North America Biodegradable Film Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.24 Billion

USD

4.76 Billion

2025

2033

USD

3.24 Billion

USD

4.76 Billion

2025

2033

| 2026 –2033 | |

| USD 3.24 Billion | |

| USD 4.76 Billion | |

|

|

|

|

Segmentação do mercado de filmes biodegradáveis na América do Norte, por tipo (PLA, misturas de amido, poliéster biodegradável, PHA, à base de soja, à base de celulose, à base de lignina e outros), tipo de produto (oxobiodegradável e hidrobiodegradável), tipo de cultura (frutas e vegetais, grãos e oleaginosas, flores e plantas e outros), aplicação (embalagens de alimentos, agricultura e horticultura, produtos cosméticos e de higiene pessoal, embalagens industriais e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de filmes biodegradáveis na América do Norte

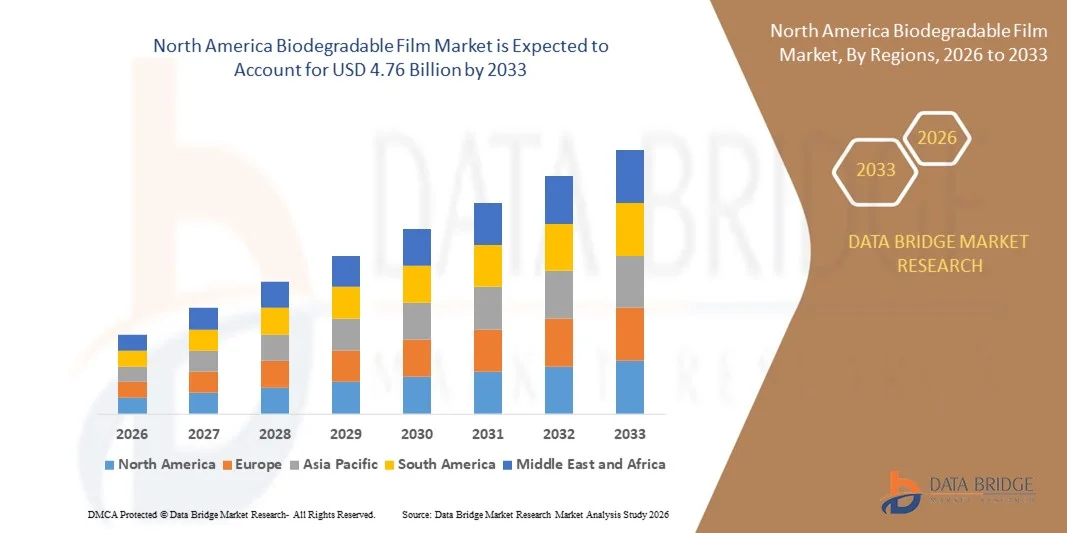

- O mercado de filmes biodegradáveis na América do Norte foi avaliado em US$ 3,24 bilhões em 2025 e espera-se que alcance US$ 4,76 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 4,90% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por soluções de embalagens sustentáveis em aplicações nos setores de alimentos, agricultura e bens de consumo.

- A crescente pressão regulatória para reduzir o uso de plásticos descartáveis e promover materiais ecológicos está acelerando significativamente a adoção dessas práticas.

Análise do mercado de filmes biodegradáveis na América do Norte

- O mercado está testemunhando um forte impulso à medida que as indústrias se voltam para práticas de economia circular e priorizam materiais compostáveis e de base biológica para atingir as metas de sustentabilidade.

- Além disso, a inovação contínua em matérias-primas e técnicas de processamento está aprimorando a paridade de desempenho com os filmes plásticos convencionais, melhorando a competitividade de custos e a viabilidade de mercado a longo prazo.

- Os EUA dominaram o mercado de filmes biodegradáveis, com a maior participação na receita em 2025, impulsionados pela crescente demanda por soluções de embalagens sustentáveis nos setores de alimentos, agricultura e bens de consumo.

- Prevê-se que o Canadá registre a maior taxa de crescimento anual composta (CAGR) no mercado de filmes biodegradáveis da América do Norte, devido ao aumento das iniciativas de sustentabilidade, à crescente adoção de filmes biodegradáveis em embalagens e na agricultura, a políticas governamentais favoráveis e ao foco crescente na redução do desperdício de plástico em todos os setores.

- O segmento de misturas de amido detinha a maior participação de mercado em 2025, impulsionado por sua relação custo-benefício, ampla disponibilidade de matéria-prima e propriedades de biodegradabilidade equilibradas. Filmes de mistura de amido são amplamente utilizados em embalagens e aplicações agrícolas devido à sua flexibilidade, facilidade de processamento e compatibilidade com as tecnologias de fabricação de filmes existentes.

Escopo do relatório e segmentação do mercado de filmes biodegradáveis na América do Norte

|

Atributos |

Principais informações sobre o mercado de filmes biodegradáveis na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de filmes biodegradáveis na América do Norte

Aumento da adoção de embalagens sustentáveis em filmes biodegradáveis

- A crescente tendência em direção a soluções de embalagens sustentáveis está transformando o mercado de filmes biodegradáveis, incentivando a substituição de filmes plásticos convencionais por alternativas ecológicas. Esses filmes ajudam a reduzir o impacto ambiental, ao mesmo tempo que apoiam as metas de compostagem e reciclagem em diversas aplicações de embalagens. Sua adoção também está alinhada com as metas de sustentabilidade corporativa e as iniciativas de economia circular em toda a cadeia de valor das embalagens.

- A crescente demanda por embalagens ecologicamente responsáveis nos setores de alimentos, agricultura e bens de consumo está acelerando a adoção de filmes biodegradáveis. As empresas estão integrando cada vez mais esses materiais para cumprir seus compromissos de sustentabilidade e atender às normas mais rigorosas de redução do uso de plástico. Essa mudança também está ajudando as marcas a aprimorarem sua credibilidade ambiental e a se adequarem às diretrizes de embalagem em constante evolução.

- Aprimoramentos nas formulações de materiais e nas tecnologias de processamento estão melhorando o desempenho funcional de filmes biodegradáveis. Maior resistência, flexibilidade e propriedades de barreira estão expandindo seu uso em diversos formatos de embalagem, sem comprometer a proteção do produto. Esses avanços estão contribuindo para uma maior aceitação em aplicações de embalagens primárias e secundárias.

- Por exemplo, diversos fabricantes de alimentos e bens de consumo relataram reduções na geração de resíduos plásticos após a transição para soluções de embalagens de filme biodegradável. Essa transição contribuiu para o alcance das metas de sustentabilidade, mantendo a eficiência das embalagens e a segurança dos produtos. Também ajudou as empresas a reduzir a dependência de plásticos derivados de combustíveis fósseis.

- Embora a adoção impulsionada pela sustentabilidade esteja fortalecendo o crescimento do mercado, o impacto a longo prazo depende da inovação contínua de materiais, da fabricação em escala e da otimização de custos. Garantir qualidade consistente e fornecimento confiável continua sendo essencial para assegurar uma aceitação comercial mais ampla em todos os setores.

Dinâmica do mercado de filmes biodegradáveis na América do Norte

Motorista

Aumento das regulamentações ambientais e crescente preferência do consumidor por embalagens ecológicas.

- O endurecimento das regulamentações ambientais sobre plásticos descartáveis está impulsionando as indústrias a priorizarem filmes biodegradáveis como uma alternativa viável. Os marcos regulatórios voltados para a redução da poluição plástica estão acelerando os investimentos em tecnologias de filmes compostáveis e de base biológica. Essas medidas estão criando um ambiente favorável à adoção de embalagens sustentáveis.

- Os consumidores estão cada vez mais conscientes do impacto ambiental dos resíduos de embalagens, o que leva as marcas a adotarem soluções de filmes biodegradáveis. Essa mudança está incentivando os fabricantes a reformularem suas estratégias de embalagem com foco em materiais sustentáveis. A crescente preferência por produtos ecológicos está reforçando a demanda nos setores de varejo e serviços de alimentação.

- Iniciativas de apoio por parte de órgãos reguladores e organizações do setor estão fortalecendo o dinamismo do mercado. Programas de certificação, padrões de sustentabilidade e iniciativas de conscientização estão ajudando a acelerar a adoção em todos os setores de uso final. Esses esforços também estão melhorando a transparência e a confiança nas alegações de embalagens biodegradáveis.

- Por exemplo, a implementação de políticas de redução do uso de plástico levou a um aumento notável na demanda por filmes biodegradáveis em embalagens de alimentos e aplicações agrícolas. As empresas estão respondendo a essa demanda expandindo a capacidade de produção e investindo em inovação de materiais sustentáveis. Essa tendência está contribuindo para a expansão constante do mercado.

- Embora a pressão regulatória e a conscientização do consumidor estejam impulsionando o mercado, manter a qualidade consistente dos materiais e a conformidade com os padrões de compostagem continua sendo fundamental. Gerenciar os custos de produção e a estabilidade do fornecimento também é essencial para garantir o crescimento sustentável e a adoção a longo prazo.

Restrição/Desafio

Custos de produção mais elevados e limitações de desempenho em comparação com filmes plásticos convencionais.

- O custo de produção mais elevado dos filmes biodegradáveis em comparação com os filmes plásticos convencionais continua sendo um desafio crucial para o crescimento do mercado. As matérias-primas de base biológica e os requisitos de processamento especializados frequentemente aumentam as despesas gerais de fabricação. Essa diferença de custo pode limitar a adoção entre os usuários finais sensíveis ao preço.

- Em certas aplicações, os filmes biodegradáveis enfrentam limitações de desempenho, como menor resistência à umidade ou durabilidade mecânica reduzida. Esses desafios restringem seu uso em ambientes de embalagem exigentes que requerem maior vida útil. As compensações de desempenho podem retardar a substituição dos filmes plásticos tradicionais.

- A adoção pelo mercado é ainda mais limitada pela infraestrutura restrita para o processamento no fim da vida útil. Sistemas inadequados de compostagem e separação de resíduos podem reduzir os benefícios ambientais práticos dos filmes biodegradáveis. Essa lacuna afeta a confiança entre fabricantes e proprietários de marcas.

- Por exemplo, as partes interessadas do setor destacaram as restrições de custos e as compensações de desempenho como as principais barreiras à substituição em larga escala. Essas limitações frequentemente atrasam as decisões de investimento e restringem a penetração nos segmentos de embalagens do mercado de massa. Superar esses problemas continua sendo uma prioridade para os desenvolvedores de tecnologia.

- Embora as tecnologias de materiais continuem a avançar, abordar a competitividade de custos e a consistência de desempenho permanece essencial. O alinhamento com os sistemas de gestão de resíduos e as normas de descarte também é crucial para desbloquear todo o potencial do mercado de filmes biodegradáveis.

Escopo do mercado de filmes biodegradáveis na América do Norte

O mercado é segmentado com base no tipo, tipo de produto, tipo de cultura e aplicação.

- Por tipo

Com base no tipo, o mercado de filmes biodegradáveis na América do Norte é segmentado em PLA, misturas de amido, poliéster biodegradável, PHA, à base de soja, à base de celulose, à base de lignina e outros. O segmento de misturas de amido detinha a maior participação de mercado em 2025, impulsionado por sua relação custo-benefício, ampla disponibilidade de matéria-prima e propriedades de biodegradabilidade equilibradas. Os filmes de mistura de amido são amplamente utilizados em embalagens e aplicações agrícolas devido à sua flexibilidade, facilidade de processamento e compatibilidade com as tecnologias de fabricação de filmes existentes.

O segmento de PLA deverá apresentar o crescimento mais rápido entre 2026 e 2033, devido à crescente demanda por materiais de base biológica e compostáveis. Os filmes de PLA oferecem boa transparência e resistência, tornando-os adequados para embalagens de alimentos e bens de consumo, além de estarem alinhados com os objetivos de sustentabilidade e conformidade regulatória.

- Por tipo de produto

Com base no tipo de produto, o mercado de filmes biodegradáveis na América do Norte é segmentado em oxo-biodegradáveis e hidrobiodegradáveis. O segmento de hidrobiodegradáveis representou a maior participação na receita em 2025 devido à sua capacidade de se decompor naturalmente por meio da atividade microbiana, sem deixar resíduos de microplásticos. Esses filmes são amplamente preferidos em aplicações que exigem biodegradabilidade e compostabilidade genuínas.

Espera-se que o segmento de materiais oxo-biodegradáveis apresente a taxa de crescimento mais rápida entre 2026 e 2033, impulsionado pelo seu menor custo de produção e semelhança com os filmes plásticos convencionais. No entanto, o crescimento permanece moderado devido ao crescente escrutínio sobre a eficiência da degradação e o impacto ambiental.

- Por tipo de cultivo

Com base no tipo de cultura, o mercado de filmes biodegradáveis na América do Norte é segmentado em frutas e vegetais, grãos e oleaginosas, flores e plantas, e outros. O segmento de frutas e vegetais dominou o mercado em 2025 devido ao uso extensivo de filmes biodegradáveis para cobertura morta e embalagens, visando melhorar a qualidade da produção e reduzir o desperdício de plástico. Esses filmes contribuem para a retenção de umidade e a saúde do solo, minimizando as perdas pós-colheita.

Prevê-se que o segmento de flores e plantas apresente um crescimento notável entre 2026 e 2033 devido à crescente adoção de filmes biodegradáveis em viveiros e paisagismo. Esses filmes ajudam a melhorar os ciclos de crescimento das plantas e a reduzir os custos de mão de obra associados à remoção do filme.

- Por meio de aplicação

Com base na aplicação, o mercado de filmes biodegradáveis na América do Norte é segmentado em embalagens de alimentos, agricultura e horticultura, cosméticos e produtos de higiene pessoal, embalagens industriais e outros. O segmento de embalagens de alimentos detinha a maior participação de mercado em 2025, impulsionado pela forte demanda por soluções de embalagens sustentáveis e pela crescente ênfase na redução do desperdício de plástico. Os filmes biodegradáveis são cada vez mais utilizados para produtos frescos, itens de panificação e alimentos prontos para consumo.

Prevê-se que o segmento de agricultura e horticultura apresente o crescimento mais rápido entre 2026 e 2033, devido à crescente adoção de cobertura morta biodegradável e filmes para estufas. Esses filmes promovem práticas agrícolas sustentáveis e ajudam a reduzir a contaminação do solo a longo prazo causada por plásticos convencionais.

Análise Regional do Mercado de Filmes Biodegradáveis na América do Norte

- Os EUA dominaram o mercado de filmes biodegradáveis, com a maior participação na receita em 2025, impulsionados pela crescente demanda por soluções de embalagens sustentáveis nos setores de alimentos, agricultura e bens de consumo.

- As empresas do país estão adotando cada vez mais filmes biodegradáveis para atingir metas de sustentabilidade corporativa e atender à crescente demanda do consumidor por produtos ecologicamente responsáveis.

- Essa forte posição de mercado é sustentada por avanços tecnológicos, alta capacidade de inovação e uso crescente de materiais biodegradáveis tanto em embalagens flexíveis quanto em aplicações agrícolas.

Análise do Mercado de Filmes Biodegradáveis no Canadá

O mercado canadense de filmes biodegradáveis deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente conscientização sobre a redução do desperdício de plástico e pela adoção cada vez maior de alternativas de embalagens sustentáveis. Fabricantes e proprietários de marcas estão migrando ativamente para filmes biodegradáveis para atender aos padrões ambientais e aprimorar suas credenciais de sustentabilidade. O foco crescente em embalagens ecológicas para alimentos e filmes agrícolas, juntamente com iniciativas de apoio à sustentabilidade e inovação em materiais de base biológica, está contribuindo ainda mais para a rápida expansão do mercado.

Participação de mercado de filmes biodegradáveis na América do Norte

A indústria de filmes biodegradáveis na América do Norte é liderada principalmente por empresas consolidadas, incluindo:

• NatureWorks LLC (EUA)

• Danimer Scientific (EUA)

• Cortec Corporation (EUA)

• Biome Technologies (EUA)

• Eastman Chemical Company (EUA)

• Teknor Apex Company (EUA)

• Novolex (EUA)

• Arkema Inc. (EUA)

• Green Dot Bioplastics (EUA)

• Cedar Grove Packaging (Canadá)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.