Mercado de papel revestido da América do Norte, por produto (papel de madeira moído revestido, papel fino revestido padrão, papel de baixa gramagem, papel revestido com pigmento, papel de arte, papel esmaltado e outros), camada de revestimento (revestido num lado e revestido em ambos os lados) , Material de revestimento (argila, carbonato de cálcio , talco, argila de caulino, cera, dióxido de titânio e outros), acabamento (brilhante, acetinado, mate, opaco e outros), método de revestimento ( revestido à mão, revestido a pincel, revestido à máquina e Outros), Processo de acabamento (calendário online e calendário offline), Aplicação (impressão, embalagem e etiquetagem e outros) - Tendências e previsões do setor até 2030.

Análise e insights do mercado de papel revestido na América do Norte

Papel que recebeu uma camada de acabamento ou revestimento aplicado para melhorar o seu acabamento e capacidade de impressão durante o processo de fabrico. O revestimento tem como objetivo melhorar certas características do papel, tais como a opacidade, o brilho, a brancura, a cor, a suavidade da superfície, o brilho e a recetividade à tinta, para que o produto de papel acabado tenha as propriedades necessárias para a aplicação pretendida. Os papéis revestidos são classificados de acordo com a quantidade de revestimento aplicado; estas classificações incluem papéis com revestimento leve, médio, alto revestimento e papéis artísticos (que são utilizados para obras de arte de alta resolução).

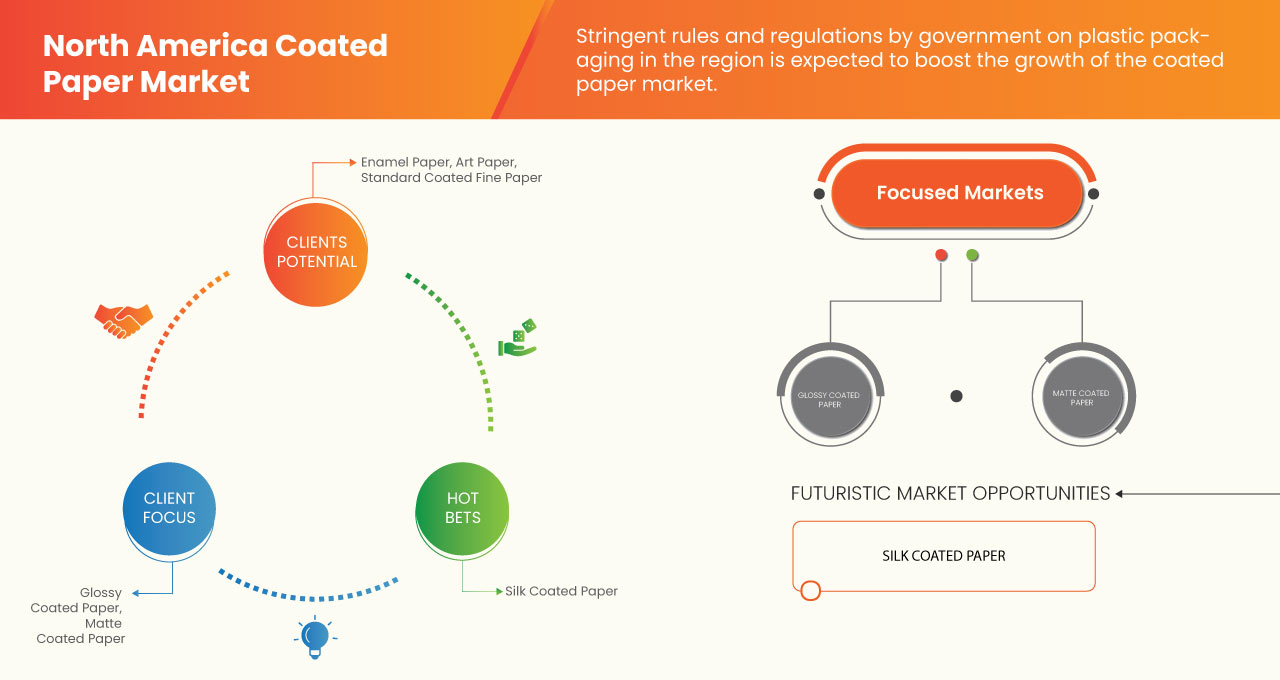

Os novos avanços na tecnologia de revestimento de papel, juntamente com as mudanças e melhorias no estilo de vida dos consumidores, resultam numa procura significativa de produtos com embalagens revestidas, o que criará uma imensa oportunidade para os fabricantes do mercado de papel revestido. Espera-se que a flutuação dos preços das matérias-primas desafie o crescimento do mercado.

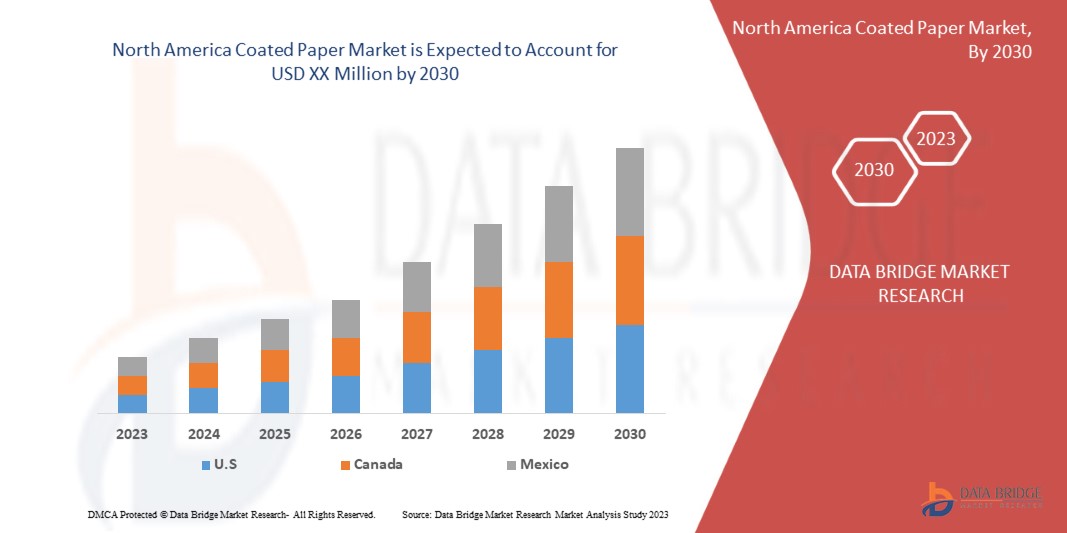

A Data Bridge Market Research analisa que o mercado norte-americano de papel revestido irá crescer a um CAGR de 4,2% durante o período previsto de 2023 a 2030.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (Personalizável para 2020 - 2015) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos, preço em dólares americanos |

|

Segmentos abrangidos |

Produto (papel de madeira moído revestido, papel fino revestido standard, papel de baixa gramagem, papel revestido com pigmento, papel de arte, papel esmaltado e outros), camada de revestimento (revestido num dos lados e revestido nos dois lados), material de revestimento (argila, Carbonato de cálcio, talco, argila de caulino, cera, dióxido de titânio e outros), acabamento (brilhante, acetinado, mate, mate e outros), método de revestimento (revestido à mão, revestido a pincel, revestido à máquina e outros), processo de acabamento (online Calendário e calendário offline), Aplicação (Impressão, Embalagem e Etiquetagem e Outros) |

|

Países abrangidos |

EUA, Canadá e México |

|

Atores do mercado abrangidos |

Oji Holdings Corporation, Nippon Paper Industries Co., Ltd., Stora Enso, Sappi Ltd., Asia Pulp & Paper (APP) Sinar Mas, skpmil.com, UPM, DS Smith, Dunn Paper Company, Paradise Packaging, Burgo Group Spa, JK Paper, Emami Paper Mills Ltd., Koehler Holding SE & Co. KG, Lecta, Twin Rivers Paper Company, Svenska Cellulosa Aktiebolaget SCA (Publ) e Billerud Americas Corporation, entre outras. |

Definição de Mercado

O papel revestido é um papel que foi revestido com um polímero ou uma mistura de materiais para conferir qualidades específicas ao papel, tais como gramagem, brilho da superfície, suavidade ou menor absorção de tinta. Para revestir papel para impressão de alta qualidade na indústria de embalagens e revistas, podem ser utilizados vários materiais como a caulinita, o carbonato de cálcio, a bentonite e o talco. Os papéis revestidos são aqueles que têm um acabamento brilhante, semibrilhante ou mate. Um agente de revestimento é aplicado na superfície do papel revestido para melhorar o brilho, a suavidade ou outras propriedades de impressão. Os rolos são utilizados para polir o papel depois de este ter sido revestido. Preenche os pequenos buracos e espaços entre as fibras para criar uma superfície lisa e plana.

Dinâmica do mercado de papel revestido na América do Norte

Motoristas

-

Aumento da procura por imagens impressas de alta qualidade

Os papéis revestidos imprimem imagens nítidas e brilhantes devido à sua elevada refletividade. Além disso, proporcionam uma superfície de impressão superior aos papéis não revestidos, o que resulta numa impressão de alta qualidade. Os papéis revestidos são resistentes à sujidade e à humidade e, por não serem absorventes, utilizam menos tinta para imprimir. O papel revestido é geralmente revestido com cera, barro, barro de caulino, látex, óxido de titânio etc., o que permite que o papel brilhe mais e melhora a qualidade das imagens nele impressas. O papel revestido pode ser utilizado numa variedade de aplicações de utilização final, tais como catálogos, encartes de jornais, produtos de papel convertidos, papéis de segurança, revistas e materiais publicitários, uma vez que normalmente tem um acabamento brilhante ou mate. Uma vez que produz imagens nítidas e complexas, o papel revestido é frequentemente utilizado para fins de impressão.

Os papéis revestidos são geralmente mais pesados do que os papéis não revestidos, o que confere peso ao trabalho de impressão. O papel revestido é mais adequado para determinadas técnicas de acabamento, como o verniz localizado ou por imersão, ou outros revestimentos de acabamento, porque é mais liso e tem uma melhor retenção de tinta (é menos absorvente) do que o papel não revestido. Os papéis de revestimento proporcionam impressões de alta qualidade e são fabricados por vários intervenientes importantes no mercado norte-americano de papéis revestidos.

Assim, espera-se que a crescente procura de impressões e imagens de alta qualidade em diversas revistas, brochuras, folhetos, etc.

-

Aumento da procura de papel revestido na indústria alimentar

Os papéis revestidos têm diversas aplicações em diferentes indústrias, incluindo a alimentar, na qual são amplamente utilizados para embrulhar alimentos em todo o mundo. As embalagens alimentares estão a migrar do plástico para materiais de papel mais biodegradáveis e recicláveis, à medida que a procura por soluções sustentáveis aumenta na América do Norte. Para melhorar a qualidade, o desempenho e substituir os enchimentos plásticos, os papéis revestidos utilizados necessitam de ser de elevada qualidade e de natureza não reativa.

O papel encerado é adequado para alimentos, principalmente para embrulhar peixe, carne e barras de chocolate, devido à sua resistência à humidade e à gordura, sendo especialmente adequado para o contacto direto com queijos, manteiga e para embrulhar barras de chocolate e alimentos oleosos . Por ser resistente à água, óleos e gorduras, o papel vegetal ajuda a conservar os alimentos. Os papéis revestidos com resina são ideais para alimentos frescos, alimentos gordurosos e alimentos húmidos, bem como para sacos de qualidade alimentar.

As embalagens fabricadas em papel polietileno são adequadas para o contacto direto com alimentos, oferecem garantia de frescura, proteção e cumprem os mais elevados padrões de higiene alimentar. Papéis revestidos e folhas de hambúrguer são utilizados para embrulhar alimentos de balcão, como carne, queijo e alimentos cozinhados em supermercados, talhos, charcutarias e charcutarias. Os papéis revestidos a polietileno são utilizados em talhos, charcutarias e supermercados para embrulhar alimentos frescos. Na verdade, o filme de polietileno de alta densidade atua como uma barreira protetora contra a humidade, gordura e odores.

Oportunidades

-

Os estilos de vida em mudança e melhoria dos consumidores resultam numa procura significativa de produtos com embalagens revestidas

O estilo de vida dos consumidores muda e melhora à medida que o seu rendimento disponível aumenta, assim como o seu consumo de produtos de saúde, alimentos e bebidas e cuidados domésticos, particularmente nas economias em desenvolvimento. Nos próximos anos, espera-se que isto aumente a procura de papel revestido.

Além disso, os proprietários de marcas estão cada vez mais interessados na impressão e embalagens ecológicas devido às regulamentações governamentais que restringem os plásticos de utilização única. Por este motivo, os fabricantes estão a adotar técnicas de impressão e embalagem mais ecológicas, o que ajudará a criar oportunidades no mercado do papel revestido.

A geração Y prefere comprar alimentos preparados devido ao seu estilo de vida agitado e à crescente consciencialização sobre a saúde, o que está a impulsionar a procura de materiais de embalagem revestidos devido à crescente necessidade de embalagens modificadas. Isto gera ainda mais oportunidades de expansão de mercado

Restrições/Desafios

- A digitalização generalizada em todos os setores limita a utilização de papel

Houve um aumento da digitalização em todos os setores. A facilidade e a comodidade da digitalização estão a permitir aos industriais optar pelas plataformas digitais. À medida que o mundo continua a passar por uma enorme transformação digital, setores e indústrias importantes estão a adotar a tecnologia digital para garantir que estão prontos para o futuro e bem posicionados para ter sucesso a nível global.

Por exemplo,

- Em março de 2022, de acordo com o CII, os negócios digitais evoluíram para além da simples compra e venda num website. O digital é agora mais um meio de troca de bens e serviços, garantindo que estes chegam às pessoas certas. Os mercados multilaterais aproveitam o poder dos efeitos de rede através do comércio colaborativo para crescer exponencialmente, criando valor para os seus utilizadores de forma contínua.

Além disso, a crescente digitalização permitiu que as indústrias fornecessem os seus serviços e informações apenas nos seus websites. Vários fabricantes do setor mudaram para folhetos eletrónicos, revistas e relatórios anuais, etc., o que resultou numa grande desvantagem para o setor do papel revestido. Os fabricantes estão a anunciar através de meios de comunicação online, anúncios de TV e outras plataformas de redes sociais, o que reprimiu o crescimento dos meios de comunicação impressos, o que está a afetar significativamente o setor do papel revestido.

Por conseguinte, a crescente digitalização em todos os setores pode prejudicar o crescimento do mercado de papel revestido na América do Norte.

Impacto pós-COVID-19 no mercado norte-americano de papel revestido

A COVID-19 afetou o mercado até certo ponto. Devido ao bloqueio, o fabrico e a produção de muitas empresas pequenas e grandes foram interrompidos, e a procura de papel revestido também diminuiu, influenciando o mercado. Devido à mudança em muitos mandatos e regulamentos, os fabricantes podem conceber e lançar novos produtos no mercado, o que ajudará no crescimento do mercado.

Desenvolvimentos recentes

- Em dezembro de 2021, a Lecta anunciou o lançamento de papéis de revestimento. O Linerset CCK Duo é um papel de libertação revestido com argila nos dois lados para siliconização com um tratamento especial no verso. Ampliou o portfólio de produtos da empresa.

Âmbito do mercado de papel revestido na América do Norte

O mercado norte-americano de papel revestido está segmentado em segmentos notáveis com base no produto, camada de revestimento, material de revestimento, acabamento, método de revestimento, processo de acabamento e aplicação. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nos setores e fornecerá aos utilizadores uma visão geral valiosa do mercado e informações de mercado para tomar decisões estratégicas para identificar as principais aplicações de mercado.

Produto

- Papel de madeira revestido

- Papel fino revestido standard

- Papel de baixa gramagem

- Papel revestido com pigmento

- Papel de Arte

- Papel Esmaltado

- Outros

Com base no produto, o mercado de papel revestido da América do Norte está segmentado em papel revestido de madeira moída, papel fino revestido padrão, papel de baixa gramagem, papel revestido de pigmento, papel de arte, papel esmaltado e outros.

Camada de revestimento

- Revestimento de um lado

- Revestimento em dois lados

Com base na camada de revestimento, o mercado norte-americano de papel revestido é segmentado em revestido de um lado e revestido de ambos os lados

Material de revestimento

- Argila

- Carbonato de cálcio

- Talco

- Argila de Caulino

- Cera

- Dióxido de titânio

- Outros

Com base no material de revestimento, o mercado norte-americano de papel revestido está segmentado em argila, carbonato de cálcio, talco, argila de caulino, cera, dióxido de titânio e outros.

Terminar

- Lustro

- Cetim

- Fosco

- Monótono

- Outros

Com base no acabamento, o mercado de papel revestido da América do Norte está segmentado em brilhante, acetinado, mate, mate e outros

Método de revestimento

- Revestido à mão

- Revestido com pincel

- Revestido à máquina

- Outros

Com base no método de revestimento, o mercado norte-americano de papel revestido está segmentado em revestido à mão, revestido a pincel, revestido à máquina e outros.

Processo de Acabamento

- Calendário Online

- Calendário Offline

Com base no processo de acabamento, o mercado norte-americano de papel revestido está segmentado em calendário online e calendário offline

Aplicação

- Impressão

- Embalagem e rotulagem

- Outros

Com base na aplicação, o mercado norte-americano de papel revestido está segmentado em impressão, embalagem e etiquetagem e outros

Análise/Insights Regionais do Mercado de Papel Revestido da América do Norte

O mercado de papel revestido da América do Norte é analisado, e são fornecidos insights e tendências sobre o tamanho do mercado com base no país e conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de revestimentos da América do Norte são os EUA, o Canadá e o México.

Espera-se que os EUA dominem o mercado de papel revestido da América do Norte em termos de quota de mercado e receitas e que mantenham o seu domínio durante o período previsto devido ao crescente aumento de papel revestido em vários setores e à crescente procura por parte dos consumidores finais .

A secção regional do relatório também fornece fatores individuais que impactam o mercado e alterações nas regulamentações do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados, como vendas de produtos novos e de reposição, demografia do país, epidemiologia de doenças e tarifas de importação e exportação, são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade das marcas da América do Norte e os desafios enfrentados devido à elevada concorrência das marcas locais e nacionais e o impacto dos canais de vendas são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do panorama competitivo e da quota de mercado do papel revestido na América do Norte

O panorama competitivo do mercado norte-americano de papel revestido fornece detalhes sobre os concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude e abrangência do produto, e domínio da aplicação. Os pontos de dados acima estão apenas relacionados com o foco da empresa no mercado norte-americano de papel revestido.

Alguns dos principais participantes que operam no mercado norte-americano de papel revestido são a Oji Holdings Corporation, a Nippon Paper Industries Co., Ltd., a Stora Enso, a Sappi Ltd., a Asia Pulp & Paper (APP) Sinar Mas, skpmil.com, UPM, DS Smith, Dunn Paper Company, Paradise Packaging, Burgo Group Spa, JK Paper, Emami Paper Mills Ltd., Koehler Holding SE & Co. KG, Lecta, Twin Rivers Paper Company, Svenska Cellulosa Aktiebolaget SCA (Publ) e Billerud Americas Corporation entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA COATED PAPER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.2 TECHNOLOGICAL ADVANCEMENT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR HIGH-QUALITY PRINT IMAGES

5.1.2 INCREASE IN DEMAND FOR COATED PAPER IN THE FOOD INDUSTRY

5.1.3 RISE IN E-COMMERCE AND ONLINE SHOPPING ACTIVITIES THUS CREATING DEMAND FOR THE PACKAGING INDUSTRY

5.1.4 STRINGENT GOVERNMENT RULES ON PLASTIC PACKAGING

5.2 RESTRAINTS

5.2.1 WIDESPREAD DIGITALIZATION ACROSS INDUSTRIES LIMITING THE USE OF PAPER

5.2.2 NEGATIVE IMPACT OF THE PAPER INDUSTRY ON THE ENVIRONMENT

5.2.3 HIGH INITIAL INVESTMENT IN COATED PAPER INDUSTRY

5.3 OPPORTUNITIES

5.3.1 NEW ADVANCES IN PAPER COATING TECHNOLOGY

5.3.2 CONSUMERS' CHANGING AND IMPROVING LIFESTYLES RESULT IN A SIGNIFICANT DEMAND FOR PRODUCTS WITH COATED PACKAGING

5.3.3 SHIFTING TOWARDS THE ECO-FRIENDLY PRINTING AND PACKAGING FORMATS

5.4 CHALLENGES

5.4.1 FLUCTUATION IN PRICES OF RAW MATERIAL

5.4.2 LOW RECYCLING VALUE FOR COATED PAPER

5.4.3 GOVERNMENT OVERSEAS REGULATIONS FOR IMPORT-EXPORT

6 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 STANDARD COATED FINE PAPER

6.2.1 TWO-COATED

6.2.1.1 MACHINE COATED

6.2.1.2 HAND-COATED

6.2.1.3 BRUSH-COATED

6.2.1.4 OTHERS

6.2.2 ONE-SIDE COATED

6.2.3 MACHINE COATED

6.2.4 BRUSH-COATED

6.2.5 OTHERS

6.3 COATED GROUND WOOD PAPER

6.3.1 TWO-COATED

6.3.1.1 MACHINE COATED

6.3.1.2 HAND-COATED

6.3.1.3 BRUSH-COATED

6.3.1.4 OTHERS

6.3.2 ONE-SIDE COATED

6.3.3 MACHINE COATED

6.3.4 HAND-COATED

6.3.5 BRUSH-COATED

6.3.6 OTHERS

6.4 ART PAPER

6.4.1 TWO-COATED

6.4.1.1 MACHINE COATED

6.4.1.2 HAND-COATED

6.4.1.3 BRUSH-COATED

6.4.1.4 OTHERS

6.4.2 ONE-SIDE COATED

6.4.2.1 MACHINE COATED

6.4.2.2 HAND-COATED

6.4.2.3 BRUSH-COATED

6.4.2.4 OTHERS

6.5 PIGMENT COATED PAPER

6.5.1 TWO-COATED

6.5.1.1 MACHINE COATED

6.5.1.2 HAND-COATED

6.5.1.3 BRUSH-COATED

6.5.1.4 OTHERS

6.5.2 ONE-SIDE COATED

6.5.2.1 MACHINE COATED

6.5.2.2 HAND-COATED

6.5.2.3 BRUSH-COATED

6.5.2.4 OTHERS

6.6 ENAMEL PAPER

6.6.1 TWO-COATED

6.6.1.1 MACHINE COATED

6.6.1.2 HAND-COATED

6.6.1.3 BRUSH-COATED

6.6.1.4 OTHERS

6.6.2 ONE-SIDE COATED

6.6.2.1 MACHINE COATED

6.6.2.2 HAND-COATED

6.6.2.3 BRUSH-COATED

6.6.2.4 OTHERS

6.7 LOW COAT WEIGHT PAPER

6.7.1 TWO-COATED

6.7.1.1 MACHINE COATED

6.7.1.2 HAND-COATED

6.7.1.3 BRUSH-COATED

6.7.1.4 OTHERS

6.7.2 ONE-SIDE COATED

6.7.2.1 MACHINE COATED

6.7.2.2 HAND-COATED

6.7.2.3 BRUSH-COATED

6.7.2.4 OTHERS

6.8 OTHERS

6.8.1 TWO-COATED

6.8.1.1 MACHINE COATED

6.8.1.2 HAND-COATED

6.8.1.3 BRUSH-COATED

6.8.1.4 OTHERS

6.8.2 ONE-SIDE COATED

6.8.2.1 MACHINE COATED

6.8.2.2 HAND-COATED

6.8.2.3 BRUSH-COATED

6.8.2.4 OTHERS

7 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER

7.1 OVERVIEW

7.2 TWO-SIDE COATED

7.3 ONE-SIDE COATED

8 NORTH AMERICA COATED PAPER MARKET, BY FINISH

8.1 OVERVIEW

8.2 GLOSS

8.3 SATIN

8.4 MATTE

8.5 DULL

8.6 OTHERS

9 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PACKAGING AND LABELLING

9.2.1 STANDARD COATED FINE PAPER

9.2.2 COATED GROUND WOOD PAPER

9.2.3 ART PAPER

9.2.4 PIGMENT COATED PAPER

9.2.5 ENAMEL PAPER

9.2.6 LOW COAT WEIGHT PAPER

9.2.7 OTHERS

9.3 PRINTING

9.3.1 STANDARD COATED FINE PAPER

9.3.2 COATED GROUND WOOD PAPER

9.3.3 ART PAPER

9.3.4 PIGMENT COATED PAPER

9.3.5 ENAMEL PAPER

9.3.6 LOW COAT WEIGHT PAPER

9.3.7 OTHERS

9.4 OTHERS

9.4.1 STANDARD COATED FINE PAPER

9.4.2 COATED GROUND WOOD PAPER

9.4.3 ART PAPER

9.4.4 PIGMENT COATED PAPER

9.4.5 ENAMEL PAPER

9.4.6 LOW COAT WEIGHT PAPER

9.4.7 OTHERS

10 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS

10.1 OVERVIEW

10.2 ONLINE CALENDARING

10.3 OFFLINE CALENDARING

11 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD

11.1 OVERVIEW

11.2 MACHINE COATED

11.3 HAND-COATED

11.4 BRUSH-COATED

11.5 OTHERS

12 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL

12.1 OVERVIEW

12.2 CALCIUM CARBONATE

12.2.1 PRECIPITATED CALCIUM CARBONATE (PCC)

12.2.2 GROUND CALCIUM CARBONATE (GCC)

12.3 KAOLIN CLAY

12.4 CLAY

12.5 TITANIUM DIOXIDE

12.6 WAX

12.7 TALC

12.8 OTHERS

13 NORTH AMERICA COATED PAPER MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA COATED PAPER MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 SAPPI

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 BILLERUD AMERICAS CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 UPM

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 DS SMITH

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 STORA ENSO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 OJI HOLDINGS CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 NIPPON PAPER INDUSTRIES CO., LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 LECTA

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 EMAMI PAPER MILLS LTD.

16.9.1 COMPANY SNAPSHOT

16.9.2 RECENT FINANCIALS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 SVENSKA CELLULOSA AKTIEBOLAGET SCA

16.10.1 COMPANY SNAPSHOT

16.10.2 RECENT FINANCIALS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 DUNN PAPER COMPANY

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 KOEHLER HOLDING SE & CO. KG

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 BURGO GROUP S.P.A.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 JK PAPER

16.14.1 COMPANY SNAPSHOT

16.14.2 RECENT FINANCIALS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 ASIA PULP & PAPER (APP) SINAR MAS.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 TWIN RIVERS PAPER COMPANY

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SKPMILL.COM

16.17.1 COMPANY SNAPSHOT

16.17.2 RECENT FINANCIALS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 PARADISE PACKAGING

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 3 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 5 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 7 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 9 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 11 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 13 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 15 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 17 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 19 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 21 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 23 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 25 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 27 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 29 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 31 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 33 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 35 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)(B2C)

TABLE 36 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 37 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 39 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 41 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 43 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 45 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 47 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 49 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 51 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 53 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 55 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 57 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 59 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 61 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 63 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 65 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 67 NORTH AMERICA GLOSS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA GLOSS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 69 NORTH AMERICA SATIN IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA SATIN IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 71 NORTH AMERICA MATTE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA MATTE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 73 NORTH AMERICA DULL IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA DULL IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 75 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 77 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 79 NORTH AMERICA PACKAGING AND LABELLING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA PACKAGING AND LABELLING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 81 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 83 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 85 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 87 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 89 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 91 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 93 NORTH AMERICA ONLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA ONLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 95 NORTH AMERICA OFFLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA OFFLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 97 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 99 NORTH AMERICA MACHINE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA MACHINE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 101 NORTH AMERICA HAND-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA HAND-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 103 NORTH AMERICA BRUSH-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA BRUSH-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 105 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 107 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 109 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 111 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 113 NORTH AMERICA KAOLIN CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA KAOLIN CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 115 NORTH AMERICA CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 117 NORTH AMERICA TITANIUM DIOXIDE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA TITANIUM DIOXIDE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 119 NORTH AMERICA WAX IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA WAX IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 121 NORTH AMERICA TALC IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA TALC IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 123 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 125 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (KILO TON)

TABLE 127 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (ASP)

TABLE 128 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 130 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 131 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 132 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 133 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 135 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 137 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 138 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 139 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 140 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 141 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 142 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 143 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 144 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 145 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 146 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 147 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 148 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 149 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 150 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 151 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 152 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 153 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 154 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 155 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 156 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 157 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 158 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 159 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 160 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 161 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 162 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 163 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 164 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 165 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 166 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 167 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 168 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 169 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 170 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 171 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 172 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 173 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 174 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 175 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 176 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 177 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 178 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 179 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 180 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 181 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 182 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 183 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 184 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 185 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 186 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 187 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 188 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 189 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 190 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 191 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 192 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 193 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 194 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 195 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 196 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 197 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 198 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 199 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 200 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 201 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 202 U.S. STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 203 U.S. STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 204 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 205 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 206 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 207 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 208 U.S. COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 209 U.S. COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 210 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 211 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 212 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 213 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 214 U.S. ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 215 U.S. ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 216 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 217 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 218 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 219 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 220 U.S. PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 221 U.S. PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 222 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 223 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 224 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 225 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 226 U.S. ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 227 U.S. ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 228 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 229 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 230 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 231 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 232 U.S. LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 233 U.S. LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 234 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 235 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 236 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 237 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 238 U.S. OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 239 U.S. OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 240 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 241 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 242 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 243 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 244 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 245 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 246 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 247 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 248 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 249 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 250 U.S. CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 251 U.S. CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 252 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 253 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 254 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 255 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 256 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 257 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 258 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 259 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 260 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 261 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 262 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 263 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 264 U.S. PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 265 U.S. PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 266 U.S. PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 267 U.S. PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 268 U.S. OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 269 U.S. OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 270 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 271 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 272 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 273 CANADA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 274 CANADA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 275 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 276 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 277 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 278 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 279 CANADA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 280 CANADA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 281 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 282 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 283 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 284 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 285 CANADA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 286 CANADA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 287 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 288 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 289 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 290 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 291 CANADA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 292 CANADA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 293 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 294 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 295 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 296 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 297 CANADA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 298 CANADA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 299 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 300 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 301 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 302 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 303 CANADA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 304 CANADA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 305 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 306 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 307 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 308 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 309 CANADA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 310 CANADA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 311 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 312 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 313 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 314 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 315 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 316 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 317 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 318 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 319 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 320 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 321 CANADA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 322 CANADA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 323 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 324 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 325 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 326 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 327 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 328 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 329 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 330 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 331 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 332 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 333 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 334 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 335 CANADA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 336 CANADA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 337 CANADA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 338 CANADA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 339 CANADA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 340 CANADA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 341 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 342 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 343 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 344 MEXICO STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 345 MEXICO STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 346 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 347 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 348 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 349 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 350 MEXICO COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 351 MEXICO COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 352 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 353 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 354 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 355 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 356 MEXICO ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 357 MEXICO ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 358 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 359 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 360 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 361 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 362 MEXICO PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 363 MEXICO PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 364 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 365 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 366 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 367 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 368 MEXICO ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 369 MEXICO ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 370 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 371 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 372 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 373 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 374 MEXICO LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 375 MEXICO LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 376 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 377 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 378 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 379 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 380 MEXICO OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 381 MEXICO OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 382 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 383 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 384 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 385 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 386 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 387 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 388 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 389 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 390 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 391 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 392 MEXICO CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 393 MEXICO CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 394 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 395 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 396 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 397 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 398 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 399 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 400 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 401 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 402 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 403 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 404 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 405 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 406 MEXICO PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 407 MEXICO PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 408 MEXICO PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 409 MEXICO PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 410 MEXICO OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 411 MEXICO OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

Lista de Figura

FIGURE 1 NORTH AMERICA COATED PAPER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COATED PAPER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COATED PAPER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COATED PAPER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COATED PAPER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COATED PAPER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA COATED PAPER MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 NORTH AMERICA COATED PAPER MARKET: APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA COATED PAPER MARKET VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA COATED PAPER MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF COATED PAPER IN FOOD INDUSTRY IS DRIVING THE COATED PAPER MARKET IN THE FORECAST PERIOD

FIGURE 12 STANDARD COATED FINE PAPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COATED PAPER MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA COATED PAPER MARKET

FIGURE 14 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2022

FIGURE 15 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2022

FIGURE 16 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2022

FIGURE 17 NORTH AMERICA COATED PAPER MARKET: BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA COATED PAPER MARKET: BY FINISHING PROCESS, 2022

FIGURE 19 NORTH AMERICA COATED PAPER MARKET: BY COATING METHOD, 2022

FIGURE 20 NORTH AMERICA COATED PAPER MARKET: BY COATING MATERIAL, 2022

FIGURE 21 NORTH AMERICA COATED PAPER MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA COATED PAPER MARKET: BY PRODUCT (2023-2030)

FIGURE 26 NORTH AMERICA COATED PAPER MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.