Middle East And Africa Rubber Testing Equipment Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

11.47 Million

USD

15.81 Million

2024

2032

USD

11.47 Million

USD

15.81 Million

2024

2032

| 2025 –2032 | |

| USD 11.47 Million | |

| USD 15.81 Million | |

|

|

|

|

Segmentação do mercado de equipamentos de teste de borracha no Oriente Médio e África, por tipo de teste (teste de viscosidade, teste de densidade, teste de dureza, teste de flexibilidade, testador de espessura, testador de estabilidade mecânica, testador de impacto e teste de forno de envelhecimento), tecnologia (viscosímetro Mooney, reômetro de matriz móvel, testador de densidade automatizado, testador de dureza automatizado e analisador de processo), tipo de borracha (borracha de estireno butadieno, borracha EPDM, borracha butílica, borracha natural, borracha de silicone, borracha de neoprene, borracha nitrílica e outras), faixa de frequência (mais de 4 Hz, 1 a 4 Hz e menos de 1 Hz), aplicação (pneus e peças automotivas, produtos de borracha industrial, vedações de borracha e anéis de vedação, solas de sapato, correias transportadoras, correias, tapetes e carpetes de borracha e esportes e condicionamento físico) - Tendências e previsões do setor até 2032

Tamanho do mercado de equipamentos de teste de borracha no Oriente Médio e África

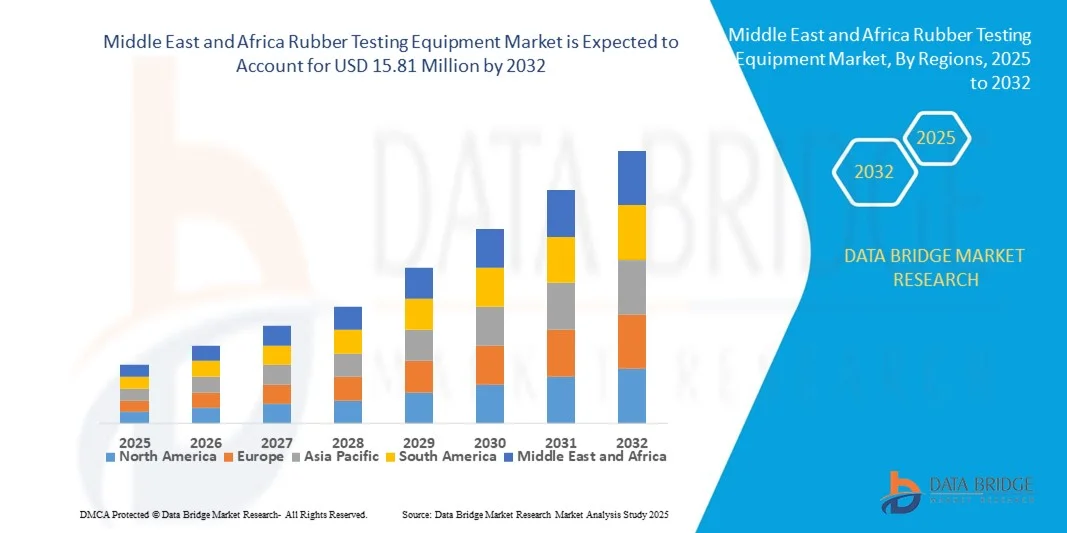

- O tamanho do mercado de equipamentos de teste de borracha do Oriente Médio e África foi avaliado em US$ 11,47 milhões em 2024 e deve atingir US$ 15,81 milhões até 2032 , com um CAGR de 4,1% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por componentes de borracha de alto desempenho nos setores automotivo, aeroespacial e industrial, juntamente com regulamentações rigorosas de qualidade e segurança que impulsionam a adoção de soluções de teste avançadas

- Além disso, os avanços tecnológicos em equipamentos de teste, como automação, análise de dados em tempo real e integração com plataformas digitais, estão aumentando a precisão e a eficiência dos testes, apoiando ainda mais a expansão do mercado.

Análise de mercado de equipamentos para teste de borracha no Oriente Médio e África

- O mercado de equipamentos para teste de borracha está apresentando crescimento constante, à medida que os fabricantes se concentram cada vez mais na garantia de qualidade para atender aos padrões de desempenho em aplicações industriais

- A crescente ênfase na consistência e segurança dos produtos em setores como o automotivo e o de manufatura está incentivando o uso de soluções precisas e automatizadas para testes de borracha

- O mercado da África do Sul capturou a maior fatia da receita em 2024, impulsionado principalmente por uma indústria automotiva robusta e pela expansão da produção industrial de borracha

- Espera-se que os Emirados Árabes Unidos testemunhem a maior taxa de crescimento anual composta (CAGR) no mercado de equipamentos para testes de borracha no Oriente Médio e na África devido à rápida industrialização, à crescente demanda por produtos de borracha automotiva e de construção e à crescente adoção de tecnologias de testes automatizados e de precisão.

- O segmento de testes de viscosidade foi responsável pela maior fatia da receita de mercado em 2024, impulsionado por seu papel crítico na avaliação da processabilidade e das características de fluxo dos compostos de borracha. Os fabricantes dependem fortemente dos testes de viscosidade para garantir a consistência na produção e atender aos requisitos de desempenho das aplicações de uso final.

Escopo do relatório e segmentação do mercado de equipamentos para teste de borracha no Oriente Médio e África

|

Atributos |

Principais insights de mercado sobre equipamentos de teste de borracha no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, produção e capacidade de empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas de tendências de preços e análises de déficit da cadeia de suprimentos e demanda. |

Tendências do mercado de equipamentos de teste de borracha no Oriente Médio e na África

Adoção crescente de soluções avançadas de testes de borracha

- O uso crescente de equipamentos avançados para teste de borracha está transformando o cenário do controle de qualidade, permitindo uma avaliação precisa e confiável das propriedades da borracha, como resistência à tração, dureza e elasticidade. Esses sistemas permitem que os fabricantes garantam o desempenho consistente do produto e a conformidade com os padrões da indústria, reduzindo defeitos e melhorando a qualidade geral do produto. Além disso, a integração com relatórios digitais e análise de dados ajuda os fabricantes a monitorar as tendências de produção e tomar decisões informadas para o aprimoramento do produto.

- A crescente demanda por produtos de borracha em aplicações automotivas, industriais e de consumo está acelerando a adoção de dispositivos de teste automatizados e portáteis. Essas soluções são particularmente eficazes na identificação de inconsistências de materiais e na garantia de que os componentes de borracha atendam aos requisitos de segurança e durabilidade. Essa tendência é ainda mais fortalecida pelo aumento das regulamentações globais de qualidade e pela necessidade de certificações nos mercados de exportação.

- A facilidade de uso, a precisão e a versatilidade dos modernos instrumentos de teste de borracha os tornam atraentes para inspeções de qualidade de rotina, ajudando os fabricantes a manter a eficiência da produção e reduzir o desperdício de material. Além disso, esses sistemas frequentemente apresentam designs modulares e recursos de monitoramento remoto, permitindo implantação flexível em múltiplas linhas de produção e instalações. A adoção também contribui para as metas de sustentabilidade, minimizando a produção defeituosa e o desperdício de recursos.

- Por exemplo, em 2023, diversos fabricantes de pneus e borracha industrial na região relataram melhora na consistência dos produtos e redução de defeitos de produção após a implementação de máquinas automatizadas de testes de tração e dureza. Essas melhorias reforçaram a reputação da marca e a satisfação do cliente, além de reduzir as taxas de recall e as reclamações de garantia. A integração de sensores inteligentes e o feedback em tempo real permitiram que os fabricantes ajustassem ainda mais seus processos e mantivessem a qualidade uniforme dos produtos.

- Embora equipamentos avançados para teste de borracha estejam ganhando força, seu impacto depende de inovação tecnológica contínua, treinamento de operadores e acessibilidade. Os fabricantes devem se concentrar no desenvolvimento de sistemas modulares, escaláveis e confiáveis para capitalizar totalmente o crescimento do mercado. Atualizações contínuas de software e compatibilidade com soluções emergentes de IoT também são essenciais para manter a eficiência operacional e atender aos padrões em evolução do setor.

Dinâmica do mercado de equipamentos para teste de borracha no Oriente Médio e na África

Motorista

Ênfase crescente na qualidade, segurança e padronização dos produtos

- O foco crescente na segurança dos produtos e na conformidade com as normas internacionais está impulsionando a adoção de equipamentos de teste de borracha. As empresas estão priorizando cada vez mais soluções de teste que garantam durabilidade, desempenho e conformidade regulatória nos segmentos automotivo, industrial e de consumo. A crescente conscientização sobre a segurança do usuário final e a responsabilidade da marca também levam os fabricantes a adotar sistemas de teste de alta precisão.

- Os fabricantes buscam cada vez mais sistemas de teste automatizados, precisos e confiáveis para otimizar os processos de produção, reduzir o desperdício e manter a qualidade consistente em todos os lotes. Equipamentos de teste avançados permitem a caracterização detalhada do material, ajudando a aprimorar o design e o desempenho do produto. O uso de dispositivos conectados e análises garante a rastreabilidade do processo, apoiando auditorias regulatórias e iniciativas internas de garantia da qualidade.

- A expansão da indústria da borracha, especialmente em pneus automotivos, vedações industriais e bens de consumo, está impulsionando ainda mais a demanda do mercado. Soluções de teste fornecem insights cruciais sobre as propriedades dos materiais, garantindo que os produtos finais atendam às expectativas de desempenho e aos requisitos do cliente. Além disso, o aumento das exportações para regiões com padrões de segurança rigorosos está incentivando as empresas a adotar protocolos avançados de teste para manter o acesso ao mercado.

- Por exemplo, em 2022, vários fabricantes de componentes de borracha da região integraram sistemas automatizados de testes de dureza e tração em suas linhas de produção, resultando em maior uniformidade do produto e redução das taxas de falhas. A adoção também melhorou a eficiência operacional, reduzindo a intervenção manual e minimizando o erro humano, resultando em maior produtividade e custos mais baixos.

- Embora a qualidade e a padronização dos produtos sejam os principais impulsionadores do crescimento, a adoção depende da relação custo-benefício, da facilidade de uso e da disponibilidade de pessoal treinado para operar equipamentos de teste sofisticados. Programas de treinamento contínuo e serviços de suporte técnico estão se tornando essenciais para garantir a utilização ideal e evitar paradas, apoiando, em última análise, a expansão do mercado a longo prazo.

Restrição/Desafio

Alto custo de equipamentos de teste avançados e acessibilidade limitada em operações de pequena escala

- O alto custo de instrumentos avançados para teste de borracha, incluindo máquinas universais de teste, durômetros e reômetros, limita a adoção entre fabricantes de pequeno e médio porte. As restrições de preço restringem o acesso a tecnologias de ponta que aprimoram o controle de qualidade. Além disso, contratos de manutenção caros e requisitos de calibração aumentam as despesas operacionais, desencorajando empresas menores a investir.

- Em muitas regiões, há escassez de pessoal qualificado capaz de operar e manter equipamentos de teste complexos. A falta de treinamento e conhecimento técnico dificulta a utilização eficaz, reduzindo os benefícios dos sistemas avançados. Esse desafio é particularmente pronunciado em mercados emergentes, onde a formação profissional para equipamentos laboratoriais avançados é limitada.

- Os desafios da cadeia de suprimentos e a disponibilidade limitada de instrumentos de teste especializados em regiões em desenvolvimento restringem ainda mais a penetração no mercado. Pequenos fabricantes frequentemente recorrem a métodos de teste manuais ou desatualizados, o que pode resultar em qualidade inconsistente. Atrasos na importação de equipamentos e peças de reposição de alta qualidade podem interromper os cronogramas de produção, afetando a eficiência operacional geral.

- Por exemplo, em 2023, diversos produtores de componentes de borracha da região relataram atrasos na atualização para equipamentos de teste automatizados devido a restrições orçamentárias e logísticas, afetando a eficiência da produção e a confiabilidade do produto. Esses contratempos levaram ao não cumprimento de prazos e limitaram sua capacidade de atender aos padrões de qualidade para exportação, impactando a receita e a competitividade no mercado.

- À medida que as tecnologias de teste continuam a evoluir, abordar as lacunas de custo, acessibilidade e qualificação é essencial para uma adoção mais ampla e um crescimento sustentável no mercado de equipamentos para teste de borracha. Colaborações industriais, apoio governamental e opções de financiamento flexíveis podem permitir que empresas menores adotem sistemas de teste avançados e melhorem os padrões gerais do mercado.

Escopo do mercado de equipamentos de teste de borracha no Oriente Médio e na África

O mercado de equipamentos de teste de borracha do Oriente Médio e da África é segmentado com base no tipo de teste, tecnologia, tipo de borracha, faixa de frequência e aplicação.

- Por tipo de teste

Com base no tipo de teste, o mercado é segmentado em testes de viscosidade, testes de densidade, testes de dureza, testes de flexibilidade, testes de espessura, testes de estabilidade mecânica, testes de impacto e testes em forno de envelhecimento. O segmento de testes de viscosidade foi responsável pela maior fatia da receita de mercado em 2024, impulsionado por seu papel crítico na avaliação da processabilidade e das características de fluxo de compostos de borracha. Os fabricantes dependem fortemente dos testes de viscosidade para garantir a consistência na produção e atender aos requisitos de desempenho das aplicações de uso final.

Espera-se que o segmento de testes de dureza apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por componentes de borracha de alto desempenho em setores como automotivo, construção civil e aeroespacial. Os testes de dureza fornecem avaliações precisas da resistência do material sob pressão, garantindo a durabilidade e a confiabilidade das peças de borracha usadas em condições extremas.

- Por Tecnologia

Com base na tecnologia, o mercado é segmentado em viscosímetro Mooney, reômetro de matriz móvel, testador de densidade automatizado, testador de dureza automatizado e analisador de processo. O segmento de viscosímetro Mooney deteve a maior participação em 2024, pois continua sendo um padrão amplamente aceito para medir a viscosidade de borracha bruta e compostos de borracha. Sua operação simples e ampla aplicabilidade o tornam uma ferramenta fundamental nos processos de controle de qualidade da borracha.

Espera-se que o segmento de analisadores de processos apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por monitoramento em tempo real dos parâmetros de produção. Os analisadores de processos aumentam a eficiência operacional, reduzindo o tempo de inatividade e permitindo a tomada de decisões baseada em dados, o que está se tornando vital em ambientes de manufatura automatizados e de larga escala.

- Por tipo de borracha

Com base no tipo de borracha, o mercado é segmentado em borracha de estireno-butadieno, borracha de EPDM, borracha butílica, borracha natural, borracha de silicone, borracha de neoprene, borracha nitrílica e outras. A borracha natural dominou o mercado em 2024, devido ao seu amplo uso em aplicações automotivas, industriais e de consumo, devido à sua elasticidade e resistência mecânica. Sua compatibilidade com diversos métodos de teste e disponibilidade em mercados globais reforçam ainda mais a dominância do segmento.

Espera-se que o segmento de borracha de silicone apresente a maior taxa de crescimento entre 2025 e 2032, devido à sua excelente estabilidade térmica, propriedades de isolamento elétrico e uso crescente nos setores de eletrônicos e saúde. Este material exige testes rigorosos para atender a rigorosos padrões de qualidade, o que alimenta a demanda por equipamentos especializados para teste de borracha.

- Por faixa de frequência

Com base na faixa de frequência, o mercado é segmentado em mais de 4 Hz, 1 a 4 Hz e menos de 1 Hz. O segmento de 1 a 4 Hz deteve a maior participação de mercado em 2024 devido à sua ampla aplicação em análises mecânicas dinâmicas padrão e ensaios de fadiga. Essa faixa é ideal para avaliar o desempenho sob condições de estresse repetitivo em setores como automotivo e de calçados.

Espera-se que o segmento acima de 4 Hz apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado por seu uso crescente em aplicações avançadas de testes de fadiga e impacto. Equipamentos operando nessa faixa permitem ciclos de teste mais rápidos e maior precisão, o que é crucial para ambientes industriais de alto rendimento.

- Por aplicação

Com base na aplicação, o mercado é segmentado em pneus e peças automotivas, produtos industriais de borracha, vedações e anéis de vedação de borracha, solas de calçados, correias transportadoras, correias, tapetes e carpetes de borracha e artigos esportivos e fitness. O segmento de pneus e peças automotivas representou a maior fatia em 2024, impulsionado pelos rigorosos requisitos de qualidade e normas de segurança do setor automotivo. Os testes garantem que componentes como pneus e buchas atendam aos critérios de desempenho de resistência ao desgaste, pressão e temperatura.

Espera-se que o segmento de correias transportadoras apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela expansão da industrialização e pela necessidade de materiais duráveis em logística e mineração. Testes robustos de propriedades mecânicas e resistência ao envelhecimento são cruciais para garantir um desempenho duradouro em operação contínua e ambientes abrasivos.

Análise regional do mercado de equipamentos para teste de borracha no Oriente Médio e África

- O mercado da África do Sul capturou a maior fatia da receita em 2024, impulsionado principalmente por uma indústria automotiva robusta e pela expansão da produção industrial de borracha

- Os fabricantes estão adotando cada vez mais sistemas automatizados de testes de tração, dureza e reologia para garantir a consistência do material e atender aos rigorosos padrões regulatórios

- As iniciativas governamentais que promovem a modernização industrial e o foco em componentes de borracha de alta qualidade apoiam ainda mais o crescimento do mercado e o investimento em tecnologias avançadas de testes

Visão do mercado de equipamentos para teste de borracha nos Emirados Árabes Unidos

Espera-se que o mercado dos Emirados Árabes Unidos apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela rápida industrialização e pela crescente demanda por produtos de borracha para os setores automotivo, de construção e de consumo. A adoção de soluções avançadas de teste, incluindo sistemas automatizados e modulares, está aprimorando a precisão e a eficiência da produção. Os fabricantes estão priorizando a conformidade com os padrões internacionais e garantindo o desempenho confiável dos materiais. Além disso, iniciativas governamentais de apoio à qualidade e inovação industrial estão contribuindo para o crescimento acelerado do mercado de equipamentos para teste de borracha nos Emirados Árabes Unidos.

Participação no mercado de equipamentos de teste de borracha no Oriente Médio e África

O setor de equipamentos para testes de borracha no Oriente Médio e na África é liderado principalmente por empresas bem estabelecidas, incluindo:

- Saudi Aramco (Arábia Saudita)

- Emirates Group (EAU)

- SABIC (Arábia Saudita)

- Qatar Petroleum (Catar)

- Primeiro Banco de Abu Dhabi (EAU)

- Emaar Properties (Emirados Árabes Unidos)

- DP World (Emirados Árabes Unidos)

- Banco Al Rajhi (Arábia Saudita)

- Grupo Etisalat (Emirados Árabes Unidos)

- Grupo Ooredoo (Catar)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.