCIAL

7.2.2.4 RESIDENTIAL

7.3 MEDIUM POWER (125 A-800 A)

7.3.1 MEDIUM POWER (125 A-800 A), BY TYPE

7.3.1.1 125 AMP TO 200 AMP

7.3.1.2 200 AMP TO 400 AMP

7.3.1.3 400 AMP TO 800 AMP

7.3.2 MEDIUM POWER (125 A-800 A), BY END USER

7.3.2.1 TRANSMISSION & DISTRIBUTION UTILITIES

7.3.2.2 INDUSTRIAL

7.3.2.3 COMMERCIAL

7.3.2.4 RESIDENTIAL

7.4 HIGH POWER (ABOVE 800 A)

7.4.1 HIGH POWER (ABOVE 800 A), BY TYPE

7.4.1.1 800 AMP TO 1,000 AMP

7.4.1.2 1,000 AMP TO 1200 AMP

7.4.2 HIGH POWER (ABOVE 800 A), BY END USER

7.4.2.1 TRANSMISSION & DISTRIBUTION UTILITIES

7.4.2.2 INDUSTRIAL

7.4.2.3 COMMERCIAL

7.4.2.4 RESIDENTIAL

8 NORTH AMERICA COPPER BUSBAR MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 LAMINATE BUSBAR/ COMPOSITE BUSBAR

8.3 MULTIPLE CONDUCTOR BUSBARS

8.4 FLEXIBLE BUSBARS

8.5 SINGLE CONDUCTOR BUSBARS

9 NORTH AMERICA COPPER BUSBAR MARKET, BY PLATING

9.1 OVERVIEW

9.2 TIN

9.3 NICKEL

9.4 SILVER

10 NORTH AMERICA COPPER BUSBAR MARKET, BY INSULATION

10.1 OVERVIEW

10.2 EPOXY POWDER COATING

10.3 PET

10.4 PA12

10.5 PVC

10.6 PE

11 NORTH AMERICA COPPER BUSBAR MARKET, BY LENGTH

11.1 OVERVIEW

11.2 1M TO 2 MT

11.3 2 MT TO 3 MT

11.4 MORE THAN 3 MT

11.5 LESS THAN 1MT

12 NORTH AMERICA COPPER BUSBAR MARKET, BY END USER

12.1 OVERVIEW

12.2 TRANSMISSION & DISTRIBUTION UTILITIES

12.2.1 BY TYPE

12.2.1.1 RENEWABLE ENERGY

12.2.1.1.1 HYDROELECTRIC POWER

12.2.1.1.2 SOLAR ENERGY

12.2.1.1.3 WIND POWER

12.2.1.1.4 BIOENERGY

12.2.1.1.5 GEOTHERMAL ENERGY

12.2.1.2 SMART GRID

12.2.1.3 MICRO-GRIDS

12.2.1.4 OTHERS

12.2.2 BY CONDUCTOR

12.2.2.1 COPPER

12.2.2.2 ALUMINUM

12.3 INDUSTRIAL

12.3.1 BY TYPE

12.3.1.1 ELECTRIC/HYBRID ELECTRIC VEHICLES (EV/HEV)

12.3.1.1.1 CHARGING STATION

12.3.1.1.2 ELECTRIC CAR BATTERY PACK

12.3.1.1.3 EBUSES

12.3.1.1.4 ETRUCK

12.3.1.1.5 ELECTRIC FORKLIFT

12.3.1.1.6 OTHERS

12.3.1.2 FOOD AND BEVERAGES

12.3.1.3 LOGISTICS

12.3.1.4 TELECOMMUNICATION

12.3.1.5 RAILWAY

12.3.1.6 CHEMICAL

12.3.1.7 OIL AND GAS

12.3.1.8 MINING

12.3.1.9 DATA CENTER

12.3.1.10 OTHERS

12.3.2 BY CONDUCTOR

12.3.2.1 COPPER

12.3.2.2 ALUMINUM

12.4 COMMERCIAL

12.4.1 BY TYPE

12.4.1.1 OFFICES

12.4.1.2 HOSPITALITY

12.4.1.3 RETAILS AND SHOPPING MALLS

12.4.1.4 EDUCATION

12.4.1.5 RECREATIONAL FACILITIES

12.4.1.6 OTHERS

12.4.2 BY CONDUCTOR

12.4.2.1 COPPER

12.4.2.2 ALUMINUM

12.5 RESIDENTIAL SECTOR

12.5.1 COPPER

12.5.2 ALUMINUM

13 NORTH AMERICA COPPER BUSBAR MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 DIRECT CHANNEL

13.3 INDIRECT CHANNEL

14 NORTH AMERICA COPPER BUSBAR MARKET BY COUNTRIES

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA COPPER BUSBAR MARKET

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 RITTAL GMBH & CO. KG

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENTS

17.2 AMPHENOL CORPORATION

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 EATON

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 LEGRAND

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 AMETEK. INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 AMERICAN ELEMENTS

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ABB

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 CAPLINQ CORPORATION

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 EG ELECTRONICS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 ENNOVI HOLDINGS PTE. LTD.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 FANSHUN MACHINERY

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 HUBBELL

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 LANTRIC TECHNOLOGIES INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 MERSEN PROPERTY

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 METINFO INC.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 MOLEX, LLC

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 ROGERS CORPORATION

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 SCHNEIDER ELECTRIC

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTSS

17.19 SIEMENS

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 SPF AMERICA

17.20.1 COMPANY SNAPSHOT

17.20.2 SERVICE PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 WATTEREDGE, LLC

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 EXPORT DATA FOR NORTH AMERICA COPPER BUSBAR MARKET

TABLE 2 IMPORT DATA FOR NORTH AMERICA COPPER BUSBAR MARKET

TABLE 3 EXPORT DATA FOR NORTH AMERICA COPPER BUSBAR MARKET

TABLE 4 IMPORT DATA FOR NORTH AMERICA COPPER BUSBAR MARKET

TABLE 5 NORTH AMERICA COPPER BUSBAR MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA COPPER BUSBAR MARKET, BY POWER RATING, 2022-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA LOW POWER IN COPPER BUSBAR MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA LOW POWER IN COPPER BUSBAR MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA MEDIUM POWER (125 A-800 A) IN COPPER BUSBAR MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA MEDIUM POWER (125 A-800 A) IN COPPER BUSBAR MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA HIGH POWER (ABOVE 800 A) IN COPPER BUSBAR MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA HIGH POWER (ABOVE 800 A) IN COPPER BUSBAR MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA COPPER BUSBAR MARKET, BY PRODUCT TYPE, 2022-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA COPPER BUSBAR MARKET, BY PLATING, 2022-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA COPPER BUSBAR MARKET, BY INSULATION, 2022-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA COPPER BUSBAR MARKET, BY LENGTH, 2022-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA COPPER BUSBAR MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA TRANSMISSION & DISTRIBUTION UTILITIES IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA RENEWABLE ENERGY IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA TRANSMISSION & DISTRIBUTION UTILITIES IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA INDUSTRIAL IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA ELECTRIC/HYBRID ELECTRIC VEHICLES (EV/HEV) IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA INDUSTRIAL IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA COMMERCIAL IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA COMMERCIAL IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA RESIDENTIAL IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA COPPER BUSBAR MARKET, BY SALES CHANNEL, 2022-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA COPPER BUSBAR MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 29 U.S. COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 U.S. COPPER BUSBAR MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 31 U.S. LOW POWER IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 U.S. LOW POWER IN COPPER BUSBAR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 33 U.S. MEDIUM POWER (125 A-800 A) IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 U.S. MEDIUM POWER (125 A-800 A) IN COPPER BUSBAR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 35 U.S. HIGH POWER (ABOVE 800 A) IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 U.S. HIGH POWER (ABOVE 800 A) IN COPPER BUSBAR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 37 U.S. COPPER BUSBAR MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 U.S. COPPER BUSBAR MARKET, BY PLATING, 2018-2032 (USD THOUSAND)

TABLE 39 U.S. COPPER BUSBAR MARKET, BY INSULATION, 2018-2032 (USD THOUSAND)

TABLE 40 U.S. COPPER BUSBAR MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 41 U.S. COPPER BUSBAR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 42 U.S. TRANSMISSION & DISTRIBUTION UTILITIES IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. RENEWABLE ENERGY IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 U.S. TRANSMISSION & DISTRIBUTION UTILITIES IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. INDUSTRIAL IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. ELECTRIC/HYBRID ELECTRIC VEHICLES (EV/HEV) IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. INDUSTRIAL IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. COMMERCIAL IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 U.S. COMMERCIAL IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 50 U.S. RESIDENTIAL SECTOR IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. COPPER BUSBAR MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 52 CANADA COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 CANADA COPPER BUSBAR MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 54 CANADA LOW POWER IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 CANADA LOW POWER IN COPPER BUSBAR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 56 CANADA MEDIUM POWER (125 A-800 A) IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 CANADA MEDIUM POWER (125 A-800 A) IN COPPER BUSBAR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 58 CANADA HIGH POWER (ABOVE 800 A) IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 CANADA HIGH POWER (ABOVE 800 A) IN COPPER BUSBAR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 60 CANADA COPPER BUSBAR MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 CANADA COPPER BUSBAR MARKET, BY PLATING, 2018-2032 (USD THOUSAND)

TABLE 62 CANADA COPPER BUSBAR MARKET, BY INSULATION, 2018-2032 (USD THOUSAND)

TABLE 63 CANADA COPPER BUSBAR MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA COPPER BUSBAR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA TRANSMISSION & DISTRIBUTION UTILITIES IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 CANADA RENEWABLE ENERGY IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 CANADA TRANSMISSION & DISTRIBUTION UTILITIES IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 68 CANADA INDUSTRIAL IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 CANADA ELECTRIC/HYBRID ELECTRIC VEHICLES (EV/HEV) IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 CANADA INDUSTRIAL IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 71 CANADA COMMERCIAL IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 CANADA COMMERCIAL IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 73 CANADA RESIDENTIAL SECTOR IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 74 CANADA COPPER BUSBAR MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 75 MEXICO COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MEXICO COPPER BUSBAR MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 77 MEXICO LOW POWER IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 MEXICO LOW POWER IN COPPER BUSBAR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 79 MEXICO MEDIUM POWER (125 A-800 A) IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MEXICO MEDIUM POWER (125 A-800 A) IN COPPER BUSBAR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 81 MEXICO HIGH POWER (ABOVE 800 A) IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 MEXICO HIGH POWER (ABOVE 800 A) IN COPPER BUSBAR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 83 MEXICO COPPER BUSBAR MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 MEXICO COPPER BUSBAR MARKET, BY PLATING, 2018-2032 (USD THOUSAND)

TABLE 85 MEXICO COPPER BUSBAR MARKET, BY INSULATION, 2018-2032 (USD THOUSAND)

TABLE 86 MEXICO COPPER BUSBAR MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 87 MEXICO COPPER BUSBAR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 88 MEXICO TRANSMISSION & DISTRIBUTION UTILITIES IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MEXICO RENEWABLE ENERGY IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MEXICO TRANSMISSION & DISTRIBUTION UTILITIES IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 91 MEXICO INDUSTRIAL IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 MEXICO ELECTRIC/HYBRID ELECTRIC VEHICLES (EV/HEV) IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MEXICO INDUSTRIAL IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 94 MEXICO COMMERCIAL IN COPPER BUSBAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MEXICO COMMERCIAL IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 96 MEXICO RESIDENTIAL SECTOR IN COPPER BUSBAR MARKET, BY CONDUCTOR, 2018-2032 (USD THOUSAND)

TABLE 97 MEXICO COPPER BUSBAR MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 NORTH AMERICA COPPER BUSBAR MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COPPER BUSBAR MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COPPER BUSBAR MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COPPER BUSBAR MARKET: NORTH AMERICA VS REGIONS MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COPPER BUSBAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COPPER BUSBAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA COPPER BUSBAR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA COPPER BUSBAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA COPPER BUSBAR MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA COPPER BUSBAR MARKET: SEGMENTATION

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 THREE SEGMENTS COMPRISE THE NORTH AMERICA COPPER BUSBAR MARKET, BY TYPE

FIGURE 13 RISING ADOPTION OF SMART GRID TECHNOLOGY IS EXPECTED TO DRIVE THE NORTH AMERICA COPPER BUSBAR MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 ELECTROLYTIC TOUGH PITCH IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COPPER BUSBAR MARKET IN 2024 & 2032

FIGURE 15 VALUE CHAIN FOR NORTH AMERICA COPPER BUSBAR MARKET

FIGURE 16 COMPANY COMPARISON

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA COPPER BUSBAR MARKET

FIGURE 18 INDUSTRIAL ENERGY CONSUMPTION

FIGURE 19 COPPER PRICE

FIGURE 20 COMMODITY DEMAND CHANGE-100% EV

FIGURE 21 NORTH AMERICA COPPER BUSBAR MARKET: BY TYPE, 2024

FIGURE 22 NORTH AMERICA COPPER BUSBAR MARKET: BY POWER RATING, 2024

FIGURE 23 NORTH AMERICA COPPER BUSBAR MARKET: BY PRODUCT TYPE, 2024

FIGURE 24 NORTH AMERICA COPPER BUSBAR MARKET: BY PLATING, 2024

FIGURE 25 NORTH AMERICA COPPER BUSBAR MARKET: BY INSULATION, 2024

FIGURE 26 NORTH AMERICA COPPER BUSBAR MARKET: BY LENGTH, 2024

FIGURE 27 NORTH AMERICA COPPER BUSBAR MARKET: BY END USER, 2024

FIGURE 28 NORTH AMERICA COPPER BUSBAR MARKET: BY SALES CHANNEL 2024

FIGURE 29 NORTH AMERICA COPPER BUSBAR MARKET SNAPSHOT

FIGURE 30 NORTH AMERICA COPPER BUSBAR MARKET: COMPANY SHARE 2023 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.