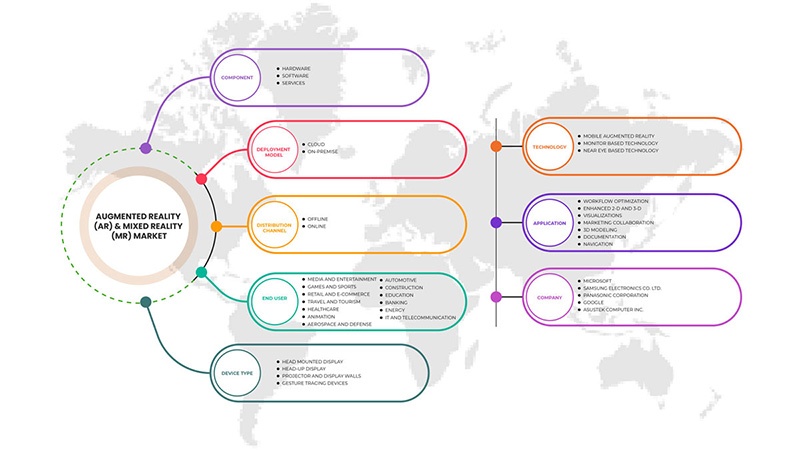

Mercado de Realidade Aumentada (RA) e Realidade Mista (RM) da América do Norte, por componente (hardware, software, serviços), modelo de implementação (cloud, local), canal de distribuição (off-line, on-line), tipo de dispositivo (head up display, head Display montado , projetor e parede de exibição, dispositivos de rastreamento de gestos), tecnologia (realidade aumentada móvel, tecnologia baseada em monitor, tecnologia baseada em visão próxima ao olho), aplicação (otimização de fluxo de trabalho, colaboração de marketing, 2-D e 3-D melhorados, visualizações, 3D Modelação, Documentação, Navegação), Utilizador final (Retalho e comércio eletrónico, TI e telecomunicações, Automóvel, Aeroespacial e defesa, Saúde, Animação, Viagens e turismo, Energia, Media e entretenimento, Educação, Construção, Jogos e desporto, Banca) - Tendências e previsões do setor até 2029.

Análise e dimensão do mercado de realidade aumentada (RA) e realidade mista (RM) na América do Norte

A realidade aumentada e a realidade mista trouxeram uma nova mudança à digitalização. Agora é mais fácil experienciar o mundo real definindo diferentes condições ambientais. A realidade aumentada e a realidade mista têm uma vasta gama de aplicações. O crescimento do mercado aumentou muito à medida que a utilização da realidade aumentada e da realidade mista se tornou popular nos simuladores de condução. A realidade aumentada e a realidade mista proporcionam ao condutor uma noção real da estrada, das condições de condução, dos manuais do automóvel e do trânsito, o que ajuda a evitar acidentes numa fase inicial de aprendizagem e prepara os condutores para diversas situações. Estes atributos levaram a uma maior utilização da realidade aumentada e da realidade mista também na defesa e na indústria aeroespacial. O pessoal do exército utilizou-o para treino em diversas condições, como salto de paraquedas, submarino, situações de combate e condução em diversas condições ambientais.

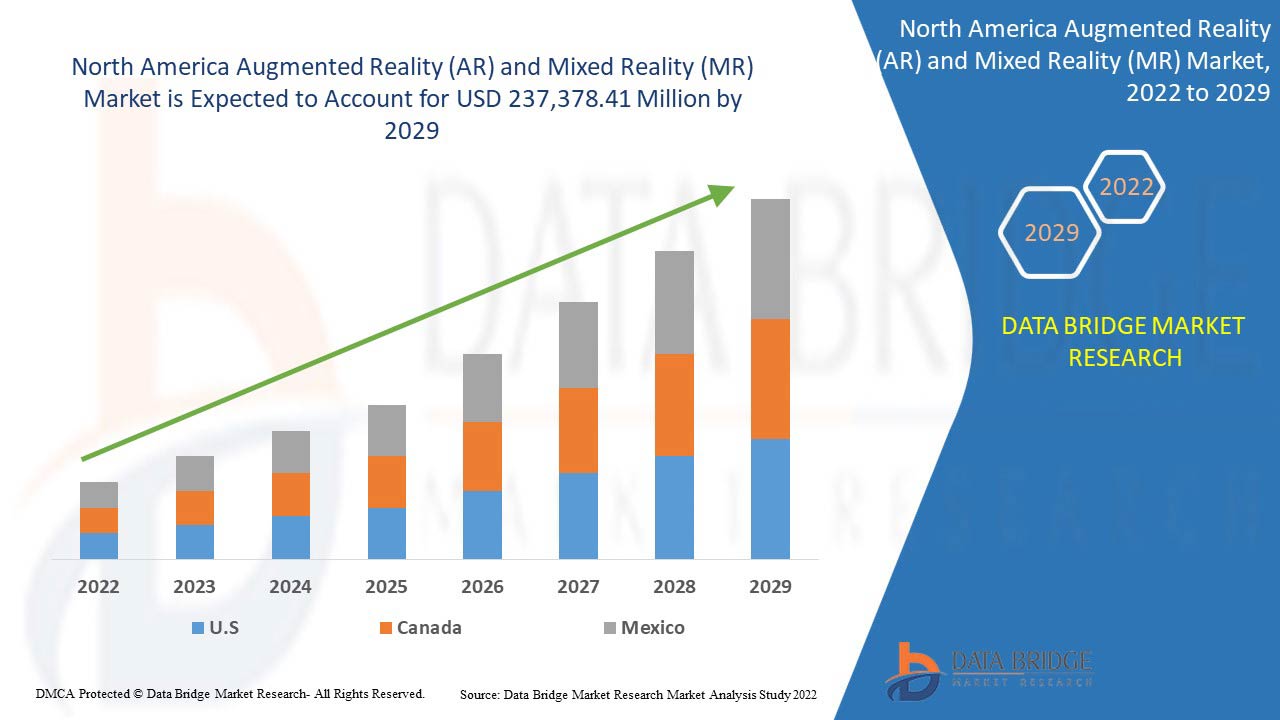

A Data Bridge Market Research analisa que o mercado norte-americano de realidade aumentada (RA) e realidade mista (RM) deverá atingir o valor de 237.378,41 milhões de dólares até 2029, com um CAGR de 50,8% durante o período previsto. O segmento de hardware é responsável pelo maior segmento de componentes no mercado norte-americano de realidade aumentada (RA) e realidade mista (RM). O relatório do mercado de realidade aumentada (RA) e realidade mista (RM) da América do Norte também abrange a análise de preços, a análise de patentes e os avanços tecnológicos em profundidade.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (Personalizável para 2019-2014) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos, preço em dólares americanos |

|

Segmentos abrangidos |

Por componente (hardware, software, serviços), modelo de implantação (cloud, local), canal de distribuição (off-line, on-line), tipo de dispositivo (head up display, head mounted display, projetor e parede de exibição, dispositivos de rastreio de gestos), tecnologia ( Realidade Aumentada Móvel, Tecnologia Baseada em Monitor, Tecnologia Baseada em Olho Próximo), Aplicação (Otimização de Fluxo de Trabalho, Colaboração de Marketing, 2-D e 3-D Aprimorados, Visualizações, Modelação 3D , Documentação, Navegação), Utilizador Final (Retalho e E-Commerce , TI e telecomunicações, automóvel, aeroespacial e defesa, saúde, animação, viagens e turismo, energia, media e entretenimento, educação, construção, jogos e desporto, banca) |

|

Países abrangidos |

EUA, Canadá e México |

|

Atores do mercado abrangidos |

HP Development Company, LP, HTC Corporation, Autodesk Inc., Barco, Intel Corporation, PTC, Seiko Epson Corporation, Ultraleap Limited, ASUSTek Computer Inc., Dell, Google (uma subsidiária da Alphabet Inc.), Sony Corporation, Lenovo, Microsoft , SAMSUNG ELECTRONICS CO., LTD., Panasonic Corporation, RealWear, Inc., Magic Leap, Inc., EON Reality e TeamViewer, entre outros |

Definição de Mercado

A realidade aumentada é uma tecnologia que utiliza o ambiente existente do utilizador e sobrepõe conteúdo ou informação digital ou virtual para oferecer uma experiência digital imersiva num ambiente em tempo real. As aplicações de realidade aumentada são desenvolvidas em programas 3D especiais, que permitem aos programadores integrar conteúdo contextual ou digital com o mundo real em tempo real. A realidade aumentada oferece experiências interativas através de diversas modalidades sensoriais, incluindo tátil, auditiva, visual, somatossensorial e muito mais. A tecnologia tem uma vasta gama de aplicações em áreas de entretenimento, formação e educação. Indústrias como a indústria transformadora, a saúde e a logística, entre outras, estão mais focadas na adoção desta tecnologia para aplicações de formação, manutenção, assistência e monitorização.

A realidade mista simboliza a colisão controlada das tendências de RA/RV e IoT. A realidade mista (RM), também chamada de realidade híbrida, é a tecnologia utilizada para fundir mundos reais e virtuais e produzir novos ambientes e visualizações onde objetos físicos e digitais coexistem e interagem em tempo real. A realidade mista é um campo interdisciplinar que envolve computação gráfica, processamento de sinal, computação gráfica, interfaces de utilizador, computação móvel, computação vestível, visualização de informação e design de ecrãs e sensores. Os conceitos de realidade mista estão a ser cada vez mais adotados por vários setores, incluindo o automóvel, a saúde e os ambientes de escritório, entre outros.

Dinâmica de Mercado

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Aumento da penetração de dispositivos inteligentes e serviços de internet

Com a introdução dos dispositivos inteligentes, a RA proporcionou oportunidades valiosas para os retalhistas envolverem os consumidores, exibirem os seus produtos e criarem uma vantagem competitiva, o que deverá impulsionar significativamente o mercado de realidade aumentada (RA) e realidade mista (RM) da América do Norte.

- Aumento da adoção de realidade aumentada pelas instituições de ensino

A RA na educação permite que os alunos adquiram conhecimentos através de recursos visuais avançados e imersão no assunto. Além disso, a tecnologia de fala também envolve os alunos ao fornecer detalhes abrangentes sobre o tema num formato de voz. Por conseguinte, o conceito de eLearning com RA tornou-se uma estratégia essencial para recolher informações, o que deverá impulsionar significativamente o mercado de realidade aumentada (RA) e realidade mista (RM) na América do Norte.

- Foco crescente nos sistemas ciberfísicos

A Realidade Aumentada (RA) permite interações intuitivas e eficientes entre humanos e CPMT (Cyber-Physical Machine Tool). À medida que os sistemas de cibersegurança se tornam baseados em modelos e aproveitam a realidade aumentada, virtual ou mista, as lacunas entre a formação, o planeamento/análise e as simulações de consciência situacional desaparecem. Através de uma interface contextual orientada por modelo, os utilizadores podem experimentar uma representação virtual de uma instalação do mundo real.

- Mais avanço tecnológico e digitalização

A contínua convergência da digitalização nos mundos real e virtual tornou-se o principal factor de inovação e mudança em todos os sectores da nossa economia. A Tecnologia de Realidade Aumentada (RA) tornou-se uma das tecnologias críticas de transformação digital em áreas industriais e não industriais. O surgimento da realidade aumentada transformou vidas e operações quotidianas em tecnologia, hotelaria, saúde e outros setores. A utilização da realidade aumentada ajuda os clientes a compreender o produto ou serviço mais facilmente e ajuda-os a tomar decisões mais facilmente. Além disso, a realidade aumentada também pode ajudar a construir e melhorar a imagem da marca da organização, proporcionando aos clientes uma experiência de compra perfeita.

Oportunidades

-

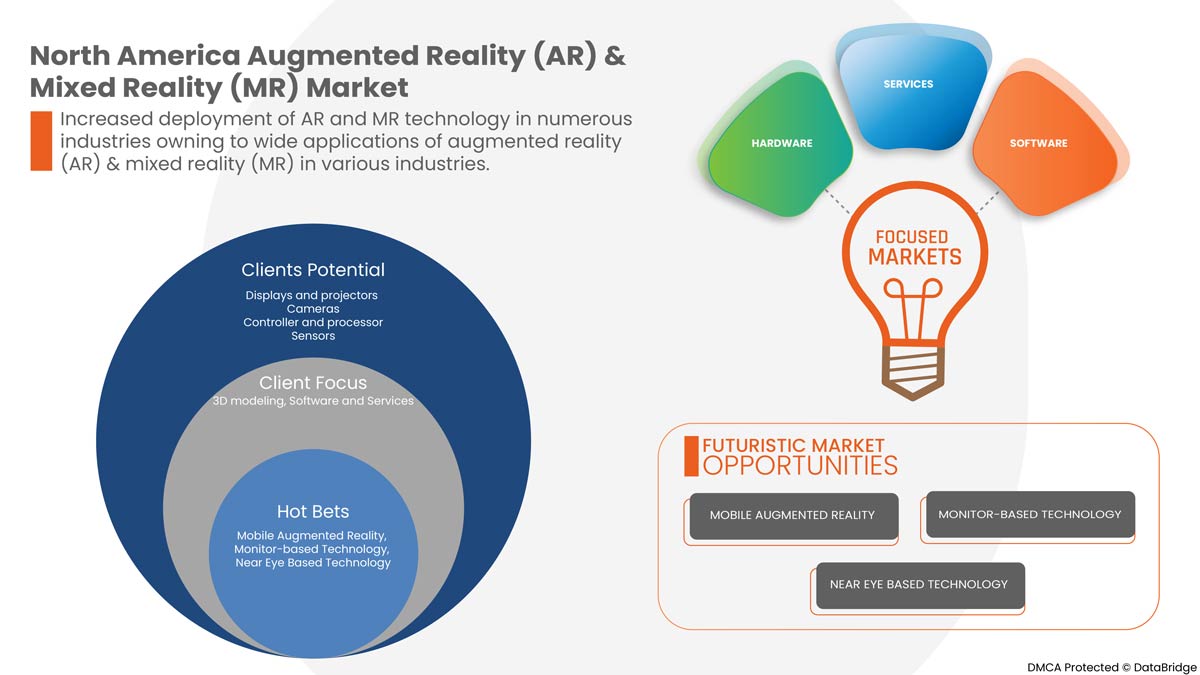

Aumento da implementação da tecnologia de RA e RM em vários setores

As aplicações em vários setores industriais, especialmente na indústria de defesa, utilizam extensivamente a realidade aumentada e mista. Espera-se que isto crie oportunidades para o mercado norte-americano de realidade aumentada (RA) e realidade mista (RM).

Restrições/Desafios

- Regulamentações governamentais rigorosas para organizações variadas

Os dispositivos e aplicações de RA (realidade aumentada) e RM (realidade mista) já estão sujeitos a diversas leis e regulamentos que regem a privacidade individual e os dados dos utilizadores em todos os países. No entanto, o atual panorama regulamentar aborda apenas alguns dos riscos da utilização de dispositivos de realidade aumentada. Os requisitos específicos complicam a recolha de dados necessária para proporcionar experiências imersivas robustas e seguras em todos os setores.

Impacto da COVID-19 no mercado norte-americano de realidade aumentada (RA) e realidade mista (RM)

A COVID-19 causou um grande impacto em vários setores, uma vez que quase todos os países optaram pelo encerramento de todas as instalações, exceto as que lidam com o segmento de bens essenciais. O governo tomou algumas medidas rigorosas, como o encerramento de instalações e a venda de produtos não essenciais, bloqueou o comércio internacional e muitas outras para impedir a propagação da COVID-19. Os únicos negócios que estão a lidar com esta situação de pandemia são os serviços essenciais que estão autorizados a abrir e executar os processos.

O uso crescente de dispositivos baseados em realidade aumentada proporcionou oportunidades significativas no meio da pandemia de COVID-19. Embora o poder de compra do consumidor tenha diminuído muito como resultado da crise económica induzida pelo coronavírus, resultando no declínio das margens de lucro nas organizações. Embora muitos profissionais de marketing e líderes importantes tenham visto sinais de melhoria em relação aos anos anteriores, continua a ser difícil determinar a situação real do mercado, uma vez que a procura reprimida pode estar a encobrir um nível intrínseco mais baixo de procura por dispositivos baseados em RA. O aumento das aplicações de realidade aumentada para smartphones, o aumento da procura de colaboração remota e os avanços tecnológicos nas aplicações médicas são alguns dos fatores que impulsionam o crescimento do mercado de realidade aumentada e realidade mista.

Os fabricantes estão a tomar várias decisões estratégicas para satisfazer a crescente procura no período da COVID-19. Os participantes estiveram envolvidos em atividades estratégicas, tais como parcerias, colaborações, aquisições e outras, para melhorar a tecnologia envolvida no mercado norte-americano de realidade aumentada (RA) e realidade mista (RM). Com isto, as empresas levarão para o mercado soluções avançadas e precisas. Além disso, as iniciativas governamentais para impulsionar a digitalização em todos os setores levaram ao crescimento do mercado.

Desenvolvimentos recentes

- Em abril de 2021, a Microsoft anunciou um contrato do Pentágono com o exército norte-americano para capacetes de realidade aumentada para soldados no valor de 21,88 mil milhões de dólares. Este HoloLens proporcionará aos soldados uma visibilidade mais eficiente, uma visão noturna de última geração e uma consciência situacional para qualquer guerra. Isto também ajudou a empresa a transcender os limites tradicionais de espaço e tempo no campo da RA, expandindo assim os seus produtos no mercado.

- Em julho de 2021, a SAMSUNG ELECTRONICS CO., LTD. expandiu as suas ofertas contactless para os consumidores com um novo serviço habilitado para Realidade Aumentada (RA) para os seus principais produtos. Com isto, os consumidores podem experimentar virtualmente um produto nas suas casas, verificar as dimensões do produto e fazer uma seleção informada com o serviço de RA. Isto também ajudou a empresa a expandir o seu portfólio de produtos no mercado da realidade aumentada

Âmbito do mercado de realidade aumentada (RA) e realidade mista (RM) na América do Norte

O mercado norte-americano de realidade aumentada (RA) e realidade mista (RM) está segmentado com base no componente, modelo de implementação, canal de distribuição, tipo de dispositivo, tecnologia, aplicação e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de crescimento escassos nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Por componente

- Hardware

- Software

- Serviços

Com base no componente, o mercado norte-americano de realidade aumentada (RA) e realidade mista (RM) está segmentado em hardware, software e serviços.

Por modelo de implementação

- No local

- Nuvem

Com base no modelo de implementação, o mercado norte-americano de realidade aumentada (RA) e realidade mista (RM) está segmentado em local e na nuvem.

Por canal de distribuição

- Desligado

- Online

Com base no tamanho da organização, o mercado norte-americano de realidade aumentada (RA) e realidade mista (RM) está segmentado em offline e online.

Por tipo de dispositivo

- Área de trabalho

- Exibição Head Up

- Visor montado na cabeça

- Projetor e parede de exposição

- Dispositivos de rastreio de gestos

Com base no tipo de dispositivo, o mercado norte-americano de realidade aumentada (RA) e realidade mista (RM) foi segmentado em head up display, head mounted display, projetor e parede de exibição e dispositivos de seguimento de gestos.

Por Tecnologia

- Realidade Aumentada Móvel

- Tecnologia baseada em monitor

- Tecnologia baseada na visão próxima do olho

Com base na tecnologia, o mercado norte-americano de realidade aumentada (RA) e realidade mista (RM) foi segmentado em realidade aumentada móvel, tecnologia baseada em monitor e tecnologia baseada em visão próxima do olho.

Por aplicação

- Bancos, Serviços Financeiros e Seguros (BFSI)

- Otimização do fluxo de trabalho

- Colaboração de Marketing

- 2-D e 3-D melhorados

- Visualizações

- Modelação 3D

- Documentação

- Navegação

Com base na aplicação, o mercado de realidade aumentada (RA) e realidade mista (RM) da América do Norte foi segmentado em otimização de fluxo de trabalho, colaboração de marketing, 2D e 3D melhorados, visualizações, modelação 3D, documentação e navegação.

Por utilizador final

- Bancos, Serviços Financeiros e Seguros (BFSI)

- Retalho e comércio eletrônico

- Informática e Telecomunicações

- Automotivo

- Aeroespacial e Defesa

- Assistência médica

- Animação

- Viagens e Turismo

- Energia

- Media e entretenimento

- Educação

- Construção

- Jogos e Desportos

- Bancário

- Outros

Com base no utilizador final, o mercado de realidade aumentada (RA) e realidade mista (RM) da América do Norte está segmentado em retalho e comércio eletrónico, TI e telecomunicações, automóvel, aeroespacial e defesa, saúde, viagens e turismo, energia, media e entretenimento, educação, construção, jogos e desporto, bancos e outros.

Análise/Insights regionais do mercado norte-americano de realidade aumentada (RA) e realidade mista (RM)

O mercado de realidade aumentada (RA) e realidade mista (RM) da América do Norte é analisado, e são fornecidos insights e tendências sobre o tamanho do mercado por país, componente, modelo de implementação, canal de distribuição, tipo de dispositivo, tecnologia , aplicação e utilizador final, conforme acima referenciado.

Os países abrangidos pelo relatório de mercado de realidade aumentada (RA) e realidade mista (RM) da América do Norte são os EUA, o Canadá e o México. Espera-se que os EUA dominem o mercado norte-americano de realidade aumentada (RA) e realidade mista (RM) e serão provavelmente a região de crescimento mais rápido na América do Norte devido ao crescente local de trabalho digital e à força de trabalho móvel. Além disso, os EUA têm sido extremamente recetivos à adoção dos mais recentes avanços tecnológicos nas empresas, o que está a impulsionar o crescimento do mercado.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da América do Norte e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas domésticas e das rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país .

Análise do panorama competitivo e da quota de mercado da realidade aumentada (RA) e da realidade mista (RM) na América do Norte

O panorama competitivo do mercado norte-americano de realidade aumentada (RA) e realidade mista (RM) fornece detalhes de um concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude e abrangência do produto, domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado norte-americano de realidade aumentada (RA) e realidade mista (RM).

Alguns dos principais players que operam no mercado de realidade aumentada (RA) e realidade mista (RM) na América do Norte são a HP Development Company, LP, HTC Corporation, Autodesk Inc., Barco, Intel Corporation, PTC, Seiko Epson Corporation, Ultraleap Limited, ASUSTek Computer Inc., Dell, Google (uma subsidiária da Alphabet Inc.), Sony Corporation, Lenovo, Microsoft, SAMSUNG ELECTRONICS CO., LTD., Panasonic Corporation, RealWear, Inc., Magic Leap, Inc., EON Reality e TeamViewer entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATIONS

4.1.1 IEEE STANDARDS

4.2 POST COVID

4.3 MARKETING

4.4 PRICING ANALYSIS/PRICE SENSITIVITY

4.5 KOREAN CONTENT'S POPULARITY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING PENETRATION OF SMART DEVICES AND INTERNET SERVICES

5.1.2 RISE IN ADOPTION OF AUGMENTED REALITY BY EDUCATIONAL INSTITUTES

5.1.3 INCREASING FOCUS ON CYBER-PHYSICAL SYSTEMS

5.1.4 MORE OF TECHNOLOGICAL ADVANCEMENT AND DIGITIZATION

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATIONS OF GOVERNMENT FOR VARIED ORGANIZATIONS

5.2.2 LOSS OF DATA AND PRIVACY

5.3 OPPORTUNITIES

5.3.1 INCREASED DEPLOYMENT OF AR AND MR TECHNOLOGY IN NUMEROUS INDUSTRIES

5.3.2 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

5.3.3 DEVELOPMENT OF HARDWARE WITH FASTER PROCESSING SPEEDS

5.3.4 RISE IN INVESTMENT AND FUNDING BY DEVELOPED COUNTRIES

5.4 CHALLENGES

5.4.1 NORTH AMERICA ECONOMIC SLOWDOWN LIMITS THE MARKET DEVELOPMENT

5.4.2 COMPLICATIONS WHILE OPERATING AUGMENTED REALITY (AR) & MIXED REALITY (MR) BASED PRODUCT

6 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 DISPLAYS AND PROJECTORS

6.2.2 CAMERAS

6.2.3 CONTROLLER AND PROCESSOR

6.2.4 SENSORS

6.2.4.1 ACCELEROMETERS

6.2.4.2 GYROSCOPES

6.2.5 PROXIMITY SENSORS

6.2.6 MAGNETOMETERS

6.2.7 OTHERS

6.2.8 POSITION TRACKERS

6.2.9 OTHERS

6.3 SOFTWARE

6.4 SERVICES

6.4.1 IMPLEMENTATION

6.4.2 SUPPORT AND MAINTENANCE

6.4.3 TRAINING

7 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 CLOUD

7.3 ON-PREMISE

8 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEVICE TYPE

8.1 OVERVIEW

8.2 HEAD MOUNTED DISPLAY

8.2.1 SMART GLASSES

8.2.2 SMART HELMET

8.3 HEAD UP DISPLAY

8.4 PROJECTOR & DISPLAY WALLS

8.5 GESTURE-TRACKING DEVICES

9 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 MOBILE AUGMENTED REALITY

9.3 MONITOR-BASED TECHNOLOGY

9.4 NEAR EYE BASED TECHNOLOGY

10 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 WORKFLOW OPTIMIZATION

11.3 ENHANCED 2-D AND 3-D

11.4 VISUALIZATIONS

11.5 MARKETING COLLABORATION

11.6 3D MODELING

11.7 DOCUMENTATION

11.8 NAVIGATION

12 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY END USER

12.1 OVERVIEW

12.2 MEDIA AND ENTERTAINMENT

12.2.1 BROADCAST

12.2.2 MUSIC

12.2.3 ART GALLERIES AND EXHIBITIONS

12.2.4 MUSEUMS

12.2.5 THEME PARKS

12.3 GAMES AND SPORTS

12.4 RETAIL AND E-COMMERCE

12.4.1 JEWELLERY

12.4.2 BEAUTY AND COSMETICS

12.4.3 APPAREL FITTING

12.4.4 GROCERY SHOPPING

12.4.5 FOOTWEAR

12.4.6 FURNITURE AND LIGHTING DESIGN

12.5 TRAVEL AND TOURISM

12.6 HEALTHCARE

12.6.1 SURGERY

12.6.2 FITNESS MANAGEMENT

12.6.3 PATIENT CARE MANAGEMENT

12.6.4 PHARMACY MANAGEMENT

12.6.5 OTHERS

12.7 ANIMATION

12.7.1 CHARACTER

12.7.2 CARTOON

12.8 AEROSPACE AND DEFENSE

12.9 AUTOMOTIVE

12.1 CONSTRUCTION

12.11 EDUCATION

12.12 BANKING

12.13 ENERGY

12.14 IT AND TELECOMMUNICATION

12.15 OTHERS

13 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION

13.1 NORTH AMERICA

14 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MICROSOFT

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 SAMSUNG ELECTRONICS CO., LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 PANASONIC CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCTS PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 DELL

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCTS PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 LENOVO

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCTS PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AUTODESK INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCTS PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 ASUSTEK COMPUTER INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 BARCO

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 EON REALITY

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 HP DEVELOPMENT COMPANY, L.P.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCTS PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 HTC CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 INTEL CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 MAGIC LEAP, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 PTC

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCTS PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 REALWEAR, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SEIKO EPSON CORPORATION

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 SONY CORPORATION

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCTS PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 TEAMVIEWER

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 ULTRALEAP LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 AVERAGE DEVELOPMENT TIME AND COST FOR AR:

TABLE 2 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA HARDWARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA HARDWARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SENSORS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SOFTWARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SERVICES IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SERVICES IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA CLOUD IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ON-PREMISE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA HEAD MOUNTED DISPLAY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA HEAD MOUNTED DISPLAY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HEAD UP DISPLAY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA PROJECTORS & DISPLAY WALLS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA GESTURE-TRACKING DEVICES IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA MOBILE AUGMENTED REALITY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA MONITOR-BASED TECHNOLOGY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA NEAR EYE BASED TECHNOLOGY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA OFFLINE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA ONLINE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA WORKFLOW OPTIMIZATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ENHANCED 2-D AND 3-D IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA VISUALIZATIONS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA MARKETING COLLABORATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA 3D MODELING IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA DOCUMENTATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA NAVIGATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA MEDIA AND ENTERTAINMENT IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA MEDIA AND ENTERTAINMENT IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA GAMES AND SPORTS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA RETAIL AND E-COMMERCE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA RETAIL AND E-COMMERCE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA TRAVEL AND TOURISM IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HEALTHCARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA HEALTHCARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ANIMATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA ANIMATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA AEROSPACE AND DEFENSE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA AUTOMOTIVE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA CONSTRUCTION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA EDUCATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA BANKING IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA ENERGY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA IT AND TELECOMMUNICATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA OTHERS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA HARDWARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA SENSORS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA SERVICES IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA HEAD MOUNTED DISPLAY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA MEDIA AND ENTERTAINMENT IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA RETAIL AND E-COMMERCE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA HEALTHCARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA ANIMATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: COMPONENT TIMELINE CURVE

FIGURE 11 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: SEGMENTATION

FIGURE 13 INCREASING PENETRATION OF SMART DEVICES AND INTERNET SERVICES IS EXPECTED TO DRIVE NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 THE HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET FROM 2022 TO 2029

FIGURE 15 NORTH AMERICA IS EXPECTED TO DOMINATE, AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET

FIGURE 17 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY COMPONENT, 2021

FIGURE 18 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY DEPLOYMENT MODEL, 2021

FIGURE 19 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY DEVICE TYPE, 2021

FIGURE 20 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY TECHNOLOGY, 2021

FIGURE 21 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY END USER, 2021

FIGURE 24 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH ANERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY COMPONENT (2022 & 2029)

FIGURE 26 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: COMPANY SHARE 2021(%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.