Middle East And Africa Skin Packaging For Fresh Meat Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

51.82 Million

USD

68.77 Million

2025

2033

USD

51.82 Million

USD

68.77 Million

2025

2033

| 2026 –2033 | |

| USD 51.82 Million | |

| USD 68.77 Million | |

|

|

|

|

Segmentação do mercado de embalagens a vácuo para carne fresca no Oriente Médio e África, por tipo (embalagens a vácuo termoformáveis com e sem cartão), material (plástico, papel e cartão, e outros), revestimento de selagem térmica (à base de água, à base de solvente e outros), enchimento com ar (a vácuo e sem vácuo), função (conservar e proteger, adequado ao fim a que se destina, rotulagem regulamentar, apresentação e outros), natureza (micro-ondas e não micro-ondas), uso final (carnes, aves e frutos do mar) - Tendências e previsões do setor até 2033.

Embalagem a vácuo para carne fresca no Oriente Médio e África - Tamanho ideal para o mercado.

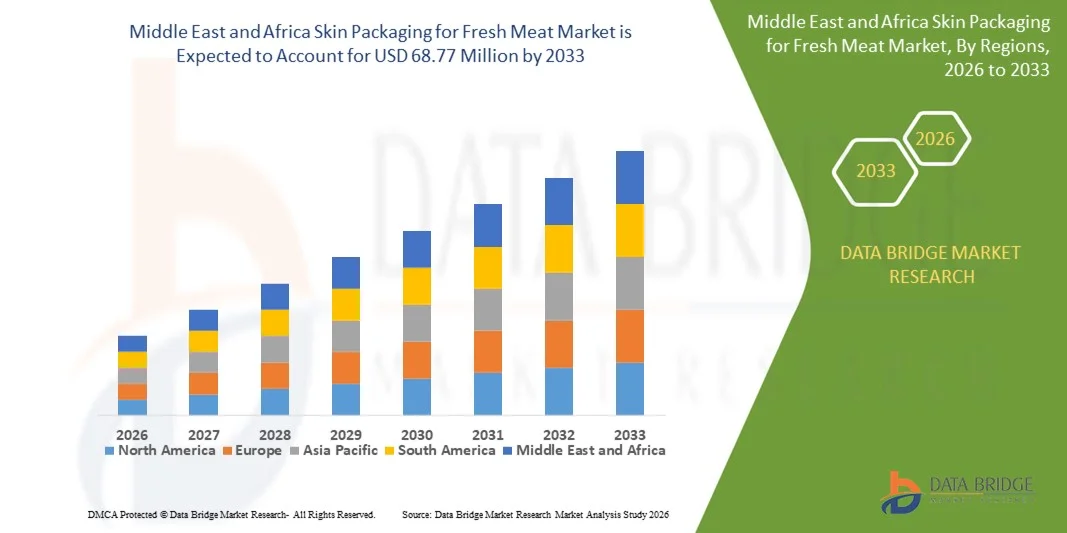

- O mercado de embalagens a vácuo para carne fresca no Oriente Médio e na África foi avaliado em US$ 51,82 milhões em 2025 e deverá atingir US$ 68,77 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 3,60% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por maior prazo de validade e melhor visibilidade do produto em embalagens de carne fresca, visto que a embalagem a vácuo ajuda a preservar o frescor e, ao mesmo tempo, aumenta o apelo visual nas prateleiras.

- O aumento do consumo de carnes frescas e de alta qualidade, juntamente com a crescente preferência por embalagens à prova de vazamentos e seladas a vácuo, está impulsionando a expansão constante do mercado.

Análise de mercado de embalagens a vácuo para carne fresca no Oriente Médio e na África

- O mercado tem apresentado crescimento consistente devido à capacidade da embalagem a vácuo de se ajustar perfeitamente aos produtos cárneos, reduzindo a exposição ao oxigênio e mantendo a qualidade do produto por períodos mais longos.

- As embalagens a vácuo são cada vez mais preferidas em relação aos formatos de embalagem convencionais, pois melhoram a higiene, minimizam o desperdício de líquidos e aumentam a confiança do consumidor na segurança e no frescor do produto.

- A Arábia Saudita dominou o mercado de embalagens a vácuo para carne fresca em 2025, impulsionada pelo alto consumo per capita de carne e pela forte demanda por soluções de embalagem higiênicas e duradouras.

- A África do Sul deverá apresentar a maior taxa de crescimento anual composta (CAGR) no mercado de embalagens a vácuo para carne fresca no Oriente Médio e na África, devido à crescente demanda por produtos cárneos frescos e processados, ao rápido crescimento do varejo organizado, à crescente adoção de tecnologias avançadas de embalagem e às melhorias nas redes de armazenamento refrigerado e distribuição.

- O segmento de embalagens termoformáveis sem cartão detinha a maior participação de mercado em receita em 2025, impulsionado por seu amplo uso em embalagens de carne fresca, custo-benefício e forte compatibilidade com linhas de embalagem automatizadas. Esse tipo de embalagem permite uma adesão firme do filme ao redor dos cortes de carne, melhorando a conservação do frescor e reduzindo o desperdício. É amplamente adotado por grandes processadores de carne e varejistas devido à sua escalabilidade e desempenho de selagem consistente. Além disso, os formatos sem cartão suportam a produção em alto volume, mantendo a visibilidade e a higiene do produto.

Escopo do relatório e segmentação do mercado de embalagens a vácuo para carne fresca no Oriente Médio e África.

|

Atributos |

No Oriente Médio e na África, as principais informações sobre embalagens a vácuo para carne fresca. |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de embalagens a vácuo para carne fresca no Oriente Médio e na África

Crescente demanda por maior prazo de validade e apresentação de produtos premium.

- A crescente preocupação em manter o frescor e o apelo visual de produtos cárneos frescos está moldando significativamente o mercado de embalagens a vácuo para carnes frescas, visto que varejistas e consumidores preferem soluções de embalagem que preservem a qualidade e, ao mesmo tempo, realcem a aparência do produto. As embalagens a vácuo estão ganhando forte aceitação devido à sua capacidade de selar hermeticamente os produtos cárneos, reduzir a exposição ao oxigênio e prolongar a vida útil sem o uso de conservantes. Essa tendência está fortalecendo seu uso nos canais de varejo e food service, incentivando os fabricantes de embalagens a desenvolver filmes e tecnologias de selagem avançadas.

- O crescente consumo de carnes frescas, refrigeradas e de alta qualidade está impulsionando a demanda por embalagens a vácuo em supermercados e açougues especializados. Os consumidores estão cada vez mais atraídos por embalagens herméticas e seladas a vácuo que oferecem visibilidade clara dos cortes de carne, garantindo higiene e segurança. Isso levou os processadores de carne a adotarem embalagens a vácuo para atender às expectativas em constante evolução dos consumidores e reduzir as perdas relacionadas à deterioração.

- As tendências de premiumização na indústria de carnes estão influenciando as decisões de compra, com as marcas enfatizando qualidade, frescor e apelo estético. As embalagens a vácuo apoiam esses objetivos, melhorando a diferenciação nas prateleiras e possibilitando oportunidades de branding por meio de filmes transparentes e designs de bandejas atraentes. Esses fatores estão ajudando os fabricantes a fortalecer o posicionamento da marca, aumentar a confiança do consumidor e melhorar as taxas de recompra em ambientes de varejo competitivos.

- Por exemplo, em 2024, as principais processadoras de carne e redes varejistas em mercados desenvolvidos expandiram o uso de embalagens a vácuo para carne bovina, de aves e suína frescas, visando melhorar a apresentação nas prateleiras e reduzir o desperdício de alimentos. Essas melhorias nas embalagens foram introduzidas em resposta à crescente demanda por carne fresca de alta qualidade, com produtos distribuídos por meio de grandes varejistas e lojas especializadas. As embalagens aprimoradas também reforçaram a mensagem de sustentabilidade, reduzindo a deterioração e as taxas de devolução dos produtos.

- Embora a adoção de embalagens a vácuo para carne fresca continue a crescer, o desenvolvimento sustentado do mercado depende da otimização de custos, da inovação em materiais e da compatibilidade com as linhas de processamento existentes. Os fabricantes de embalagens estão focados no desenvolvimento de filmes recicláveis e mais finos, na melhoria da eficiência da selagem e na garantia de desempenho consistente para apoiar uma adoção mais ampla em processadores de carne de pequeno e grande porte.

Dinâmica do mercado de embalagens a vácuo para carne fresca no Oriente Médio e na África

Motorista

Crescente demanda por embalagens que preservem o frescor e sejam à prova de vazamentos.

- A crescente demanda por soluções de embalagem que prolonguem a vida útil e mantenham a qualidade da carne é um dos principais impulsionadores do mercado de embalagens a vácuo para carnes frescas. Essas embalagens minimizam o contato com o ar e mantêm os produtos firmemente no lugar, reduzindo o crescimento microbiano e a perda de líquidos. Isso ajuda os processadores e varejistas de carne a atenderem aos padrões de segurança alimentar, ao mesmo tempo que melhora a durabilidade do produto durante o armazenamento e o transporte.

- A expansão da distribuição de carne fresca no varejo, por meio de supermercados e hipermercados, está impulsionando o crescimento do mercado, visto que esses canais exigem embalagens que aumentem a visibilidade do produto e reduzam as perdas no manuseio. As embalagens a vácuo permitem que os varejistas exibam a carne fresca por períodos mais longos sem comprometer a aparência, favorecendo a gestão eficiente do estoque e a redução do desperdício.

- As empresas de processamento de carne e embalagens estão promovendo ativamente a carne fresca embalada a vácuo por meio da inovação de produtos, designs de bandejas aprimorados e compatibilidade com linhas de embalagem automatizadas. Esses esforços são apoiados pela demanda dos varejistas por embalagens de alto desempenho e pela crescente preferência do consumidor por formatos higiênicos e invioláveis, incentivando a colaboração entre fornecedores de embalagens e processadores de carne.

- Por exemplo, em 2023, os principais fornecedores de soluções de embalagem fizeram parceria com processadores de carne fresca para introduzir filmes de embalagem a vácuo de alta barreira para produtos de carne bovina e de aves. Essas soluções ajudaram a melhorar a vida útil e o apelo visual, resultando em maior conversão de vendas e redução de devoluções de produtos para os varejistas. Benefícios de sustentabilidade, como menor desperdício de alimentos, também foram destacados para fortalecer a adoção.

- Embora a forte demanda por embalagens que preservam o frescor impulsione o crescimento do mercado, a expansão contínua depende do equilíbrio entre desempenho e custo-benefício. Investimentos em materiais avançados, produção escalável e integração com equipamentos de embalagem de alta velocidade serão essenciais para manter a competitividade e atender à crescente demanda global.

Restrição/Desafio

Aumento dos custos de embalagem e preocupações com a sustentabilidade dos materiais

- O custo relativamente mais elevado dos sistemas de embalagem a vácuo e dos filmes especiais, em comparação com as embalagens convencionais em bandejas e com filme plástico, continua sendo um desafio fundamental para o crescimento do mercado. Materiais avançados, equipamentos de vácuo e tecnologias de selagem contribuem para o aumento dos custos iniciais e operacionais, o que pode limitar a adoção por processadores de carne de pequeno e médio porte.

- As preocupações com a sustentabilidade relacionadas ao uso e à reciclabilidade do plástico também representam desafios, visto que as embalagens a vácuo geralmente dependem de filmes multicamadas de difícil reciclagem. O crescente escrutínio regulatório e a pressão dos consumidores por soluções de embalagens ecologicamente corretas estão levando os fabricantes a repensarem suas escolhas de materiais, o que aumenta a complexidade do desenvolvimento de produtos.

- Os desafios operacionais e técnicos impactam ainda mais a adoção, uma vez que a embalagem a vácuo exige controle preciso de temperatura, compatibilidade do filme e manuseio especializado para garantir selagem consistente e qualidade do produto. Qualquer desvio pode resultar em falha na selagem, redução da vida útil ou rejeição do produto, aumentando o risco operacional para os processadores.

- Por exemplo, em 2024, vários pequenos processadores de carne relataram uma adoção mais lenta de embalagens a vácuo devido aos altos custos dos equipamentos e ao acesso limitado a opções de filmes recicláveis. Preocupações com a conformidade com as novas regulamentações de sustentabilidade e a necessidade de conhecimento técnico também afetaram as decisões de investimento, principalmente entre os operadores sensíveis a custos.

- Para enfrentar esses desafios, será necessário inovar em filmes recicláveis e monomateriais, maquinário com boa relação custo-benefício e suporte técnico para os processadores. A colaboração entre fabricantes de embalagens, processadores de carne e fornecedores de materiais será fundamental para reduzir custos, melhorar a sustentabilidade e desbloquear o potencial de crescimento a longo prazo do mercado de embalagens a vácuo para carne fresca.

Embalagem a vácuo para carne fresca no Oriente Médio e África. Escopo do mercado.

O mercado é segmentado com base no tipo, material, revestimento de selagem térmica, enchimento de ar, função, natureza e uso final.

- Por tipo

Com base no tipo, o mercado de embalagens a vácuo para carne fresca no Oriente Médio e na África é segmentado em Embalagens a Vácuo Termoformáveis com Cartão e Embalagens a Vácuo Termoformáveis sem Cartão. O segmento de embalagens a vácuo termoformáveis sem cartão detinha a maior participação na receita de mercado em 2025, impulsionado por seu uso extensivo em embalagens de carne fresca, custo-benefício e forte compatibilidade com linhas de embalagem automatizadas. Esse tipo permite uma adesão firme do filme ao redor dos cortes de carne, melhorando a retenção do frescor e reduzindo o desperdício. É amplamente adotado por grandes processadores de carne e varejistas devido à sua escalabilidade e desempenho de selagem consistente. Além disso, os formatos sem cartão suportam a produção em alto volume, mantendo a visibilidade e a higiene do produto.

O segmento de embalagens termoformáveis a vácuo em cartões deverá apresentar um crescimento constante de 2026 a 2033, impulsionado pela crescente demanda por produtos cárneos frescos premium e de marca. Esse formato oferece uma apresentação aprimorada e espaço adicional para informações de marca e regulamentação. Seu uso tem aumentado no varejo especializado e em ofertas de carnes com valor agregado, onde a diferenciação visual é importante. O foco crescente na premiumização e na narrativa do produto também contribui para a adoção de formatos em cartões.

- Por material

Com base no material, o mercado de embalagens a vácuo para carne fresca no Oriente Médio e na África é segmentado em plástico, papel e cartão, e outros. O segmento de plástico representou a maior participação em 2025 devido às suas excelentes propriedades de barreira, flexibilidade e durabilidade. Os materiais plásticos oferecem fortes barreiras contra oxigênio e umidade, que são essenciais para prolongar a vida útil dos produtos de carne fresca. Sua transparência também aumenta a visibilidade do produto, auxiliando nas decisões de compra do consumidor. Além disso, os materiais plásticos são compatíveis com sistemas de embalagem a vácuo e linhas de processamento de alta velocidade.

O segmento de papel e cartão deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente ênfase em soluções de embalagens sustentáveis e recicláveis. Os fabricantes estão desenvolvendo bandejas de papel com revestimentos de barreira para reduzir o uso de plástico, mantendo o desempenho funcional. A crescente pressão regulatória e a preferência do consumidor por embalagens ecológicas estão incentivando ainda mais a inovação nesse segmento. Esses materiais estão ganhando espaço, principalmente em canais de varejo premium e focados em sustentabilidade.

- Por revestimento de selagem térmica

Com base no revestimento de selagem térmica, o mercado de embalagens a vácuo para carne fresca no Oriente Médio e na África é segmentado em revestimentos à base de água, à base de solvente e outros. O segmento de revestimentos de selagem térmica à base de água dominou o mercado em 2025 devido ao seu baixo impacto ambiental e adequação para aplicações em contato com alimentos. Esses revestimentos oferecem desempenho de selagem eficaz, ao mesmo tempo que atendem às metas de sustentabilidade e conformidade regulatória. Eles são amplamente preferidos pelos fabricantes de embalagens que buscam reduzir as emissões de COVs (Compostos Orgânicos Voláteis). Além disso, os revestimentos à base de água proporcionam boa adesão em diversos substratos de embalagem.

O segmento de revestimentos à base de solventes deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela sua forte adesão e desempenho em aplicações de alta barreira. No entanto, sua adoção é cada vez mais influenciada por regulamentações ambientais e preocupações com a sustentabilidade. Os fabricantes estão utilizando revestimentos à base de solventes seletivamente em aplicações que exigem maior resistência de vedação. A inovação contínua está focada na redução do impacto ambiental, mantendo o desempenho.

- Por enchimento de ar

Com base no enchimento com ar, o mercado de embalagens a vácuo para carne fresca no Oriente Médio e na África é segmentado em enchimento a vácuo e enchimento sem vácuo. O segmento de enchimento a vácuo detinha a maior participação de mercado em 2025, impulsionado por sua eficácia na remoção de oxigênio e no prolongamento da vida útil de produtos cárneos frescos. A embalagem a vácuo ajuda a inibir o crescimento microbiano e a reduzir a perda de líquidos, melhorando a qualidade geral do produto. Esse formato é amplamente utilizado nos canais de varejo e food service para garantir o frescor durante a distribuição e o armazenamento. Também contribui para a redução do desperdício de alimentos e para uma melhor gestão de estoque.

O segmento de envase sem vácuo deverá apresentar o crescimento mais rápido entre 2026 e 2033, principalmente em aplicações com requisitos de prazo de validade mais curtos. Esse segmento se beneficia de custos menores de embalagem e equipamentos, tornando-o adequado para processadores de menor porte. É comumente utilizado em canais de distribuição locais e regionais, onde se espera uma alta rotatividade de produtos. A facilidade de processamento e a relação custo-benefício continuam a impulsionar sua adoção.

- Por função

Com base na função, o mercado de embalagens a vácuo para carne fresca no Oriente Médio e na África é segmentado em Conservação e Proteção, Adequação ao Uso, Rotulagem Regulatória, Apresentação e Outros. O segmento de conservação e proteção representou a maior participação em 2025, visto que manter o frescor e a segurança é o principal objetivo das embalagens para carne fresca. As embalagens a vácuo oferecem forte proteção contra contaminação, danos físicos e perda de umidade. Essa função é crucial para atender aos padrões de segurança alimentar e prolongar a vida útil do produto. Ela também contribui para uma gestão eficiente da cadeia de frio.

Espera-se que o segmento de apresentação apresente o crescimento mais rápido de 2026 a 2033, impulsionado pela crescente ênfase no apelo visual e no posicionamento premium. A embalagem a vácuo aprimora a estética do produto, exibindo claramente os cortes de carne e reduzindo a poluição visual da embalagem. Essa função contribui para a diferenciação da marca e melhora a visibilidade nas prateleiras em ambientes de varejo competitivos. A crescente preferência do consumidor por produtos de carne fresca visualmente atraentes impulsiona ainda mais esse segmento.

- Por natureza

Com base na natureza, o mercado de embalagens a vácuo para carne fresca no Oriente Médio e na África é segmentado em embalagens próprias para micro-ondas e embalagens que não são próprias para micro-ondas. O segmento de embalagens que não são próprias para micro-ondas dominou o mercado em 2025, visto que a maioria dos produtos de carne fresca destina-se ao cozimento após a remoção da embalagem. Este segmento se beneficia de estruturas de materiais mais simples e custos de produção mais baixos. É amplamente adotado nos formatos tradicionais de varejo de carne fresca. A forte demanda por produtos de carne crua e minimamente processados continua a sustentar este segmento.

O segmento de produtos para micro-ondas deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente demanda por produtos cárneos práticos e prontos para o preparo. A urbanização e as mudanças nos estilos de vida estão incentivando a adoção de embalagens que facilitem o preparo rápido de refeições. Os fabricantes de embalagens estão desenvolvendo materiais resistentes ao calor e compatíveis com o aquecimento em micro-ondas. Esse segmento está ganhando força, principalmente entre os consumidores mais jovens e famílias com membros no mercado de trabalho.

- Por uso final

Com base no uso final, o mercado de embalagens a vácuo para carne fresca no Oriente Médio e na África é segmentado em carnes, aves e frutos do mar. O segmento de carnes detinha a maior participação na receita em 2025, impulsionado pelo alto consumo global de carne bovina, suína e ovina. As embalagens a vácuo são amplamente utilizadas para aumentar o frescor, reduzir a deterioração e melhorar a apresentação de produtos de carne vermelha. O segmento se beneficia da forte demanda do varejo e da infraestrutura de cadeia de frio já estabelecida. A oferta de carnes premium também impulsiona a adoção de soluções avançadas de embalagens a vácuo.

Espera-se que o segmento de aves apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pelo aumento do consumo de frango e peru. Os produtos avícolas têm menor prazo de validade, o que aumenta a necessidade de soluções de embalagem eficazes, como a embalagem a vácuo. A crescente demanda por embalagens higiênicas e à prova de vazamentos está impulsionando a adoção nesse segmento. A expansão dos canais de varejo organizado e de serviços de alimentação também contribui para o crescimento do mercado.

Análise Regional do Mercado de Embalagens a Selo para Carne Fresca no Oriente Médio e África

- A Arábia Saudita dominou o mercado de embalagens a vácuo para carne fresca em 2025, impulsionada pelo alto consumo per capita de carne e pela forte demanda por soluções de embalagem higiênicas e duradouras.

- A expansão de supermercados e hipermercados, juntamente com o aumento das importações de carne fresca embalada, favorece a adoção generalizada. O país se beneficia da melhoria da logística da cadeia de frio e de padrões rigorosos de qualidade alimentar.

- Além disso, a crescente preferência por apresentações de carne de alta qualidade está fortalecendo o uso de embalagens a vácuo.

Análise de mercado de embalagens a vácuo para carne fresca na África do Sul

A África do Sul deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionada pelo aumento do consumo de carne e pela rápida expansão do varejo organizado. Os processadores de carne estão adotando embalagens a vácuo para reduzir a deterioração, aumentar a vida útil e melhorar a atratividade do produto. A crescente conscientização dos consumidores sobre segurança e higiene alimentar também está impulsionando essa adoção. Melhorias na infraestrutura de armazenamento refrigerado e distribuição também contribuem para a expansão do mercado.

Participação de mercado de embalagens a vácuo para carne fresca no Oriente Médio e na África

O setor de embalagens a vácuo para carne fresca no Oriente Médio e na África é liderado principalmente por empresas consolidadas, incluindo:

- Napco Nacional (Arábia Saudita)

- Indústrias de embalagens do Golfo (Arábia Saudita)

- Indústrias de embalagens Hotpack (EAU)

- Pacote Falcon (EAU)

- Grupo de Investimentos Obeikan (Arábia Saudita)

- Indústrias Avançadas Takween (Arábia Saudita)

- Grupo Interplast (EAU)

- Future Pack Industries (EAU)

- Empresa de Embalagens Modernas da Arábia Saudita (Arábia Saudita)

- Detpak Oriente Médio (EAU)

- Embalagem de policarvalho (África do Sul)

- Mpact Limited (África do Sul)

- Nampak Ltda. (África do Sul)

- Manjushree Africa Packaging (Quênia)

- Indústrias de Embalagens Flexíveis Ltda. (Nigéria)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.