North America Advanced Composite Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

10.55 Billion

USD

19.24 Billion

2025

2033

USD

10.55 Billion

USD

19.24 Billion

2025

2033

| 2026 –2033 | |

| USD 10.55 Billion | |

| USD 19.24 Billion | |

|

|

|

|

Segmentação do mercado de compósitos avançados na América do Norte, por tipo (compósitos de fibra de carbono, compósitos de fibra de vidro tipo S, compósitos de fibra de aramida e outros), resina (termoplásticos avançados e termofixos avançados), processo de fabricação (laminação automática de fita (ATL) e colocação automática de fibra (AFP), laminação manual/laminação por aspersão, moldagem por compressão, moldagem por transferência de resina (RTM), moldagem por injeção, enrolamento de filamentos, pultrusão e outros), usuário final (aeroespacial e defesa, energia e potência, automotivo, equipamentos esportivos, engenharia civil, elétrica e eletrônica, saúde e outros) - Tendências e previsões do setor até 2033

Tamanho do mercado de compósitos avançados na América do Norte

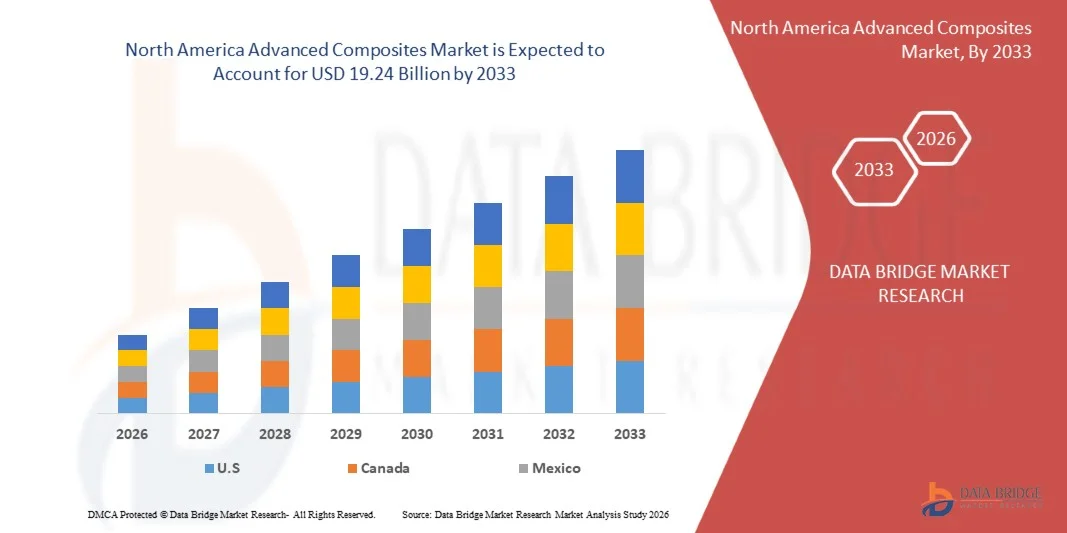

- O mercado de compósitos avançados na América do Norte foi avaliado em US$ 10,55 bilhões em 2025 e espera-se que alcance US$ 19,24 bilhões em 2033 , com uma taxa de crescimento anual composta (CAGR) de 7,8% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por materiais leves e de alta resistência nos setores aeroespacial, automotivo, de energia e de defesa, o que estimula a adoção de compósitos avançados para aplicações estruturais e de alto desempenho.

- Além disso, a crescente ênfase na eficiência de combustível, na redução de emissões e na sustentabilidade nos setores automotivo e aeroespacial está consolidando os compósitos avançados como o material preferido para componentes leves e duráveis. Esses fatores convergentes estão acelerando a adoção de soluções em compósitos, impulsionando significativamente o crescimento do setor.

Análise do Mercado de Compósitos Avançados na América do Norte

- Os compósitos avançados, que oferecem relações resistência/peso superiores, resistência à corrosão e flexibilidade de design, são cada vez mais vitais em aplicações aeroespaciais, automotivas, de energia e industriais devido à sua capacidade de aprimorar o desempenho, reduzir os custos de manutenção e melhorar a eficiência operacional.

- A crescente demanda por compósitos avançados é impulsionada principalmente por normas regulatórias rigorosas para eficiência de combustível e emissões, pela adoção cada vez maior de veículos elétricos e pelo aumento dos investimentos em infraestrutura de alto desempenho, refletindo uma preferência crescente por materiais leves, duráveis e sustentáveis.

- Os EUA dominaram o mercado de compósitos avançados na América do Norte em 2025, devido às suas indústrias aeroespacial, automotiva e de defesa bem estabelecidas, amplas capacidades de P&D e forte adoção de materiais leves e de alto desempenho.

- Prevê-se que o Canadá seja o país de crescimento mais rápido no mercado de compósitos avançados da América do Norte durante o período de previsão, devido ao aumento das atividades industriais nos setores aeroespacial, automotivo e de desenvolvimento de infraestrutura.

- O segmento de compósitos de fibra de carbono dominou o mercado com uma participação de 66,73% em 2025, devido à sua excelente relação resistência/peso, rigidez excepcional e ampla adoção em aplicações aeroespaciais, automotivas e esportivas de alto desempenho. Seu uso disseminado em componentes estruturais de aeronaves, painéis de carroceria automotiva e pás de turbinas eólicas impulsiona uma demanda constante, e as inovações contínuas nas técnicas de produção de fibra de carbono aprimoraram ainda mais a acessibilidade e o desempenho. Fabricantes e usuários finais preferem os compósitos de fibra de carbono por sua durabilidade, resistência à fadiga e capacidade de suportar condições ambientais adversas, tornando-os a escolha preferida para aplicações críticas que exigem materiais leves, porém de alta resistência.

Escopo do relatório e segmentação do mercado de compósitos avançados na América do Norte

|

Atributos |

Principais informações de mercado sobre compósitos avançados |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de compósitos avançados na América do Norte

“Adoção de compósitos leves nos setores aeroespacial e automotivo”

- O mercado de compósitos avançados na América do Norte está testemunhando uma adoção acelerada de materiais compósitos leves e de alta resistência nas indústrias aeroespacial e automotiva. O foco na redução do consumo de combustível, na melhoria da eficiência e na minimização das emissões está levando os fabricantes a incorporar compósitos de fibra de carbono e fibra de vidro em estruturas de aeronaves, carrocerias de veículos elétricos e componentes de alto desempenho.

- Por exemplo, a Hexcel Corporation e a Toray Industries investiram na fabricação automatizada de compósitos de carbono para asas de aeronaves, chassis automotivos e veículos elétricos de última geração. Seus avanços em nanotecnologia e fabricação automatizada aprimoram a redução de peso, a rigidez e a resistência à fadiga, atendendo a metas regulatórias e de sustentabilidade rigorosas em todo o mundo.

- A crescente adoção de compósitos nos setores de energia eólica, construção civil e ferrovias de alta velocidade está expandindo ainda mais o potencial de mercado. Empresas estão inovando em tecnologias como compósitos autorreparáveis, resinas de base biológica e reciclagem avançada, que aumentam a vida útil, minimizam a manutenção e apoiam iniciativas de construção sustentável.

- O investimento em processos de fabricação inteligentes — como laminação robótica, manufatura aditiva e controle de qualidade em tempo real — facilita a escalabilidade e a redução de custos. Essa automação permite a produção em massa de componentes complexos, ampliando as aplicações de compósitos em veículos e infraestrutura para o mercado de massa.

- Além disso, a crescente colaboração entre centros de pesquisa, fabricantes de equipamentos originais (OEMs) e fornecedores de materiais acelera o desenvolvimento e a comercialização de soluções sustentáveis em compósitos. Incentivos políticos e normas internacionais que apoiam materiais recicláveis e de baixo carbono impulsionam o uso de compósitos como uma estratégia essencial para uma mobilidade e energia mais limpas.

- Essas tendências refletem uma transformação de mercado focada em eficiência, sustentabilidade e inovação. À medida que os ambientes regulatórios evoluem e a tecnologia amadurece, os compósitos avançados estão destinados a se tornarem fundamentais nos ecossistemas globais de transporte e indústria.

Dinâmica do Mercado de Compósitos Avançados na América do Norte

Motorista

“Demanda por materiais sustentáveis e com baixo consumo de combustível”

- A demanda por materiais sustentáveis e com baixo consumo de combustível impulsiona o crescimento do mercado de compósitos avançados na América do Norte, alimentado pela necessidade de reduzir custos operacionais e o impacto ambiental nos setores de transporte, energia e infraestrutura. Os compósitos oferecem excelentes relações resistência/peso, resistência à corrosão e flexibilidade de design, tornando-os ideais para iniciativas de design sustentável.

- Por exemplo, a Boeing e a BMW expandiram a utilização de compósitos de fibra de carbono para produzir componentes mais leves e resistentes. Esses materiais ajudam os fabricantes de aeronaves e automóveis a alcançar maior eficiência de combustível, menores emissões e maior integridade estrutural, apoiando programas ambiciosos de conformidade regulatória e sustentabilidade corporativa.

- A economia de combustível nas indústrias aeroespacial e automotiva atribuível aos compósitos é significativa, com uma redução de 10% no peso permitindo uma melhoria de até 8% na economia de combustível das aeronaves. O crescimento dos setores de veículos elétricos, energia eólica e construção sustentável amplia ainda mais a necessidade de compósitos avançados, dado o seu impacto na eficiência e nas emissões do ciclo de vida.

- Iniciativas focadas em construção verde, energia renovável e mobilidade sustentável impulsionam a adoção de compósitos em aplicações estruturais, de rotores e de construção modular. Compósitos emergentes de base biológica e reciclagem em circuito fechado contribuem para os objetivos da economia circular, aprimorando a reputação e a viabilidade de materiais avançados.

- A colaboração entre empresas e políticas públicas está acelerando a inovação e a penetração no mercado, à medida que os fabricantes alinham seus portfólios de produtos para atender às metas de consumo de combustível, emissões e reciclagem. A transição para materiais sustentáveis deverá ser um fator crucial na expansão futura do mercado de compósitos.

Restrição/Desafio

“Altos custos de produção e de matéria-prima”

- Os altos custos de produção e de matéria-prima representam um desafio significativo para a expansão do mercado de compósitos avançados na América do Norte. A fabricação de compósitos, particularmente os de fibra de carbono, envolve processos de alto consumo energético, exigindo insumos de alta pureza e equipamentos especializados, o que eleva os custos operacionais.

- Por exemplo, empresas como a SGL Carbon e o Mitsubishi Chemical Group enfrentam custos elevados para precursores de fibra de carbono, etapas de processamento complexas e controle de qualidade rigoroso. Essas despesas frequentemente resultam em preços mais altos que limitam a viabilidade dos compósitos para categorias de produtos sensíveis a custos.

- A personalização, a certificação e a conformidade aumentam os custos, principalmente em aplicações aeroespaciais e de defesa, já que cada componente deve atender a rigorosos padrões regulatórios e de desempenho. Embora os avanços tecnológicos em automação e reciclagem ofereçam potencial de redução de custos, os investimentos iniciais continuam sendo uma barreira para muitos novos participantes e pequenos fabricantes.

- As opções limitadas de reciclagem, especialmente para compósitos à base de termofixos, representam desafios adicionais em termos ambientais e de descarte, aumentando os custos totais do ciclo de vida. À medida que as regulamentações se tornam mais rigorosas e os padrões de sustentabilidade evoluem, a necessidade de desenvolver soluções de compósitos recicláveis e economicamente viáveis torna-se cada vez mais urgente.

- Superar essas barreiras exigirá ampliar a inovação em matérias-primas de base biológica, fabricação automatizada e reciclagem de última geração. Parcerias estratégicas com a indústria, apoio político e investimento em tecnologia de produção em massa serão essenciais para alcançar um crescimento sustentável e acessível para compósitos avançados em todo o mundo.

Escopo do mercado de compósitos avançados na América do Norte

O mercado é segmentado com base no tipo, resina, processo de fabricação e usuário final.

• Por tipo

Com base no tipo, o mercado de compósitos avançados da América do Norte é segmentado em compósitos de fibra de carbono, compósitos de fibra de vidro tipo S, compósitos de fibra de aramida e outros. O segmento de compósitos de fibra de carbono dominou o mercado com a maior participação na receita, de 66,73% em 2025, impulsionado por sua excelente relação resistência/peso, rigidez excepcional e ampla adoção em aplicações aeroespaciais, automotivas e esportivas de alto desempenho. Seu uso generalizado em componentes estruturais de aeronaves, painéis de carroceria automotiva e pás de turbinas eólicas alimenta uma demanda constante, e as inovações contínuas nas técnicas de produção de fibra de carbono aprimoraram ainda mais a acessibilidade e o desempenho. Fabricantes e usuários finais preferem os compósitos de fibra de carbono por sua durabilidade, resistência à fadiga e capacidade de suportar condições ambientais adversas, tornando-os a escolha preferida para aplicações críticas que exigem materiais leves, porém de alta resistência.

Prevê-se que o segmento de compósitos de fibra de aramida apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pelo aumento do uso em proteção balística, aeroespacial e em aplicações de defesa. Por exemplo, empresas como a DuPont estão inovando com compósitos à base de aramida para capacetes, coletes à prova de balas e painéis aeroespaciais, aproveitando sua alta resistência a impactos e estabilidade térmica. A crescente conscientização sobre equipamentos de proteção nas indústrias de defesa e segurança, combinada com o uso crescente nos setores automotivo e industrial, impulsiona uma forte demanda. A leveza, a alta resistência à tração e a resistência à abrasão e à degradação química tornam os compósitos de aramida uma opção cada vez mais atraente para diversas aplicações de alto desempenho.

• Por Resina

Com base na resina, o mercado é segmentado em Termoplásticos Avançados e Termofixos Avançados. O segmento de resinas termofixas avançadas dominou o mercado com a maior participação na receita em 2025, impulsionado por sua capacidade de oferecer excelente resistência térmica e química, estabilidade estrutural e resistência mecânica em condições extremas. As indústrias aeroespacial, automotiva e de energia eólica utilizam amplamente compósitos termofixos em aplicações de alta carga e alta temperatura, proporcionando confiabilidade a longo prazo. Por exemplo, a Hexcel e a Cytec fabricam pré-impregnados e laminados termofixos para estruturas de aeronaves e máquinas industriais, ressaltando o papel fundamental da resina em aplicações de compósitos de alto desempenho.

Prevê-se que o segmento de resinas termoplásticas avançadas apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente adoção nos setores automotivo, médico e de bens de consumo para componentes leves, recicláveis e de alto desempenho. Os compósitos termoplásticos oferecem ciclos de fabricação mais rápidos e maior resistência em comparação com os termofixos, tornando-os ideais para produção em massa. Empresas como a Solvay estão inovando com compósitos termoplásticos para peças estruturais automotivas e componentes aeroespaciais leves, impulsionando o mercado. A capacidade de reprocessar e termoformar compósitos termoplásticos aumenta a sustentabilidade e a relação custo-benefício, atraindo fabricantes ambientalmente conscientes.

• Por processo de fabricação

Com base no processo de fabricação, o mercado é segmentado em Colocação Automatizada de Fitas (ATL) e Colocação Automatizada de Fibras (AFP), Laminação Manual/Laminação por Aspersão, Moldagem por Compressão, Moldagem por Transferência de Resina (RTM), Moldagem por Injeção, Enrolamento de Filamentos, Pultrusão e Outros. O segmento de Colocação Automatizada de Fibras (AFP) dominou o mercado com a maior participação na receita em 2025, impulsionado por sua precisão, automação e eficiência na produção de estruturas compostas de alto desempenho em larga escala para aplicações aeroespaciais e de defesa. A AFP permite a colocação consistente de fibras, a utilização otimizada de materiais e a redução dos custos de mão de obra, apoiando sua adoção em fuselagens de aeronaves, componentes de asas e espaçonaves. Por exemplo, a Boeing e a Lockheed Martin implementam amplamente a AFP para painéis reforçados com fibra de carbono, destacando seu papel crucial na manufatura avançada.

O segmento de moldagem por transferência de resina (RTM, na sigla em inglês) deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado por sua relação custo-benefício, repetibilidade e adequação para componentes de médio a grande porte nos setores automotivo, de energia e industrial. A RTM oferece excelente acabamento superficial, alta fração volumétrica de fibras e flexibilidade de design, tornando-a atraente para a produção em massa de peças compostas. Empresas como a Gurit estão inovando em processos de RTM para pás de turbinas eólicas e componentes estruturais automotivos, impulsionando sua adoção. O equilíbrio entre eficiência de produção, desempenho estrutural e escalabilidade contribui para o rápido crescimento da RTM.

• Por usuário final

Com base no usuário final, o mercado de compósitos avançados da América do Norte é segmentado em Aeroespacial e Defesa, Energia e Potência, Automotivo, Equipamentos Esportivos, Engenharia Civil, Elétrica e Eletrônica, Saúde e Outros. O segmento aeroespacial e de defesa dominou o mercado com a maior participação na receita em 2025, impulsionado pela demanda crítica por materiais leves, de alta resistência e resistentes à fadiga em aeronaves, espaçonaves e equipamentos de defesa. Padrões de segurança rigorosos, metas de eficiência de combustível e a necessidade de componentes de alto desempenho em aeronaves e satélites militares reforçam o domínio do mercado. Por exemplo, a Airbus utiliza amplamente compósitos de fibra de carbono em painéis de fuselagem e estruturas de asas, destacando a importância estratégica do segmento.

Prevê-se que o segmento automotivo apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pela mudança global em direção a veículos leves, com baixo consumo de combustível e elétricos. Os materiais compósitos oferecem redução significativa de peso, maior eficiência energética e melhor resistência a impactos, atendendo às exigências regulatórias e dos consumidores. Empresas como BMW e Tesla estão integrando compósitos avançados em chassis e componentes estruturais de veículos elétricos, acelerando sua adoção. A expansão das aplicações em veículos comerciais, carros esportivos e soluções de mobilidade urbana contribui para a trajetória de rápido crescimento do setor automotivo.

Análise Regional do Mercado de Compósitos Avançados na América do Norte

- Os EUA dominaram o mercado de compósitos avançados da América do Norte, com a maior participação na receita em 2025, impulsionados por suas indústrias aeroespacial, automotiva e de defesa bem estabelecidas, amplas capacidades de P&D e forte adoção de materiais leves e de alto desempenho.

- A infraestrutura de manufatura avançada do país e a expertise tecnológica na produção de compósitos estão sustentando uma demanda constante em componentes aeroespaciais, peças estruturais automotivas e aplicações industriais.

- A presença de grandes fabricantes nacionais de compósitos, a inovação contínua em sistemas de resina e tecnologias de fibras, e as colaborações estratégicas com OEMs sustentam a posição dominante do país. Investimentos crescentes em expansão de capacidade, automação e práticas de produção sustentáveis continuam a aprimorar a eficiência operacional e a reforçar o crescimento do mercado.

Análise do Mercado de Compósitos Avançados no Canadá e na América do Norte

Prevê-se que o Canadá registre a taxa de crescimento anual composta (CAGR) mais rápida no mercado de compósitos avançados da América do Norte entre 2026 e 2033, impulsionado pelo aumento das atividades industriais nos setores aeroespacial, automotivo e de desenvolvimento de infraestrutura. O foco do país em materiais leves para aplicações que economizam combustível e energia está impulsionando a demanda do mercado. Os fabricantes canadenses de compósitos estão priorizando tecnologias avançadas de fibras, sistemas de resina e práticas de produção sustentáveis para atender às exigências da indústria. Parcerias estratégicas com OEMs globais e iniciativas governamentais que promovem a inovação em materiais avançados fortalecem a posição competitiva do Canadá. Espera-se que o foco do país na otimização de recursos e na modernização das instalações de produção impulsione um crescimento significativo do mercado durante todo o período previsto.

Análise do Mercado de Compósitos Avançados no México e na América do Norte

Prevê-se que o México testemunhe um crescimento constante entre 2026 e 2033, impulsionado pela expansão dos seus setores automotivo, aeroespacial e de manufatura industrial, que dependem cada vez mais de compósitos avançados para aplicações leves e de alta resistência. A integração do país nas cadeias de suprimentos norte-americanas está sustentando a demanda por materiais compósitos de alto desempenho e baixo custo. Os crescentes investimentos em instalações de produção de compósitos no país e a adoção de tecnologias de fabricação automatizadas e energeticamente eficientes estão contribuindo para a expansão do mercado. As colaborações entre fabricantes mexicanos e OEMs internacionais estão aprimorando a qualidade dos materiais, a capacidade de produção e a expertise tecnológica. A ênfase do México na eficiência industrial, no desenvolvimento de infraestrutura e na manufatura sustentável sustenta sua trajetória de crescimento estável no mercado regional.

Participação de mercado de compósitos avançados na América do Norte

O setor de compósitos avançados é liderado principalmente por empresas consolidadas, incluindo:

- TORAY INDUSTRIES, INC. (Japão)

- Teijin Aramid BV (Países Baixos)

- Mitsubishi Chemical Group Corporation (Japão)

- Huntsman International LLC. (EUA)

- BASF SE (Alemanha)

- Solvay (Bélgica)

- Akzo Nobel NV (Países Baixos)

- DuPont (EUA)

- Hexion (EUA)

- Honeywell International Inc. (EUA)

- Owens Corning (EUA)

- Formosa Plastics Corporation (Taiwan)

- Henkel AG & Co. KGaA (Alemanha)

- Lyondellbasell Industries Holdings BV (Países Baixos)

- Hanwha Solutions (Coreia do Sul)

- SGL Carbon (Alemanha)

- Kemira (Finlândia)

- HB Fuller (EUA)

- Evonik Industries AG (Alemanha)

Últimos desenvolvimentos no mercado de compósitos avançados na América do Norte

- Em maio de 2025, a Solvay apresentou uma resina composta termoplástica totalmente reciclável, desenvolvida especificamente para carcaças de baterias de veículos elétricos. Essa inovação reduz significativamente o peso total dos veículos, mantendo os rigorosos padrões de segurança contra incêndio e estruturais. O desenvolvimento impulsiona a adoção de compósitos no setor de veículos elétricos, que está em rápido crescimento, atendendo à necessidade dos fabricantes por materiais leves, duráveis e ambientalmente sustentáveis. Ao combinar desempenho com reciclabilidade, a Solvay está promovendo uma mudança em direção a soluções mais ecológicas e de alto desempenho em aplicações automotivas e de alto consumo de energia.

- Em janeiro de 2025, a Mallinda lançou sua resina Vitrimax VHM (Versatile Hot Melt), um sistema à base de vitrímero que combina o alto desempenho mecânico dos termofixos com a reciclabilidade dos termoplásticos. Essa inovação possibilita a reciclagem e a reutilização econômica de resíduos de compósitos, reduzindo o desperdício e apoiando práticas de manufatura circular. O lançamento da Vitrimax VHM fortalece o aspecto de sustentabilidade dos compósitos avançados, atraindo fabricantes dos setores automotivo, aeroespacial e industrial que buscam materiais ecológicos e de alto desempenho.

- Em junho de 2022, a Hexcel Corporation anunciou que a Sikorsky, uma empresa da Lockheed Martin, concedeu um contrato de longo prazo para o fornecimento de estruturas compostas avançadas para o programa do helicóptero de transporte pesado CH-53K King Stallion. Este contrato reforça a crescente dependência de compósitos leves e de alta resistência em aplicações aeroespaciais críticas, onde desempenho e durabilidade são fundamentais. A colaboração também destaca a importância estratégica dos compósitos avançados em programas de defesa e seu papel no aprimoramento da eficiência das aeronaves, da capacidade de carga útil e da confiabilidade operacional.

- Em março de 2022, a Hexcel Corporation expandiu suas operações de fabricação de núcleos de engenharia no Marrocos para atender à crescente demanda por compósitos avançados e leves de clientes do setor aeroespacial. A expansão fortalece a cadeia de suprimentos global da Hexcel, permitindo entregas mais rápidas e melhor suporte para projetos aeroespaciais de grande escala. Essa iniciativa também reflete a tendência mais ampla do setor de aumentar os investimentos em capacidade produtiva para atender à crescente demanda por materiais que reduzem o peso, melhoram a eficiência de combustível e mantêm a integridade estrutural em aeronaves e espaçonaves.

- Em fevereiro de 2022, a Teijin Automotive Technologies, principal entidade do setor de compósitos automotivos do Grupo Teijin, inaugurou uma nova unidade de produção de 39.000 metros quadrados em Changzhou, província de Jiangsu, China, dentro da Zona Industrial Nacional de Alta Tecnologia de Wujin. A empresa também anunciou a construção de uma terceira unidade de 13.000 metros quadrados, com previsão de conclusão para o verão de 2023. Essas expansões fortalecem a capacidade produtiva da Teijin, apoiam o crescente mercado de compósitos automotivos na China e permitem que a empresa forneça materiais leves e de alta resistência para componentes estruturais de veículos, melhorando o desempenho e a eficiência de combustível no setor automotivo.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.