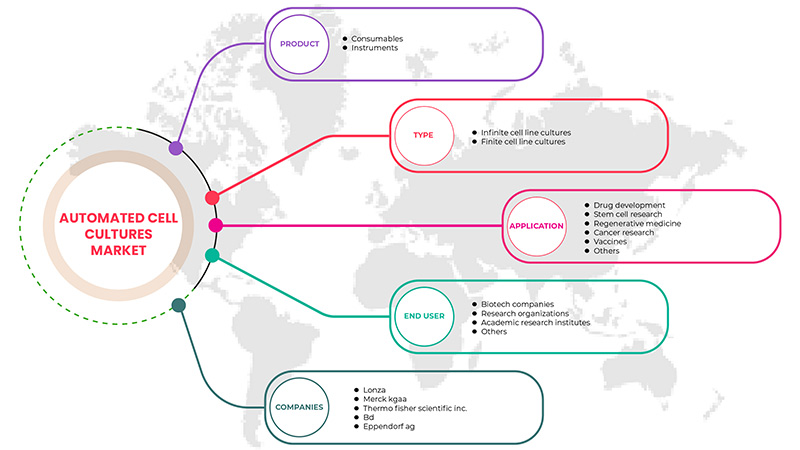

North America Automated Cell Cultures Market, By Product (Consumables, Instruments), Type (Infinite Cell Line Cultures, Finite Cell Line Cultures), Application (Drug Development, Stem Cell Research, Regenerative Medicine, Cancer Research, Vaccines, Others), End User (Biotech Companies, Research Organizations, Academic Research Institutes, Other) Industry Trends and Forecast to 2029.

North America Automated Cell Cultures Market Analysis and Insights

The automated cell cultures market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal.

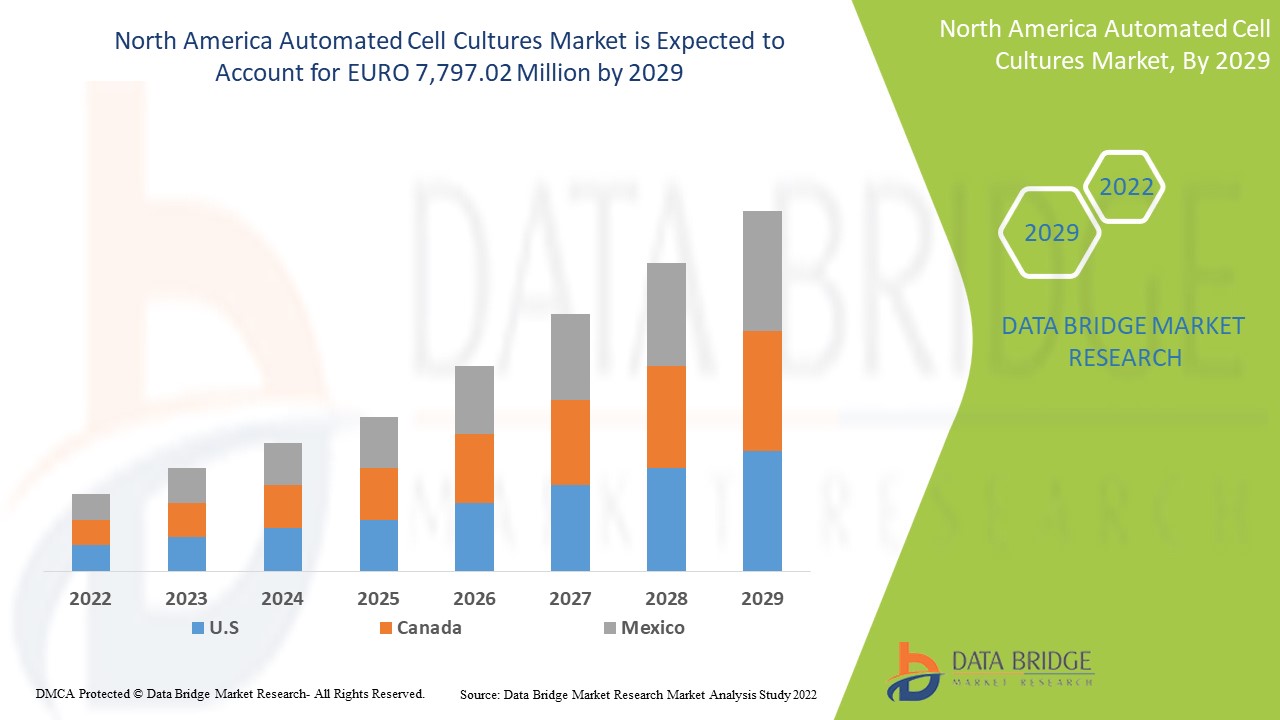

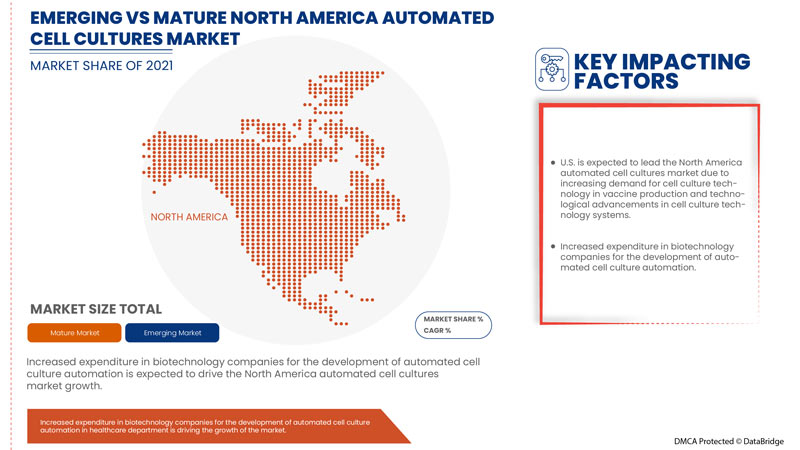

North America automated cell cultures market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 9.1% in the forecast period of 2022 to 2029 and is expected to reach EURO 7,797.02 million by 2029. Increasing demand of cell culture technology in vaccine production, and Wide acceptance of cell culture techniques in various applications are the major drivers which propelled the demand of the market in the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in EURO Million, Volumes in Units, Pricing in EURO |

|

Segments Covered |

By Product (Consumables, Instruments), Type (Infinite Cell Line Cultures, Finite Cell Line Cultures), Application (Drug Development, Stem Cell Research, Regenerative Medicine, Cancer Research, Vaccines, Others), End User (Biotech Companies, Research Organizations, Academic Research Institutes, Other). |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

Lonza, Merck KGaA, Thermo Fisher Scientific Inc., BD, Eppendorf AG and Others |

North America Automated Cell Cultures Market Definition

Automated cell culture systems are instruments that mechanically carries out the steps involved in growing and maintaining a cell culture. Useful in any lab that works with cell biology, cell signaling, protein expression, or drug discovery, an automated cell culture system helps to grow cell cultures while saving labor time and reducing errors. Automated cell culture systems can be capable of diluting samples, growing cultures in liquid with constant swirling, plating cultures, or placing cultures in wells. Increase in demand for 3D cell cultures, increasing collaboration among market players, and increasing outsourcing facilities are expected to provide a lucrative growth opportunity for the market. However, high cost of automated cell culture systems, and limitations associated with automated cell cultures are the factors expected to restraint the market growth in the forecast period.

North America Automated Cell Cultures Market Dynamics

This section deals with understanding the market drivers, opportunity, restraint, and challenge. All of this is discussed in detail below:

- Drivers

Increasing Demand for Cell Culture Technology in Vaccine Production

Cell culture is an essential tool for molecular and cellular biology research. Today, most biotechnology products primarily rely on mass culturing cell lines. Cell cultures have applications in diverse areas and serve as a model system for numerous research efforts.

An increase in funding from the government for cell-based research is significantly triggering the market's growth. In addition, cell culture techniques are widely being used as an alternative to current egg-based strategies for developing cell-based vaccines. Cell culture has potential applications in developing viral vaccines with increased communicable diseases and pandemic risk. Thus, cell culture technology is being extensively used in developing U.S. licensed vaccines such as vaccines against rubella, smallpox, chickenpox, hepatitis, rotavirus, and polio.

Technological Advancements in Cell Culture Technology Systems

As the demand for advanced cell culture technologies in vaccine production, cancer research, and virology, among others, is increasing, certain technological developments are taking place in automated cell culture.

Thus, market players operating in the market adopt various technological developments in cell culture equipment to boost their business in various dimensions and lead to market growth. This factor could drive the North America automated cell cultures market growth.

- Restraint

High Cost of Automated Cell Culture Systems

The cost of the product is the major setback for the market as it is expected to decrease the demand due to high cost. In the case of automated cell culture systems, the price is also high, and below the given instance will showcase the product's price.

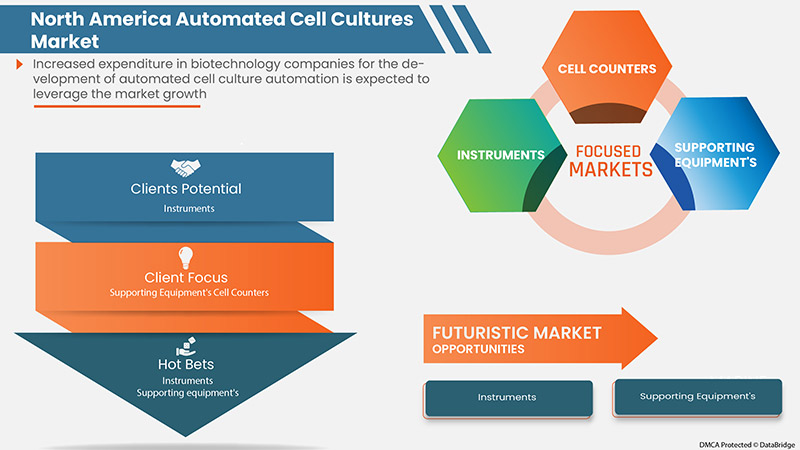

The instruments and consumables-related products such as cell counters, reagents, buffers, and others have high prices, which shows that the cost of automated cell cultures is the primary factor expected to restrain the North America automated cell cultures market in the forecasted period.

- Opportunity

New Product Launches and Technology Developments

Pharmaceutical and biotechnology-driven companies are working towards developing and launching new products and technologies for automated cell culture advancement and making the treatment and diagnosis methods more reachable. This has also increased the demand for an automated cell culture market for 3D cell cultures. The development of new bioreactors, platforms, softwares has led to an advancement in the automated cell culture market and its growth.

The new products and technologies launched and worked upon create good opportunities for the North America automated cell cultures market. The new platforms with advanced technologies act as a footstep closer to the advancement of the market.

- Challenge

Development and Maintenance of Expertise

Recruitment and retention of trained and qualified staff, staff development, capital budgets for equipment purchase, operating budget management, facility infrastructure, and change management all require proper attention for the growth and success of any market. Failure to meet needs in any of these areas can lead to a serious weakness that, if uncorrected, may compromise the credibility of a laboratory and create a situation that will be difficult to correct in the short term.

Testing and maintaining the level of expertise in testing laboratories is a tough task, and it needs high experience, which sometimes is not accessible, which causes the development process for a particular company to hinder. Thus it is anticipated to challenge the North America automated cell cultures market growth in the forecasted period.

Recent Developments

- In August 2021, Advanced Instruments, a leading manufacturer of analytical instruments and services for bioprocessing, announced the execution of a definitive agreement to acquire Solentim, a trusted North America leader of solutions for the isolation and characterization of high-value single-cell clones in cell line development (CLD) applications. The acquisition expands both companies' positions in the bioprocess workflows for advanced therapies

- In July 2021, BD has launched bdbiosciences.com, an updated digital marketplace for flow cytometry. The new website provides an enhanced online purchasing experience for flow cytometry users and their procurement teams

North America Automated Cell Cultures Market Scope

North America automated cell cultures market is segmented into Product, Type, Application, and End User. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

North America Automated Cell Cultures Market, By Product

- Consumables

- Instruments

On the basis of product, the North America automated cell cultures market is segmented into consumables and instruments

North America Automated Cell Cultures Market, By Type

- Infinite Cell Line Cultures

- Finite Cell Line Cultures

On the basis of type, the North America automated cell cultures market is segmented into infinine Cell line cultures and finite Cell line cultures

North America Automated Cell Cultures Market, By Application

- Drug Development

- Stem Cell Research

- Regenerative Medicine

- Cancer Research

- Vaccines

- Other

On the basis of application, the North America automated cell cultures market is segmented into drug development, stem cell research, regenerative medicine, cancer research, vaccine and other.

North America Automated Cell Cultures Market, By End User

- Biotech Companies

- Research Organizations

- Academic Research Institutes

- Other

On the basis of end user, the North America automated cell cultures market is segmented into biotech companies, research organizations, academic research institutes and other.

North America Automated Cell Cultures Market Regional Analysis/Insights

The North America automated cell cultures market is analyzed and market size information is provided by Product, Type, Application, and End User.

The countries covered in this market report are U.S., Canada, and Mexico.

In 2022, The North America automated cell cultures market is expected to grow due to increasing applications in stem cell research, vaccine production, regenerative medicines production, and drug discovery.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Automated Cell Cultures Market Share Analysis

North America automated cell cultures market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America automated cell cultures market.

The key market players for North America automated cell cultures market are Lonza, Merck KGaA, Thermo Fisher Scientific Inc., BD, Eppendorf AG, Advanced Instruments,Benchmark scientific, Inc., BioSpherix, Ltd., Biotron Healthcare, Bulldog Bio, Cell Culture Company, LLC, CellGenix GmbH, ChemoMetec, Corning Incorporated, Cytiva (Subsidiary of Danahar Corporation), FUJIFILM Holdings America Corporation, Hemilton Company, Hitachi, Ltd., Kawasaki Heavy Industries, ltd., HiMedia Laboratories, NanoEntek America, Inc., Nexcelom Bioscience LLC., PromoCell GmbH, RWD Life Science Co., LTD, Sartorius AG, Scientica Instrumentation, Inc., SHIBUYA CORPORATION, Sphere Fluidics Limited, Tecan Trading AG,Thrive Bioscience, Inc., and Others.

Research Methodology: North America Automated Cell Cultures Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America vs Regional, and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGULATORY FRAMEWORK FOR NORTH AMERICA AUTOMATED CELL CULTURES MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR CELL CULTURE TECHNOLOGY IN VACCINE PRODUCTION

6.1.2 TECHNOLOGICAL ADVANCEMENTS IN CELL CULTURE TECHNOLOGY SYSTEMS

6.1.3 WIDE ACCEPTANCE OF CELL CULTURE TECHNIQUES IN VARIOUS APPLICATIONS

6.1.4 GROWING BIOTECHNOLOGY SECTOR, ALONG WITH RISING HEALTHCARE EXPENDITURE

6.1.5 ADVANTAGES OF AUTOMATED CELL CULTURE SYSTEMS OVER MANUAL METHODS

6.2 RESTRAINTS

6.2.1 HIGH COST OF AUTOMATED CELL CULTURE SYSTEMS

6.2.2 LIMITATIONS ASSOCIATED WITH AUTOMATED CELL CULTURES

6.2.3 MAINTENANCE AND UPDATING OF EQUIPMENT

6.2.4 LACK OF SKILLED AND CERTIFIED PROFESSIONALS

6.3 OPPORTUNITIES

6.3.1 NEW PRODUCT LAUNCHES AND TECHNOLOGY DEVELOPMENTS

6.3.2 INCREASING COLLABORATION AMONG MARKET PLAYERS

6.3.3 INCREASING OUTSOURCING FACILITIES

6.3.4 INCREASE IN DEMAND FOR 3D CELL CULTURE

6.4 CHALLENGES

6.4.1 DEVELOPMENT AND MAINTENANCE OF EXPERTISE

6.4.2 LACK OF INFRASTRUCTURE FOR CELL-BASED RESEARCH IN EMERGING ECONOMIES

7 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CONSUMABLES

7.2.1 MEDIA

7.2.1.1 SERUM FREE MEDIA

7.2.1.2 CLASSICAL MEDIA & SALTS

7.2.1.3 STEM CELL CULTURE MEDIA

7.2.1.4 SPECIALTY MEDIA

7.2.2 BUFFERS AND SUPPLEMENTS

7.2.2.1 PLASMA

7.2.2.2 SERA

7.2.2.3 FETAL BOVINE SERA

7.2.2.4 ADULT BOVINE SERA

7.2.2.5 OTHERS ANIMAL SERA

7.2.3 REAGENTS

7.2.3.1 SUPPLEMENTS & GROWTH FACTORS

7.2.3.2 BUFFERS & CHEMICALS

7.2.3.3 CELL DISASSOCIATION REAGENTS

7.2.3.4 BALANCED SALT SOLUTIONS

7.2.3.5 ATTACHMENT & MATRIX FACTORS

7.2.3.6 ANTIBIOTICS/ANTIMYCOTICS

7.2.3.7 CONTAMINATION DETECTION KITS

7.2.3.8 CRYOPROTECTIVE REAGENTS

7.2.3.9 OTHERS CELL CULTURE REAGENTS

7.2.4 ACCESSORIES

7.3 INSTRUMENTS

7.3.1 SUPPORTING EQUIPMENTS

7.3.1.1 CELL COUNTERS

7.3.1.2 IMAGE BASED CELL COUNTERS

7.3.1.3 FLOW CYTOMETERS

7.3.1.4 COULTER COUNTERS

7.3.1.5 CELL EXPANSION

7.3.1.6 LIQUID HANDLERS

7.3.1.7 OTHERS

7.3.2 BIOREACTORS

7.3.2.1 SINGLE USE BIOREACTORS

7.3.2.2 CONVENTIONAL BIOREACTORS

7.3.2.3 OTHERS

7.3.3 STORAGE EQUIPMENTS

7.3.3.1 REFRIGERATORS & FREEZERS

7.3.3.2 CRYOSTORAGE SYSTEMS

7.3.3.3 OTHERS

8 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY TYPE

8.1 OVERVIEW

8.2 INFINITE CELL LINE CULTURES

8.3 FINITE CELL LINE CULTURES

9 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 DRUG DEVELOPMENT

9.3 STEM CELL RESEARCH

9.3.1 EMBRYONIC STEM CELLS

9.3.2 TISSUE-SPECIFIC STEM CELLS

9.3.3 MESENCHYMAL STEM CELLS

9.3.4 INDUCED PLURIPOTENT STEM CELLS

9.4 REGENERATIVE MEDICINE

9.4.1 STEM CELL THERAPY

9.4.2 PLATELET-RICH PLASMA THERAPY (OR PRP INJECTIONS)

9.4.3 TISSUE ENGINEERING

9.4.4 AMNIOTIC-MEMBRANE DERIVED STEM CELLS

9.5 CANCER RESEARCH

9.6 VACCINES

9.7 OTHERS

10 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY END USER

10.1 OVERVIEW

10.2 BIOTECH COMPANIES

10.3 RESEARCH ORGANIZATIONS

10.4 ACADEMIC RESEARCH INSTITUTES

10.5 OTHERS

11 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 COMPANY PROFILE

13.1 LONZA

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.1.6 SWOT ANALYSIS

13.2 MERCK KGAA

13.2.1 COMPANY SNAPSHOT

13.2.2 RECENT FINANCIALS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.2.6 SWOT ANALYSIS

13.3 THERMO FISHER SCIENTIFIC INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 RECENT FINANCIALS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.3.6 SWOT ANALYSIS

13.4 BD

13.4.1 COMPANY SNAPSHOT

13.4.2 RECENT FINANCIALS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.4.6 SWOT ANALYSIS

13.5 EPPENDORF AG

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.5.6 SWOT ANALYSIS

13.6 ADVANCED INSTRUMENTS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BENCHMARK SCIENTIFIC INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BIOSPHERIX LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 BIOTRON HEALTHCARE

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 BULLDOG-BIO, INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.11 CELL CULTURE COMPANY, LLC

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 CELLGENIX GMBH

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 CHEMOMETEC

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 CORNING INCORPORATED

13.14.1 COMPANY SNAPSHOT

13.14.2 RECENT FINANCIALS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 CYTIVA (SUBSIDIARY OF DANAHER CORPORATION)

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 FUJIFILM HOLDINGS AMERICA CORPORATION

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 HAMILTON COMPANY

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 HITACHI, LTD.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 KAWASAKI HEAVY INDUSTRIES, LTD.

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 HIMEDIA LABORATORIES

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 NANOENTEK AMERICA INC. (A SUBSIDIARY OF NANOENTEK)

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

13.22 NEXCELOM BIOSCIENCE LLC.

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENTS

13.23 PROMOCELL GMBH

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENTS

13.24 RWD LIFE SCIENCE CO LTD.

13.24.1 COMPANY SNAPSHOT

13.24.2 PRODUCT PORTFOLIO

13.24.3 RECENT DEVELOPMENTS

13.25 SARTORIUS AG

13.25.1 COMPANY SNAPSHOT

13.25.2 REVENUE ANALYSIS

13.25.3 PRODUCT PORTFOLIO

13.25.4 RECENT DEVELOPMENTS

13.26 SCIENTICA INSTRUMENTATION, INC.

13.26.1 COMPANY SNAPSHOT

13.26.2 PRODUCT PORTFOLIO

13.26.3 RECENT DEVELOPMENTS

13.27 SHIBUYA CORPORATION

13.27.1 COMPANY SNAPSHOT

13.27.2 RECENT FINANCIALS

13.27.3 PRODUCT PORTFOLIO

13.27.4 RECENT DEVELOPMENTS

13.28 SPHERE FLUIDICS LIMITED

13.28.1 COMPANY SNAPSHOT

13.28.2 PRODUCT PORTFOLIO

13.28.3 RECENT DEVELOPMENTS

13.29 TECAN TRADING AG

13.29.1 COMPANY SNAPSHOT

13.29.2 RECENT FINANCIALS

13.29.3 PRODUCT PORTFOLIO

13.29.4 RECENT DEVELOPMENT

13.3 THRIVE BIOSCIENCE, INC.

13.30.1 COMPANY SNAPSHOT

13.30.2 PRODUCT PORTFOLIO

13.30.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 2 NORTH AMERICA CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 3 NORTH AMERICA CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 4 NORTH AMERICA MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 5 NORTH AMERICA BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 6 NORTH AMERICA REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCTS, 2020-2029 (EURO MILLION)

TABLE 7 NORTH AMERICA INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 8 NORTH AMERICA INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 9 NORTH AMERICA SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 10 NORTH AMERICA BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 11 NORTH AMERICA STORAGE EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 12 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 13 NORTH AMERICA INFINITE CELL LINE CULTURES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 14 NORTH AMERICA FINITE CELL LINE CULTURES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 15 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 16 NORTH AMERICA DRUG DEVELOPMENT IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 17 NORTH AMERICA STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 18 NORTH AMERICA STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 19 NORTH AMERICA REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 20 NORTH AMERICA REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 21 NORTH AMERICA CANCER RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 22 NORTH AMERICA VACCINES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 23 NORTH AMERICA OTHERS IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 24 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 25 NORTH AMERICA BIOTECH COMPANIES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 26 NORTH AMERICA RESEARCH ORGANIZATIONS IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 27 NORTH AMERICA ACADEMIC RESEARCH INSTITUTES IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 28 NORTH AMERICA OTHERS IN AUTOMATED CELL CULTURES MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 29 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY COUNTRY, 2020-2029 (EURO MILLION)

TABLE 30 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 31 NORTH AMERICA CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 32 NORTH AMERICA MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 33 NORTH AMERICA BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 34 NORTH AMERICA REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 35 NORTH AMERICA INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 36 NORTH AMERICA SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 37 NORTH AMERICA BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 38 NORTH AMERICA STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 39 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 40 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 41 NORTH AMERICA STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 42 NORTH AMERICA REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 43 NORTH AMERICA AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 44 U.S. AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 45 U.S. CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 46 U.S. MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 47 U.S. BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 48 U.S. REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 49 U.S. INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 50 U.S. SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 51 U.S. BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 52 U.S. STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 53 U.S. AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 54 U.S. AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 55 U.S. STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 56 U.S. REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 57 U.S. AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 58 CANADA AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 59 CANADA CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 60 CANADA MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 61 CANADA BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 62 CANADA REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 63 CANADA INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 64 CANADA SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 65 CANADA BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 66 CANADA STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 67 CANADA AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 68 CANADA AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 69 CANADA STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 70 CANADA REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 71 CANADA AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

TABLE 72 MEXICO AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 73 MEXICO CONSUMABLES IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 74 MEXICO MEDIA IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 75 MEXICO BUFFERS & SUPPLEMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 76 MEXICO REAGENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 77 MEXICO INSTRUMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 78 MEXICO SUPPORTING EQUIPMENTS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 79 MEXICO BIOREACTORS IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 80 MEXICO STORAGE EQUIPMENT IN AUTOMATED CELL CULTURES MARKET, BY PRODUCT, 2020-2029 (EURO MILLION)

TABLE 81 MEXICO AUTOMATED CELL CULTURES MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 82 MEXICO AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 83 MEXICO STEM CELL RESEARCH IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 84 MEXICO REGENERATIVE MEDICINE IN AUTOMATED CELL CULTURES MARKET, BY APPLICATION, 2020-2029 (EURO MILLION)

TABLE 85 MEXICO AUTOMATED CELL CULTURES MARKET, BY END USER, 2020-2029 (EURO MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: SEGMENTATION

FIGURE 11 WIDE ACCEPTANCE OF CELL CULTURE TECHNIQUES IN VARIOUS APPLICATIONS AND THE GROWING BIOTECHNOLOGY SECTOR ARE EXPECTED TO DRIVE THE NORTH AMERICA AUTOMATED CELL CULTURES MARKET IN THE FORECAST PERIOD

FIGURE 12 CONSUMABLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AUTOMATED CELL CULTURES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA AUTOMATED CELL CULTURES MARKET

FIGURE 14 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY PRODUCT, 2021

FIGURE 15 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY PRODUCT, 2022-2029 (EURO MILLION)

FIGURE 16 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY TYPE, 2021

FIGURE 19 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY TYPE, 2022-2029 (EURO MILLION)

FIGURE 20 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY APPLICATION, 2022-2029 (EURO MILLION)

FIGURE 24 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY END USER, 2021

FIGURE 27 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY END USER, 2022-2029 (EURO MILLION)

FIGURE 28 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA AUTOMATED CELL CULTURES MARKET : SNAPSHOT (2021)

FIGURE 31 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY COUNTRY (2021)

FIGURE 32 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 NORTH AMERICA AUTOMATED CELL CULTURES MARKET : BY PRODUCT (2022-2029)

FIGURE 35 NORTH AMERICA AUTOMATED CELL CULTURES MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.