North America Compressed Natural Gas Cng Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

16.32 Billion

USD

21.16 Billion

2024

2032

USD

16.32 Billion

USD

21.16 Billion

2024

2032

| 2025 –2032 | |

| USD 16.32 Billion | |

| USD 21.16 Billion | |

|

|

|

|

Segmentação do mercado de gás natural comprimido (GNC) da América do Norte, por fonte (gás associado e gás não associado), kits (sequenciais e Venturi), tipo de distribuição (cilindros/tanques, acumuladores, coletores compostos e outros), uso final (veículos leves, médios e pesados) – Tendências e previsões do setor até 2032.

Tamanho do mercado de gás natural comprimido (GNC) na América do Norte

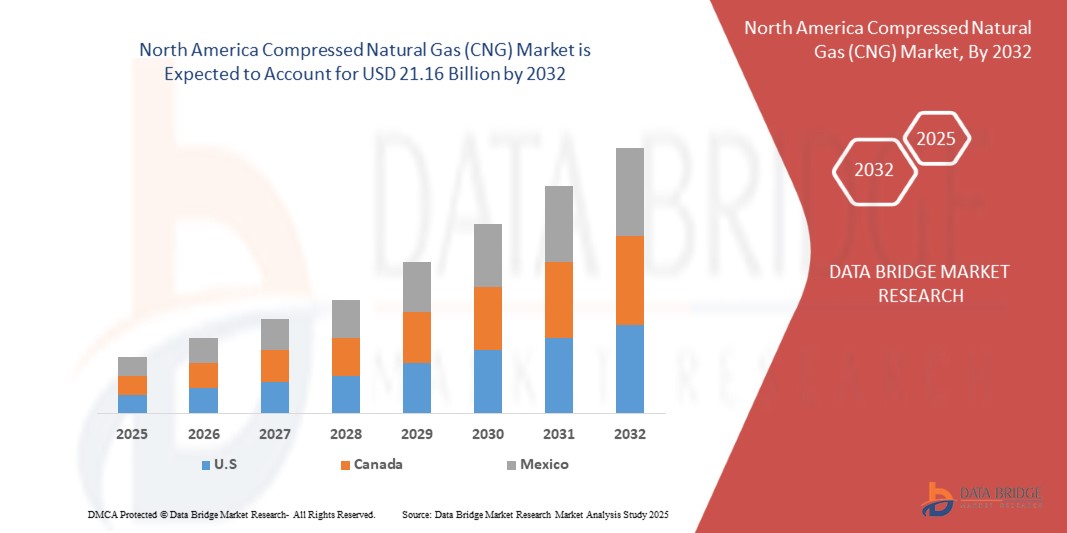

- O mercado de gás natural comprimido (GNC) da América do Norte foi avaliado em US$ 16,32 bilhões em 2024 e deverá atingir US$ 21,16 bilhões até 2032 , crescendo a um CAGR de 3,30% durante o período previsto.

- O crescimento está sendo impulsionado pela crescente demanda por combustíveis de transporte mais limpos, subsídios governamentais para veículos movidos a gás natural (GNVs) e expansão da infraestrutura de reabastecimento de gás natural comprimido nos EUA e Canadá.

- A crescente adoção de veículos movidos a gás natural comprimido em frotas, especialmente em logística, transporte público e serviços de transporte por aplicativo, está aumentando ainda mais a demanda

- O apoio regulatório, incluindo mandatos para veículos de baixa emissão e metas de redução de carbono, fortalece o argumento a favor do gás natural comprimido em detrimento da gasolina e do diesel

- Espera-se que a presença de reservas de gás natural em grande escala e os investimentos contínuos na integração de gás natural renovável (GNR) apoiem significativamente o crescimento a longo prazo

Análise do mercado de gás natural comprimido (GNC) na América do Norte

- O mercado de gás natural comprimido da América do Norte está testemunhando uma forte adoção devido às vantagens econômicas, já que o combustível de gás natural comprimido é geralmente 30–40% mais barato do que a gasolina ou o diesel na região

- Aplicações pesadas, como ônibus, caminhões de longo curso e frotas municipais, representam os segmentos de crescimento mais promissores

- A competição de mercado está se intensificando com empresas de energia, OEMs automotivos e fornecedores de RNG colaborando para expandir a disponibilidade e a confiabilidade das soluções de gás natural comprimido

- Os EUA detêm a maior fatia de 69,32% do mercado de gás natural comprimido da América do Norte, alimentado por suas vastas reservas de gás de xisto, infraestrutura bem desenvolvida e fortes iniciativas governamentais para promover combustíveis alternativos.

- O México está emergindo como um mercado de rápido crescimento com um CAGR de 12,02% na América do Norte, em grande parte impulsionado pelo esforço do governo para diversificar as fontes de combustível e reduzir a dependência de gasolina e diesel importados.

- O segmento de gás não associado dominou o mercado com a maior participação de receita de 57,8% em 2024, impulsionado por sua ampla disponibilidade, eficiência de custos e adequação para aplicações de energia e combustível em larga escala

Escopo do relatório e segmentação do mercado de gás natural comprimido (GNC) na América do Norte

|

Atributos |

Principais insights do mercado de gás natural comprimido (GNC) na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise das Cinco Forças de Porter e estrutura regulatória. |

Tendências do mercado de gás natural comprimido (GNC) na América do Norte

Adoção crescente de veículos movidos a GNC impulsionada pela expansão da infraestrutura

- Uma tendência importante que molda o mercado de gás natural comprimido na América do Norte é a crescente implantação de postos de abastecimento de gás natural comprimido públicos e privados, aumentando significativamente a acessibilidade e a conveniência do gás natural comprimido como combustível para transporte.

- Por exemplo, nos EUA, várias empresas de energia estão a fazer parcerias com fornecedores de logística para estabelecer corredores de postos de abastecimento de gás natural comprimido ao longo das principais auto-estradas interestaduais, reduzindo a ansiedade de autonomia dos operadores de frotas.

- Os avanços tecnológicos em cilindros de armazenamento compostos leves estão aumentando a capacidade de armazenamento de combustível, ao mesmo tempo que melhoram o desempenho do veículo e reduzem o peso geral

- Outra tendência é a integração do gás natural renovável (GNR) com o gás natural comprimido convencional, permitindo que o setor de transporte reduza ainda mais as emissões de gases com efeito de estufa do ciclo de vida.

- Os fabricantes de equipamentos originais (OEMs) automotivos estão expandindo suas ofertas dedicadas de veículos movidos a gás natural comprimido, enquanto os kits de retrofit pós-venda estão se tornando cada vez mais avançados, confiáveis e econômicos.

- A narrativa da eletrificação da frota também está influenciando o mercado de gás natural comprimido, com muitos governos promovendo modelos híbridos de combustível duplo que combinam gás natural comprimido com sistemas de transmissão elétricos, tornando a mudança em direção à sustentabilidade mais flexível

- Coletivamente, esses avanços estão impulsionando a percepção do gás natural comprimido como um combustível de transição na transição da América do Norte em direção a sistemas de transporte com emissões líquidas zero.

Dinâmica do mercado de gás natural comprimido (GNC) na América do Norte

Motorista

Apoio governamental e foco crescente na redução de emissões

- O aumento das iniciativas governamentais, subsídios e estruturas políticas destinadas a reduzir a dependência de combustíveis fósseis convencionais e minimizar as pegadas de carbono são um fator-chave para o mercado de gás natural comprimido na América do Norte.

- Por exemplo, as políticas regulatórias nos EUA e no Canadá estão a oferecer incentivos fiscais para a adopção de gás natural comprimido, incentivando tanto a produção OEM como a conversão de frotas para veículos a gás natural.

- Os veículos movidos a gás natural comprimido emitem 20 a 30% menos gases de efeito estufa em comparação com o diesel, o que os torna altamente atrativos para atingir as metas de sustentabilidade corporativa.

- A crescente acessibilidade do gás natural em comparação com os combustíveis à base de petróleo está aumentando ainda mais a competitividade de custos, incentivando a logística, o transporte público e os operadores de frotas privadas a fazer a transição para veículos movidos a gás natural comprimido.

- A expansão da infraestrutura, aliada a fortes parcerias entre provedores de serviços públicos, operadores de frotas e inovadores em tecnologia, está acelerando a adoção em diversas categorias de veículos

Restrição/Desafio

Lacunas de infraestrutura e altos custos iniciais de conversão

- Apesar da rápida expansão, a infraestrutura limitada de abastecimento de gás natural comprimido em certas regiões da América do Norte continua sendo uma grande barreira, restringindo a adoção de longa distância fora de aglomerados urbanos ou industriais.

- O alto custo inicial de veículos movidos a gás natural comprimido e kits de adaptação, em comparação aos veículos convencionais, cria hesitação entre consumidores individuais e operadores de pequenas frotas.

- Os desafios contínuos em torno da manutenção do sistema de armazenamento, substituição de cilindros e regulamentações de segurança aumentam as despesas operacionais, especialmente em frotas comerciais

- Incentivos governamentais inconsistentes entre estados e províncias levam a uma adoção fragmentada no mercado, com algumas áreas apresentando uma penetração mais rápida, enquanto outras ficam para trás

- A concorrência de alternativas emergentes, como veículos elétricos e veículos movidos a células de combustível de hidrogênio, também é um desafio, já que as empresas avaliam investimentos de longo prazo em gás natural comprimido em comparação com outras tecnologias de combustível limpo.

- A superação destes obstáculos exige o desenvolvimento de infra-estruturas estratégicas, a normalização tecnológica e os incentivos financeiros, que desempenharão um papel fundamental na sustentação do impulso do mercado.

Escopo do mercado de gás natural comprimido (GNC) na América do Norte

O mercado é segmentado com base na fonte, kit, tipo de distribuição e usuário final.

• Por fonte

Com base na fonte, o mercado é segmentado em gás associado e gás não associado. O segmento de gás não associado dominou o mercado, com a maior participação na receita, de 57,8% em 2024, impulsionado por sua ampla disponibilidade, eficiência de custos e adequação para aplicações de energia e combustível em larga escala. O gás não associado, extraído independentemente do petróleo bruto, oferece uma cadeia de suprimentos confiável para atender à crescente demanda por energia, ao mesmo tempo em que apoia estratégias de descarbonização. Sua escalabilidade o torna a escolha preferencial para usos industriais e automotivos.

O segmento de gás associado deverá apresentar o CAGR mais rápido entre 2025 e 2032, à medida que os avanços nas tecnologias de recuperação de gás aumentam a eficiência e reduzem as perdas por queima. Com o foco crescente na sustentabilidade e em medidas regulatórias para minimizar o desperdício, espera-se que a utilização de gás associado se expanda rapidamente. Essa tendência posiciona o gás associado como uma fonte emergente para atender às metas globais de transição energética.

• Por Kits

Com base nos kits, o mercado é segmentado em sequenciais e venturi. O segmento de kits sequenciais foi responsável pela maior participação na receita, 61,3% em 2024, impulsionado por sua maior eficiência, precisão na injeção de combustível e emissões reduzidas em comparação aos sistemas tradicionais. Os kits sequenciais são cada vez mais adotados em veículos leves e médios devido à sua capacidade de proporcionar melhor quilometragem, desempenho e conformidade com as rigorosas normas de emissões. Seu amplo uso em mercados desenvolvidos e emergentes sustenta sua dominância.

Prevê-se que o segmento de kits Venturi apresentará a maior taxa de crescimento entre 2025 e 2032, impulsionado pelo menor custo de instalação e pela adequação a modelos de veículos mais antigos em mercados sensíveis a preços. Os kits Venturi, embora menos sofisticados, continuam atraentes para frotistas e consumidores que buscam soluções econômicas de conversão de combustível. A crescente adoção em economias em desenvolvimento garante sua expansão constante, apesar do predomínio dos kits sequenciais.

• Por tipo de distribuição

Com base no tipo de distribuição, o mercado é segmentado em cilindros/tanques, acumuladores, coletores compostos e outros. O segmento de cilindros/tanques dominou o mercado, com a maior participação na receita, de 49,5% em 2024, apoiado por sua infraestrutura consolidada, certificações de segurança e amplo uso em veículos leves e pesados. Sua durabilidade e compatibilidade com os postos de abastecimento existentes os tornam a escolha padrão para armazenamento e distribuição de gás.

O segmento de coletores compostos deverá registrar o CAGR mais rápido entre 2025 e 2032, devido à sua leveza, aos recursos de segurança aprimorados e à capacidade de armazenar maiores volumes de gás em pressões otimizadas. Com foco crescente na redução do peso dos veículos e na eficiência de combustível, os coletores compostos estão emergindo como a solução de próxima geração para sistemas de distribuição de gás automotivo. Sua rápida adoção em frotas de veículos avançados fortalece sua trajetória de crescimento.

• Até o uso final

Com base no uso final, o mercado é segmentado em veículos leves, médios e pesados. O segmento de veículos leves detinha a maior participação de mercado, de 54,1% em 2024, impulsionado pela crescente demanda por soluções de mobilidade pessoal e comercial econômicas e ecologicamente corretas. A urbanização, o crescimento do compartilhamento de viagens e a preferência do consumidor por alternativas de combustível acessíveis reforçam ainda mais a dominância desse segmento.

Espera-se que o segmento de veículos pesados apresente o CAGR mais rápido entre 2025 e 2032, à medida que a logística, o transporte de cargas e o transporte de longa distância adotam cada vez mais sistemas a gás para reduzir os custos operacionais e a pegada de carbono. Com normas de emissão mais rigorosas e uma infraestrutura crescente para reabastecimento de combustíveis alternativos, as frotas de veículos pesados estão em rápida transição para a adoção do gás, tornando este segmento um motor vital para o crescimento futuro.

Análise regional do mercado de gás natural comprimido (GNC) na América do Norte

- Os EUA detêm a maior fatia de 69,32% do mercado de gás natural comprimido da América do Norte, alimentado por suas vastas reservas de gás de xisto, infraestrutura bem desenvolvida e fortes iniciativas governamentais para promover combustíveis alternativos.

- O país está testemunhando uma adoção significativa de gás natural comprimido em frotas de transporte comercial e público, especialmente em regiões metropolitanas onde as regulamentações de emissões são rigorosas

- Além disso, os avanços tecnológicos em kits sequenciais e coletores compostos estão melhorando a eficiência e a adoção dos veículos. Grandes players, como a Clean Energy Fuels, a Trillium e projetos apoiados por concessionárias de serviços públicos, estão impulsionando ainda mais o crescimento.

Visão do mercado de gás natural comprimido (GNC) do Canadá

O mercado canadense de gás natural comprimido está em constante expansão, apoiado por seu foco em transporte sustentável e compromissos climáticos. Embora a infraestrutura não seja tão extensa quanto a dos EUA, iniciativas governamentais estão promovendo o uso de gás natural comprimido em ônibus, frotas municipais e logística. O aumento dos custos dos combustíveis e o comércio transfronteiriço com os EUA também estão incentivando os operadores de frotas a adotar o gás natural comprimido como uma solução econômica. A demanda por veículos motorizados médios e pesados movidos a gás natural comprimido é particularmente forte em centros urbanos como Toronto e Vancouver, onde os padrões de emissão são mais rigorosos.

Visão do mercado de gás natural comprimido (GNC) no México

O México está emergindo como um mercado em rápido crescimento, com uma taxa composta de crescimento anual (CAGR) de 12,02% na América do Norte, impulsionada em grande parte pela iniciativa do governo de diversificar as fontes de combustível e reduzir a dependência de gasolina e diesel importados. A disponibilidade de gás natural comprimido a preços acessíveis, aliada ao crescente investimento em infraestrutura de abastecimento, está incentivando a adoção por táxis, ônibus e frotas de entrega. Kits sequenciais estão ganhando força no transporte urbano, enquanto veículos pesados estão gradualmente migrando devido aos benefícios de custo. A posição estratégica do México como um polo logístico na América Latina aumenta ainda mais a demanda por gás natural comprimido como um combustível alternativo sustentável e econômico.

A indústria de gás natural comprimido da América do Norte é liderada principalmente por empresas bem estabelecidas, incluindo:

- Clean Energy Fuels Corp. (EUA)

- Cummins Inc. (EUA)

- Hexagon Agility (EUA)

- Westport Fuel Systems Inc. (Canadá)

- Empresa de veículos movidos a gás natural (EUA)

- Quantum Fuel Systems LLC (EUA)

- NGV Global Group (EUA)

- Chart Industries, Inc. (EUA)

- Cilindros de gás Luxfer (EUA)

Últimos desenvolvimentos no mercado de gás natural comprimido (GNC) da América do Norte

- Em fevereiro de 2025, a Clean Energy Fuels (EUA) anunciou a abertura de 25 novos postos de abastecimento de GNC na Califórnia e no Texas, com o objetivo de apoiar frotas de caminhões pesados em transição para o diesel. A expansão fortalece a liderança da empresa em transporte sustentável e apoia iniciativas estaduais de descarbonização.

- Em novembro de 2024, a Trillium Energy Solutions (EUA) firmou parceria com a Love's Travel Stops para implantar infraestrutura avançada de reabastecimento de GNC em importantes corredores de carga. A iniciativa visa permitir que empresas de transporte rodoviário de longa distância tenham acesso a um fornecimento confiável de GNC, melhorando a eficiência de custos e reduzindo as emissões em toda a logística interestadual.

- Em setembro de 2024, a FortisBC (Canadá) lançou um programa de conversão de frota para ônibus municipais na Colúmbia Britânica, introduzindo kits sequenciais de GNC de alta capacidade. Essa iniciativa faz parte da estratégia mais ampla de conformidade com o Padrão de Combustível Limpo do Canadá e deve reduzir as emissões da frota em mais de 25% ao ano.

- Em junho de 2024, a Hexagon Agility (EUA/Canadá) revelou sua próxima geração de tanques de GNC de compósito leve para veículos médios e pesados. A nova tecnologia melhora a eficiência do armazenamento de combustível, reduz o peso do veículo e aumenta a autonomia, tornando a adoção do GNC mais atraente para operadores logísticos.

- Em abril de 2024, a GAIL Global (divisão do México) anunciou seu investimento no desenvolvimento de 50 novos postos de GNC nas principais áreas metropolitanas, incluindo a Cidade do México e Monterrey. O projeto apoia a transição do México para combustíveis mais limpos e melhora a acessibilidade para veículos comerciais e de passageiros.

- Em dezembro de 2023, a Chesapeake Utilities Corporation (EUA) expandiu sua distribuição de GNC por meio de sua subsidiária Marlin Gas Services, introduzindo unidades móveis de abastecimento de GNC para regiões rurais e carentes. Esse desenvolvimento melhora a acessibilidade e garante o fornecimento confiável onde a infraestrutura permanente é limitada.

- Em outubro de 2023, a Enbridge Gas (Canadá) firmou parceria com a Cummins para promover a adoção do GNC em frotas de caminhões de longa distância. A parceria envolve o fornecimento de motores e kits de GNC atualizados, visando frotas que buscam cumprir padrões de emissões mais rigorosos em Ontário e Quebec.

- Em agosto de 2023, a Naturgy México introduziu um programa de subsídios para frotas de táxis e serviços de transporte compartilhado que estejam convertendo para kits sequenciais de GNC. O programa de incentivo já acelerou a adoção no transporte urbano, especialmente na Cidade do México, onde a demanda por soluções de mobilidade limpas e econômicas está aumentando.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.