Mercado de sensores de toque do Médio Oriente e África , por tipo (resistivo, capacitivo, onda acústica de superfície (SAW), infravermelho, ótico), flexibilidade (convencional, flexível, outros), canal (multicanal, canal único), aplicação ( electrónica de consumo , Electrodomésticos, Dispositivos Médicos, Sistemas Biométricos, Automóvel, Caixas Automáticos (ATM), Sistemas Biométricos, Automóvel e Outros) Tendências e Previsão da Indústria até 2029

Análise de Mercado e Tamanho

A crescente integração de sensores devido ao número crescente de ecrãs tácteis e dispositivos pode aumentar o crescimento do mercado de sensores tácteis no Médio Oriente e em África. A crescente procura de produtos eletrónicos de consumo, como televisores inteligentes, colunas e sistemas de domótica, está a complementar o crescimento do mercado.

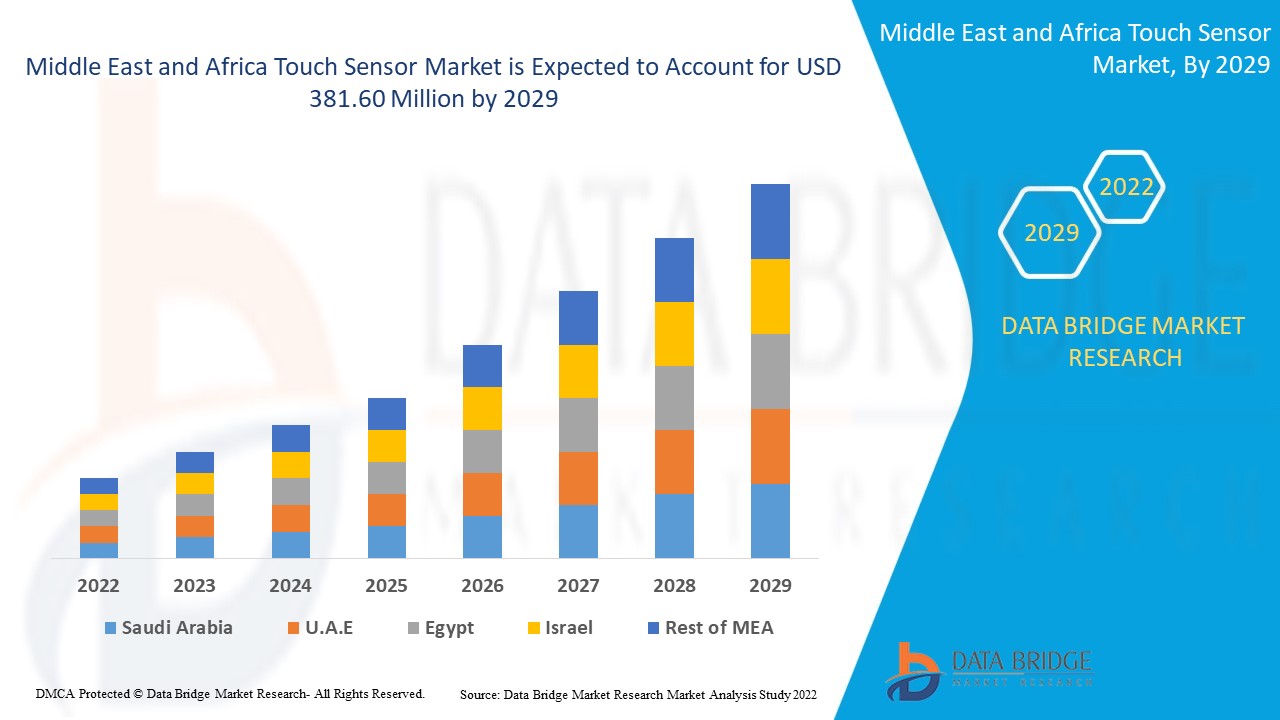

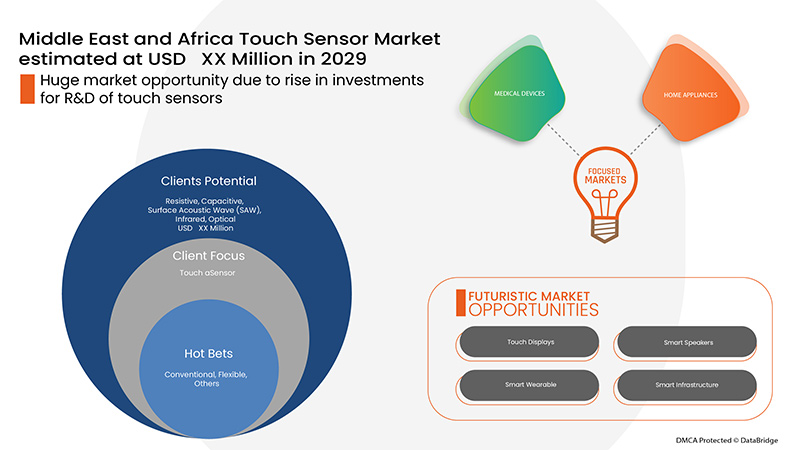

A crescente procura por sinalização digital interativa em lojas de retalho e centros comerciais impulsiona a procura por estes sensores de toque. A Data Bridge Market Research analisa que o mercado de sensores tácteis do Médio Oriente e África deverá atingir o valor de 381,60 milhões de dólares até ao ano de 2029, com um CAGR de 11,5% durante o período previsto. Além disso, a crescente procura de sinalética digital interativa em lojas de retalho e centros comerciais, que reduz o trabalho manual e atua como autoajuda para os consumidores, acelera ainda mais o crescimento do mercado. A rápida evolução da tecnologia de sensores tácteis e a crescente utilização de ecrãs tácteis nos setores educacional e empresarial para aumentar a interatividade impulsionam o crescimento do mercado. O segmento automóvel tem um enorme potencial para liderar a procura por sensores tácteis devido à rápida integração dos painéis tácteis nos veículos.

Os participantes do mercado de sensores de toque do Médio Oriente e de África estão mais focados no desenvolvimento de novos produtos, parcerias e outras estratégias para aumentar a quota de mercado de sensores de toque do Médio Oriente e de África.

Os principais fatores que deverão impulsionar o crescimento do mercado de sensores tácteis no Médio Oriente e em África são a crescente adoção de ecrãs tácteis, a crescente procura de eletrónica de consumo, a crescente utilização de ecrãs tácteis na indústria automóvel e as iniciativas governamentais para a digitalização. No entanto, a queda da procura de PCs multifuncionais pode restringir o crescimento do mercado.

O relatório de mercado com curadoria da equipa de pesquisa de mercado da Data Bridge inclui uma análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e cenário da cadeia climática.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (Personalizável para 2019 - 2014) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos, preço em dólares americanos |

|

Segmentos abrangidos |

Por tipo (resistivo, capacitivo, onda acústica de superfície (SAW), infravermelho, ótico), flexibilidade (convencional, flexível, outros), canal (multicanal, canal único), aplicação (eletrónica de consumo, eletrodomésticos, dispositivos médicos, sistemas biométricos , Automóvel, Caixas Automáticos (ATM), Sistemas Biométricos, Automóvel e Outros) |

|

Países abrangidos |

Arábia Saudita, Emirados Árabes Unidos, África do Sul, Israel, Egito e o resto do Médio Oriente e África |

|

Atores do mercado abrangidos |

Renesas Electronics Corporation., Silicon Laboratories, Zytronic PLC, Synaptics Incorporated, Infineon Technologies AG, Nissha Co., Ltd., Azoteq (PTY) Ltd, Microchip Technology Inc., entre outros |

Definição de Mercado

Um sensor de toque é definido como um sensor eletrónico utilizado para detetar e registar o toque físico. São considerados alternativas económicas em miniatura aos interruptores mecânicos tradicionais . O sensor funciona geralmente quando um contacto ou pressão é aplicado na superfície, o que permite que a corrente flua através do circuito . São de vários tipos, incluindo capacitivos, resistivos, infravermelhos e de ondas acústicas de superfície (SAW).

São utilizados em diversas aplicações, incluindo eletrónica de consumo , dispositivos médicos e automóveis, devido às suas inúmeras vantagens. Os dispositivos eletrónicos de consumo variam desde sistemas de entretenimento, como colunas, a dispositivos de comunicação, como telemóveis, até casas inteligentes e domótica.

A dinâmica de mercado do mercado de sensores tácteis do Médio Oriente e África inclui:

- Adoção crescente de ecrãs sensíveis ao toque

O mundo tem mudado constantemente de dispositivos mecânicos tradicionais para dispositivos modernos baseados no toque. Indivíduos, empresas e empresas de fabrico adotam ecrãs e interfaces baseados em toque para melhor visualização e experiência. Um dos principais motivos para a advocacia é que são interativas, envolventes e muito simples de operar. O rato e o teclado foram substituídos por uma interface de utilizador simples, altamente responsiva e que pode ser facilmente utilizada para navegação. São também altamente duráveis e resilientes, o que lhes confere uma vida útil mais longa. Assim, a rápida incorporação de dispositivos sensíveis ao toque e com ecrã táctil em setores que vão desde a restauração a empresas de manufatura e serviços financeiros é um fator que pode impulsionar o crescimento do mercado.

- Aumento da procura por eletrónicos de consumo

A tendência crescente da procura de produtos eletrónicos de consumo, alimentada pela forte procura de dispositivos com melhores características, é um fator importante que deverá impulsionar o crescimento do mercado de sensores tácteis no Médio Oriente e em África.

- Utilização crescente de sensores de toque na indústria automóvel

O controlo por toque tem sido utilizado há muitos anos, mas era limitado na sua aplicação. No entanto, à medida que vários setores da indústria mudam de sistemas mecânicos para sistemas baseados no toque, os dispositivos sensíveis ao toque têm sido uma explosão. A indústria automóvel tornou-se uma das principais utilizadoras de ecrãs tácteis e espera-se que impulsione o crescimento do mercado de sensores tácteis no Médio Oriente e em África.

- Iniciativas governamentais para a digitalização

A digitalização transformou radicalmente as nossas vidas, e o advento desta pandemia mudou tudo. Isto obrigou as economias de todo o mundo a repensar as suas estratégias e a manter o país a funcionar. Ela destacou as suas deficiências em termos de transformação. O impulso do governo no sentido da digitalização através de iniciativas e investimentos estrangeiros é um factor importante que deverá impulsionar o crescimento do mercado.

- Aumento da procura por sinalização digital interativa

Os monitores locais foram introduzidos pela primeira vez na década de 1970, quando os grandes televisores CRT eram utilizados como monitores para a gestão de conteúdos. Em 1980, era amplamente utilizado no retalho. Entretanto, em 2000, a sinalização baseada em software explodiu e tornou-se amplamente popular. Uma década depois, os ecrãs flexíveis e curvos entraram em cena e abriram caminho à interação máquina-máquina e homem-máquina, dando origem à sinalização digital interativa. O progresso tecnológico e a conectividade de alta velocidade abriram uma nova porta de possibilidades.

Restrições/Desafios enfrentados pelo mercado de sensores tácteis do Médio Oriente e África

- Procura decrescente por computadores tudo-em-um

Hoje em dia, os PC são amplamente utilizados em todas as empresas para o seu trabalho. Um computador normal vem com um CPU, monitor e outros componentes separados, enquanto que num PC All-In-One (AIO), todas as peças e componentes estão integrados no monitor. O Apple iMac é considerado um dos AIOs de maior sucesso em geral. Em geral, o AIO é muito atraente e tem um monitor touchscreen. Como mais empresas estão a fornecer portáteis aos seus funcionários para trabalharem em casa em vez de tudo num PC, espera-se que isto restrinja o crescimento do mercado.

- Escassez de fornecimento de chips

Os líderes e executivos das empresas multinacionais do Médio Oriente e de África estão preocupados com a escassez de semicondutores, que afetou o fabrico e as vendas em vários países. Nenhuma solução imediata está à vista. Isto representa um desafio significativo para o crescimento do mercado.

Este relatório de mercado de sensores tácteis do Médio Oriente e África fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsos emergentes receitas, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado da categoria, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas , inovações tecnológicas no mercado. Para mais informações sobre o mercado de sensores tácteis, contacte a Data Bridge Market Research para obter um briefing de analista. A nossa equipa irá ajudá-lo a tomar uma decisão de mercado informada para alcançar o crescimento do mercado.

Desenvolvimento recente

- Em dezembro de 2021, a Infineon Technologies AG lançou a tecnologia de interface homem-máquina (HMI) de deteção de toque capacitiva e indutiva CAPSENSE de quinta geração. A solução CAPSENSE de última geração incorporada em microcontroladores PSoC oferece um elevado desempenho e baixo consumo de energia para interfaces de utilizador exigentes em eletrodomésticos, produtos de consumo, industriais e IoT. O novo produto aumentou a oferta de produtos da empresa

Âmbito do mercado de sensores tácteis no Médio Oriente e África

O mercado de sensores tácteis do Médio Oriente e África está segmentado com base no tipo, flexibilidade, canal e aplicação. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de crescimento escassos nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo

- Resistivo

- Capacitivo

- Onda Acústica de Superfície (SAW)

- Infravermelho

- Óptico

Com base no tipo, o mercado de sensores tácteis do Médio Oriente e África está segmentado em resistivo, capacitivo, onda acústica de superfície (saw), infravermelho e ótico.

Flexibilidade

- Convencional

- Flexível

- Outros

Com base na flexibilidade, o mercado de sensores tácteis do Médio Oriente e África está segmentado em convencionais, flexíveis e outros.

Canal

- Canal único

- Multicanal

Com base no canal, o mercado de sensores tácteis do Médio Oriente e África está segmentado em canal único e multicanal.

Aplicação

- Eletrónicos de consumo

- Eletrodomésticos

- Dispositivos médicos

- Caixas automáticas (ATM)

- Sistemas Biométricos

- Automotivo

- Outros

Com base na aplicação, o mercado de sensores tácteis do Médio Oriente e África foi segmentado em eletrónica de consumo, eletrodomésticos, dispositivos médicos, caixas multibanco (ATM), sistemas biométricos, automóveis e outros.

Análise/Insights regionais do mercado de sensores tácteis no Médio Oriente e África

O mercado de sensores tácteis do Médio Oriente e África é analisado, e são fornecidos insights e tendências sobre o tamanho do mercado por país, tipo, flexibilidade, canal e aplicação, conforme referenciado acima.

Alguns dos países abrangidos pelo relatório de mercado de sensores tácteis do Médio Oriente e África são a Arábia Saudita, os Emirados Árabes Unidos, a África do Sul, Israel, o Egito e o resto do Médio Oriente e África.

Saudi Arabia is expected to dominate the Middle East and Africa touch sensor market due to increasing growth in the semiconductor industry in the region. Global digitalization trends have led many companies to increase their footprint in the region to meet the demands. This is leading the growth in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the Middle East and African brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Touch Sensor Market Share Analysis

The Middle East and Africa touch sensor market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the Middle East and Africa touch sensor market.

Some of the major players operating in the Middle East and Africa touch sensor market are Renesas Electronics Corporation., Silicon Laboratories, Zytronic PLC, Synaptics Incorporated, Infineon Technologies AG, Nissha Co., Ltd., Azoteq (PTY) Ltd, Microchip Technology Inc., among others.

Research Methodology: Middle East and Africa Touch Sensor Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or can drop down your inquiry.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados, que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Além disso, os modelos de dados incluem a Grelha de Posicionamento de Fornecedores, Análise da Linha do Tempo de Mercado, Visão Geral e Guia de Mercado, Análise de Especialistas, Análise de Importação/Exportação, Análise de Preços, Análise de Consumo de Produção, Cenário da Cadeia Climática, Grelha de Posicionamento da Empresa, Análise da Quota de Mercado da Empresa, Padrões de Medição, Análise Global versus Regional e de Participação dos Fornecedores. Para saber mais sobre a metodologia do inquérito, envie um pedido para falar com os nossos especialistas do setor.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA TOUCH SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 PREMIUM INSIGHTS

5.1 TOUCH SENSOR PRICING ANALYSIS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING ADOPTION OF TOUCH-BASED DISPLAYS

6.1.2 RISING DEMAND FOR CONSUMER ELECTRONICS

6.1.3 INCREASING USE OF TOUCH SCREENS IN THE AUTOMOTIVE INDUSTRY

6.1.4 GOVERNMENT INITIATIVES FOR DIGITALIZATION

6.1.5 RISING DEMAND FOR INTERACTIVE DIGITAL SIGNAGE

6.2 RESTRAINTS

6.2.1 DECLINING DEMAND FOR ALL-IN-ONE PC

6.2.2 SHORTAGE OF SKILLED LABOUR

6.2.3 SHORT SUPPLY OF INDIUM

6.3 OPPORTUNITIES

6.3.1 SURGE IN INDUSTRIAL APPLICATIONS OF TOUCH-BASED PANELS AND EQUIPMENT

6.3.2 DEVELOPMENTS IN MULTI-TOUCH TECHNOLOGY

6.3.3 RISE IN INVESTMENTS FOR R&D OF TOUCH SENSORS

6.4 CHALLENGES

6.4.1 CHIP SUPPLY SHORTAGE

6.4.2 ACCIDENTAL TOUCHES DUE TO HIGH SENSITIVITY

7 COVID-19 IMPACT ON THE MIDDLE EAST & AFRICA TOUCH SENSOR MARKET

7.1 ANALYSIS OF IMPACT OF COVID-19 ON THE MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON PRICE

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY TYPE

8.1 OVERVIEW

8.2 RESISTIVE

8.2.1 5 –WIRE

8.2.2 8 –WIRE

8.2.3 4 –WIRE

8.3 CAPACITIVE

8.3.1 BY TECHNOLOGY

8.3.1.1 PROJECTED CAPACITANCE

8.3.1.2 SURFACE CAPACITANCE

8.3.2 BY SURFACE TYPE

8.3.2.1 GLASS

8.3.2.2 NON-GLASS

8.3.2.2.1 PLASTIC/POLYMER

8.3.2.2.1.1 PET & PETG

8.3.2.2.1.2 POLYCARBONATES

8.3.2.2.1.3 PMMA

8.3.2.2.1.4 OTHERS

8.3.2.2.2 SAPPHIRE

8.4 SURFACE ACOUSTIC WAVE (SAW)

8.5 INFRARED

8.6 OPTICAL

9 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY FLEXIBILITY

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 FLEXIBLE

9.4 OTHERS

10 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY CHANNEL

10.1 OVERVIEW

10.2 MULTI-CHANNEL

10.3 SINGLE CHANNEL

11 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.2.1 LAPTOPS

11.2.2 MONITORS

11.2.3 WEARABLE

11.2.4 ALL-IN-ONE (AIO) PCS

11.2.5 OTHERS

11.3 HOME APPLIANCES

11.3.1 WASHING MACHINES

11.3.2 OVEN

11.3.3 REFRIGERATOR

11.3.4 OTHERS

11.4 MEDICAL DEVICES

11.5 BIOMETRIC SYSTEMS

11.6 AUTOMOTIVE

11.7 AUTOMATED TELLER MACHINES (ATM)

11.8 OTHERS

12 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 SAUDI ARABIA

12.1.2 U.A.E.

12.1.3 SOUTH AFRICA

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MICROCHIP TECHNOLOGY INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 INFINEON TECHNOLOGIES AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 JAPAN DISPLAY INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 TEXAS INSTRUMENTS INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 NISSHA CO. LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 RENESAS ELECTRONICS CORPORATION

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 APEX MATERIAL TECHNOLOGY CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 AZOTEQ (PTY) LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CAPTRON

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 CIRQUE CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 DMC CO., LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 ELO TOUCH SOLUTIONS INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FUTABA CORPORATION

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 NEONODE INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 SCHURTER

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 SEMTECH CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 SILICON LABORATORIES

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 SYNAPTICS INCORPORATED

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 TSITOUCH

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 XYMOX TECHNOLOGIES, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 ZYTRONIC PLC

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA RESISTIVE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA SURFACE ACOUSTIC WAVE (SAW) IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA INFRARED IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA OPTICAL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CONVENTIONAL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA FLEXIBLE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA MULTI-CHANNEL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA SINGLE CHANNEL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN TOUCH SENSOR, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA HOME APPLIANCES IN TOUCH SENSOR, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA MEDICAL DEVICES IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA BIOMETRIC SYSTEMS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA AUTOMOTIVE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA AUTOMATED TELLER MACHINES (ATM) IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 SAUDI ARABIA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 SAUDI ARABIA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 SAUDI ARABIA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 44 SAUDI ARABIA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 45 SAUDI ARABIA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 SAUDI ARABIA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 SAUDI ARABIA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 48 SAUDI ARABIA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 49 SAUDI ARABIA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.A.E. TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.A.E. RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.A.E. CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 55 U.A.E. CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.A.E. NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.A.E. PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.A.E. TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 59 U.A.E. TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 U.A.E. TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 U.A.E. CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 SOUTH AFRICA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 66 SOUTH AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH AFRICA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 70 SOUTH AFRICA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 ISRAEL TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ISRAEL RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 ISRAEL CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 ISRAEL CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 78 ISRAEL NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 ISRAEL PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 ISRAEL TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 81 ISRAEL TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 ISRAEL TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 ISRAEL CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 ISRAEL HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 EGYPT TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 EGYPT RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 EGYPT CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 EGYPT CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 EGYPT PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 EGYPT TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 92 EGYPT TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 EGYPT TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 EGYPT CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 EGYPT HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 REST OF MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: SEGMENTATION

FIGURE 12 GROWING INTEGRATION OF SENSORS IN TOUCH-ENABLED DEVICES IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA TOUCH SENSOR MARKET IN THE FORECAST PERIOD

FIGURE 13 RESISTIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA TOUCH SENSOR MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN MIDDLE EAST & AFRICA TOUCH SENSOR MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA TOUCH SENSOR MARKET

FIGURE 16 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY FLEXIBILITY, 2021

FIGURE 18 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY CHANNEL, 2021

FIGURE 19 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY APPLICATION, 2021

FIGURE 20 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: SNAPSHOT (2021)

FIGURE 21 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY TYPE (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.