North America Automotive Level Sensor Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

356.60 Million

USD

282.60 Million

2024

2032

USD

356.60 Million

USD

282.60 Million

2024

2032

| 2025 –2032 | |

| USD 356.60 Million | |

| USD 282.60 Million | |

|

|

|

|

Segmentação do mercado de sensores de nível automotivos na América do Norte, por tipo de produto (sensor de nível de combustível, sensor de nível de óleo do motor, sensor de nível de líquido de arrefecimento, sensor de nível de fluido de freio, sensor de nível de fluido de direção hidráulica sensor magnético e outros), tipo (capacitivo, película resistiva, ultrassônico, resistores discretos, óptico e outros), tipo de monitoramento (monitoramento de nível contínuo e monitoramento de nível de ponto), aplicação (monitoramento de reabastecimento e drenagem de combustível de tanques, prevenção de roubo de combustível e monitoramento de consumo de combustível), tipo de veículo (veículo de passageiros e veículo comercial), canal de vendas (fabricante de equipamento original (OEM) e mercado de reposição canal de distribuição (on-line e off-line) - Tendências do setor e previsão até 2032.

Tamanho do mercado de sensores de nível automotivos na América do Norte

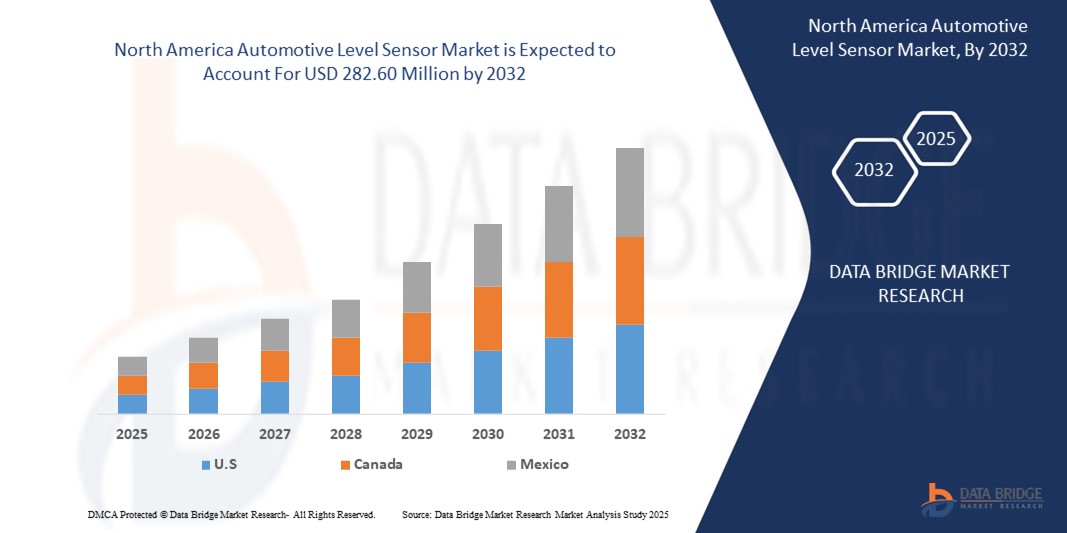

- Espera-se que o mercado de sensores de nível automotivos da América do Norte alcance US$ 356,60 milhões até 2032 , ante US$ 282,60 milhões em 2024 , crescendo com um CAGR substancial de 2,95% no período previsto de 2025 a 2032.

- Os sensores de nível automotivos desempenham um papel fundamental no monitoramento de diversos níveis de fluidos, como combustível, óleo do motor, líquido de arrefecimento, fluido de freio e fluido do limpador de para-brisa. A demanda por esses sensores está aumentando devido ao aumento da produção de veículos, às regulamentações de emissões mais rigorosas e às crescentes expectativas dos consumidores em relação à segurança e ao desempenho. Em particular, a mudança para veículos elétricos e híbridos está criando novas oportunidades, visto que esses veículos exigem sistemas de monitoramento de fluidos altamente precisos e confiáveis.

- Além disso, os avanços nas tecnologias de sensores — como sensores capacitivos, ultrassônicos e baseados em MEMS — estão aprimorando a funcionalidade, a durabilidade e as capacidades de integração. As montadoras estão adotando cada vez mais soluções de sensores inteligentes que permitem diagnósticos e conectividade em tempo real, alinhando-se às tendências mais amplas de digitalização automotiva e integração da Internet das Coisas (IoT).

Análise do mercado de sensores de nível automotivos na América do Norte

- Sensores de nível automotivos, que monitoram os níveis de fluidos como combustível, óleo, líquido de arrefecimento e fluidos de freio, estão se tornando essenciais nos veículos modernos para garantir o desempenho ideal, a conformidade regulatória e a manutenção preventiva. Esses sensores desempenham um papel fundamental no aprimoramento da segurança veicular, da eficiência do motor e da conscientização do motorista nos segmentos de veículos de passeio e comerciais.

- A crescente demanda por sensores de nível automotivos na América do Norte é impulsionada por regulamentações governamentais rigorosas sobre emissões e eficiência de combustível, crescente adoção de veículos elétricos (VE) e crescente integração de sistemas de diagnóstico de bordo e tecnologias avançadas de assistência ao motorista.

- Espera-se que os EUA dominem o mercado de sensores de nível automotivos da América do Norte com uma participação de mercado de 65,12% devido à sua infraestrutura automotiva bem estabelecida, tecnologias avançadas de fabricação de sensores e investimento significativamente maior em pesquisa e desenvolvimento em comparação com outros países da região.

- O Canadá é a região com crescimento mais rápido no mercado de sensores de nível automotivo da América do Norte, com um CAGR de 11,23%, apoiado por um setor automotivo estável e crescente interesse em transporte sustentável.

- O segmento de sensores de nível de combustível dominou o mercado com uma participação de 38,6% em 2024, principalmente devido ao seu papel crítico no monitoramento do uso de combustível e no fornecimento de dados precisos aos motoristas e operadores de frotas

Escopo do relatório e segmentação do mercado de sensores de nível automotivos na América do Norte

|

Métrica de Relatório |

Principais insights do mercado de sensores de nível automotivos na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de sensores de nível automotivos na América do Norte

Aumento da demanda do consumidor por segurança e conforto

- As crescentes expectativas dos consumidores por maior segurança e conforto desempenham um papel fundamental no crescimento do mercado de sensores de nível automotivos na América do Norte. Os compradores de veículos atuais priorizam recursos de segurança avançados e experiências de direção fluidas, fortemente respaldadas pela integração de sensores de nível precisos e confiáveis.

- Os veículos modernos são equipados com uma série de sistemas de segurança que dependem do monitoramento do nível de fluidos. Sensores para fluido de freio, óleo do motor e fluido do limpador de para-brisa são essenciais para manter a segurança operacional e prevenir falhas mecânicas. Com regulamentações de segurança mais rigorosas e crescente conscientização entre os consumidores, as montadoras estão adotando sensores de nível de alto desempenho para aumentar a confiabilidade dos veículos e atender aos padrões de conformidade.

- O conforto é outro fator crítico que influencia a adoção de sensores. Sistemas avançados de controle climático, incluindo aquecimento, ventilação e ar condicionado (HVAC ), dependem da medição precisa dos níveis do líquido de arrefecimento e refrigerante para manter as condições da cabine consistentes. À medida que os consumidores buscam maior conforto térmico e operação mais silenciosa, a demanda por esses sensores continua a crescer.

- Além disso, o aumento nas vendas de veículos premium e de luxo contribui para essa tendência. Recursos como monitoramento automático do fluido da transmissão, suspensão adaptativa e sistemas avançados de assistência ao motorista (ADAS) exigem detecção precisa do nível para funcionar com eficácia.

- À medida que a inovação automotiva continua, os sensores de nível continuam sendo essenciais para garantir desempenho, segurança e uma experiência de direção elevada.

Dinâmica do mercado de sensores de nível automotivos na América do Norte

Motoristas

Aumento da produção de veículos e da demanda por sistemas avançados de assistência ao motorista (ADAS)

- O mercado de sensores de nível automotivos na América do Norte está experimentando um crescimento significativo, impulsionado pelo aumento da produção de veículos e pela crescente integração de sistemas avançados de assistência ao motorista (ADAS) em automóveis modernos. As montadoras estão cada vez mais incorporando sensores sofisticados para aprimorar a segurança, o desempenho e o conforto dos veículos.

- Por exemplo, em março de 2024, a TE Connectivity expandiu sua linha de sensores automotivos com sensores de nível de fluidos de última geração, projetados para maior durabilidade e precisão em ambientes veiculares adversos. Inovações como essas atendem à demanda por sensores de alto desempenho em diversas aplicações, como detecção de nível de combustível, óleo e líquido de arrefecimento.

- As regulamentações de eficiência de combustível e os padrões de emissões nos EUA e Canadá também estão incentivando os fabricantes de equipamentos originais (OEMs) a adotar sensores de nível para otimizar o gerenciamento do motor e dos fluidos, impulsionando ainda mais a demanda. A mudança para veículos elétricos (VEs) é outro fator crucial, já que os VEs exigem monitoramento preciso dos níveis do líquido de arrefecimento da bateria e do fluido de freio.

- Os consumidores estão priorizando cada vez mais a segurança e a conveniência, com muitos veículos exigentes equipados com tecnologias ADAS. Esses sistemas dependem de sensores precisos, incluindo sensores de nível, para funcionar corretamente, tornando-os essenciais para o design de veículos modernos.

- Além disso, o aumento no desenvolvimento de veículos autônomos e tecnologias de carros conectados está aumentando a necessidade de dados precisos e em tempo real sobre os níveis de fluidos dos veículos, impulsionando a adoção de soluções avançadas de detecção de nível em todo o setor automotivo na América do Norte.

Restrição/Desafio

Limitações de precisão do sensor e restrições de custo na integração de veículos

- Apesar do crescimento robusto, o mercado de sensores de nível automotivos na América do Norte enfrenta desafios relacionados à precisão dos sensores e aos custos de integração. Fatores ambientais como temperaturas extremas, vibrações e exposição a produtos químicos podem afetar a confiabilidade do sensor e levar a leituras imprecisas, especialmente em veículos mais antigos ou com uso intenso.

- O desempenho inconsistente do sensor pode resultar em alertas falsos ou mau funcionamento do sistema, potencialmente minando a confiança do consumidor em sistemas avançados de veículos. Resolver esses problemas exige investimentos contínuos em tecnologias de calibração e durabilidade dos sensores.

- Além disso, o custo de incorporação de sensores de nível de alta precisão pode ser significativo, especialmente para veículos econômicos ou de médio porte. Os fabricantes de equipamentos originais (OEMs) devem equilibrar os benefícios das funcionalidades adicionais com a acessibilidade para garantir a ampla adoção.

- Por exemplo, enquanto marcas de carros de luxo adotaram sistemas avançados de detecção de nível como padrão, as montadoras tradicionais podem limitar esses recursos a níveis de acabamento mais altos para gerenciar os custos gerais de produção.

- Para superar essas barreiras, os participantes do setor devem se concentrar em aprimorar a robustez e a eficiência de custos dos sensores. Parcerias entre fabricantes de sensores e OEMs, juntamente com avanços tecnológicos em miniaturização e ciência dos materiais, serão essenciais para abordar as preocupações com desempenho e custo e impulsionar a expansão futura do mercado.

Escopo do mercado de sensores de nível automotivos na América do Norte

O mercado é segmentado com base no tipo de produto, tipo, tipo de monitoramento, aplicação, tipo de veículo, canal de vendas e canal de distribuição.

- Por tipo de produto

Com base no tipo de produto, o mercado de sensores de nível de combustível é segmentado em sensores de nível de combustível, sensores de nível de óleo do motor, sensores de nível do líquido de arrefecimento, sensores de nível do fluido de freio, sensores de nível do fluido da direção hidráulica, sensores magnéticos e outros. O segmento de sensores de nível de combustível dominou o mercado com uma participação de 38,6% em 2024, principalmente devido ao seu papel crítico no monitoramento do consumo de combustível e no fornecimento de dados precisos para motoristas e operadores de frotas. A crescente ênfase na eficiência dos veículos e na conformidade com as normas de emissões tem sustentado sua demanda em veículos de passeio e comerciais.

O segmento de sensores de nível de óleo do motor deverá crescer a uma taxa composta de crescimento anual (CAGR) mais rápida, de 20,9%, de 2025 a 2032, impulsionado pela crescente demanda por soluções de manutenção preventiva e integração de sistemas de monitoramento de óleo em veículos conectados e elétricos para garantir a longevidade e a confiabilidade do motor.

- Por tipo

Com base no tipo, o mercado é segmentado em capacitivos, de filme resistivo, ultrassônicos, resistores discretos, ópticos e outros. O segmento capacitivo representou a maior fatia de mercado, com 41,2% em 2024, devido à sua alta precisão, maior vida útil e compatibilidade com sistemas digitais modernos. Sensores capacitivos são amplamente utilizados em veículos de passeio e comerciais devido à sua adaptabilidade a diversos tipos de combustível.

Enquanto isso, espera-se que o segmento ultrassônico apresente o CAGR mais rápido, de 22,1%, entre 2025 e 2032, já que a tecnologia ultrassônica permite medições sem contato, tornando-a ideal para aplicações avançadas, como sistemas de gerenciamento térmico de veículos elétricos e gestão de frotas baseada em telemática. A crescente adoção de sensores de precisão em veículos autônomos impulsiona ainda mais esse crescimento.

- Por tipo de monitoramento

Com base no tipo de monitoramento, o mercado é segmentado em monitoramento de nível contínuo e monitoramento de nível pontual. O segmento de monitoramento de nível contínuo dominou o mercado com uma participação de 57,8% em 2024, impulsionado por sua capacidade de fornecer rastreamento de combustível e fluidos em tempo real e altamente preciso. Este segmento é crucial nos setores de logística e frotas, onde a eficiência e o monitoramento de roubo de combustível são prioridades.

Espera-se que o segmento de monitoramento de nível de ponto registre o CAGR mais rápido de 19,4% durante 2025–2032, impulsionado por seu menor custo, design mais simples e crescente demanda por veículos menores e modelos econômicos, especialmente em mercados emergentes onde a acessibilidade é um fator-chave.

- Por aplicação

Com base na aplicação, o mercado é segmentado em monitoramento de abastecimento e drenagem de combustível, prevenção de roubo de combustível e monitoramento de consumo de combustível. O segmento de monitoramento de consumo de combustível dominou o mercado, com 45,6% de participação em 2024, visto que dados precisos de consumo são vitais tanto para indivíduos quanto para operadores de frotas, a fim de reduzir custos operacionais e cumprir os padrões de emissão.

Espera-se que o segmento de prevenção contra roubo de combustível cresça a uma CAGR mais rápida, de 21,3%, de 2025 a 2032, impulsionado pelo aumento dos preços dos combustíveis, pelo aumento do tamanho das frotas e pela demanda de empresas de logística por tecnologias antirroubo avançadas integradas com plataformas telemáticas e IoT.

- Por tipo de veículo

Com base no tipo de veículo, o mercado é segmentado em veículos de passeio e veículos comerciais. O segmento de veículos de passeio detinha a maior participação de mercado, de 62,4% em 2024, impulsionado pelo aumento das vendas globais de automóveis, pela preferência do consumidor por maior segurança e pela integração de sistemas de monitoramento inteligentes em carros de médio e alto padrão.

O segmento de veículos comerciais deverá crescer a uma CAGR (taxa composta de crescimento anual) mais rápida, de 20,1%, entre 2025 e 2032, apoiado pela crescente adoção de soluções de gerenciamento de frotas, necessidades de eficiência no transporte de longa distância e padrões de emissão mais rigorosos que exigem monitoramento preciso dos níveis de combustível e fluidos.

- Por canal de vendas

Com base no canal de vendas, o mercado é segmentado em fabricante de equipamento original (OEM) e mercado de reposição. O segmento OEM dominou, com uma participação de mercado de 68,7% em 2024, atribuída à forte preferência das montadoras pela integração de sensores avançados de nível de combustível durante a fabricação dos veículos para garantir a conformidade com as normas globais de segurança e emissões.

O segmento de reposição deverá registrar o CAGR mais rápido, de 18,8%, de 2025 a 2032, à medida que veículos mais antigos estão sendo equipados com sensores modernos e a conscientização do consumidor sobre manutenção preventiva continua a crescer.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em online e offline. O segmento offline detinha a maior participação de mercado, de 72,5% em 2024, devido à forte presença de distribuidores de peças automotivas, centros de serviço físicos e à confiança do consumidor em comprar por meio de redes de concessionárias estabelecidas.

Espera-se que o segmento on-line cresça na CAGR mais rápida de 23,4% durante 2025–2032, impulsionado pela expansão de plataformas de comércio eletrônico, pela crescente demanda por entrega porta a porta de componentes automotivos e pela crescente adoção digital entre consumidores de varejo e operadores de frotas.

Análise regional do mercado de sensores de nível automotivos na América do Norte

- Espera-se que os EUA dominem o mercado de sensores de nível automotivos da América do Norte com uma participação de mercado de 65,12% devido à sua infraestrutura automotiva bem estabelecida, tecnologias avançadas de fabricação de sensores e investimento significativamente maior em pesquisa e desenvolvimento em comparação com outros países da região.

- A forte presença das principais montadoras, o aumento da produção de veículos elétricos e híbridos e a adoção antecipada de sistemas avançados de segurança veicular contribuem ainda mais para a rápida expansão do mercado dos EUA

- A presença de OEMs e fabricantes de sensores líderes, juntamente com o foco em padrões rigorosos de segurança e emissões, alimenta a demanda por sensores de nível de alta precisão. O apoio regulatório e a inovação em tecnologias de veículos conectados aumentam ainda mais o potencial de mercado.

Visão do mercado canadense

O Canadá é a região com crescimento mais rápido no mercado de sensores de nível automotivos na América do Norte, com um CAGR de 11,23%, impulsionado por um setor automotivo estável e pelo crescente interesse em transporte sustentável. Iniciativas governamentais que promovem a adoção de veículos elétricos, juntamente com colaborações entre empresas de tecnologia e montadoras, estão ajudando a expandir a demanda por sistemas de monitoramento de fluidos. No entanto, o crescimento do mercado é ligeiramente mais lento em comparação com os EUA devido aos menores volumes de produção e à moderada atividade de P&D.

Visão do mercado mexicano

O México atua como um importante polo de manufatura para a indústria automotiva norte-americana. Com uma sólida base de montadoras e baixos custos de produção, o país testemunha uma crescente integração de tecnologias avançadas de sensores, especialmente em veículos exportados para os EUA e outras regiões. No entanto, desafios como a variabilidade regulatória e a dependência de fornecedores externos de tecnologia podem afetar o ritmo de adoção tecnológica em sistemas de sensores.

Participação no mercado de sensores de nível automotivos na América do Norte

Os líderes de mercado de sensores de nível automotivos na América do Norte que operam no mercado são:

- Continental AG (Alemanha)

- Littelfuse, Inc. (EUA)

- Bosch Rexroth Sp. Z OO (Polônia)

- Elobau GmbH & Co. KG.C (Alemanha),

- Pricol Limited (Índia)

- Bourns Inc (EUA)

- Tecnologia de Detecção Zhengyang de Guangdong Co., Ltd. (China)

- Misensor Tech Co., Ltd. (China)

- Omnicomm (Estônia), Soway Tech Limited (China)

- Spark Minda (Índia)

- Standex Electronics, Inc (EUA)

- Technoton (República Tcheca)

- Wema UK (Reino Unido)

Últimos desenvolvimentos no mercado de sensores de nível automotivos da América do Norte

- Em julho de 2023, a TE Connectivity, líder global em soluções de sensores e conectividade, lançou no mercado norte-americano uma nova linha de sensores de nível de fluidos, projetados especificamente para veículos elétricos e híbridos. Esses sensores são projetados para monitorar os níveis do líquido de arrefecimento da bateria e do fluido de freio com alta precisão, oferecendo gerenciamento térmico aprimorado para veículos elétricos. O lançamento reflete o compromisso da TE em apoiar a transição da região para a mobilidade elétrica, fornecendo tecnologias de sensores robustas e prontas para uso em veículos que atendem às necessidades em constante evolução de fabricantes de equipamentos originais (OEMs) e fornecedores de nível 1 (Tier 1).

- Em maio de 2023, a Sensata Technologies anunciou uma parceria estratégica com uma importante montadora de veículos (OEM) norte-americana para fornecer sensores de nível de óleo de última geração para as próximas plataformas de veículos. Os sensores contam com diagnósticos avançados e recursos de saída digital, alinhados à tendência da indústria em direção a sistemas de veículos inteligentes. Esta colaboração destaca o foco da Sensata em fornecer soluções de sensores de alta confiabilidade que melhoram o desempenho do motor, estendem os intervalos de manutenção e permitem o monitoramento em tempo real em arquiteturas de veículos conectados.

- Em abril de 2023, a Continental AG expandiu sua fábrica em Michigan para aumentar a capacidade de produção de sensores capacitivos de nível de fluidos. O investimento visa atender à crescente demanda de montadoras americanas que buscam soluções avançadas de sensoriamento para sistemas de combustível e refrigerante. A expansão também apoia a estratégia da Continental de localizar a produção de sensores e aumentar a resiliência da cadeia de suprimentos na América do Norte.

- Em fevereiro de 2023, a Texas Instruments (TI) lançou uma nova plataforma de circuito integrado (CI) otimizada para sistemas automotivos de detecção de nível de líquidos. Este CI permite o desenvolvimento de sensores de nível compactos e energeticamente eficientes que suportam ADAS e funções de veículos autônomos. A inovação da TI permite que fabricantes de nível 1 construam sensores com maior precisão e tempos de resposta mais rápidos, contribuindo para a melhoria da segurança e do diagnóstico de sistemas em veículos modernos.

- Em janeiro de 2023, a Amphenol Advanced Sensors anunciou uma colaboração com uma startup americana de veículos elétricos para o desenvolvimento conjunto de sensores de nível de líquido de arrefecimento sem fio. A solução foi projetada para operar de forma confiável em ambientes de alta tensão, oferecendo transmissão de dados em tempo real para os sistemas de gerenciamento do veículo. Esta parceria demonstra o compromisso da Amphenol com soluções pioneiras sob medida para veículos elétricos e apoia a adoção mais ampla de tecnologias de sensoriamento sem fio em todo o cenário automotivo norte-americano.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.