Mercado de agentes quelantes da América do Norte, por tipo (agentes quelantes sintéticos e agentes quelantes naturais), forma (biodegradável e não biodegradável), canal de distribuição (vendas diretas/B2B, lojas especializadas, armazéns, comércio eletrónico e outros), aplicação ( Celulose e papel , agricultura, produtos de limpeza e detergentes, limpeza/desincrustação industrial, mineração, processamento têxtil, petróleo e gás, produção de polímeros, construção civil, fotografia, eléctrica e electrónica, aditivos para alimentos e rações, cuidados pessoais, produtos farmacêuticos e Outros) - Tendências e previsões do setor até 2030.

Análise e insights do mercado de agentes quelantes da América do Norte

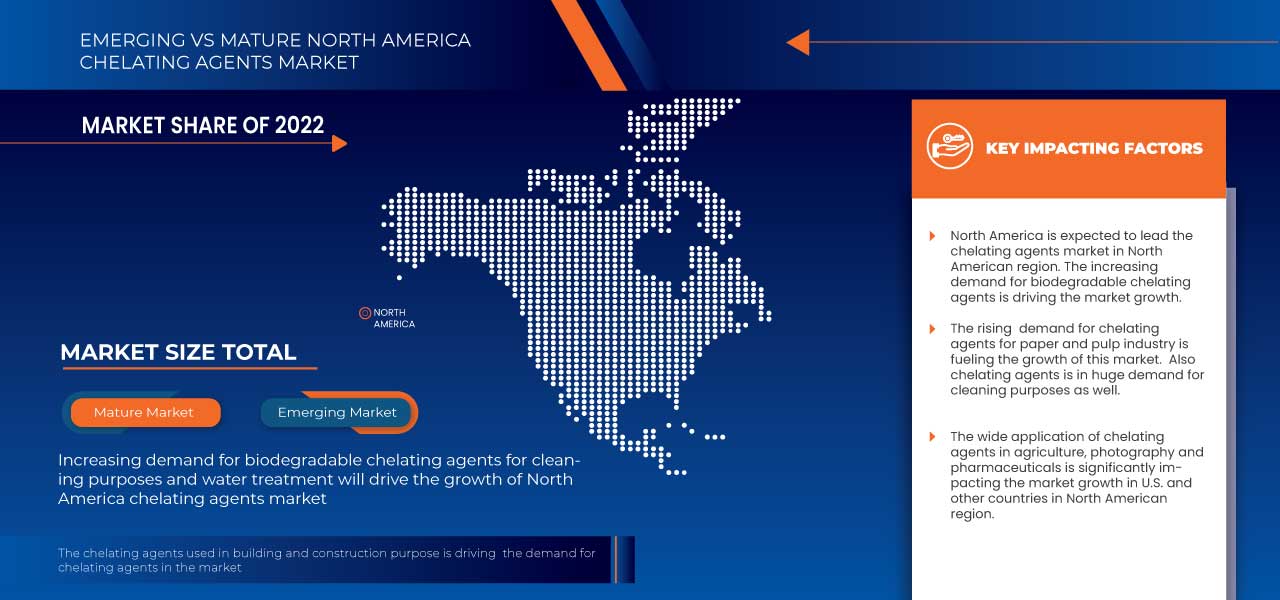

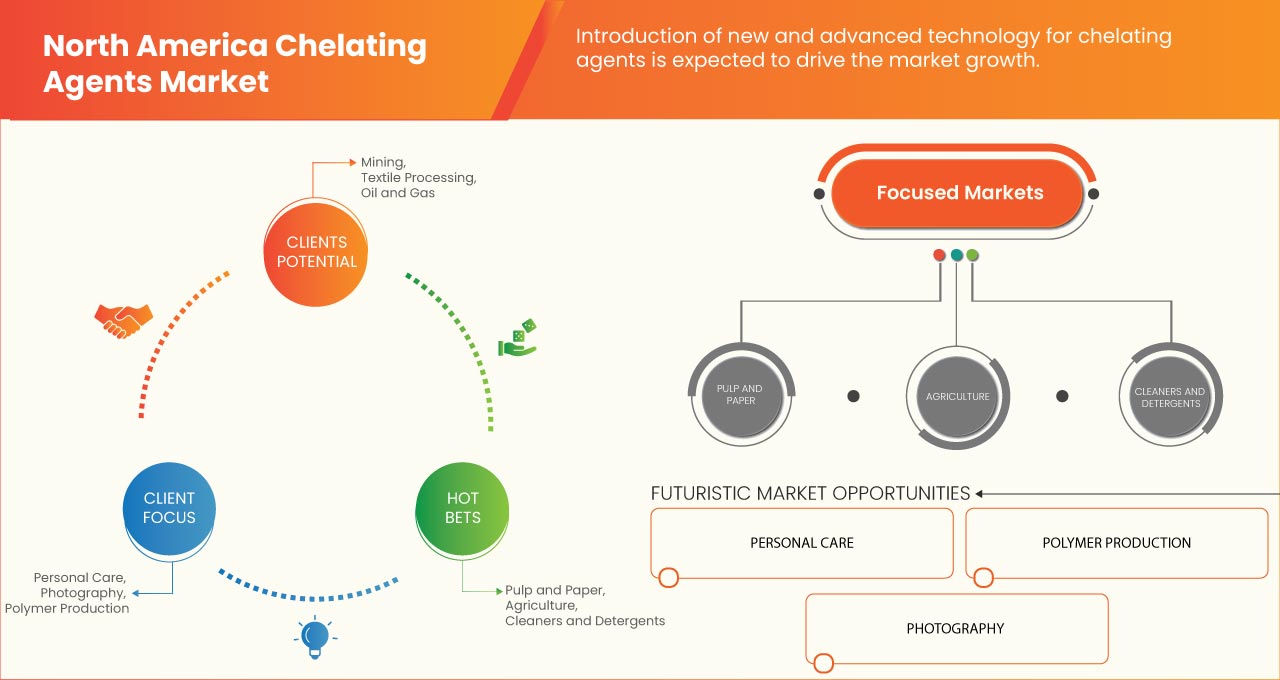

O mercado de agentes quelantes está a ganhar um crescimento significativo devido ao aumento da utilização de agentes quelantes em vários setores. São utilizados em diferentes indústrias, como cuidados pessoais, celulose e papel, agricultura, entre outros produtos, e têm uma grande procura no mercado.

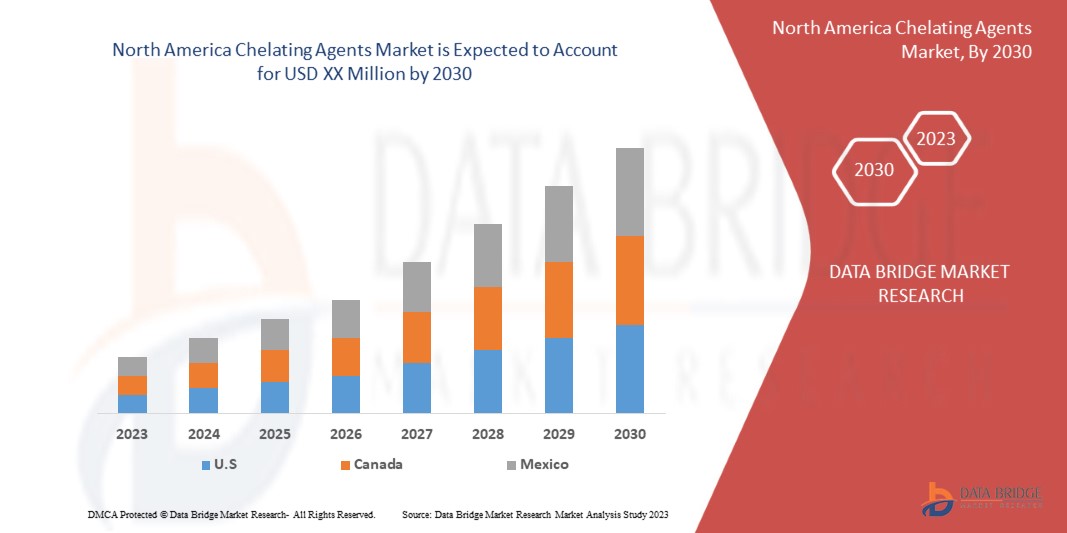

O principal factor que impulsiona o crescimento deste mercado é o aumento do consumo de água tratada para uso industrial e a elevada procura de limpeza doméstica, impulsionando o mercado no período previsto, enquanto por outro; riscos ecotoxicológicos dos agentes quelantes convencionais e o declínio no consumo de agentes à base de fosfato afetam o mercado de agentes quelantes na América do Norte A Data Bridge Market Research analisa que o mercado de agentes quelantes crescerá a um CAGR de 5,0% durante o período previsto de 2023 a 2030 .

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (Personalizável para 2020 - 2016) |

|

Unidades quantitativas |

Receita em milhões, volume em mil toneladas, preço em dólares americanos |

|

Segmentos abrangidos |

Por tipo (agentes quelantes sintéticos e agentes quelantes naturais), forma (biodegradável e não biodegradável), canal de distribuição (venda direta/B2B, lojas especializadas, armazéns, comércio eletrónico e outros), aplicação (celulose e papel, Agricultura, Produtos de limpeza e detergentes, Limpeza/desincrustação industrial, Mineração, Processamento têxtil, Petróleo e gás, Produção de polímeros, Construção civil, Fotografia, Elétrica e eletrónica, Aditivos para alimentos e rações, Cuidados pessoais, Produtos farmacêuticos e outros) |

|

Regiões abrangidas |

|

|

Atores do mercado abrangidos |

BASF SE, Eastman Chemical Company, Chevron Phillips Chemical Company LLC, LANXESS, INEOS, ADM, Mitsubishi Chemical Corporation, SABIC, Dow, Nouryon, Kemira, Ascend Performance Materials, NIPPON SHOKUBAI CO., LTD., Lonza, Evonik Industries AG, Zhonglan Industry Co., Ltd., Akzo Nobel NV, entre outros.

|

Definição de Mercado

Os agentes quelantes são compostos químicos cujas composições fazem com que dois ou mais átomos doadores (ou sítios) estejam ligados simultaneamente ao mesmo ião metálico e criem um ou mais anéis. Estes complexos metálicos têm o potencial de se dissolver em formas opticamente ativas (R&L). A estabilidade dos complexos metálicos varia de acordo com o padrão de formação da matriz e a instabilidade da variação torna-se mais importante em soluções cada vez mais saturadas de processos biológicos, como o soro ou o tecido. A cinética tóxica e a dinâmica tóxica dos metais e dos agentes quelantes são compostos químicos cujas composições permitem que dois ou mais átomos doadores (ou sítios) se liguem simultaneamente ao mesmo ião metálico e criem um ou mais anéis.

Dinâmica do mercado dos agentes quelantes

Esta secção trata da compreensão dos impulsionadores, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

-

Aumento da procura da indústria de pasta de papel e papel

Os agentes quelantes desempenham um papel significativo na indústria da pasta de papel e do papel. A operação de iões metálicos solúveis sem acumulação é dificultada pelos agentes quelantes, ácido etilenodiaminotracético (EDTA) e ácido dietilenotriaminopentaacético (DTPA) na celulose e no papel utilizados no branqueamento de voltagem. Os agentes quelantes são utilizados nas cadeias de branqueamento, em particular nos processos de dióxido de cloro e hidrossulfato de sódio. Também podem ser utilizados para aplicações de entintamento e dimensionamento. Existem várias propriedades dos agentes quelantes na purificação química e acústica da água e a utilização de agentes quelantes no fabricante de esfoliação com cloro.

Na indústria da pasta de papel e do papel, são utilizados agentes quelantes para melhorar a precisão do processo, como a secagem com cloro. Os aminopolicarboxilatos, incluindo o EDTA e o DTPA, são de longe os agentes quelantes mais utilizados.

-

Aumento do Consumo de Água Tratada para Uso Industrial

Os agentes quelantes são amaciadores de água utilizados em análises químicas. O EDTA é um agente quelante sintético comum. É utilizado em programas de tratamento de água, particularmente na tecnologia de vapor, em sistemas de tratamento de água de caldeiras. O agente quelante é utilizado na caldeira para dissolver tipos comuns de incrustações e proporcionar uma remoção eficaz de incrustações on-line e off-line dentro da caldeira.

Os agentes quelantes formam complexos solúveis em água com iões de metais alcalinos e de transição, aumentando a solubilidade do metal e prevenindo reações catalisadas por metais. Os agentes quelantes de aminopolicarboxilato são amplamente utilizados em diversos produtos domésticos e processos industriais, sendo as aplicações mais importantes no tratamento de águas industriais.

Oportunidades

1 Desenvolvimento de agentes quelantes ecológicos para aplicações de limpeza

Os agentes quelantes têm demonstrado enormes aplicações na limpeza, especialmente nas ações detergentes. Os agentes quelantes e a sua capacidade de produzir metais complexos são amplamente utilizados em muitas aplicações industriais, domésticas e agrícolas. Nas últimas décadas, têm sido utilizados em diversas aplicações, incluindo a limpeza.

Os agentes quelantes são normalmente utilizados em detergentes domésticos para evitar que os iões metálicos naturalmente presentes na água formem espuma de sabão. Existem muitos agentes quelantes por aí, mas o EDTA e o ácido cítrico são dois normalmente encontrados em produtos de limpeza, utilizando ácidos fosfóricos que são proibidos na maioria dos países. É mais comumente utilizado em produtos de limpeza para evitar que reaja com depósitos minerais e crie espuma de sabão. O mecanismo pelo qual os agentes quelantes funcionam é complexo. Basicamente, ligam-se a certos iões metálicos para formar complexos moleculares que prendem ou quelam os iões de cálcio para que não exibam propriedades iónicas.

Restrições/Desafios

- Declínio do consumo de agentes à base de fosfato

Em solos sem fertilizante P adicional, o EDTA e o HEEDTA resultam num aumento substancial das concentrações de WSP, bem como num aumento das concentrações de Mehlich-1 P e Mehlich-3 P.

A utilização de agentes quelantes, com e sem fertilizante P, poderia teoricamente melhorar o fornecimento de P à planta e, assim, diminuir o fertilizante P. Verificou-se que as raízes de agentes quelantes naturais alternativos auxiliam na remoção de iões metálicos dentro da rizosfera. Os investigadores estudaram o envolvimento entre fármacos de excreção e metais de superfície em resposta a agentes quelantes sintetizados. Os iões metálicos são absorvidos quando possuem orbitais vazios, o que faz com que o ião metálico interaja com um sítio de ligação que inclui um átomo com um par de eletrões. Determinados pela estrutura química, os agentes quelantes podem exigir mais do que uma molécula para ligar o ácido carboxílico metálico devido ao número de conceitos e capacidades no ligante.

Desenvolvimentos recentes

- Em outubro de 2021, o gluconato de sódio Jungbunzlauer é produzido através da fermentação de matérias-primas renováveis, como os hidratos de carbono de milho. Muitos organismos biodegradam-no facilmente em condições aeróbicas e anaeróbicas de águas residuais, bem como no ambiente natural.

- Os agentes quelantes da Dow combinam a ligação superior de iões metálicos com formulações relativamente simples. São parte integrante e barata da maioria dos produtos de limpeza. Comparativamente a muitos outros agentes quelantes, os agentes quelantes da Dow superam os contaminantes tradicionais dos iões metálicos

Âmbito de mercado de agentes quelantes

O mercado dos agentes quelantes está segmentado com base no tipo, forma, canal de distribuição e aplicação. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nos setores e fornecerá aos utilizadores uma visão geral valiosa do mercado e informações de mercado para tomar decisões estratégicas para identificar as principais aplicações de mercado.

Tipo

- Agentes quelantes sintéticos

- Agentes quelantes naturais

Com base no tipo, o mercado está segmentado em agentes quelantes sintéticos e agentes quelantes naturais.

Forma

- Biodegradável

- Não biodegradável

Com base na forma, o mercado dos agentes quelantes está segmentado em biodegradáveis e não biodegradáveis.

Canal de Distribuição

- Vendas Diretas/B2B

- Lojas especializadas

- Armazéns

- Comércio eletrónico

- Outros

Com base no canal de distribuição, o mercado dos agentes quelantes está segmentado em vendas diretas/B2B, lojas especializadas, armazéns, comércio eletrónico e outros.

Aplicação

- Celulose e Papel

- Agricultura

- Limpadores e Detergentes

- Limpeza Industrial/Descalcificação

- Mineração

- Processamento Têxtil

- Petróleo e gás

- Produção de Polímeros

- Construção e Edificação

- Fotografia

- Elétrica e Eletrónica

- Alimentos e aditivos para rações

- Cuidados pessoais

- Produtos farmacêuticos

- Outros

Com base na aplicação, o mercado de agentes quelantes está segmentado em pasta de papel e papel, agricultura, produtos de limpeza e detergentes, limpeza/desincrustação industrial, mineração, processamento têxtil, petróleo e gás, produção de polímeros, construção civil, fotografia, eletricidade e eletrónica.

Análise/Insights Regionais do Mercado de Agentes Quelantes

O mercado dos agentes quelantes é analisado, e são fornecidos insights sobre o tamanho do mercado e as tendências com base nas referências acima.

Os países abrangidos pelo relatório de mercado de agentes quelantes são os EUA, o Canadá e o México.

Espera-se que os EUA dominem o mercado dos agentes quelantes devido ao aumento da procura de agentes quelantes nas indústrias de fertilizantes.

A secção regional do relatório também fornece fatores individuais que impactam o mercado e alterações nas regulamentações do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados, como vendas de produtos novos e de reposição, demografia do país, epidemiologia de doenças e tarifas de importação e exportação, são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade das marcas da América do Norte e os desafios enfrentados devido à elevada concorrência das marcas locais e nacionais e o impacto dos canais de vendas são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado dos agentes quelantes

O mercado competitivo de agentes quelantes fornece detalhes sobre os concorrentes. Os detalhes incluem a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude e amplitude do produto e domínio da aplicação. Os pontos de dados acima estão apenas relacionados com o foco das empresas no mercado dos agentes quelantes.

Alguns dos principais participantes que operam no mercado são a BASF SE, Eastman Chemical Company, Chevron Phillips Chemical Company LLC, LANXESS, INEOS, ADM, Mitsubishi Chemical Corporation, SABIC, Dow, Nouryon, Kemira, Ascend Performance Materials, NIPPON SHOKUBAI CO., LTD ., Lonza, Evonik Industries AG, Zhonglan Industry Co., Ltd., Akzo Nobel NV, entre outras.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA CHELATING AGENTS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICING ANALYSIS –NORTH AMERICA CHELATING AGENTS MARKET

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET –NORTH AMERICA CHELATING AGENTS MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FROM THE PULP & PAPER INDUSTRY

5.1.2 INCREASE IN CONSUMPTION OF TREATED WATER FOR INDUSTRIAL USAGE

5.1.3 HIGH DEMAND FOR CHELATING AGENTS IN HOUSEHOLD CLEANING

5.1.4 SHIFT TOWARDS BIODEGRADABLE CHELATING AGENTS FROM NON-BIODEGRADABLE

5.2 RESTRAINTS

5.2.1 ECO-TOXICOLOGICAL RISKS OF CONVENTIONAL CHELATING AGENTS

5.2.2 DECLINE IN CONSUMPTION OF PHOSPHATE-BASED AGENTS

5.2.3 POOR DEGRADABILITY OF EDTA AND DTPA

5.3 OPPORTUNITIES

5.3.1 GROWTH IN R&D INVESTMENT TO DEVELOP BIO-BASED CHELATING AGENTS

5.3.2 DEVELOPMENT OF ECO-FRIENDLY CHELATING AGENTS FOR CLEANING APPLICATION

5.3.3 INCREASE IN THE USE OF CHELATING AGENTS FOR THE PHARMACEUTICAL INDUSTRY

5.4 CHALLENGES

5.4.1 ENVIRONMENTAL CONCERNS RELATED TO CHELATING AGENTS

5.4.2 LESS AWARENESS IN DEVELOPING ECONOMIES ABOUT THE BENEFITS OF GREEN CHELATES

6 NORTH AMERICA CHELATING AGENTS MARKET, BY TYPE

6.1 OVERVIEW

6.2 SYNTHETIC CHELATING AGENTS

6.2.1 AMINOPOLYCARBOLXYLATES (APCS)

6.2.1.1 ETHYLENEDIAMINETETRAACETIC ACID (EDTA)

6.2.1.2 DIETHYLENETRIAMINEPENTAACETIC ACID (DTPA)

6.2.1.3 NITRILOTRIACETIC ACID (NTA)

6.2.1.4 OTHERS

6.2.2 ORGANOPHOSPHATES

6.2.2.1 DIETHYLENETRIAMINE PENTA (METHYLENE PHOSPHONIC ACID)(DTPMP)

6.2.2.2 HYDROXYETHYLIDENEDIPHOSPHONIC ACID (HEDP)

6.2.2.3 NITRILOTRIMETHYLENEPHOSPHONIC ACID (NTMP)

6.2.2.4 OTHERS

6.2.3 ORGANIC ACIDS

6.2.3.1 CITRIC ACID

6.2.3.2 TARTARIC ACID

6.2.3.3 OTHERS

6.2.4 OTHERS

6.3 NATURAL CHELATING AGENTS

6.3.1 FOOD-GRADE ACTIVATED CHARCOAL

6.3.2 CHLORELLA

6.3.3 GLYCINE

6.3.4 OTHERS

7 NORTH AMERICA CHELATING AGENTS MARKET, BY FORM

7.1 OVERVIEW

7.2 BIODEGRADABLE

7.2.1 NTA

7.2.2 GLDA

7.2.3 MGDA

7.2.4 OTHERS

7.3 NON-BIODEGRADABLE

8 NORTH AMERICA CHELATING AGENTS MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 DIRECT SALES/B2B

8.3 SPECIALTY STORES

8.4 WAREHOUSES

8.5 E-COMMERCE

8.6 OTHERS

9 NORTH AMERICA CHELATING AGENTS MARKET, BY END USER

9.1 OVERVIEW

9.2 PULP AND PAPER

9.2.1 BIODEGRADABLE

9.2.2 NON-BIODEGRADABLE

9.3 AGRICULTURE

9.3.1 BIODEGRADABLE

9.3.2 NON-BIODEGRADABLE

9.4 CLEANERS AND DETERGENTS

9.4.1 BIODEGRADABLE

9.4.2 NON-BIODEGRADABLE

9.5 INDUSTRIAL CLEANING/DESCALING

9.5.1 BIODEGRADABLE

9.5.2 NON-BIODEGRADABLE

9.6 MINING

9.6.1 BIODEGRADABLE

9.6.2 NON-BIODEGRADABLE

9.7 TEXTILE PROCESSING

9.7.1 BIODEGRADABLE

9.7.2 NON-BIODEGRADABLE

9.8 OIL AND GAS

9.8.1 BIODEGRADABLE

9.8.2 NON-BIODEGRADABLE

9.9 POLYMER PRODUCTION

9.9.1 BIODEGRADABLE

9.9.2 NON-BIODEGRADABLE

9.1 BUILDING AND CONSTRUCTION

9.10.1 BIODEGRADABLE

9.10.2 NON-BIODEGRADABLE

9.11 PHOTOGRAPHY

9.11.1 BIODEGRADABLE

9.11.2 NON-BIODEGRADABLE

9.12 ELECTRICAL AND ELECTRONICS

9.12.1 BIODEGRADABLE

9.12.2 NON-BIODEGRADABLE

9.13 FOOD AND FEED ADDITIVES

9.13.1 BIODEGRADABLE

9.13.2 NON-BIODEGRADABLE

9.14 PERSONAL CARE

9.14.1 BIODEGRADABLE

9.14.2 NON-BIODEGRADABLE

9.15 PHARMACEUTICALS

9.15.1 BIODEGRADABLE

9.15.2 NON-BIODEGRADABLE

9.16 OTHERS

9.16.1 BIODEGRADABLE

9.16.2 NON-BIODEGRADABLE

10 NORTH AMERICA CHELATING AGENTS MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA CHELATING AGENTS MARKET COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ADM

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATE

13.2 MITSUBISHI CHEMICAL CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 RECENT FINANCIALS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 LANXESS

13.3.1 COMPANY SNAPSHOT

13.3.2 RECENT FINANCIALS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 DOW

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT UPDATE

13.5 EVONIK INDUSTRIES AG

13.5.1 COMPANY SNAPSHOT

13.5.2 RECENT FINANCIALS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 AQUAPHARM CHEMICAL PVT LTD.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ASCEND PERFORMANCE MATERIALS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 AVA CHEMICALS PRIVATE LIMITED

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 BASF SE

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATE

13.1 CHEVRON PHILLIPS CHEMICAL COMPANY

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 EASTMAN CHEMICAL COMPANY

13.11.1 COMPANY SNAPSHOT

13.11.2 RECENT FINANCIALS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 JARCHEM INNOVATIVE INGREDIENTS LLC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 KEMIRA

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATES

13.14 LONZA

13.14.1 COMPANY SNAPSHOT

13.14.2 RECENT FINANCIALS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENT

13.15 NANJING SUNRISE IMP. & EXP. CO., LTD

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 NIPPON SHKUBAI CO., LTD.

13.16.1 COMPANY SNAPSHOT

13.16.2 RECENT FINANCIALS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 NOURYON

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT UPDATE

13.18 SABIC

13.18.1 COMPANY SNAPSHOT

13.18.2 RECENT FINANCIALS

13.18.3 .PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 SHANDONG IRO CHELATING CHEMICAL CO., LTD.

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 ZHONGLAN INDUSTRY CO., LTD

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 2 NORTH AMERICA CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 3 NORTH AMERICA SYNTHETIC CHELATING AGENTS IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 4 NORTH AMERICA SYNTHETIC CHELATING AGENTS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 5 NORTH AMERICA SYNTHETIC CHELATING AGENTS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 6 NORTH AMERICA AMINOPOLYCARBOLXYLATES (APCS) IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 7 NORTH AMERICA AMINOPOLYCARBOLXYLATES (APCS) IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 8 NORTH AMERICA ORGANOPHOSPHATES IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 9 NORTH AMERICA ORGANOPHOSPHATES IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 10 NORTH AMERICA ORGANIC ACIDS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 11 NORTH AMERICA ORGANIC ACIDS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 12 NORTH AMERICA NATURAL CHELATING AGENTS IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 13 NORTH AMERICA NATURAL CHELATING AGENTS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 14 NORTH AMERICA NATURAL CHELATING AGENTS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 15 NORTH AMERICA CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 16 NORTH AMERICA CHELATING AGENTS MARKET, BY FORM, 2016-2030 (TONS)

TABLE 17 NORTH AMERICA BIODEGRADABLE IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 18 NORTH AMERICA BIODEGRADABLE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 19 NORTH AMERICA BIODEGRADABLE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (TONS)

TABLE 20 NORTH AMERICA NON-BIODEGRADEABLE IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 21 NORTH AMERICA CHELATING AGENTS MARKET, BY DISTRIBUTION CHANNEL, 2016-2030 (USD MILLION)

TABLE 22 NORTH AMERICA CHELATING AGENTS MARKET, BY DISTRIBUTION CHANNEL, 2016-2030 (TONS)

TABLE 23 NORTH AMERICA DIRECT SALES/B2B IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 24 NORTH AMERICA SPECIALTY STORES IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 25 NORTH AMERICA WAREHOUSES IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 26 NORTH AMERICA E-COMMERCE IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 28 NORTH AMERICA CHELATING AGENTS MARKET, BY END USER, 2016-2030 (USD MILLION)

TABLE 29 NORTH AMERICA CHELATING AGENTS MARKET, BY END USER, 2016-2030 (TONS)

TABLE 30 NORTH AMERICA PULP AND PAPER IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 31 NORTH AMERICA PULP AND PAPER IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 32 NORTH AMERICA AGRICULTURE IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 33 NORTH AMERICA AGRICULTURE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 34 NORTH AMERICA CLEANERS AND DETERGENTS IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 35 NORTH AMERICA CLEANERS AND DETERGENTS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 36 NORTH AMERICA INDUSTRIAL CLEANING/DESCALING IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 37 NORTH AMERICA INDUSTRIAL CLEANING/DESCALING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 38 NORTH AMERICA MINING IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 39 NORTH AMERICA MINING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 40 NORTH AMERICA TEXTILE PROCESSING IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 41 NORTH AMERICA TEXTILE PROCESSING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 42 NORTH AMERICA OIL AND GAS IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 43 NORTH AMERICA OIL AND GAS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 44 NORTH AMERICA POLYMER PRODUCTION IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 45 NORTH AMERICA POLYMER PRODUCTION IN CHELATING AGENTS MARKET, BY FROM, 2016-2030 (USD MILLION)

TABLE 46 NORTH AMERICA BUILDING AND CONSTRUCTION IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 47 NORTH AMERICA BUILDING AND CONSTRUCTION IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 48 NORTH AMERICA PHOTOGRAPHY IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 49 NORTH AMERICA PHOTOGRAPHY IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 50 NORTH AMERICA ELECTRICAL AND ELECTRONICS IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 51 NORTH AMERICA ELECTRICAL AND ELECTRONICS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 52 NORTH AMERICA FOOD AND FEED ADDITIVES IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 53 NORTH AMERICA FOOD AND FEED ADDITIVES IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 54 NORTH AMERICA PERSONAL CARE IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 55 NORTH AMERICA PERSONAL CARE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 56 NORTH AMERICA PHARMACEUTICALS IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 57 NORTH AMERICA PHARMACEUTICALS IN CHELATING AGENTS MARKET BY FORM, 2016-2030 (USD MILLION)

TABLE 58 NORTH AMERICA OTHERS IN CHELATING AGENTS MARKET, BY REGION, 2016-2030 (USD MILLION)

TABLE 59 NORTH AMERICA CHELATING AGENTS MARKET, OTHERS BY TYPE, 2016-2030 (USD MILLION)

TABLE 60 NORTH AMERICA CHELATING AGENTS MARKET, BY COUNTRY, 2016-2030 (USD MILLION)

TABLE 61 NORTH AMERICA CHELATING AGENTS MARKET, BY COUNTRY, 2016-2030 (TONS)

TABLE 62 NORTH AMERICA CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 63 NORTH AMERICA CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 64 NORTH AMERICA SYNTHETIC IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 65 NORTH AMERICA SYNTHETIC IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 66 NORTH AMERICA AMINOPOLYCARBOLXYLATES (APCS) IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 67 NORTH AMERICA AMINOPOLYCARBOLXYLATES (APCS) IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 68 NORTH AMERICA ORGANOPHOSPHATES IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 69 NORTH AMERICA ORGANOPHOSPHATES IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 70 NORTH AMERICA ORGANIC ACIDS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 71 NORTH AMERICA ORGANIC ACIDS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 72 NORTH AMERICA NATURAL IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 73 NORTH AMERICA NATURAL IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 74 NORTH AMERICA CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 75 NORTH AMERICA CHELATING AGENTS MARKET, BY FORM, 2016-2030 (TONS)

TABLE 76 NORTH AMERICA BIODEGRADABLE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 77 NORTH AMERICA BIODEGRADABLE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (TONS)

TABLE 78 NORTH AMERICA CHELATING AGENTS MARKET, BY DISTRIBUTION CHANNEL, 2016-2030 (USD MILLION)

TABLE 79 NORTH AMERICA CHELATING AGENTS MARKET, BY DISTRIBUTION CHANNEL, 2016-2030 (TONS)

TABLE 80 NORTH AMERICA CHELATING AGENTS MARKET, BY END-USER, 2016-2030 (USD MILLION)

TABLE 81 NORTH AMERICA CHELATING AGENTS MARKET, BY END-USER, 2016-2030 (TONS)

TABLE 82 NORTH AMERICA PULP AND PAPER IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 83 NORTH AMERICA AGRICULTURE IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 84 NORTH AMERICA CLEANERS AND DETERGENTS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 85 NORTH AMERICA INDUSTRIAL CLEANING/DESCALING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 86 NORTH AMERICA MINING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 87 NORTH AMERICA TEXTILE PROCESSING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 88 NORTH AMERICA OIL AND GAS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 89 NORTH AMERICA POLYMER PRODUCTION IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 90 NORTH AMERICA BUILDING AND CONSTRUCTION IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 91 NORTH AMERICA PHOTOGRAPHY IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 92 NORTH AMERICA ELECTRICAL AND ELECTRONICS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 93 NORTH AMERICA FOOD AND FEED ADDITIVES IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 94 NORTH AMERICA PERSONAL CARE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 95 NORTH AMERICA PHARMACEUTICALS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 96 NORTH AMERICA OTHERS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 97 U.S. CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 98 U.S. CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 99 U.S. SYNTHETIC IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 100 U.S. SYNTHETIC IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 101 U.S. AMINOPOLYCARBOLXYLATES (APCS) IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 102 U.S. AMINOPOLYCARBOLXYLATES (APCS) IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 103 U.S. ORGANOPHOSPHATES IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 104 U.S. ORGANOPHOSPHATES IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 105 U.S. ORGANIC ACIDS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 106 U.S. ORGANIC ACIDS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 107 U.S. NATURAL IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 108 U.S. NATURAL IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 109 U.S. CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 110 U.S. CHELATING AGENTS MARKET, BY FORM, 2016-2030 (TONS)

TABLE 111 U.S. BIODEGRADABLE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 112 U.S. BIODEGRADABLE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (TONS)

TABLE 113 U.S. CHELATING AGENTS MARKET, BY DISTRIBUTION CHANNEL, 2016-2030 (USD MILLION)

TABLE 114 U.S. CHELATING AGENTS MARKET, BY DISTRIBUTION CHANNEL, 2016-2030 (TONS)

TABLE 115 U.S. CHELATING AGENTS MARKET, BY END-USER, 2016-2030 (USD MILLION)

TABLE 116 U.S. CHELATING AGENTS MARKET, BY END-USER, 2016-2030 (TONS)

TABLE 117 U.S. PULP AND PAPER IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 118 U.S. AGRICULTURE IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 119 U.S. CLEANERS AND DETERGENTS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 120 U.S. INDUSTRIAL CLEANING/DESCALING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 121 U.S. MINING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 122 U.S. TEXTILE PROCESSING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 123 U.S. OIL AND GAS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 124 U.S. POLYMER PRODUCTION IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 125 U.S. BUILDING AND CONSTRUCTION IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 126 U.S. PHOTOGRAPHY IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 127 U.S. ELECTRICAL AND ELECTRONICS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 128 U.S. FOOD AND FEED ADDITIVES IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 129 U.S. PERSONAL CARE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 130 U.S. PHARMACEUTICALS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 131 U.S. OTHERS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 132 CANADA CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 133 CANADA CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 134 CANADA SYNTHETIC IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 135 CANADA SYNTHETIC IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 136 CANADA AMINOPOLYCARBOLXYLATES (APCS) IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 137 CANADA AMINOPOLYCARBOLXYLATES (APCS) IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 138 CANADA ORGANOPHOSPHATES IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 139 CANADA ORGANOPHOSPHATES IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 140 CANADA ORGANIC ACIDS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 141 CANADA ORGANIC ACIDS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 142 CANADA NATURAL IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 143 CANADA NATURAL IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 144 CANADA CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 145 CANADA CHELATING AGENTS MARKET, BY FORM, 2016-2030 (TONS)

TABLE 146 CANADA BIODEGRADABLE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 147 CANADA BIODEGRADABLE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (TONS)

TABLE 148 CANADA CHELATING AGENTS MARKET, BY DISTRIBUTION CHANNEL, 2016-2030 (USD MILLION)

TABLE 149 CANADA CHELATING AGENTS MARKET, BY DISTRIBUTION CHANNEL, 2016-2030 (TONS)

TABLE 150 CANADA CHELATING AGENTS MARKET, BY END-USER, 2016-2030 (USD MILLION)

TABLE 151 CANADA CHELATING AGENTS MARKET, BY END-USER, 2016-2030 (TONS)

TABLE 152 CANADA PULP AND PAPER IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 153 CANADA AGRICULTURE IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 154 CANADA CLEANERS AND DETERGENTS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 155 CANADA INDUSTRIAL CLEANING/DESCALING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 156 CANADA MINING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 157 CANADA TEXTILE PROCESSING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 158 CANADA OIL AND GAS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 159 CANADA POLYMER PRODUCTION IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 160 CANADA BUILDING AND CONSTRUCTION IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 161 CANADA PHOTOGRAPHY IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 162 CANADA ELECTRICAL AND ELECTRONICS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 163 CANADA FOOD AND FEED ADDITIVES IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 164 CANADA PERSONAL CARE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 165 CANADA PHARMACEUTICALS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 166 CANADA OTHERS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 167 MEXICO CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 168 MEXICO CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 169 MEXICO SYNTHETIC IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 170 MEXICO SYNTHETIC IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 171 MEXICO AMINOPOLYCARBOLXYLATES (APCS) IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 172 MEXICO AMINOPOLYCARBOLXYLATES (APCS) IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 173 MEXICO ORGANOPHOSPHATES IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 174 MEXICO ORGANOPHOSPHATES IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 175 MEXICO ORGANIC ACIDS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 176 MEXICO ORGANIC ACIDS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 177 MEXICO NATURAL IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 178 MEXICO NATURAL IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 179 MEXICO CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 180 MEXICO CHELATING AGENTS MARKET, BY FORM, 2016-2030 (TONS)

TABLE 181 MEXICO BIODEGRADABLE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 182 MEXICO BIODEGRADABLE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (TONS)

TABLE 183 MEXICO CHELATING AGENTS MARKET, BY DISTRIBUTION CHANNEL, 2016-2030 (USD MILLION)

TABLE 184 MEXICO CHELATING AGENTS MARKET, BY DISTRIBUTION CHANNEL, 2016-2030 (TONS)

TABLE 185 MEXICO CHELATING AGENTS MARKET, BY END-USER, 2016-2030 (USD MILLION)

TABLE 186 MEXICO CHELATING AGENTS MARKET, BY END-USER, 2016-2030 (TONS)

TABLE 187 MEXICO PULP AND PAPER IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 188 MEXICO AGRICULTURE IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 189 MEXICO CLEANERS AND DETERGENTS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 190 MEXICO INDUSTRIAL CLEANING/DESCALING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 191 MEXICO MINING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 192 MEXICO TEXTILE PROCESSING IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 193 MEXICO OIL AND GAS IN CHELATING AGENTS MARKET, BY TYPE, 2016-2030 (USD MILLION)

TABLE 194 MEXICO POLYMER PRODUCTION IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 195 MEXICO BUILDING AND CONSTRUCTION IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 196 MEXICO PHOTOGRAPHY IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 197 MEXICO ELECTRICAL AND ELECTRONICS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 198 MEXICO FOOD AND FEED ADDITIVES IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 199 MEXICO PERSONAL CARE IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 200 MEXICO PHARMACEUTICALS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

TABLE 201 MEXICO OTHERS IN CHELATING AGENTS MARKET, BY FORM, 2016-2030 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA CHELATING AGENTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CHELATING AGENTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CHELATING AGENTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CHELATING AGENTS MARKET : NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CHELATING AGENTS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CHELATING AGENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CHELATING AGENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CHELATING AGENTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA CHELATING AGENTS MARKET: SEGMENTATION

FIGURE 10 RISE IN DEMAND FROM PULP & PAPER INDUSTRY IS DRIVING THE NORTH AMERICA CHELATING AGENTS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE SYNTHETIC CHELATING AGENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CHELATING AGENTS MARKET IN 2023 & 2030

FIGURE 12 THE CHANGE IN PRICES OF CHELATING AGENTS IN THE NORTH AMERICA MARKET HAS BEEN GIVEN BELOW.

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA CHELATING AGENTS MARKET

FIGURE 14 NORTH AMERICA CHELATING AGENTS MARKET: BY TYPE, 2022

FIGURE 15 NORTH AMERICA CHELATING AGENTS MARKET: BY FORM, 2022

FIGURE 16 NORTH AMERICA CHELATING AGENTS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 17 NORTH AMERICA CHELATING AGENTS MARKET: BY END USER, 2022

FIGURE 18 NORTH AMERICA CHELATING AGENTS MARKET: SNAPSHOT (2022)

FIGURE 19 NORTH AMERICA CHELATING AGENTS MARKET: BY COUNTRY (2022)

FIGURE 20 NORTH AMERICA CHELATING AGENTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 NORTH AMERICA CHELATING AGENTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 NORTH AMERICA CHELATING AGENTS MARKET: BY TYPE (2023-2030)

FIGURE 23 NORTH AMERICA CHELATING AGENTS MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.