North America Aesthetic Devices Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

8.06 Billion

USD

18.71 Billion

2024

2032

USD

8.06 Billion

USD

18.71 Billion

2024

2032

| 2025 –2032 | |

| USD 8.06 Billion | |

| USD 18.71 Billion | |

|

|

|

|

Segmentação do mercado de dispositivos estéticos na América do Norte, por produtos (produtos estéticos faciais, dispositivos de contorno corporal , implantes cosméticos, dispositivos estéticos para a pele, dispositivos de remoção de pelos e outros), matérias-primas (polímeros, biomateriais e metais), usuário final (hospitais, clínicas dermatológicas, clínicas, institutos de pesquisa acadêmicos e privados e outros), canal de distribuição (licitação direta e vendas no varejo) - tendências do setor e previsão até 2032

Tamanho do mercado de dispositivos estéticos na América do Norte

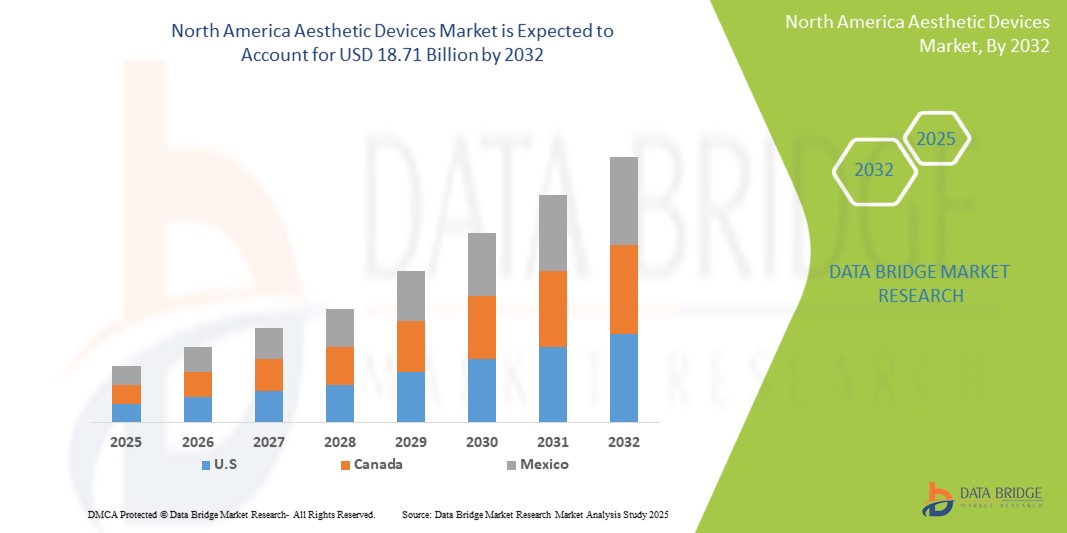

- O tamanho do mercado de dispositivos estéticos da América do Norte foi avaliado em US$ 8,06 bilhões em 2024 e deve atingir US$ 18,71 bilhões até 2032 , com um CAGR de 11,10% durante o período previsto.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por procedimentos estéticos minimamente invasivos e pela crescente conscientização sobre opções de aprimoramento estético entre diversos grupos de consumidores. Os avanços tecnológicos aumentaram a segurança, a eficácia e a variedade de dispositivos estéticos disponíveis, incentivando uma adoção mais ampla tanto em clínicas médicas quanto em centros de bem-estar.

- Além disso, a crescente influência das mídias sociais e a ênfase na aparência pessoal estão motivando mais pessoas a buscar tratamentos estéticos, impulsionando a expansão constante do mercado. Os consumidores buscam cada vez mais soluções não cirúrgicas que ofereçam tempos de recuperação mais rápidos e resultados naturais.

Análise do mercado de dispositivos estéticos na América do Norte

- Os dispositivos estéticos estão testemunhando uma forte adoção na América do Norte, impulsionados pela crescente demanda por procedimentos cosméticos minimamente invasivos e não invasivos, pela crescente conscientização sobre estética pessoal e pelo aumento da renda disponível.

- A crescente influência das mídias sociais, o foco crescente em tratamentos antienvelhecimento e os avanços tecnológicos em dispositivos de laser, ultrassom e radiofrequência estão impulsionando a demanda por soluções estéticas. Clínicas dermatológicas, spas médicos e hospitais na América do Norte estão investindo cada vez mais em plataformas estéticas multifuncionais para aumentar a precisão dos tratamentos, reduzir o tempo de inatividade e expandir seu portfólio de serviços.

- Os EUA dominaram o mercado de dispositivos estéticos da América do Norte, respondendo pela maior fatia da receita de 87,6% em 2024. Esse domínio é atribuído aos altos gastos do consumidor em procedimentos estéticos, à ampla disponibilidade de dispositivos avançados e à presença de marcas estéticas globalmente reconhecidas com sede nos EUA. Inovação contínua, fortes campanhas de marketing e uma grande base de profissionais treinados fortalecem ainda mais a liderança do país.

- O Canadá deverá ser o país com crescimento mais rápido no mercado de dispositivos estéticos na América do Norte, com um CAGR estimado de 6,8% entre 2025 e 2032. O crescimento no Canadá é impulsionado pela crescente aceitação de procedimentos estéticos não cirúrgicos, pela expansão de prestadores de serviços estéticos em áreas urbanas e suburbanas e por vias regulatórias favoráveis à aprovação de dispositivos. A crescente conscientização da população idosa e o crescente turismo médico também contribuem para a expansão do mercado.

- O segmento de polímeros detinha a maior participação de mercado, com 47,6% em 2024, devido à ampla aplicação de materiais à base de polímeros em diversos dispositivos estéticos, devido à sua flexibilidade, leveza e biocompatibilidade. Esses materiais são amplamente utilizados em implantes cosméticos, preenchimentos dérmicos e diversos dispositivos para tratamento da pele.

Escopo do relatório e segmentação do mercado de dispositivos estéticos na América do Norte

|

Atributos |

Principais insights do mercado de dispositivos estéticos na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de dispositivos estéticos na América do Norte

Avanços em tecnologias minimamente invasivas e soluções centradas no paciente

- Uma tendência significativa e crescente no mercado de dispositivos estéticos na América do Norte é a inovação contínua em tecnologias de tratamento minimamente invasivas e não invasivas, visando melhorar o conforto do paciente e reduzir o tempo de recuperação. Esses avanços estão impulsionando uma adoção mais ampla entre médicos e pacientes que buscam soluções cosméticas eficazes, porém menos invasivas.

- Por exemplo, dispositivos de ponta baseados em laser e ultrassom estão sendo aprimorados para oferecer tratamento direcionado com efeitos colaterais mínimos, permitindo que os pacientes retomem suas atividades normais rapidamente. Dispositivos como o sistema de laser Cynosure Elite+ e a tecnologia de ultrassom Ultherapy exemplificam essa mudança em direção a procedimentos estéticos mais seguros e eficientes.

- O foco crescente na personalização centrada no paciente levou os fabricantes a desenvolver dispositivos que podem ser adaptados a tipos de pele, condições e objetivos de tratamento individuais. Por exemplo, o uso de ferramentas avançadas de imagem e diagnóstico ajuda os profissionais a personalizar os planos de tratamento, melhorando os resultados e a satisfação do paciente.

- A integração de plataformas multifuncionais que combinam diversas modalidades de tratamento — como radiofrequência, laser e crioterapia — em um único dispositivo também está ganhando força. Isso proporciona maior versatilidade aos profissionais de estética, permitindo ofertas de tratamento abrangentes em um ambiente clínico simplificado.

- Essas tendências estão remodelando o cenário dos dispositivos estéticos, enfatizando a segurança, a eficácia e o cuidado personalizado. Empresas como Allergan e Lumenis estão na vanguarda, inovando continuamente seus portfólios de produtos para atender às crescentes demandas dos consumidores e aos requisitos clínicos.

- A demanda por dispositivos estéticos avançados e minimamente invasivos está crescendo rapidamente nos mercados desenvolvidos e emergentes, impulsionada pela conscientização crescente, expansão de clínicas estéticas e um foco crescente no bem-estar e no autocuidado.

Dinâmica do mercado de dispositivos estéticos na América do Norte

Motorista

Demanda crescente impulsionada pela conscientização crescente e expansão de procedimentos cosméticos

- A crescente conscientização sobre tratamentos estéticos entre um grupo demográfico mais amplo, incluindo a geração Y e o envelhecimento, juntamente com a crescente demanda por procedimentos estéticos minimamente invasivos e não invasivos, é uma grande força motriz por trás do aumento da demanda por dispositivos estéticos avançados.

- Por exemplo, em abril de 2024, a Lumenis Ltd. anunciou o lançamento de sua plataforma de laser de última geração, projetada para atender a uma ampla gama de aplicações, como rejuvenescimento da pele, redução de rugas e tratamentos de lesões vasculares, oferecendo maior precisão e maior conforto ao paciente. Espera-se que essas inovações contínuas de empresas líderes acelerem o crescimento do mercado de dispositivos estéticos ao longo do período previsto.

- À medida que os consumidores buscam cada vez mais soluções eficazes, porém de baixo risco, para rejuvenescimento da pele, contorno corporal e depilação, os dispositivos estéticos que oferecem tempos de recuperação mais rápidos e menos efeitos colaterais estão ganhando ampla aceitação em clínicas de dermatologia, centros de cirurgia plástica e spas médicos na América do Norte.

- Além disso, a crescente preferência por planos de tratamento personalizados e dispositivos multifuncionais capazes de abordar diversas preocupações estéticas em uma única sessão impulsiona ainda mais o crescimento do mercado. Dispositivos que utilizam tecnologias como radiofrequência, ultrassom, criolipólise e lasers fracionados são particularmente favorecidos por sua segurança e eficácia.

- O número crescente de profissionais de estética qualificados e o aumento do turismo médico nas economias emergentes também estão contribuindo para a crescente adoção desses dispositivos, permitindo o acesso a tratamentos estéticos avançados em diversas regiões geográficas.

Restrição/Desafio

Preocupações com altos custos iniciais e conformidade regulatória

- O elevado investimento inicial de capital necessário para adquirir dispositivos estéticos de ponta continua sendo uma barreira significativa, especialmente para clínicas menores e participantes de mercados emergentes que podem enfrentar restrições orçamentárias. Esse desafio é agravado pela necessidade contínua de atualizações e manutenção de dispositivos, que aumentam as despesas gerais.

- Por exemplo, os dispositivos estéticos premium equipados com recursos avançados, como tecnologia de laser fracionado ou ultrassom focalizado de alta intensidade (HIFU), geralmente têm um preço considerável, o que limita sua acessibilidade em mercados sensíveis ao preço.

- Além disso, os requisitos regulatórios rigorosos e variáveis em diferentes países exigem ensaios clínicos, certificações e aprovações rigorosos, o que pode atrasar o lançamento de produtos e aumentar as despesas relacionadas à conformidade, impactando assim o crescimento do mercado.

- Embora os fabricantes estejam progressivamente a introduzir modelos mais rentáveis e soluções de financiamento flexíveis para aliviar o fardo financeiro dos utilizadores finais, o custo premium percebido e o complexo panorama regulamentar continuam a restringir uma penetração mais ampla no mercado.

- Para garantir um crescimento sustentado, a indústria deve concentrar-se no desenvolvimento de soluções acessíveis e inovadoras, na simplificação dos caminhos regulamentares e no fornecimento de formação abrangente aos profissionais para melhorar a usabilidade dos dispositivos e os resultados para os pacientes.

Escopo do mercado de dispositivos estéticos na América do Norte

O mercado é segmentado com base em produtos, matérias-primas, usuário final e canal de distribuição.

- Por produtos

Com base nos produtos, o mercado de dispositivos estéticos é segmentado em produtos estéticos faciais, dispositivos de contorno corporal, implantes cosméticos, dispositivos estéticos para a pele, dispositivos de depilação e outros. O segmento de produtos estéticos faciais deteve a maior participação de mercado, com 38,7% de receita em 2024, impulsionado pela crescente ênfase norte-americana em beleza, bem-estar e envelhecimento saudável. A crescente popularidade de tratamentos não invasivos e minimamente invasivos, como peelings químicos, microdermoabrasão, resurfacing a laser e injetáveis, como toxina botulínica e preenchimentos dérmicos, está impulsionando significativamente a demanda. As inovações tecnológicas aprimoraram os perfis de segurança, reduziram o tempo de inatividade e melhoraram a eficácia do tratamento, atraindo um público mais amplo, incluindo consumidores mais jovens que buscam cuidados preventivos.

A previsão é de que o segmento de dispositivos de contorno corporal registre o CAGR mais rápido, de 15,8%, entre 2025 e 2032. Esse crescimento é impulsionado pela crescente prevalência de obesidade e sedentarismo, aliados à crescente preferência do consumidor por técnicas de redução de gordura não cirúrgicas, como criolipólise, ultrassom e terapias de radiofrequência. Além disso, a crescente conscientização sobre a estética corporal e a autoimagem está incentivando a adoção tanto em mercados desenvolvidos quanto emergentes.

- Por Matérias-Primas

Com base nas matérias-primas, o mercado de dispositivos estéticos é segmentado em polímeros, biomateriais e metais. O segmento de polímeros detinha a maior participação de mercado, com 47,6% em 2024, devido à ampla aplicação de materiais à base de polímeros em diversos dispositivos estéticos, devido à sua flexibilidade, leveza e biocompatibilidade. Esses materiais são amplamente utilizados em implantes cosméticos, preenchimentos dérmicos e diversos dispositivos para tratamento da pele.

A projeção é de que os biomateriais apresentem o crescimento mais rápido durante o período previsto, com um CAGR de 14,2%, impulsionado pelos avanços na medicina regenerativa e na engenharia de tecidos, que utilizam materiais de origem natural para promover a cura e a integração ao corpo humano. Este segmento se beneficia do aumento das atividades de pesquisa e desenvolvimento com foco em medicina personalizada e dispositivos implantáveis que imitam tecidos biológicos. Metais como titânio, aço inoxidável e ligas de cobalto-cromo continuam a desempenhar um papel vital, particularmente no fornecimento de integridade estrutural e durabilidade em implantes cosméticos, instrumentos cirúrgicos e outras aplicações de alta resistência, detendo uma participação de mercado de 28,3% em 2024, especialmente onde a estabilidade a longo prazo e a biocompatibilidade são cruciais.

- Por usuário final

Com base no usuário final, o mercado de dispositivos estéticos é segmentado em hospitais, clínicas dermatológicas, clínicas, institutos de pesquisa acadêmicos e privados, entre outros. Os hospitais dominaram o mercado em 2024, respondendo por 42,5% da receita, graças à sua infraestrutura bem estabelecida, acesso a especialistas multidisciplinares e capacidade de realizar procedimentos estéticos cirúrgicos e não cirúrgicos avançados. A presença de departamentos especializados e as colaborações com fabricantes de dispositivos médicos permitem que os hospitais ofereçam tratamentos de ponta, impulsionando o fluxo de pacientes.

Espera-se que as clínicas de dermatologia apresentem o CAGR mais rápido, de 14,9%, entre 2025 e 2032, com foco crescente em dermatologia cosmética e procedimentos estéticos ambulatoriais. O aumento da conscientização estética e a preferência por tratamentos menos invasivos levaram mais pacientes a optar por clínicas de dermatologia, que frequentemente oferecem atendimento personalizado, tempos de espera mais curtos e tecnologias inovadoras adaptadas às preocupações relacionadas à pele. Além disso, institutos de pesquisa acadêmicos e privados contribuem com o pioneirismo em novas tecnologias e ensaios clínicos, fomentando a inovação contínua no setor.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de dispositivos estéticos é segmentado em licitação direta e vendas no varejo. O segmento de licitação direta liderou o mercado em 2024, com uma participação de receita de 54,3%, principalmente devido a contratos de compras em massa com hospitais, organizações governamentais de saúde e grandes prestadores de serviços de saúde, que garantem fornecimento consistente, negociam melhores preços e mantêm estoque para dispositivos de alta demanda. Este segmento se beneficia de contratos de longo prazo e poder de compra institucional.

Por outro lado, espera-se que o segmento de vendas no varejo registre o CAGR mais rápido, de 13,6%, durante o período previsto, impulsionado pela proliferação de plataformas de e-commerce e marketplaces online, que ampliaram a acessibilidade dos produtos a clínicas menores, profissionais autônomos e consumidores finais. O crescimento das vendas no varejo é ainda sustentado pela crescente confiança do consumidor na compra de dispositivos estéticos online, pela disponibilidade de dispositivos fáceis de usar e para uso doméstico e pelo aumento dos esforços de marketing direcionados aos canais de venda direta ao consumidor, ampliando assim o alcance do mercado e incentivando a experimentação dos produtos.

Análise regional do mercado de dispositivos estéticos na América do Norte

- O mercado de dispositivos estéticos da América do Norte representou 39,8% da receita global do mercado em 2024, impulsionado pela crescente demanda por procedimentos estéticos minimamente invasivos e não invasivos, pela crescente conscientização sobre estética pessoal e pelo aumento da renda disponível. A região se beneficia de uma infraestrutura de saúde consolidada, forte presença de clínicas especializadas e ampla aceitação de tratamentos estéticos avançados pelos consumidores. A inovação contínua dos principais fabricantes – desde plataformas multifuncionais a laser até sistemas avançados de ultrassom e radiofrequência – posicionou a América do Norte como um polo global para a adoção de tecnologias estéticas.

- A crescente influência das tendências das mídias sociais, o foco crescente em tratamentos antienvelhecimento e os avanços na precisão e segurança dos dispositivos estão acelerando a demanda por procedimentos estéticos. Clínicas dermatológicas, spas médicos e hospitais na América do Norte estão investindo cada vez mais em plataformas multifuncionais para oferecer soluções completas de rejuvenescimento da pele, contorno corporal e depilação. O segmento de clínicas dermatológicas contribuiu com aproximadamente 46,2% da receita total do mercado norte-americano em 2024, destacando o papel fundamental dos tratamentos direcionados e liderados por especialistas para impulsionar a satisfação do paciente e a repetição dos procedimentos.

- Avanços tecnológicos — como ferramentas de análise de pele baseadas em IA, dispositivos portáteis de tratamento domiciliar e sistemas híbridos que combinam múltiplas modalidades — estão aprimorando ainda mais os resultados do tratamento, encurtando os períodos de recuperação e expandindo a gama de condições tratáveis. A liderança de mercado da América do Norte também é apoiada por programas robustos de treinamento de profissionais, altos padrões regulatórios que garantem segurança e eficácia, e um forte ecossistema de marketing e parcerias de marca que amplificam o engajamento do consumidor.

Visão do mercado de dispositivos estéticos dos EUA

O mercado de dispositivos estéticos dos EUA dominou o mercado de dispositivos estéticos da América do Norte, comandando a maior fatia da receita de 87,6% em 2024. Essa liderança decorre dos altos gastos do consumidor em aprimoramentos cosméticos, da adoção antecipada de tecnologias de ponta e da presença de marcas globalmente reconhecidas, como Allergan Aesthetics, Cynosure e Cutera. A extensa rede de clínicas dermatológicas, spas médicos e centros de cirurgia estética do país oferece amplo acesso a serviços estéticos cirúrgicos e não cirúrgicos. A inovação contínua em resurfacing a laser, lifting facial por ultrassom e contorno corporal minimamente invasivo — combinada com estratégias agressivas de marketing e opções de financiamento — expandiu significativamente a base de consumidores do mercado. A prevalência de tendências de beleza impulsionadas por celebridades e o forte setor de turismo médico do país reforçam ainda mais sua posição como líder global na adoção de dispositivos estéticos.

Visão geral do mercado de dispositivos estéticos do Canadá

O mercado canadense de dispositivos estéticos está prestes a se tornar o país com o crescimento mais rápido na América do Norte, com um CAGR estimado de 6,8% entre 2025 e 2032. O crescimento do mercado é impulsionado pela crescente aceitação de procedimentos estéticos não cirúrgicos entre diversas faixas etárias, aliada à crescente acessibilidade a serviços estéticos tanto em regiões metropolitanas quanto suburbanas. A expansão de clínicas dermatológicas, medspas e centros estéticos ambulatoriais – apoiada por marcos regulatórios favoráveis à aprovação de dispositivos – está ampliando o acesso dos pacientes a tecnologias avançadas, como microagulhamento por radiofrequência, criolipólise e lasers fracionados. O envelhecimento da população canadense está impulsionando a demanda por tratamentos antienvelhecimento, enquanto o crescente turismo médico, especialmente dos EUA, está impulsionando ainda mais os fluxos de receita. Campanhas de conscientização pública e a influência nas mídias sociais também estão contribuindo para uma mudança cultural em direção a cuidados estéticos preventivos e de manutenção, acelerando a adoção de dispositivos avançados em todo o país.

Participação no mercado de dispositivos estéticos na América do Norte

O setor de dispositivos estéticos é liderado principalmente por empresas bem estabelecidas, incluindo:

- AbbVie Inc. (EUA)

- Shanghai Fosun Pharmaceutical (Grupo) Co., Ltd (China)

- Bausch Health Companies Inc (Canadá)

- Candela Medical (EUA)

- Cutera (EUA)

- Cynosure (EUA)

- LUTRONIC INC (Coreia do Sul)

- BTL (República Tcheca)

- Medytox (Coreia do Sul)

- SharpLight Technologies Inc (Israel)

- Aerolase Corp (EUA)

- Suneva Medical (EUA)

- AirXpanders, Inc. (EUA)

- Lumenis Be Ltd. (Israel)

- Conceito de Vênus (Canadá)

- Sientra, Inc. (EUA)

- Merz North America, Inc. (EUA)

- Sistema Quanta (Itália)

- GC Aesthetics (Irlanda)

Últimos desenvolvimentos no mercado de dispositivos estéticos da América do Norte

- Em janeiro de 2021, a Candela, empresa líder em dispositivos médicos estéticos na América do Norte, anunciou a disponibilidade do sistema Frax Pro, um dispositivo fracionado não ablativo, aprovado pela FDA, para resurfacing cutâneo, com aplicadores Frax 1550 e Frax 1940. Isso ajudou a empresa a expandir o portfólio de produtos estéticos no mercado.

- Em abril de 2025, a LYMA Life Ltd. recebeu a aprovação da FDA para o seu LYMA Laser PRO, um dispositivo portátil projetado para fornecer terapia de luz laser de baixa intensidade para o tratamento de rugas. Essa aprovação representou um marco significativo, pois o LYMA Laser PRO é o primeiro dispositivo desse tipo a receber a aprovação da FDA, expandindo a disponibilidade de tratamentos estéticos avançados em casa no mercado americano.

- Em agosto de 2025, os avanços em tratamentos não cirúrgicos de rejuvenescimento da pele ganharam destaque, com dispositivos como Ultherapy, Sofwave e terapia de luz vermelha oferecendo alternativas menos dolorosas e mais sofisticadas aos liftings faciais tradicionais. Esses dispositivos à base de energia são projetados para estimular a produção de colágeno e rejuvenescer a pele, atendendo à crescente demanda por uma pele jovem.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.