Middle East And Africa Surgical Instrument Tracking Systems Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

6.95 Million

USD

17.20 Million

2025

2033

USD

6.95 Million

USD

17.20 Million

2025

2033

| 2026 –2033 | |

| USD 6.95 Million | |

| USD 17.20 Million | |

|

|

|

|

Mercado de sistemas de rastreio de instrumentos cirúrgicos do Médio Oriente e África, por tipo (sites profissionais, vários sites), componente (hardware, software, serviços), tecnologia (rastreio de códigos de barras, identificação por radiofrequência (RFID), rastreio eletrónico , outros), utilizador final ( Hospitais, Centros Cirúrgicos Ambulatório, Centros de Investigação, Clínicas, Outros), Canal de Distribuição (Concurso Directo, Distribuidor Terceirizado), País (Arábia Saudita, África do Sul, Emirados Árabes Unidos, Kuwait e Resto do Médio Oriente e África) Tendências e Previsão da Indústria até 2028

Análise de mercado e insights: Mercado de sistemas de rastreio de instrumentos cirúrgicos do Médio Oriente e África

Análise de mercado e insights: Mercado de sistemas de rastreio de instrumentos cirúrgicos do Médio Oriente e África

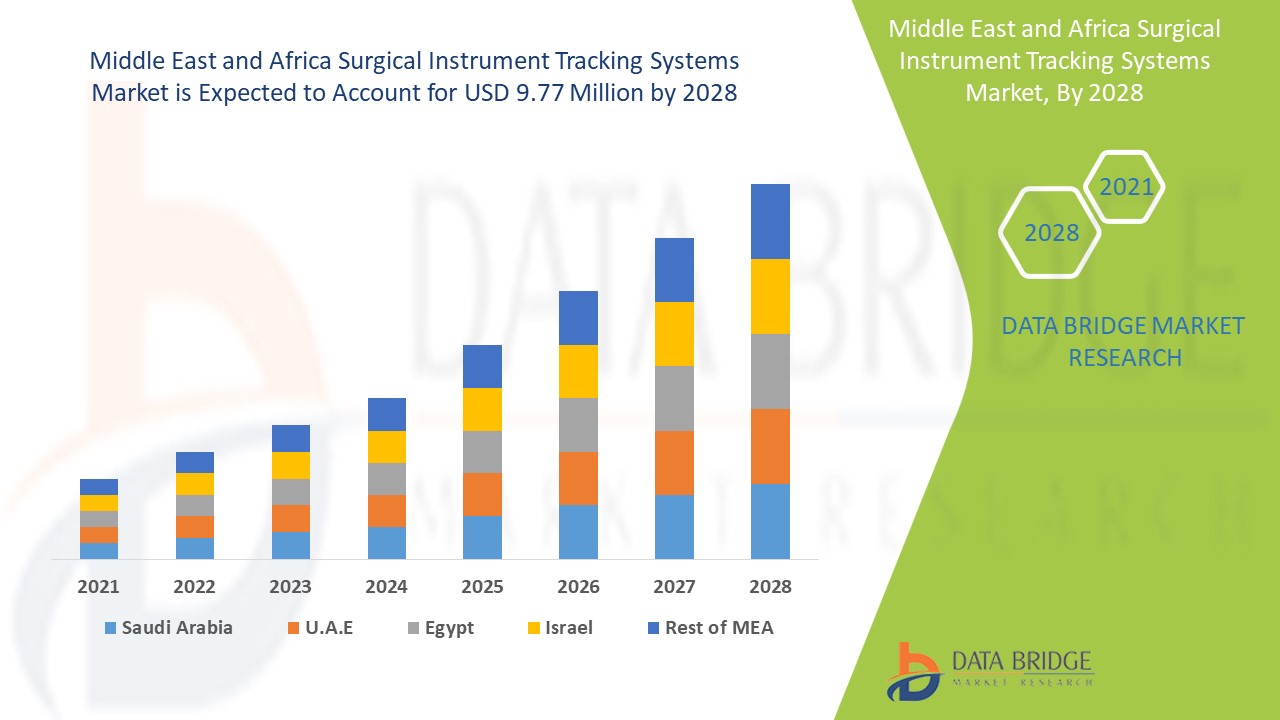

Espera-se que o mercado de sistemas de rastreio de instrumentos cirúrgicos ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 12,0% no período previsto de 2021 a 2028 e prevê-se que atinja os 9,77 milhões de dólares até 2028. O número crescente de processos cirúrgicos em todo o mundo está a atuar como um impulsionador do mercado de sistemas de rastreio de instrumentos cirúrgicos.

Os sistemas de rastreio de instrumentos cirúrgicos são sistemas que combinam tecnologia de digitalização e software de aplicação. É um sistema útil para auxiliar os profissionais de saúde a obter acesso a instrumentos que poupam tempo e resultam em processos seguros e eficientes. Os sistemas de rastreio de instrumentos cirúrgicos ajudam a fornecer informações sobre os processos da organização para aumentar a eficácia dos colaboradores.

O estabelecimento do sistema de identificação única de dispositivos (UDI) pela FDA está a aumentar a procura do mercado de sistemas de rastreio de instrumentos cirúrgicos. O elevado custo do sistema de rastreio completo está a funcionar como uma restrição para o mercado de sistemas de rastreio de instrumentos cirúrgicos. As iniciativas estratégicas dos participantes do mercado aumentarão ainda mais as oportunidades de crescimento para o mercado de sistemas de rastreio de instrumentos cirúrgicos. Os problemas relacionados com a integração com outros sistemas representam um desafio para os prestadores de cuidados de saúde, o que pode desafiar o mercado dos sistemas de rastreio de instrumentos cirúrgicos.

O relatório de mercado de sistemas de rastreio de instrumentos cirúrgicos fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, produtos lançamentos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para um briefing analítico.

Âmbito e dimensão do mercado de sistemas de rastreio de instrumentos cirúrgicos

Âmbito e dimensão do mercado de sistemas de rastreio de instrumentos cirúrgicos

O mercado dos sistemas de rastreio de instrumentos cirúrgicos está segmentado com base no tipo, componente, tecnologia, utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no tipo, o mercado de sistemas de rastreio de instrumentos cirúrgicos está segmentado em sites profissionais e multisites. Em 2021, espera-se que o segmento de vários locais domine o mercado dos sistemas de rastreio de instrumentos cirúrgicos, uma vez que estes sistemas cobrem a maioria dos hospitais e entregam todos os instrumentos necessários a tempo, aumentando a segurança do paciente.

- Com base no componente, o mercado de sistemas de rastreio de instrumentos cirúrgicos está segmentado em hardware, software e serviços. Em 2021, prevê-se que o segmento de software domine o mercado dos sistemas de rastreio de instrumentos cirúrgicos devido ao contínuo avanço tecnológico.

- Com base na tecnologia, o mercado dos sistemas de rastreamento de instrumentos cirúrgicos está segmentado em rastreamento por código de barras, identificação por radiofrequência (RFID) , rastreamento eletrónico e outros. Em 2021, prevê-se que o segmento de identificação por radiofrequência (RFID) domine o mercado dos sistemas de rastreio de instrumentos cirúrgicos, uma vez que oferece maior memória e maior alcance de deteção, além de poder detetar instrumentos cirúrgicos de tamanho muito reduzido.

- Com base no utilizador final, o mercado dos sistemas de rastreio de instrumentos cirúrgicos está segmentado em hospitais, centros de cirurgia ambulatória , centros de investigação, clínicas e outros. Em 2021, prevê-se que o segmento hospitalar domine o mercado dos sistemas de rastreio de instrumentos cirúrgicos porque os hospitais têm uma maior taxa de adoção do instrumento de rastreio cirúrgico durante o ciclo de trabalho, incluindo procedimentos cirúrgicos, pós-cirúrgicos, de armazenamento e esterilização, entre outros.

- Com base no canal de distribuição, o mercado de sistemas de rastreamento de instrumentos cirúrgicos está segmentado em licitação direta e distribuidor terceirizado. Em 2021, prevê-se que o segmento de licitação direta domine o mercado dos sistemas de rastreio de instrumentos cirúrgicos, uma vez que o software utilizado para o rastreio de instrumentos cirúrgicos está a ser instalado em grande escala nos hospitais, o que exige um esquema com uma boa relação custo-benefício.

Análise ao nível do país do mercado de sistemas de rastreio de instrumentos cirúrgicos

O mercado de sistemas de rastreio de instrumentos cirúrgicos é analisado e são fornecidas informações sobre o tamanho do mercado por país, tipo, componente, tecnologia, utilizador final e canal de distribuição, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado Sistemas de rastreio de instrumentos cirúrgicos do Médio Oriente e África são a Arábia Saudita, África do Sul, Emirados Árabes Unidos, Kuwait e Resto do Médio Oriente e África.

Espera-se que o segmento RFID na região do Médio Oriente e África cresça com a maior taxa de crescimento no período previsto de 2020 a 2027 porque oferece maior memória e maior alcance de deteção. Além disso, a tecnologia RFID pode detetar instrumentos cirúrgicos muito pequenos, que são mais caros. A Arábia Saudita está a liderar o crescimento do mercado do Médio Oriente e de África, e o segmento RFID está a dominar o país devido ao aumento dos gastos com a saúde e à crescente consciencialização sobre a nova tecnologia, o que poupará tempo e dinheiro aos profissionais de saúde .

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas do Médio Oriente e de África e os desafios enfrentados devido à grande ou escassa concorrência das marcas locais e nacionais, bem como o impacto dos canais de venda, são considerados quando se fornece uma análise de previsão dos dados do país.

A crescente adoção de TI de saúde nos hospitais está a impulsionar o crescimento do mercado de sistemas de rastreio de instrumentos cirúrgicos

O mercado de sistemas de rastreio de instrumentos cirúrgicos também fornece uma análise detalhada do mercado para cada crescimento do país na indústria de sistemas de rastreio de instrumentos cirúrgicos com vendas de medicamentos para sistemas de rastreio de instrumentos cirúrgicos, impacto do avanço na tecnologia de sistemas de rastreio de instrumentos cirúrgicos e mudanças nos cenários regulamentares com o seu suporte para o mercado de sistemas de rastreio de instrumentos cirúrgicos. Os dados estão disponíveis para o período histórico de 2011 a 2019.

Análise do cenário competitivo e da quota de mercado dos sistemas de rastreio de instrumentos cirúrgicos

O panorama competitivo do mercado de sistemas de rastreio de instrumentos cirúrgicos fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, largura e amplitude do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado global de sistemas de rastreio de instrumentos cirúrgicos.

As principais empresas que operam em sistemas de rastreio de instrumentos cirúrgicos são a BD, STERIS, Getinge AB, Scanlan International, ASANUS Medizintechnik GmbH, B. Braun Melsungen AG, entre outros participantes nacionais e globais. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos lançamentos de produtos e acordos são também iniciados por empresas de todo o mundo, o que está também a acelerar o mercado dos sistemas de rastreio de instrumentos cirúrgicos.

Por exemplo,

- Em dezembro de 2020, a Censis Technologies, Inc. (uma subsidiária da Fortive) assinou um acordo de parceria com a Cantel Medical Corp para o desenvolvimento e fabrico de um fluxo de trabalho de reprocessamento de endoscópios para prevenção de infeções, equipado com soluções de gestão de ativos cirúrgicos e rastreamento de instrumentos. Esta parceria ajudou a empresa a expandir a sua presença no mercado dos sistemas de rastreio de instrumentos cirúrgicos.

A colaboração, o lançamento de produtos, a expansão de negócios, prémios e reconhecimentos, joint ventures e outras estratégias dos participantes do mercado estão a aumentar o mercado da empresa no mercado de sistemas de rastreio de instrumentos cirúrgicos, o que também traz o benefício para a organização melhorar a sua oferta de sistemas de rastreio de instrumentos cirúrgicos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.