Biometria na América do Norte no Mercado Governamental, Por Modo (Reconhecimento de Impressão Digital, Reconhecimento Facial, Reconhecimento de Íris, Reconhecimento de Impressão Palmar, Reconhecimento de Veias, Reconhecimento de Assinatura, Reconhecimento de Voz, Outros), Componentes (Hardware e Software) , Tipo (Sem Contacto, Baseado em Contacto e Híbrido/Multimodal), Autenticação (Autenticação de Fator Único e Autenticação de Múltiplos Fatores), Candidatura (Civil, Militar, Policial, Passaporte Eletrónico, Vistos Eletrónicos, Comercial e Outros), País (Alemanha , França, Reino Unido, Itália, Espanha, Tendências e previsões do setor (Holanda, Suíça, Rússia, Turquia, Bélgica e resto da América do Norte) até 2028.

Análise de Mercado e Insights: Biometria no Mercado Governamental da América do Norte

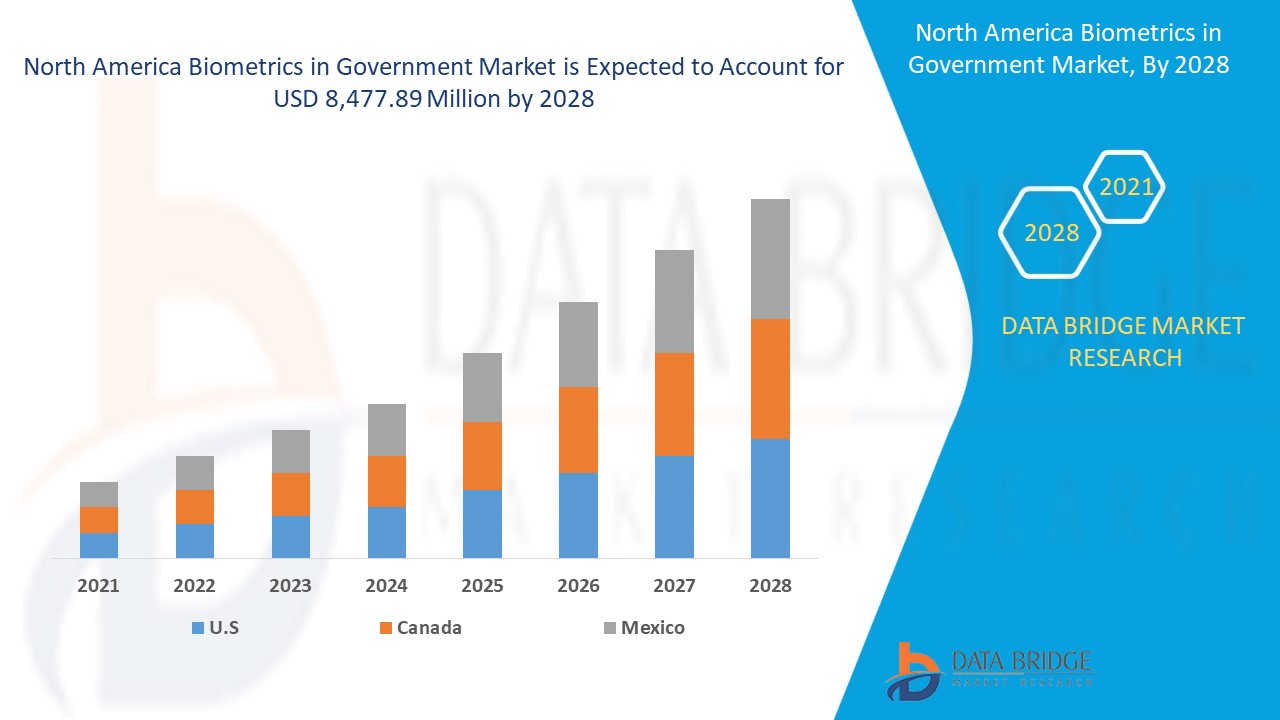

Espera-se que o mercado de biometria no governo da América do Norte ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 15,2% no período previsto de 2021 a 2028 e prevê-se que atinja os 8.477,89 milhões de dólares até 2028. A crescente necessidade de segurança e vigilância com a crescente ameaça de ataques terroristas atua como um motor para o crescimento do mercado de biometria no governo.

A biometria é a medição e análise estatística das características físicas e comportamentais únicas de uma pessoa. O termo biometria é derivado das palavras gregas bio, que significa vida, e métrica, que significa medir. São utilizadas diferentes tecnologias para a identificação e controlo de acesso de um indivíduo. Na autenticação biométrica, os traços físicos ou comportamentais intrínsecos de cada pessoa serão identificados com precisão. A biometria é utilizada em todos os setores, como o da saúde, automóvel, eletrónica de consumo , militar e outros, para controlo de acessos, identificação e reconhecimento da pessoa sob vigilância. O sistema é utilizado pelas autoridades governamentais para a segurança dos seus cidadãos que utilizam a biometria. A biometria é difícil de falsificar ou roubar (ao contrário das palavras-passe), fácil e conveniente de utilizar, intransmissível e eficiente porque os modelos ocupam menos espaço de armazenamento.

A crescente utilização da biometria no governo para a manutenção de uma base de dados central de cidadãos para identificação nacional é o principal fator impulsionador do mercado. O risco de segurança devido à violação de dados pode ser um desafio e o avanço na tecnologia e nos sistemas para aplicações de biometria no governo pode ser uma oportunidade. No entanto, o elevado custo de implementação e os desafios enfrentados devido ao impacto da COVID-19 na cadeia de abastecimento de matérias-primas são os factores restritivos.

O relatório do mercado de biometria no governo fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise do pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos , expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado da Biometria no Governo, contacte a Data Bridge Market Research para um briefing de analista.

Âmbito e dimensão do mercado de biometria no governo da América do Norte

O mercado de biometria no governo da América do Norte está segmentado com base no modo, componentes, tipo, autenticação e aplicação. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no modo, a biometria no mercado governamental está segmentada em reconhecimento de impressões digitais, reconhecimento facial, reconhecimento de íris, reconhecimento de impressões palmares, reconhecimento de veias, reconhecimento de assinaturas, reconhecimento de voz e outros. Em 2021, o reconhecimento de impressões digitais está a dominar a biometria no mercado governamental devido à sua elevada velocidade de deteção.

- Com base nos componentes, a biometria no mercado governamental está segmentada em hardware e software. Em 2021, o segmento de hardware está a dominar o mercado da biometria no governo devido ao seu custo mais elevado.

- Com base no tipo, a biometria no mercado governamental é segmentada em contactless, contact-based e híbrida/multimodal. Em 2021, o segmento contactless está a dominar a biometria no mercado governamental devido às preocupações dos consumidores com a segurança de alta tecnologia.

- Com base na autenticação, a biometria no mercado governamental é segmentada em autenticação de fator único e autenticações de múltiplos fatores. Em 2021, o segmento de autenticação de fator único está a dominar o mercado da biometria no governo, uma vez que o sistema é mais rápido e simples em termos de implementação.

- Com base na aplicação, a biometria no mercado governamental está segmentada em civil, militar, policial, passaporte eletrónico, vistos eletrónicos, comercial e outros. Em 2021, o segmento civil está a dominar a biometria no mercado governamental devido à maior adoção da biometria para identificação nacional.

Análise ao nível do país de biometria no mercado governamental da América do Norte

O mercado da biometria no governo é analisado e são fornecidas informações sobre o tamanho do mercado por país, modo, componentes, tipo, autenticação e aplicação, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado da biometria no governo são os EUA, o Canadá e o México. Os EUA dominam o mercado devido ao maior número de fabricantes e à procura de biometria no governo.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da América do Norte e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

O uso crescente da biometria no governo para segurança e vigilância está a impulsionar o crescimento do mercado da América do Norte Biometria no mercado governamental

O mercado de biometria governamental da América do Norte também fornece análises de mercado detalhadas para o crescimento de cada país num mercado específico. Além disso, fornece informações detalhadas sobre a estratégia dos participantes do mercado e a sua presença geográfica. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Cenário competitivo e análise da quota de mercado da biometria no governo na América do Norte

A biometria no cenário competitivo do mercado governamental fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, largura e amplitude do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa na biometria no mercado governamental.

As principais empresas que lidam com a biometria no governo da América do Norte são a Thales Group, NEC Corporation, HID Global Corporation, IDEMIA, Shenzhen Goodix Technology Co., Aratek, Aware, Inc., Paravision, SecuGen Corporation, BioID, Cognitec Systems GmbH, FUJITSU, id3 Technologies, Innovatrics, Integrated Biometrics, Jenetric GmbH e BIO-key International, entre outros participantes nacionais. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos contratos e acordos são também iniciados por empresas de todo o mundo, o que está também a acelerar a biometria no mercado governamental.

Por exemplo,

- Em janeiro de 2021, a Jenetric GmbH introduziu um revestimento antimicrobiano para os leitores de impressões digitais para proteger o utilizador de qualquer tipo de infeção. O revestimento previne a transmissão de microrganismos e contribui de forma valiosa para a prevenção de infeções. O mais importante no revestimento é que não afeta a qualidade da impressão digital do scanner. Com isto, a empresa poderá fornecer uma solução permanente de proteção contra infeções ao seu utilizador.

- Em junho de 2021, a Aware, Inc. anunciou que iria estabelecer uma parceria com a Iris ID Systems Inc., líder mundial em reconhecimento de íris e tecnologia de autenticação de identidade. Através desta parceria, as empresas desenvolverão uma identificação rápida e precisa baseada na íris para uma variedade de casos de utilização da justiça criminal. Combinando os softwares AwareABIS e Nexa|Iris da Aware com o hardware da Iris ID, as empresas irão produzir o sistema. Isto ajudará a empresa a expandir o seu portfólio de produtos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 MODE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING USE OF BIOMETRICS IN CONSUMER ELECTRONIC DEVICES FOR AUTHENTICATION AND IDENTIFICATION

5.1.2 GROWING NEED FOR SECURITY AND SURVEILLANCE WITH THE HEIGHTENED THREAT OF TERRORIST ATTACK

5.1.3 UPSURGE IN THE USAGE OF BIOMETRIC IN E-PASSPORT, E-VISAS AND NATIONAL ID CARDS

5.1.4 GROWING UTILIZATION OF ADVANCED BIOMETRICS FOR SAFE AND SECURED CROSS-BORDER MOBILITY

5.1.5 GOVERNMENT INITIATIVES SUPPORTING THE ADOPTION OF BIOMETRICS

5.1.6 INCREASING USE OF BIOMETRIC SYSTEMS IN THE ORGANIZATION FOR TIME AND ATTENDANCE

5.2 RESTRAINT

5.2.1 HIGH DEPLOYMENT COST OF BIOMETRIC SYSTEM

5.3 OPPORTUNITIES

5.3.1 IMPLICATION OF CONTACTLESS BIOMETRIC AUTHENTICATION

5.3.2 GROWING ADVANCEMENT IN BIOMETRIC IDENTIFICATION TECHNOLOGY

5.3.3 EXPANSION IN DEMAND FOR STRENGTHENING OF SYSTEMS AND MONITORING SERVICES

5.4 CHALLENGES

5.4.1 SECURITY CONCERNS REGARDING DATA BREACH

5.4.2 LACK OF TECHNICAL KNOW-HOW AND AWARENESS AMONG THE PEOPLE

6 IMPACT OF COVID-19 ON THE NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY MODE

7.1 OVERVIEW

7.2 FINGERPRINT RECOGNITION

7.2.1 BY TECHNOLOGY

7.2.1.1 Optical

7.2.1.2 Capacitive

7.2.1.3 Ultrasonic

7.2.1.4 Thermal

7.3 FACE RECOGNITION

7.3.1 BY APPLICATION

7.3.1.1 Access Control

7.3.1.2 Security and Surveillance

7.3.1.3 Attendance tracking and Monitoring

7.3.1.4 Emotion recognition

7.4 IRIS RECOGNITION

7.4.1 BY APPLICATION

7.4.1.1 identity management and access control

7.4.1.2 time monitoring

7.4.1.3 E-payment

7.5 PALMPRINT RECOGNITION

7.6 VEIN RECOGNITION

7.6.1 BY TYPE

7.6.1.1 Finger vein recognition

7.6.1.2 palm vein recognition

7.6.1.3 eye vein recognition

7.7 SIGNATURE RECOGNITION

7.8 VOICE RECOGNITION

7.8.1 BY TYPE

7.8.1.1 Artificial intelligence

7.8.1.2 non-Artificial intelligence

7.9 OTHERS

8 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 BY TYPE

8.2.1.1 Microcontroller

8.2.1.2 cameras

8.2.1.3 scanners

8.2.1.4 Finger print readers

8.2.1.5 others

8.3 SOFTWARE

9 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY TYPE

9.1 OVERVIEW

9.2 CONTACTLESS

9.3 CONTACT-BASED

9.4 HYBRID/MULTIMODAL

10 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION

10.1 OVERVIEW

10.2 SINGLE FACTOR AUTHENTICATION

10.3 MULTIPLE FACTOR AUTHENTICATION

11 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CIVIL

11.2.1 CIVIL, BY TYPE

11.2.1.1 national id

11.2.1.2 Civil boarder immigration/ border control

11.2.1.3 voter registration and voting

11.2.1.4 employee background checks

11.2.2 CIVIL, BY COMPONENTS

11.2.2.1 Hardware

11.2.2.1.1 Microcontroller

11.2.2.1.2 cameras

11.2.2.1.3 scanners

11.2.2.1.4 Fingerprint Readers

11.2.2.1.5 Others

11.2.2.2 Software

11.3 MILITARY

11.3.1 MILITARY, BY TYPE

11.3.1.1 protection of military bases

11.3.1.2 illegal border crossing/asylum application processing

11.3.2 BY COMPONENTS

11.3.2.1 Hardware

11.3.2.1.1 Microcontroller

11.3.2.1.2 cameras

11.3.2.1.3 scanners

11.3.2.1.4 Fingerprint Readers

11.3.2.1.5 Others

11.3.2.2 Software

11.4 LAW ENFORCEMENT

11.4.1 LAW ENFORCEMENT, BY PRODUCT TYPE

11.4.1.1 police booking systems

11.4.1.2 latent fingerprint machine

11.4.1.3 public safety

11.4.1.4 rapid id products

11.4.2 LAW ENFORCEMENT, BY COMPONENTS

11.4.2.1 Hardware

11.4.2.1.1 Microcontroller

11.4.2.1.2 cameras

11.4.2.1.3 scanners

11.4.2.1.4 Fingerprint Readers

11.4.2.1.5 Others

11.4.2.2 Software

11.5 E-PASSPORT

11.5.1 E-PASSPORT, BY COMPONENTS

11.5.1.1 Hardware

11.5.1.1.1 Microcontroller

11.5.1.1.2 cameras

11.5.1.1.3 scanners

11.5.1.1.4 Fingerprint Readers

11.5.1.1.5 Others

11.5.1.2 Software

11.6 E-VISAS

11.6.1 E-VISAS, BY COMPONENTS

11.6.1.1 Hardware

11.6.1.1.1 Microcontroller

11.6.1.1.2 cameras

11.6.1.1.3 scanners

11.6.1.1.4 Fingerprint Readers

11.6.1.1.5 Others

11.6.1.2 Software

11.7 COMMERCIAL

11.7.1 COMMERCIAL, BY TYPE

11.7.1.1 banking with biometrics

11.7.1.2 healthcare and welfare

11.7.1.3 Biometrics in restaurant point-of-sale

11.7.2 COMMERCIAL, BY COMPONENTS

11.7.2.1 Hardware

11.7.2.1.1 Microcontroller

11.7.2.1.2 cameras

11.7.2.1.3 scanners

11.7.2.1.4 Fingerprint Readers

11.7.2.1.5 Others

11.7.2.2 Software

11.8 OTHER

12 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 THALES GROUP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SOLUTION PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 NEC CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 SOLUTION & SERVICE PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 HID NORTH AMERICA CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 SOLUTION PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 IDEMIA

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 SHENZHEN GOODIX TECHNOLOGY CO., LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ARATEK

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 AWARE, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 BEIJING KUANGSHI TECHNOLOGY CO.,LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 BIOENABLE TECHNOLOGIES PVT. LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 BIOID

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 BIO-KEY INTERNATIONAL

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 COGNITEC SYSTEMS GMBH

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 FUJITSU

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 ID3 TECHOLOGIES

15.14.1 COMPANY SNAPSHOT

15.14.2 SOLUTION & PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 INNOVATRICS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 INTEGRATED BIOMETRICS

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 JENETRIC GMBH

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 PARAVISION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 SECUGEN CORPORATION

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 SENSETIME

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

LIST OF TABLES

TABLE 1 HIGH DEPLOYMENT COST OF BIOMETRIC SYSTEM

TABLE 2 COST OF DIFFERENT TYPES OF BIOMETRIC SYSTEM

TABLE 3 EFFECT OF SECURITY AWARENESS TRAINING ON THE USE OF BIOMETRIC AUTHENTICATION

TABLE 4 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY MODE, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA FINGERPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA FINGERPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA FACE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA FACE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA IRIS RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA IRIS RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA PALMPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA VEIN RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA VEIN RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA SIGNATURE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA VOICE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA VOICE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA SOFTWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA CONTACTLESS IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA CONTACT-BASED IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA HYBRID/MULTIMODAL IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA SINGLE FACTOR AUTHENTICATION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA MULTIPLE FACTOR AUTHENTICATION IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA E-PASSPORT IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA E-PASSPORT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA E-VISAS IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 46 NORTH AMERICA E-VISAS IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 47 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 48 NORTH AMERICA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 49 NORTH AMERICA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 50 NORTH AMERICA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 51 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 52 NORTH AMERICA OTHER IN BIOMETRICS IN GOVERNMENT MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 53 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 54 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY MODE, 2019-2028 (USD MILLION)

TABLE 55 NORTH AMERICA FINGERPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 56 NORTH AMERICA FACE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 57 NORTH AMERICA IRIS RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 58 NORTH AMERICA VEIN RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 59 NORTH AMERICA VOICE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 60 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 61 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 62 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 63 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION, 2019-2028 (USD MILLION)

TABLE 64 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 65 NORTH AMERICA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 66 NORTH AMERICA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 67 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 68 NORTH AMERICA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 69 NORTH AMERICA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 70 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 71 NORTH AMERICA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 72 NORTH AMERICA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 73 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 74 NORTH AMERICA E-PASSPORT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 75 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 76 NORTH AMERICA E-VISAS IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 77 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 78 NORTH AMERICA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 79 NORTH AMERICA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 80 NORTH AMERICA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 81 U.S. BIOMETRICS IN GOVERNMENT MARKET, BY MODE, 2019-2028 (USD MILLION)

TABLE 82 U.S. FINGERPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 83 U.S. FACE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 84 U.S. IRIS RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 85 U.S. VEIN RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 86 U.S. VOICE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 87 U.S. BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 88 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 89 U.S. BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 90 U.S. BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION, 2019-2028 (USD MILLION)

TABLE 91 U.S. BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 92 U.S. CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 93 U.S. CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 94 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 95 U.S. MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 96 U.S. MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 97 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 98 U.S. LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 99 U.S. LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 100 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 101 U.S. E-PASSPORT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 102 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 103 U.S. E-VISAS IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 104 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 105 U.S. COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 106 U.S. COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 107 U.S. HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 108 CANADA BIOMETRICS IN GOVERNMENT MARKET, BY MODE, 2019-2028 (USD MILLION)

TABLE 109 CANADA FINGERPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 110 CANADA FACE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 111 CANADA IRIS RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 112 CANADA VEIN RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 113 CANADA VOICE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 114 CANADA BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 115 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 116 CANADA BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 117 CANADA BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION, 2019-2028 (USD MILLION)

TABLE 118 CANADA BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 119 CANADA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 120 CANADA CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 121 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 122 CANADA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 123 CANADA MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 124 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 125 CANADA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 126 CANADA LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 127 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 128 CANADA E-PASSPORT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 129 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 130 CANADA E-VISAS IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 131 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 132 CANADA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 133 CANADA COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 134 CANADA HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 135 MEXICO BIOMETRICS IN GOVERNMENT MARKET, BY MODE, 2019-2028 (USD MILLION)

TABLE 136 MEXICO FINGERPRINT RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 137 MEXICO FACE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 138 MEXICO IRIS RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 139 MEXICO VEIN RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 140 MEXICO VOICE RECOGNITION IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 141 MEXICO BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 142 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 143 MEXICO BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 144 MEXICO BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION, 2019-2028 (USD MILLION)

TABLE 145 MEXICO BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 146 MEXICO CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 147 MEXICO CIVIL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 148 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 149 MEXICO MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 150 MEXICO MILITARY IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 151 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 152 MEXICO LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 153 MEXICO LAW ENFORCEMENT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 154 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 155 MEXICO E-PASSPORT IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 156 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 157 MEXICO E-VISAS IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 158 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 159 MEXICO COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 160 MEXICO COMMERCIAL IN BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2019-2028 (USD MILLION)

TABLE 161 MEXICO HARDWARE IN BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2019-2028 (USD MILLION)

Lista de Figura

LIST OF FIGURES

FIGURE 1 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: SEGMENTATION

FIGURE 11 INCREASE USE OF BIOMETRICS IN CONSUMER ELECTRONIC DEVICES FOR AUTHENTICATION AND IDENTIFICATION IS EXPECTED TO DRIVE NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 FINGERPRINT RECOGNITION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET

FIGURE 14 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY MODE, 2020

FIGURE 15 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY COMPONENTS, 2020

FIGURE 16 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY TYPE, 2020

FIGURE 17 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY AUTHENTICATION, 2020

FIGURE 18 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET, BY APPLICATION, 2020

FIGURE 19 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: SNAPSHOT (2020)

FIGURE 20 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: BY COUNTRY (2020)

FIGURE 21 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: BY COUNTRY (2021 & 2028)

FIGURE 22 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: BY COUNTRY (2020 & 2028)

FIGURE 23 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: BY MODE (2021-2028)

FIGURE 24 NORTH AMERICA BIOMETRICS IN GOVERNMENT MARKET: COMPANY SHARE 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.